by Calculated Risk on 9/09/2009 09:04:00 AM

Wednesday, September 09, 2009

Bankruptcies: Movin' on Up!

From Bloomberg: Wealthy Families Succumb to Bankruptcy as Real Estate Crashes

Wealthy individuals’ Chapter 11 bankruptcy filings jumped 73 percent in the second quarter from a year earlier, according to the National Bankruptcy Research Center, a research firm in Burlingame, California.Overall personal bankruptcies were up 36% in Q2 2009 compared to Q2 2008 - so high end bankruptcies are increasing twice as fast as the average.

More individuals or families with at least $1,010,650 in secured debt and $336,900 unsecured are using Chapter 11 of the U.S. bankruptcy code typically associated with business reorganizations. Falling U.S. home prices leave them unable to refinance or sell properties when they drop below the value of the mortgage, said Chicago bankruptcy attorney Joseph Baldi.

... Wealthier people filing for bankruptcy typically have large homes, two car payments and children in private schools, said Leslie Linfield, executive director of the Institute for Financial Literacy in Portland, Maine ...

“There are a lot of people with real estate, and they can’t afford it,” said Baldi ... “They can’t make the payments, and they can’t sell the house.”

emphasis added

This fits with the articles yesterday on Option ARMs and Interest Only loans that were used predominantly in mid-to-high end areas.

Monday, September 07, 2009

One Family: Option ARM, failed Modification, Health Issues, Bankruptcy, and more

by Calculated Risk on 9/07/2009 05:50:00 PM

This story has it all: negative equity, Option ARM, health problems, a modification horror story and more - all with one family in Orange County.

From the O.C. Register: Family faces loss of home amid health crisis

... the Kempffs' option adjustable-rate mortgage payment skyrocketed to $4,300 a month from $2,500 last December. Seeing no way to afford the new payments, the Kempffs opted for a loan modification from their bank, IndyMac which was later purchased by OneWest from the FDIC in March.I'm curious about the timing in the article. IndyMac was seized by the FDIC on July 11, 2008, and was then run by the FDIC until March of 2009. Did this happen when IndyMac was being used by the FDIC to demonstrate how to modify loans? Tanta correctly predicted that the FDIC would discover that modifying loans was not easy, see: IndyMac-FDIC Mortgage Modification Plan: Still in the Real World

...

The Kempffs said they were told by an IndyMac representative on the phone that they had to miss three payments before a deal could be worked out. ... For a family that had never missed payments in 14 years of being homeowners, purposely skipping payments was hard for the Kempffs, but they consented.

I wrote a snotty post at the end of August after Sheila Bair's plan for "affordability modifications" of the former IndyMac loans was announced, the burden ofBack to the article:snotwisdom of which was my prediction that Bair was going to discover that it's a lot harder than she thinks to get successful mortgage modifications done on a wide scale in a very short period of time. However, I did express the hope that the Bair plan would prove remarkably successful and indicated my willingness to eat my words should it prove necessary.

Looks like I'll have to stick to my usual dry toast and bananas after all.

A OneWest Bank spokesperson said the Kempffs didn't qualify for a loan modification because the amount they owed on their first mortgage was more than $729,750.A sympathetic borrower - a professor at the University of California, Irvine with a serious health issue - negative equity, using the home as an ATM, an Option ARM, a personal bankruptcy, miscommunication with the lender on a modification (apparently while the FDIC was running IndyMac) - and a home in the upper middle price range. This story has it all.

The unpaid amount on the Kempffs' loan is $786,802.59, short of qualifying for a modification by about $60,000.

Since the Kempffs purchased their home in 2002, they took out loans and refinanced their mortgage. The equity from those transactions enabled the Kempff family to fix their cracked pool, remedy a slipping backyard slope by putting in three retaining walls, help three children pay for college and pay for the medical bills of their youngest son who had malignant melanoma.

...

Juergen Kempff, 65, has battled leukemia and lymphoma for a decade, on and off. His bone marrow has been debilitated from his treatments, and his oncologist has given him about six months to live.

...

Desperate to stall the foreclosure process, the Kempffs declared bankruptcy.

Wednesday, September 02, 2009

ABI: Personal Bankruptcy Filings up 24 Percent compared to August 2008

by Calculated Risk on 9/02/2009 11:46:00 AM

From the American Bankruptcy Institute: August Consumer Bankruptcy Filings up 24 Percent over Last Year

The 119,874 consumer bankruptcy filings in August represented a 24 percent increase over last year’s monthly total, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). Although an increase over the previous year, the August 2009 consumer filings represented a 5 percent decrease from the July 2009 total of 126,434. Chapter 13 filings constituted 28.3 percent of all consumer cases in August, unchanged from the July rate.Note that there is some month to month variability, so the decline from July is probably noise.

"Consumers are continuing to turn to bankruptcy as a shield from the sustained financial pressures of today’s economy," said ABI Executive Director Samuel J. Gerdano. "As a result, we expect consumer filings to top 1.4 million this year."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 928 thousand personal bankrutpcy filings through Aug 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

Sunday, August 30, 2009

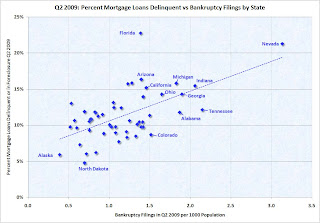

Bankruptcy Filings and Mortgage Delinquencies by State

by Calculated Risk on 8/30/2009 10:47:00 AM

Here is a graph of bankruptcy filings vs. mortgage delinquencies (including homes in foreclosure process) by state for Q2 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The bankruptcy filings data is from the American Bankruptcy Institute.

The mortgage delinquency data is from the Mortgage Bankers Association.

No surprise - there is a clear correlation, although each state has different bankruptcy laws that can impact the relationship (see Florida).

Here is a sortable table to find the data for each state (use scroll bar to see all data).

Tuesday, August 11, 2009

Taylor Bean BK "Imminent"

by Calculated Risk on 8/11/2009 05:23:00 PM

From the WSJ: Bankruptcy Filing Near for Taylor Bean

A bankruptcy filing is "imminent" for Taylor, Bean & Whitaker Mortgage Corp., lawyers representing the mortgage lender said in a federal court filing last week.No surprise.

...

Meanwhile, an internal email at Taylor Bean dated Monday, Aug. 10, referred to a new computer folder "to assemble all of our bankruptcy detailed spreadsheets and support."

Nothing new on Colonial Bank (or Corus Bank, or Guaranty Bank in Texas).

CIT created a little stir this morning with an NT 10-Q SEC filing. This was just a notice of CIT being unable to file on time - because the executives are busy - and that CIT expects to file by August 17th (just happens to be the date of the cash tender offer).

CIT reiterated in the NT 10-Q that:

If the tender offer is successfully completed, the Company intends to use the proceeds of the Credit Facility to complete the tender offer and make payment for the August 17 notes. Further, the Company and a Steering Committee of the bond holder lending group do not intend for the Company to seek relief under the U.S. Bankruptcy Code, but rather will pursue restructuring efforts as part of the comprehensive restructuring plan to enhance the Company’s liquidity and capital position. If the pending tender offer is not successfully completed, and the Company is unable to obtain alternative financing, an event of default under the provisions of the Credit Facility would result and the Company could seek relief under the U.S. Bankruptcy Code.That isn't new.

emphasis added

CIT also reiterated that there are substantial doubts that the company will continue as a going concern.

In addition, as disclosed in the same Current Report on Form 8-K, the Company’s funding strategy and liquidity position have been materially adversely affected by on-going stress in the credit markets, operating losses, credit ratings downgrades, and regulatory and cash restrictions such that there is substantial doubt about the Company’s ability to continue as a going concern.Also nothing new.

Saturday, August 08, 2009

U.K. Record 33 Thousand People Declared Insolvent in Q2

by Calculated Risk on 8/08/2009 11:38:00 AM

From the Independent: Banks take the blame as 33,000 are declared insolvent

More than 33,000 people were declared insolvent during the second quarter of the year, official statistics revealed yesterday, the highest number ever recorded. ...In the U.S., bankruptcy filings are rising sharply too, but are not are record levels because of the change to the bankruptcy law in 2005.

Almost 19,000 people were declared bankrupt during the second quarter of the year ... while a further 12,000 people entered into individual voluntary arrangements, agreements with creditors that fall short of full-scale bankruptcy. ... In addition, 2,000 people signed up to debt relief orders, a new type of insolvency agreement introduced in April for those with relatively small amounts of borrowing.

Insolvency experts warned that the combination of rising unemployment and the lack of stigma attached to options such as IVAs and debt relief orders meant the number of people affected would go on rising.

Mark Sands, director of personal insolvency at Tenon Recovery, predicted 140,000 people would be declared insolvent during 2009, 30 per cent more than in 2006 – the worst year on record so far – when the figure was 107,000.

"The overall record level of personal insolvencies, whilst at first shocking, hides the detail which suggests the worst is yet to come," Mr Sands warned.

For the U.S., see: Personal Bankruptcy Filings up 34.3 Percent compared to July 2008

When it comes to bankruptcy (or insolvency) apparently misery does love company.

Tuesday, August 04, 2009

ABI: Personal Bankruptcy Filings up 34.3 Percent compared to July 2008

by Calculated Risk on 8/04/2009 12:25:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Reach Highest Monthly Total Since 2005 Bankruptcy Law Overhaul

U.S. consumer bankruptcy filings reached 126,434 in July, the highest monthly total since the Bankruptcy Abuse Prevention and Consumer Protection Act was implemented in October 2005, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The July 2009 consumer filing total represented a 34.3 percent increase nationwide from the same period a year ago, and an 8.7 percent increase over the June 2009 consumer filing total of 116,365. Chapter 13 filings constituted 28.3 percent of all consumer cases in July, slightly above the June rate.

"Today's bankruptcy filing number reflects the sustained and growing financial stress on U.S. households," said ABI Executive Director Samuel J. Gerdano. "Rising unemployment on top of high pre-existing debt burdens is a formula for higher bankruptcies through the end of this year."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 802 thousand personal bankrutpcy filings through July 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

Wednesday, July 22, 2009

Report: CIT Advisers Pushing for BK after August Swap

by Calculated Risk on 7/22/2009 07:38:00 PM

Note: Comments working! Thanks Ken!

From Bloomberg: CIT Bond Advisers Said to Push for Bankruptcy After August Swap (ht Bob_in_MA)

Even if CIT succeeds in getting 90 percent of the $1 billion of floating-rate notes due Aug. 17 swapped at a discount, the advisers will seek a so-called pre-packaged bankruptcy ... Should the CIT offer ... fail, Houlihan ... will recommend the steering committee let CIT file for bankruptcy before paying the August maturity ...The "Tony Soprano" debt deal was just a delaying tactic. That appeared clear given the terms. And this is why the deal required the onerous 5% upfront fee - and significant overcollaterization - because it was BK if you do, BK if you don't.

Friday, July 17, 2009

Report: CIT in Talks for DIP Financing

by Calculated Risk on 7/17/2009 03:02:00 PM

From CNBC: CIT Talks Now Include Possible Financing in Bankruptcy

CIT Group's talks with many lenders have transitioned primarily to how the company would receive financing once it files for bankruptcy, CNBC has learned.A bad sign ...

Although talks are continuing on financing outside of bankruptcy, sources said that discussions are also focused on a so-called debtor-in-possession loan, in which CIT would receive money after a bankruptcy filing.

For that reason, a bankruptcy filing is unlikely on Friday, although the situation remains fluid.

Wednesday, July 15, 2009

CIT: Government Support Unlikely

by Calculated Risk on 7/15/2009 06:09:00 PM

Update 2: WSJ is reporting that a Treasury official says that the U.S. expects to lose entire TARP investment in CIT ($2.3 billion). I think that means a BK is certain, probably before the market opens tomorrow.

From MarketWatch:

CIT says government support unlikely near term

CIT says board, management evaluating alternatives

CIT: Appears no likelihood of add't gov't support

CIT: Talks with government agencies have ceased

Bankruptcy is probable.

Update: CIT Press Release:

CIT Group Inc., a leading provider of financing to small businesses and middle market companies, today announced that it has been advised that there is no appreciable likelihood of additional government support being provided over the near term.

The Company’s Board of Directors and management, in consultation with its advisors, are evaluating alternatives.

Friday, July 10, 2009

GM Emerges from Bankruptcy, Press Conferenace at 9 AM ET

by Calculated Risk on 7/10/2009 08:53:00 AM

Here is the press conference at 9 AM ET:

From the NY Times: With Sale of Its Good Assets, G.M. Tries for a Fresh Start

General Motors completed a major step in its turnaround on Friday and closed the sale of its good assets to a new, government-backed carmaker....That was fast!

G.M.’s sale of its desirable assets, including brands like Chevrolet, Cadillac and GMC, to the new company — now named Vehicle Acquisition Company but soon to be renamed the General Motors Company — is meant to shed decades of buckling liabilities. The federal government will hold nearly 61 percent of the new company ...

The new company will be much smaller, with brands like Saturn, Hummer, Opel and Pontiac in the process of being sold or closed.

Thursday, July 09, 2009

Condo Association Files Bankruptcy

by Calculated Risk on 7/09/2009 04:25:00 PM

This might be the start of a number of condo / homeowner associations filing bankruptcy because of the housing bust ...

From the Daily Business Review: Bankruptcy: $1 million debt sends condo association into Chapter 11 (ht Soylent Green is People)

Facing almost $1 million in claims by unsecured creditors, a troublesome recreational lease, and at least 100 unit owners delinquent on payments of their fees, the association filed a Chapter 11 petition last month in U.S. Bankruptcy Court in Miami.

As one of the first condo association bankruptcies of the current economic crisis ... With residential foreclosures and personal bankruptcies soaring in South Florida, Maison Grande’s decision is expected to become more commonplace, said attorney Aleida Martinez Molina of Becker & Poliakoff in Coral Gables.

...

The significant drop in property values is a key factor pushing associations toward bankruptcy filings, said attorney Robert Kaye of Kaye & Bender in Fort Lauderdale. ... “In prior times, there was enough equity in all the properties [in an association] so that assets would likely exceed liabilities,” he said. “Now, since a large percentage of associations are upside down, that’s changing their view about bankruptcy. Their debts have overtaken their assets.”

Monday, July 06, 2009

GM Bankruptcy Plan Approved

by Calculated Risk on 7/06/2009 09:03:00 AM

From the NY Times: Court Ruling Clears Path for G.M. to Restructure

A federal judge approved a plan by General Motors late on Sunday to sell its best assets to a new, government-backed company ...The ruling is being appealed.

In his 95-page opinion, Judge Gerber wrote that he agreed with G.M.’s main contention: that the asset sale was needed to preserve its business in the face of steep losses and government financing that is scheduled to run out by the end of the week.

“Bankruptcy courts have the power to authorize sales of assets at a time when there still is value to preserve — to prevent the death of the patient on the operating table,” Judge Gerber wrote.

...

Other groups, including those representing product liability claims and asbestos litigants, ... fought against G.M.’s plan. Under the terms of the sale, most of those claims would remain with the remnants of G.M. in bankruptcy, meaning they were likely to recover little, if anything.

This was quick - GM filed for bankruptcy on June 1st.

Thursday, July 02, 2009

Personal Bankruptcy Filings increase 40% in June (YoY)

by Calculated Risk on 7/02/2009 02:57:00 PM

From Bloomberg: Consumer Bankruptcy Filings Rose 36.5% in First Half, ABI Says (ht Ron)

U.S. consumers made 675,351 bankruptcy filings in the first half, a 36.5 percent increase from a year ago, according to the American Bankruptcy Institute.The monthly rate slowed in June (from May), but monthly ups and downs are not unusual for this data.

June filings by consumers totaled 116,365, up 40.6 percent from the same period in 2008 ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q1 and Q2 2009 based on monthly data from American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

The American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll definitely take the over!

Sunday, June 28, 2009

Boom Time: Personal Bankruptcies in SoCal

by Calculated Risk on 6/28/2009 10:29:00 AM

From the LA Times: Personal bankruptcies surge in Southern California

Going legally broke has made a big comeback -- especially in the Los Angeles area -- despite a mid-decade revision to the U.S. Bankruptcy Code intended to curb filings.Ahhh ... "adventuresome borrowers" ... sounds better than gamblers or speculators.

The number of Southern Californians seeking bankruptcy protection nearly doubled in 2008 from 2007 in the U.S. Bankruptcy Court's seven-county California Central District, by far the biggest increase in the nation.

Bankruptcy is still booming. Personal filings from January through April, the most recent month available, rose 75% in the Central District compared with the year-earlier period.

Bankruptcy experts attribute the growth mainly to the mortgage meltdown, which hit the region's adventuresome borrowers particularly hard.

| Click on cartoon for larger image in new window. Repeat: Cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

Saturday, June 27, 2009

New GM Agrees to Assume Future Product Liability Claims

by Calculated Risk on 6/27/2009 07:58:00 PM

From the WSJ: GM to Take on Future Product-Liability Claims (ht sportsfan, Basel Too)

General Motors Corp ... has agreed to assume legal responsibility for injuries drivers suffer from vehicle defects after the auto maker emerges from bankruptcy protection.This agreement doesn't cover current product liability plaintiffs - this just appears to cover future car-accident victims.

...

Under GM's original bankruptcy plan, the auto maker planned to leave such liabilities behind after selling its "good" assets to a "New GM" owned by the government. That meant future GM car-accident victims who believed faulty manufacturing caused their injuries would be unable to sue the New GM. Instead, they would have been treated as unsecured creditors, fighting over the remains of GM's old bankruptcy estate.

GM's move to take responsibility for future product-liability claims, outlined in a court filing late Friday evening, represents a partial victory for more than a dozen state attorneys general and several consumer advocacy groups.

...

Car-accident victims with pending lawsuits and those who had won damages against GM before it filed for bankruptcy would still be unable to bring claims against the new GM. They would remain with other unsecured creditors making claims against the "old GM." As GM's old estate winds down, those victims are likely to recover little or nothing.

Saturday, June 20, 2009

More GM Bankruptcy

by Calculated Risk on 6/20/2009 12:11:00 AM

During the Chrysler bankruptcy, I excerpted and linked to lawyer Steve Jakubowski's Bankruptcy Litigation Blog. Steve has taken it a step further and stepped into the GM fray ...

From Steve: Objecting to the GM 363 Sale's Treatment of Product Liability Claims: Stepping Into The Fray

[A] lot of panicked plaintiffs' lawyers involved in cases against GM are screaming these days as they watch years of toil on behalf of people seriously injured by defective GM products (like crushed roofs, exploding "side saddle" gas tanks, and collapsing seat backs) potentially go for naught as GM makes its grandest attempt ever to crush an entire class of former customers and existing and future products liability claimants in a sale that many plaintiffs lawyers of record only received written notice of in the past couple of days.From the NY Times: New Objections May Delay G.M. Exit From Bankruptcy

Those following this blog know my rising concern (even anger) over how products liability claimants were completely stiffed in Chrysler ...

So, I decided to do something about it, and officially stepped into the fray by filing this Objection to the GM Sale and this Memorandum in Support jointly with counsel for the Center for Auto Safety, Consumer Action, Consumers for Auto Reliability and Safety, National Association of Consumer Advocates, and Public Citizen.

A group of General Motors bondholders and some of the automaker’s labor unions filed objections on Friday to G.M.’s plan to sell its assets to a new company that could emerge from bankruptcy protection.The GM bankruptcy might take a little longer than Chrysler.

Their opposition, with objections filed by consumer groups, a handful of states and cities, and individual retirees, shareholders and bondholders, threatens to put the brakes on what the company and the government had hoped would be a rapid trip through the Chapter 11 process.

Tuesday, June 09, 2009

Supreme Court Lifts Stay on Chrysler Deal

by Calculated Risk on 6/09/2009 07:36:00 PM

From SCOTUS Blog: Court clears Chrysler sale

Ending four days of intense, round-the-clock and high-stakes legal maneuvering in the Supreme Court, the Justices on Tuesday evening removed a legal obstacle to sale of the troubled auto industry giant, Chrysler.More at link ...

Insisting that it was denying a postponement “in this case alone,” the two-page order said the challengers had not met their burden of showing that a delay was justified. The order allows a closing of the deal as of next Monday, because it lifts a temporary stay that Justice Ruth Bader Ginsburg had issued on Monday, apparently to give the Court time to ponder the issue.

The Court said nothing about the biggest issue lurking in the case: the legality of using federal “bailout” money to pay for the rescue of an auto manufacturer. In fact, the order stressed that “a denial of a stay is not a ddecision on the merits of the underlying legal issues.”

Monday, June 08, 2009

Supreme Court temporarily blocks Chrysler deal

by Calculated Risk on 6/08/2009 06:14:00 PM

From the SCOTUS Blog: Ginsburg temporarily blocks Chrysler deal

Supreme Court Justice Ruth Bader Ginsburg put a temporary hold Monday on the deal to sell Chrysler to save it from collapse. Her order, however, simply gives her or the full Court more time to ponder whether to postpone the sale further, or allow it to go forward. The order can be found here.There is more ...

...

The deal remains in legal limbo until Ginsburg, as the Circuit Justice, or the full Court takes some definitive action. There is now no timetable for further action at the Supreme Court, although the terms of the deal allow Chrysler’s new business spouse — Fiat, the Italian automaker — to back out as of next Monday if the deal has not closed. Moreover, the papers filed in the Supreme Court have suggested that Chrysler is losing money at the rate of $100 million a day, pending the sale. That gives the Justices some incentive not to let much time pass before acting.

Saturday, June 06, 2009

Consumer Bankruptcy Filings up Sharply

by Calculated Risk on 6/06/2009 08:26:00 AM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings up 37 Percent in May

U.S. consumer bankruptcy filings rose 37 percent nationwide in May from the same period a year ago, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The overall May consumer filing total of 124,838 was roughly level from the April total of 125,618. Chapter 13 filings constituted 27 percent of all consumer cases in May, slightly above the April rate.

“As consumers continue to face increasing levels of unemployment and rising foreclosure rates, bankruptcy filings will continue to accelerate as families seek financial relief from the tough economic climate,” said ABI Executive Director Samuel J. Gerdano. “We predict more than 1.4 million new bankruptcies by year end.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q1 data and Q2 estimate (based on April and May) from American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

| Click on cartoon for larger image in new window. Another great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

The American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll definitely take the over!