by Calculated Risk on 12/08/2009 05:38:00 PM

Tuesday, December 08, 2009

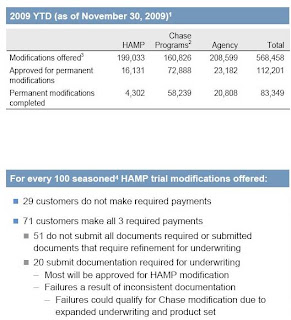

JPMorgan: 200,000 HAMP Mods Offered, Only 2% Permanent

The following information is from the JPMorgan Chase presentation today at the Goldman Sachs Financial Services Conference. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first slide (page 18 in the presentation) shows the progress of the various modification programs at JPM Chase. Only 2% of all trial modification have become permanent (4,302 or 199,033 trial mods).

29% fail to make all their payments during the trial modification program. Another 51% fail to submit all documentation.

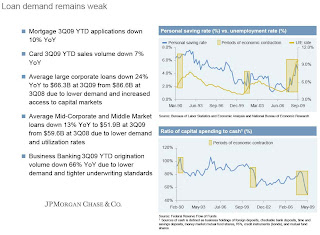

The other modification programs are having more success. The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The presentation isn't all gloomy (see page 14):

Overall CommentarySome initial signs of stability in consumer delinquency trends, but we are not certain if this trend will continue Prime and subprime mortgage delinquencies impacted by foreclosure moratorium, extended REO timelines and trial modifications