by Calculated Risk on 4/30/2011 06:10:00 PM

Saturday, April 30, 2011

Goldman estimates 3.5 million Excess Vacant Housing Units

Some key numbers for the U.S. economy are: 1) the current number of excess housing units, 2) how many new households are being formed each year, and 3) how many housing units are being added to the housing stock each year (at a record low this year).

Unfortunately reliable data for the first two numbers is unavailable except with a significant lag.

I've used the quarterly Housing Vacancy Survey (HVS), but that is not really designed for this purpose.

Goldman Sachs put out an estimate yesterday of 3.5 million units based on the HVS: "Based on data from the Census Bureau, we estimate that about 3.5 million housing units currently sit vacant, above and beyond normal seasonal and frictional vacancies." They calculated a range of 2.5 to 4.5 million units based on different assumptions.

Recently economist Tom Lawler took a long look at the 2010 Census data, and estimated there were about 2 to 3 million excess vacant housing units as of April 1, 2010. With the record low number of housing units delivered last year, Lawler estimated that as of April 1, 2011 the excess “would be somewhere in the range of 1.45 to 2.45 million units – with the latter almost certainly too high”. With another record low number of units added to the housing stock this year, the excess will be in the 750 thousand to 1.7 million range next April (with the latter “certainly too high"). This suggests the excess supply will be gone sometime between early 2014 and 2016.

Goldman has a higher estimate of excess vacant units, but they also have a higher estimate for household formation (partially because of pent up formation from all those people who doubled up during the recession). The conclude "[W]e think the recovery in single family housing starts will remain very slow. A plausible central scenario would be an increase in starts from about 475,000 units in 2010 to 600,000 by 2012. We do not expect single-family housing starts to return to their historical average rate of about 1 million units until 2015 or later."

In Thoughts on Residential Investment Recovery, I noted: 'My guess is housing starts will return to "normal" in 2015 or 2016.' It is hard to pinpoint an exact date because the data is uncertain. Frustrating!

But here is a little good news on data via Tom Lawler:

The Census Bureau announced that beginning next week it will release “demographic” profiles of 13 states each Thursday in May, with the first round of “states” will be the District of Columbia, Florida, Kentucky, Maine, Massachusetts, Michigan, Mississippi, New Mexico, North Dakota, Rhode Island, South Carolina, Tennessee and West Virginia. For folks interested in the housing markets, the data will include (among other things) data on housing tenure (owners/renters), occupancy/vacancy (include vacancy status – for rent, for sale, seasonal, etc.), age and sex distributions, and household types. These releases will help analysts get a much better “feel” for the overall housing market as of April 1, 2010, and will highlight just how “messed up” the data from the Census Housing Vacancy Survey really is – and why analysts should not use it to try to estimate the “excess supply” of housing.I think the Goldman estimate is too high, but no one really knows. Hopefully by the end of May we will have a much better estimate for the excess supply as of April 1, 2010.

Earlier:

• Summary for Week ending April 29th

Summary for Week ending April 29th

by Calculated Risk on 4/30/2011 11:15:00 AM

Below is a summary of economic data last week mostly in graphs (I'll add some thoughts on the economy later):

• New Home Sales in March at 300 Thousand SAAR, Record low for March

The Census Bureau reported New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 300 thousand. This was up from a revised 270 thousand in February.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Although the 300 thousand sales (SAAR) was slightly above the consensus forecast, this was a new record low for March.

The second graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The second graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In March 2011 (red column), 29 thousand new homes were sold (NSA). This is a new record low for the month of March.

The previous record low for March was 31 thousand in 2009. The high was 127 thousand in 2005.

The third graph shows existing home sales (left axis) and new home sales (right axis) through March. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

The third graph shows existing home sales (left axis) and new home sales (right axis) through March. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

The gap is due mostly to the flood of distressed sales. This has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

• Case Shiller: Home Prices near post-bubble lows in February

S&P/Case-Shiller released the monthly Home Price Indices for February (actually a 3 month average of December, January and February).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.7% from the peak, and down 0.2% in February (SA). The Composite 10 is still 1.8% above the May 2009 post-bubble bottom.

The Composite 20 index is also off 31.4% from the peak, and down 0.2% in February (SA). The Composite 20 is only 0.4% above the May 2009 post-bubble bottom and will probably be at a new post-bubble low soon.

This shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

This shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 6 of the 20 Case-Shiller cities in February seasonally adjusted. Prices in Las Vegas are off 58% from the peak, and prices in Dallas only off 6.8% from the peak.

Real Prices: This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 and CoreLogic House Price Indexes (both through February release) in real terms (adjusted for inflation using CPI less Shelter).

Real Prices: This graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 and CoreLogic House Price Indexes (both through February release) in real terms (adjusted for inflation using CPI less Shelter).

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to November 2000, and the CoreLogic index back to January 2000.

• Q1 2011: Homeownership Rate at 1998 Levels

The Census Bureau reported the homeownership rate declined to 66.4%, down from 66.5% in Q4 2010. This is the same as in 1998.

The Census Bureau reported the homeownership rate declined to 66.4%, down from 66.5% in Q4 2010. This is the same as in 1998.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. Some of the increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to around 66%, and probably not all the way back to 64%.

• Advance Report: Real Annualized GDP Grew at 1.8% in Q1

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q1 at 1.8% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q1 at 1.8% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Residential Investment (RI) made a negative contribution to GDP in Q1 2011, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010.

Residential Investment (RI) made a negative contribution to GDP in Q1 2011, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010.

Equipment and software investment has made a significant positive contribution to GDP for seven straight quarters (it is coincident).

The contribution from nonresidential investment in structures was negative in Q1. Nonresidential investment in structures typically lags the recovery. The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory.

Here is a look at office, mall and lodging investment:

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 70% (note that investment includes remodels, so this will not fall to zero). Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by 80% already.

This graph shows the various components of Residential Investment (RI) as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

This graph shows the various components of Residential Investment (RI) as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $151.0 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.0% of GDP), significantly above the level of investment in single family structures of $106.3 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions declined slightly in Q1, and are near the lowest level (as a percent of GDP) since the early '80s. In nominal dollar terms, brokers' commissions are back to the 1999 level.

And investment in multifamily structures has been bouncing along at a series low for the last few quarters, although this is expected to increase this year as starts increase.

• Regional Fed Manufacturing Surveys show slower expansion in April

Three regional Fed manufacturing surveys released this week showed slower expansion in April:

From the Richmond Fed: Manufacturing Growth Moderates in April

From the Dallas Fed: Texas Manufacturing Activity Increases but at a Slower Pace

From the Kansas City Fed: Growth in Tenth District manufacturing activity moderated somewhat in April

Even with slower expansion, these reports were fairly solid. Here is a graph comparing the regional Fed surveys to the ISM manufacturing survey.

Even with slower expansion, these reports were fairly solid. Here is a graph comparing the regional Fed surveys to the ISM manufacturing survey.

The New York and Philly Fed surveys are averaged together (dashed green, through April), and averaged five Fed surveys (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

The regional surveys suggest the ISM manufacturing index will in the mid-to-high 50s range (fairly strong expansion). The ISM index for April will be released on Monday, May 2nd.

• Other Economic Stories ...

• A few takeaways from Bernanke Press Briefing

• LPS: Mortgage Delinquency Rates declined in March, Foreclosure pipeline "Bloated"

• HVS: Homeowner and Rental Vacancy Rates

• Restaurant Performance Index increases in March

• Consumer Sentiment increases slightly in April compared to March

• Personal Income and Outlays Report for March

• Unofficial Problem Bank list at 978 Institutions

Best wishes to all!

Unofficial Problem Bank list increases to 984 Institutions

by Calculated Risk on 4/30/2011 08:03:00 AM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 29, 2011.

Changes and comments from surferdude808:

The FDIC got back to closing banks this and released its enforcement actions for March 2011, which contributed to many changes to the Unofficial Problem Bank List. In total, there were six removals and 14 additions this week. After these changes, the list includes 984 institutions with assets of $422.1 billion, compared to 976 institutions with assets of $422.2 billion last week.

Among the removals are two action terminations AmericanWest Bank, Spokane, WA ($1.6 billion Ticker: AWBCQ); and Bank of Franklin, Meadville, MS ($95 million). Of the five failures this week, only four were on the list -- The Park Avenue Bank, Valdosta, GA ($953 million Ticker: PABK); Community Central Bank, Mount Clemens, MI ($476 million Ticker: CCBD); First National Bank of Central Florida, Winter Park, FL ($352 million); and Cortez Community Bank, Brooksville, FL ($72 million Ticker: COTZ).

Most notable among the 14 additions are Artisans' Bank, Wilmington, DE ($643 million); Arthur State Bank, Union, SC ($636 million); The Business Bank, Appleton, WI ($357 million); The Pueblo Bank and Trust Company, Pueblo, CO ($333 million); and Ojai Community Bank, Ojai, CA ($124 million Ticker: OJCB).

A number of Prompt Corrective Action orders were released this week to Bank of Choice, Greeley, CO ($1.2 billion); Oxford Bank, Oxford, MI ($285 million); Summit Bank, Burlington, WA ($147 million); Coastal Bank, Cocoa Beach, FL ($133 million); Bank of Shorewood, Shorewood, IL ($125 million); and Signature Bank, Windsor, CO ($73 million). The FDIC terminated the PCA order against Prosper Bank, Prosper, TX ($69 million).

Comparing names and locations of institutions on the Unofficial Problem Bank List with the FDIC's structure database resulted in 15 name changes and 16 city changes. In these instances, the FDIC certificate number is unchanged. However, should anyone not be able to locate an institution from a previous week's list drop us a note and we will get back to you on where that institutions has gone.

There may be some good news when looking at the monthly numbers. The list declined by one institution at the end of April 2011 to 984 from 985 at the end of March 2011. This is the smallest monthly change since the list was first published in August 2009 with the next smallest being an increase of two institutions in December 2009. For the month, there were 27 additions and 28 removals including 11 failures, 10 unassisted mergers, and 7 action terminations. For the past 21 months, on average, there have been about 46 additions, 12 failures, 3 unassisted mergers, and 4 action terminations. During April 2010, the slowdown in additions and the increase in unassisted mergers (namely multi-bank holding company subsidiary combinations) contributed to the net decline.

Friday, April 29, 2011

Jim the Realtor: A Stinker REO

by Calculated Risk on 4/29/2011 10:57:00 PM

Jim was just assigned this REO - in a pretty nice neighborhood - but it is a real "stinker". I looked at an REO in the early '80s with a similar issue, but this one has been sitting closed up and vacant for 30 months. Oh my ...

Earlier:

• Consumer Sentiment increases slightly in April compared to March

• Personal Income and Outlays Report for March

• Restaurant Performance Index increases in March

• Q1 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

• LPS: Mortgage Delinquency Rates declined in March, Foreclosure pipeline "Bloated"

Bank Failures #35 through #39 in 2011

by Calculated Risk on 4/29/2011 07:20:00 PM

Five finance fatalities

Bereaving bankers.

by Soylent Green is People

From the FDIC: Premier American Bank, National Association, Miami, Florida, Acquires All the Deposits of Two Florida Banks, First National Bank of Central Florida, Winter Park and Cortez Community Bank, Brooksville

As of December 31, 2010, First National Bank of Central Florida had total assets of $352.0 million and total deposits of $312.1 million; and Cortez Community Bank had total assets of $70.9 million and total deposits of $61.4 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for First National Bank of Central Florida will be $42.9 million; and for Cortez Community Bank, $18.6 million. ... The closings are the 35th and 36th FDIC-insured institutions to fail in the nation so far this yearFrom the FDIC: Bank of the Ozarks, Little Rock, Arkansas, Acquires All the Deposits of Two Georgia Banks, First Choice Community Bank, Dallas and The Park Avenue Bank, Valdosta

As of December 31, 2010, First Choice Community Bank had total assets of $308.5 million and total deposits of $310.0 million; and The Park Avenue Bank had total assets of $953.3 million and total deposits of $827.7 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for First Choice Community Bank will be $92.4 million; and for The Park Avenue Bank, $306.1 million. ... The closings are the 37th and 38th FDIC-insured institutions to fail in the nation so far this yearFrom the FDIC: Talmer Bank & Trust, Troy, Michigan, Assumes All of the Deposits of Community Central Bank, Mount Clemens, Michigan

As of December 31, 2010, Community Central Bank had approximately $476.3 million in total assets and $385.4 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $183.2 million. ... Community Central Bank is the 39th FDIC-insured institution to fail in the nation this year

LPS: Mortgage Delinquency Rates declined in March, Foreclosure pipeline "Bloated"

by Calculated Risk on 4/29/2011 04:55:00 PM

LPS Applied Analytics released their March Mortgage Performance data. From LPS:

• Delinquencies ended the quarter 12% lower than the end of last year, over 500,000 loans have left the delinquent pool over the last three months.

• New problem loan rates are at a three year low as fewer loans are going bad. At the same time, seasonal trends have helped support a large increase in monthly cure rates.

• March typically sees large seasonal declines in new delinquency rates, though this year was the second largest on record.

• Modification activity also contributes to the improved landscape with almost a quarter of 90+ delinquencies from last year now current on their payments.

• The foreclosure pipeline is still bloated with overhang at every level:

– There are almost twice as many loans deteriorating greater than 90+ days delinquent vs. starting foreclosure.• Origination activity has dropped off in early 2011 and due to much stricter underwriting, recent vintages have been performing exceptionally well.

– There are almost three times the number foreclosure starts vs. foreclosure sales.

– 90+ and foreclosure inventory levels are almost 45 times monthly foreclosure sales.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph provided by LPS Applied Analytics shows the percent delinquent and percent in foreclosure.

The percent in the foreclosure process has been trending up because of the foreclosure issues.

According to LPS, 7.78% of mortgages are delinquent (down from 8.80% in February), and a record 4.21% are in the foreclosure process (up from 4.15% in February) for a total of 11.93%. It breaks down as:

• 2.12 million loans less than 90 days delinquent.

• 1.99 million loans 90+ days delinquent.

• 2.22 million loans in foreclosure process.

For a total of 6.33 million loans delinquent or in foreclosure.

The second graph shows the break down of foreclosures by days delinquent.

The second graph shows the break down of foreclosures by days delinquent."31% of loans in foreclosure have not made a payment in over 2 years." So about one third of the 2.22 million loans in the foreclosure process haven't made a payment in over 2 years.

The decline in the delinquency rate is partially seasonal, but the sharp decline is a positive. A key problem is all those homes in the foreclosure process. As LPS notes: "Delinquencies have dropped to about 1.8 times the 1995-2005 average, foreclosure inventories are 8 times historical “norms”." There were only 94,780 foreclosure sales in March and 270,681 foreclosure starts - so the foreclosure inventory just keeps growing.

Q1 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

by Calculated Risk on 4/29/2011 03:04:00 PM

The BEA released the underlying detail data today for the Q1 Advance GDP report. Here is a look at office, mall and lodging investment:

Click on graph for larger image in new graph gallery.

Click on graph for larger image in new graph gallery.

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 70% (note that investment includes remodels, so this will not fall to zero). Mall investment is also at a series low (as a percent of GDP).

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by 80% already.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

The second graph is for Residential investment (RI) components. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $151.0 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.0% of GDP), significantly above the level of investment in single family structures of $106.3 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions declined slightly in Q1, and are near the lowest level (as a percent of GDP) since the early '80s. In nominal dollar terms, brokers' commissions are back to the 1999 level.

And investment in multifamily structures has been bouncing along at a series low for the last few quarters, although this is expected to increase this year as starts increase.

These graphs show there is currently very little investment in offices, malls and lodging - and also very little investment in most components of residential investment. I expect investment in commercial real estate to bottom mid-year, but the recovery will not start until the vacancy rates fall. For Residential Investment, I expect RI to make a positive contribution to GDP this year for the first time since 2005 - mostly because of increases in multifamily investment and home improvement.

Restaurant Performance Index increases in March

by Calculated Risk on 4/29/2011 11:56:00 AM

This is one of several industry specific indexes I track each month.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The index increased to 101.0 in March (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

From the National Restaurant Association: Restaurant Industry Outlook Gained Strength in March as Same-Store Sales, Customer Traffic Levels Continued to Improve

The National Restaurant Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.0 in March, up 0.3 percent from February and the third gain in the last four months. In addition, March represented the sixth time in the last seven months that the RPI stood above 100, which signifies expansion in the index of key industry indicators.Increased traffic and sales, and a positive outlook for capital spending and hiring ... another solid report.

“The March increase in the Restaurant Performance Index was fueled by continued improvements in the same-store sales and customer traffic indicators,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Most notably, the overall Current Situation component of the RPI stood above 100 for the first time in 43 months, which signifies expansion in the indicators of current industry performance.”

...

Restaurant operators continued to report improvements in same-store sales in March. ... Restaurant operators also reported a net increase in customer traffic levels in March.

...

Along with an optimistic sales outlook, restaurant operators’ plans for capital spending rose to its highest level in 41 months.

...

For the sixth consecutive month, restaurant operators reported a positive outlook for staffing gains in the months ahead.

Earlier:

• Consumer Sentiment increases slightly in April compared to March

• Personal Income and Outlays Report for March

Consumer Sentiment increases slightly in April compared to March

by Calculated Risk on 4/29/2011 09:55:00 AM

• From the Chicago Business Barometer™ Tempered: "The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER slackened but remained strong, indicating expanding economic activity for the nineteenth consecutive month. In response to special questions about the Japanese disaster, panelists reported minimal impact."

The overall index decreased to 67.6 from 70.6 in March. This was below consensus expectations of 69.2. Note: any number above 50 shows expansion. The employment index decreased to a still strong 63.7 from 65.6. This was another fairly strong report.

• The final April Reuters / University of Michigan consumer sentiment index decreased to 68.9 in April from the preliminary 69.6. This was up slightly from the March reading of 67.5.

Click on graph for larger image in graphic gallery.

Click on graph for larger image in graphic gallery.

This was below the consensus forecast of 70.0.

In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices.

This low reading is probably due to $4 per gallon gasoline prices.

Personal Income and Outlays Report for March

by Calculated Risk on 4/29/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for March:

Personal income increased $67.0 billion, or 0.5 percent ... Personal consumption expenditures (PCE) increased $60.7 billion, or 0.6 percent.Real PCE was revised up significantly for both January and February.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in March, compared with an increase of 0.5 percent in February.

The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.PCE increased 0.5% in March, but real PCE only increased 0.2% as the price index for PCE increased 0.4 percent in March.

Note: Core PCE - PCE excluding food and energy - increased 0.1% in March.

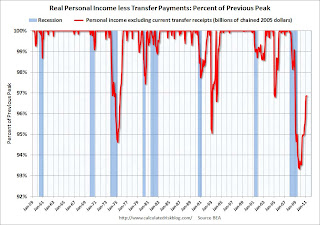

The second graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and real personal income less transfer payments declined slightly in March. This remains 3.1% below the previous peak.

The second graph shows real personal income less transfer payments as a percent of the previous peak. This has been slow to recover - and real personal income less transfer payments declined slightly in March. This remains 3.1% below the previous peak.The personal saving rate was unchanged at 5.5% in March.

Personal saving -- DPI less personal outlays -- was $651.2 billion in March, compared with $647.5 billion in February. Personal saving as a percentage of disposable personal income was 5.5 percent in March, the same as in February.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the March Personal Income report.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the March Personal Income report. One of the surprises in the Q1 GDP report was the 2.7% annualized growth rate for PCE. PCE growth in January and February was revised up significantly, and PCE in March increased at a 3.1% annualized rate (over the last 3 months).

Thursday, April 28, 2011

European Bond and CDS Spreads

by Calculated Risk on 4/28/2011 09:22:00 PM

Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of April 27th):

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

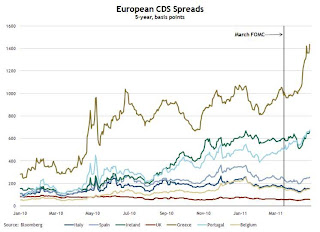

Since the March FOMC meeting, peripheral European bond spreads (over German bonds) continue to be elevated, with those of Greece, Ireland, and Portugal setting record highs.The second graph shows the Credit Default Swap (CDS) spreads:

Since the March FOMC meeting, the 10-year Greece-to-German bond spread has widened by 189 basis points (bps), through April 26. The spreads for Ireland and Portugal have soared higher by 85 and 237 bps, respectively, over the same period.

From the Atlanta Fed:

From the Atlanta Fed: The CDS spread on Greek debt has widened about 430 basis points (bps) since the March FOMC meeting, while those on Portuguese and Irish debt continue to be high.Here is a story from Reuters discussing the Greece CDS (and possible haircuts of 60%): Upward bias seen for Greek bond yields, trade choppy

The yield on Greece ten year bonds decreased to 15.7% today and the two year yield was down slightly to 24.9%.

Here are the ten year yields for Ireland at 10.4%, Portugal up to a record 9.7%, and Spain at 5.4%.

Earlier:

• Advance Report: Real Annualized GDP Grew at 1.8% in Q1

• Residential Investment and Non-Residential investment in Structures at Record Lows as Percent of GDP

Fannie Mae and Freddie Mac Delinquency Rates decline

by Calculated Risk on 4/28/2011 06:03:00 PM

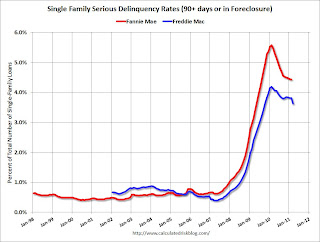

Fannie Mae reported that the serious delinquency rate decreased to 4.44% in February from 4.45% in January. This is down from the all time high 5.59% in February 2010.

Freddie Mac reported that the serious delinquency rate decreased to 3.63% in March from 3.82% in February. (Note: Fannie reports a month behind Freddie). This is down from 4.13% in March 2010.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent. As modifications have become permanent, they are no longer counted as delinquent.

Although delinquencies typically decline in March, the decline for Freddie Mac delinquencies is larger than usual - and other data suggest the overall delinquency rate declined further in Q1. The MBA will release the Q1 National Delinquency Survey in May.

Earlier:

• Advance Report: Real Annualized GDP Grew at 1.8% in Q1

• Residential Investment and Non-Residential investment in Structures at Record Lows as Percent of GDP

Multifamily: Rents Rising, Record low completions, Starts increasing rapidly, more "hate" for owning

by Calculated Risk on 4/28/2011 03:04:00 PM

Here are some conference call comments from AvalonBay Communities, Inc (ht Brian). AVB has close to 50,000 apartment units. We've discussed many of these key point:

• The percent of residents moving out to purchase a home was at 12%; an all time record low (we are starting to feel the "hate" for owning).

• A record low number of multifamily units will be completed this year. AVB mentions starts of around 150,000 units this year, and probably 240,000 units next year (for delivery in 2013 and 2014). There were just over 100,000 multifamily starts in 2010, so there will be a strong increase this year.

• Rents are increasing - around 7% year-over-year for leases expiring in June (this probably includes some concessions last year). AVB is seeing some push back (moveouts) due to higher rents, but not a large number - this might limit future rent increases.

AVB: The factors driving the improvement in apartment fundamentals are reasonably well known. Probably most visibly is an improving economy, now generating approximately 200,000 new jobs per month. It's both the magnitude and the composition of the jobs that matter and importantly, a disproportionate share of the new jobs created have been in the under 35 age cohort. Over the past year, job growth in the younger age group has been at a rate more than two times than that of the economy as a whole. With more jobs, they are increasingly unbundling. Secondly, corporate investment and equipment and software is rising at an annual rate of approximately 15% nationally, setting off strong job growth in our key high tech markets such as San Jose, Seattle, and Boston. Another key factor affecting rental demand is the continued weakness in the for sale market. Yesterday, the first quarter homeownership data was released, which showed the homeownership rate falling once again, now down to 66.5%. The weakness in the for sale market provides an obvious and direct benefit to the rental market, with households that are increasingly choosing to rent versus buy. As you know, we tracked the reasons for moveout, and during the first quarter, the percent of residents moving out to purchase a home fell to 12%, down from 15% last quarter, and is now at the lowest level since we began tracking this data. Historically -- low to mid 20% range. The increase in rental housing demand is being met by a sharp reduction in the supply of new apartments. Just to put this into perspective, over the 10-year period from 1998 through 2008, there's an average of about 240,000 new rental completions per year. Last year, there were 160,000. And this year, completions are expected to be below 80,000 units, which would make it a 50-year low. This level of new completions is actually less than the estimated annual loss due to obsolescence, meaning that we're seeing essentially a net zero increase in the stock at a time of strong demand. Recently there's been a fair amount of discussion regarding the likelihood of an increased volume of new apartment starts, and there's little doubt that the volume will increase, it's important to remember that we're coming off of a 50-year low. For 2011, third party estimates project new rental starts in the range of about 150,000 new units, which is substantially below the 10-year average of 240,000 I previously mentioned. New starts are not expected to approach historical levels until late next year, 2012, which means it would likely not be until late '13 and into '14 that we'll see completions return to historical levels. And obviously it's the completions that are what's important in affecting the supply demand fundamentals. ...

AVB on Rents: Growth in portfolio rents is broad-based, as accelerating as we move into the peak leasing season in the second and third quarters, when over 60% of leases expire. During Q1, year-over-year growth in same-store revenues accelerated through the quarter from 3.2% in January to over 4% in March. This momentum is continuing, with April revenues projected to be up around 4.5%, driven by an average rental rate increase of 4.8% compared to April 2010. Renewal rates are continuing to escalate as well, with offers for renewal increases averaging around 7% per May lease expirations and over 8% for June expirations, up from around 5% April. For June, in Northern California, New York, New Jersey, and New England, the range is around 9 to 9.5%. Every region is experiencing acceleration and renewal increases, except the DC market, where renewal increases leveled off in the 7% range for June. As we mentioned last quarter, Seattle and Southern California had been lagging other regions in recovery. However, during Q1, these regions began to recover as they posted the highest levels of sequential rent growth for new leases over the quarter. Over the last three months alone, new lease rents, which are a blend of new move-ins and renewals, have risen in Seattle and Southern California by 9.5% and 6.5% respectively. Both of these regions have been helped by positive job growth over the last six months. With the recent improvement in Seattle and Southern California, every region is now experiencing improving performance. As the year progresses, we expect that the West Coast markets will continue to accelerate at a faster rate than the East Coast, although every region should continue to experience a healthy rate of growth.

Q&A:

Analyst: I just was wondering if you're seeing any pressure from rental housing?

AVB: We're not seeing anything new, any new pressure from rental housing. If you're alluding to, like, a gray market. If anything, we're seeing the gray market pull back. Whereas a year ago, I would have said there were certain submarkets where we saw more gray market activity. As I speak to the people that run the various regions, we're actually seeing less competition from that, that rental housing stock.

Analyst: What is the main reason moveouts are saying right now?

AVB: The top reason for move out that we're experiencing is when people are just relocating. But it's right consistent with historic averages. You know, as Bryce indicated, home purchase is an area where it's changed, where we're well under historic averages. And then related to rent increase or financial reasons, that's up. And that's up to around 14%, where it's typically run 8 to 10%.

Earlier:

• Advance Report: Real Annualized GDP Grew at 1.8% in Q1

• Residential Investment and Non-Residential investment in Structures at Record Lows as Percent of GDP

Kansas City Manufacturing Survey: Slower expansion in April

by Calculated Risk on 4/28/2011 12:18:00 PM

From the Kansas City Fed: Survey of Tenth District Manufacturing

Growth in Tenth District manufacturing activity moderated somewhat in April, but remained solid. Most producers continued to report healthyNote: both the composite index and employment index were at record highs last month. Any reading above zero indicates expansion.

expectations. Raw materials prices continued to rise, and more producers raised selling prices.

The month-over-month composite index was 14 in April, down from 27 in March and 19 in February. The employment index dropped from 25 to 17 ...

This is the last of the regional Fed surveys for April. The regional surveys provide a hint about the ISM manufacturing index, as the following graph shows.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through April), and averaged five Fed surveys (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

The regional surveys suggest the ISM manufacturing index will in the mid-to-high 50s range (fairly strong expansion). The ISM index for April will be released on Monday, May 2nd.

Earlier:

• Advance Report: Real Annualized GDP Grew at 1.8% in Q1

• Residential Investment and Non-Residential investment in Structures at Record Lows as Percent of GDP

Residential Investment and Non-Residential investment in Structures at Record Lows as Percent of GDP

by Calculated Risk on 4/28/2011 10:08:00 AM

First from the NAR: Pending Home Sales Rise Again in March

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 5.1 percent to 94.1 in March from a downwardly revised 89.5 in February [revised down from 90.8]. The index is 11.4 percent below 106.2 in March 2010 ...This suggests a slight increase in sales in April and May.

And a couple more graphs from the GDP report ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Residential Investment (RI) decreased in Q1, and as a percent of GDP, RI is at a post-war record low at 2.21%.

Some people have asked how a sector that only accounts for 2.2% of GDP could be so important? The answer is that usually RI accounts for a large percentage of the employment and GDP growth in the first year or so of a recovery (and increases in RI have a positive impact on other areas like furniture, etc). Not this time because of the huge overhang of existing vacant units.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

I expect RI to increase in 2011 and add to both GDP and employment growth - for the first time since 2005 (even with the weak start in Q1).

The second graph shows non-residential investment in structures and equipment and software.

The second graph shows non-residential investment in structures and equipment and software. Equipment and software investment has been increasing sharply, and investment growth increased in Q1 at a 11.6% annualized rate.

Non-residential investment in structures is at a record low of 2.48% of GDP, and will probably stayed depressed for some time. I expect non-residential investment in structures to bottom later this year, but the recovery will be very sluggish for some time with the high vacancy rates for offices and malls. I'll also post the investment in offices, malls and hotels after the GDP details are released.

Earlier:

• Advance Report: Real Annualized GDP Grew at 1.8% in Q1

Advance Report: Real Annualized GDP Grew at 1.8% in Q1

by Calculated Risk on 4/28/2011 08:55:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.8 percent in the first quarter of 2011 (that is, from the fourth quarter to the first quarter) according to the "advance" estimate released by the Bureau of Economic Analysis

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years. The dashed line is the current growth rate. Growth in Q1 at 1.8% annualized was below trend growth (around 3.1%) - and very weak for a recovery, especially with all the slack in the system.

A few key numbers:

• Real personal consumption expenditures increased 2.7 percent (annual rate) in the fourth quarter, compared with an increase of 4.0 percent in Q4 2010. This is higher than the pace in January and February, and indicates a pickup in March.

• Investment: Nonresidential structures decreased 21.7 percent, equipment and software increased 11.6 percent and real residential fixed investment decreased 4.1 percent.

• Government spending subtracted 1.09 percentage points in Q1 (unusual), and change in private inventories added 0.93 percentage points.

The following graph shows the rolling 4 quarter contribution to GDP from residential investment, equipment and software, and nonresidential structures. This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, blue.

Residential Investment (RI) made a negative contribution to GDP in Q1 2011, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010.

Residential Investment (RI) made a negative contribution to GDP in Q1 2011, and the four quarter rolling average is negative again following the slight boost from the tax credit early in 2010. Equipment and software investment has made a significant positive contribution to GDP for seven straight quarters (it is coincident).

The contribution from nonresidential investment in structures was negative in Q1. Nonresidential investment in structures typically lags the recovery.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually RI is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and this is a key reason why the recovery has been sluggish so far. However I expect residential investment will turn positive this year mostly from investment in multi-family structures and home improvement.

Weekly Initial Unemployment Claims increase, 4-Week average over 400,000

by Calculated Risk on 4/28/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 23, the advance figure for seasonally adjusted initial claims was 429,000, an increase of 25,000 from the previous week's revised figure of 404,000. The 4-week moving average was 408,500, an increase of 9,250 from the previous week's revised average of 399,250.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 408,250.

Weekly claims have increased over the last few weeks, and this is the first time the four-week average was above 400,000 in two months.

Wednesday, April 27, 2011

Tim Duy: Very High Bar for QE3

by Calculated Risk on 4/27/2011 10:14:00 PM

From Professor Tim Duy: Very High Bar for QE3

...The Fed's forecasts for inflation and the unemployment rate would seem to suggest more QE, but I think Tim Duy's assessment is correct: Bernanke has set the bar very high for QE3. And the odds of more fiscal policy aimed at the unemployed are zero.

Apparently the threat of headline deflation off the table, Bernanke is not inclined to pursue sustained easing despite low core inflation and high unemployment. Again, I am not entirely surprised, except that Bernanke appear to suggest we are much closer to an inflation tipping point than I would expect. He could have tempered these comments with a more forceful discussion of labor costs, but did not. It seems clear these comments were intended to calm the non-existent bond market vigilantes, but is it consistent with the outlook? Arguably, no. For what it’s worth, I think Bernanke appeared most uncomfortable during this portion of the conference.

Bottom Line: When I look at the revisions to the Fed’s outlook and listen to Bernanke, I get the sense that the basic Fed policy is summarized as follows: “The economic situation continues to fall short of that consistent with the dual mandate, we have the tools to address that deviation, but will take no additional action because some people in the Middle East are seeking democracy.”

Earlier:

• A few takeaways from Bernanke Press Briefing

• Q1 2011: Homeownership Rate at 1998 Levels

A few takeaways from Bernanke Press Briefing

by Calculated Risk on 4/27/2011 06:04:00 PM

First, there were no surprises.

• Here is the video of the press conference (about 57 minutes).

• Bernanke commented that "extended period" probably implies that the Fed would not raise rates for a "couple of meetings" after the "extended period" language is removed from the FOMC statement. Back in 2003/2004, the Fed raised rates in June 2004, about six months after the last appearance of the "considerable period" language in December 2003.

• Bernanke discussed the "stock" versus "flow" view of the QE2 purchases, and he said the Fed does not expect any significant impact on markets when QE2 ends in June (we already knew this was the Fed's view). Bernanke also said the program would not be tapered off, but would just end.

• When asked if the Fed could do more about unemployment, Bernanke responded: "Going forward we'll have to continue to make judgments about whether additional steps are warranted. But as we do so, we have to keep in mind that we do have a dual mandate, that we do have to worry about both the rate of growth but also the inflation rate. And, as I was indicating earlier, I think that even purely from an employment perspective that if inflation were to become unmoored - inflation expectations were to rise significantly - that the cost of that in terms of employment loss in the future if we had to respond to that would be quite significant." This sounds like QE3 is unlikely unless the economy slows sharply (or inflation falls).

• Bernanke noted that an early exit step would be to stop reinvesting maturing securities. This suggests that the Fed will continue to reinvest maturing securities after QE2 ends in June. This is exactly what I've been expecting (from FOMC preview):

This suggests a timeline for the earliest Fed funds rate increase:• And here are the updated forecasts. The GDP forecast is lower, inflation is higher and the unemployment rate lower:

• End of QE2 in June.

• End of reinvestment 2+ months later.

• Drop extended period language a couple months later

• Raise rates in early to mid-2012.

That is probably the earliest the Fed would raise rates - and it could be much later.

| April 2011 Economic projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| 2011 | 2012 | 2013 | |

| Change in Real GDP | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 |

| Previous Projection (Jan 2011) | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| Unemployment Rate | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 |

| Previous Projection (Jan 2011) | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| PCE Inflaton | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 |

| Previous Projection (Jan 2011) | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| Core PCE Inflation | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 |

| Previous Projection (Jan 2011) | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

FOMC definitions:

1 Projections of change in real GDP and in inflation are from the fourth quarter of the previous year to the fourth quarter of the year indicated.

2 Projections for the unemployment rate are for the average civilian unemployment rate in the fourth quarter of the year indicated.

Earlier:

• Q1 2011: Homeownership Rate at 1998 Levels

Bernanke Press Briefing 2:15 PM ET

by Calculated Risk on 4/27/2011 02:01:00 PM

Forecast added below (GDP down, inflation up, unemployment rate down):

| April 2011 Economic projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| 2011 | 2012 | 2013 | |

| Change in Real GDP | 3.1 to 3.3 | 3.5 to 4.2 | 3.5 to 4.3 |

| Previous Projection (Jan 2011) | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| Unemployment Rate | 8.4 to 8.7 | 7.6 to 7.9 | 6.8 to 7.2 |

| Previous Projection (Jan 2011) | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| PCE Inflaton | 2.1 to 2.8 | 1.2 to 2.0 | 1.4 to 2.0 |

| Previous Projection (Jan 2011) | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| Core PCE Inflation | 1.3 to 1.6 | 1.3 to 1.8 | 1.4 to 2.0 |

| Previous Projection (Jan 2011) | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

FOMC definitions:

1 Projections of change in real GDP and in inflation are from the fourth quarter of the previous year to the fourth quarter of the year indicated.

2 Projections for the unemployment rate are for the average civilian unemployment rate in the fourth quarter of the year indicated.

FOMC Statement: No Change, "Economic recovery is proceeding at a moderate pace"

by Calculated Risk on 4/27/2011 12:32:00 PM

A little weaker on economy ("firmer footing" last statement - the Fed's forecast will be released at the press briefing). A little more on inflation, but still "transitory".

From the Federal Reserve:

Information received since the Federal Open Market Committee met in March indicates that the economic recovery is proceeding at a moderate pace and overall conditions in the labor market are improving gradually. Household spending and business investment in equipment and software continue to expand. However, investment in nonresidential structures is still weak, and the housing sector continues to be depressed. Commodity prices have risen significantly since last summer, and concerns about global supplies of crude oil have contributed to a further increase in oil prices since the Committee met in March. Inflation has picked up in recent months, but longer-term inflation expectations have remained stable and measures of underlying inflation are still subdued.Earlier:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The unemployment rate remains elevated, and measures of underlying inflation continue to be somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Increases in the prices of energy and other commodities have pushed up inflation in recent months. The Committee expects these effects to be transitory, but it will pay close attention to the evolution of inflation and inflation expectations. The Committee continues to anticipate a gradual return to higher levels of resource utilization in a context of price stability.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to continue expanding its holdings of securities as announced in November. In particular, the Committee is maintaining its existing policy of reinvesting principal payments from its securities holdings and will complete purchases of $600 billion of longer-term Treasury securities by the end of the current quarter. The Committee will regularly review the size and composition of its securities holdings in light of incoming information and is prepared to adjust those holdings as needed to best foster maximum employment and price stability.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Richard W. Fisher; Narayana Kocherlakota; Charles I. Plosser; Sarah Bloom Raskin; Daniel K. Tarullo; and Janet L. Yellen.

• Q1 2011: Homeownership Rate at 1998 Levels

Q1 2011: Homeownership Rate at 1998 Levels

by Calculated Risk on 4/27/2011 10:00:00 AM

The Census Bureau reported the homeownership and vacancy rates for Q1 2011 this morning.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The homeownership rate declined to 66.4%, down from 66.5% in Q4 2010. This is the same as in 1998.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. Some of the increase due to demographics (older population) will probably stick, so I've been expecting the rate to decline to around 66%, and probably not all the way back to 64%.

The homeowner vacancy rate decreased to 2.6% in Q1 2011, down from 2.7% in Q4 2010. This has been bouncing around in the 2.5% to 2.7% range for two years, and is slightly below the peak of 2.9% in 2008.

The homeowner vacancy rate decreased to 2.6% in Q1 2011, down from 2.7% in Q4 2010. This has been bouncing around in the 2.5% to 2.7% range for two years, and is slightly below the peak of 2.9% in 2008.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.9 percentage points above normal. This data is not perfect, but based on the approximately 75 million homeowner occupied homes, we can estimate that there are close to 675 thousand excess vacant homes.

The rental vacancy rate increased to 9.7% in Q1 2011 from 9.4% in Q4 2010.

This increase doesn't fit with the Reis apartment vacancy data and the NMHC apartment survey. However this report is nationwide and includes homes for rent.

This increase doesn't fit with the Reis apartment vacancy data and the NMHC apartment survey. However this report is nationwide and includes homes for rent.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 42 million rental units in the U.S. If the rental vacancy rate declined from 9.7% to 8%, then 1.7% X 42 million units or about 700 thousand excess units would have to be absorbed.

This suggests there are still close to 1.4 million excess housing units.

Note: Some analysts also add in the increase in "held off market, other" units to track the excess housing units - and that has increased from 2.6 million units at the end of 2005 to 3.861 million units in Q1 2011 - or another 1.26 million excess units. That would suggest over 2.6 million excess units. Either way, this survey suggests there is still a large number of excess units.

MBA: Mortgage Purchase Application activity decreases

by Calculated Risk on 4/27/2011 07:19:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 0.6 percent from the previous week. The seasonally adjusted Purchase Index decreased 13.6 percent to its lowest level since February 25, 2011, driven by a 26.6 percent decrease in government purchase applications.

...

"Purchase applications fell last week, driven primarily by a sharp decrease in government purchase applications as new, higher FHA premiums went into effect," said Michael Fratantoni, MBA’s Vice President of Research and Economics. “This decrease reverses a 20 percent increase in government purchase applications over a four week period, which was likely driven by borrowers attempting to beat this deadline.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.80 percent from 4.83 percent, with points decreasing to 1.01 from 1.06 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

With the higher FHA premiums, the purchase index fell last week to the lowest level since February.

The four week average is at about 1997 levels, although - as far as sales - this doesn't include the very high percentage of cash buyers. From the NAR: "All-cash sales were at a record market share of 35 percent in March, up from 33 percent in February; they were 27 percent in March 2010."

Tuesday, April 26, 2011

Bernanke Wednesday

by Calculated Risk on 4/26/2011 11:05:00 PM

From Michael Derby at the WSJ: Bernanke's Code: a Guide to Fed Chairman's First Q&A Derby discusses "inflation expectations", TIPS, the "extended period" language, commodity prices, the Fed's balance sheet, the dollar and "jobs, jobs, jobs". A good preview.

Here was my earlier preview of the FOMC meeting. Note that the FOMC statement will be released earlier than usual at 12:30 PM ET, and the Bernanke press briefing will be at 2:15 PM (and Bernanke will release the Fed's updated forecast).

Also tomorrow:

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders after decreasing 0.9% in February.

10:00 AM: Q1 Housing Vacancies and Homeownership report from the Census Bureau.

On House Prices earlier:

• Case Shiller: Home Prices near post-bubble lows in February

• Real House Prices and Price-to-Rent

• House Price Graphs

Misc: More "Hate" for Housing, Record number of homes in foreclosure process

by Calculated Risk on 4/26/2011 05:22:00 PM

• From the Associated Estates Realty Corp (AEC) conference call, an apartment REIT in IN, OH, MI and PA (ht Brian):

Looking at certain performance metrics throughout our portfolio, we continue to see residents staying longer - on average, 18 months. Also, it has been well publicized, households have a greater propensity to rent versus own as renting allow for increased financial flexibility and physical mobility. To this point our annual resident turnover is down 10 basis points year-over-year and buying home as a reason for moveout is just over 14%, down from better than 25% just a few years ago. These trends are contributing to increased occupancy, increased rents, and improved same community NOI as a result of the lower turnover costs.Other apartment owners have also told me that the number of renters "moving out to buy a home" is way down.

• Although LPS has not released their mortgage metrics for March yet, I've heard that the "foreclosure in process" category is at a record high (no surprise) while the overall delinquencies declined sharply (a seasonal decline is normal for March). Also Freddie Mac released the monthly volume report for March, and they showed 90+ day delinquencies down to 3.63% - a high level, but the lowest since September 2009. I'll have graphs for both reports in the next few days.

• Earlier I posted the ATA press release showing the trucking index was up 1.7% in March.

• Earlier I posted the ATA press release showing the trucking index was up 1.7% in March. Click on graph for larger image in graph gallery.

Here is a long term graph that shows ATA's Fore-Hire Truck Tonnage index.

On House Prices earlier:

• Case Shiller: Home Prices near post-bubble lows in February

• Real House Prices and Price-to-Rent

• House Price Graphs

Misc: Richmond Fed shows slower expansion, ATA Trucking index increases in March

by Calculated Risk on 4/26/2011 02:15:00 PM

• From the Richmond Fed: Manufacturing Growth Moderates in April

In April, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — fell ten points to 10 from March's reading of 20.Also the Richmond Fed service survey showed improvement: Service Sector Activity Strengthens: Retail Revenues Rise; Services Firms Make Gains (This is new and not closely followed, but this showing a strong pickup in the service sector with little increase in prices).

...

Hiring conditions at Fifth District plants changed little in April from their March pace. The manufacturing employment index slipped two points to end at 14 and the average workweek measure eased three points to 7. In contrast, wage growth added three points to 22.

• From ATA Trucking: ATA Truck Tonnage Index Rose 1.7 Percent in March

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 1.7 percent in March after falling a revised 2.7 percent in February 2011.• From CNBC: Consumer Confidence Index rises in April

...

Compared with March 2010, SA tonnage climbed 6.3 percent, which was higher than February’s 4.4 percent year-over-year gain, but below the 7.6 percent jump in January. For the first quarter of 2011, tonnage increased 3.8 percent from the previous quarter and 6.1 percent from the first quarter 2010.

“Despite my concern that higher energy costs are going to begin cutting into consumer spending, tonnage levels were pretty good in March and the first quarter of the year,” said ATA Chief Economist and Vice President Bob Costello. Looking ahead, Costello said, “While I still think the industry will continue to grow and recover from the weak freight environment we've seen in recent years, the rapid spike in fuel prices will slow that growth.”

...

Trucking serves as a barometer of the U.S. economy, representing 68 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

The Conference Board said Tuesday the index rose to 65.4 from a revised 63.8 in March.Expectations were for an increase to 64.4.

On House Prices:

• Case Shiller: Home Prices near post-bubble lows in February

• Real House Prices and Price-to-Rent

• House Price Graphs

Real House Prices and Price-to-Rent

by Calculated Risk on 4/26/2011 11:08:00 AM

First, here is a graph showing nominal house prices for three indexes:

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index (through Q4 2010), and the monthly Case-Shiller Composite 20 and CoreLogic House Price Indexes (both through February release) in nominal terms (as reported).

In nominal terms, the National index is back to Q1 2003 levels, the Composite 20 index is 0.4% above the May 2009 low, and the CoreLogic index is back to January 2003 levels.

Once the Case-Shiller Composite 20 falls below the May 2009 low, the index will be back to early 2003 levels.

Nominal prices will probably fall some more, and my forecast is for a decline of 5% to 10% from the October 2010 levels for the national price indexes.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter).

Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q1 2000 levels, the Composite 20 index is back to November 2000, and the CoreLogic index back to January 2000.

A few key points:

• In real terms, all appreciation in the last decade is gone.

• I don't expect national real prices to fall to '98 levels. In many areas - if the population is increasing - house prices increase slightly faster than inflation over time, so there is an upward slope for real prices.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

Here is a similar graph through January 2011 using the Case-Shiller Composite 20 and CoreLogic House Price Index.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Composite 20 index is just above the May 2009 levels, and the CoreLogic index is back to January 2000.

An interesting point: the measure of Owners' Equivalent Rent (OER) is at about the same level as two years ago - so the price-to-rent ratio has mostly followed changes in nominal house prices since then. Rents are starting to increase again, and OER will probably increase in 2011 - lowering the price-to-rent ratio.

This ratio could decline another 10%, and possibly more if prices overshoot to the downside. The decline in the ratio will probably be a combination of falling house prices and increasing rents.

Earlier:

• Case Shiller: Home Prices near post-bubble lows in February