by Calculated Risk on 11/30/2014 08:27:00 PM

Sunday, November 30, 2014

Monday: ISM Manufacturing

From Professor Hamilton at Econbrowser: A glut of oil?

The world is awash in oil, I’m hearing. The problem is, it’s fairly expensive oil.Monday:

...

[C]onsider the United States, where production has grown 2 mb/d since 2004. More than 3 mb/d of that growth has come from fracking of oil trapped in tight geologic formations. Without tight oil, U.S. production would be down more than a million barrels a day over the last ten years and down 5-1/2 mb/d from its peak in 1970.

...

So here’s the basic picture. The current surplus of oil was brought about primarily by the success of unconventional oil production in North America, most new investments in which are not sustainable at current prices. Without that production, the price of oil could not remain at current levels. It’s just a matter of how long it takes for the high-cost North American producers to cut back in response to current incentives. And when they do, the price has to go back up.

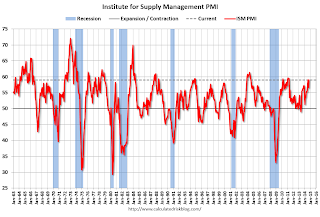

• At 10:00 AM ET, the ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October. The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

Weekend:

• Schedule for Week of November 30th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down 4 and DOW futures are down 25 (fair value).

Oil prices were down sharply over the last week with WTI futures at $64.37 per barrel and Brent at $68.50 per barrel. A year ago, WTI was at $93 and Brent was at $111 per barrel - so prices are down more 30% to 40% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.77 per gallon (down about 50 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

WSJ: "Mortgage Lenders Set to Relax Standards"

by Calculated Risk on 11/30/2014 10:16:00 AM

These are the changes (mostly to reps and warrants) that FHFA Director Melvin Watt discussed in October: Prepared Remarks of Melvin L. Watt, Director, FHFA, At the Mortgage Bankers Association Annual Convention

From Joe Light at the WSJ: Mortgage Lenders Set to Relax Standards

Some of the largest U.S. mortgage lenders are preparing to further ease standards for borrowers after the release of new guidelines this month from mortgage giants Fannie Mae and Freddie Mac.This should make mortgages available to more people, but I expect the overall impact will be small.

...

Some lenders, including Wells Fargo & Co. and SunTrust Banks Inc., said borrowers should begin to see initial changes in a few weeks, including faster turnaround times for mortgage applications to be processed.

...

After the financial crisis, Fannie and Freddie made banks repurchase tens of billions of dollars in loans that the companies said didn’t meet their standards. In turn, many lenders stopped making loans to all but the most pristine of borrowers.

In many cases, they required borrowers to have substantially higher credit scores and put in place other measures—so-called credit overlays—that were more stringent than what Fannie and Freddie required.

With the new agreement, “I’ve been told with absolute confidence that some lenders are lifting almost all of their overlays,” said David Stevens, president of the Mortgage Bankers Association.

Saturday, November 29, 2014

Schedule for Week of November 30th

by Calculated Risk on 11/29/2014 01:21:00 PM

The key report this week is the November employment report on Friday.

Other key reports include the November ISM manufacturing index on Monday, November vehicle sales on Tuesday, the November ISM non-manufacturing index on Wednesday, and the October Trade Deficit on Friday.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

8:30 AM: Employment Report for November. The consensus is for an increase of 225,000 non-farm payroll jobs added in November, up from the 214,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to decline to 5.7% in November.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.64 million jobs, and it appears the pace of hiring is increasing. Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.5 billion in October from $43.0 billion in September.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1 decrease in October orders.

3:00 PM: Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $16.3 billion.

Unofficial Problem Bank list declines to 408 Institutions

by Calculated Risk on 11/29/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 28, 2014.

Changes and comments from surferdude808:

This week, the FDIC provided an update on its latest enforcement action activity and updated aggregate figures for their official problem banks. After four additions and seven removals, the Unofficial Problem Bank List holds 408 institutions with assets of $124.7 billion. A year ago, the list held 645 institutions with assets of $221.2 billion. During November, the list count dropped by 14 institutions after four additions, 13 action terminations, four mergers, and one failure. It was the most institutions added in a month since five were added back in October 2013.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 408. Almost a round trip ...

The FDIC terminated actions against CNLBank, Orlando, FL ($1.3 billion); Chambers Bank, Danville, AR ($773 million); Pine River Valley Bank, Bayfield, CO ($142 million); Hanover Community Bank, Garden City Park, NY ($142 million); Heritage Bank & Trust, Columbia, TN ($102 million); Thayer County Bank, Hebron, NE ($55 million); and Riverland Bank, Jordan, MN ($44 million).

The FDIC issued actions against Noah Bank, Elkins Park, PA ($317 million); Pacific Valley Bank, Salinas, CA ($231 million Ticker: PVBK); Lafayette State Bank, Mayo, FL ($93 million); and Bison State Bank, Bison, KS ($9 million).

The FDIC reported its number of problem banks had fallen for 14 consecutive quarters to 329 institutions with assets of $102 billion. So the difference between the FDIC numbers and the Unofficial number is 79 institutions and $22.7 billion in assets, which is down from a difference of 85 institutions and $30 billion in assets last quarter.

Friday, November 28, 2014

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/28/2014 09:11:00 PM

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change.

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller National index since 1987 (both through September). The seasonal pattern was smaller back in the '90s and early '00s, and increased since the bubble burst.

Both indexes were negative seasonally (NSA) in September and will probably stay slightly negative for a few months.

It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Possible Headline for Next Friday: "Best Year for Employment since the '90s"

by Calculated Risk on 11/28/2014 03:05:00 PM

As of the October BLS report, the economy has added 2.225 million private sector jobs, and 2.285 million total jobs in 2014.

The consensus is the economy will add another 220 thousand jobs in November (215 thousand private sector jobs). If that happens, 2014 will be the best year for private employment since 1999.

Here is a table showing the best years for nonfarm employment growth since 1995. To be the best year since the '90s, the economy needs to add an additional 222 thousand total nonfarm jobs. This could happen in the November report to be released next Friday, December 5th or in the December employment report to be released in early January.

This is happening with only 60 thousand public sector jobs added so far this year. For comparison, there were 186 thousand public sector jobs added in 2005

| Top Years Since 1995 Change in Nonfarm Payrolls per Year (000s) | ||

|---|---|---|

| Year | Total Nonfarm Employment | |

| 1997 | 3,408 | |

| 1999 | 3,177 | |

| 1998 | 3,047 | |

| 1996 | 2,825 | |

| 2005 | 2,506 | |

| 2013 | 2,331 | |

| 20141 | 2,285 | |

| 2012 | 2,236 | |

| 1995 | 2,159 | |

| 1 2014 is through October. | ||

For private employment, to be the best year since the '90s, the economy needs to add an additional 176 thousand private sector jobs (probably happen in the November report).

There is a small chance that 2014 will be the best year since 1998 for private employment. However it would take an additional 491 thousand private sector jobs added in November and December (it would take 505 thousand additional jobs to be the best since 1997). That would be a very strong finish to the year - unlikely, but not impossible.

| Top Years Since 1995 Change in Private Payrolls per Year (000s) | ||

|---|---|---|

| Year | Private Employment | |

| 1997 | 3,213 | |

| 1998 | 2,734 | |

| 1996 | 2,720 | |

| 1999 | 2,716 | |

| 2011 | 2,400 | |

| 2013 | 2,365 | |

| 2005 | 2,320 | |

| 2012 | 2,294 | |

| 20141 | 2,225 | |

| 1995 | 2,081 | |

| 1 2014 is through October. | ||

Right now it seems very likely that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

Hotels: Occupancy Rate Finishing 2014 Strong, Best Year since 2000

by Calculated Risk on 11/28/2014 10:41:00 AM

From HotelNewsNow.com: US hotel results for week ending 22 November

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 16-22 November 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 5.5 percent to 60.7 percent. Average daily rate increased 4.1 percent to finish the week at US$112.52. Revenue per available room for the week was up 9.8 percent to finish at US$68.34.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now heading into the slow period of the year.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and since mid-June, the 4-week average of the occupancy rate has been a little higher than for the same week in 2000.

Right now it looks like 2014 will be the best year since 2000 for hotels. And since it takes some time to plan and build hotels, I expect 2015 will be even better for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Thursday, November 27, 2014

Vehicle Sales Forecast: "Strongest November since 2001"

by Calculated Risk on 11/27/2014 08:02:00 PM

The automakers will report November vehicle sales on Tuesday, December 2nd. Sales in October were at 16.35 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in November might be at or above 17 million SAAR.

Note: There were 25 selling days in November this year compared to 26 last year.

Here are a few forecasts:

From WardsAuto: Forecast: SAAR Could Reach 17 Million for Second Time in Four Months

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17 million-unit seasonally adjusted annual rate for just the second time since 2006, after crossing that threshold most recently in August, when deliveries equated to a 17.4 million SAAR. The WardsAuto report is calling for 1.29 million light vehicles to be delivered over 25 selling days. The resulting daily sales rate of 51,461 units represents an 8.1% improvement over same-month year-ago (over 26 days) and a 9.1% month-to-month gain on October (27 days), slightly ahead of an average 6% October-November gain over the past three years. The 17 million-unit SAAR would be significantly higher than the 16.3 million recorded year-to-date through October, and would help bring 2014 sales in line with WardsAuto’s full year forecast of 16.4 million units.From J.D. Power: New-Vehicle Retail Sales On Pace for 1.1 Million, the Strongest November Since 2001

New-vehicle retail sales in November 2014 are projected to come in at 1.1 million units, a 5.5 percent increase on a selling-day adjusted basis, compared with November 2013 (November 2014 has one fewer selling day than November 2013).From Kelley Blue Book: New-Vehicle Sales To Rise 2.2 Percent In November On Black Friday Deals, According To Kelley Blue Book

...

“The industry continues to demonstrate strong sales growth, which is exceptional considering that November is currently on pace to record the highest average customer-facing transaction prices ever,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. [Total forecast 16.5 million SAAR]

In November 2014, new light-vehicle sales, including fleet, are expected to hit 1,270,000 units, up 2.2 percent from November 2013, and down 0.6 percent from October 2014. The seasonally adjusted annual rate (SAAR) for November 2014 is estimated to be 16.8 million, up from 16.2 million in November 2013, and up from 16.3 million in October 2014.From TrueCar: TrueCar Forecasts 17 Million SAAR in November as Early Black Friday Events Prime the Market

TrueCar, Inc. ... forecasts the pace of auto sales in November accelerated to a seasonally adjusted annualized rate ("SAAR") of 17 million new units with the early launch of Black Friday sales campaigns.Another strong month for auto sales, and 2014 should be the best year since 2006.

New light vehicle sales in the U.S. (including fleet) are expected to reach 1,296,700 units for the month, up 4.1 percent from a year ago. On a daily selling rate (DSR) basis, with one less selling day this November, deliveries are expected to rise 8.2 percent. ... Best November since 2001

WTI Crude Oil Falls Below $70

by Calculated Risk on 11/27/2014 12:48:00 PM

From the WSJ: OPEC Leaves Production Target Unchanged

The Organization of the Petroleum Exporting Countries said its 12 members, who collectively pump around one-third of the world’s oil, would comply with its current production ceiling of 30 million barrels a day. That would involve a supply cut of around 300,000 barrels a day based on the cartel’s output in October, according to the group’s own data.

...

The oil producer group’s decision led to a further sharp selloff in major global oil benchmarks, with U.S. markets closed for the Thanksgiving holiday. Brent crude fell about 6% to below $73, a four-year low, while the West Texas Intermediate benchmark was down 3.2% to $71.36 a barrel.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen over 4% today to $69.40 per barrel, and Brent to $72.97.

Prices are off over 35% from the peak for the year, and if this price decline holds, there should be further declines in gasoline prices over the next couple of weeks. Gasoline futures are down about 10 cents per gallon.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.80 per gallon (down about 45 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Word of the Year

by Calculated Risk on 11/27/2014 11:16:00 AM

Each year since 2003, Merriam-Webster has listed the Words of the Year mostly based on the frequency that each word was looked up that year.

Some years the "words of the year" have been relevant to Calculated Risk, as an example, in 2004 the word of the year was "blog" (CR was started in January 2005 partly because I was wondering what a "blog" was). In 2008, the word of the year was "bailout", and in 2010 the word was "austerity".

For fun, here are a few suggestions for "word of the year" related to the blog since 2004 (I'm sure others will have better suggestions):

2004: Blog (Merriam-Webster)

2005: Bubble. This was the peak year for the housing bubble (activity peaked in 2005, although prices peaked in early 2006). Writing about the housing bubble was the main topic on the blog in 2005.

2006: Bust. This was when the housing bust started.

2007: Subprime or Recession. It was 2007 that "subprime" started to be used by the general public. An alternative would be "recession" since the Great Recession started in December 2007, and a key topic on the blog all year was when the recession would start. Other words could be: delinquency, Alt-A, and NINJA (No income, jobs or asset loans).

2008: Bailout (Merriam-Webster). Three alternatives could be "Financial Crisis", "TARP" and "foreclosure".

2009: Stimulus. An alternative could be "deflation".

2010: Austerity (Merriam-Webster). Unfortunately austerity could be the "word of the year" for several years.

2011: Default. This was the year Congress threatened to default on paying the bills.

2012: Short Sale. This was probably the year that short sales peaked. This was the year house prices bottomed (but I couldn't think of a "word")

2013: Shutdown. In 2013, Congress shut down the government.

2014: Employment. In May 2014, employment surpassed the pre-recession peak, and 2014 will be the best year for employment since the '90s.

2015: Wages (Just being hopeful - maybe 2015 will be the year that real wages start to increase)

Happy Thanksgiving to all!

Wednesday, November 26, 2014

Fannie Mae: Mortgage Serious Delinquency rate declined in October, Lowest since October 2008

by Calculated Risk on 11/26/2014 08:21:00 PM

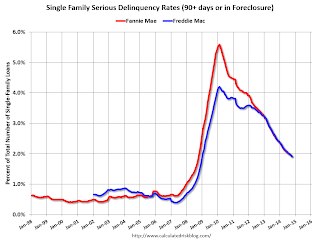

Fannie Mae reported yesterday that the Single-Family Serious Delinquency rate declined in October to 1.92% from 1.96% in September. The serious delinquency rate is down from 2.48% in October 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 1.91% from 1.96% in September. Freddie's rate is down from 2.48% in September 2013, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.56 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in 2016 - although the rate of decline has slowed recently.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in late 2016.

Zillow: Case-Shiller House Price Index year-over-year change expected to slow further in October

by Calculated Risk on 11/26/2014 03:47:00 PM

The Case-Shiller house price indexes for September were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Oct. 2014 Case-Shiller Prediction: Expect the Slowdown to Continue

The September S&P/Case-Shiller (SPCS) data out [yesterday] showed more slowing in the housing market, with annual growth in the 20-city index falling 0.7 percentage points from August’s pace to 4.9 percent in September. This is the first time annual appreciation for the 20-city index has been below 5 percent since October 2012. The national index was up 4.8 percent on an annual basis in September.So the Case-Shiller index will probably show a lower year-over-year gain in October than in September (4.9% year-over-year for the Composite 20 in September, 4.8% year-over-year for the National Index).

Our current forecast for October SPCS data indicates further slowing, with the annual increase in the 20-City Composite Home Price Index falling to 4.3 percent.

The non-seasonally adjusted (NSA) 20-City index was flat from August to September, and we expect it to decrease 0.4 percent in October. We also expect a monthly decline for the 10-City Composite Index, which is projected to fall 0.4 percent from September to October (NSA).

All forecasts are shown in the table below. These forecasts are based on the September SPCS data release and the October 2014 Zillow Home Value Index (ZHVI), released Nov. 20. Officially, the SPCS Composite Home Price Indices for October will not be released until Tuesday, Dec. 30.

| Zillow October 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | October 2013 | 180.29 | 178.20 | 165.90 | 164.01 |

| Case-Shiller (last month) | September 2014 | 188.68 | 184.84 | 173.72 | 170.19 |

| Zillow Forecast | YoY | 4.2% | 4.2% | 4.3% | 4.3% |

| MoM | -0.4% | 0.2% | -0.4% | 0.2% | |

| Zillow Forecasts1 | 187.9 | 185.4 | 173.0 | 170.8 | |

| Current Post Bubble Low | 146.45 | 149.87 | 134.07 | 137.05 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 28.3% | 23.7% | 29.1% | 24.6% | |

| Bubble Peak | 226.29 | 226.87 | 206.52 | 206.61 | |

| Date of Bubble Peak | Jun-06 | Apr-06 | Jul-06 | Apr-06 | |

| Below Bubble Peak | 17.0% | 18.3% | 16.2% | 17.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Comments on October New Home Sales

by Calculated Risk on 11/26/2014 12:24:00 PM

The new home sales report for October was below expectations at 458 thousand on a seasonally adjusted annual rate basis (SAAR).

Also, sales for the previous three months (July, August and September), were revised down.

Sales this year are significantly below expectations, however, based on the low level of sales, more lots coming available, and demographics, it seems likely sales will continue to increase over the next several years.

Earlier: New Home Sales at 458,000 Annual Rate in October

The Census Bureau reported that new home sales this year, through October, were 371,000, Not seasonally adjusted (NSA). That is up 1% from 367,000 during the same period of 2013 (NSA). Not much of a gain from last year. Right now it looks like sales will barely be up this year.

Sales were up 1.8% year-over-year in October.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will be small in Q4, but I expect sales to be up for the quarter and for the year.

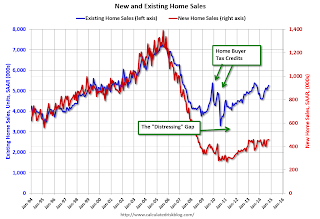

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be somewhat offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 458,000 Annual Rate in October

by Calculated Risk on 11/26/2014 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 458 thousand.

September sales were revised down from 467 thousand to 455 thousand, and August sales were revised down from 466 thousand to 453 thousand.

"Sales of new single-family houses in October 2014 were at a seasonally adjusted annual rate of 458,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.7 percent above the revised September rate of 455,000 and is 1.8 percent above the October 2013 estimate of 450,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottom for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply increased in October to 5.6 months from 5.5 months in September.

The months of supply increased in October to 5.6 months from 5.5 months in September. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of October was 212,000. This represents a supply of 5.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2014 (red column), 37 thousand new homes were sold (NSA). Last year 36 thousand homes were sold in October. This was the best October since 2007.

The high for October was 105 thousand in 2005, and the low for October was 23 thousand in 2010.

This was below expectations of 470,000 sales in October, and there were downward revisions to sales in July, August and September.

I'll have more later today.

Personal Income increased 0.2% in October, Spending increased 0.2%

by Calculated Risk on 11/26/2014 08:48:00 AM

The BEA released the Personal Income and Outlays report for October:

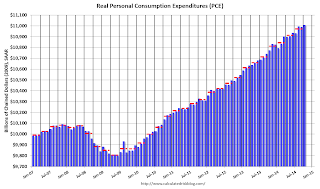

Personal income increased $32.9 billion, or 0.2 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $27.3 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October 2014 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in October, in contrast to a decrease of less than 0.1 percent in September. ... The price index for PCE increased 0.1 percent in October, the same increase as in September. The PCE price index, excluding food and energy, increased 0.2 percent in October, compared with an increase of 0.1 percent in September.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was lower than expected, Also the increase in PCE was below the 0.3% consensus, however that consensus was prior to the upward revisions to August and September PCE in the GDP report. It looks like PCE is off to a decent start to Q4.

On inflation: The PCE price index increased 1.4 percent year-over-year, and at a 0.7% annualized rate in October. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in October, and at a 2.2% annualized rate in October.

Weekly Initial Unemployment Claims increased to 313,000

by Calculated Risk on 11/26/2014 08:30:00 AM

The DOL reported:

In the week ending November 22, the advance figure for seasonally adjusted initial claims was 313,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 291,000 to 292,000. The 4-week moving average was 294,000, an increase of 6,250 from the previous week's revised average. The previous week's average was revised up by 250 from 287,500 to 287,750.The previous week was revised up to 292,000

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 294,000.

This was higher than the consensus forecast of 288,000, but the level suggests few layoffs.

Tuesday, November 25, 2014

Wednesday: New Home Sales, Personal Income, Durable Goods, Unemployment Claims, Pending Home sales

by Calculated Risk on 11/25/2014 08:12:00 PM

Earlier the FDIC released the Quarterly Banking Profile for Q3 today.

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $38.7 billion in the third quarter of 2014, up $2.6 billion (7.3 percent) from earnings of $36.1 billion the industry reported a year earlier. The increase in earnings was mainly attributable to a $7.8 billion (4.8 percent) increase in net operating revenue (the sum of net interest income and total noninterest income), the biggest since the fourth quarter of 2009. ...Wednesday:

The number of "problem banks" fell for the 14th consecutive quarter. The number of banks on the FDIC's "Problem List" declined from 354 to 329 during the quarter, the lowest since the 305 in the first quarter of 2009. The number of "problem" banks now is 63 percent below the post-crisis high of 888 at the end of the first quarter of 2011. Two FDIC-insured institutions failed in the third quarter, compared to six in the third quarter of 2013.

The Deposit Insurance Fund (DIF) balance continued to increase. The DIF balance (the net worth of the Fund) rose to a record $54.3 billion as of September 30 from $51.1 billion at the end of June. The Fund balance increased primarily due to assessment income, recoveries from litigation settlements, and receivership asset recoveries that exceeded estimates.

• At 7:00 AM ET, (This might be delayed due to the holiday) the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 288 thousand from 291 thousand last week.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.5% decrease in durable goods orders.

• Also at 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for a reading of 90.0, up from the preliminary reading of 89.4, and up from the October reading of 86.9.

• At 10:00 AM, the New Home Sales for October from the Census Bureau. The consensus is for an increase in sales to 470 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 467 thousand in September.

• Also at 10:00 AM, Pending Home Sales Index for October. The consensus is for a 0.6% increase in the index.

Freddie Mac: Mortgage Serious Delinquency rate declined in October, Lowest since December 2008

by Calculated Risk on 11/25/2014 04:13:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 1.91% from 1.96% in September. Freddie's rate is down from 2.48% in October 2013, and this is the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for October in a few days.

Although this indicates progress, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.57 percentage points over the last year - and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

Note: Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales for perhaps 2 more years (mostly in judicial foreclosure states).

House Prices: Real Prices and Price-to-Rent Ratio in September

by Calculated Risk on 11/25/2014 01:11:00 PM

The expected slowdown in year-over-year price increases is ongoing. In November 2013, the Comp 20 index was up 13.8% year-over-year (YoY). Now the index is only up 4.9% YoY. This is the smallest YoY increase since October 2012 (the National index was up 10.9% YoY in October 2013, is now up 4.8% - also the slowest YoY increase since October 2012.

Looking forward, I expect the indexes to slow further on a YoY basis, however: 1) I don't expect the indexes to turn negative YoY (in 2015) , and 2) I think most of the slowdown on a YoY basis is now behind us.

This slowdown was expected by several key analysts, and I think it is good news. As Zillow chief economist Stan Humphries said today:

“The days of double-digit home value appreciation continue to rapidly fade away as more inventory comes on line, and the market is becoming more balanced between buyers and sellers,” said Zillow Chief Economist Dr. Stan Humphries. “Like a perfectly prepared Thanksgiving turkey, it’s important for things to cool off a bit in the housing market, because too-fast appreciation risks burning both buyers and sellers. In this more sedate environment, buyers can take more time to find the right deal for them, and sellers can rest assured they won’t be left without a seat at the table when they turn around and become buyers. This slowdown is a critical step on the road back to a normal housing market, and as we approach the end of 2014, the housing market has plenty to be thankful for.”In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,600 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

emphasis added

Another point on real prices: In the Case-Shiller release this morning, the National Index was reported as being 10.4% below the bubble peak. However, in real terms, the National index is still about 25% below the bubble peak.

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.

The first graph shows the monthly Case-Shiller National Index SA, the monthly Case-Shiller Composite 20 SA, and the CoreLogic House Price Indexes (through July) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to March 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to October 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to September 2002 levels, the Composite 20 index is back to June 2002, and the CoreLogic index back to March 2003.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2003 levels, the Composite 20 index is back to September 2002 levels, and the CoreLogic index is back to May 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels - and maybe moving a little sideways now.

NY Fed: Household Debt increased in Q3 2014, "Deleveraging process has ended"

by Calculated Risk on 11/25/2014 11:00:00 AM

Here is the Q3 report: Household Debt and Credit Report. From the NY Fed:

Aggregate household debt balances increased slightly in the 3rd quarter of 2014. As of September 30, 2014, total household indebtedness was $11.71 trillion, up by 0.7% from its level in the second quarter of 2014, an increase of $78 billion. Overall household debt still remains 7.6% below its 2008Q3 peak of $12.68 trillion.

Mortgages, the largest component of household debt, edged up by 0.4%. Mortgage balances shown on consumer credit reports stand at $8.13 trillion, up by $35 billion from their level in the second quarter. Balances on home equity lines of credit (HELOC) dropped by $9 billion (1.7%) in the third quarter and now stand at $512 billion. Non-housing debt balances increased by 1.7 %, boosted by gains in all categories. Auto loan balances increased by $29 billion; student loan balances increased by $8 billion; credit card balances increased by $11 billion.

New extensions increased for auto loans and credit cards, but were roughly flat for both mortgages and HELOCs. There were $105 billion in new auto loan originations, the highest volume since 2005Q3. The aggregate credit card limit continued to increase, and is up by 0.9% from the previous quarter. Mortgage originations, which we measure as appearances of new mortgage balances on consumer credit reports and which include refinanced mortgages, increased slightly to $337 billion but remain low by historical standards. HELOC limits were flat, down by 0.4%.

Overall delinquency rates were flat overall in 2014Q3 As of September 30, 6.3% of outstanding debt was in some stage of delinquency, compared with 6.2% in 2014Q2. About $732 billion of debt is delinquent, with $506 billion seriously delinquent (at least 90 days late or “severely derogatory”).

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased slightly in Q3. Household debt peaked in 2008, and bottomed in Q2 2013.

The recent increase in debt suggests households (in the aggregate) deleveraging is over. Also from the NY Fed: Household Debt Balances Increase as Deleveraging Period Concludes

Total cash flow from mortgage debt and nonmortgage debt combined (black dotted line) has turned slightly positive during the past four quarters, ending a five-year period of negative values, suggesting that, by this measure, the deleveraging process has ended; households have begun to use credit to supplement their cash flow again.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate increased slightly to 6.3% in Q3, from 6.2% in Q2. However the slight increase was in the less than 30 day category, and is not a concern.

The Severely Derogatory (red) rate has fallen to 2.18%, the lowest since Q1 2008.

The 120+ days late (orange) rate has declined to 1.82%, the lowest since Q2 2008.

Short term delinquencies are back to normal levels.

Here is the press release from the NY Fed: New York Fed Report Shows Household Debt Edges Higher

There are a number of credit graphs at the NY Fed site.

Case-Shiller: National House Price Index increased 4.8% year-over-year in September

by Calculated Risk on 11/25/2014 09:14:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Broad-based Slowdown for Home Prices According to the S&P/Case-Shiller Home Price Indices

S&P Dow Jones Indices today released the September 2014 index data for the S&P/Case-Shiller Home Price Indices ... Results show that home prices continue to decelerate. The 10-City Composite gained 4.8% year-over-year, down from 5.5% in August. The 20-City Composite gained 4.9% year-over-year, compared to 5.6% in August.

The National and Composite Indices were both slightly negative in September. Both the 10 and 20-City Composites reported a slight downturn while the National Index posted a -0.1% change for the month. Charlotte and Miami led all cities in September with increases of 0.6%. Atlanta and Washington D.C. offset those gains by reporting decreases of 0.3% and 0.4%. ...

The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.8% annual gain in September 2014. The 10- and 20-City Composites reported year-over-year increases of 4.8% and 4.9%.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 18.5% from the peak, and up 0.3% in September (SA). The Composite 10 is up 23.3% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 17.6% from the peak, and up 0.3% (SA) in September. The Composite 20 is up 24.2% from the post-bubble low set in Jan 2012 (SA).

The National index is off 10.4% from the peak, and up 0.7% (SA) in September. The National index is up 21.0% from the post-bubble low set in Dec 2012 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.9% compared to September 2013.

The Composite 20 SA is up 4.9% compared to September 2013.

The National index SA is up 4.8% compared to September 2013.

Prices increased (SA) in 16 of the 20 Case-Shiller cities in September seasonally adjusted. (Prices increased in 9 of the 20 cities NSA) Prices in Las Vegas are off 42.3% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was above than the consensus forecast for a 4.5% YoY increase for the National index, and suggests a further slowdown in price increases. I'll have more on house prices later.

Q3 GDP Revised Up to 3.9% Annual Rate

by Calculated Risk on 11/25/2014 08:36:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2014 (Second Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- increased at an annual rate of 3.9 percent in the third quarter of 2014, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.6 percent.Here is a Comparison of Second and Advance Estimates. PCE was revised up from 1.8% to 2.2%, and private investment was revised up. A solid report.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 3.5 percent. With the second estimate for the third quarter, private inventory investment decreased less than previously estimated, and both personal consumption expenditures (PCE) and nonresidential fixed investment increased more. In contrast, exports increased less than previously estimated.

The increase in real GDP in the third quarter reflected positive contributions from PCE, nonresidential fixed investment, federal government spending, exports, residential fixed investment, and state and local government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

Monday, November 24, 2014

Tuesday: GDP, Case-Shiller House Prices, Q3 Household Debt and Credit Report and much more

by Calculated Risk on 11/24/2014 08:11:00 PM

There has been little precipitation in California so far this year - following three years of drought - from the NY Times: As Snow Fades, California Ski Resorts Are Left High and Very Dry

The season is just starting, and snow may yet pile high, but the harvest in California the last three years was bleak, and the globe’s long-range forecast is grim.The article is about ski resorts, but the main impact of another year of drought will be on agriculture and food prices (California is by far the largest agricultural producing State).

Last year’s snow pack at the University of California, Berkeley’s Central Sierra Snow Lab, in the heart of California ski country near Lake Tahoe, topped out at a depth of 133 centimeters (about 52 inches), the second lowest of the last 90 years. With most of the snow arriving late in the season, skier and snowboarder visits in this area were down by 25 percent from the season before, according to the National Ski Area Association.

Similarly meager snow packs in 2012 and 2013 have exacerbated the statewide drought, with ramifications far beyond the ski industry. A fourth lackluster season would be unprecedented, according to snow records kept since 1879.

Tuesday:

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2014 (second estimate); Corporate Profits, 3rd quarter 2014 (preliminary estimate). The consensus is that real GDP increased 3.3% annualized in Q3, revised down from the advance estimate of 3.5%.

• At 9:00 AM, the FHFA House Price Index for September 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• Also at 9:00 AM, the S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices. The consensus is for a 4.5% year-over-year increase in the National Index for September, down from 5.1% in August (consensus 4.8% increase in Comp 20). The Zillow forecast is for the Composite 20 to increase 4.7% year-over-year in September, and for prices to increase 0.1% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed surveys for November.

• Also at 10:00 AM, the Conference Board's consumer confidence index for November. The consensus is for the index to increase to 95.7 from 94.5.

• At 11:00 AM, the NY Fed Q3 2014 Household Debt and Credit Report. The New York Fed will also release an accompanying blog, which will analyze household deleveraging.

Mortgage News Daily: Mortgage Rates below 4%, Lowest in 1-Month

by Calculated Risk on 11/24/2014 05:35:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Now at 1-Month Lows

Mortgage rates continue making improvements so small and so steady that they're barely noticeable, but they're improvements just the same. That's recently left us in the best territory in nearly a month. Today extends those slow and steady gains just enough to technically claim the "1-month low" designation, despite the fact that rates aren't materially different than they have been. The most prevalently-quoted conforming 30yr fixed rate remains 4.0% for top tier borrowers, but each day of modest improvement brings us closer to 3.875% and puts 4.125% farther in the rearviewHere is a table from Mortgage News Daily:

Black Knight: House Price Index down slightly in September, Up 4.6% year-over-year

by Calculated Risk on 11/24/2014 01:14:00 PM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). The timing of different house prices indexes; Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: U.S. Home Prices Down Slightly for the Month; Up 4.6 Percent Year-Over-Year

Today, the Data and Analytics division of Black Knight Financial Services released its latest Home Price Index (HPI) report, based on September 2014 residential real estate transactions. The Black Knight HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The Black Knight HPI declined 0.01% percent in September, and is off 10.2% from the peak in June 2006 (not adjusted for inflation).

The year-over-year increases have been getting steadily smaller for the last year - as shown in the table below:

| Month | YoY House Price Increase |

|---|---|

| Jan-13 | 6.7% |

| Feb-13 | 7.3% |

| Mar-13 | 7.6% |

| Apr-13 | 8.1% |

| May-13 | 7.9% |

| Jun-13 | 8.4% |

| Jul-13 | 8.7% |

| Aug-13 | 9.0% |

| Sep-13 | 9.0% |

| Oct-13 | 8.8% |

| Nov-13 | 8.5% |

| Dec-13 | 8.4% |

| Jan-14 | 8.0% |

| Feb-14 | 7.6% |

| Mar-14 | 7.0% |

| Apr-14 | 6.4% |

| May-14 | 5.9% |

| June-14 | 5.5% |

| July-14 | 5.1% |

| Aug-14 | 4.9% |

| Sep-14 | 4.6% |

The press release has data for the 20 largest states, and 40 MSAs.

Black Knight shows prices off 41.0% from the peak in Las Vegas, off 34.3% in Orlando, and 31.7% off from the peak in Riverside-San Bernardino, CA (Inland Empire). Prices are at new highs in Colorado and Texas (Denver, Austin, Dallas, Houston and San Antonio metros). Prices are also at new highs in Honolulu, HI, Nashville, TN and San Jose, CA.

Note: Case-Shiller for September will be released tomorrow.

Dallas Fed: Texas Manufacturing "Posts Slower Growth" in November

by Calculated Risk on 11/24/2014 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Activity Posts Slower Growth

Texas factory activity increased again in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 13.7 to 6, indicating output growth slowed in November.The last of the regional Fed surveys (Richmond) will be released tomorrow. So far the surveys have been solid in November.

Other measures of current manufacturing activity also reflected slower growth during the month. The capacity utilization index fell sharply from 18.1 to 9.8. The new orders index also declined notably from 14.2 to 5.6, although more than a quarter of firms continued to note increases in new orders over October levels. The shipments index was 12.1, nearly unchanged from its October reading.

Perceptions of broader business conditions remained positive this month, while outlooks were less optimistic. The general business activity index held steady at a solid reading of 10.5. The company outlook index dropped from 18.2 to 8.8, due to a smaller share of firms noting an improved outlook in November than in October.

Labor market indicators reflected continued employment growth and longer workweeks. The November employment index posted a sixth robust reading, coming in at 9.6.

emphasis added

Chicago Fed: Index shows "economic activity was near its historical trend" in October

by Calculated Risk on 11/24/2014 08:41:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth decelerated in August

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to +0.14 in October from +0.29 in September. Two of the four broad categories of indicators that make up the index decreased from September, and two of the four categories made negative contributions to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, declined to –0.01 in October from +0.12 in September. October’s CFNAI-MA3 suggests that growth in national economic activity was near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in October (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, November 23, 2014

Sunday Night Futures

by Calculated Risk on 11/23/2014 07:30:00 PM

From Professor Hamilton at Econbrowser: Lower oil prices and the U.S. economy

Last year Americans consumed 135 billion gallons of gasoline. That means that if prices stay where they are, consumers will have an extra $108 billion each year to spend on other things. And if the historical pattern holds, spend it they will.Overall a nice boost for the U.S. economy.

...

[A]nother thing that’s changed is that much more of the oil we consume is now being produced right here at home. While lower prices are a boon for consumers, they pose a potential threat to producers ... Nevertheless, there should be no question that at this point this is a favorable development on-balance for the U.S. economy. We’re still importing 5 million more barrels each day of petroleum and products than we are exporting. Importing fewer barrels, and paying less for the barrels we do import, is a good thing.

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for October. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for November.

Weekend:

• Schedule for Week of November 16th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are up slightly and DOW futures are also up slightly (fair value).

Oil prices were up a little over the last week with WTI futures at $76.58 per barrel and Brent at $80.04 per barrel. A year ago, WTI was at $94, and Brent was at $108 - so prices are down more than 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.82 per gallon (down about 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Update: Business Cycles and Markets

by Calculated Risk on 11/23/2014 11:47:00 AM

For fun ... recently we've seen another recession call for 2015, this time from the Jerome Levy Forecasting Center (following their an incorrect recession call in 2011). Over the last few years, there were several incorrect recession calls from ECRI and others. I disagreed with all of them, and I wrote I wasn't even on recession watch then, and I'm not on recession watch now!

But why do we care? Here is a repeat of a post I wrote in early 2011 (with updated tables and charts):

From 2011 [updates in brackets]: Here is something very different. This is NOT intended as investment advice.

Why is there so much focus on the business cycle? For companies, especially cyclical companies, the reason is obvious – it helps with planning, staffing and investment.

But why are investors so focused on the business cycle? Obviously earnings decline in a recession, and stock prices fall too. The following graph shows the year-over-year (YoY) change in the S&P 500 (using average monthly prices) since 1970. Notice that the market usually declines YoY in a recession.

Note: Because this is “year-over-year” there is a lag to the S&P 500 data. [Graph updated to November 2014]

So calling a recession isn’t just an academic exercise, there is some opportunity to preserve capital.

Not all downturns in the stock market are associated with recessions. As an example, the 1987 market crash was during an economic expansion. And the stock bubble collapse lasted from March 2000 through early 2003 – and the only official economic recession during that period was 7 months in 2001.

Although I don’t give investment advice, I think investors should measure their performance with some index. Warren Buffett likes to use the S&P 500 index, so I also used the S&P 500 for this exercise.

Imagine if we could call recessions in real time, and if we could predict recoveries in advance. The following table shows the performance of a buy-and-hold strategy (with dividend reinvestment), compared to a strategy of market timing based on 1) selling when a recession starts, and 2) buying 6 months before a recession ends.

For the buy and sell prices, I averaged the S&P 500 closing price for the entire month (no cherry picking price – just cherry picking the timing with 20/20 hindsight).

I assumed an investor started at four different times, in January of 1970, 1980, 1990, and 2000 [UPDATE: added 2010 start].

Note: Table columns for sensitivity corrected (ht YT)

| Return from Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | 9.3% | 12.7% | 11.8% | 12.4% | 12.6% | 12.1% |

| Jan-80 | 10.4% | 13.0% | 12.9% | 12.9% | 13.2% | 12.5% |

| Jan-90 | 8.6% | 11.8% | 11.5% | 11.7% | 11.7% | 11.2% |

| Jan-00 | 3.4% | 7.4% | 7.9% | 7.6% | 7.5% | 7.6% |

| Jan-10 | 14.4% | 14.4% | -- | -- | -- | -- |

The “recession timing” column gives the annualized return for each of the starting dates. Timing the recession correctly always outperforms buy-and-hold. The last four columns show the performance if the investor is two months early (both in and out), one month early, one month late, and two months late. The investor doesn’t have to be perfect!

Note: This includes dividends, but not taxes. Also I assumed no interest earned when the investor is out of the market (money in the mattress).

The second table provides the same information, but this time in dollars (assuming a $10,000 initial investment). Notice that someone could have bought the S&P 500 index in January 2000, and they’d be up about $150 [November 2014 Update: Up $16,410] now using buy-and-hold even though the market is still below the January 2000 average price of 1425 [Update: Now well above January 2000].

| Value based on Start Date | Recession Timing Sensitivity | |||||

|---|---|---|---|---|---|---|

| Start Investing | Buy and Hold | Recession Timing | Two Months Early | One Month Early | One Month Late | Two Months Late |

| Jan-70 | $532,650 | $2,113,480 | $1,497,100 | $1,905,810 | $2,053,620 | $1,678,730 |

| Jan-80 | $310,120 | $706,780 | $678,110 | $679,200 | $745,040 | $607,400 |

| Jan-90 | $77,950 | $159,530 | $148,160 | $156,400 | $157,430 | $140,910 |

| Jan-00 | $16,410 | $28,810 | $30,690 | $29,830 | $29,220 | $29,680 |

| Jan-10 | $19,150 | $19,150 | -- | -- | -- | -- |

Unfortunately forecasters have a terrible record of predicting downturns. The running joke is that forecasters have predicted 9 of the last 5 recessions! Although a forecaster doesn’t have to be perfect, they still have to be right. And that is very rare.

As economist Victor Zarnowitz said way back in 1960: “The record of predicting turning points — changes in the direction of economic activity — is on the whole poor." Forecasting hasn't improved much since then.

As an example, here are some comments from then Fed Chairman Alan Greenspan in 1990 (a recession began in July 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].”I'd say he missed that downturn. Of course Wall Street and Fed Chairmen are notoriously bad at calling downturns.

Chairman Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.”

Greenspan, August 1990

“... the economy has not yet slipped into recession.”

Greenspan, October 1990

But the track record for calling recoveries isn’t much better. ... Calling recessions is a mug’s game, but I like to play. I was very lucky with the [2007] recession, but the key wasn’t calling the end in June 2009 (I thought it ended in July), but looking for the bottom in early 2009 (that is why I posted several times in early 2009 that I was looking for the sun).

This is NOT intended as investment advice. I am NOT an investment advisor. Just some (hopefully) fun musing ...

[Final Update: If investors sold when ECRI first made their recession call in Sept 2011, they would have a missed around a 75% increase in the market This shows why trying to add recession timing is difficult; investors have to be correct on the business cycle - and most forecasters and investors are wrong].