by Calculated Risk on 5/31/2015 08:27:00 PM

Sunday, May 31, 2015

Monday: Personal Income and Outlays, ISM Mfg Index, Construction Spending

From Jim Hamilton at Econbrowser: Current economic conditions: not as bad as it sounds

The new BEA data also allow us to calculate an alternative estimate of GDP, building the estimate up from income data instead of expenditures. In terms of the underlying concepts, the income-based and expenditure-based calculations should produce the identical number for GDP. But because the data sources are different, in practice the two estimates differ, with the difference officially reported as a “statistical discrepancy.” While the expenditure-based GDP estimate showed a 0.7% decline at an annual rate, the income-based GDP estimate implied 1.4% growth for the first quarter. Moreover, using the statistical method for reconciling and combining the different estimates proposed by Aruoba, Diebold, Nalewaik, Schorfheide, and Song (ADNSS), the best estimate of first-quarter real GDP growth based on the existing data might be about 2%.No worries.

Monday:

• At 8:30 AM ET, Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April. The ISM manufacturing index indicated expansion at 51.5% in April. The employment index was at 48.3%, and the new orders index was at 53.5%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

Weekend:

• Schedule for Week of May 31, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 3 and DOW futures are up 36 (fair value).

Oil prices were down over the last week with WTI futures at $59.97 per barrel and Brent at $65.19 per barrel. A year ago, WTI was at $103, and Brent was at $108 - so, even with the recent increases, prices are down 40%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.75 per gallon (down about $0.90 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Hotels: Best April Ever

by Calculated Risk on 5/31/2015 09:54:00 AM

It looks like 2015 will be the best year ever for hotels (record occupancy and RevPAR).

It also looks like we are starting to see a pickup in supply growth (more rooms coming online). Most supply - in reaction to record demand - will eventually slow RevPAR growth, but will boost the economy by creating jobs.

Some interesting numbers from Jan Freitag at HotelNewsNow.com: Annualized occupancy at new high

1. A new number to report

April had the highest occupancy ever (66.8%) and the highest room demand (99.4 million rooms) ever.

This pushed annualized occupancy (measured as a 12-month moving average) up to 65%.

What does this mean? All key performance indicators (rooms available, rooms sold, revenue, average daily rate, occupancy and revenue per available room) are still at all-time highs.

...

Demand was 3 million rooms higher than last year, and supply was only 1.7 million roomnights higher. Ultimately that will change and the industry will sell less new rooms than build new rooms, but we do not expect that to happen until 2017.

3. This is the third consecutive month of +0.1% supply growth Supply growth hit 1.2% during the month. This is finally the acceleration of supply growth that we have been predicting after a slow 2014. Clearly there is momentum in the pipeline and the supply growth.

Saturday, May 30, 2015

May 2015: Unofficial Problem Bank list declines to 324 Institutions

by Calculated Risk on 5/30/2015 09:40:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2015. During the month, the list fell from 342 institutions to 324 after 17 removals. Assets dropped by $13.9 billion to an aggregate $91.2 billion. Asset figures were updated during the month with the release of q1 financials, which added $2.2 billion. A year ago, the list held 496 institutions with assets of $154.1 billion.

Actions were terminated against FirstBank Puerto Rico, Santurce, PR ($12.4 billion Ticker: FBP); The Talbot Bank of Easton, Maryland, Easton, MD ($591 million Ticker: SHBI); Naugatuck Valley Savings and Loan, Naugatuck, CT ($497 million Ticker: NVSL); Suburban Bank & Trust Company, Elmhurst, IL ($488 million); Sterling Federal Bank, F.S.B., Sterling, IL ($458 million); Bloomfield State Bank, Bloomfield, IN ($383 million); Newton Federal Bank, Covington, GA ($229 million); United Midwest Savings Bank, De Graff, OH ($175 million); Greeneville Federal Bank, FSB, Greeneville, TN ($146 million); Marathon Savings Bank, Wausau, WI ($145 million); Home Federal Savings and Loan Association of Collinsville, Collinsville, IL ($96 million); Heritage Bank of St Tammany, Covington, LA ($90 million); Ozark Heritage Bank, National Association, Mountain View, AR ($85 million); Home Bank of Arkansas, Portland, AR ($75 million); and Eastside Commercial Bank, National Association, Bellevue, WA ($32 million).

Other removals include the failed Edgebrook Bank, Chicago, IL ($95 million) and two banks that found merger partners -- The West Michigan Savings Bank, Bangor, MI ($36 million) and Lake County Bank, Saint Ignatius, MT ($32 million).

The FDIC terminated a Prompt Corrective Action order against United American Bank, San Mateo, CA ($286 million).

This past Wednesday, the FDIC released industry results for the first quarter of 2015 and an update on the Official Problem Bank List. The FDIC said the official list had fallen from 291 to 253 institutions and that assets had dropped from $86.7 billion to $60.3 billion. Thus, the institutions count fell by 13.1 percent and assets declined by 30.4 percent. The official list peaked at 888 institutions with assets of $397 billion, so it is not surprising to see the official list continuing to decline. However, what is surprising is the pace of the decline this quarter in the institution count and assets, which are at their fastest quarterly rate since the official list peaked. It is a challenge to identify how problem bank assets declined by $26.4 billion during the first quarter. Perhaps the FDIC pre-maturely included the $12.4 billion from the action termination in May against FirstBank Puerto Rico.

Schedule for Week of May 31, 2015

by Calculated Risk on 5/30/2015 08:41:00 AM

The key report this week is the May employment report on Friday.

Other key indicators include the April Personal Income and Outlays report on Thursday, May ISM manufacturing index on Friday, May vehicle sales on Friday, April Trade Deficit on Tuesday, and the May ISM non-manufacturing index also on Tuesday.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.5% in April. The employment index was at 48.3%, and the new orders index was at 53.5%.

10:00 AM: Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is a 0.1% decrease in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in May, up from 169,000 in April.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.9 billion in April from $51.4 billion in March. Note: The trade deficit increased sharply in March after the West Coast port slowdown was resolved in February. The deficit should decline significantly in April.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 57.2 from 57.8 in April.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 276 thousand from 282 thousand.

8:30 AM: Productivity and Costs for Q1. The consensus is for a 6.0% increase in unit labor costs.

8:30 AM: Employment Report for May. The consensus is for an increase of 220,000 non-farm payroll jobs added in May, up from the 213,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate be unchanged at 5.4%.

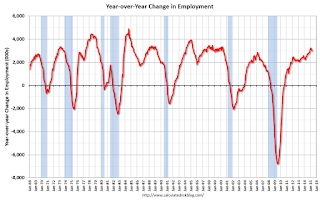

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was just under 3.0 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for an increase of $16.0 billion in credit.

Friday, May 29, 2015

Restaurant Performance Index increased in April

by Calculated Risk on 5/29/2015 07:10:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Posts Moderate Gain in April

Driven by stronger same-stores sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) posted a moderate gain in April. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.7 in April, up 0.5 percent from a level of 102.2 in March. In addition, April represented the 26th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

"While individual indicators experienced some choppiness in recent months, the overall RPI stood above the 102 level for seven consecutive months,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “This was driven by consistent majorities of restaurant operators reporting positive same-store sales as well as an optimistic outlook for sales growth in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.7 in April, up from 102.2 in March. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is another solid reading.

Fannie Mae: Mortgage Serious Delinquency rate declined in April, Lowest since September 2008

by Calculated Risk on 5/29/2015 04:10:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in April to 1.73% from 1.78% in March. The serious delinquency rate is down from 2.13% in April 2014, and this is the lowest level since September 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier week, Freddie Mac reported that the Single-Family serious delinquency rate was declined in April to 1.66%. Freddie's rate is down from 2.15% in April 2014, and is at the lowest level since November 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.40 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will close to 1% in late 2016.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal at the end of 2016. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Business Executives are NOT experts in Economics

by Calculated Risk on 5/29/2015 02:53:00 PM

Excuse this pet peeve, but for some reason, when a business executive is interviewed on CNBC (and elsewhere), they are asked about economics in addition to their assumed areas of expertise. News flash: Business executives are NOT experts in economics (This should be called the "Jack Welch rule").

An example today: Richard Kovacevich, former chairman and CEO at Wells Fargo was on CNBC today, and said:

"We should be growing at 3 percent, given the difficulty of this last recession," he told CNBC's "Squawk Box." "We always get a higher and faster recovery from a tough recession, and this is the slowest ever, and I think it's the policies that are coming out of Washington DC that are causing this."Wrong.

Imagine an economy with an unchanging labor force, and no innovation (everyone just does things they way they've always been done). How much should GDP grow? Zero.

Now imagine a second economy with a labor force growing 5% per year, no resource constraints, a short learning curve, and no innovation. How much should GDP grow? About 5% per year.

That is why I wrote Demographics and GDP: 2% is the new 4% earlier this year.

Two lessons: 1) Experts in one field are not necessarily experts in another, and 2) demographics matter - and right now 2% is the new 4%.

Philly Fed: State Coincident Indexes increased in 40 states in April

by Calculated Risk on 5/29/2015 12:51:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2015. In the past month, the indexes increased in 40 states, decreased in six, and remained stable in four, for a one-month diffusion index of 68. Over the past three months, the indexes increased in 45 states, decreased in three, and remained stable in two, for a three-month diffusion index of 84.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In April, 43 states had increasing activity (including minor increases).

It appears we are seeing weakness in several oil producing states including Alaska, North Dakota and Oklahoma. It wouldn't be surprising if Texas and other oil producing states also turned red sometime this year.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again. Note: Blue added for Red/Green issues.

Final May Consumer Sentiment at 90.7, Chicago PMI declines Sharply

by Calculated Risk on 5/29/2015 10:03:00 AM

Click on graph for larger image.

The final University of Michigan consumer sentiment index for May was at 90.7, up from the preliminary reading of 88.6, and down from 95.9 in April.

This was close to the consensus forecast of 90.0.

Chicago PMI May 2015: Chicago Business Barometer Back into Contraction in May

The Barometer fell 6.1 points to 46.2 in May from 52.3 in April. All five components of the Barometer weakened with three dropping by more than 10% and all of them now below the 50 breakeven mark.This was well below the consensus forecast of 53.0.

April’s positive move had suggested that the first quarter slowdown was transitory and had been impacted by the cold snap and port strikes. May’s weakness points to a more fundamental slowdown with the Barometer running only slightly above February’s 5½-year low of 45.8.

...

Chief Economist of MNI Indicators Philip Uglow said, “We had thought that the April bounce was consistent with a partial return to normal following the weather and port related slowdown in the first quarter. The latest data for May, however, suggest that this was a false dawn and that sluggish activity has carried through to the second quarter.”

emphasis added

Q1 GDP Revised Down to -0.7% Annual Rate

by Calculated Risk on 5/29/2015 08:37:00 AM

From the BEA: Gross Domestic Product: First Quarter 2015 (Second Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- decreased at an annual rate of 0.7 percent in the first quarter of 2015, according to the "second" estimate released by the Bureau of Economic Analysis. ...Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 1.9% to 1.8%. Residential investment was revised up from 1.3% to 5.0%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, real GDP increased 0.2 percent. With the second estimate for the first quarter, imports increased more and private inventory investment increased less than previously estimated ...

emphasis added

Net exports was revised down, private inventory investment was revised down, and government was revised down (from -0.8% to -1.1%).

Thursday, May 28, 2015

Friday: Ugly GDP, Chicago PMI, Consumer Sentiment

by Calculated Risk on 5/28/2015 06:52:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Microscopically Lower

Mortgage rates barely budged today. Those that budged moved almost imperceptibly lower from yesterday's latest rate sheets. In general, there was simply very little movement in underlying markets and lenders' rate sheets matched the tone. [Rates at 4.0%]Friday:

Ironically, Freddie Mac's weekly rate survey results came out this morning indicating higher rates. Keep in mind that the Freddie survey receives most of it's responses early in the week and then reports on Thursday mornings. That means that any changes in rates over the intervening days are not captured in the data. In the current case, it's not that rates have moved significantly lower in the past few days, but more to do with the fact that last week's Freddie survey didn't capture the brunt of the rise in rates that occurred on Tuesday.

emphasis added

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2015 (second estimate). The consensus is that real GDP decreased 0.9% annualized in Q1, revised down from the 0.2% advance estimate.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 53.0, up from 52.3 in April.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 90.0, up from the preliminary reading of 88.6, and down from the April reading of 95.9.

Vehicle Sales Forecasts for May: Over 17 Million Annual Rate

by Calculated Risk on 5/28/2015 03:04:00 PM

The automakers will report May vehicle sales on Tuesday, June 2nd. Sales in April were at 16.5 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales will be strong in May too.

Note: There were 26 selling days in May, one less than in May 2014. Here are a few forecasts:

From Edmunds.com: Nearly 1.6 Million New Cars Sold in May Push Seasonally Adjusted Annual Rate (SAAR) to Impressive 17.4 Million, says Edmunds.com

Edmunds.com ... forecasts that 1,591,221 new cars and trucks will be sold in the U.S. in May for an estimated Seasonally Adjusted Annual Rate (SAAR) of 17.4 million.From J.D. Power: New-Vehicle Retail Sales SAAR in May to Hit 14.1M Units, Highest Level So Far in 2015

Total light-vehicle sales in May 2015 are projected to reach 1,591,100, a 3 percent increase on a selling day adjusted basis compared with May 2014. [Total forecast 17.3 million SAAR]From Kelley Blue Book: New-Car Sales to Reach 17.3 Million SAAR in May 2015, According to Kelley Blue Book

New-vehicle sales are expected to decline 1 percent year-over-year to a total of 1.59 million units in May 2015, resulting in an estimated 17.3 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...Another strong month for auto sales. Good times!

...

"May sales will reach the highest total year-to-date, and could remain the highest until December of this year," said Alec Gutierrez, senior analyst for Kelley Blue Book. "While we expect an overall decline in volume versus last year, the difference is the result of one fewer sales day from May 2014, and total SAAR will reflect year-over-year improvement."

Freddie Mac: Mortgage Serious Delinquency rate declined in April

by Calculated Risk on 5/28/2015 01:02:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in April to 1.66%, down from 1.73% in March. Freddie's rate is down from 2.15% in April 2014, and the rate in March was the lowest level since November 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for April in a few days.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.49 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

NAR: Pending Home Sales Index increased 3.4% in April, up 14% year-over-year

by Calculated Risk on 5/28/2015 10:02:00 AM

From the NAR: Pending Home Sales Climb in April to Highest Level since May 2006

Pending home sales rose in April for the fourth straight month and reached their highest level in nine years, according to the National Association of Realtors®. Led by the Northeast and Midwest, all four major regions saw increases in April.This was abpve expectations of a 0.8% increase.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 3.4 percent to 112.4 in April from a slight upward revision of 108.7 in March and is now 14.0 percent above April 2014 (98.6) — the largest annual increase since September 2012 (15.1 percent). The index has now increased year-over-year for eight consecutive months and is at its highest level since May 2006 (112.5).

Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

Weekly Initial Unemployment Claims increased to 282,000

by Calculated Risk on 5/28/2015 08:34:00 AM

The DOL reported:

In the week ending May 23, the advance figure for seasonally adjusted initial claims was 282,000, an increase of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 274,000 to 275,000. The 4-week moving average was 271,500, an increase of 5,000 from the previous week's revised average. The previous week's average was revised up by 250 from 266,250 to 266,500.The previous week was revised to 275,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 271,500.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, May 27, 2015

Thursday: Pending Home Sales, Unemployment Claims

by Calculated Risk on 5/27/2015 08:06:00 PM

From Reuters: EU officials dismiss Greek statement on aid agreement being drafted

Greece's government on Wednesday said it is starting to draft an agreement with creditors that would pave the way for aid, but European officials quickly dismissed that as wishful thinking.Thursday:

...

But European Commission Vice President Valdis Dombrovskis said the two sides still had some way to go before any agreement could be drawn up.

"We are working very intensively to ensure a staff-level agreement," he said. "We are still not there yet."

Other officials in the euro zone, speaking to Reuters on condition of anonymity, were more blunt. One called the Greek remarks "nonsense". Another said: "I wish it were true."

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 274 thousand.

• At 10:00 AM, the Pending Home Sales Index for April. The consensus is for a 0.8% increase in the index.

Zillow Forecast: Expect Case-Shiller National House Price Index up 4.0% year-over-year change in April

by Calculated Risk on 5/27/2015 03:22:00 PM

The Case-Shiller house price indexes for March were released this yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Expect More of the Same from Case-Shiller in April

The March S&P/Case-Shiller (SPCS) data published [yesterday] showed home prices continuing to appreciate at around 5 percent annually for both the 10- and 20- City Indices, and roughly 4 percent for the national index. March marks the seventh consecutive month in which the national home price index has appreciated at a less than 5 percent annual appreciation rate (seasonally adjusted).So the year-over-year change in for April Case-Shiller National index will be about the same as in the March report.

In March, the 10-City Index appreciated at an annual rate of 4.7 percent, compared to 5.0 percent for the 20-City Index (SA). The non-seasonally adjusted (NSA) 10-City Index was up 0.8 percent month-over-month, while the 20-City index rose 0.9 percent (NSA) from February to March. We expect the change from March to April to show increases of more than 1 percent (NSA) for both the 10- and 20- City Indices.

All forecasts are shown in the table below. These forecasts are based on the March SPCS data release and the April 2015 Zillow Home Value Index (ZHVI), published May 21. Officially, the SPCS Composite Home Price Indices for March will not be released until Tuesday, June 30.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| March Actual YoY | 4.7% | 4.7% | 5.0% | 5.0% | 4.1% | 4.1% |

| April Forecast YoY | 4.9% | 4.9% | 5.2% | 5.2% | 4.0% | 4.0% |

| April Forecast MoM | 1.2% | 0.5% | 1.3% | 0.6% | 1.0% | 0.0% |

From Zillow:

Annual appreciation in the Zillow Home Value Index (ZHVI) peaked in April 2014 and has declined since then. In April, the U.S. ZHVI rose 3 percent year-over-year, one percentage point lower than the annual change in rents (4 percent). The April Zillow Home Value Forecast calls for a 2 percent rise in home values through April 2016. Further details on our forecast of home values can be found here.

FDIC: Fewer Problem banks, Residential REO Declines in Q1

by Calculated Risk on 5/27/2015 11:55:00 AM

The FDIC released the Quarterly Banking Profile for Q1 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $39.8 billion in the first quarter of 2015, up $2.6 billion (6.9 percent) from a year earlier. The increase in earnings was mainly attributable to a $4.3 billion rise in net operating revenue (net interest income plus total noninterest income). Financial results for the first quarter of 2015 are included in the FDIC's latest Quarterly Banking Profile released today.

...

"Problem List" Continues to Shrink: The number of banks on the FDIC's Problem List fell from 291 to 253 during the first quarter. This is the smallest number of banks on the Problem List in six years. The number of problem banks was down 72 percent from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $86.7 billion to $60.3 billion during the first quarter.

Deposit Insurance Fund (DIF) Rises $2.5 Billion to $65.3 Billion: The DIF increased from $62.8 billion to $65.3 billion in the first quarter, largely driven by $2.2 billion in assessment income. The DIF reserve ratio rose to 1.03 percent from 1.01 percent during the quarter.

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1 2015, and year end prior to 2015):

The number of insured commercial banks and savings institutions filing quarterly financial reports declined from 6,509 to 6,419 in the first quarter. Mergers absorbed 86 institutions, while four insured institutions failed. For a fifth consecutive quarter, no new charters were added. The number of full-time equivalent employees declined by 5,349 to 2,042,596. The number of institutions on the FDIC’s “Problem List” declined for the 16th consecutive quarter, falling from 291 to 253. Total assets of problem institutions fell from $86.7 billion to $60.3 billion.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.98 billion in Q4 2014 to $5.72 billion in Q1. This is the lowest level of REOs since Q3 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $5.98 billion in Q4 2014 to $5.72 billion in Q1. This is the lowest level of REOs since Q3 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

BLS: Twenty-Three States had Unemployment Rate Decreases in April

by Calculated Risk on 5/27/2015 10:10:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in April. Twenty-three states and the District of Columbia had unemployment rate decreases from March, 11 states had increases, and 16 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nebraska had the lowest jobless rate in April, 2.5 percent. Nevada had the highest rate among the states, 7.1 percent. The District of Columbia had a rate of 7.5 percent.

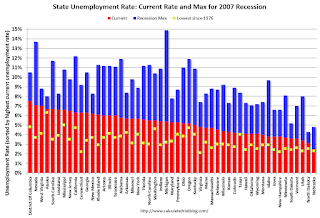

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Only two states (Nevada and West Virginia) and D.C. are still at or above 7% (dark blue).

MBA: Mortgage Refinance Applications Decrease in Latest Weekly Survey, Purchase Index up 14% YoY

by Calculated Risk on 5/27/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 22, 2015. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index was essentially unchanged compared with the previous week and was 14 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.07 percent from 4.04 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

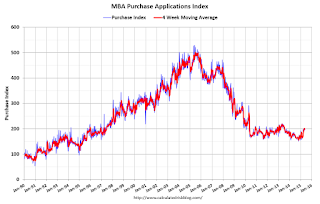

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.

Tuesday, May 26, 2015

Regional Fed Manufacturing Surveys for May and the ISM Index

by Calculated Risk on 5/26/2015 04:32:00 PM

Earlier today the last two regional Fed surveys for May were released. As expected, the Dallas Fed was especially weak due primarily to weakness in the oil sector.

From the Dallas Fed: Texas Manufacturing Activity Contracts Further

Texas factory activity declined again in May, according to business executives responding to the Texas Manufacturing Outlook Survey. ... The general business activity index fell to -20.8 in May, its lowest reading since June 2009.And from the Richmond Fed: Manufacturing Sector Activity Remained Tepid; Employment Edged Up, Wage Growth Accelerated

Labor market indicators reflected employment declines and shorter workweeks. The May employment index declined 10 points to -8.2, after rebounding slightly above zero last month. Twelve percent of firms reported net hiring, compared with 21 percent reporting net layoffs. The hours worked index fell from -5 to -11.6.

emphasis added

Manufacturing activity remained soft this month, with several components flattening. The composite index for manufacturing moved to 1 following April's reading of −3, while the shipments index leveled off to −1 from −6. In addition, the index for new orders gained eight points, reaching a nearly flat reading of 2. ...Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Manufacturing employment continued to grow at a modest pace in May. The index ended the survey period at 3 compared to last month's reading of 7. The average workweek increased; the index moved up two points to end at 6. Additionally, the index for average wages advanced 11 points to finish at a reading of 20.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

It seems likely the ISM index will be weak again in May, and will probably be around the same level as in April.

Real Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/26/2015 02:29:00 PM

The expected slowdown in year-over-year price increases has occurred. In October 2013, the National index was up 10.9% year-over-year (YoY). In March 2015, the index was up 4.1% YoY. However the YoY change has only declined slightly over the last six months.

As I've noted before, I think most of the slowdown on a YoY basis is now behind us (I don't expect price to go negative this year). This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to March 2005.

Real House Prices

In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to July 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.5% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to June 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

Comments on New Home Sales

by Calculated Risk on 5/26/2015 11:32:00 AM

The new home sales report for April was above expectations at 517 thousand on a seasonally adjusted annual rate basis (SAAR).

Earlier: New Home Sales increased to 517,000 Annual Rate in April

The Census Bureau reported that new home sales this year, through April, were 179,000, Not seasonally adjusted (NSA). That is up 23.7% from 145,000 during the same period of 2014 (NSA). That is a solid first four months!

Sales were up 26.1% year-over-year in April, but that was an easy comparison.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will probably be strong through July (the first seven months were especially weak in 2014), however I expect the year-over-year increases to slow later this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 517,000 Annual Rate in April

by Calculated Risk on 5/26/2015 10:16:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 517 thousand.

The previous three months were revised up by a total of 5 thousand (SA).

"Sales of new single-family houses in April 2015 were at a seasonally adjusted annual rate of 517,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.8 percent above the revised March rate of 484,000 and is 26.1 percent above the April 2014 estimate of 410,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottoms for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 4.8 months.

The months of supply decreased in April to 4.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of April was 205,000. This represents a supply of 4.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2015 (red column), 49 thousand new homes were sold (NSA). Last year 39 thousand homes were sold in April. This is the highest for April since 2008.

The high for April was 116 thousand in 2005, and the low for April was 30 thousand in 2011.

This was above expectations of 509,000 sales in April, and this is still a solid start for 2015. I'll have more later today.

Case-Shiller: National House Price Index increased 4.1% year-over-year in March

by Calculated Risk on 5/26/2015 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Accelerate, Led by San Francisco and Denver According to the S&P/Case-Shiller Home Price Indices

Data released today for March 2015 show that home prices continued their rise across the country over the last 12 months. ... Both the 10-City and 20-City Composites saw year-over-year increases in March. The 10-City Composite gained 4.7% year-over-year, while the 20-City Composite gained 5.0% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.1% annual gain in March 2015 versus a 4.2% increase in February 2015.

...

The National index increased again in March with a 0.8% increase for the month. Both the 10- and 20-City Composites increased significantly, reporting 0.8% and 0.9% month-over-month increases, respectively. Of the 19 cities reporting increases, San Francisco led all cities with an increase of 3.0%. Seattle followed next with a reported increase of 2.3%. Cleveland reported an increase of 0.4%, its first positive month-over-month increase since August 2014. New York was the only city to report a negative month-over-month change with a -0.1% decrease for March 2015.

...

“Home prices have enjoyed year-over-year gains for 35 consecutive months,” says David M. Blitzer, Managing Director & Chairman of the Index Committee for S&P Dow Jones Indices. “The pattern of consistent gains is national and seen across all 20 cities covered by the S&P/Case-Shiller Home Price Indices. The longest run of gains is in Detroit at 45 months, the shortest is New York with 27 months. However, the pace has moderated in the last year; from August 2013 to February 2014, the national index gained more than 10% year-over-year, compared to 4.1% in this release.

“Given the long stretch of strong reports, it is no surprise that people are asking if we’re in a new home price bubble. The only way you can be sure of a bubble is looking back after it’s over. The average 12 month rise in inflation adjusted home prices since 1975 is about 1.0% per year compared to the current 4.1% pace, arguing for a bubble. However, the annual rate of increase halved in the last year, as shown in the first chart. Home prices are currently rising more quickly than either per capita personal income (3.1%) or wages (2.2%), narrowing the pool of future home-buyers. All of this suggests that some future moderation in home prices gains is likely. Moreover, consumer debt levels seem to be manageable. I would describe this as a rebound in home prices, not bubble and not a reason to be fearful.”

emphasis added

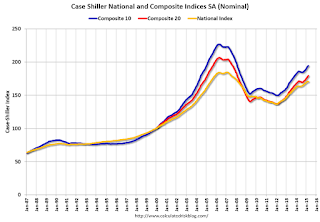

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.2% from the peak, and up 0.9% in March (SA).

The Composite 20 index is off 13.1% from the peak, and up 0.9% (SA) in March.

The National index is off 7.6% from the peak, and up 0.1% (SA) in March. The National index is up 24.7% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to March 2014.

The Composite 20 SA is up 5.0% year-over-year..

The National index SA is up 4.1% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in March seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 40.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 50% above January 2000 (50% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 10% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston and, Charlotte). Detroit prices are still below the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.

Monday, May 25, 2015

Tuesday: New Home Sales, Case-Shiller House Prices, Durable Goods and More

by Calculated Risk on 5/25/2015 08:13:00 PM

From Bloomberg: What Would Happen If Greece Doesn’t Pay the IMF: Q&A

Q: What will the IMF do?From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 3 and DOW futures are down 20 (fair value).

A: A missed payment date starts the clock ticking. Two weeks after the initial due date and a cable from Washington urging immediate payment, the fund sends another cable stressing the “seriousness of the failure to meet obligations” and again urges prompt settlement. Two weeks after that, the managing director informs the Executive Board that an obligation is overdue. For Greece, that’s when the serious consequences kick in. These are known as cross-default and cross-acceleration.

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

• At 9:00 AM, the FHFA House Price Index for March 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices. The consensus is for a 4.6% year-over-year increase in the Comp 20 index for March.

• At 10:00 AM, New Home Sales for April from the Census Bureau. The consensus is for an increase in sales to 509 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 481 thousand in March.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

• At 10:30 AM, Dallas Fed Manufacturing Survey for May.

Gasoline Prices: Down a Dollar from last year on Memorial Day

by Calculated Risk on 5/25/2015 10:11:00 AM

According to Gasbuddy.com (see graph at bottom), gasoline prices are down to a national average of $2.75 per gallon. One year ago for the week of Memorial Day, prices were at $3.75 per gallon, and for the same week two years ago prices were $3.70 per gallon.

Ten years ago, price were at $2.17 per gallon, and fifteen years ago at $1.57.

| Memorial Day | Weekly Average Gasoline Price |

|---|---|

| 29-May-00 | $1.57 |

| 28-May-01 | $1.74 |

| 27-May-02 | $1.43 |

| 26-May-03 | $1.53 |

| 31-May-04 | $2.10 |

| 30-May-05 | $2.17 |

| 29-May-06 | $2.94 |

| 28-May-07 | $3.25 |

| 26-May-08 | $3.99 |

| 25-May-09 | $2.49 |

| 31-May-10 | $2.84 |

| 30-May-11 | $3.90 |

| 28-May-12 | $3.73 |

| 27-May-13 | $3.70 |

| 26-May-14 | $3.75 |

| 25-May-15 | $2.75 |

According to Bloomberg, WTI oil is at $59.40 per barrel, and Brent is at $65.37 per barrel. Last year on Memorial Day, Brent was at $110.01 per barrel, and two years ago Brent was at $103.77.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Sunday, May 24, 2015

Hotels: RevPAR up almost 50% since 2009

by Calculated Risk on 5/24/2015 10:01:00 PM

Revenue per available room (RevPAR) is now at $85.50. In May 2009, RevPAR had fallen to $58.39. So, RevPAR is up 46.9% over the last 6 years - and the occupancy rate will probably be at a new record high this year. A great year for hotels!

From HotelNewsNow.com: STR: US hotel results for week ending 16 May

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 10-16 May 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year measurements, the industry’s occupancy increased 0.5 percent to 70.3 percent. Average daily rate increased 5.2 percent to finish the week at US$122.10. Revenue per available room for the week was up 5.7 percent to finish at US$85.80.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above last year.

Right now 2015 is even above 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Report: Greece will not make June IMF Payment

by Calculated Risk on 5/24/2015 11:30:00 AM

From the WSJ: Greece Won’t Meet IMF Repayments in June, Interior Minister Says

Greece said Sunday that it won’t have the money it is due to repay to the International Monetary Fund next month unless it strikes a deal with international creditors over further rescue funding.

Interior Minister Nikos Voutsis told privately owned television station Mega that Greece is scheduled to repay €1.6 billion ($1.76 billion) to the IMF between June 5-19, but the payments cannot be met.

“This money will not be given,” he said. “It does not exist.”

Saturday, May 23, 2015

Schedule for Week of May 24, 2015

by Calculated Risk on 5/23/2015 08:31:00 AM

The key reports this week are April New Home sales on Tuesday, the 2nd estimate of Q1 GDP on Friday, and March Case-Shiller house prices on Tuesday.

For manufacturing, the May Richmond and Dallas Fed surveys will be released this week.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

9:00 AM: FHFA House Price Index for March 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the February 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the Comp 20 index for March. The Zillow forecast is for the National Index to increase 4.2% year-over-year in March, and for prices to increase 1.0% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an increase in sales to 509 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 481 thousand in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

10:30 AM: Dallas Fed Manufacturing Survey for May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Regional and State Employment and Unemployment (Monthly), April 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 274 thousand.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.8% increase in the index.

8:30 AM: Gross Domestic Product, 1st quarter 2015 (second estimate). The consensus is that real GDP decreased 0.9% annualized in Q1, revised down from the 0.2% advance estimate.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 53.0, up from 52.3 in April.

10:00 AM: University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 90.0, up from the preliminary reading of 88.6, and down from the April reading of 95.9.

Friday, May 22, 2015

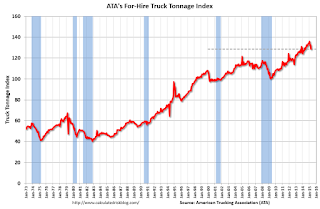

ATA Trucking Index decreased 3% in April

by Calculated Risk on 5/22/2015 04:01:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 3% in April

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index fell 3% in April, following a revised gain of 0.4% during the previous month. In April, the index equaled 128.6 (2000=100), which was the lowest level since April 2014. The all-time high is 135.8, reached in January 2015.

Compared with April 2014, the SA index increased just 1%, which was well below the 4.2% gain in March and the smallest year-over-year gain since February 2013. ...

“Like most economic indicators, truck tonnage was soft in April,” said ATA Chief Economist Bob Costello. “Unless tonnage snaps back in May and June, GDP growth will likely be suppressed in the second quarter.”

Costello added that truck tonnage is off 5.3% from the high in January.

“The next couple of months will be telling for both truck freight and the broader economy. Any significant jump from the first quarter is looking more doubtful,” he said.

Trucking serves as a barometer of the U.S. economy, representing 68.8% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled just under 10 billion tons of freight in 2014. Motor carriers collected $700.4 billion, or 80.3% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.0% year-over-year.

Yellen: Expect Rate Hike in 2015, Several Years before Fed Funds Rate "back to normal" level

by Calculated Risk on 5/22/2015 01:18:00 PM

From Fed Chair Janet Yellen: The Outlook for the Economy

[I]f the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy. To support taking this step, however, I will need to see continued improvement in labor market conditions, and I will need to be reasonably confident that inflation will move back to 2 percent over the medium term.

After we begin raising the federal funds rate, I anticipate that the pace of normalization is likely to be gradual. The various headwinds that are still restraining the economy, as I said, will likely take some time to fully abate, and the pace of that improvement is highly uncertain. If conditions develop as my colleagues and I expect, then the FOMC's objectives of maximum employment and price stability would best be achieved by proceeding cautiously, which I expect would mean that it will be several years before the federal funds rate would be back to its normal, longer-run level.

Having said that, I should stress that the actual course of policy will be determined by incoming data and what that reveals about the economy. We have no intention of embarking on a preset course of increases in the federal funds rate after the initial increase. Rather, we will adjust monetary policy in response to developments in economic activity and inflation as they occur. If conditions improve more rapidly than expected, it may be appropriate to raise interest rates more quickly; conversely, the pace of normalization may be slower if conditions turn out to be less favorable.

emphasis added

Key Measures Show Low Inflation in April

by Calculated Risk on 5/22/2015 11:54:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.2% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.2% annualized rate) in April. The CPI less food and energy rose 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for March and increased 1.35% year-over-year.

On a monthly basis, median CPI was at 2.2% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 3.1% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is slightly above 2%).

The key question for the Fed is if these key measures will move back towards 2%.

BLS: CPI increased 0.1% in April, Core CPI increased 0.3%

by Calculated Risk on 5/22/2015 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in April on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index declined 0.2 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.1% increase for CPI, and above the forecast of a 0.1% increase in core CPI.

The index for all items less food and energy rose 0.3 percent in April and led to the slight increase in the seasonally adjusted all items index.

emphasis added

Black Knight: Mortgage Delinquencies increased slightly in April

by Calculated Risk on 5/22/2015 07:01:00 AM

According to Black Knight's First Look report for April, the percent of loans delinquent increased 1% in April compared to March, and declined 15% year-over-year.

The percent of loans in the foreclosure process declined 2% in March and were down 25% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.77% in April, up from 4.70% in March.

The percent of loans in the foreclosure process declined in April to 1.51%. This was the lowest level of foreclosure inventory since January 2008.

The number of delinquent properties, but not in foreclosure, is down 406,000 properties year-over-year, and the number of properties in the foreclosure process is down 252,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for April in early June.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2015 | Mar 2015 | Apr 2014 | Apr 2013 | |

| Delinquent | 4.77% | 4.70% | 5.62% | 6.21% |

| In Foreclosure | 1.51% | 1.55% | 2.02% | 3.17% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,463,000 | 1,409,000 | 1,634,000 | 1,717,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 952,000 | 971,000 | 1,187,000 | 1,394,000 |

| Number of properties in foreclosure pre-sale inventory: | 764,000 | 782,000 | 1,016,000 | 1,588,000 |

| Total Properties | 3,179,000 | 3,162,000 | 3,837,000 | 4,699,000 |

Thursday, May 21, 2015

Friday: CPI, Yellen

by Calculated Risk on 5/21/2015 07:03:00 PM

Earlier from the Philly Fed: May Manufacturing Survey

Manufacturing activity in the region increased modestly in May, according to firms responding to this month’s Manufacturing Business Outlook Survey. Indicators for general activity, new orders, and shipments were positive but remain at low readings. Employment increased at the reporting firms, but the employment index moderated compared with April. Firms reported continued price reductions in May, with indicators for prices of inputs and the firms’ own products remaining negative. The survey’s indicators of future activity suggest that firms expect continuing growth in the manufacturing sector over the next six months.This was below the consensus forecast of a reading of 8.0 for May.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 7.5 in April to 6.7 in May. ...

Firms’ responses suggest some weakening in labor market conditions this month compared with April. ... The current employment index, however, fell 5 points, to 6.7.

emphasis added

Also the Kansas City Fed reported: Tenth District Manufacturing Activity Declined More Sharply

“Factories in our region saw an even sharper decline in May than in March or April, as exports fell further and energy-related producers saw another drop in orders,” said [Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City] “However, firms’ overall still plan a modest increase in employment over the next six to twelve months.”

...

Tenth District manufacturing activity declined more sharply in May than in previous months and producers’ expectations also fell, with both reaching their lowest levels since mid-2009. ... The month-over-month composite index was -13 in May, down from -7 in April and -4 in March ... Production fell most sharply in energy-producing states like Oklahoma and New Mexico, but it was also down in most other District states.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through May. The ISM and total Fed surveys are through April.

The average of the Empire State and Philly Fed surveys increased slightly in May, and this suggests a another weak ISM report for May.

Friday:

• At 8:30 AM ET, the Consumer Price Index for April from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core CPI.

• At 1:00 PM, Speech by Fed Chair Janet L. Yellen, U.S. Economic Outlook, At the Greater Providence Chamber of Commerce Economic Outlook Luncheon, Providence, Rhode Island