by Calculated Risk on 5/31/2018 06:58:00 PM

Thursday, May 31, 2018

Friday: Employment Report, Auto Sales, ISM Manufacturing, Construction Spending

My May Employment Preview

Goldman: May Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April. The consensus is for the unemployment rate to be unchanged at 3.9%.

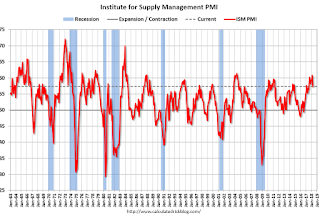

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April. The PMI was at 57.3% in April, the employment index was at 54.2%, and the new orders index was at 61.2%.

• At 10:00 AM, Construction Spending for April. The consensus is for a 0.8% increase in construction spending.

• All day, Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).

Goldman: May Payrolls Preview

by Calculated Risk on 5/31/2018 03:02:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 205k in May, 15k above consensus. While labor supply constraints often weigh on May job creation when the labor market is beyond full employment, we believe strong jobless claims data, rebounding business surveys, and a return to normal weather suggest a pickup in payroll growth in tomorrow’s report.

... we estimate the unemployment rate remained stable at 3.9% in May. ... We estimate a 0.2% month-over-month increase in average hourly earnings (and 2.6% year-on-year)

emphasis added

May Employment Preview

by Calculated Risk on 5/31/2018 12:19:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus, according to Bloomberg, is for an increase of 190,000 non-farm payroll jobs in May (with a range of estimates between 155,000 to 220,000), and for the unemployment rate to be unchanged at 3.9%.

The BLS reported 164,000 jobs added in April.

Here is a summary of recent data:

• The ADP employment report showed an increase of 178,000 private sector payroll jobs in May. This was slightly below consensus expectations of 186,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing and non-manufacturing surveys will be released after the employment report this month.

• Initial weekly unemployment claims averaged 222,000 in May, about the same as in April. For the BLS reference week (includes the 12th of the month), initial claims were at 223,000, down from 233,000 during the reference week in April.

The slight decrease during the reference week suggests a slightly stronger employment report in May than in April.

• The final May University of Michigan consumer sentiment index decreased to 98.0 from the April reading of 98.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Merrill Lynch has introduced a new payrolls tracker based on private internal BAC data. The tracker suggests private payrolls increased by 227,000 in May, and this suggests employment growth above expectations.

• Looking back at the three previous years:

In May 2017, the consensus was for 185,000 jobs, and the BLS reported 138,000 jobs added. In May 2016, the consensus was for 158,000 jobs, and the BLS reported 38,000 jobs added. In May 2015, the consensus was for 220,000 jobs, and the BLS reported 280,000 jobs added.

• Conclusion: In general, these reports suggest a solid employment report, and probably close to expectations. The ADP report suggests a report slightly below expectations, but the reference week for unemployment claims, and the Merrill payrolls tracker suggest a stronger report. My guess is that the employment report will be close to the consensus in May.

NAR: Pending Home Sales Index Decreased 1.3% in April, Down 2.1% Year-over-year

by Calculated Risk on 5/31/2018 10:03:00 AM

From the NAR: Pending Home Sales Lose Steam in April, Decline 1.3 Percent

After two straight months of modest increases, pending home sales dipped in April to their third-lowest level over the past year, according to the National Association of Realtors. All major regions saw no gain in contract activity last month.This was well below expectations of a 0.7% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 1.3 percent to 106.4 in April from an upwardly revised 107.8 in March. With last month’s decrease, the index is down on an annualized basis (2.1 percent) for the fourth straight month.

...

The PHSI in the Northeast remained at 90.6 in April, and is 2.1 percent below a year ago. In the Midwest the index decreased 3.2 percent to 98.5 in April, and is 5.1 percent lower than April 2017.

Pending home sales in the South declined 1.0 percent to an index of 127.3 in April, but is still 2.7 percent higher than last April. The index in the West inched backward 0.4 percent in April to 94.4, and is 4.6 percent below a year ago.

emphasis added

Personal Income increased 0.3% in April, Spending increased 0.6%

by Calculated Risk on 5/31/2018 08:39:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $49.5 billion (0.3 percent) in April according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $60.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $79.8 billion (0.6 percent).The April PCE price index increased 2.0 percent year-over-year and the April PCE price index, excluding food and energy, increased 1.8 percent year-over-year.

Real DPI increased 0.2 percent in April and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

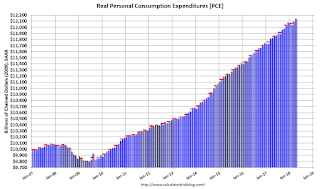

The following graph shows real Personal Consumption Expenditures (PCE) through April 2018 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at expectations, and the increase in PCE was above expectations.

Weekly Initial Unemployment Claims decrease to 221,000

by Calculated Risk on 5/31/2018 08:33:00 AM

The DOL reported:

In the week ending May 26, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 13,000 from the previous week's unrevised level of 234,000. The 4-week moving average was 222,250, an increase of 2,500 from the previous week's unrevised average of 219,750.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 222,250.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, May 30, 2018

Thursday: Unemployment Claims, Personal Income and Outlays, Pending Home sales and more

by Calculated Risk on 5/30/2018 07:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher After Yesterday's Big Drop

Mortgage rates were somewhat higher today as politicians struck a more conciliatory tone in Italy. To be clear, we are indeed talking about mortgage rates in the United States in relation to European politics. It's not the first time and it likely won't be the last. [30YR FIXED - 4.5-4.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, down from 234 thousand the previous week.

• At 8:30 AM, Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 58.1, up from 57.6 in April.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.7% increase in the index.

Fed's Beige Book: "Economic activity expanded moderately", "concern about trade policy"

by Calculated Risk on 5/30/2018 02:07:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Cleveland based on information collected on or before May 21, 2018."

Economic activity expanded moderately in late April and early May with few shifts in the pattern of growth. The Dallas District was an exception, where overall economic activity sped up to a solid pace. Manufacturing shifted into higher gear with more than half of the Districts reporting a pickup in industrial activity and a third of the Districts classifying activity as "strong." Fabricated metals, heavy industrial machinery, and electronics equipment were noted as areas of strength. Rising goods production led to higher freight volumes for transportation firms. By contrast, consumer spending was soft. Nonauto retail sales growth moderated somewhat and auto sales were flat, although there was considerable variation by District and vehicle type. In banking, demand for loans ticked higher and banks reported that increased competition had led to higher deposit rates. Delinquency rates were mostly stable at low levels. Homebuilding and home sales increased modestly, on net, and nonresidential construction continued at a moderate pace. Contacts noted some concern about the uncertainty of international trade policy. Still, outlooks for near term growth were generally upbeat.

...

Employment rose at a modest to moderate rate across most Districts. Again, the Dallas District was the exception, where solid and widespread employment growth was reported. Labor market conditions remained tight across the country, and contacts continued to report difficulty filling positions across skill levels. Shortages of qualified workers were reported in various specialized trades and occupations, including truck drivers, sales personnel, carpenters, electricians, painters, and information technology professionals. Many firms responded to talent shortages by increasing wages as well as the generosity of their compensation packages. In the aggregate, however, wage increases remained modest in most Districts. Contacts in some Districts expected similar employment and wage gains in the coming months.

emphasis added

Q1 GDP Revised down to 2.2% Annual Rate

by Calculated Risk on 5/30/2018 08:35:00 AM

From the BEA: National Income and Product Accounts Gross Domestic Product: First Quarter 2018 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.2 percent in the first quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2017, real GDP increased 2.9 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 1.1% to 1.0%. Residential investment was revised down from no change to -2.0%. Most revisions were small. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.3 percent. With this second estimate for the first quarter, the general picture of economic growth remains the same; downward revisions to private inventory investment, residential fixed investment, and exports were partly offset by an upward revision to nonresidential fixed investment.

emphasis added

ADP: Private Employment increased 178,000 in May

by Calculated Risk on 5/30/2018 08:24:00 AM

Private sector employment increased by 178,000 jobs from April to May according to the May ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was slightly below the consensus forecast for 186,000 private sector jobs added in the ADP report.

...

“The hot job market has cooled slightly as the labor market continues to tighten,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Healthcare and professional services remain a model of consistency and continue to serve as the main drivers of growth in the services sector and the broader labor market as well.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is strong, but slowing, as businesses are unable to fill a record number of open positions. Wage growth is accelerating in response, most notably for young, new entrants and those changing jobs. Finding workers is increasingly becoming businesses number one problem.”

The BLS report for May will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in May.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refi Index lowest since December 2000

by Calculated Risk on 5/30/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 25, 2018.

... The Refinance Index decreased 5 percent from the previous week to its lowest level since December 2000. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.77 percent from 4.78 percent, with points remaining unchanged at 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity is at the lowest level since December 2000.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, May 29, 2018

Wednesday: GDP, ADP Employment, Beige Book

by Calculated Risk on 5/29/2018 06:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 186,000 payroll jobs added in May, down from 204,000 added in April.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2018 (Second estimate). The consensus is that real GDP increased 2.2% annualized in Q1, down from the advance estimate of 2.3% in Q1.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Real House Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/29/2018 04:14:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.5% year-over-year in March

It has been eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 8.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 10.0% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 6%. In March, the index was up 6.5% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $284,000 today adjusted for inflation (42%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to December 2004 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to December 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

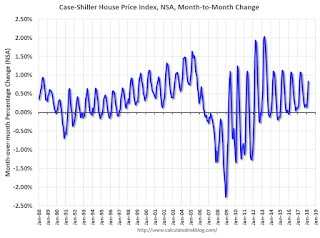

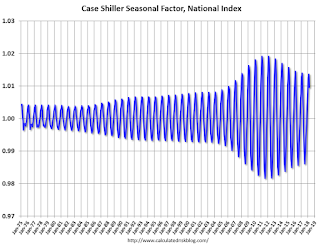

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 5/29/2018 01:31:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Dallas Fed: "Texas Manufacturing Expansion Accelerates Notably"

by Calculated Risk on 5/29/2018 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Accelerates Notably

Texas factory activity rose markedly in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, increased 10 points to a 12-year high of 35.2, signaling further acceleration in output growth.This was the last of the regional Fed surveys for May.

Most other indexes of manufacturing activity also indicated a sharp acceleration in May. The capacity utilization index rose notably from 18.7 to 32.2, and the shipments index jumped 20 points to 39.5. Demand growth picked up as the growth rate of orders index increased eight points to 26.5. All three measures reached their highest readings since 2006. Meanwhile, the new orders index held steady at 27.7.

Perceptions of broader business conditions were even more positive in May than in April. The general business activity index rose five points to 26.8, and the company outlook index rose four points to 28.0. These readings are far above their respective averages.

Labor market measures suggested stronger growth in employment and notably longer work hours in May. The employment index pushed up six points to 23.4, its highest reading in six years. Twenty-nine percent of firms noted net hiring, compared with 5 percent that noted net layoffs. The hours worked index shot up nine points to 23.2.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

Based on these regional surveys, it is possible the ISM manufacturing index will be close to 60 in May (to be released on Friday, June 1st).

Case-Shiller: National House Price Index increased 6.5% year-over-year in March

by Calculated Risk on 5/29/2018 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Not Slowing Down According to S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.5% annual gain in March, the same as the previous month. The 10-City Composite annual increase came in at 6.5%, up from 6.4% in the previous month. The 20-City Composite posted a 6.8% year-over-year gain, no change from the previous month.

Seattle, Las Vegas, and San Francisco continue to report the highest year-over-year gains among the 20 cities. In March, Seattle led the way with a 13.0% year-over-year price increase, followed by Las Vegas with a 12.4% increase and San Francisco with an 11.3% increase. Twelve of the 20 cities reported greater price increases in the year ending March 2018 versus the year ending February 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.8% in March. The 10-City and 20-City Composites reported increases of 0.9% and 1.0%, respectively. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase in March. The 10-City and 20-City Composites posted 0.4% and 0.5% month-over-month increases, respectively. All 20 cities reported increases in March before seasonal adjustment, while 19 of 20 cities reported increases after seasonal adjustment.

“The home price increases continue with the National Index rising at 6.5% per year,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Seattle continues to report the fastest rising prices at 13% per year, double the National Index pace. While Seattle has been the city with the largest gains for 19 months, the ranking among other cities varies. Las Vegas and San Francisco saw the second and third largest annual gains of 12.4% and 11.3%. A year ago, they ranked 10th and 16th. Any doubts that real, or inflation-adjusted, home prices are climbing rapidly are eliminated by considering Chicago; the city reported the lowest 12-month gain among all cities in the index of 2.8%, almost a percentage point ahead of the inflation rate.

“Looking across various national statistics on sales of new or existing homes, permits for new construction, and financing terms, two figures that stand out are rapidly rising home prices and low inventories of existing homes for sale. Months-supply, which combines inventory levels and sales, is currently at 3.8 months, lower than the levels of the 1990s, before the housing boom and bust. Until inventories increase faster than sales, or the economy slows significantly, home prices are likely to continue rising. Compared to the price gains of the last boom in the early 2000s, things are calmer today. Gains in the National Index peaked at 14.5% in September 2005, more quickly than Seattle is rising now.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 1.1% from the peak, and up 0.4% in March (SA).

The Composite 20 index is 1.8% above the bubble peak, and up 0.5% (SA) in March.

The National index is 8.8% above the bubble peak (SA), and up 0.4% (SA) in March. The National index is up 47.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.4% compared to March 2017. The Composite 20 SA is up 6.7% year-over-year.

The National index SA is up 6.5% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, May 28, 2018

Tuesday: Case-Shiller House Prices, Dallas Fed Mfg

by Calculated Risk on 5/28/2018 09:39:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. The consensus is for a 6.4% year-over-year increase in the Comp 20 index for March.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

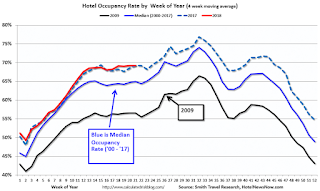

Hotels: Occupancy Rate decreases Year-over-Year, Close to Record Annual Pace

by Calculated Risk on 5/28/2018 10:44:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 19 May

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 13-19 May 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 14-20 May 2017, the industry recorded the following:

• Occupancy: -0.5% to 70.2%

• Average daily rate (ADR): +3.5% to US$132.36

• Revenue per available room (RevPAR): +3.0% to US$92.92

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

On a seasonal basis, the occupancy rate will pick up soon when the summer travel season starts.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, May 27, 2018

May 2018: Unofficial Problem Bank list; Which Bank is the "Mystery" Problem Bank?

by Calculated Risk on 5/27/2018 08:12:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2018. The list had a net decline of two insured institutions to 92 banks after three additions and five removals. After the net changes to the list and updating asset with 2018Q1 figures, aggregate assets declined during the month by $911 million to $18.0 billion. A year ago, the list held 140 institutions with assets of $34.2 billion.CR Note: When the unofficial weekly was list was first published on August 7, 2009 it had 389 institutions. The list peaked at just over 1,000 institutions in 2011. Now there are only 92 banks on the unofficial list (the FDIC reported 92 banks on the official problem bank list at the end of 2017).

Actions were terminated against HomeStar Bank and Financial Services, Manteno, IL ($359 million); Freedom Bank of Oklahoma, Tulsa, OK ($156 million); and Superior Bank, Hazelwood, MO ($29 million). Finding their way off the list through merger were Indus American Bank, Edison, NJ ($231 million) and Wawel Bank, Wallington, NJ ($73 million).

Additions this month were Maryland Financial Bank, Towson, MD ($66 million); Sunrise Bank Dakota, Onida, SD ($65 million); and The First National Bank of Sedan, Sedan, KS ($64 million).

Name and location changes made this month include Saigon National Bank (Cert #57974), Westminster, CA with a name change to California International Bank, N.A. and a headquarters move to Rosemead, CA; First State Bank (Cert #9502), Danville, VA with a name change to Movement Bank; Covenant Bank (Cert #34460), Leeds, AL with a name change to Millennial Bank; California Business Bank (Cert #58037), Los Angeles, CA with a headquarters move to Irvine, CA; and BNB Hana Bank, National Association (Cert #26790), Fort Lee, NJ with a name change to KEB Hana Bank USA, National Association.

This week the FDIC released their official Problem Bank figures for the end of the first quarter of 2018, with their list holding 92 institutions with assets of $56.4 billion. At the end of the fourth quarter of 2017, the FDIC reported the 95 institutions with assets of $13.9 billion were on the official Problem Bank List. So if we understand the FDIC correctly, over the past 90 days, the official Problem Bank List has declined by three institutions but aggregate assets increased by a whopping $42.5 billion.

During the press conference this week and its press release, the FDIC highlighted the decline in the number of problem banks being the lowest since the first quarter of 2008, but there was no mention of the significant jump in problem bank assets. In the question and answer section of the press conference, an intrepid reporter asked FDIC Chairman Gruenberg about the increase. In response, Chairman Gruenberg, consistent with normal protocol, said he would not comment about the condition of an open institution.

Given that the FDIC does not disclose the contents of its official Problem Bank List, we are left to ponder what large-sized institution they added. Because of the small change in the number of banks on the list, our first guess is that a single institution with assets in the $40 billion to $46 billion range was added to the list. We have scoured all available information sources such as the enforcement action search engines of the Federal Reserve, FDIC, and OCC and SEC disclosures of publicly traded bank/bank holding companies without finding any recent safety & soundness actions issued against banks with asset sizes in the $40 billion to $46 billion range. There are six institutions with assets in this range, with five being controlled by a parent company whose stock is publicly traded. Obviously, receiving an enforcement action that should be issued to a bank that is on the Problem Bank List, is worthy of an 8-K disclosure. There is only one institution in that asset range, without an ultimate domestic parent, which would not have to disclose issuance of an enforcement action. We will continue to monitor the banking regulator websites and other information sources. Ideally, this mystery is solved by our next update.

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

Saturday, May 26, 2018

Schedule for Week of May 27, 2018

by Calculated Risk on 5/26/2018 08:12:00 AM

The key reports this week are the May employment report on Friday, and the second estimate of Q1 GDP on Wednesday.

Other key indicators include Personal Income and Outlays for April, the May ISM manufacturing index, and May auto sales.

All US markets will be closed in observance of Memorial Day.

9:00 AM ET: S&P/Case-Shiller House Price Index for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for March.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2018 report (the Composite 20 was started in January 2000).

The consensus is for a 6.4% year-over-year increase in the Comp 20 index for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 186,000 payroll jobs added in May, down from 204,000 added in April.

8:30 AM: Gross Domestic Product, 1st quarter 2018 (Second estimate). The consensus is that real GDP increased 2.2% annualized in Q1, down from the advance estimate of 2.3% in Q1.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, down from 234 thousand the previous week.

8:30 AM: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 58.1, up from 57.6 in April.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.7% increase in the index.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April. The consensus is for the unemployment rate to be unchanged at 3.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In April the year-over-year change was 2.280 million jobs.

A key will be the change in wages.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April.Here is a long term graph of the ISM manufacturing index.

The PMI was at 57.3% in April, the employment index was at 54.2%, and the new orders index was at 61.2%.

10:00 AM: Construction Spending for April. The consensus is for a 0.8% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

Friday, May 25, 2018

Oil Rigs: "Big rig add reversing last week"

by Calculated Risk on 5/25/2018 06:19:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on May 25, 2018:

• Total US oil rigs were up 15 to 859

• Horizontal oil rigs added 9 to 755

...

• The gains this week were largely a catch-up on last week’s flat numbers

• Oil prices moved down sharply on Friday as traders sold their positions heading into the Memorial Day weekend and on news OPEC may add volumes

• We do not believe OPEC will add material volumes

• The Brent spread advanced to $8.65 and the futures curve remains in pronounced backwardation, suggesting demand remains robust

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: "US Deaths Jumped in 2017"

by Calculated Risk on 5/25/2018 03:16:00 PM

From housing economist Tom Lawler: US Deaths Jumped in 2017

Provisional estimates from the National Center for Health Statistics (NCHS) indicate that the number of US deaths increased sharply last year, both in absolute terms and adjusted for age. According to the NCHS’ “mortality dashboard”, the “crude” US death rate (deaths per 100,000 of population) averaged 866.2 in 2017, up from 839.3 in 2016. The NCHS’ “age-adjusted” death rate (which adjusts for the changing age distribution of the population) for 2017 was 733.6, up from 728.8 in 2017 and the highest age-adjusted death rate since 2011. These data suggest that the total number of US deaths last year was around 2.821 million, compared to 2.744 million in 2016.

While data on deaths by age (or full-year deaths by cause) are not yet available, these data suggest that the recent alarming trend of significantly higher death rates among teenagers and non-elderly adults (shown in the table below) continued last year.

| US Death Rates (deaths per 100,000 population), Total and Selected Age Groups (NCHS) | ||||||||

|---|---|---|---|---|---|---|---|---|

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | |

| All Ages | 866.2 | 839.3 | 844.0 | 823.7 | 821.5 | 810.2 | 807.3 | 799.5 |

| <1 | 587.0 | 589.6 | 588.0 | 594.7 | 599.3 | 600.1 | 623.4 | |

| 1-4 | 25.2 | 24.9 | 24.0 | 25.5 | 26.3 | 26.3 | 26.5 | |

| 5-14 | 13.4 | 13.2 | 12.7 | 13.0 | 12.6 | 13.2 | 12.9 | |

| 15-24 | 74.9 | 69.5 | 65.5 | 64.8 | 66.4 | 67.7 | 67.7 | |

| 25-34 | 129.0 | 116.7 | 108.4 | 106.1 | 105.4 | 104.7 | 102.9 | |

| 35-44 | 192.2 | 180.1 | 175.2 | 172.0 | 170.7 | 172.0 | 170.5 | |

| 45-54 | 405.5 | 404.0 | 404.8 | 406.1 | 405.4 | 409.8 | 407.1 | |

| 55-64 | 883.8 | 875.3 | 870.3 | 860.0 | 854.2 | 849.4 | 851.9 | |

| 65-74 | 1788.6 | 1796.8 | 1786.3 | 1802.1 | 1802.5 | 1846.2 | 1875.1 | |

| 75-84 | 4474.8 | 4579.2 | 4564.2 | 4648.1 | 4674.5 | 4753.0 | 4790.2 | |

| 85+ | 13392.1 | 13673.9 | 13407.9 | 13660.4 | 13678.6 | 13779.3 | 13934.3 | |

| Age Adjusted | 733.6 | 728.8 | 733.1 | 724.6 | 731.9 | 732.8 | 741.3 | 747.0 |

What is especially striking about this table is the substantial increase in death rates for the 15-44 year old age groups from 2014 to 2016.

While full-year provisional estimates of deaths by cause are not yet available, here are some death rates by selected causes for the four-quarters ending in the second quarter.

| Death Rate (per 100,000 population) by Selected Cause | |||

|---|---|---|---|

| Four Quarter Period Ended: | Drug Overdose | Firearm Injury | Suicide |

| Q2/2017 | 21.0 | 14.1 | 11.6 |

| Q2/2016 | 17.8 | 13.8 | 12.2 |

With respect to drug overdose deaths, the “trending” quarterly data suggest that drug overdose deaths in 2017 were probably around 70,000. Here is a table showing recent history

| Drug Overdose Deaths by Selected Age Groups, NCHS | ||||||||

|---|---|---|---|---|---|---|---|---|

| 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Total | ||

| 2012 | 3,518 | 8,508 | 8,948 | 11,895 | 6,423 | 2,094 | 41,386 | |

| 2013 | 3,664 | 8,947 | 9,320 | 12,045 | 7,551 | 2,344 | 43,871 | |

| 2014 | 3,798 | 10,055 | 10,134 | 12,263 | 8,122 | 2,568 | 46,940 | |

| 2015 | 4,235 | 11,880 | 11,505 | 12,974 | 8,901 | 2,760 | 52,255 | |

| 2016 | 5,376 | 15,443 | 14,183 | 14,771 | 10,632 | 3,075 | 63,480 | |

| 2017 | 70,0001 | |||||||

| 1estimate | ||||||||

For folks who rely on Census population projections to forecast other variables such as labor force growth, household growth, etc., these recent death statistics suggest that they should not do so. The latest Census long-term population projections not only did not reflect the increased death rates for certain age groups from 2014 to 2016, but also assumed that death rates for most age groups would decline from the assumed rates for 2017. E.g., here is a table showing the projected deaths in the Census population projections (released earlier this year) for the year ended 6/30/2017 compared to the NCHS data for deaths for calendar year 2016.

| Age Group | Census 2017 Projections 7/1/15-6/30/17 | NCHS 2016 (Calendar Year) | Difference |

|---|---|---|---|

| <1 | 39,741 | 23,161 | 16,580 |

| 1-4 | 8,482 | 4,045 | 4,437 |

| 5-9 | 2,422 | 2,490 | -68 |

| 10-14 | 2,883 | 3,013 | -130 |

| 15-24 | 23,543 | 32,575 | -9,032 |

| 25-34 | 43,981 | 57,616 | -13,635 |

| 35-44 | 62,599 | 77,792 | -15,193 |

| 45=54 | 151,976 | 173,516 | -21,540 |

| 55-64 | 330,420 | 366,445 | -36,025 |

| 65-74 | 493,422 | 512,080 | -18,658 |

| 75-84 | 619,610 | 636,916 | -17,306 |

| >85 | 909,723 | 854,462 | 55,261 |

| N/A | 137 | -137 | |

| Total | 2,688,802 | 2,744,248 | -55,446 |

Note that the latest Census population projections were dramatically too high for infant deaths (they made a mistake) and too high for the very elderly, but way too low for the 15-84 year old groups.

Here is another table comparing the death assumptions in the latest Census population projection to NCHS data.

| Census 2017 Projections 12 month period ended 6/30 | NCHS Calendar Year | |

|---|---|---|

| 2016 | 2,744,248 | |

| 2017 | 2,688,802 | 2,821,379* |

| 2018 | 2,717,297 | |

| 2019 | 2,744,661 | |

| 2020 | 2,772,160 |

If death rates by age were to move back down to 2016 levels from 2018 to 2020, then deaths from 2018 to 2020 would cumulatively be about 260,000 higher than those in the Census’ latest projection. However, deaths of 15-84 year olds would be whopping 496,000 higher over this three year period than what is shown in the Census’ latest projections, while deaths of 85 year olds and older would be about 180,000 fewer. These are actually fairly large number.

Net, the latest provisional data on US deaths is bad news from a societal perspective. They also indicate that the latest Census population projections are of limited usefulness, and analysts relying on population projection to forecast other key variables must actually produce their own population projections based on reasonable assessments of population growth’s key drivers – births, deaths, and net international migration – the latter of which is an even thornier issue, which I won’t touch on today.

Sometime in the near future I will produce updated population projections by age incorporating the recently release “Vintage 2017” estimates, more realistic death assumptions, and different scenarios for net international migration.

Q2 GDP Forecasts

by Calculated Risk on 5/25/2018 11:18:00 AM

From Merrill Lynch:

On balance, today's data added a tenth to 2Q GDP tracking, to 3.5% qoq saar [May 25 estimate].From Goldman Sachs:

emphasis added

[W]e are lowering our Q2 GDP tracking estimate by one tenth to +3.4% (qoq ar). [May 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.0 percent on May 25, down from 4.1 percent on May 16. [May 25 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.0% for 2018:Q2. [May 25 estimate]CR Note: These early estimates suggest real annualized GDP in the 3% to 4% in Q2.

Fed Chair Powell: "Financial Stability and Central Bank Transparency"

by Calculated Risk on 5/25/2018 09:30:00 AM

An excerpt from Fed Chair Jerome Powell's comments at "350 years of Central Banking: The Past, the Present and the Future," in Stockholm, Sweden: Financial Stability and Central Bank Transparency

The post-crisis framework remains novel and unfamiliar. Some of these new policies, such as stress testing and resolution planning, are inherently complex and challenging for all involved. As a result, transparency and accountability around financial stability tools present particular challenges. We will continue to strive to find better ways to enhance transparency around our approach to preserving financial stability. Efforts to engage with the public‑‑including consumer groups, academics, and the financial sector‑‑are likely to lead to improved policies. Moreover, ongoing dialogue will work to enhance public trust, as well as our ability to adapt to new threats as they emerge.

There is every reason to expect that technology and communications will continue to rapidly evolve, and to affect the financial system and financial stability in ways that we cannot fully anticipate. While future innovations may well improve the delivery of financial services and make the system stronger, they may also contain the seeds of potential future systemic vulnerabilities. We will need to keep up with the pace of innovation, which will doubtless require changes to our approach to financial stability. As we consider such changes, it will remain critically important to provide transparency and accountability. By doing so, we strengthen the foundation of democratic legitimacy that enables central banks to serve the needs of our citizens, in the long and proud tradition of the Riksbank.

Thursday, May 24, 2018

Friday: Durable Goods

by Calculated Risk on 5/24/2018 08:43:00 PM

Friday:

• At 8:30 AM, Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.3% decrease in durable goods orders.

• At 9:20 AM, Panel Discussion, Fed Chair Jerome Powell, Financial Stability and Central Bank Transparency, At the Sveriges Riksbank Conference: 350 Years of Central Banking--The Past, The Present and The Future, Stockholm, Sweden

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 99.0, up from 98.8.

Housing Inventory Tracking

by Calculated Risk on 5/24/2018 03:59:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Here is a table from housing economist Tom Lawler showing the year-over-year (YoY) change for National inventory from the NAR, and the YoY change for California from the CAR.

It appears the YoY declines are slowing nationally, and inventory has started to increase YoY in California.

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

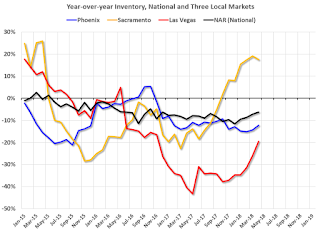

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento (through April), and also total existing home inventory as reported by the NAR (also through April 2018).

Click on graph for larger image.

Click on graph for larger image.This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 18% year-over-year in April (inventory was still very low), and has increased year-over-year for seven consecutive months.

Also note that inventory is still down in Las Vegas (red), but the YoY decline has been getting smaller.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory to be up YoY by the end of 2018 (but still be low).

A Few Comments on April Existing Home Sales

by Calculated Risk on 5/24/2018 01:08:00 PM

Earlier: NAR: "Existing-Home Sales Slide 2.5 Percent in April"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in April.

2) Inventory is still very low and falling year-over-year (YoY) with inventory down 6.3% year-over-year in March). This was the 35th consecutive month with a year-over-year decline in inventory, however the YoY declines have been getting smaller. And some areas of the country are now reporting YoY increases in inventory.

More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

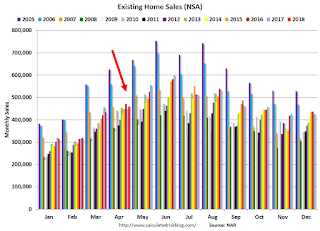

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in April (460,000, red column) were above sales in April 2017 (447,000, NSA).

Sales NSA through April are down about 1% from the same period in 2017.

This is a small decline - and it is too early to tell if there is an impact from higher interest rates and / or the changes to the tax law on home sales.

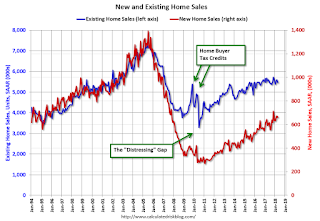

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity "Continued to Expand Rapidly" in May

by Calculated Risk on 5/24/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Expand Rapidly

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand at a rapid pace, and optimism remained high for future activity.So far all of the regional Fed surveys have shown strong growth in May.

“Our composite index rose to another record high in May, with continued optimism for future growth,” said Wilkerson. “Prices indexes were stable but remained at high levels.”

...

The month-over-month composite index was 29 in May, up from readings of 26 in April and 17 in March. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity increased at both durable and nondurable goods plants, particularly at nondurable plants producing chemicals and food. Most month-over-month indexes continued to rise. The production index jumped from 33 to 41, and the shipments, new orders, and new orders for exports indexes also moved higher. In contrast, the order backlog and employment indexes eased somewhat. The raw materials inventory index edged up from 17 to 19, and the finished goods inventory index also increased.

emphasis added

NAR: "Existing-Home Sales Slide 2.5 Percent in April"

by Calculated Risk on 5/24/2018 10:09:00 AM

From the NAR: Existing-Home Sales Slide 2.5 Percent in April

After moving upward for two straight months, existing-home sales retreated in April on both a monthly and annualized basis, according to the National Association of Realtors®. All four major regions saw no gain in sales activity last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 2.5 percent to a seasonally adjusted annual rate of 5.46 million in April from 5.60 million in March. With last month’s decline, sales are now 1.4 percent below a year ago and have fallen year-over-year for two straight months.

...

Total housing inventory at the end of April increased 9.8 percent to 1.80 million existing homes available for sale, but is still 6.3 percent lower than a year ago (1.92 million) and has fallen year-over-year for 35 consecutive months. Unsold inventory is at a 4.0-month supply at the current sales pace (4.2 months a year ago).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.46 million SAAR) were 2.5% lower than last month, and were 1.4% below the April 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.80 million in April from 1.67 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

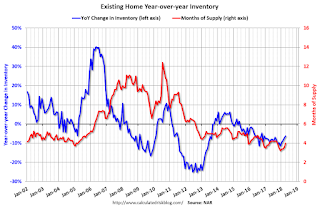

According to the NAR, inventory increased to 1.80 million in April from 1.67 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.3% year-over-year in April compared to April 2017.

Inventory decreased 6.3% year-over-year in April compared to April 2017. Months of supply was at 4.0 months in April.

Sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increase to 234,000

by Calculated Risk on 5/24/2018 08:33:00 AM

The DOL reported:

In the week ending May 19, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 219,750, an increase of 6,250 from the previous week's revised average. The previous week's average was revised up by 250 from 213,250 to 213,500.The previous week was revised up.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 219,750.

This was higher than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, May 23, 2018

Thursday: Unemployment Claims, Existing Home Sales

by Calculated Risk on 5/23/2018 08:31:00 PM

Thursday:

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, down from 222 thousand the previous week.

• At 9:00 AM: FHFA House Price Index for March 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.60 million SAAR, unchanged from 5.60 million in March. Housing economist Tom Lawler estimates the NAR will reports sales of 5.48 million SAAR for April.

• At 11:00 AM: the Kansas City Fed manufacturing survey for May.

Philly Fed: State Coincident Indexes increased in 45 states in April

by Calculated Risk on 5/23/2018 06:31:00 PM

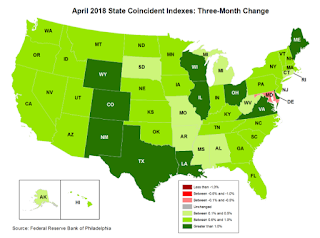

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2018. Over the past three months, the indexes increased in 49 states and decreased in one, for a three-month diffusion index of 96. In the past month, the indexes increased in 45 states, decreased in one, and remained stable in four, for a one-month diffusion index of 88.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Once again, the map is almost all green on a three month basis.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In April, 48 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Black Knight: National Mortgage Delinquency Rate Decreased in April, Foreclosure Inventory Lowest since August 2006

by Calculated Risk on 5/23/2018 02:38:00 PM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Buck Upward Seasonal Trend in April, Fall to Second Lowest Point in 12 Years

• Historically, mortgage delinquencies have risen 85 percent of the time in April; this month they declined 1.6 percent – about equal to the size of their average usual increaseAccording to Black Knight's First Look report for April, the percent of loans delinquent decreased 1.6% in April compared to March, and decreased 10.2% year-over-year.

• April’s improvement halted a seven-month trend of annual increases in the national delinquency rate

• Areas impacted by Hurricanes Harvey and Irma led April’s delinquency improvement, but slight declines were seen in non-affected areas as well

• Over 90,000 seriously delinquent mortgages (90 or more days past due) attributed to the 2017 hurricane season remain in affected areas of Texas, Florida and Georgia

• The number of mortgages in active foreclosure hit its lowest point since August 2006

The percent of loans in the foreclosure process decreased 2.3% in April and were down 28.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.67% in April, down from 3.73% in March.

The percent of loans in the foreclosure process decreased in April to 0.61%.

The number of delinquent properties, but not in foreclosure, is down 187,000 properties year-over-year, and the number of properties in the foreclosure process is down 119,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2018 | Mar 2018 | Apr 2017 | Apr 2016 | |

| Delinquent | 3.67% | 3.73% | 4.08% | 4.24% |

| In Foreclosure | 0.61% | 0.63% | 0.85% | 1.17% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,885,000 | 1,912,000 | 2,072,000 | 2,146,000 |

| Number of properties in foreclosure pre-sale inventory: | 314,000 | 321,000 | 433,000 | 820,000 |

| Total Properties | 2,199,000 | 2,232,000 | 2,505,000 | 2,741,000 |

FOMC Minutes: "A temporary period of inflation modestly above 2 percent would be consistent with inflation objective"

by Calculated Risk on 5/23/2018 02:14:00 PM

Still on pace for 3 or 4 rate hikes in 2018. Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, May 1-2, 2018:

With regard to the medium-term outlook for monetary policy, all participants reaffirmed that adjustments to the path for the policy rate would depend on their assessments of the evolution of the economic outlook and risks to the outlook relative to the Committee's statutory objectives. Participants generally agreed with the assessment that continuing to raise the target range for the federal funds rate gradually would likely be appropriate if the economy evolves about as expected. These participants commented that this gradual approach was most likely to be conducive to maintaining strong labor market conditions and achieving the symmetric 2 percent inflation objective on a sustained basis without resulting in conditions that would eventually require an abrupt policy tightening. A few participants commented that recent news on inflation, against a background of continued prospects for a solid pace of economic growth, supported the view that inflation on a 12-month basis would likely move slightly above the Committee's 2 percent objective for a time. It was also noted that a temporary period of inflation modestly above 2 percent would be consistent with the Committee's symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective.

emphasis added

A few Comments on April New Home Sales

by Calculated Risk on 5/23/2018 11:59:00 AM

New home sales for April were reported at 662,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months were revised down.

Sales in April were up 11.6% year-over-year compared to April 2017, however, this was a fairly easy comparison.

Earlier: New Home Sales decrease to 662,000 Annual Rate in April.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 7.2% through April compared to the same period in 2017. Decent growth so far, and the next four months will also be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors.

AIA: "Architecture Firm Billings Strengthen in April"

by Calculated Risk on 5/23/2018 11:11:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Firm Billings Strengthen in April

The American Institute of Architects (AIA) is reporting today that architecture firm billings rose for the seventh consecutive month, with the pace of growth in April increasing modestly from March.

Overall, the AIA’s Architecture Billings Index (ABI) score for April was 52.0 (any score over 50 is billings growth), which indicates the business environment continues to be healthy for architecture firms despite continued labor shortages, growing inflation in building materials costs and rising interest rates. The ABI also revealed that business conditions remained strong at firms located in the West, while billings softened slightly at Midwest firms.

“While there was slower growth in April for new project work coming into architecture firms, business conditions have remained healthy for the first four months of the year,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Although growth in regional design activity was concentrated at firms in the sunbelt, there was balanced growth so far this year across all major construction sectors.”

...

• Regional averages: West (55.1), Midwest (49.6), South (51.8), Northeast (50.3)

• Sector index breakdown: multi-family residential (50.7), institutional (52.0), commercial/industrial (52.7), mixed practice (50.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in April, up from 51.0 in March. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018.

New Home Sales decrease to 662,000 Annual Rate in April

by Calculated Risk on 5/23/2018 10:16:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 662 thousand.

The previous three months were revised down, combined.

"Sales of new single-family houses in April 2018 were at a seasonally adjusted annual rate of 662,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent below the revised March rate of 672,000, but is 11.6 percent above the April 2017 estimate of 593,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 5.4 months from 5.3 months in March.

The months of supply increased in April to 5.4 months from 5.3 months in March. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April was 300,000. This represents a supply of 5.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2018 (red column), 64 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in April.

The all time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was below expectations of 677,000 sales SAAR, and the previous months were revised down. I'll have more later today.