by Calculated Risk on 9/30/2018 04:48:00 PM

Sunday, September 30, 2018

Monday: ISM Mfg Index, Construction Spending

CR Note: Gone hiking! I will return on Thursday, Oct 4th. See the links below for the official releases.

Monday:

• At 10:00 AM: ISM Manufacturing Index for September. The PMI was at 61.3% in August, the employment index was at 58.5%, and the new orders index was at 65.1%.

• At 10:00 AM: Construction Spending for August.

Saturday, September 29, 2018

Schedule for Week of September 30, 2018

by Calculated Risk on 9/29/2018 08:11:00 AM

The key report this week is the September employment report on Friday.

Other key indicators include the September ISM manufacturing and non-manufacturing indexes, September auto sales, and the August trade deficit.

10:00 AM: ISM Manufacturing Index for September.

10:00 AM: ISM Manufacturing Index for September.Here is a long term graph of the ISM manufacturing index.

The PMI was at 61.3% in August, the employment index was at 58.5%, and the new orders index was at 65.1%.

10:00 AM: Construction Spending for August.

All day: Light vehicle sales for September.

All day: Light vehicle sales for September.The BEA estimated sales of 16.596 million SAAR in August 2018 (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

Early: Reis Q3 2018 Mall Survey of rents and vacancy rates.

8:00 AM: Corelogic House Price index for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for September. This report is for private payrolls only (no government).

Early: Reis Q3 2018 Office Survey of rents and vacancy rates.

10:00 AM: the ISM non-Manufacturing Index for September.

8:30 AM: The initial weekly unemployment claims report will be released.

8:30 AM: Employment Report for September.

8:30 AM: Employment Report for September. There were 201,000 jobs added in August, and the unemployment rate was unchanged at 3.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In August the year-over-year change was 2.33 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for August from the Census Bureau.

8:30 AM: Trade Balance report for August from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The U.S. trade deficit was at $50.1 billion in July.

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, September 28, 2018

2007: The Trillion Dollar Bear

by Calculated Risk on 9/28/2018 01:00:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th.

In December 2007, most analysts were still dramatically underestimating the probabe losses for lenders and financial institutions.

Here is an article from the WSJ quoting a crazy blogger: How High Will Subprime Losses Go?

The global race is on to find the best phrase to describe the housing and credit mess. The U.K.’s Telegraph quotes an economist who says it “could make 1929 look like a walk in the park” if central banks don’t solve the crisis in a matter of weeks.Many people thought I was crazy. But losses for lenders and financial institutions ended up over $1 Trillion.

The report cites the recent prediction from Barclays Capital that losses from the subprime-mortgage meltdown could hit $700 billion. That would top Merrill Lynch’s recent estimate of $500 billion. The Australian newspaper notes that a $700 billion “bloodbath” — potentially leading the U.S. economy into “the blackest year since the Great Depression” — would top the GDPs of all but 15 nations.

Back in the U.S., the Calculated Risk blog sidestepped the colorful language and went straight for the big number: “The losses for the lenders and investors might well be over $1 trillion.”

And if you look at the post the WSJ referenced, the first paragraph starts: "Within the next couple of years, probably somewhere between 10 million and 20 million U.S. homeowners will owe more on their homes, than their homes are worth."

I was a grizzly bear!

2007: Tanta Changed the Blogging World

by Calculated Risk on 9/28/2018 10:07:00 AM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. Another post on Tanta!

Every finance and economics blogger owes Tanta a debt of gratitude. Before Tanta wrote the following essay, newspapers would "borrow" ideas and subjects from bloggers, and never mention the source. In March 2007 - with a powerful essay - she changed the way the main street media treated bloggers.

In the week following publication of this piece, Tanta or myself were mentioned in just about every major newspaper in the US!

Sadly the media has trouble distinguishing between informed commentary and nonsense (like Zero Right) ... but at least bloggers now get mentioned.

From March 2007: Media Inquiries Policy

Calculated Risk is a hobby blog, created and maintained by a retired executive, with occasional assistance from a former bank officer and mortgage lending specialist who is currently on extended medical leave. Both of these people get endless questions, answers, hat tips, links, analysis, and overall inspiration from a very diverse group of commenters, regulars and occasional de-lurkers, all of whom are beloved except some of them.

CR regularly gets emails and comments from paid reporters who wish to know if CR or Tanta would like to be interviewed, or would simply like to answer one or several questions that the reporter has about economic or housing or mortgage issues. Because, so far, the answer has always been something on the order of “no,” we would like to explain to you why this is the case.

...

Dear reporters, we quote your stuff periodically, giving credit both to the reporter and the publication, under fair use terms. We have no objection to your returning the favor. If you have an editor who will not allow that, and you think that the problem can be solved by getting one of us to drop our online personas, give you our real names, and say the same thing to you over the phone, so that you can get your editor to accept it as something other than just blogging, which everybody knows is untrustworthy ranting by anonymous nuts, you are making a faulty assumption about the relationship among us, our birthdays, and yesterday. Neither CR nor Tanta wishes to play into a set of assumptions that render what we say on the blog as unworthy of coverage by the Big Media, but what we might say on the phone to Intrepid Reporter as good dirt and straight skinny.

Thursday, September 27, 2018

Friday: Personal Income and Outlays

by Calculated Risk on 9/27/2018 06:43:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. See the links below for the official releases.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for August from the BEA. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for September. The consensus is for a reading of 62.0, down from 63.6 in August.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 100.8.

From 2007 and 2008: The Compleat UberNerd

by Calculated Risk on 9/27/2018 01:01:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. There will be a few posts on Tanta today.

In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk.

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

If you want to understand the mortgage industry, read Tanta's posts (here is The Compleat UberNerd and a Compendium of Tanta's Posts).

As an example, here is a brief excerpt from Foreclosure Sales and REO For UberNerds

The following is not an exhaustive discussion of all of the issues involved in foreclosures and REO. It’s a start at unpacking some of the concepts and definitions. We have been seeing, and are going to continue to see, a lot of information presented on foreclosure sales, REO sales, and their impacts on existing home transaction volumes and prices in various market areas. As always with “UberNerd” posts, this is long and excruciating. Proceed with typical motivation as you may consider your own best interest in an open market in blog postings.And an excerpts from Mortgage Servicing for UberNerds

StillLearning asked in the comments about mortgage servicing, and since y’all are nerds, not dummies, here’s my highly-selective occasionally-oversimplified summary for you that skips the boring parts like how your check gets out of the “lockbox” and that stuff. We can discuss extra-credit issues like “excess servicing” and “subservicing” and “SFAS 144 meets MSR” and “negative convexity” and other kinds of inside baseball in the comments. There is a lot that can be said about loan servicing, but let’s start with the basics:Also see In Memoriam: Doris "Tanta" Dungey for photos, links to obituaries in the NY Times, Washington Post and much more.

Servicers have two major types of servicing portfolio: loans they service for themselves and loans they service for other investors. In accounting terms, the “compensation” is the same, meaning that even if you are the noteholder, you pay yourself to service the loans in the same way that an outside investor would pay you, and it shows on the books that way. The differences in compensation stem from the basic fact that one is generally more motivated to do a good job servicing (particularly collecting and efficiently liquidating REO) for one’s own investment than for someone else’s.

December 2006: Tanta joined CR!

by Calculated Risk on 9/27/2018 10:02:00 AM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. There will be a few posts on Tanta today.

In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk.

When some people say that here are few women bloggers in finance and economics, I remind them that Tanta was the best of all of us!

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

Here are excerpts from her first two posts:

From December 2006: Let Slip the Dogs of Hell

I still haven’t gotten over the fact that there’s a “capital management” group out there having named itself “Cerberus”. Those of you who were not asleep in Miss Buttkicker’s Intro to Western Civ will recognize Cerberus; the rest of you may have picked up the mythological fix from its reprise as “Fluffy” in the first Harry Potter novel. Wherever you get your culture, Cerberus is the three-headed dog who guards the gates of Hell. It takes three heads to do that, of course, because it’s never clear, in theology or finance, whether the idea is to keep the righteous from falling into the pit or the demons from escaping out of it (the third head is busy meeting with the regulators). Cerberus is relevant not just because it supplies me with today’s metaphor, but because it was the Biggest Dog of three (including Citigroup and Aozora, a Japanese bank) who in April bought a 51% stake in GMAC’s mega-mortgage operation, GM having, of course, once been renowned as one of the Big Three Automakers until it became one of the Big Three Financing Outfits With A Sideline In Cars. I tried to find a link for you to Aozora Bank’s announcement of the purchase, but the only press release I could find for that day involved the loss of customer data. They must have been so busy letting GMAC into the underworld that the dog head keeping the deposit tickets from getting out got distracted.And from December 2006: On Hybrids, Teasers, and Other Mortgage Guidance Problems

...

Now, I’m just a Little Mortgage Weenie, not a Big Finance Dog, but bear with me while I ask some stupid questions. Like: how do the Big Dogs maintain “diverse and flexible production channels” (i.e., little mortgage banker Puppies to sell you correspondent business and little broker Puppies to sell you wholesale business) when “market share currently held by top-tier players” expands to two-thirds (meaning less diverse off-load strategies for the Little Puppies in the “production channels,” putting them at further pipeline/counterparty risk unless they become Bigger Puppies, which makes them competitors instead of “channels,”), while at the same time watching some of the Little Puppies (in whom the Big Dogs have a major equity stake) crawl under the porch to die? I know Citi doesn’t seem to have noticed that the “increased regulatory scrutiny” is not just of “products” but of “wholesale operational/management controls,” but I did.

First of all, a “hybrid ARM” is called a “hybrid” because it is, basically, a cross between a fixed rate and adjustable rate mortgage. Before the early 90s, an “ARM” basically meant a one-year ARM. The initial interest rate was set for one year, and the rate adjusted every year. The only real variations on this theme involved shortening the adjustment frequency: you could get an ARM that adjusted every six months instead of one year.CR Note: If you want to understand the mortgage industry, read Tanta's posts (here is The Compleat UberNerd and a Compendium of Tanta's Posts).

Around the early 90s, the “hybrid ARM” was introduced. It had an initial period in which the rate was “fixed” that didn’t match the subsequent adjustment frequency: this is the classic 3/1, 5/1, 7/1, and even 10/1 ARM. The whole idea of the hybrid ARM was to provide a kind of medium-range risk/reward tradeoff for borrowers and lenders.

Also see In Memoriam: Doris "Tanta" Dungey for photos, links to obituaries in the NY Times, Washington Post and much more.

Wednesday, September 26, 2018

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 9/26/2018 04:36:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th. See the links below for the official releases.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 201 thousand the previous week. Note: Look for the impact of Hurricane Florence.

• At 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

• At 8:30 AM, Gross Domestic Product, 2nd quarter 2018 (Third estimate) from the BEA. The consensus is that real GDP increased 4.3% annualized in Q2, up from the second estimate of 4.2%.

• Early, Reis Q3 2018 Apartment Survey of rents and vacancy rates.

• At 10:00 AM, Pending Home Sales Index for August from the NAR. The consensus is 0.2% increase in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

FOMC Statement, Projections, and Press Conference

by Calculated Risk on 9/26/2018 02:00:00 PM

CR Note: Gone hiking! I will return on Thursday, Oct 4th.

The FOMC Statement is here. (all FOMC statements are here)

You can watch the Powell press conference video here.

The updated projections are here.

For excellent commentary, please see Tim Duy's Fed Watch.

A few Comments on August New Home Sales

by Calculated Risk on 9/26/2018 11:59:00 AM

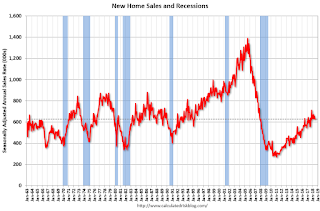

New home sales for August were reported at 629,000 on a seasonally adjusted annual rate basis (SAAR). This was close to the consensus forecast, however the three previous months were revised down significantly.

Sales in August were up 12.7% year-over-year compared to August 2017. This was strong YoY growth, however this was an easy comparison since new home sales were soft in mid-year 2017.

On Inventory: Months of inventory is now close to the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch.

Earlier: New Home Sales increase to 629,000 Annual Rate in August.

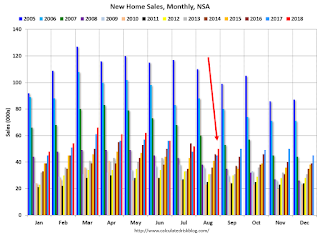

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Note that new home sales have been up year-over-year every month this year (so far).

Sales are up 6.9% through August compared to the same period in 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors. And new home sales had a strong last few months in 2017, so the comparisons will be more difficult.

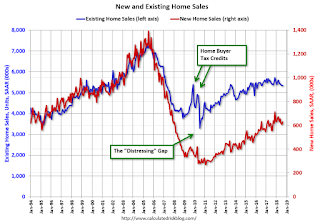

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 629,000 Annual Rate in August

by Calculated Risk on 9/26/2018 10:12:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 629 thousand.

The previous three months were revised down singnificantly.

"Sales of new single-family houses in August 2018 were at a seasonally adjusted annual rate of 629,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.5 percent above the revised July rate of 608,000 and is 12.7 percent above the August 2017 estimate of 558,000. "

emphasis added

Click on graph for larger image.

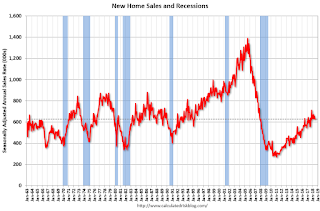

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

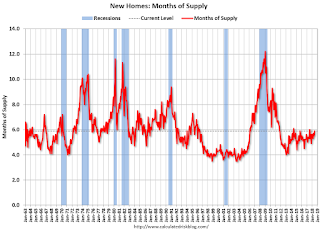

The second graph shows New Home Months of Supply.

The months of supply decreased in August to 6.1 months from 6.2 months in July.

The months of supply decreased in August to 6.1 months from 6.2 months in July. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of August was 318,000. This represents a supply of 6.1 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2018 (red column), 53 thousand new homes were sold (NSA). Last year, 45 thousand homes were sold in August.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in 2010.

This was close to expectations of 630,000 sales SAAR, however the previous months were revised down significantly. I'll have more later today.

Zillow Case-Shiller Forecast: Slower House Price Gains in August

by Calculated Risk on 9/26/2018 08:20:00 AM

The Case-Shiller house price indexes for July were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Melissa Allison at Zillow: July Case-Shiller Results and August Forecast: Autumn Chill

A slight autumn chill has fallen over the housing market, and after an incredibly hot past few years, it’s probably fair to say the cooldown is a welcome development for many would-be home buyers.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be smaller in August than in July.

...

Seasons, just like the housing market, change slowly as environmental conditions shift. Winter in the housing market is certainly not here yet, but it’s increasingly clear that the end of the hot season is rapidly approaching.

Zillow forecasts a further annual slowdown in August, of 5.7 percent. Those Case-Shiller results will be available on Tuesday, Oct. 30.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 9/26/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 21, 2018.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since April 2011, 4.97 percent from 4.88 percent, with points increasing to 0.47 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, September 25, 2018

Wednesday: FOMC Announcement, New Home Sales

by Calculated Risk on 9/25/2018 08:21:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM: New Home Sales for August from the Census Bureau. The consensus is for 630 thousand SAAR, up from 627 thousand in July.

• At 2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• At 2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in August

by Calculated Risk on 9/25/2018 05:12:00 PM

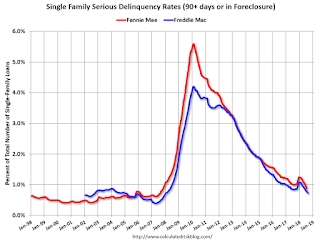

Freddie Mac reported that the Single-Family serious delinquency rate in August was 0.73%, down from 0.78% in July. Freddie's rate is down from 0.84% in August 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since January 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The increase in the delinquency rate late last year was due to the hurricanes (These are serious delinquencies, so it took three months late to be counted). We will probably see another, smaller, bump this year following hurricane Florence.

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.75% range - but this is close to a bottom.

Note: Fannie Mae will report for August soon.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 9/25/2018 02:10:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through July 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Real House Prices and Price-to-Rent Ratio in July

by Calculated Risk on 9/25/2018 11:18:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.0% year-over-year in July

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 9.9% above the previous bubble peak. However, in real terms, the National index (SA) is still about 9.6% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 6%. In July, the index was up 6.0% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $285,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to December 2004 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Richmond Fed: "Fifth District Manufacturing Activity Was Robust in September"

by Calculated Risk on 9/25/2018 10:02:00 AM

From the Richmond Fed: Fifth District Manufacturing Activity Was Robust in September

Fifth District manufacturing activity was robust in September, according to results of the most recent survey from the Federal Reserve Bank of Richmond. The composite index rose from 24 in August to 29 in September, buoyed by increases in shipments and new orders, while the index of the third component, employment, dropped. Survey respondents were optimistic, expecting growth to continue in the next six months.So far the regional surveys for September have indicated solid growth.

The employment index fell in September but remained positive, while growth in wages and the average workweek expanded. Manufacturing firms continued to struggle to find employees with the skills they needed, and they expect this difficulty to continue in the coming months.

emphasis added

Case-Shiller: National House Price Index increased 6.0% year-over-year in July

by Calculated Risk on 9/25/2018 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Slow According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.0% annual gain in July, down from 6.2% in the previous month. The 10-City Composite annual increase came in at 5.5%, down from 6.0% in the previous month. The 20-City Composite posted a 5.9% year-over-year gain, down from 6.4% in the previous month.

Las Vegas, Seattle and San Francisco continued to report the highest year-over-year gains among the 20 cities. In July, Las Vegas led the way with a 13.7% year-over-year price increase, followed by Seattle with a 12.1% increase and San Francisco with a 10.8% increase. Five of the 20 cities reported greater price increases in the year ending July 2018 versus the year ending June 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in July. The 10-City and 20-City Composites reported increases of 0.2% and 0.3%, respectively. After seasonal adjustment, the National Index recorded a 0.2% month-over-month increase in July. The 10-City Composite remained flat and the 20-City Composite posted a 0.1% month-over-month increase. Eighteen of 20 cities reported increases in June before seasonal adjustment, while 13 of 20 cities reported increases after seasonal adjustment.

“Rising homes prices are beginning to catch up with housing,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Year-over-year gains and monthly seasonally adjusted increases both slowed in July for the S&P Corelogic Case-Shiller National Index and the 10 and 20-City Composite indices. The slowing is widespread: 15 of 20 cities saw smaller monthly increases in July 2018 than in July 2017. Sales of existing single family homes have dropped each month for the last six months and are now at the level of July 2016. Housing starts rose in August due to strong gains in multifamily construction. The index of housing affordability has worsened substantially since the start of the year.

“Since home prices bottomed in 2012, 12 of the 20 cities tracked by the S&P Corelogic Case-Shiller indices have reached new highs before adjusting for inflation. The eight that remain underwater include the four cities which led the home price boom: Las Vegas, Miami, Phoenix and Tampa. All are enjoying rising prices, especially Las Vegas which currently has the largest year-over-year increases of all 20 cities. The other cities where prices are still not over their earlier peaks are Washington DC, Chicago, New York and Atlanta."

emphasis added

The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 0.9% from the bubble peak, and unchanged in July (SA).

The Composite 20 index is 2.4% above the bubble peak, and up 0.1% (SA) in July.

The National index is 9.9% above the bubble peak (SA), and up 0.2% (SA) in July. The National index is up 48.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.5% compared to July 2017. The Composite 20 SA is up 5.9% year-over-year.

The National index SA is up 6.0% year-over-year.

Note: According to the data, prices increased in 13 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, September 24, 2018

Tuesday: Case-Shiller House Prices

by Calculated Risk on 9/24/2018 06:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Treading Water Near Long-Term Highs

Mortgage rates are having a bleak September, having risen at least an eighth of a percentage point in all cases and by a quarter of a point in many cases. Depending on the lender and scenario, conventional 30yr fixed rates of 5.0% aren't out of the question although 4.875% remains far more prevalent for borrowers with lots of equity/down-payment and top-tier credit. Either way, that's as high as mortgage rates have been since 2011 for most lenders. [30YR FIXED - 4.75-4.875%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for July. The consensus is for a 6.3% year-over-year increase in the Comp 20 index for July.

• At 9:00 AM, FHFA House Price Index for July 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for September.

Housing Inventory Tracking

by Calculated Risk on 9/24/2018 02:36:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 2.7% year-over-year (YoY) in July, this the first YoY increase since early 2015.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento, and Phoenix (through August) and total existing home inventory as reported by the NAR (also through August).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 22% year-over-year in August (inventory was still very low), and has increased YoY for eleven consecutive months.

Also note that inventory was up 20% YoY in Las Vegas in August (red), the second consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up slightly in Houston in August (but the YoY change might be distorted by Hurricane Harvey last year).

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still be low).

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

So this is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble.

Also inventory is still very low. Consider Sacramento and Las Vegas - two cities with large YoY increases in inventory - the recent increases pushed inventory in Sacramento to 1.9 months supply. And in Las Vegas, the recent increases pushed up the months-of-supply in Las Vegas to 1.8 months.

Black Knight: National Mortgage Delinquency Rate Decreased in August

by Calculated Risk on 9/24/2018 12:21:00 PM

From Black Knight: Black Knight’s First Look: Strong Summer of Improvement for Mortgage Delinquencies; Industry Bracing for Impact from Hurricane Florence

• Mortgage delinquencies fell again in August and are now down 5.7 percent over the past two monthsAccording to Black Knight's First Look report for August, the percent of loans delinquent decreased 2.4% in August compared to July, and decreased 10.4% year-over-year.

• This marks the strongest such decline during July-August on record, since before 2000

• Foreclosure starts also eased in August and are now more than 12 percent below last year’s level

• Delinquencies resulting from 2017’s hurricanes continue to decline – just 25,100 remain in the mainland U.S.

• Some 391,000 homeowners with mortgages were located in Hurricane Florence’s evacuation area, with an estimated 283,000 in the 18 North Carolina counties declared disaster areas so far by FEMA

The percent of loans in the foreclosure process decreased 4.4% in August and were down 28.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.52% in August, down from 3.61% in July.

The percent of loans in the foreclosure process decreased in August to 0.54% (from 0.57% in July).

The number of delinquent properties, but not in foreclosure, is down 185,000 properties year-over-year, and the number of properties in the foreclosure process is down 105,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2018 | July 2018 | Aug 2017 | Aug 2016 | |

| Delinquent | 3.52% | 3.61% | 3.93% | 4.24% |

| In Foreclosure | 0.54% | 0.57% | 0.76% | 1.04% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,818,000 | 1,861,000 | 2,003,000 | 2,151,000 |

| Number of properties in foreclosure pre-sale inventory: | 280,000 | 293,000 | 385,000 | 527,000 |

| Total Properties | 2,099,000 | 2,154,000 | 2,388,000 | 2,678,000 |

Dallas Fed: "Texas Manufacturing Expansion Continues amid Increased Uncertainty"

by Calculated Risk on 9/24/2018 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues amid Increased Uncertainty

Texas factory activity continued to expand in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped six points to 23.3, indicating output growth continued but at a slower pace than last month.So far the regional surveys for September have indicated solid growth.

Other indexes of manufacturing activity also suggested slower expansion in September. The new orders index fell nine points to 14.7, its lowest reading in six months. Similarly, the growth rate of orders index slipped to 11.5, also a six-month low. The capacity utilization index retreated slightly to 21.6, while the shipments index fell five points to 20.8.

Perceptions of broader business conditions remained positive this month, although outlooks were less optimistic and uncertainty increased further. The general business activity index edged down but remained highly elevated at 28.1. The company outlook index held above average but retreated nine points to 18.2, its lowest reading in more than a year. The relatively new index measuring uncertainty regarding companies’ outlooks moved up four points to a new high of 19.9.

Labor market measures suggest employment levels and work hours rose at a slower pace in September. The employment index remained positive but dropped 11 points to 17.7. One-quarter of firms noted net hiring, compared with 7 percent noting net layoffs. The hours worked index moved down to 12.7.

emphasis added

Chicago Fed "Index Points to Steady Economic Growth in August"

by Calculated Risk on 9/24/2018 08:37:00 AM

From the Chicago Fed: Index Points to Steady Economic Growth in August

The Chicago Fed National Activity Index (CFNAI) was unchanged at +0.18 in August. Three of the four broad categories of indicators that make up the index increased from July, and two of the four categories made positive contributions to the index in August. The index’s three-month moving average, CFNAI-MA3, rose to +0.24 in August from +0.02 in July.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in August (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, September 23, 2018

Sunday Night Futures

by Calculated Risk on 9/23/2018 07:22:00 PM

Weekend:

• Schedule for Week of September 23, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 8 and DOW futures are down 80 (fair value).

Oil prices were up over the last week with WTI futures at $71.48 per barrel and Brent at $79.73 per barrel. A year ago, WTI was at $52, and Brent was at $59 - so oil prices are up about 30% to 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $2.55 per gallon (jumped last year due to hurricane Harvey) - so gasoline prices are up 29 cents per gallon year-over-year.

FOMC Preview

by Calculated Risk on 9/23/2018 08:11:00 AM

The consensus is that the Fed will increase the Fed Funds Rate 25bps at the meeting this week, and the tone will remain upbeat.

Assuming the expected happens, the focus will be on the wording of the statement, the projections, and Fed Chair Jerome Powell's press conference to try to determine how many rate hikes to expect in 2018 (probably four) and in 2019.

Here are the June FOMC projections.

Current projections for Q3 GDP are in mid-3% range. GDP increased at a 2.2% real annual rate in Q1, and 4.2% in Q2. This puts GDP, so far in 2018, above the expected range, and GDP projections might be revised up.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.7 to 3.0 | 2.2 to 2.6 | 1.8 to 2.0 |

| Mar 2018 | 2.6 to 3.0 | 2.2 to 2.6 | 1.8 to 2.1 |

The unemployment rate was at 3.9% in August. So the unemployment rate projection for 2018 will probably be mostly unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Jun 2018 | 3.6 to 3.7 | 3.4 to 3.5 | 3.4 to 3.7 |

| Mar 2018 | 3.6 to 3.8 | 3.4 to 3.7 | 3.5 to 3.8 |

As of July, PCE inflation was up 2.3% from July 2017. So PCE inflation might be revised up for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.0 to 2.1 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

PCE core inflation was up 2.0% in July year-over-year. Core PCE inflation might also be revised up for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 1.9 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

In general the data has been somewhat firmer than the FOMC's June projections, so it seems likely the FOMC will be on track for four rate hikes in 2018.

Saturday, September 22, 2018

Schedule for Week of September 23, 2018

by Calculated Risk on 9/22/2018 08:11:00 AM

The key reports this week are August New Home sales, and the third estimate of Q2 GDP.

Other key indicators include Personal Income and Outlays for August and Case-Shiller house prices for July.

For manufacturing, the Dallas, Richmond, and Kansas City Fed manufacturing surveys will be released this week.

Also, the FOMC meets this week, and is expected to raise the Fed Funds rate 25bps.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.3% year-over-year increase in the Comp 20 index for July.

9:00 AM: FHFA House Price Index for July 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 630 thousand SAAR, up from 627 thousand in July.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 201 thousand the previous week.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Third estimate). The consensus is that real GDP increased 4.3% annualized in Q2, up from the second estimate of 4.2%.

Early: Reis Q3 2018 Apartment Survey of rents and vacancy rates.

10:00 AM: Pending Home Sales Index for August. The consensus is 0.2% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 62.0, down from 63.6 in August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 100.8.

Friday, September 21, 2018

Oil Rigs Decline Slightly

by Calculated Risk on 9/21/2018 07:15:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on September 21, 2018:

• Oil rigs declined, -1 to 866

• Horizontal oil rigs fell, -3 to 766

...

• Horizontal oil rigs are essentially unchanged in the last 14 weeks

• The Permian added 3 rigs, the Cana Woodford was hammered with a loss of 6 rigs

• The breakeven oil price to add horizontal oil rigs is now $70 WTI, about the same as WTI.

• The model suggests horizontal oil rig counts will decline again next week.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q3 GDP Forecasts

by Calculated Risk on 9/21/2018 03:25:00 PM

From Merrill Lynch:

We are tracking robust 3.7% qoq saar growth for 3Q and 4.4% for 2Q. [Sept 21 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.4 percent on September 19, unchanged from September 14. [Sept 19 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.3% for 2018:Q3 and 2.7% for 2018:Q4. [Sept 21 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

Merrill: "Existing Home Sales have Peaked"

by Calculated Risk on 9/21/2018 02:48:00 PM

A few excerpts from a Merrill Lynch research note:

We are calling it: existing home sales have peaked. We believe that the peak was at 5.72 million, reached in November last year. From here on, sales should trend sideways. If this is indeed the peak, it would be comparable to the rate we last saw in the early 2000s before the bubble set in. Here is the catch — while existing home sales have likely peaked, we do not think we have seen the same for new home sales. New home sales have lagged existing in this recovery and we believe there is room to run for new home sales, leaving builders to add more single family homes to the market.CR Note: As I noted in July (see: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2)

The peak in existing home sales can largely be explained by the decline in affordability. With housing prices hovering close to bubble highs and mortgage rates on the rise, affordability has been declining.

emphasis added

First, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Also I think the growth in multi-family starts is behind us, and that multi-family starts peaked in June 2015. See: Comments on June Housing Starts

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

If new home sales and single family starts have peaked that would be a significant warning sign. Although housing is under pressure from policy (negative impact from tax, immigration and trade policies), I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.

BLS: Unemployment Rates in Idaho, Oregon, South Carolina and Washington at New Lows

by Calculated Risk on 9/21/2018 10:25:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in August in 13 states, higher in 3 states, and stable in 34 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eleven states had jobless rate decreases from a year earlier and 39 states and the District had little or no change. The national unemployment rate was unchanged from July at 3.9 percent but was 0.5 percentage point lower than in August 2017.

...

Hawaii had the lowest unemployment rate in August, 2.1 percent. The rates in Idaho (2.8 percent), Oregon (3.8 percent), South Carolina (3.4 percent), and Washington (4.5 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.7 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue).

Mortgage Equity Withdrawal slightly positive in Q2

by Calculated Risk on 9/21/2018 08:01:00 AM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q2 2018, the Net Equity Extraction was a positive $9 billion, or a 0.2% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 8 of the last 11 quarters. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $66 billion in Q2.

The Flow of Funds report also showed that Mortgage debt has declined by $0.546 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

Thursday, September 20, 2018

Earlier: Philly Fed Manufacturing Survey Suggested Faster Growth in September

by Calculated Risk on 9/20/2018 06:05:00 PM

Earlier: From the Philly Fed: September 2018 Manufacturing Business Outlook Survey

Regional manufacturing activity continued to grow in September, according to results from this month’s Manufacturing Business Outlook Survey. The survey’s broad indicators for general activity, new orders, shipments, and employment remained positive and increased from their readings in August. The survey’s respondents reported diminished price pressures this month. Expectations for the next six months remained optimistic, but most broad future indicators showed some moderation.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased 11 points this month to 22.9, returning the index to near its average reading for 2018. … The firms continued to report overall higher employment. Over 26 percent of the responding firms reported increases in employment this month, up from 18 percent last month, while nearly 9 percent of the firms reported decreases in employment. The current employment index increased 3 points to 17.6.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through September), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

This suggests the ISM manufacturing index will show solid expansion again in September.

CoreLogic: 2.2 million Homes still in negative equity at end of Q2 2018

by Calculated Risk on 9/20/2018 02:01:00 PM

From CoreLogic: Homeowner Equity Q2 2018

CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63 percent of all properties) have seen their equity increase by a total of nearly $981 billion since the second quarter 2017, an increase of 12.3 percent, year over year.CR Note: A year ago, in Q2 2017, there were 2.8 million properties with negative equity - now there are 2.2 million. A significant change.

Homeowners Emerge from the Negative Equity Trap: In the second quarter 2018, the total number of mortgaged residential properties with negative equity decreased 9 percent from the first quarter 2017 to 2.2 million homes, or 4.3 percent of all mortgaged properties. Compared to the second quarter 2017, negative equity decreased 20.1 percent from 2.8 million homes, or 5.4 percent of all mortgaged properties.

...

Negative equity peaked at 26 percent of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

emphasis added

Fed's Flow of Funds: Household Net Worth increased in Q2

by Calculated Risk on 9/20/2018 12:26:00 PM

The Federal Reserve released the Q2 2018 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q2 2018 to $106.9 Trillion, for $104.7 Trillion in Q1 2018:

The net worth of households and nonprofits rose to $106.9 trillion during the second quarter of 2018. The value of directly and indirectly held corporate equities increased $0.8 trillion and the value of real estate increased $0.6 trillion.The Fed estimated that the value of household real estate increased to $25.4 trillion in Q2. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and this also includes new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2018, household percent equity (of household real estate) was at 59.9% - up from Q1, and the highest since 2002. This was because of an increase in house prices in Q2 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 59.9% equity - and about 2.2 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $66 billion in Q2.

Mortgage debt has declined by $0.54 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, declined slightly in Q2, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

A Few Comments on August Existing Home Sales

by Calculated Risk on 9/20/2018 11:26:00 AM

Earlier: NAR: Existing-Home Sales Unchanged at 5.34 million in August

Two key points:

1) This is a reasonable level for existing home sales, and doesn't suggest any significant weakness in housing or the economy. The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

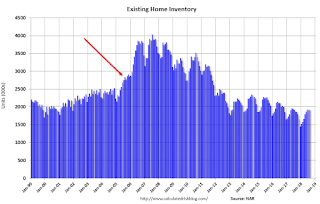

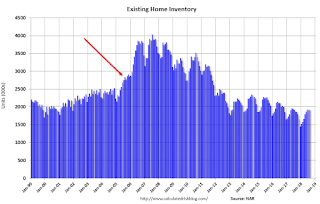

2) Inventory is still very low, but was up 2.7% year-over-year (YoY) in August. This was the first year-over-year increase since May 2015. (Note: Inventory for June was initially reported as up slightly year-over-year, but inventory was revised down).

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase significantly and still be at normal levels. No worries.

Sales NSA in August (539,000, red column) were slightly above sales in August 2017 (535,000, NSA).

Sales NSA through August (first eight months) are down about 1.2% from the same period in 2017.

This is a small YoY decline in sales to-date - but it is possible there has been an impact from higher interest rates and / or the changes to the tax law (eliminating property taxes write-off, etc).