by Calculated Risk on 4/30/2017 08:50:00 PM

Sunday, April 30, 2017

Monday: Personal Income and Outlays, ISM Mfg Survey, Construction Spending

Weekend:

• Schedule for Week of Apr 30, 2017

Monday:

• At 8:30 AM ET, Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to be unchanged.

• At 10:00 AM, ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March. The ISM manufacturing index indicated expansion at 57.2% in March. The employment index was at 58.9%, and the new orders index was at 64.5%.

• Also at 10:00 AM, Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $49.22 per barrel and Brent at $51.91 per barrel. A year ago, WTI was at $46, and Brent was at $46 - so oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.38 per gallon - a year ago prices were at $2.23 per gallon - so gasoline prices are up about 15 cents a gallon year-over-year.

April 2017: Unofficial Problem Bank list declines to 151 Institutions

by Calculated Risk on 4/30/2017 10:26:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2017. During the month, the list dropped from 151 to 148 institutions after four removals and one addition. Aggregate assets fell by $5.2 billion to $36.1 billion. A year ago, the list held 223 institutions with assets of $64.6 billion.

Actions were terminated against The Heritage Bank, Hinesville, GA ($542 million); The Bank of Commerce, Sarasota, FL ($183 million); and Peoples National Bank, Niceville, FL ($103 million).

This Friday, the FDIC closed a bank for the fourth time this year shuttering First NBC Bank, New Orleans, LA ($4.7 billion). This is the largest failure since the $5.9 billion Doral Bank, San Juan, PR on February 27, 2015. Since the on-set of the Great Recession in 2007, 525 insured institutions with assets of $749 billion have failed with resolution costs of $96.3 billion.

The addition this month was Admirals Bank, Boston, MA ($323 million). Also, the FDIC issued a deposit insurance termination action against Builders Bank, Chicago, IL ($41 million).

Saturday, April 29, 2017

Schedule for Week of Apr 30, 2017

by Calculated Risk on 4/29/2017 08:12:00 AM

The key report this week is the April employment report on Friday.

Other key indicators include the April ISM manufacturing and non-manufacturing indexes, April auto sales, and the March Trade Deficit.

8:30 AM: Personal Income and Outlays for March. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to be unchanged.

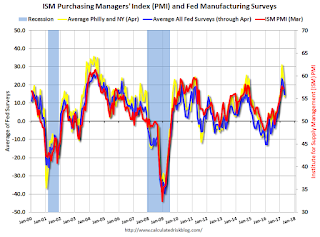

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 56.5, down from 57.2 in March.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 57.2% in March. The employment index was at 58.9%, and the new orders index was at 64.5%.

10:00 AM: Construction Spending for March. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.2 million SAAR in April, from 16.6 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to increase to 17.2 million SAAR in April, from 16.6 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the March sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in April, down from 263,000 added in March.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to increase to 55.8 from 55.2 in March.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, down from 257 thousand the previous week.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through January. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.5 billion in March from $43.6 billion in February.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is a 0.4% increase in orders.

8:30 AM: Employment Report for April. The consensus is for an increase of 185,000 non-farm payroll jobs added in April, up from the 98,000 non-farm payroll jobs added in March.

The consensus is for the unemployment rate to increase to 4.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 2.13 million jobs.

A key will be the change in wages.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.6 billion increase in credit.

Friday, April 28, 2017

Goldman: U.S. Economy "now at full employment"

by Calculated Risk on 4/28/2017 10:03:00 PM

A few excerpts from a note by Goldman Sachs economists Jan Hatzius and Daan Struyven:

On a broad range of measures, the US economy is now at full employment. Headline unemployment has fallen below most estimates of the structural rate, the discouraged worker share is back to pre-recession lows, and the still somewhat elevated share of involuntary part-timers is arguably structural.

And while the employment/population ratio remains well below its pre-recession level, the gap is fully explained by a combination of population aging and declining participation of prime-age men. This trend among prime-age men has continued for over six decades, has not stood in the way of a strong recent wage acceleration in that demographic, and therefore looks structural.

...

Job growth remains well above the pace needed to stabilize unemployment. The speed of the likely overshoot is comparable to the average postwar cycle, and we have lowered our end-2018 unemployment rate forecast to 4.1% from 4.3% prior.

emphasis added

Fannie Mae: Mortgage Serious Delinquency rate declined in March, Lowest since Feb 2008

by Calculated Risk on 4/28/2017 06:36:00 PM

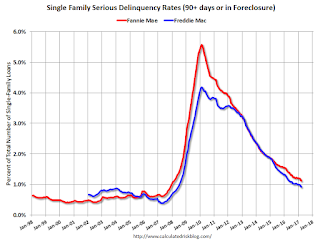

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.12% in March, from 1.19% in February. The serious delinquency rate is down from 1.44% in March 2016.

This is the lowest serious delinquency rate since February 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.32 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until this Summer.

Note: Freddie Mac reported earlier.

Oil: "Yet another strong week" for Rig Count

by Calculated Risk on 4/28/2017 03:26:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 28, 2017:

• Total US oil rigs were up 9 to 697

• US horizontal oil rigs surged at twice the ‘call’ pace, up 11 to 592

• Next week, horizontal oil rigs will reach the full ‘call’ analysts have penciled in for this cycle.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Chicago PMI increases in April

by Calculated Risk on 4/28/2017 01:33:00 PM

Earlier, the Chicago PMI: April Chicago Business Barometer at 58.3 vs 57.7 in March

The MNI Chicago Business Barometer increased to 58.3 in April from 57.7 in March, the highest level since January 2015.This was above the consensus forecast of 56.5.

“The April Chicago report showcased another impressive month, with firms reporting solid growth. Rising demand and firm production led to a pick-up in hiring by firms. Although the employment indicator has been bumpy, in and out of contraction, if the current month’s rise is sustained, it could provide a boost to the labor market,” said Shaily Mittal, senior economist at MNI Indicators.

emphasis added

Q1 GDP: Investment

by Calculated Risk on 4/28/2017 09:59:00 AM

First, the soft Q1 GDP data is part of a recent trend of weak first quarters, and was mostly due to weak PCE and inventory adjustment - no worries. It was pretty clear that PCE would be weak in Q1 (see two-month method). However investment was solid.

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased at a 13.7% annual rate in Q1. Equipment investment increased at a 9.1% annual rate, and investment in non-residential structures increased at a 22.1% annual rate.

On a 3 quarter trailing average basis, RI (red) is unchanged, equipment (green) is also unchanged, and nonresidential structures (blue) is slightly positive.

I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward, and for the economy to continue to grow.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has generally been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Still no worries.

BEA: Real GDP increased at 0.7% Annualized Rate in Q1

by Calculated Risk on 4/28/2017 08:34:00 AM

From the BEA: Gross Domestic Product: First Quarter 2017 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 0.7 percent in the first quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2016, real GDP increased 2.1 percent.The advance Q1 GDP report, with 0.7% annualized growth, was below expectations of a 1.1% increase.

...

The increase in real GDP in the first quarter reflected positive contributions from nonresidential fixed investment, exports, residential fixed investment, and personal consumption expenditures (PCE), that were offset by negative contributions from private inventory investment, state and local government spending, and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased

The deceleration in real GDP in the first quarter reflected a deceleration in PCE and downturns in private inventory investment and in state and local government spending that were partly offset by an upturn in exports and accelerations in both nonresidential and residential fixed investment.

emphasis added

Personal consumption expenditures (PCE) only increased at a 0.3% annualized rate in Q1, down from 3.5% in Q4. Residential investment (RI) increased at a 13.7% pace. Equipment investment increased at a 9.1% annualized rate, and investment in non-residential structures decreased at a 22.1% pace.

I'll have more later ...

Thursday, April 27, 2017

Friday: GDP, Chicago PMI

by Calculated Risk on 4/27/2017 08:23:00 PM

From the Altanta Fed: GDPNow

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2017 is 0.2 percent on April 27, down from 0.5 percent on April 18. The forecast of first-quarter real consumer spending growth fell from 0.3 percent to 0.1 percent after yesterday's annual retail trade revision by the U.S. Census Bureau. The forecast of the contribution of inventory investment to first-quarter growth declined from -0.76 percentage points to -1.11 percentage points after this morning's advance reports on durable manufacturing and wholesale and retail inventories from the Census Bureau. The forecast of real equipment investment growth increased from 5.5 percent to 6.6 percent after the durable manufacturing report and the incorporation of previously published data on light truck sales to businesses from the U.S. Bureau of Economic Analysis.From the NY Fed Nowcasting Report

emphasis added

The FRBNY Staff Nowcast stands at 2.7% for 2017:Q1 and 2.1% for 2017:Q2.Friday:

Mixed news from this week's data releases left the nowcast for Q1 and Q2 essentially unchanged.

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2017 (Advance estimate). The consensus is that real GDP increased 1.1% annualized in Q1.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 56.5, down from 57.7 in March.

• At 10:00 AM, <University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 98.0, unchanged from the preliminary reading 98.0.

HVS: Q1 2017 Homeownership and Vacancy Rates

by Calculated Risk on 4/27/2017 01:40:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2017.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.6% in Q1, from 63.7% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate is probably close to the bottom.

Kansas City Fed: Regional Manufacturing Activity "Expanded at Slow Pace" in April

by Calculated Risk on 4/27/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded at a Slower Pace

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a slower pace with solid expectations for future activity.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding again.

“We came down a bit from the rapid growth rate of the past two months,” said Wilkerson. “But firms still reported a good increase in activity and expected this to continue.”

...

The month-over-month composite index was 7 in April, down from the very strong readings of 20 in March and 14 in February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity in both durable and nondurable goods plants eased slightly, particularly for metals, machinery, food, and plastic products. Most month-over-month indexes expanded at a slower pace in April. The production, shipments, and new orders indexes fell but remained positive, and the employment index edged lower from 13 to 9. In contrast, the new orders for exports index increased from 2 to 4. Both inventory indexes fell moderately after rising the past two months.

emphasis added

This was the last of the regional Fed surveys for April.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

It seems likely the ISM manufacturing index will decline in April, but still show solid expansion (to be released next week).

NAR: Pending Home Sales Index decreased 0.8% in March, up 0.8% year-over-year

by Calculated Risk on 4/27/2017 10:00:00 AM

From the NAR: Pending Home Sale Dip 0.8% in March

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 0.8 percent to 111.4 in March from 112.3 in February. Despite last month's decrease, the index is 0.8 percent above a year ago.This was below expectations of a 0.4% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in April and May.

...

The PHSI in the Northeast decreased 2.9 percent to 99.1 in March, but is still 1.8 percent above a year ago. In the Midwest the index declined 1.2 percent to 109.6 in March, and is now 2.4 percent lower than March 2016.

Pending home sales in the South rose 1.2 percent to an index of 129.4 in March and are now 3.9 percent above last March. The index in the West fell 2.9 percent in March to 94.5, and is now 2.7 percent below a year ago.

emphasis added

Weekly Initial Unemployment Claims increase to 257,000

by Calculated Risk on 4/27/2017 08:33:00 AM

The DOL reported:

In the week ending April 22, the advance figure for seasonally adjusted initial claims was 257,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 244,000 to 243,000. The 4-week moving average was 242,250, a decrease of 500 from the previous week's revised average. The previous week's average was revised down by 250 from 243,000 to 242,750.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 242,250.

This was above the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, April 26, 2017

Thursday: Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 4/26/2017 08:59:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, down from 244 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 0.4% decrease in the index.

• Also at 10:00 AM, the Q1 2017 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for April. This is the last of the regional Fed surveys for April.

Freddie Mac: Mortgage Serious Delinquency rate declined in March, Lowest since May 2008

by Calculated Risk on 4/26/2017 05:14:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in March was at 0.92%, down from 0.98% in February. Freddie's rate is down from 1.20% in March 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate since May 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.4 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report soon.

Philly Fed: State Coincident Indexes increased in 45 states in March

by Calculated Risk on 4/26/2017 01:40:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2017. Over the past three months, the indexes increased in 45 states, decreased in three, and remained stable in two, for a three-month diffusion index of 84. In the past month, the indexes increased in 45 states and decreased in five, for a one-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In March 45states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and almost all green now.Source: Philly Fed. Note: For complaints about red / green issues, please contact the Philly Fed.

New Home Prices

by Calculated Risk on 4/26/2017 11:02:00 AM

As part of the new home sales report, the Census Bureau reported the number of homes sold by price and the average and median prices.

From the Census Bureau: "The median sales price of new houses sold in March 2017 was $315,100. The average sales price was $388,200."

The following graph shows the median and average new home prices.

During the housing bust, the builders had to build smaller and less expensive homes to compete with all the distressed sales. When housing started to recovery - with limited finished lots in recovering areas - builders moved to higher price points to maximize profits.

The average price in March 2017 was $388,200, and the median price was $315,100. Both are above the bubble high (this is due to both a change in mix and rising prices).

The second graph shows the percent of new homes sold by price.

The $400K+ bracket has increased significantly. I'll break that bracket up in the future.

A majority of new home in the U.S. are in the $200K to $400K range.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 4/26/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Surve

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 21, 2017.

... The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 0.1 percent compared with the previous week and was 0.4 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.20 percent, from 4.22 percent, with points increasing to 0.37 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity increased last week as rates declined, but remains low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up slightly year-over-year.

Tuesday, April 25, 2017

Zillow Forecast: "The national Case-Shiller index is projected to climb 5.9 percent year-over-year in March"

by Calculated Risk on 4/25/2017 08:39:00 PM

The Case-Shiller house price indexes for February were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: March Case-Shiller Forecast: The Home Price Party Rages On

Home prices are expected to continue to climb in March, but the pace of month-over-month growth is expected to slow, according to Zillow’s March Case-Shiller forecast.The year-over-year change for the Case-Shiller national index will probably increase in March.

The national Case-Shiller index is projected to climb 5.9 percent year-over-year in March, following a 5.8 percent gain in February. Month-to-month, the national index is expected to be up a seasonally adjusted 0.3 percent in March, following a 0.4 percent monthly gain in February.

Annual growth in the smaller 10- and 20-city indices is also expected to slow slightly: The 10-city forecast is for a 5.1 percent gain in annual growth for March, following 5.2 percent annual growth in February. And the 20-city index is projected to gain 5.7 percent in March, below its 5.9 percent annual gain in February.

The 10-city index is forecast to climb a seasonally adjusted 0.7 percent in March from February, following 0.6 percent monthly growth between January and February. Growth in the 20-city index is expected to hold steady on a seasonally adjusted, month-over-month basis, rising 0.7 percent in March as it did in February.

Zillow’s March Case-Shiller forecast is shown below. These forecasts are based on today’s February Case-Shiller data release and the March 2017 Zillow Home Value Index. The March S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, May 30.

Real House Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/25/2017 05:09:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.8% year-over-year in February

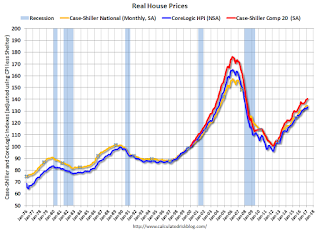

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 2.1% above the previous bubble peak. However, in real terms, the National index (SA) is still about 14.4% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In February, the index was up 5.8% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels, and the CoreLogic index (NSA) is back to September 2005.

Real House Prices

In real terms, the National index is back to April 2004 levels, the Composite 20 index is back to December 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, the Composite 20 index is back to August 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 / early 2004 - and the price-to-rent ratio maybe moving a little more sideways now.

Chemical Activity Barometer increases in April

by Calculated Risk on 4/25/2017 02:41:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Economic Indicator Marks Strong Opening to Second Quarter; Up More Than Five Percent Over Last Year

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), marked the second quarter by posting a robust 5.6 percent year-over-year gain, suggesting continued growth through year-end 2017.

The barometer posted a 0.4 percent gain in April, following three successive months of upward revisions to the monthly data. All data is measured on a three-month moving average (3MMA). On an unadjusted basis the CAB climbed 0.2 percent in April.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production in 2017.

A few Comments on March New Home Sales

by Calculated Risk on 4/25/2017 11:59:00 AM

New home sales for March were reported at 621,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the three previous months combined were revised up significantly. This was a strong report.

Sales were up 15.6% year-over-year in March. However, January, February and March were the weakest months last year on a seasonally adjusted annual rate basis - so this was an easy comparison.

So far the increase in mortgage rates has not negatively impacted new home sales.

Earlier: New Home Sales increase to 621,000 Annual Rate in March.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 15.6% year-over-year in March.

For the first three months of 2017, new home sales are up 12.0% compared to the same period in 2016.

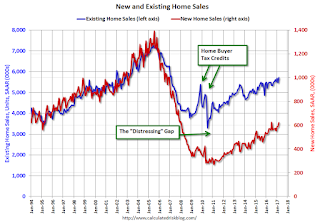

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 621,000 Annual Rate in March

by Calculated Risk on 4/25/2017 10:16:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 621 thousand.

The previous three months combined were revised up significantly.

"Sales of new single-family houses in March 2017 were at a seasonally adjusted annual rate of 621,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.8 percent above the revised February rate of 587,000 and is 15.6 percent above the March 2016 estimate of 537,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply declined in March to 5.2 months.

The months of supply declined in March to 5.2 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of March was 268,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2017 (red column), 58 thousand new homes were sold (NSA). Last year, 50 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was above expectations of 584,000 sales SAAR. I'll have more later today.

Case-Shiller: National House Price Index increased 5.8% year-over-year in February

by Calculated Risk on 4/25/2017 09:17:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P Corelogic Case-Shiller National Home Price NSA Index Sets Fourth Consecutive All-Time High

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.8% annual gain in February, up from 5.6% last month and setting a 32-month high. The 10-City Composite posted a 5.2% annual increase, up from 5.0% the previous month. The 20-City Composite reported a year-over-year gain of 5.9%, up from 5.7% in January.

Seattle, Portland, and Dallas reported the highest year-over-year gains among the 20 cities. In February, Seattle led the way with a 12.2% year-over-year price increase, followed by Portland with 9.7%. Dallas replaced Denver in the top three with an 8.8% increase. Fifteen cities reported greater price increases in the year ending February 2017 versus the year ending January 2017

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in February. The 10-City Composite posted a 0.3% increase, and the 20-City Composite reported a 0.4% increase in February. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase. The 10-City Composite posted a 0.6% increase and the 20-City Composite reported a 0.7% month-over-month increase. Sixteen of 20 cities reported increases in February before seasonal adjustment; after seasonal adjustment, 19 cities saw prices rise

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 7.2% from the peak, and up 0.6% in February (SA).

The Composite 20 index is off 4.8% from the peak, and up 0.7% (SA) in February.

The National index is 2.1% above the bubble peak (SA), and up 0.4% (SA) in February. The National index is up 38.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.1% compared to February 2016. The Composite 20 SA is up 5.8% year-over-year.

The National index SA is up 5.7% year-over-year.

Note: According to the data, prices increased in all 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, April 24, 2017

Tuesday: New Home Sales, Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 4/24/2017 08:03:00 PM

From Bloomberg: Trump Said to Plan 20% Tariff on Canadian Softwood Lumber

U.S. President Donald Trump said Monday he would impose a 20 percent tariff on Canadian softwood lumber, according to a White House official and two people present when he made the comment at a reception for conservative journalists.This would negatively impact homebuilders.

Tuesday:

• At 9:00 AM ET, FHFA House Price Index for February 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices. The consensus is for a 5.8% year-over-year increase in the Comp 20 index for February.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for a decrease in sales to 584 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 592 thousand in February.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2016

by Calculated Risk on 4/24/2017 02:28:00 PM

Three year ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

Last year I followed up with Largest 5-year Population Cohorts are now "20 to 24" and "25 to 29" and

U.S. Demographics: Ten most common ages in 2010, 2015, 2020, and 2030.

Note: For the impact on housing, also see: Demographics: Renting vs. Owning

Last week the Census Bureau released the population estimates for 2016, and I've updated the table from the previous post (replacing 2015 with 2016 data).

The table below shows the top 11 cohorts by size for 2010, 2016 (released this month), and Census Bureau projections for 2020 and 2030.

By the year 2020, 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

There will be plenty of "gray hairs" walking around in 2020 and 2030, but the key for the economy is the population in the prime working age group is now increasing.

This is very positive for housing and the economy.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2016 | 2020 | 2030 |

| 1 | 45 to 49 years | 25 to 29 years | 25 to 29 years | 35 to 39 years |

| 2 | 50 to 54 years | 20 to 24 years | 30 to 34 years | 40 to 44 years |

| 3 | 15 to 19 years | 55 to 59 years | 35 to 39 years | 30 to 34 years |

| 4 | 20 to 24 years | 50 to 54 years | Under 5 years | 25 to 29 years |

| 5 | 25 to 29 years | 30 to 34 years | 55 to 59 years | 5 to 9 years |

| 6 | 40 to 44 years | 15 to 19 years | 20 to 24 years | 10 to 14 years |

| 7 | 10 to 14 years | 45 to 49 years | 5 to 9 years | Under 5 years |

| 8 | 5 to 9 years | 35 to 39 years | 60 to 64 years | 15 to 19 years |

| 9 | Under 5 years | 10 to 14 years | 15 to 19 years | 20 to 24 years |

| 10 | 35 to 39 years | 5 to 9 years | 10 to 14 years | 45 to 49 years |

| 11 | 30 to 34 years | Under 5 years | 50 to 54 years | 50 to 54 years |

Click on graph for larger image.

This graph, based on the 2016 population estimate, shows the U.S. population by age in July 2016 according to the Census Bureau.

Note that the largest age groups are all in their mid-20s.

And below is a table showing the ten most common ages in 2010, 2016, 2020, and 2030 (projections are from the Census Bureau).

Note the younger baby boom generation dominated in 2010. By 2016 the millennials are taking over. And by 2020, the boomers are off the list.

My view is this is positive for both housing and the economy, especially in the 2020s.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2016 | 2020 | 2030 | |

| 1 | 50 | 25 | 29 | 39 |

| 2 | 49 | 26 | 30 | 40 |

| 3 | 20 | 24 | 28 | 38 |

| 4 | 19 | 27 | 27 | 37 |

| 5 | 47 | 23 | 31 | 36 |

| 6 | 46 | 56 | 26 | 35 |

| 7 | 48 | 55 | 32 | 41 |

| 8 | 51 | 22 | 25 | 30 |

| 9 | 18 | 52 | 35 | 34 |

| 10 | 52 | 28 | 34 | 33 |

Merrill: "Fed to take a breather"

by Calculated Risk on 4/24/2017 12:54:00 PM

The consensus view is that the Fed will hike two more times this year (probably in June and September), and then announce a changed to the balance sheet policy at the December FOMC meeting (slow down reinvestment). Merrill Lynch economists think that the Fed will move slower.

A few excerpts from a Merrill Lynch note today: Fed to take a breather

Two more hikes ... then balance sheet

Fed officials have been preparing the market for a change to the balance sheet policy. This is consistent with the Fed’s larger communication strategy – slowly hint at policy changes and test the market reaction. ... In our view, the Fed is still prioritizing interest rate normalization over the balance sheet. Moreover, we think that the Fed would like to bring rates to at least a range of 1.25 – 1.50% (two more hikes) before shrinking the balance sheet. We believe it is a tall order for the Fed to deliver two more hikes and change the balance sheet policy before yearend, leaving us to argue that balance sheet reduction is a story for early 2018.

June is a close call

Our expectation has been for the Fed to skip the June meeting and hike in September and December ... our central scenario is as follows. June: the data are not quite strong enough to pull the trigger and the Fed hints at a later date for changing the balance sheet policy. September: the Fed hikes and offers more details on the reinvestment policy. December: another hike and a formal plan for the balance sheet is released. March: they announce the change to balance sheet policy in the statement, effective April [2018]

Dallas Fed: "Texas Manufacturing Expansion Continues" in April

by Calculated Risk on 4/24/2017 10:54:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity increased for the 10th consecutive month in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, moved down three points to 15.4, suggesting output growth continued but at a slightly slower pace this month.Based on the regional surveys released so far, it appears the ISM index will be solid again in April - but down from March.

Other measures of current manufacturing activity also indicated continued expansion in April. The survey’s demand indicators saw upward movement, with the new orders and growth rate of orders indexes edging up to 11.5 and 5.1, respectively. The shipments index also moved up, rising three points to 9.5. The capacity utilization index fell slightly but stayed positive for a 10th month in a row, coming in at 11.5.

Perceptions of broader business conditions improved again. The general business activity index held steady at 16.8, and the company outlook index inched down but remained positive at 15.1. Labor market measures indicated employment gains and longer workweeks in April. The employment index posted a fourth consecutive positive reading and remained unchanged at 8.5. Eighteen percent of firms noted net hiring, compared with 9 percent noting net layoffs. The hours worked index fell three points to 5.9.

Chicago Fed "Slower Economic Growth in March"

by Calculated Risk on 4/24/2017 09:42:00 AM

From the Chicago Fed: Chicago Fed National Activity Index Points to Slower Economic Growth in March

Led by slower growth in employment-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to +0.08 in March from +0.27 in February. Two of the four broad categories of indicators that make up the index decreased from February, and one category made a negative contribution to the index in March. The index’s three-month moving average, CFNAI-MA3, decreased to +0.03 in March from +0.16 in February, but remained positive for the fourth consecutive month.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat above the historical trend in March (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Black Knight: House Price Index up 0.8% in February, Up 5.7% year-over-year

by Calculated Risk on 4/24/2017 07:00:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: U.S. Home Prices Hit New Peak in February, Rising 0.8 Percent for the Month, Up 5.7 Percent Year-Over-Year

• Nationally, home prices rose 0.8% for the month and gained 5.7% on a year-over-year basisThe year-over-year increase in this index has been about the same for the last year.

• U.S. home prices hit a new, post-crisis high in February, with the national HPI hitting $268K, surpassing the previous peak set in June 2006

• February marked 58 consecutive months of annual national home price appreciation

• Home prices in six of the nation’s 20 largest states and 14 of the 40 largest metros hit new peaks in February

Note that house prices are just above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for February will be released tomorrow.

Sunday, April 23, 2017

Sunday Night Futures

by Calculated Risk on 4/23/2017 07:54:00 PM

Weekend:

• Schedule for Week of Apr 23, 2017

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for March. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 24 and DOW futures are up 187 (fair value) due to the outcome of the election in France (and early polls).

Oil prices were down over the last week with WTI futures at $49.83 per barrel and Brent at $52.27 per barrel. A year ago, WTI was at $43, and Brent was at $44 - so oil prices are up about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.42 per gallon - a year ago prices were at $2.14 per gallon - so gasoline prices are up about 28 cents a gallon year-over-year.

Vehicle Sales Forecast: Sales close to 17 Million SAAR in April

by Calculated Risk on 4/23/2017 01:01:00 PM

The automakers will report April vehicle sales on Tuesday, May 2nd.

Note: There were 26 selling days in April 2017, down from 27 in April 2016.

From WardsAuto: U.S. Forecast: Mild Sales, Growing Inventory

The report puts the seasonally adjusted annual rate of sales for the month at 17.1 million units, well above last month’s 16.5 million, but below year-ago’s 17.3 million.Looks like a decent month for vehicle sales, but overall sales are mostly moving sideways.

The monthly volume will be 3.1% below last year. Beyond one fewer selling day, Easter occurred in April this year, unlike 2016, possibly delaying sales for some shoppers in the second half of the month. ...

Sluggish sales in March left inventory levels high, with LV stock of 4.15 million units at month-end. The forecasted April inventory level sits at 4.16 million units, resulting in a fourth straight month above the 4 million mark. The only time this previously happened was in 2004, when five consecutive months surpassed that level. emphasis added

Saturday, April 22, 2017

Schedule for Week of Apr 23, 2017

by Calculated Risk on 4/22/2017 08:11:00 AM

The key economic reports this week are Q1 GDP and March New Home sales.

8:30 AM: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April.

9:00 AM: FHFA House Price Index for February 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.

9:00 AM ET: S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Comp 20 index for February.

10:00 AM ET: New Home Sales for March from the Census Bureau.

10:00 AM ET: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for a decrease in sales to 584 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 592 thousand in February.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 243 thousand initial claims, down from 244 thousand the previous week.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 0.4% decrease in the index.

10:00 AM: the Q1 2017 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for April. This is the last of the regional Fed surveys for April.

8:30 AM: Gross Domestic Product, 1st quarter 2017 (Advance estimate). The consensus is that real GDP increased 1.1% annualized in Q1.

9:45 AM: Chicago Purchasing Managers Index for April. The consensus is for a reading of 56.5, down from 57.7 in March.

10:00 AM: University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 98.0, unchanged from the preliminary reading 98.0.

Friday, April 21, 2017

OIl: Decent increase for Oil Rig Count

by Calculated Risk on 4/21/2017 05:34:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 21, 2017:

• Total US oil rigs were up 5 to 688

• US horizontal oil rigs added 9 to 581

...

• The US horizontal oil rig count is now within two weeks of the entire number necessary to cover the US contribution to incremental global oil supply.

• The market has clearly become jittery, and OPEC promises to extend production cuts are no longer comforting worried investors

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the evolution of the EIA's Short-Term Energy Outlook (STEO) production forecasts by month. The production outlook keeps increasing.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

BLS: March Unemployment Rates in Arkansas, Colorado, Maine and Oregon at New Series Lows

by Calculated Risk on 4/21/2017 03:05:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in March in 17 states and stable in 33 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eighteen states had jobless rate decreases from a year earlier, and 32 states and the District had little or no change. The national unemployment rate declined by 0.2 percentage point from February to 4.5 percent and was 0.5 point lower than in March 2016.

...

Colorado had the lowest unemployment rate in March, 2.6 percent, closely followed by Hawaii, 2.7 percent, and New Hampshire, North Dakota, and South Dakota, 2.8 percent each. The rates in Arkansas (3.6 percent), Colorado (2.6 percent), Maine (3.0 percent), and Oregon (3.8 percent) set new series lows. (All state series begin in 1976.) New Mexico had the highest jobless rate, 6.7 percent.

emphasis added

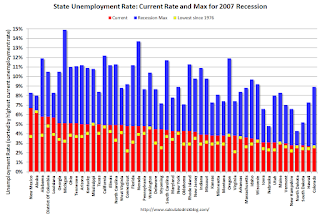

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. New Mexico, at 6.7%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only two states are at or above 6% (dark blue). The states are New Mexico (6.7%), and Alaska (6.4%).

Note: The series low for Alaska is 6.3% (almost a new low in Alaska too).

A Few Comments on March Existing Home Sales

by Calculated Risk on 4/21/2017 12:10:00 PM

Earlier: NAR: "Existing-Home Sales Jumped 4.4% in March"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in March

"I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.74 million in March"2) Warmer weather in February might have boosted sales for March and early April.

3) Inventory is still very low and falling year-over-year (down 6.6% year-over-year in March). More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

I expect inventory will be increasing year-over-year by the end of 2017.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in March (red column) were the highest for March since 2006 (NSA).

Note that sales NSA are now in the seasonally strong period (March through September).

NAR: "Existing-Home Sales Jumped 4.4% in March"

by Calculated Risk on 4/21/2017 10:09:00 AM

From the NAR: Existing-Home Sales Jumped 4.4% in March

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, ascended 4.4 percent to a seasonally adjusted annual rate of 5.71 million in March from a downwardly revised 5.47 million in February. March's sales pace is 5.9 percent above a year ago and surpasses January as the strongest month of sales since February 2007 (5.79 million).

Total housing inventory at the end of March increased 5.8 percent to 1.83 million existing homes available for sale, but is still 6.6 percent lower than a year ago (1.96 million) and has fallen year-over-year for 22 straight months. Unsold inventory is at a 3.8-month supply at the current sales pace (unchanged from February).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March (5.71 million SAAR) were 4.4% higher than last month, and were 5.9% above the March 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.83 million in March from 1.75 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.83 million in March from 1.75 million in February. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.6% year-over-year in March compared to March 2016.

Inventory decreased 6.6% year-over-year in March compared to March 2016. Months of supply was at 3.8 months in March.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...