by Calculated Risk on 11/19/2009 11:08:00 AM

Thursday, November 19, 2009

MBA Forecasts Foreclosures to Peak in 2011

On the MBA conference call concerning the "Q3 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: Many more questions this time!

A few graphs ...

Click on graph for larger image in new window.

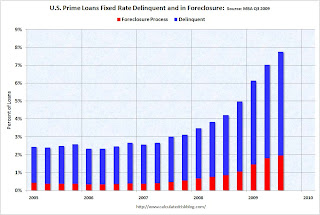

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for about 76% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about two-thirds of all loans).

The second graph shows just fixed rate prime loans (about two-thirds of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

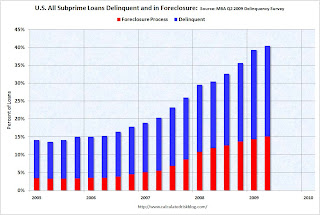

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 14.4 Percent of Mortgage Loans in Foreclosure or Delinquent in Q3

by Calculated Risk on 11/19/2009 10:00:00 AM

The MBA reports a record 14.4 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2009. This is an increase from 13.2% in Q2 2009.

From the MBA: Delinquencies Continue to Climb in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.64 percent of all loans outstanding as of the end of the third quarter of 2009, up 40 basis points from the second quarter of 2009, and up 265 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 108 basis points from 8.86 percent in the second quarter of 2009 to 9.94 percent this quarter.

Top Line Results

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 4.47 percent, an increase of 17 basis points from the second quarter of 2009 and 150 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 14.41 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 1.42 percent, up six basis points from last quarter and up 35 basis points from one year ago.

The percentages of loans 90 days or more past due, loans in foreclosure, and foreclosures started all set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

Increases Driven by Prime and FHA Loans

“Despite the recession ending in mid-summer, the decline in mortgage performance continues. Job losses continue to increase and drive up delinquencies and foreclosures because mortgages are paid with paychecks, not percentage point increases in GDP. Over the last year, we have seen the ranks of the unemployed increase by about 5.5 million people, increasing the number of seriously delinquent loans by almost 2 million loans and increasing the rate of new foreclosures from 1.07 percent to 1.42 percent,” said Jay Brinkmann, MBA’s Chief Economist.

“Prime fixed-rate loans continue to represent the largest share of foreclosures started and the biggest driver of the increase in foreclosures. 33 percent of foreclosures started in the third quarter were on prime fixed-rate and loans and those loans were 44 percent of the quarterly increase in foreclosures. The foreclosure numbers for prime fixed-rate loans will get worse because those loans represented 54 percent of the quarterly increase in loans 90 days or more past due but not yet in foreclosure.

“The performance of prime adjustable rate loans, which include pay-option ARMs in the MBA survey, continue to deteriorate with the foreclosure rate on those loans for the first time exceeding the rate for subprime fixed-rate loans. In contrast, both subprime fixed-rate and subprime adjustable rate loans saw decreases in foreclosures.

“The foreclosure rate on FHA loans also increased, despite having a large increase in the number of FHA-insured loans outstanding. The number of FHA loans outstanding has increased by about 1.1 million over the last year. This increase in the denominator depresses the delinquency and foreclosure percentages. If we assume these newly-originated loans are not the ones defaulting and remove the big denominator increase from the calculation results, the foreclosure rate would be1.76 percent rather than 1.31 percent reported.

....

“The outlook is that delinquency rates and foreclosure rates will continue to worsen before they improve. First, it is unlikely the employment picture will get better until sometime next year and even then jobs will increase at a very slow pace. Perhaps more importantly, there is no reason to expect that when the economy begins to add more jobs, those jobs will be in areas with the biggest excess housing inventory and the highest delinquency rates. Second, the number of loans 90 days or more past due or in foreclosure is now a little over 4 million as compared with 3.9 million new and previously occupied homes currently for sale, although there is likely some overlap between the two numbers. The ultimate resolution of these seriously delinquent loans will put added pressure on the hardest hit sections of the country.”

Monday, November 09, 2009

Distressed Sales: Sacramento as Example

by Calculated Risk on 11/09/2009 03:19:00 PM

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series as an example to see changes in the mix in a former bubble area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

UPDATE: percentages corrected.

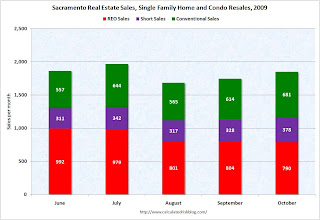

Here is the October data.

They started breaking out REO sales last year, but this is only the fifth monthly report with short sales. About 63.2 percent of all resales (single family homes and condos) were distressed sales in October. The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

The second graph shows the mix for the last four months. REO sales declined, but short sales and conventional sales were up. It will be interesting to see if foreclosure resales pick up later this year - or early next year - when the early trial modifications period is over.

Total sales in October were off 17.5% compared to October 2008; the fifth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (24.6%) or FHA loans (28.9%), suggesting most of the activity in distressed former bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credit), and investors paying cash.

This is a local market still in distress.

Sunday, November 08, 2009

Default Notices: Movin' on Up!

by Calculated Risk on 11/08/2009 08:28:00 PM

Here is some more on a theme we've been discussing ...

From Carolyn Said at the San Francisco Chronicle: Default notices rising in upper echelon ZIPs (ht Hymn)

In upscale communities such as Los Altos, Greenbrae and Alamo, where median prices top $1 million, about twice as many households received default notices from January to September as in the same period in 2008, according to recorders' office data compiled by MDA DataQuick, a San Diego real estate research firm.There is much more in the article. The mid-to-high end will never see the levels of foreclosure activity as some of the low end areas - and the process will take longer because many of these homeowners have other financial resources. But I do expect further price declines in many mid-to-high end areas as distress sales increase.

The same is true for mid-scale areas with median prices around $500,000, such as Walnut Creek, Los Gatos and Campbell.

"The question is, could this be the beginning of something that gets a whole lot worse?" said Andrew LePage, an analyst with DataQuick. "The distress in the high end right now is important to watch; it helps explain why we have more sales (of high-end homes). More distress means more-motivated and more-realistic sellers. We're just starting to find out whether the riskier loans that were not subprime will come back to haunt us."

Putting the MERS Controversies in Perspective

by Calculated Risk on 11/08/2009 11:59:00 AM

CR Note: This is a guest post from albrt.

A great deal has been written in the last year or so about cases in which a court has denied a lender the right to foreclose on a mortgaged house. Lately many of the decisions have involved MERS, an acronym for the nationwide Mortgage Electronic Registration Systems, Inc. This post focuses on two August decisions in which the courts decided MERS should be able to foreclose, despite vigorous legal efforts by the homeowners.

Bucci vs. Lehman Brothers

This is a trial court decision from Rhode Island. The homeowners stopped making mortgage payments in September of 2008, the lender sent a notice of non-judicial foreclosure sale the following March. After slight delays the foreclosure sale ended up being scheduled in July. So lesson number one from this case is that you can’t necessarily count on staying in your house for years if you stop paying the mortgage. The amount of time to foreclosure will vary a great deal depending on the lender and the state you live in.

The day before the scheduled sale, the homeowners filed a lawsuit to stop it. The homeowners’ primary argument was that the foreclosure was being carried out in the name of MERS, but MERS was not really the owner of the mortgage and note. After a short hearing in July, the court decided that MERS could foreclose. The judge primarily based his decision on the plain language of the mortgage document, which said:

MERS (as nominee for Lender and Lender’s successors and assigns) has the right to exercise any or all of those interests, including, but not limited to, the right to foreclose and sell the Property.The homeowners also argued the lender had not properly designated MERS as a nominee with power to foreclose on the lender’s behalf, because the lender didn’t sign the mortgage. The judge held:

[I]n consideration for Mr. Bucci receiving $249,900, the Buccis granted a mortgage to MERS. If Lehman had not approved of MERS acting as its nominee, Lehman would not have disbursed the loan proceeds to the Buccis.This is only a trial court decision, but I don’t see anything glaringly wrong with it. It’s pretty typical of the large number of decisions finding that MERS can indeed foreclose on mortgages if it has the paperwork more or less in order. The lawyer representing the homeowners obviously disagrees. He says he has devoted his entire legal practice to challenging MERS, and he has appealed the Bucci decision.

Jackson v. MERS

This is a decision from the Minnesota Supreme Court. Several homeowners facing foreclosure banded together to bring a lawsuit arguing that MERS had not properly recorded its loan assignments under Minnesota law. The case was removed to federal court, but because this precise issue had not been decided by Minnesota state courts, the federal court punted the issue to the Minnesota Supreme Court. The Minnesota Supreme Court accepted the following question:

Where an entity, such as defendant [MERS], serves as mortgagee of record as nominee for a lender and that lender’s successors and assigns and there has been no assignment of the mortgage itself, is an assignment of the ownership of the underlying indebtedness for which the mortgage serves as security an assignment that must be recorded prior to the commencement of a mortgage foreclosure by advertisement under Minn. Stat. ch. 580?The court ultimately decided that the MERS process did not violate the recording requirements of Minnesota’s non-judicial foreclosure statute. The court only considered an idealized version of what is supposed to happen with MERS assignments, so this decision does not tell us what happens when the note is missing or the final assignment back to MERS is not properly completed. The court also considered a number of policy arguments raised by the homeowners, but in the absence of any compelling individual facts, the Court decided that the general policy concerns were not enough to change the outcome. One justice dissented, saying that every assignment of the loan should be recorded before MERS can foreclose.

The decision includes several points of interest. First, the Minnesota legislature passed a statute in 2004 that was specifically intended to allow a “nominee or agent” like MERS to record documents on behalf of lenders. The MERS recording statute did not directly control the requirements of the foreclosure statute, but the majority of the justices seemed to think it was important that the legislature had approved the MERS system.

Second, the decision was substantially based on the notion that MERS retained legal title and the right to foreclose the mortgage, even though the beneficial interest in the mortgage had been assigned when the note was assigned. This analysis pretty clearly requires a trust relationship between MERS and the lender (See Jackson Decision at 25). My strong impression (as an outsider) is that MERS is not set up to fulfill the fiduciary duties of a trustee, and has done everything in its power to avoid taking on fiduciary duties to lenders, borrowers or anyone else. This means the Jackson case, and others like it, may turn out to be something of a Pyrrhic victory for MERS once the litigation among the lenders and securitizers really gets going. This could be one more factor weighing against restarting Wall Street’s liar-loan securitization machine.

Finally, the homeowners argued that allowing MERS to cover up the chain of title was generally bad policy, and would prevent borrowers from seeking rescission or other remedies based on misrepresentation claims or federal truth in lending laws. The court declined to address these general policy concerns because that is the legislature’s job.

So what does it take for a homeowner to win a foreclosure case?

To win in the short run, the homeowner needs to show something wrong with the paperwork – an incomplete or untimely chain of assignments, a lost note, or a violation of whatever peculiar requirements may exist under the local foreclosure law. In order to win in the long run, the homeowner probably needs to be able to show some type of harm beyond the foreclosure itself. Bankruptcy cases are a little different, but in foreclosure cases the vast majority of judges simply aren’t going to start canceling mortgage debt without a very good reason. Here are some potential issues a homeowner might be able to raise to stop or seriously slow down a foreclosure:

Loss of claims and defenses. The Jackson court recognized that some homeowners might not be able to raise predatory lending claims and defenses because the person foreclosing on the loan was not the same person who made the loan. This is frequently true regardless of whether MERS is involved. Maybe in a future post we can talk about how lenders and securitizers deliberately use assignments to insulate themselves from liability for predatory lending claims. For now it is enough to note that a homeowner who was the victim of predatory lending will probably need to get a lawyer in order raise these issues during the foreclosure process. In fact, the foreclosure process does not necessarily give the borrower a chance to raise any claims or defenses at all. Notice that in both of the cases discussed today, the foreclosures were non-judicial and the homeowners had to file their own lawsuits in order to get a hearing on their claims. In addition, there may be numerous parties involved in the origination and handling of the loan, and the homeowner will need to use the local court rules to discover who those people were and what they have to say. But if a homeowner has plausible claims about predatory lending, a decent lawyer should be able to find a way to get those claims in front of a judge.

Loss of opportunity to negotiate. I don’t believe I’ve seen any cases on this specific issue yet, but if a homeowner can show that a non-responsive lender prevented the homeowner from getting a loan modification or from qualifying for an assistance program, that might be a good reason for a judge to stop the foreclosure proceeding. The judge might at least require the lender to disclose who can approve the modification before proceeding with the foreclosure. The judge may also have power to require the parties to negotiate in good faith in front of a mediator or another judge.

Double recovery. If there is a realistic chance the wrong person is getting the money from the foreclosure, a judge may stop the process until the right person is identified. If the investors were paid off by AIG through a credit default swap, for example, it may be an open question whether the pool trustee is entitled to foreclose on the mortgage. If legitimate questions along these lines can be raised, the case could get very complicated and go on for a very long time.

Fair Debt Collection Practices. Christopher Peterson, a law professor at the University of Utah, has raised the interesting issue of whether MERS should be treated as a debt collector under federal law. The Fair Debt Collection Practices Act imposes a number of limitations on debt collection activities, and Professor Peterson argues that some of MERS’ methods are just the sort of deceptive practices that ought to be regulated under the Act. This might not be a defense against foreclosure, but it might improve the homeowner’s negotiating leverage quite a bit. A draft article by Professor Peterson is available here. The article contains a great deal of information, but it is a rough draft and contains some typos and incomplete footnote references.

CR Note: This is a guest post from albrt.

First American CoreLogic Economist: Decline in Distressed Inventory a "Mirage"

by Calculated Risk on 11/08/2009 09:16:00 AM

Matt Padilla has an interesting chart on REOs and delinquent loans in Orange County, California: Banks hold few foreclosures.

The chart shows the number of REOs (bank owned real estate) has dropped sharply while 90+ day delinquencies continue to increase. Although this chart is for Orange County, we are seeing the same dynamics in many areas across the county (declining REOs, rising delinquency rates).

Sam Khater, senior economist with First American CoreLogic gave Matt his view of why this is happening:

The reason REOs have declined is that flow of distressed properties into REO has been artificially restricted due to local, state and GSE foreclosure moratoria, loan modifications and servicer backlogs. This has led to a drop in the supply of REO properties, while at the same time sales (including REO sales) increased due to the artificially low rates and first-time homebuyer tax credits, which further depleted the supply of REOs. This dynamic has led to the rapid improvement in home prices over the last six to eight months.We have to be careful with the 90+ day delinquency data because that includes loans in the trial modification process. If many of these trial modifications are successful - and become permanent - the delinquency rate could drop sharply without a large increase in foreclosures. We should know much more in Q1 when many of the trial modifications end.

However, the mortgage distress is high and rising as is evident by the 90+ day category, which means the pending supply is building up due to high levels of negative equity and rising unemployment. So we have a situation where at the back end (ie REOs) it appears as if it’s getting better, but it’s really a mirage as we know that the pending supply pipeline default (ie 90+ day DQs) is looming larger.

emphasis added

Tuesday, October 20, 2009

DataQuick: California Mortgage Defaults Trend Down in Q3

by Calculated Risk on 10/20/2009 01:30:00 PM

There is a lot of interesting data in the DataQuick report. A few key points:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Notices of Default (NOD) by year through 20091 in California from DataQuick.

1 2009 estimated as total NODs to date, plus Q3 NODs (as estimate for Q4).

Clearly 2009 is on pace to break the record of 2008. I'd expect something close to 500 thousand NODs for the entire year.

From DataQuick: California Mortgage Defaults Trend Down Again

The number of mortgage default notices filed against California homeowners fell last quarter compared with the prior three-month period, the result of lenders' evolving foreclosure policies, an uncertain legislative environment and an uptick in the number of mortgages being renegotiated, a real estate information service reported.

A total of 111,689 default notices were sent out during the July-through-September period. That was down 10.3 percent from 124,562 for the prior quarter, and up 18.5 percent from 94,240 in third quarter 2008, according to San Diego-based MDA DataQuick.

The number of recorded default notices peaked in the first quarter of this year at 135,431, although that number was inflated by deferred activity from the prior four months.

"It may well be that lenders have intentionally slowed down the pace of formal foreclosure proceedings. If so, it's not out of the goodness of their hearts. It's because they've concluded that flooding the market with cheap foreclosures in this economic environment may not be in their best financial interest. Trying to keep motivated, employed homeowners in their homes might be the most cost-efficient way to stem losses," said John Walsh, DataQuick president.

...

While most foreclosure activity was still concentrated in affordable inland communities, the foreclosure problem continued to slowly migrate into more expensive areas. The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 52.2 percent of all default activity a year ago. In third-quarter 2009 it fell to 42.9 percent.

...

Although 111,689 default notices were filed last quarter, they involved 108,372 homes because some borrowers were in default on multiple loans (e.g. a primary mortgage and a line of credit). Multiple default recordings on the same home are trending down, DataQuick reported.

...

Trustees Deeds recorded, or the actual loss of a home to foreclosure, totaled 50,013 during the third quarter. That was up 9.5 percent from 45,667 for the prior quarter, and down 37.1 percent from 79,511 for third-quarter 2008, which was the all-time peak.

In the last real estate cycle, Trustees Deeds peaked at 15,418 in third-quarter 1996. The state's all-time low was 637 in the second quarter of 2005, MDA DataQuick reported.

emphasis added

Sunday, October 18, 2009

U.S. Bank v. Ibanez: More fun with foreclosures

by Calculated Risk on 10/18/2009 04:34:00 PM

CR Note: This is a guest post from albrt.

Another interesting foreclosure decision came down this week – U.S. Bank v. Ibanez by Massachusetts Land Court Judge Keith Long. The case is about securitized subprime mortgages that were foreclosed in mid 2007. The originating banks had assigned the notes and mortgages “in blank,” and the documents were then given to a custodian who kept them safely filed away while the securitization machine went to work. The mortgages were assigned to pools, and the pool trustees eventually sought to foreclose on these particular mortgages.

The pool trustees used a non-judicial process called a “power of sale.” In states that allow non-judicial foreclosures, banks can legally take back a house and sell it with little or no oversight if they follow the steps of the statute carefully. The Massachusetts statute required the banks to give notice of who held the mortgage. The pool trustees in Ibanez named the wrong party on the notices because they had not updated the assignment stamps on the documents at the time they advertised the sale.

The pool trustees were not able to get title insurance for the properties after the sales, so they filed complaints with the land court asking to have their titles validated. Judge Long held that the foreclosure sales were void. The pool trustees asked the court to reconsider, and filed a lot of paperwork explaining the securitization process. Judge Long held that the foreclosure sales were still void, and also made some interesting comments along the way about the representations in the securitization documents.

Ibanez is a trial court decision, but it is apparently expected to have significant influence in Massachusetts because of the special nature of the court. The Massachusetts Land Court has the job of examining titles and conclusively certifying who owns land. This is different from most states, where private parties record title documents with a local official, but the local official usually has very limited power to decide whether the document is any good. In most states, courts will look at the records and quiet title as between the parties who are in court, but the courts will not necessarily preclude another party from coming in later and challenging the title on a different basis. I don’t practice in Massachusetts, but I would expect that because the Massachusetts Land Court is specialized and its judgments are conclusive, the judges probably try not to differ too much in their interpretation of the law. I would expect the basic points of Judge Long’s decision in Ibanez to be followed by other land court judges unless the case is overturned on appeal.

Please note that Judge Long invalidated the foreclosures, not the mortgages. In all likelihood, the holders of the mortgages will be able to go back and foreclose eventually, but they will spend some additional time and money doing it. This gentleman has been following the case and has provided some local commentary, and has also graciously posted a copy of the Ibanez decision .

There were a few points in the case that I thought were worth discussing further:

Non-judicial foreclosure. The foreclosure in this case was done using an abbreviated process without much oversight from a judge. The Massachusetts statute on powers of sale allows the bank to enter the property, publish notices, and then sell the property on a specified date at least thirty days later. If the bank is not able to use the accelerated process, it takes three years for the bank to get clear title in Massachusetts. Any time during the three year period the former borrower has a right of redemption, which means the borrower can come back, pay the bank whatever is due on the mortgage, and get the property back.

More than half the states have accelerated foreclosure processes that have little or no involvement by the court, including states that allow “deeds of trust” instead of mortgages. Banks generally like non-judicial foreclosures because they are faster and cheaper. But if the bank screws up a non-judicial foreclosure, the sale may be invalid and the bank may be liable for problems caused by the invalid sale. Many states allow either judicial or non-judicial foreclosures. If there is something wrong with the transaction, for example questionable assignments as in the Ibanez case, the bank may want to consider a judicial foreclosure. If there is a judge handling the case, the judge will usually have the power to consider evidence and decide whether the foreclosing bank really is the owner of the mortgage. Once the judge decides who owns the mortgage, the foreclosure should be able to go forward. Situations where the mortgage completely disappears and the borrower gets to keep the house without paying should be rare.

On the other hand, this gentleman has an interesting if somewhat speculative point:

The true holder of the Note was insured by AIG so they are covered. AIG and the banks were bailed out by taxpayers. So, unless the American tax payer can produce a “blue-ink” original Note, no one has standing to foreclose.The process of figuring out whether an insurance company should be able to collect from somebody else after the insurance company pays a claim is called “subrogation.” When the word subrogation appears in a legal pleading, well, let’s just say it tends to complicate the case a little bit. It seems to me this gives the average borrower something to talk about when explaining to a judge why he or she wants to see the original note. I have not seen a case where a borrower could show that the holder of the note had been bailed out by AIG or the taxpayers, but it must have happened. In fact, I would say it seems to have happened a lot.

Representations and warranties. Judge Long mentioned several times that he was shocked to discover the security offering documents represented to investors that the mortgages had been validly assigned, when in fact the mortgages had not been validly assigned. There is a lot of law here, but Judge Long’s discussion is pretty clear on most points so I won’t try to rehash it. This certainly gives us something to think about when we are wondering why the Fed and the Treasury and all the other wholly-owned subsidiaries of Goldman Sachs are so motivated to overpay for mortgage securities. If the government ends up buying all the bonds at some large fraction of face value, then the government is probably the only party that can sue the securitizers for making misrepresentations like this.

MERS. This case also demonstrates that recorded title documents can get plenty screwed up without any help from a third party like MERS. As Tanta explained, banks have been using third-party custodians to hold original documents for a long time, and the proper assignments didn’t always get made in a timely fashion. In fact, Judge Long seemed to suggest in two footnotes that the banks would have had an easier time in this case if they had used MERS.

Title Insurance. The Ibanez banks brought these cases because they couldn’t get title insurance. For anyone who wants to avoid complications like this, title insurance is the key. Title insurance doesn’t guarantee that you’ll never have any problems – like any insurance company, sometimes title insurers will deny claims and leave you hanging. But for the most part it is the title insurer’s job to figure out if there are problems with your title, and then provide insurance to cover your legal expenses and your losses if any problems come up. The way you get title insurance is different in different states, but the policies are generally standardized in something called “ALTA” format. ALTA stands for “American Land Title Association.”

If you want to buy a house from a bank and the title insurance company thinks the foreclosure sale was no good, the title company most likely won’t insure the title at all. You should not buy a property that a title company won’t insure unless you can afford a good lawyer and are looking for adventure.

It is also possible that the title company will insure the title subject to “Exceptions.” When you get a title policy commitment before the sale, Schedule A will show your proposed coverage, Schedule B will show the Exceptions, and there will also be a list of “Requirements” that need to be completed before the title company will actually issue the policy. Requirements that aren’t completed before closing will generally migrate over to the Exceptions page.

It is very important to understand the Exceptions in you title policy. Sometimes, after careful consideration, you can decide to disregard the Exceptions. For example, my title policy has an Exception for water rights. I live in the city and have city water, so I am not going to spend a lot of time worrying about whether I have a right to drill a well. Maybe I will regret my decision in the Hard Times ahead, but basic plumbing is not one of the technologies I expect to disappear in the Hard Times, so I’m willing to take my chances. The title company also made an Exception for the racial covenants that were placed on my neighborhood in the 1920s. The U.S. Supreme Court has decided those are clearly not enforceable, and the title company doesn’t want to pay for anyone to try to relitigate either side of that question.

If a title company were trying to offer you a policy without covering a bad foreclosure, the exception might look something like this:

Any loss, claim or damage by virtue of the failure of the public records to disclose an assignment of interest from the instrument recorded in Book 107 of Deeds, page 49 to the instrument recorded in Book 109 of Deeds, page 377.This is hard to understand out of context because it is basically a big nominal phrase without a real subject or a verb or an object. The subject and the verb and the object are “We will not provide coverage for __________.” If there are any Exceptions in your title policy that you don’t completely understand, you should probably consult a lawyer.

There is plenty more to talk about, but this is already almost as long as the MERS post, so I’ll stop here. Ibanez appeared several times in the comments this week, but CR was the first person I heard about it from so no hat tips, except to Tanta for having all this figured out a few years ago.

CR Note: This is a guest post from albrt.

Thursday, October 15, 2009

RealtyTrac: Foreclosure Activity Increases in Q3

by Calculated Risk on 10/15/2009 09:20:00 AM

From RealtyTrac: U.S. Foreclosure Activity Increases 5 Percent in Q3

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for Q3 2009, which shows that foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 937,840 properties in the third quarter, a 5 percent increase from the previous quarter and an increase of nearly 23 percent from Q3 2008. One in every 136 U.S. housing units received a foreclosure filing during the quarter — the highest quarterly foreclosure rate since RealtyTrac began issuing its report in the first quarter of 2005.

Foreclosure filings were reported on 343,638 properties in September, a 4 percent decrease from the previous month but a 29 percent increase from September 2008. Despite the monthly decrease, September’s total was still the third highest monthly total since the RealtyTrac report began in January 2005, behind only July and August of this year.

“Bank repossessions, or REOs, jumped 21 percent from the second quarter to the third quarter, corresponding to jumps in defaults and scheduled auctions in the previous two quarters,” said James J. Saccacio, chief executive officer of RealtyTrac. “REO activity increased from the previous quarter in all but two states and the District of Columbia, indicating that lenders may be starting to work through some of the pent-up foreclosure inventory caused by legislative delays, loan modification efforts and high volumes of distressed properties.”

Wednesday, October 14, 2009

Amherst: Few HAMP Modifications to be Successful

by Calculated Risk on 10/14/2009 09:54:00 PM

From Austin Kilgore at Housing Wire: Chances Are, Most HAMP Mods Won’t Work: Amherst

The Making Home Affordable Modification Program (HAMP) adds another layer of uncertainty for private label securitization investors, making it more difficult to predict cash flows, according to a report by analysts at Amherst Securities Group, who added they expect relatively few HAMP workouts to be successful.A few comments:

Additionally, it’s taking longer for bad mortgages to move from last payment to liquidation, and the pace varies by servicer: “The trial modification period essentially holds the loan in a suspended state for 90 days, making it difficult to assess what is happening with modifications,” the report said ...

While HAMP workouts are keeping the pools of real estate owned (REO) property relatively small, Amherst predicts a low percentage of eventual success of HAMP modifications is inevitable.

emphasis added

Treasury and COP note that many of those temporary modifications may be in process of getting paperwork submitted in order for them to achieve permanent status. Treasury granted a two-month extension -- on top of the three-month trial -- for borrowers and servicers to get their documentation ready.

We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman.

Monday, October 12, 2009

Distressed Sales: Sacramento as Example

by Calculated Risk on 10/12/2009 10:12:00 AM

Note: The Sacramento Association of REALTORS® is now breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales). I'm following this series (as an example) to see changes in the mix.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

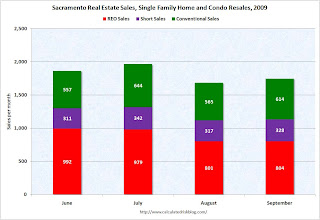

Here is the September data.

They started breaking out REO sales last year, but this is only the fourth monthly report with short sales. About 63 percent of all resales (single family homes and condos) were distressed sales in September. The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

The second graph shows the mix for the last four months. Conventional and short sales have held steady, but foreclosure resales were lower in August and September. There are many reports of more foreclosures coming, and the number of foreclosure resales should pick up later this year.

Total sales in September were off 18% compared to September 2008; the fourth month in a row with declining YoY sales.

On financing, over half the sales were either all cash (25.2%) or FHA loans (27.6%), suggesting most of the activity in distressed bubble areas like Sacramento is first-time home buyers using government-insured FHA loans (and taking advantage of the tax credits), and investors paying cash.

Tuesday, September 22, 2009

WSJ: Delayed Foreclosures and "Shadow" Inventory

by Calculated Risk on 9/22/2009 09:43:00 PM

From Ruth Simon and James Hagerty at the WSJ: Delayed Foreclosures Stalk Market

... Legal snarls, bureaucracy and well-meaning efforts to keep families in their homes are slowing the flow of properties headed toward foreclosure sales, even when borrowers are in deep distress. ... some analysts believe the delays are ... creating a growing "shadow" inventory of pent-up supply that will eventually hit the market.The foreclosures are coming. How many and when is the question. But based on the comments from the BofA spokeswoman, it sounds like foreclosures will "spike" in Q4.

...

Ivy Zelman ... believes three million to four million foreclosed homes will be put up for sale in the next few years. The question is whether the flow of these homes onto the market will resemble "a fire hose or a garden hose or a drip," she says.

... "We are going to see a spike from now to the end of the year in foreclosures as we take people out of the running" for a loan modification or other alternatives, says a Bank of America Corp. spokeswoman. Foreclosure sales had dropped to "abnormally low" levels in response to government efforts to stem foreclosures, she adds.

Monday, September 07, 2009

One Family: Option ARM, failed Modification, Health Issues, Bankruptcy, and more

by Calculated Risk on 9/07/2009 05:50:00 PM

This story has it all: negative equity, Option ARM, health problems, a modification horror story and more - all with one family in Orange County.

From the O.C. Register: Family faces loss of home amid health crisis

... the Kempffs' option adjustable-rate mortgage payment skyrocketed to $4,300 a month from $2,500 last December. Seeing no way to afford the new payments, the Kempffs opted for a loan modification from their bank, IndyMac which was later purchased by OneWest from the FDIC in March.I'm curious about the timing in the article. IndyMac was seized by the FDIC on July 11, 2008, and was then run by the FDIC until March of 2009. Did this happen when IndyMac was being used by the FDIC to demonstrate how to modify loans? Tanta correctly predicted that the FDIC would discover that modifying loans was not easy, see: IndyMac-FDIC Mortgage Modification Plan: Still in the Real World

...

The Kempffs said they were told by an IndyMac representative on the phone that they had to miss three payments before a deal could be worked out. ... For a family that had never missed payments in 14 years of being homeowners, purposely skipping payments was hard for the Kempffs, but they consented.

I wrote a snotty post at the end of August after Sheila Bair's plan for "affordability modifications" of the former IndyMac loans was announced, the burden ofBack to the article:snotwisdom of which was my prediction that Bair was going to discover that it's a lot harder than she thinks to get successful mortgage modifications done on a wide scale in a very short period of time. However, I did express the hope that the Bair plan would prove remarkably successful and indicated my willingness to eat my words should it prove necessary.

Looks like I'll have to stick to my usual dry toast and bananas after all.

A OneWest Bank spokesperson said the Kempffs didn't qualify for a loan modification because the amount they owed on their first mortgage was more than $729,750.A sympathetic borrower - a professor at the University of California, Irvine with a serious health issue - negative equity, using the home as an ATM, an Option ARM, a personal bankruptcy, miscommunication with the lender on a modification (apparently while the FDIC was running IndyMac) - and a home in the upper middle price range. This story has it all.

The unpaid amount on the Kempffs' loan is $786,802.59, short of qualifying for a modification by about $60,000.

Since the Kempffs purchased their home in 2002, they took out loans and refinanced their mortgage. The equity from those transactions enabled the Kempff family to fix their cracked pool, remedy a slipping backyard slope by putting in three retaining walls, help three children pay for college and pay for the medical bills of their youngest son who had malignant melanoma.

...

Juergen Kempff, 65, has battled leukemia and lymphoma for a decade, on and off. His bone marrow has been debilitated from his treatments, and his oncologist has given him about six months to live.

...

Desperate to stall the foreclosure process, the Kempffs declared bankruptcy.

Monday, August 31, 2009

CNBC: What Banks are doing with Foreclosures

by Calculated Risk on 8/31/2009 05:01:00 PM

Diana Olick at CNBC has some BofA info: What Banks Are Really Doing With Foreclosures

Bank of America:According to BofA, they are not sitting on REOs (Real Estate Owned) for longer than normal, but they are holding off foreclosing - pending modification attempts. That is basically what the data says too.Foreclosure sales have been abnormally low since we learned of the pending implementation of the administration’s Making Home Affordable program. From that point, we delayed the initiation of foreclosure proceedings and sales for customers that may eligible for a loan modification under MHA. As a result of this policy, our foreclosure sales in recent months have been as little as half the normal pace we experienced before.

...Now that Making Home Affordable programs are operational, we do project an increase in foreclosures as we exhaust every available option to qualify customers for modifications and other solutions.

...We do not hold foreclosed properties off the market.

The Q2 FDIC Quarterly Banking Profile showed the banks held $11.5 billion in 1-4 family residential REO at the end of Q2. That is the same level as the last several quarters.

But what has really changed is the surge in delinquencies - combined with the banks holding off foreclosing. As BofA notes, this will lead to a wave of foreclosures later this year and into 2010, however the size of the wave depends on the success of the modification programs (not looking great so far).

Thursday, August 20, 2009

U.S. Mortgage Market and Seriously Delinquent Loans by Type

by Calculated Risk on 8/20/2009 04:12:00 PM

A little more information from the MBA Q2 delinquency report (and market graph below): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the U.S. mortgage market by type. There are about 45 million loans included in the MBA survey, and that is about 85% of the U.S. market.

This is a general breakdown, and apparently Alt-A is included in Prime (it would be helpful to break that out). The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

The second graph shows the breakdown by type for loans that are either seriously delinquent (90+ days delinquent) or in the foreclosure process. There are about 3.6 million loans in this category.

Clearly subprime is disproportionately represented (much higher delinquency rate), but now over half the loans in this category are Prime - and the delinquency rate is growing faster for Prime. This is now a Prime foreclosure crisis.

For more, please see earlier posts:

MBA Forecasts Foreclosures to Peak at End of 2010 (several graphs)

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2 Instead of comparing the markets from the peak (See: the Four Bad Bears), Doug Short matched up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

MBA Forecasts Foreclosures to Peak at End of 2010

by Calculated Risk on 8/20/2009 11:21:00 AM

On the MBA conference call concerning the "Q2 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

Note: The MBA data shows about 5.8 million loans delinquent or in the foreclosure process nationwide. I believe the MBA surveys covers close to 90% of the mortgage market. Many of these loans will cure, but the foreclosure pipeline is still building.

A few graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for all 78% of all loans.

"We're all subprime now!" NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about 65.5% of all loans).

The second graph shows just fixed rate prime loans (about 65.5% of all loans).Prime ARMs have a higher delinquency rate than Prime FRMs, but the foreclosure crisis has now spread to Prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the increases have slowed, about 40% of subprime loans are delinquent or in foreclosure.

The fourth graph shows the delinquency and foreclosure rates by state (add: and D.C. and Puerto Rico!).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).

The 'in foreclosure' rate can vary widely by state, because the process is fairly quick in some states, and very slow in other states (like Florida).Although most of the delinquencies are in a few states - because of a combination of high delinquency rates and large populations - the crisis is widespread.

And a final comment: historically house prices do not bottom until after foreclosure activity peaks in a certain area. Since the subprime crisis delinquency rates might be peaking, it would not be surprising if prices are near a bottom in the low end areas. But in general I'd expect further declines in house prices - especially in mid-to-high end areas.

MBA: Record 13.2 Percent of Mortgage Loans in Foreclosure or Delinquent in Q2

by Calculated Risk on 8/20/2009 10:08:00 AM

From the Mortgage Bankers Association (MBA): Delinquencies Continue to Climb, Foreclosures Flat in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 9.24 percent of all loans outstanding as of the end of the second quarter of 2009, up 12 basis points from the first quarter of 2009, and up 283 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.We're all subprime now!

...

The delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 4.30 percent, an increase of 45 basis points from the first quarter of 2009 and 155 basis points from one year ago. The combined percentage of loans in foreclosure and at least one payment past due was 13.16 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

...

“While the rate of new foreclosures started was essentially unchanged from last quarter’s record high, there was a major drop in foreclosures on subprime ARM loans. The drop, however, was offset by increases in the foreclosure rates on the other types of loans, with prime fixed-rate loans having the biggest increase. As a sign that mortgage performance is once again being driven by unemployment, prime fixed-rate loans now account for one in three foreclosure starts. A year ago they accounted for one in five....” said Jay Brinkmann, MBA’s Chief Economist.

emphasis added

More to come ...

Sunday, August 16, 2009

Judge: WaMu's actions in Pushing for Foreclosure suggest "Bad Faith"

by Calculated Risk on 8/16/2009 03:54:00 PM

Jim Dwyer at the NY Times brings us the tale of WaMu pushing for foreclosure, even though the owner of the small multi-tenant building kept trying to pay in full after missing two payments in May and June 2008: Banks Help Small Debt Become a Big One (ht Edward)

Here is the order vacating the default from Judge Emily Jane Goodman:

"The facts in this case, in their simplicity, illustrate the state or property foreclosures in New York and the economic relationship and their borrowers, as well as the surrounding ironies."An interesting read.

WaMu actually had a strong incentive to push for foreclosure or payment in full (the entire amount of the note) or even to delay the proceedings. In the July 2008 Summons and Complaint, WaMu's attorney wrote:

As of the date hereof, (unless a different date is indicated) there is due the plaintiff upon said Note and Mortgage the following:So the note required 11.6% interest once the loan went into default (5% above the original rate). Since the building was worth more than the amount owed, by pushing for foreclosure, WaMu could collect this higher interest rate, legal fees, and other fees.

Principal balance : $460,283.26

Interest rate : 6.60%

Interest due from : April 1, 2008

Default interest : 11.60%

Default Interest due from : May 16, 2008

Late charges due as of : $150.09

May 1, 2008

Obligor shall also pay any prepayment, recapture and other fees as

set forth in the Note.

Since the default is vacated, the interest rate on late payments goes back to 6.6%, and I hope the Judge rules for WaMu's successor to pay the borrower's legal fees (usually a separate motion) - especially since she suggested WaMu had acted in bad faith.

A couple of excerpts from the Order:

"Even if the bank had no duty to alert defendant to the possible litigation, and even if their service methods are permissible, they clearly elected not to affect the most reliable available service - personal service - suggesting bad faith by Washington Mutual, especially when taken with their refusal to accept payment after only two months of lateness, as well as their decision to accelerate the entire loan."And from the footnotes:

The Court admonishes the Bank's counsel for submitting papers, referring to the oppositions papers of Owner's principal, a lawyer, as containing "fraud and deceit" and that his seeking to vacate the default and protect his property as "frivolous". These charges are not only disrespectful to another member of the bar, it is not supported by his or her papers.

Thursday, August 13, 2009

Illinois Foreclosures: Increasing Again, Impacting 'more-affluent areas'

by Calculated Risk on 8/13/2009 08:50:00 PM

In early April, a Homeowner Protection Act was signed into law in Illinois that delayed foreclosures for a short period. Foreclosure filings plummeted for a couple of months, but filings are now increasing again.

From the Chicago Tribune: Foreclosure actions delayed in spring move into system in summer

Initial notices of default, the first legal step in the foreclosure process, dropped substantially in the six-county Chicago area during the past three months, largely because of a 70 percent drop in filings over a 30-day period begun in early April, according to a midyear report from Chicago-based think tank Woodstock Institute. However, foreclosure efforts appear to again be on the rise.The low end areas will always have the most foreclosures, but foreclosure activity is picking up in the mid-to-high end areas. But where will the buyers come from in the mid-to-high end areas?

In April, default notices were recorded on 5,539 homes in the Chicago area. After plummeting to 1,694 notices in May, default filings rose to 3,468 in June, Woodstock found.

...

Woodstock's data also shows that lower-income areas continue to have a higher raw number of foreclosures, but more-affluent areas are posting the bigger percentage gains in foreclosure activity. ...

Last month [according to RealtyTrac], 14,524 Illinois properties, 35 percent more than in June, received notices of initial default, sheriff sale and bank repossessions. During July, 6,770 Illinois homeowners were served with initial notices of default. That compares with 3,648 default notices in June, 3,139 notices in May and 6,407 notices in April. Bank repossessions, which increase the number of foreclosed homes for sale, also jumped. Lenders repossessed 3,700 Illinois homes last month.

First time buyers in affluent areas? I don't think so.

Investors looking for cash flow? The number don't work.

Move-up buyers selling their homes? A large number of sellers at the low-to-mid end are lenders ...

Report: Record Foreclosure Activity in July

by Calculated Risk on 8/13/2009 10:09:00 AM

RealtyTrac ... today released its July 2009 U.S. Foreclosure Market Report™, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 360,149 U.S. properties during the month, an increase of nearly 7 percent from the previous month and an increase of 32 percent from July 2008. The report also shows that one in every 355 U.S. housing units received a foreclosure filing in July.Something to remember: questions have been raised before about the RealtyTrac numbers (see Foreclosure numbers don’t add up), and RealtyTrac has only been tracking these numbers since 2005. For California, I use the DataQuick numbers for NOD activity (released quarterly), and available since the early '90s - but that is just one state.

“July marks the third time in the last five months where we’ve seen a new record set for foreclosure activity,” noted James J. Saccacio, chief executive officer of RealtyTrac. “Despite continued efforts by the federal government and state governments to patch together a safety net for distressed homeowners, we’re seeing significant growth in both the initial notices of default and in the bank repossessions.”