by Calculated Risk on 1/14/2010 11:33:00 AM

Thursday, January 14, 2010

Modification Horror Stories

Update: Why are so many examples "mortgage brokers"? But the part about extensions not doing favors for homeowners is correct.

From Paul Kiel at ProPublica: Homeowners Say Banks Not Following Rules for Loan Modifications

A few excerpts:

Reynolds was a prime candidate for a loan adjustment and was among the earliest homeowners to receive a trial modification.Just an anecdote, but one of many. And on the length of the trial period:

His mortgage brokerage business had followed the market downward, and as a result, he’d fallen three months behind on his interest-only mortgage. ...

Soon after the loan program was announced last February, Reynolds applied. He received an application in late April and was accepted, making his first payment of about $2,400 (down from $3,300) in May. He made six more payments. ... [In late November, he received an answer: He was denied a permanent loan modification.

The reason? A Chase employee explained to Reynolds that they’d determined his financial difficulties weren’t permanent. In his application, he’d written that he believed that the government’s rescue efforts would “save the U.S. housing market” and that his business “will once again be profitable.” The Chase employee told him that statement indicated his hardship was only temporary.

...

Chase spokeswoman Christine Holevas told ProPublica that Reynolds had been denied "because the skill and ability is still there to earn the income." Since he’d "stated in his letter that business would be picking up," it was "not considered a permanent hardship," Holevas said.

emphasis added

[T]rial modifications routinely last more than six months, homeowners and housing advocates say.The trial period was extended last year from 3 months to 5 months, probably because of the low conversion rate to permanent status, and then extended again in late December to at least the end of January. This isn't doing any favors for the homeowners that will eventually be rejected.

There are a number of adverse consequences of a trial period’s dragging on, said the consumer law center’s Thompson. Because a homeowner is not making a full payment, the balance of the mortgage grows during the trial period. The servicer reports the shortfall to credit reporting agencies, so the homeowner’s credit score can drop. And most importantly, says Thompson, the homeowner isn’t saving money in case the modification fails and the home is foreclosed. "Keeping someone in a trial modification really does not do them a favor," she said.

As I've noted before, HAMP is a fine modification program for the people that qualify and aren't deep underwater on their homes - AND actually get a permanent modification! (added) However the program was oversold - I doubt this program will "reach up to 3 to 4 million at-risk homeowners" as Treasury originally projected. So too many homeowners were allowed in the trial programs without sufficient pre-screening - and the program was started before servicers were really ready.

Wednesday, December 23, 2009

As HAMP Fails, Treasury Flails

by Calculated Risk on 12/23/2009 06:43:00 PM

Update: the title just rhymes. HAMP hasn't "failed", but it is definitely struggling.

From Bloomberg: Homeowners Get More Time for Home-Loan Modifications

Mortgage servicers must give U.S. homeowners more time before kicking them out of the government’s loan-modification program ... Servicers can’t cancel an active Home Affordable trial modification scheduled to expire before Jan. 31 for any reason other than property eligibility requirements, according to a posting today on a government Web site. ...Extend and pretend. Fail and flail.

“The Treasury Department believes that this further guidance and associated requirements will provide more certainty and transparency regarding the final determination of eligibility for borrowers in trial modifications,” Meg Reilly, a department spokeswoman, said in an e-mailed statement.

Here is the press release: Supplemental Directive 09-10 Implements Temporary Review Period for Active HAMP Trial Modifications (ht Effective Demand)

In order to provide servicers an opportunity to remain focused on converting eligible borrowers to permanent HAMP modifications, effective today and lasting through January 31, 2010, Treasury is implementing a review period for all active HAMP trial modifications scheduled to expire on or before January 31, 2010. Active HAMP trial modifications include trial modifications that have been submitted to the Treasury system of record that have not been cancelled by the servicer.

During this review period, servicers should continue to convert eligible borrowers in active HAMP trial modifications to permanent HAMP modifications as quickly as possible in accordance with existing program guidance. Servicers may not cancel an active HAMP trial modification during this period for any reason other than failure to meet the HAMP property eligibility requirements.

During this review period, servicers must confirm the status of borrowers in active HAMP trial modifications scheduled to expire on or before January 31, 2010 as either current or not current. Servicers must also confirm which, if any, documents are due from borrowers. Servicers must send written notification to borrowers as appropriate to inform them that they are at risk of losing eligibility for a permanent HAMP modification because the borrower has (i) failed to make all required trial period payments, (ii) failed to submit all required documentation, or (iii) failed both to make all required trial period payments and to submit all required documentation. The notice must provide the borrower with the opportunity to correct any error in the servicer’s records or submit any missing documents or payments within 30 days of the notice or through January 31, 2010, whichever is later. If a borrower provides evidence of the servicer’s error or corrects the deficiency within the timeframe provided, the servicer must consider the new information and determine if the borrower is eligible to continue in the HAMP modification process.

Thursday, December 10, 2009

HAMP: 31,382 Permanent Mods

by Calculated Risk on 12/10/2009 02:48:00 PM

Update: Treasury link now working, graphic added.

From Diana Olick at CNBC: First Look: Inside The $75 Billion Plan to Save Housing

Of the 759,058 modifications started, 697,026 are still in the three month trial phase. ... Treasury reports that 31,382 trial modifications are now permanent. ... 30,650 modifications were disqualified.Olick has much more.

Click on graph for larger image in new window.

Click on graph for larger image in new window.That is about a 50% failure rate during the trial period - and only a fraction of the eligible borrowers even bother.

Here is the link at Treasury. See here for a list of reports.

Tuesday, December 08, 2009

JPMorgan: 200,000 HAMP Mods Offered, Only 2% Permanent

by Calculated Risk on 12/08/2009 05:38:00 PM

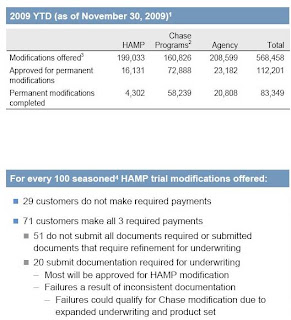

The following information is from the JPMorgan Chase presentation today at the Goldman Sachs Financial Services Conference. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first slide (page 18 in the presentation) shows the progress of the various modification programs at JPM Chase. Only 2% of all trial modification have become permanent (4,302 or 199,033 trial mods).

29% fail to make all their payments during the trial modification program. Another 51% fail to submit all documentation.

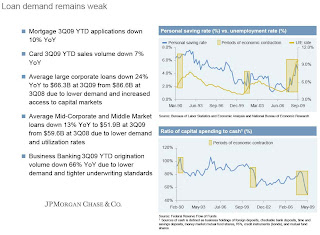

The other modification programs are having more success. The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The presentation isn't all gloomy (see page 14):

Overall CommentarySome initial signs of stability in consumer delinquency trends, but we are not certain if this trend will continue Prime and subprime mortgage delinquencies impacted by foreclosure moratorium, extended REO timelines and trial modifications

Treasury: "Thousands of Borrowers" have received Permanent Modifications

by Calculated Risk on 12/08/2009 10:53:00 AM

From Bloomberg: Most Targeted for Mortgage Relief Don’t Qualify, Official Says

A majority of the 3.2 million borrowers targeted by the U.S. Treasury Department for mortgage relief under the administration’s foreclosure prevention program are unlikely to qualify, an agency official said.Testimony from Treasury Assistant Secretary for Financial Stability Herbert Allison: “The Private Sector and Government Response to the Mortgage Foreclosure Crisis”

...

Although we know that not every borrower will qualify for a permanent modification, we are disappointed in the permanent modification results so far,” said Allison, who is the former chief executive officer for federally controlled mortgage- finance giant Fannie Mae.

The Home Affordable Modification Program (HAMP), which provides eligible homeowners the opportunity to significantly reduce their monthly mortgage payment, is a key part of this effort, designed to help millions of homeowners remain in their homes and prevent avoidable foreclosures. As of November 17, over 680,000 borrowers are in active modifications, saving an average of over $550 a month on their monthly mortgage payments. Servicers report that over 900,000 borrowers have received offers to begin trial modifications.Only "thousands" of borrowers? Ouch. The actual data should be released this week.

...

Our most immediate and critical challenge is converting trial modifications to permanent modifications. All mortgage modifications begin with a trial phase to allow borrowers to submit the necessary documentation and determine whether the modified monthly payment is sustainable for them.

...

Currently servicers report that about 375,000 trial modifications will have finished a three month trial period with timely payments before 12/31/2009. Informal survey data from servicers indicate receipt of complete documents in about 30% of active trial modifications – these modifications where borrowers have returned all required documents need to be decisioned by servicers as quickly as possible. For other borrowers, servicers report that the large majority are current on their payments, but have some of the required documentation missing from applications. Housing counselors and homeowners report that servicers are losing documents, while servicers report that homeowners are not providing documents despite repeated outreach. Thousands of borrowers have successfully converted trial modifications to permanent modifications – but this is a low number compared to the total number of trial modifications.

Monday, December 07, 2009

BofA on Modifications: Two thirds of Borrowers have not Submitted Full Docs

by Calculated Risk on 12/07/2009 05:02:00 PM

From Diana Olick at CNBC: Bank of America: 2/3 of Borrowers May Lose Mods (ht montas ankle)

[Jack Schakett, credit loss mitigation strategies executive at B of A.] told me that of the 65 thousand trial modifications set to expire Dec. 31st with B of A, a full two thirds of the borrowers, while current on their payments, have not submitted the full documentation required to turn a trial mod permanent under the HAMP guidelines.Borrowers are complaining that the banks are losing documentation and that they have to submit it multiple times. Ms. Olick also suggests the possibility that some borrowers can't document their income.

"We don't really know the major reason why the customers are not returning the documentation," Schakett claims.

BofA's Mr. Schakett said it was too soon to know why the documentation is incomplete, but this suggests that the number of permanent modifications announced this week will be very low (in the 10s of thousands).

Friday, December 04, 2009

Slow Start for Modifications

by Calculated Risk on 12/04/2009 11:55:00 PM

The Treasury is expected to announce the number of permanent modifications and other metrics for the Making Home Affordable program next week, but clearly the program is off to a slow start ...

From Renae Merle at the WaPo: Quarter of borrowers in anti-foreclosure plan are behind

About 25 percent of borrowers helped under the administration's massive foreclosure prevention plan have already fallen behind on their new mortgage payments, according to government data that raise new questions about the program's effectiveness.Floyd Norris at the NY Times has more: Why Many Home Loan Modifications Fail

...

For example, at a conference last month, J.P. Morgan Chase, which signed up more than 178,000 homeowners, noted that 22 percent of borrowers helped didn't make their first payment.

...

More than half of the borrowers eligible for a permanent modification by the end of the year have not submitted all of the required documents, from pay stubs to tax returns, including some who have provided nothing, government officials have said.

Next week will be interesting ...

Saturday, November 28, 2009

Consensus on Permanent Mods: "Program has proved inadequate"

by Calculated Risk on 11/28/2009 03:42:00 PM

It sounds like the permanent mod numbers will be grim ...

From Peter Goodman at the NY Times: U.S. to Pressure Mortgage Firms for Loan Relief

The Obama administration on Monday plans to announce a campaign to pressure mortgage companies to reduce payments for many more troubled homeowners, as evidence mounts that a $75 billion taxpayer-financed effort aimed at stemming foreclosures is foundering.There is much more in the article. We will see the numbers in a couple of weeks.

“The banks are not doing a good enough job,” Michael S. Barr, Treasury’s assistant secretary for financial institutions, said in an interview Friday.

...

“I’ve been very frustrated by the pace of the program,” said Senator Jeff Merkley, an Oregon Democrat who sits on the Senate Banking Committee. “Very few people have emerged from the trial period.”

...

Capitol Hill aides in regular contact with senior Treasury officials say a consensus has emerged inside the department that the program has proved inadequate, necessitating a new approach. ...

"[A]t senior levels, where people are looking at this and thinking ‘Good God,’ there’s a sense that we need to think about doing something more.” said a Senate Democratic aide, who spoke on the condition he not be named for fear of angering the administration.

emphasis added

Thursday, November 26, 2009

Mortgages: Few Permanent Mods

by Calculated Risk on 11/26/2009 08:53:00 AM

One of the keys to the housing market is the success of the modification programs. The Treasury Department is expected to release a key measurement next month: the number of permanent modifications for the Making Home Affordable program.

Scott Reckard at the LA Times has an overview: Few mortgages have been permanently modified

Loan-modification limbo is of high concern these days ... even after reporting this month that trial modifications had topped 650,000, the government still hasn't said how many of those loans have been permanently restructured. ...We will know more in December, but it might not have been a great idea to loan the money first, and then qualify the borrowers.

"You can't claim victory at 500,000 trial modifications and then have half of them drop out," said Paul Leonard, California director for the Center for Responsible Lending, a Durham, N.C.-based advocacy group.

...

Exactly what is holding up the conversions depends on whom you talk to.

"Getting these loans to the finish line is tough" for loan servicers, Chase Home Lending Senior Vice President Douglas Potolsky said ... The main obstacle, he and other bankers said, is borrowers who don't properly complete their paperwork.

...

Getting income documentation is a major problem now that the era of "low doc" and "no doc" loans is long gone, [Sam Khater, an economist with mortgage data firm First American CoreLogic] said in an interview.

Wednesday, November 11, 2009

WSJ on Permanent Modifications

by Calculated Risk on 11/11/2009 04:30:00 PM

Ruth Simon at the WSJ has some details on permanent modifications: Mortgage Program Gathers Steam After Slow Start

The administration won't release figures on completed modifications until December, but so far it appears that very few trial modifications are becoming permanent, often because of a lack of documentation.Diani Olick at CNBC wrote yesterday:

...

J.P. Morgan Chase & Co. said last week that more than 92,000 of its customers have made at least three trial payments under the program, but just 26% of them had submitted all the required documents for a permanent fix.

...

At Morgan Stanley's Saxon Mortgage Services, about 26,000 of the 39,000 borrowers in the program have made more than three trial payments. Roughly 500 have received completed modifications.

emphasis added

Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans ...In my list of possible upside surprises / downside risks for the economy, the percent of permanent modifications is related to the #1 downside risk. If few of these modifications are successful, there could be a flood of foreclosures on the market next year.

Unsolicited Principal Reduction Offer from BofA

by Calculated Risk on 11/11/2009 03:01:00 PM

Here is an unsolicited Principal Reduction Loan Modification (pdf) offer from BofA. (ht Dwight)

A few background details:

The offer from BofA:

If the homeowner accepts the offer, he would still owe more on the 1st than the house is worth (the 2nd mortgage would have to be resolved). The personal issue still exists, and reducing the monthly payments by a couple of hundred dollars probably will not help. My understanding is the homeowner is considering trying for a short sale, but it is interesting that BofA is sending out unsolicited principal reduction offers - probably to NegAm borrowers.

UPDATE: The number is answered by a recording that announces they are a "debt collector", and then says they are now closed (probably for Veterans Day)

Tuesday, November 10, 2009

Loan Modifications: Key Numbers not Released

by Calculated Risk on 11/10/2009 03:17:00 PM

From Reuters: Treasury says 650,000 in trial home loan workouts

[The Treasury Department] said there were 650,994 active trial modifications through October under President Barack Obama's plan to help the housing market. That was up from 487,081 ... participating through September.The key number - permanent modifications - was not released. As of Sept 1st, the Obama plan had produced only 1,711 permanent loan modifications.

The Treasury did not release figures for trial modifications that have been made permanent.

Why doesn't Treasury release the number of trial modifications started, the redefault rates for trial modifications (by month started) and the number of permanent modifications?

Diani Olick at CNBC has more: Shadow Inventory Dwarfs Loan Mods

[W]e have no idea how successful those mods are now five months after the program really got cooking.The size of the next wave of foreclosures depends on the success of the modification programs. And right now Treasury is leaving us in the dark ...

It's coming, that's what the folks at Treasury say.

They also say that a lot of borrowers got extensions on the trial period in order to get paperwork together to move on to permanent modifications. Insiders however tell me that a lot of that paperwork has to do with those so-called "stated-income" loans, where you just had to tell the lender what you make for a living, not actually prove it. In order to move to a permanent mod, you have to prove it, so now we get to find out how many of those "liar loans" were just that.

emphasis added

Tuesday, October 20, 2009

HAMP Modification Documents

by Calculated Risk on 10/20/2009 04:12:00 PM

For those interested, here are some Wells Fargo (America's Servicing Corporation) HAMP documentation (pdf) (ht Dave).

A few notes:

Friday, October 16, 2009

First Fed California Modifies Performing Loans, Brags about 28% Default Rate

by Calculated Risk on 10/16/2009 03:26:00 PM

First Federal Bank of California put out a press release claiming better modification performance than the national average:

Compared to the national average, far fewer loans modified by the Bank have defaulted as of August 31, the latest date for which there is comparative data. Just 28.3% of the loans modified by First Federal Bank of California in the first quarter of 2008 had become at least 30 days delinquent 12 months after they were modified. By contrast, that figure is 65.9% for national banks and federally regulated thrifts, according to a September report by the Office of the Comptroller of the Currency and the Office of Thrift Supervision.Wow. Maybe other banks can learn something from First Fed on loan modifications!

But wait:

Over 90% of the loans that the Bank has modified since the program started were current at the time they were modified. The Bank converted many adjustable-rate loans into fixed-rate mortgages for up to 10 years and eliminated negative-amortization provisions for modified loans. These steps have reduced the risk of foreclosure and potential loan losses.Not so impressive. Most loans that are modified by national banks are delinquent, and redefault rates are much higher than initial default rates.

Amherst Securities noted that this week (no link):

[R]e-performing loans are defined as those that were once more than 60 days delinquent, and are now less than 60 days delinquent. This can occur either through natural curing or modifications. However, these re-performing loans do not perform in the same manner as loans that have never been delinquent.Of course First Fed is targeting loans that will probably default (a good strategy), but the solution of modifying to a low fixed rate for up to ten years (without principal reduction), sounds like "extend and pretend".

In particular, the default rates on the re-performing bucket is huge. Most of these loans will eventually fail. The question is just – when?

Thursday, October 15, 2009

Citi Conference Call Comments on Impact of HAMP

by Calculated Risk on 10/15/2009 02:27:00 PM

These comments show how important HAMP is to the housing market. The key points are 1) Loans in trial modifications are included in the delinquency rates (as we've discussed), and 2) we are completely in the dark on how the trial mods are performing!

Meredith Whitney:

Since so much of your numbers today are influenced by the trial mod [HAMP] results, I wanted to ask a couple of questions. Number one, is the early experience consistent with the report that came out in October with the Congressional oversight result, which talked to the difficulty of finding documentation on the modifications? Can you provide more color there? And also a question that I have been asking management is when do you think an appropriate report card will be accessible in terms of the success of these? Is it fourth quarter, first quarter and then I have a follow-up after that please?Citi CFO John Gerspach:

The earliest modifications that we entered into were in May. And so we are just finishing up the five-month period right now. And I would say that the documentation process, both in the way that the request is given to the consumer, as well as the assistance that we are giving consumers, has improved over time. So the early stages, we are seeing some difficulty in the customers fulfilling the documentation request as either you noted or we noted. That is one of the reasons behind the extension of the trial period from three months to five months. So let's kind of wait until we at least get the October and perhaps November results in to see whether or not the documentation collection or submission process has improved. As far as an overall scorecard on HAMP, my sense, especially given the fact that you have got five months -- five-month trial for all modifications entered into prior to September 1 and then a three-month period is at best it will be towards the end of the fourth quarter, but it is probably more of a first quarter next year type of answer.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This is slide 18 from the Citi Presentation. This slide shows the increase in mortgage delinquencies and Gerspach discusses the impact of HAMP below.

Apparently the increase in the 90 to 179 day bucket is due to HAMP, and so is half of the increase in the greater than 180 day bucket. The remaining increase in the greater than 180 day bucket is due to delays in foreclosures.

Earlier from CFO John Gerspach:

Turning to first mortgages on slide 18, we take a closer look at the delinquency data. Last quarter, we discussed a trend that showed a decline in the 90 to 179 day bucket and an increase in the 180 day plus bucket. The trend in the 90 to 179 day bucket has reversed this quarter, but can be largely explained by the loan modification program known as Home Affordable Modification or HAMP. We have approximately $6 billion of on-balance sheet mortgages in this program. Under HAMP, borrowers make reduced mortgage payments for a trial period, during which they continue to age through our delinquency buckets even if they are current under the new payment terms. This serves to increase our delinquencies. Virtually all of the increase in the 90 to 179 bucket and half of the increase in the 180 plus day bucket are loans in HAMP trial modifications. The rest of the increase in the 180 plus day bucket is attributable to a backlog of foreclosure inventory driven by a slowdown in the foreclosure process in many states. HAMP also reduces net credit losses as loans in the trial period do not get charged off at 180 days past-due as long as they have made at least one payment. Nearly half the sequential decline in net credit losses on first mortgages this quarter was attributable to HAMP. We have provided additional loan loss provisions to offset this impact.Analyst:

And of all of the metrics that we see, for example, the 90 day delinquencies and the like, which do you think that we should pay the most attention to in terms of evaluating the choices that you made in terms of building reserves other than the 13 months?John Gerspach:

Well, you certainly have to take a look at the combination of the 90 day plus delinquencies. Let's talk about cards. I think cards and mortgages are somewhat different. From a cards point of view, as I mentioned, when we look at things, we are looking at both the early buckets, as well as the later buckets. And admittedly, we don't give you much information on the early buckets. But in the retail partner cards portfolio, as we mentioned, we are seeing improvements in the 90 day plus buckets and we are also seeing some stabilization in the early buckets. And that is what gives us, again, some deal of comfort when looking at that portfolio. Branded cards, I think I mentioned that we have seen reductions in the 90 plus day delinquencies, but as I noted, the net credit losses continued to grow slightly this quarter and so we are somewhat more cautious in that portfolio. And finally, when it comes to mortgages, as I mentioned on the call, or just before, the HAMP program right now has got a rather significant impact on our delinquency statistics and really makes it difficult for anyone from the outside to actually have a good view as to the inherent credit profile in our delinquency buckets.

Wednesday, October 14, 2009

Amherst: Few HAMP Modifications to be Successful

by Calculated Risk on 10/14/2009 09:54:00 PM

From Austin Kilgore at Housing Wire: Chances Are, Most HAMP Mods Won’t Work: Amherst

The Making Home Affordable Modification Program (HAMP) adds another layer of uncertainty for private label securitization investors, making it more difficult to predict cash flows, according to a report by analysts at Amherst Securities Group, who added they expect relatively few HAMP workouts to be successful.A few comments:

Additionally, it’s taking longer for bad mortgages to move from last payment to liquidation, and the pace varies by servicer: “The trial modification period essentially holds the loan in a suspended state for 90 days, making it difficult to assess what is happening with modifications,” the report said ...

While HAMP workouts are keeping the pools of real estate owned (REO) property relatively small, Amherst predicts a low percentage of eventual success of HAMP modifications is inevitable.

emphasis added

Treasury and COP note that many of those temporary modifications may be in process of getting paperwork submitted in order for them to achieve permanent status. Treasury granted a two-month extension -- on top of the three-month trial -- for borrowers and servicers to get their documentation ready.

We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman.

Tuesday, October 13, 2009

JPMorgan Proposes More 'Extend and Pretend' for Mortgage Modifications

by Calculated Risk on 10/13/2009 03:15:00 PM

From an article by Jody Shenn and Dawn Kopecki on Bloomberg: JPMorgan Pitches Interest-Only Mortgages to Boost Obama Plan

Banks will push the Obama administration to expand its mortgage-modification program to allow interest-only periods on reworked loans ... while recognizing concern that it may only postpone defaults, according to JPMorgan Chase & Co.This is simply more extend and pretend, and only postpones defaults.

“We’re working with our peers to develop a proposal to present,” Douglas Potolsky, a senior vice president at JPMorgan’s Chase home-loan unit, said yesterday at a Mortgage Bankers Association conference in San Diego.

The article also has some comments from Laurie Anne Maggiano, director of the Treasury’s policy office for homeownership preservation. Maggiano acknowleges that only "a couple thousand" modification are now permanent, and she notes that the trial period has been extended an extra two months (I guess a disappointing number of trial modifications are becoming permanent).

The key numbers to track going forward will be the number of permanent modificatons, and the redefault rate for permanent modifications. So far it is "a couple thousand" and too early to say.

The article also quotes Maggiano on the short sale initiative that should be announced next week. Housing Wire has more: Treasury to Announce New Program to Avoid Foreclosure

The Chief of the Homeowner Preservation Office at the Treasury, Laurie Maggiano, released information on the Home Affordable Foreclosure Alternatives (HAFA) while speaking at the MBA’s 96th Annual Convention going on in San Diego. The official launch is expected in the next week or so.

...

Maggiano adds that HAFA will offer financial incentives to both servicers and borrowers, and associated secondary investors, in order to facilitate a short sale or deed in lieu of the property.

Monday, October 12, 2009

Mortgage Modifications and BofA

by Calculated Risk on 10/12/2009 02:10:00 PM

Renae Merle at the WaPo writes about Bank of America's struggles to ramp-up their mortgage modification department: Racing the Clock to Avoid Foreclosures

The following section probably requires more explanation:

The company was also slow out of the box because it initially took a more conservative approach than some other banks, requiring that borrowers document their income and complete other paperwork before granting preliminary approval for a modification. In August, Bank of America softened the requirement and began authorizing some modifications without getting all the documents first.Read mort_fin notes:

"What the article doesn't make clear is that what was changed was the timing of the income documentation, not the level. It used to be the case that bofa required full documentation of income before they would even run the numbers to tell a borrower that they qualified. Now they will give an answer over the phone and start a trial mod, giving the borrower a month or 2 to provide the docs. No docs, no permanent mod. A borrower who can't document their claims gets a month or two of reduced payments before getting kicked out."This is why it will be important to watch the number of permanent modifications over the next few months. The Treasury announced last week that 500,000 modifications have been started, but the Obama plan had produced only 1,711 permanent loan modifications as of Sept. 1. That number should increase sharply soon.

Saturday, October 10, 2009

Congressional Oversight Panel: Obama Foreclosure Plan will Fall Short

by Calculated Risk on 10/10/2009 08:48:00 AM

From Peter Goodman at the NY Times: Panel Says Obama Plan Won’t Slow Foreclosures

In a report mild in language but pointed in substance, the Congressional Oversight Panel — a watchdog created last year to keep tabs on taxpayer bailout funds — said the administration’s program would, “in the best case,” prevent “fewer than half of the predicted foreclosures.”The numbers that matter are the permanent loan modifications and the redefault rate. With the report next month we should know much more ...

...

When the Obama administration began its $75 billion Making Home Affordable program in March, it said the plan would spare as many as four million households from foreclosure. On Thursday, Treasury announced that 500,000 homeowners had since had their payments lowered on a trial basis, celebrating this as a milestone.

But the report from the oversight panel directly challenged the administration’s characterizations.

Most prominently, the panel had grave uncertainty about whether large numbers of the trial loan modifications — which typically run for three months — would successfully be converted to permanent terms.

As of the beginning of September, only 1.26 percent of trial modifications that had made it through the three-month trial period had become permanent, the report found. Of course, very few of those trial loans had reached their three-month expiration because the program only recently began processing large numbers of applications. As of Sept. 1, the Obama plan had produced 1,711 permanent loan modifications.

emphasis added

Thursday, October 08, 2009

Treasury: 500,000 mortgage modifications started

by Calculated Risk on 10/08/2009 02:20:00 PM

From MarketWatch: Obama plan claims 500,000 mortgage modifications started

U.S. loan servicers have begun modifying more than 487,081 loans for troubled homeowners on the verge of foreclosure as of the end Sept. 30, according to the report. The program met its 500,000 goal in early October. More than 757,955 modification offers have been extended by loan servicers as part of the program known as the Home Affordable Modification Program, or HAMP.And from Scott Reckard at LA Land (LA Times):

Stand by ... for answers to the big question: whether these modified loans will hold up or whether “underwater” homeowners will stumble back into default after hitting new bumps along their financial roads.As I noted back in July when this goal was announced:

...

The trial modifications “are simply offers,” [Mark Zandi of Moody's Economy.com notes]. “Many won't turn into actual mods, and those mods that occur will have a high redefault rate.”

Counting the number of mods might make for useful PR, but some mods are more effective than others. A capitalization of missed payments and fees, along with a rate reduction and/or extended term, are the most common modifications. But for homeowners with significant negative equity that is just "extend and pretend" and leads to a high redefault rate and just postpones foreclosure.The September industry data is not available yet on the HopeNow website.