by Calculated Risk on 8/02/2009 04:18:00 PM

Sunday, August 02, 2009

July Economic Summary in Graphs

Here is a collection of real estate and economic graphs for data released in July ...

Note: Click on graphs for larger image in new window. For more info, click on link below graph to original post.

New Home Sales in June (NSA)

New Home Sales in June (NSA)The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2009. This is the 2nd lowest sales for June since the Census Bureau started tracking sales in 1963.

In June 2009, 36 thousand new homes were sold (NSA); the record low was 34 thousand in June 1982; the record high for June was 115 thousand in 2005.

From: New Home Sales increase in June, Highest since November 2008

New Home Sales in June

New Home Sales in JuneThis graph shows shows New Home Sales vs. recessions for the last 45 years.

"Sales of new one-family houses in June 2009 were at a seasonally adjusted annual rate of 384,000 ...

This is 11.0 percent (±13.2%)* above the revised May rate of 346,000, but is 21.3 percent (±11.4%) below the June 2008 estimate of 488,000."

From: New Home Sales increase in June, Highest since November 2008

New Home Months of Supply in June

New Home Months of Supply in JuneThere were 8.8 months of supply in June - significantly below the all time record of 12.4 months of supply set in January.

"The seasonally adjusted estimate of new houses for sale at the end of June was 281,000. This represents a supply of 8.8 months at the current sales rate."

From: New Home Sales increase in June, Highest since November 2008

Existing Home Sales in June

Existing Home Sales in June This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2009 (4.89 million SAAR) were 3.6% higher than last month, and were 0.2% lower than June 2008 (4.90 million SAAR).

From: Existing Home Sales increase in June

Existing Home Inventory June

Existing Home Inventory JuneThis graph shows nationwide inventory for existing homes. According to the NAR, inventory decreased to 3.82 million in June. The all time record was 4.57 million homes for sale in July 2008. This is not seasonally adjusted.

Typically inventory increases in June, and peaks in July or August. This decrease in inventory was a little unusual.

Also, many REOs (bank owned properties) are included in the inventory because they are listed - but not all. Recently there have been stories about a substantial number of unlisted REOs and other shadow inventory - so this inventory number is probably low.

From: Existing Home Sales increase in June

Existing Home Inventory June, Year-over-Year Change

Existing Home Inventory June, Year-over-Year ChangeThis graph shows the year-over-year change in existing home inventory.

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (closer to 6 months compared to the current 9.4 months), and that will take some time. Plus remember the shadow inventory!

From: More on Existing Home Inventory

Case Shiller House Prices for May

Case Shiller House Prices for MayThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

NOTE: This is not seasonally adjusted.

The Composite 10 index is off 33.3% from the peak, and up slightly in May.

The Composite 20 index is off 32.3% from the peak, and up slightly in May.

From: Case-Shiller House Prices for May

NAHB Builder Confidence Index in July

NAHB Builder Confidence Index in JulyThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased to 17 in July from 15 in June. The record low was 8 set in January.

From: NAHB: Builder Confidence Increases Slightly In July

Architecture Billings Index for June

Architecture Billings Index for June"It appears as though we may have not yet reached the bottom of this construction downturn," AIA Chief Economist Kermit Baker said.

The Architecture Billings Index fell more than 5 points last month to a reading of 37.7, after a slight increase in the prior month, according to the American Institute of Architects...."

From: AIA: Architecture Billings Index Declines in June

Housing Starts in June

Housing Starts in JuneTotal housing starts were at 582 thousand (SAAR) in June, up sharply over the last two months from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 470 thousand (SAAR) in June; 31 percent above the record low in January and February (357 thousand).

From: Housing Starts in June

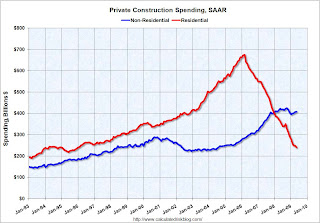

Construction Spending in May

Construction Spending in MayThis graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending fell further in May, and nonresidential spending was up a little (because of private spending on power production), but will probably decline sharply over the next two years.

From: Constructon Spending Declines in May

June Employment Report

June Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 467,000 in June. The economy has lost almost 5.7 million jobs over the last year, and 6.46 million jobs during the 18 consecutive months of job losses.

The unemployment rate rose to 9.5 percent; the highest level since 1983.

Year over year employment is strongly negative.

From: Employment Report: 467K Jobs Lost, 9.5% Unemployment Rate

June Employment Comparing Recessions

June Employment Comparing RecessionsThe second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up over the last 9 months (4.4 million jobs lost, red line cliff diving on the graph), and the current recession is now the 2nd worst recession since WWII in percentage terms - and also in terms of the unemployment rate (only early '80s recession was worse).

From: Employment Report: 467K Jobs Lost, 9.5% Unemployment Rate

June Retail Sales

June Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

The Census Bureau reported that nominal retail sales decreased 10.3% year-over-year (retail and food services decreased 9.6%), and real retail sales declined by 9.7% on a YoY basis.

From: Retail Sales in June

LA Port Traffic in June

LA Port Traffic in JuneThis graph shows the loaded inbound and outbound traffic at the port of Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported.

Inbound traffic was 22.2% below June 2008.

Outbound traffic was 19.2% below May 2008.

There had been some recovery in U.S. exports over the last few months (the year-over-year comparison was off 30% from December through February). And this showed up in the in the May trade report, but the port data suggests exports were a little weaker in June.

From: LA Area Port Traffic in June

U.S. Imports and Exports Through May

U.S. Imports and Exports Through MayThis graph shows the monthly U.S. exports and imports in dollars through May 2009.

Imports declined again in May, but U.S. exports were up slightly. On a year-over-year basis, exports are off 21% and imports are off 31%.

From: Trade Deficit Declined in May

June Capacity Utilization

June Capacity UtilizationThis graph shows Capacity Utilization. This series is at another record low (the series starts in 1967).

"Industrial production decreased 0.4 percent in June after having fallen 1.2 percent in May. ... The rate of capacity utilization for total industry declined in June to 68.0 percent, a level 12.9 percentage points below its average for 1972-2008. Prior to the current recession, the low over the history of this series, which begins in 1967, was 70.9 percent in December 1982."

From: Industrial Production Declines, Capacity Utilization at Record Low in June

Vehicle Miles driven in May

Vehicle Miles driven in MayThis graph shows the comparison of month to the same month in the previous year as reported by the DOT.

"Travel on all roads and streets changed by +0.1% (0.2 billion vehicle miles) for May 2009 as compared with May 2008."

Year-over-year miles driven started to decline in December 2007, and really fell off a cliff in March 2008. This makes for an easier comparison for May 2009.

From: DOT: Vehicle Miles Flat YoY

Unemployment Claims

Unemployment ClaimsThe four-week average of weekly unemployment claims decreased this week by 8,250, and is now 99,750 below the peak of 16 weeks ago. It appears that initial weekly claims have peaked for this cycle.

The level of initial claims has fallen fairly quickly - but is still very high (over 580K), indicating significant weakness in the job market.

From: Weekly Unemployment Claims

Restaurant Performance Index for June

Restaurant Performance Index for June"The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.8 in June, down 0.5 percent from May and its 20th consecutive month below 100.

...

Restaurant operators also reported negative customer traffic levels in June, marking the 22nd consecutive month of traffic declines."

From: Restaurants: 22nd Consecutive Month of Traffic Declines in June

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty seven states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 46 states in June, and was unchanged in 1 state.

From: Philly Fed State Coincident Indicators: Widespread Recession in June

Light vehicle sales in June

Light vehicle sales in JuneThis graph shows the historical light vehicle sales (seasonally adjusted annual rate) through June (red, light vehicle sales of 9.69 million SAAR from AutoData Corp).

June was about average for the year so far on seasonally adjusted basis, and sales are still on pace to be the worst since 1967.

From: Graphs: Auto Sales in June

Personal Bankruptcy Filings Q2 2009

Personal Bankruptcy Filings Q2 2009This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q1 and Q2 2009 based on monthly data from American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect.

From: Personal Bankruptcy Filings increase 40% in June (YoY)

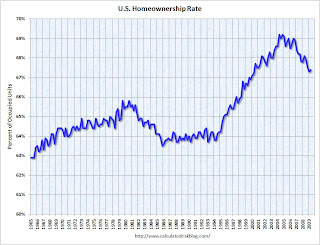

Homeownership Rate Q2 2009

Homeownership Rate Q2 2009The homeownership rate increased slightly to 67.4% and is now at the levels of Q2 2000.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

From: Q2: Homeowner Vacancy Rate Declines, Rental Vacancy Rate at Record High

Homeowner Vacancy Rate Q2 2009

Homeowner Vacancy Rate Q2 2009The homeowner vacancy rate was 2.5% in Q2 2009. This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.8% above normal, and with approximately 75 million homeowner occupied homes; this gives about 600 thousand excess vacant homes.

From: Q2: Homeowner Vacancy Rate Declines, Rental Vacancy Rate at Record High

Rental Vacancy Rate Q2 2009

Rental Vacancy Rate Q2 2009The rental vacancy rate increased to a record 10.6% in Q2 2009.

Even there has been a move from homeownership to renting, the surge in available units has been amazing - because of investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling. See: The Surge in Rental Units

From: Q2: Homeowner Vacancy Rate Declines, Rental Vacancy Rate at Record High