by Calculated Risk on 3/31/2012 07:35:00 PM

Saturday, March 31, 2012

Personal Saving Rate and Real Personal Income less Transfer Payments

By request, a couple more graphs based on the February Personal Income and Outlays report. The first graph shows real personal income less transfer payments in 2005 dollars. This has been slow to recover - real (inflation adjusted) personal income less transfer payments decreased slightly in February. This remains 4.2% below the previous peak in early 2008.

From the BEA:

Personal current transfer receipts increased $3.0 billion in February, compared with an increase of $1.6 billion in January.

Click on graph for larger image.

Click on graph for larger image.“Other” government social benefits to persons increased $1.3 billion, in contrast to a decrease of $15.8 billion; the January change was reduced $13.6 billion reflecting the expiration of the Making Work Pay refundable tax credit. Offsetting these changes, government social benefits for social security increased $2.9 billion in February, compared to an increase of $20.3 billion in January; the January change was boosted by a 3.6-percent cost-of-living adjustment (COLAs) to social security benefits.

The second graph is for the personal saving rate.

The saving rate decreased to 3.7% in February.

Personal saving -- DPI less personal outlays -- was $438.7 billion in February, compared with $509.5 billion in January. The personal saving rate -- personal saving as a percentage of disposable income -- was 3.7 percent in February, compared with 4.3 percent in January.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the February Personal Income report.

After increasing sharply during the recession, the saving rate has been moving down for the last two to three years - so spending growth has increased a little faster than income growth. This was especially true in February with spending increasing 0.8% and income only increasing 0.2%.

Earlier:

• Summary for Week Ending March 30th

• Schedule for Week of April 1st

Schedule for Week of April 1st

by Calculated Risk on 3/31/2012 01:05:00 PM

Earlier:

• Summary for Week Ending March 30th

The key report for this week will be the March employment report to be released on Friday, Apr 6th. Other key reports include the ISM manufacturing index on Monday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Wednesday. The FOMC minutes for the March meeting will be released on Tuesday.

Note: Reis is expected to release their Q1 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, a slight decline in vacancy rates for regional malls, and a slight decline in the office vacancy rate.

10:00 AM ET: ISM Manufacturing Index for March.

10:00 AM ET: ISM Manufacturing Index for March. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight increase to 53.0 from 52.4 in February.

10:00 AM: Construction Spending for February. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for March. Light vehicle sales are expected to decline to 14.7 million from 15.0 million in February (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate. TrueCar is forecasting:

The March 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 14.5 million new car sales, up from 13.1 million in March 2011 and down from 15.1 million in February 2012Edmund.com is forecasting:

Edmunds.com estimates that 1,451,956 new cars will be sold in March, for a projected Seasonally Adjusted Annual Rate (SAAR) of 14.9 million units. The projected sales results would be a 26.4 percent increase over February 2012 and a 16.5 percent increase over March 2011.10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 1.5% increase in orders.

2:00 PM: FOMC Minutes, Meeting of March 13th. The minutes might include a discussion of possible easing options.

4:05 PM: San Francisco Fed President John Williams speaks on the economy to students at University of San Diego.

Early: Reis Q1 2012 Apartment vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 208,000 payroll jobs added in March, down from the 216,000 reported last month.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a decrease to 56.7 from 57.3 in February. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a decrease to 56.7 from 57.3 in February. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Early: Reis Q1 2012 Office vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to essentially unchanged at 360,000.

Markets will be closed in observance of Good Friday.

Early: Reis Q1 2012 Mall vacancy rates.

8:30 AM: Employment Report for March. The consensus is for an increase of 201,000 non-farm payroll jobs in March, down from the 227,000 jobs added in February.

8:30 AM: Employment Report for March. The consensus is for an increase of 201,000 non-farm payroll jobs in March, down from the 227,000 jobs added in February.The consensus is for the unemployment rate to remain unchanged at 8.3%.

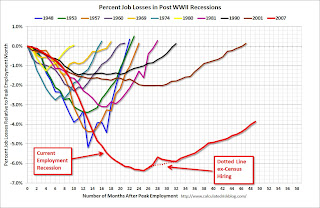

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through February.

The economy has added 3.45 million jobs since employment bottomed in February 2010 (3.94 million private sector jobs added, and 490 thousand public sector jobs lost).

The economy has added 3.45 million jobs since employment bottomed in February 2010 (3.94 million private sector jobs added, and 490 thousand public sector jobs lost).There are still 4.9 million fewer private sector jobs now than when the recession started. (5.3 million fewer total nonfarm jobs).

3:00 PM: Consumer Credit for February. The consensus is for a $12.0 billion increase in consumer credit.

Summary for Week ending March 30th

by Calculated Risk on 3/31/2012 08:05:00 AM

Last week S&P reported that the Case-Shiller house price index fell to a new post-bubble low in January. However it is important to remember that the Case-Shiller index has a significant lag to current pricing.

The report last week was for a three month average for house sales recorded in November, December and January, and sales are usually recorded a couple of months after the purchase agreement is signed. For a house that closed in November, the purchase agreement was probably signed in September or early October. So some portion of the just reported Case-Shiller index was for contract prices over 6 months ago!

Even the most recent portion of the index (for January) is probably for contracts signed in November or early December. A significant lag was fine when we expected prices to just keep on falling, but for those of us now looking for an inflection point for house prices, the Case-Shiller index will only tell us well after the event.

Other data was mixed last week. Three regional Fed manufacturing surveys showed slower expansion in March, the Chicago PMI declined, and pending home sales were down in February.

On the other hand, personal spending increased in February, consumer sentiment improved, and weekly initial unemployment continued to trend down.

Overall mixed and still sluggish growth.

Here is a summary in graphs:

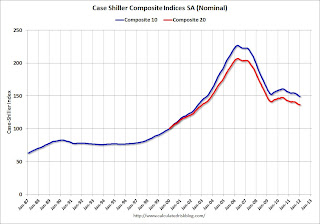

• Case Shiller: House Prices fall to new post-bubble lows in January

S&P/Case-Shiller released the monthly Home Price Indices for January (a 3 month average of November, December and January).

Click on graph for larger image.

Click on graph for larger image.

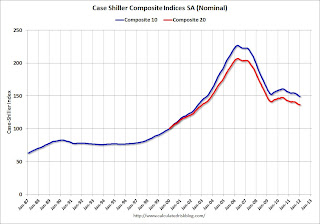

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.2% from the peak, and down 0.1% in January (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and unchanged in January (SA) from December. The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is down 3.8% compared to January 2011.

The Composite 20 SA is down 3.8% compared to January 2011. This was a slightly smaller year-over-year decline for both indexes than in December.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.

Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next couple of months (this report was for the three months ending in January).

• Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the CoreLogic, Case-Shiller Composite 20, and Case-Shiller National indexes in real terms (adjusted for inflation using CPI less Shelter).

This graph shows the CoreLogic, Case-Shiller Composite 20, and Case-Shiller National indexes in real terms (adjusted for inflation using CPI less Shelter). In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to February 2000, and the CoreLogic index back to August 1999.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to February 2000 levels, and the CoreLogic index is back to August 1999.

• Weekly Initial Unemployment Claims decline to 359,000

The following graph shows the 4-week moving average of weekly claims since January 2000.

The DOL reports "In the week ending March 24, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 5,000 from the previous week's revised figure of 364,000. The 4-week moving average was 365,000, a decrease of 3,500 from the previous week's revised average of 368,500." Note: "This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised."

The DOL reports "In the week ending March 24, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 5,000 from the previous week's revised figure of 364,000. The 4-week moving average was 365,000, a decrease of 3,500 from the previous week's revised average of 368,500." Note: "This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,000 (after annual revisions).

The 4-week moving average is at the lowest level since early 2008 (including revisions).

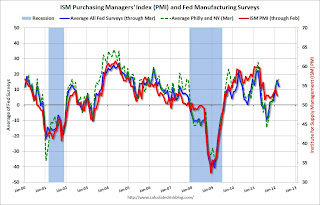

• Regional Fed Manufacturing Surveys

Three regional Fed surveys were released last week: Richmond, Dallas and Kansas City. All three showed slightly slower expansion in March.

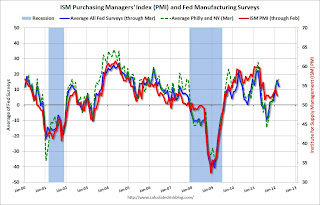

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

• Personal Income increased 0.2% in February, Spending 0.8%

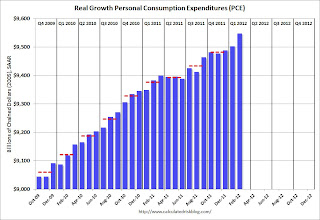

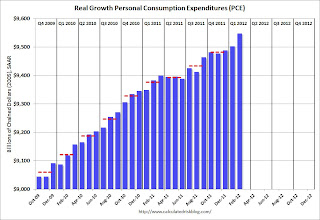

The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars).

PCE increased 0.8% in February, and real PCE increased 0.5%. January was revised up from unchanged to a 0.2% increase.

PCE increased 0.8% in February, and real PCE increased 0.5%. January was revised up from unchanged to a 0.2% increase. Note: The PCE price index, excluding food and energy, increased 0.1 percent. The personal saving rate was at 3.7% in February.

This was a sharp increase in spending in February (and January spending was revised up). Using the two-month method, it appears real PCE will increase around 2.0% in Q1 (PCE is the largest component of GDP); the mid-month method suggests an increase closer to 2.9%.

• Consumer Sentiment improves in March

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.This was above the consensus forecast of an increase to 74.7. Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer and is near the high since collapsing in late 2007 and early 2008.

• Other Economic Stories ...

• Chicago PMI declines to 62.2

• From the NAR: Pending Home Sales Ease in February but Solidly Higher Than a Year Ago

• From ATA: ATA Truck Tonnage Increased 0.5% in February

• Restaurant Performance Index increases in February

Friday, March 30, 2012

Unofficial Problem Bank list declines to 948 Institutions

by Calculated Risk on 3/30/2012 10:30:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 30, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, the FDIC released its enforcement action activity for February 2012. For the week, there were six removals and five additions, which leave the Unofficial Problem Bank List with 948 institutions and assets of $377.6 billion. A year ago, there were 985 institutions with assets of $431.1 billion. For the month of March 2012, there were 21 removals and nine additions or a net decline of 12 institutions and assets of $12.1 billion. This month there were 14 removals from action termination, which is the first month since the list has been published that action terminations greatly outpaced new additions.The unofficial problem bank list peaked at 1,004 institutions in July 2011, and has slowly declined since then.

The action terminations this week include Homestreet Bank, Seattle, WA ($2.2 billion); Security State Bank, Scott City, KS ($132 million); United Pacific Bank, City Of Industry, CA ($126 million); America California Bank, San Francisco, CA ($123 million); and Peoples Bank of the South, Bude, MS ($78 million). The failed Fidelity Bank, Dearborn, MI ($843 million Ticker: DEAR), which had been operating under a Prompt Corrective Action order since September 2011, was also removed this week.

The five additions include Community Bank of Florida, Inc., Homestead, FL ($525 million); Frontier Bank, LaGrange, GA ($298 million); Bank of Eastman, Eastman, GA ($221 million); First Enterprise Bank, Oklahoma City, OK ($167 million); and Surety Bank, DeLand, FL ($112 million).

Fannie Mae and Freddie Mac Serious Delinquency rates declined in February

by Calculated Risk on 3/30/2012 06:33:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in February to 3.82%, down from 3.90% in January. This is down from 4.44% in February 2011. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined to 3.57% in February, down from 3.59% in January. Freddie's rate is down from 3.82% in Feburary 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The serious delinquency rate has been declining, but declining very slowly. The recent sideways move for Freddie Mac would still hasn't been explained. With the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster over the next year.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Bank Failure #16 in 2012: Fidelity Bank, Dearborn, Michigan

by Calculated Risk on 3/30/2012 05:10:00 PM

Michigan mega morass

Sixteenth sour shop

by Soylent Green is People

From the FDIC: The Huntington National Bank, Columbus, Ohio, Assumes All of the Deposits of Fidelity Bank, Dearborn, Michigan

As of December 31, 2011, Fidelity Bank had approximately $818.2 million in total assets and $747.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $92.8 million. ... Fidelity Bank is the 16th FDIC-insured institution to fail in the nation this year, and the first in Michigan.It is Friday! And I need one ...

Restaurant Performance Index increases in February

by Calculated Risk on 3/30/2012 03:20:00 PM

From the National Restaurant Association: Restaurant Industry Outlook Improves as Restaurant Performance Index Stood Above 100 for 4th Consecutive Month

Bolstered by positive same-store sales and traffic results and an optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) remained above 100 for the fourth consecutive month in February. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.9 in February, up 0.6 percent from January’s level of 101.3. In addition, the RPI stood solidly above the 100 threshold in February, which signifies expansion in the index of key industry indicators.

“Buoyed by continued gains in national employment and an extra day in February as a result of Leap Year, a solid majority of restaurant operators reported positive same-store sales and traffic results,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are bullish about sales growth in the months ahead, while their outlook for the economy remains cautiously optimistic.”

“Perhaps the most positive indicator is the optimistic outlook for staffing levels in the months ahead,” Riehle added. “Only seven percent of restaurant operators expect to reduce staffing levels in the next six months, the lowest level in nearly eight years.”

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.9 in February from 101.3 in January (above 100 indicates expansion). This was boosted by the leap year (the index is not adjusted), but this is still positive.

The comment on employment was especially positive.

State Unemployment Rates "little changed" in February

by Calculated Risk on 3/30/2012 12:50:00 PM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in February. Twenty-nine states recorded unemployment rate decreases, 8 states posted rate increases, and 13 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 12.3 percent in February. Rhode Island and California posted the next highest rates, 11.0 and 10.9 percent, respectively. North Dakota again registered the lowest jobless rate, 3.1 percent, followed by Nebraska, 4.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

Misc: Chicago PMI declines to 62.2, Consumer Sentiment improves

by Calculated Risk on 3/30/2012 09:55:00 AM

• Chicago PMI: The overall index declined to 62.2 in March from 64.0 in February. This was below consensus expectations of 63.0 and indicates slower growth in March. Note: any number above 50 shows expansion. From the Chicago ISM:

The Chicago Purchasing Managers reported the March Chicago Business Barometer paused after February's ten month high. While slowing, the Chicago Business Barometer marked its fifth month above 60, a 2-1/2 year period of expansion and trend data improved. Increases were seen in five of eight Business Activity Indexes, highlighted by significant advances in Prices Paid and Inventories, and a notable lengthening in lead times for Production Material.•

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.Click on graph for larger image.

This was above the consensus forecast of an increase to 74.7. Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer and is near the high since collapsing in late 2007 and early 2008.

Personal Income increased 0.2% in February, Spending 0.8%

by Calculated Risk on 3/30/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $28.2 billion, or 0.2 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $86.0 billion, or 0.8 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in February, compared with an increase of 0.2 percent in January. ... The price index for PCE increased 0.3 percent in February, compared with an increase of 0.2 percent in January. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.PCE increased 0.8% in February, and real PCE increased 0.5%. January was revised up from unchanged to a 0.2% increase.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 3.7% in February.

This was a sharp increase in spending in February (and January spending was revised up). Using the two-month method, it appears real PCE will increase around 2.0% in Q1 (PCE is the largest component of GDP); the mid-month method suggests an increase closer to 2.9%.

Thursday, March 29, 2012

Los Angeles Mayor to "lay off a large number of employees"

by Calculated Risk on 3/29/2012 09:20:00 PM

Just a reminder that the state and local layoffs haven't ended ...

From the LA Daily News: L.A. Mayor Antonio Villaraigosa calls for layoffs of city workers

"We're going to lay off a large number of employees. I'm not going to say how many," [Mayor Antonio Villaraigosa] said ... today.According to the BLS, state and local governments have reduced payrolls by about 650 thousand over the last four years. The pace of layoffs has slowed recently, but there are still more to come.

...

City Administrative Officer Miguel Santana said this week the city's budget deficit for the next fiscal year is close to $220 million.

...

The mayor said he will push to raise the retirement age for city workers to 67, vowing to put it before voters if not approved by the City Council.

Q4 GDP and GDI

by Calculated Risk on 3/29/2012 07:19:00 PM

Early this morning the BEA released the third estimate of Q4 GDP. The BEA reported that Real gross domestic product "increased at an annual rate of 3.0 percent in the fourth quarter of 2011", the same as the previous estimate.

Also in the release, the BEA reported the real gross domestic income (GDI) increased at a 4.4% annualized rate in Q4.

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). A research paper in 2010 suggested that GDI is often more accurate than GDP. For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...During the worst period of the recession, GDI fell more than GDP as Nalewaik noted. In subsequent revisions, GDP was revised down showing the economy contracted more than originally reported - and closer to the original GDI reports.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

The opposite has happened over the last two quarters - GDI is showing stronger growth than GDP - and this suggests that 2nd half 2011 GDP might be revised up with the next annual revision that will be released on July 27th (Revised Estimates will be provided for years 2009 through 2011).

David Wessell wrote about this at the WSJ Real Time Economics this morning GDI: An Alternate Measure Showing Stronger U.S. Growth

With its third revision of fourth-quarter GDP, issued Thursday, the agency also released its GDI estimates. Here’s what they show:Of course this is all history and the focus will be on Q1.

GDP Q4 up 3.0% GDI Q4 up 4.4%

GDP Q3 up 1.8% GDI Q3 up 2.6%

FULL YEAR 2011 GDP: up 1.7% FULL YEAR 2011 GDI: up 2.1%

As our colleague Jon Hilsenrath notes: “The clues in these numbers are especially important now because of the Okun’s Law conundrum: The economy doesn’t seem to be growing fast enough to account for the recent sharp declines in the unemployment rate. It might be the case that GDP numbers are understating growth.” (Read more about the disconnect between growth and labor-market improvement.)

Reacting to the latest numbers (on Twitter), economist Justin Wolfers of the University of Pennsylvania said: “GDI growth was fast enough to explain rapid jobs growth. Historically, GDP revises toward GDI.”

Note: Personal income and outlays for February will be released tomorrow.

Bernanke: "The Federal Reserve and the Financial Crisis" Part 4

by Calculated Risk on 3/29/2012 04:12:00 PM

This is part 4 of 4 of a lecture series on the Federal Reserve.

From the WSJ: Fed Chief Bernanke Defends Bond Buys

In the period after World War II, "many central banks began to view financial stability as kind of a junior partner to monetary policy—it was not as important," Mr. Bernanke said. "It's now clear that maintaining financial stability is just as important a responsibility as monetary and economic stability, and indeed this is very much a return to where the Fed came from in the beginning."My comment: One of the key reason for the financial crisis was the lack of proper oversight during the bubble. Usually I'm pretty optimistic, but as time passes, and memories fade, the oversight will probably be ignored again.

Here is a link to the lecture series including links to videos.

Here are the slides for the lectures:

Lecture 1: Origins and Mission of the Federal Reserve

Lecture 2: The Federal Reserve after World War II

Lecture 3: The Federal Reserve’s Response to the Financial Crisis

Lecture 4: The Aftermath of the Crisis

CoreLogic: Almost 65,000 completed foreclosures in February 2012

by Calculated Risk on 3/29/2012 01:03:00 PM

From CoreLogic: CoreLogic® Reports Almost 65,000 Completed Foreclosures Nationally in February

CoreLogic ... today released its National Foreclosure Report for January, which provides monthly data on completed foreclosures, foreclosure inventory and 90+ delinquency rates. There were approximately 65,000 completed foreclosures in February 2012, compared to 66,000 in February 2011, and 71,000 in January 2012. The number of completed foreclosures for the 12 months ending in February was 862,000. From the start of the financial crisis in September 2008, there have been approximately 3.4 million completed foreclosures.This is a new monthly report and will help track the number of completed foreclosures, and to see if the lenders are starting to clear the foreclosure inventory backlog following the mortgage settlement.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the foreclosure inventory as of February 2012 compared to 1.5 million, or 3.6 percent, in February 2011 and 1.4 million, or 3.4 percent, in January 2012. Nationally, the number of borrowers in the foreclosure inventory decreased by 115,000, a decline of 7.6 percent, in February 2012 compared to February 2011.

"The pace of completed foreclosures is down slightly compared to January, running at an annualized pace of 670,000, but compares favorably to the pace of completed foreclosures in February a year ago. Even though the pace of completed foreclosures has slowed, the overall foreclosure inventory is decreasing because REO sales were up in February,” said Mark Fleming, chief economist for CoreLogic. “With the spring buying season upon us, the inventory may decline further as the pace of distressed-asset sales rises along with the rest of the housing market.”

Notes: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes, during this process, the loan will cure or a short sale approved, so not all loans in the foreclosure inventory are future "completed foreclosures".

When CoreLogic reports "completed foreclosures", they are discussing the number of homes moving from the foreclosure process to REO.

Another vendor, LPS, reported 91,086 completed foreclosures in January (significantly above the revised 71,000 reported by CoreLogic). I've heard that the LPS February numbers will probably be higher than CoreLogic too (LPS will release next week).

Kansas City Fed: Growth in Manufacturing Activity Moderated Slightly in March

by Calculated Risk on 3/29/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Moderated Slightly but Remained Solid Overall

Growth in Tenth District manufacturing activity moderated slightly but remained generally solid overall, with a continued positive outlook for future months. ... The month-over-month composite index was 9 in March, down from 13 in February but up from 7 in January ...The index for number of employees increased from 11 to 12, and the average workweek index increase to +2 from -3 in February.

The production index dropped from 20 to 13, and the order backlog index also fell after rising last month. In contrast, the shipments and new order indexes both increased from 8 to 17, and employment index also edged higher.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The ISM index for March will be released Monday April 2nd, and these surveys suggest some increase from the 52.4 reading in February.

Weekly Initial Unemployment Claims decline to 359,000

by Calculated Risk on 3/29/2012 08:30:00 AM

The DOL reports:

In the week ending March 24, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 5,000 from the previous week's revised figure of 364,000. The 4-week moving average was 365,000, a decrease of 3,500 from the previous week's revised average of 368,500.Note: "This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised."

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,000 (after annual revisions).

The 4-week moving average is at the lowest level since early 2008 (including revisions).

And here is a long term graph of weekly claims:

The ongoing decline in initial weekly claims is good news. After the revisions, this is the lowest level for claims since early 2008 and the trend is down.

Wednesday, March 28, 2012

Update: Gasoline Prices

by Calculated Risk on 3/28/2012 08:14:00 PM

From the WSJ: Iran Oil Flow Slows, and Price Fears Rise

By the end of March, with three months until a European Union embargo on Iranian oil takes effect, Iran's exports are expected to fall by about 300,000 barrels a day from last month, to 1.9 million barrels daily, a nearly 14% drop ...From Jim Hamilton at Econbrowser: A rational reason for high oil prices

Mounting fears of Iranian disruptions have sent the price U.S. motorists pay at gasoline pumps closer to $4 a gallon.

From the WaPo: Gas prices in D.C. surpass $4 a gallon

Two months before the summer driving season officially starts, average gas prices in the Washington region have hit $4, the earliest they have ever reached that milestone ... According to AAA’s national survey of gas prices, a gallon of regular-grade fuel is now averaging $4.15 in the District. ... The national average is $3.91, compared to about $3.70 last month and just below $3.59 this time last year.Hey - I wish gasoline was back to only $4 per gallon in California!

Note: The graph shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

JPMorgan CEO on Housing

by Calculated Risk on 3/28/2012 05:05:00 PM

From Margo Beller at CNBC: Improving Housing Market Driving Economy: Jamie Dimon

"I believe we’re very close to the inflection point. People look at prices that are still coming down but all the other signs are flashing green," [CEO Jamie Dimon] said during a job fair in New York for hiring veterans.The comment on inventory declining in half is a bit of an exaggeration - actually listed inventory peaked at just over 4 million in July 2007, and is down about 40% - and inventory will increase seasonally over the next 6 months.

... "the shadow inventory everyone talks about is lower today than it was 12 months ago. It will be a lot lower 12 months from now," he said.

Distressed inventory "is actually coming down, not going up. Homes for sale are about half what they were four years ago. You could come up with a pretty bullish case. If the economy grows, housing gets better, quicker."

However I agree with Dimon on his key points. The first "bottom" for housing (new home sales, housing starts and residential investment) has already happened, and the second bottom (for prices) is close to an "inflection point".

See my posts from early February: The Housing Bottom is Here and Housing: The Two Bottoms

The long term impact of unemployment

by Calculated Risk on 3/28/2012 02:09:00 PM

This is a depressing, but important post from Binyamin Appelbaum at the NY Times Economix: The Enduring Consequences of Unemployment

Our economic malaise has spurred a wave of research about the impact of unemployment on individuals and the broader economy. The findings are disheartening. The consequences are both devastating and enduring.As Appelbaum notes, much of this research was related to earlier recessions and does not address the issue of duration of unemployment.

People who lose jobs, even if they eventually find new ones, suffer lasting damage to their earnings potential, their health and the prospects of their children. And the longer it takes to find a new job, the deeper the damage appears to be.

...

A 2009 study, to cite one recent example, found that workers who lost jobs during the recession of the early 1980s were making 20 percent less than their peers two decades later. The study focused on mass layoffs to limit the possibility that the results reflected the selective firings of inferior workers.

Losing a job also is literally bad for your health. A 2009 study found life expectancy was reduced for Pennsylvania workers who lost jobs during that same period. A worker laid off at age 40 could expect to die at least a year sooner than his peers.

And a particularly depressing paper, published in 2008, reported that children also suffer permanent damage when parents lose jobs.

Here is a repeat of a graph of duration of unemployment based on the most recent employment report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

One of the defining characteristics of the 2007 recession is the large number of workers unemployed for an extended period (the red line on the graph). The consequences of long term unemployment are probably worse than the studies Appelbaum mentioned.

Report: US, UK and France considering releasing Oil

by Calculated Risk on 3/28/2012 10:28:00 AM

The Financial Times is reporting: US, France and UK consider oil release

Asked by reporters ... whether France would join a US-UK move to release strategic stocks, [French energy minister] Eric Besson replied: “It is the US that has asked for it. France is favourable to the suggestion.”The article notes that the head of the IEA has recently said that a release is not warranted because there is no disruption in supply.

The minister added: “We are waiting now for the conclusions of the International Energy Agency”.

excerpt with permission

More from Reuters: France discussing strategic oil release with UK, US

France's Energy Minister Eric Besson told journalists after the weekly ministers' meeting that the United States had asked France to join it in a possible emergency inventory release.According to Bloomberg, Brent Crude futures are at $123.99 per barrel, and West Texas Intermediate (WTI) is at $105.37 per barrel.

Such a release could happen "in a matter of weeks", Le Monde daily said on Wednesday, citing presidential sources.

MBA: Refinance Applications Drop for Sixth Consecutive Week

by Calculated Risk on 3/28/2012 08:38:00 AM

From the MBA: Refinance Applications Drop for Sixth Consecutive Week

Mortgage applications decreased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending March 23, 2012. ...Now that the automated systems are available, we will probably see an increase in HARP refinance activity going forward.

The Refinance Index decreased 4.6 percent from the previous week. The Refinance Index has decreased for six consecutive weeks, falling to its lowest level since December, and is 24.2 percent lower than its 2012 peak observed in February. The decline in the Refinance Index this week was driven largely by a 12.0 percent drop in government refinance activity, while conventional refinance applications fell by less, decreasing 3.4 percent from the previous week. The seasonally adjusted Purchase Index increased 3.3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.23 percent, the highest rate since November 2011, from 4.19 percent

Tuesday, March 27, 2012

Update: Greek Election in late April or May

by Calculated Risk on 3/27/2012 11:12:00 PM

From the WSJ: Greece's Fringe Parties Surge Amid Bailout Ire

The election, not yet scheduled but expected in April or May, is shaping up as a public revolt against Greece's political establishment, which has backed the austerity policies that are the price of financial life support from Europe and the International Monetary Fund. Mainstream politicians are increasingly painted as leading Greece into a debt trap, then impoverishing it in trying to escape.This sounds like a "just vote no" election.

As a result, Greece's major parties, which have promised Europe they will enact yet another round of deep public-spending cuts by summer, are struggling for support.

Half the electorate plans to vote for radical opposition groups, ranging from Soviet-style Communists to anti-immigrant neo-Nazis ...

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in January

• Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

• All current house price graphs

Housing: Toll Brothers "Orders up significantly", "Best Spring season in five years"

by Calculated Risk on 3/27/2012 07:06:00 PM

From CNBC: 'Best Spring in Five Years' for Housing: Toll CEO

It's been the "best spring in five years," [Toll Brothers CEO Douglas Yearley told CNBC]. In 2012 "our orders are up significantly and continue to be up significantly. I'm optimistic right now."This still hasn't shown up in the Census Bureau new home sales reports - but it will. Lennar reported sales up 33% year-over-year, Hovanian reported sales up 30% - however KB Home reported a decline in sales, though, as Tom Lawler noted today "KB Home’s surprise YOY drop in net orders for the quarter ended February 29th was company specific, and may have been related to its “preferred mortgage lender” issue."

...

"25 percent of our communities have seen a price increase since Jan 1. That’s encouraging. There are places where we don’t have pricing power (but) we’re not dropping prices. We haven’t dropped prices in over a year."

...

Phoenix is hot for housing, having gone from 14 to 16 months of supply down to four or five months. "In the last month, Phoenix is back in a big way," Yearley said.

...

"We're bumping along the bottom in certain locations but we're clearly off the bottom in other locations," Yearley said.

Also the major homebuilders have probably gained share, so the increase will not be as sharp as some builders are reporting - but I expect to see a further increase in sales in the Census Bureau monthly report.

Bernanke Interview on ABC at 6:30 PM

by Calculated Risk on 3/27/2012 06:29:00 PM

From the transcript:

CHAIRMAN BERNANKE: Well, we are in a recovery. The economy's been growing-- for almost three years. And we've had some good news lately. We've-- seen the unemployment rate come down. We've seen more jobs be created. And-- consumer and household-- and business sentiment have all improved, so that's all positive, but--

DIANE SAWYER: Strong?

CHAIRMAN BERNANKE: --we do have a long way to go. I-- I would say that we-- you know, it's-- it's far too early to declare victory. We have-- still 8.3% unemployment, that's-- that's too high. We've got a lot of people been un-- out of work for more than six months.

...

DIANE SAWYER: Another quantitative easing on the table, always possible?

CHAIRMAN BERNANKE: Well, we don't take any options off the table. We don't know what's gonna happen in the future and we have to be prepared to respond to however the economy evolves. But again we have 17 people around the table. We look at the economy-- comprehensively and-- and review it-- at every meeting and we try to assess, you know, how much progress we're making and what else we can do that will help us achieve both the growth we want, the reduction in unemployment we want, but also maintain the price stability, the low inflation which is the other part of our mandate.

...

DIANE SAWYER: I-- I want to just make sure I cover housing. And we're seeing these mixed signals on housing, housing prices still low, but we are seeing some-- up-tick in new house sales and also existing house sales. Have we hit bottom on housing?

CHAIRMAN BERNANKE: Well, housing remains-- a big concern for us. Normally in a recovery you would see housing growing much more quickly, construction-- housing related industries. So far housing is-- kinda still pretty flat. We have seen a few signs-- of-- of progress-- a few extra permits for construction. We see more construction in multi-family-- housing. More people are moving into apartment buildings for example. So there's a bit of-- a bit of a green shoot there if you-- if you will. But-- you know, we're not really yet in a full-fledged housing recovery. And you know, that will be part of-- the full recovery of the economy.

ATA Trucking index Increased 0.5% in February

by Calculated Risk on 3/27/2012 02:58:00 PM

From ATA: ATA Truck Tonnage Increased 0.5% in February

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.5% in February after falling 4.6% in January. (January’s decrease was more than the preliminary 4% drop we reported on February 28th.) The latest gain put the SA index at 119.3 (2000=100), up from January’s level of 118.7. Compared with February 2011, the SA index was up 5.5%, better than January’s 3.1% increase.

...

“Fleets told us that February was decent and that played out in the numbers,” ATA Chief Economist Bob Costello said. Costello noted that February’s month-to-month increase was sixth in the last seven months.

“I’m still expecting continued truck tonnage growth going forward. Rising manufacturing activity and temperate consumer spending should be helped a little from an improving housing market,” he said.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 5.5% year-over-year. From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.

Earlier on House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in January

• Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

• All current house price graphs

Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

by Calculated Risk on 3/27/2012 12:15:00 PM

Another Update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1998 and early 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through January) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to January 2003 levels, and the CoreLogic index is back to February 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to February 2000, and the CoreLogic index back to August 1999.

In real terms, all appreciation in the '00s - and more - is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to February 2000 levels, and the CoreLogic index is back to August 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels, and will all probably be back to late '90s levels within the next few months.

Earlier:

• Case Shiller: House Prices fall to new post-bubble lows in January

Misc: Lennar reports 33% increase in orders, Richmond Fed survey shows slower Expansion, Consumer confidence declines

by Calculated Risk on 3/27/2012 10:27:00 AM

• From Lennar:

"New sales orders in the first quarter were encouraging. We have seen the market stabilize, driven by a combination of low home prices and low interest rates, making the decision to purchase a new home more attractive, compared to the heated rental market. We recorded our strongest first quarter sales since 2008, with new orders increasing 33% year-over-year. We have been able to increase sales prices and have started to reduce sales incentives in some of our communities. We have also seen a noticeable improvement in our sales pace per community, which should lead to a significant increase in the operating leverage of our homebuilding segment in the second half of the year." [said Stuart Miller, Chief Executive Officer of Lennar Corporation]• From the Richmond Fed: Manufacturing Growth Moderates In March; Expectations Remain Positive

In March, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — declined thirteen points to 7 from February's reading of 20. Among the index's components, shipments lost twenty-three points to 2, new orders dropped ten points to finish at 11, and the jobs index moved down seven points to end at 6.This suggests slower growth in March.

• From MarketWatch: March consumer-confidence gauge declines to 70.2

A gauge of U.S. consumer confidence declined in March due to lower employment expectations, while views on the present situation rose to the highest level since 2008, the Conference Board reported Tuesday. The consumer-confidence gauge fell to 70.2 in March from a February reading of 71.6.

Case Shiller: House Prices fall to new post-bubble lows in January

by Calculated Risk on 3/27/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January (a 3 month average of November, December and January).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:

2012 Home Prices Off to a Rocky Start According to the S&P/Case-Shiller Home Price Indice

Data through January 2012, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed annual declines of 3.9% and 3.8% for the 10- and 20-City Composites, respectively. Both composites saw price declines of 0.8% in the month of January. Sixteen of 19 MSAs also saw home prices decrease over the month; only Miami, Phoenix and Washington DC home prices went up versus December 2011. (Due to delays in data reporting, the January 2012 index values for Charlotte are not included in this month’s release).

“Despite some positive economic signs, home prices continued to drop. The 10- and 20- City Composites and eight cities – Atlanta, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle and Tampa – made new lows,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Detroit and Phoenix, two cities that have suffered massive price declines, plus Denver, saw increasing prices versus January 2011. The 10-City Composite was down 3.9% and the 20-City was down 3.8% compared to January 2011.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.2% from the peak, and down 0.1% in January (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and unchanged in January (SA) from December. The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.8% compared to January 2011.

The Composite 20 SA is down 3.8% compared to January 2011. This was a slightly smaller year-over-year decline for both indexes than in December.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next couple of months (this report was for the three months ending in January). I'll have more on prices later.

Monday, March 26, 2012

House Prices and Lagged Data

by Calculated Risk on 3/26/2012 10:33:00 PM

All data is lagged, but some data is lagged more than others.

In times of economic stress, I tend to watch the high frequency data closely: initial weekly unemployment claims, monthly manufacturing surveys, and consumer sentiment. The “high frequency” data is lagged, but the lag is usually just a week or two.

Most of the time I focus on the monthly employment report, GDP, housing starts, new home sales and retail sales. The lag for most of this data is several weeks. As an example, the BLS reference period contains the 12th of the month, so the report is lagged a few weeks by the time it is released. The housing starts and new home sales data released last week were for February, so the lag is also a few weeks after the end of the month. The advance estimate of quarterly GDP is released several weeks after the end of the quarter.

But sometimes the lag can be much longer. Tomorrow morning the January Case-Shiller house price index will be released. This is actually a three month average for house sales recorded in November, December and January. (Update: April 24: S&P obtains the data when recorded, but uses closing dates, not recording dates for the price index).

But remember that the purchase agreement for a house that closed in November was probably signed in September or early October. So some portion of the Case-Shiller index will be for contract prices 6 or even 7 months ago!

Other house price indexes do a little better. CoreLogic uses a weighted 3 month average with the most recent month weighted the most – and they will release their February index next week, almost a month ahead of Case-Shiller. The LPS house price index is for just one month (not an average) and uses only closings (not recordings like other indexes that can add an additional lag).

But the key point is that the Case-Shiller index will not catch the inflection point for house prices until well after the event happens. Just something to remember ...

Dallas Fed: Texas Manufacturing Expansion Continues in March

by Calculated Risk on 3/26/2012 06:40:00 PM

This was released earlier today.

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to increase in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held steady at 11.1, suggesting growth continued at about the same pace as last month.The Dallas Fed asked some special questions on hiring plans too. The survey indicated that more firms expect to hire over the next six months as opposed to the previous special survey in January 2011. The reason given for hiring is "Expected growth of sales or revenue is high". More demand.

...

Perceptions of broader economic conditions remained positive in March. The general business activity index was positive for the third month in a row, although it fell from 17.8 to 10.8. Twenty-three percent of firms noted improvement in the level of business activity, while 12 percent noted a worsening. The company outlook index posted a sixth consecutive positive reading, but it also retreated slightly, falling to 9.5 from 15.8 last month.

Labor market indicators reflected higher labor demand. Strong employment growth continued in March, although the index edged down from 25.2 to 21.7. Twenty-nine percent of firms reported hiring new workers, while 7 percent reported layoffs. The hours worked index continued to suggest average workweeks lengthened.

Lawler on possible Fannie and Freddie Principal Reductions

by Calculated Risk on 3/26/2012 03:57:00 PM

From housing economist Tom Lawler:

Several media stories, including one from NPR/ProPublica, suggest that new analysis by folks at Fannie and Freddie indicate that engaging in some principal reduction modifications may be cost effective to the GSEs.

At least one of these stories, however, made what appears to be a “most erroneous” statement. E.g. a ProPublica reporter, in a follow-up article to the original NPR/ProPublica article on this issue, wrote that the GSE’s analysis suggested that “(s)uch loan forgiveness wouldn’t just help hundreds of thousands of families (stay) in their homes,” but “it would help save Freddie and Fannie money,” which “would help taxpayers…”

That latter statement, however, appears to be incorrect. Other reports, including an interview with Freddie’s CEO, indicate that the GSEs’ analysis finds that principal reductions would be “cost effective” for the GSEs ONLY after factoring in the new, turbo-charged incentives Treasury would pay to the GSEs (and other lenders/investors) for doing a principal reduction under HAMP. Such incentives -- which were recently tripled, and which the administration recently agreed would be paid to the GSEs as well as other HAMP participants (the GSEs didn’t use to get any HAMP incentives) – are obviously paid for by the government/taxpayers.

HousingWire reported on Friday, e.g., that Freddie CEO “Ed” Haldeman said the following at a symposium:

"I have to say recently the Treasury sweetened the program and tremendously increased the incentive payments in their offer to us. We will reevaluate that to see what may be in our economic best interest. If there are very large incentive payments — which could be 50% of what you could write down — it may be in our economic self-interest to participate in that."

So here’s the “taxpayer” scoop: as best as I can tell, the GSEs’ analysis (which, to be fair, some have questioned) suggests that principal reductions would NOT make sense for them (or, implicitly, for taxpayers) without any Treasury/taxpayer incentive payments. However, IF the GSEs receive hefty incentive payments from Treasury/taxpayers to engage in principal reductions, then in some cases doing so WOULD make sense to the GSEs – but NOT to taxpayers!

CR Note: Hopefully the analysis will be released!

Comment: QE3 Remains Likely

by Calculated Risk on 3/26/2012 01:22:00 PM

I still think QE3 is likely around mid-year. Fed Chairman Bernanke's comments this morning that the "job market remains far from normal", and that he views the high unemployment rate as cyclical, not structural (I think this is obvious), suggests the Fed remains ready to take more action.

The next two meetings of the FOMC (April 24th and 25th, and June 19th and 20th) are both two day meetings. Although the Fed remains data dependent, I think they might hint at further action in April, and possibly announce QE3 in June.

From Kristina Peterson and Jon Hilsenrath at the WSJ: Bernanke Notes Labor Market Concerns

Federal Reserve Chairman Ben Bernanke said low interest-rate policies were needed to confront deep, continuing problems in the labor market.Goldman Sachs economists wrote in early March:

The comments run counter to a view that has emerged in financial markets recently that the Fed is preparing to back away from its low-interest-rate policies. ... Mr. Bernanke's comments indicate that his own views about policy haven't shifted as much as the markets have in recent weeks.

...

Mr. Bernanke avoided trying an answer another question: Whether the Fed will launch another bond-buying program, known to many as "quantitative easing," to push long-term interest rates even lower. The Fed has clearly left the door open to another program, but hasn't made any decisions on whether or how to proceed on that front. Mr. Bernanke's comments Monday suggested another round of bond buying is still on the table if the economy slows or unemployment starts rising again, but it's not a sure thing.

We expect that the Fed will ultimately announce a return to balance sheet expansion sometime in the first half of 2012, likely including purchases of mortgagebacked securities (MBS).At the same time, Merrill Lynch noted:

In our view, it is wishful thinking to believe the Fed will do QE when the data flow is healthy. We expect renewed QE only after Operation Twist ends in June ... only if the economy is slowing ... Under our growth forecast ... QE3 comes in September.If the economy slows, and key inflation measures start falling again - then QE3 remains likely. But right now, with most data somewhat better than expected, and inflation a little higher than the Fed's target, the Fed is still in "wait and see" mode.

If we look at the most recent projections, the unemployment rate has fallen a little faster than expected, GDP has been a little stronger, and inflation is a little higher. My guess is the decline in the unemployment rate will slow, and inflation will ease - so I think QE3 remains likely around mid-year.

NAR: Pending home sales index decreases in February

by Calculated Risk on 3/26/2012 10:00:00 AM

From the NAR: Pending Home Sales Ease in February but Solidly Higher Than a Year Ago

The Pending Home Sales Index, a forward-looking indicator based on contract signings, eased 0.5 percent to 96.5 in February from 97.0 in January but is 9.2 percent above February 2011 when it was 88.4. The data reflects contracts but not closings.This was below the consensus of a 1.0% increase for this index.

...

The PHSI in the Northeast slipped 0.6 percent to 77.7 in February but is 18.4 percent above a year ago. In the Midwest the index jumped 6.5 percent to 93.8 and is 19.0 percent higher than February 2011. Pending home sales in the South fell 3.0 percent to an index of 105.8 in February but are 7.8 percent above a year ago. In the West the index declined 2.6 percent in February to 99.3 and is 1.8 percent below February 2011.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in March and April.

Chicago Fed: Economic Growth in February "near average"

by Calculated Risk on 3/26/2012 08:57:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth near average in February

Led by weaker production-related indicators, the Chicago Fed National Activity Index decreased to –0.09 in February from +0.33 in January. ...This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased from +0.22 in January to +0.30 in February—its highest level since May 2010. February’s CFNAI-MA3 suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.This suggests growth near trend in February - still not strong growth.

According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Bernanke: Labor Market "remain far from normal"

by Calculated Risk on 3/26/2012 08:11:00 AM

From Fed Chairman Ben Bernanke: Recent Developments in the Labor Market

We have seen some positive signs on the jobs front recently, including a pickup in monthly payroll gains and a notable decline in the unemployment rate. That is good news. At the same time, some key questions are unresolved. For example, the better jobs numbers seem somewhat out of sync with the overall pace of economic expansion. What explains this apparent discrepancy and what implications does it have for the future course of the labor market and the economy?

...

A wide range of indicators suggests that the job market has been improving, which is a welcome development indeed. Still, conditions remain far from normal, as shown, for example, by the high level of long-term unemployment and the fact that jobs and hours worked remain well below pre-crisis peaks, even without adjusting for growth in the labor force. Moreover, we cannot yet be sure that the recent pace of improvement in the labor market will be sustained. Notably, an examination of recent deviations from Okun's law suggests that the recent decline in the unemployment rate may reflect, at least in part, a reversal of the unusually large layoffs that occurred during late 2008 and over 2009. To the extent that this reversal has been completed, further significant improvements in the unemployment rate will likely require a more-rapid expansion of production and demand from consumers and businesses, a process that can be supported by continued accommodative policies.

I also discussed long-term unemployment today, arguing that cyclical rather than structural factors are likely the primary source of its substantial increase during the recession. If this assessment is correct, then accommodative policies to support the economic recovery will help address this problem as well. We must watch long-term unemployment especially carefully, however. Even if the primary cause of high long-term unemployment is insufficient aggregate demand, if progress in reducing unemployment is too slow, the long-term unemployed will see their skills and labor force attachment atrophy further, possibly converting a cyclical problem into a structural one.

If this hypothesis is wrong and structural factors are in fact explaining much of the increase in long-term unemployment, then the scope for countercyclical policies to address this problem will be more limited. Even if that proves to be the case, however, we should not conclude that nothing can be done. If structural factors are the predominant explanation for the increase in long-term unemployment, it will become even more important to take the steps needed to ensure that workers are able to obtain the skills needed to meet the demands of our rapidly changing economy.