by Calculated Risk on 7/03/2010 06:18:00 PM

Saturday, July 03, 2010

Recession Dating and a "Double Dip"

My forecast is for U.S. economic growth to slow in the 2nd half (a sluggish and choppy recovery), but not slide into recession. However a recession is a possibility, and the following describes how NBER differentiates between a "double dip" and a new recession.

The National Bureau of Economic Research (NBER) Business Cycle Dating Committee is the recognized group for dating recessions in the U.S. It is always difficult to tell when a recession has ended, especially with a sluggish recovery. If the economy slides back into recession - a possibility right now - the NBER has to decide if it is a continuation of the previous recession, or if the new period of economic decline is a new separate recession.

This is just a technical question: for those impacted by the recession it makes no difference if it is called a "double dip" or a new recession.

Yesterday an AP story quoted Robert Hall, the current Chairman of NBER on a "double dip": So what exactly is a 'double-dip' recession?

"The idea -- hypothetical because it has yet to happen -- is that activity might rise for a period, but not far enough to complete a cycle, then fall again, and finally rise above its original level, only then completing the cycle."The closest we've seen to a "double dip" was in the early 1980s - and the NBER dated those as two separate recessions. We can use the NBER memos from that period to look for clues. From July 8, 1981 announcing the end of the 1980 recession: Business Cycle Trough Last July

The period following July 1980 will appear in the NBER chronology as an expansion. An important factor influencing that decision is that most major indicators, including real GNP, are already close to or above their previous highs.And from the January 1982 announcing the beginning of the 1981-1982 recession: Current Recession Began in July

The committee also reviewed its earlier decision that a peak of economic activity occurred in January 1980 and a trough in July 1980 and reaffirmed that decision. Although not all economic indicators had regained their 1979-80 peaks by the summer of 1981, the committee agreed that the resurgence of economic activity in the previous year clearly constituted a business cycle recovery.And from The NBER's Recession Dating Procedure

In choosing the dates of business-cycle turning points, the committee follows standard procedures to assure continuity in the chronology. Because a recession influences the economy broadly and is not confined to one sector, the committee emphasizes economy-wide measures of economic activity. The committee views real GDP as the single best measure of aggregate economic activity. ...GDP is the key measure, and the NBER actually uses two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity.

The committee places particular emphasis on two monthly measures of activity across the entire economy: (1) personal income less transfer payments, in real terms and (2) employment. In addition, the committee refers to two indicators with coverage primarily of manufacturing and goods: (3) industrial production and (4) the volume of sales of the manufacturing and wholesale-retail sectors adjusted for price changes.

Below is a look at four of the measures mentioned: real GDP (and real GDI), industrial production, employment and real personal income excluding transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%. On all graphs the recent recession is marked as ending in July 2009 or Q3 2009 - this is preliminary and NOT an NBER determination. GDP is quarterly, the other data is monthly.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph is for GDP through Q1 2010.

This is the key measure and real GDP is only 1.3% below the pre-recession peak - and real GDI 2.0% below the previous peak. GDP probably increased in Q2 too (probably at close to a 3% annualized rate), and at the end of Q2 both of these measures will be even closer to the previous peak, but not there yet.

If you look at the period between the two early '80s recessions, both real GDP and real GDI returned to pre-recession levels before declining again.

The second graph is for monthly industrial production based on data from the Federal Reserve through May.

The second graph is for monthly industrial production based on data from the Federal Reserve through May.Industrial production is still 8.1% below the pre-recession peak -and now it appears that growth is slowing in the manufacturing sector (although still expanding). Even if growth continues, it will take some time before industrial production is back to pre-recession levels.

Between the early '80s recessions, industrial production didn't quite return to pre-recession levels - but it was only about 0.5% below the previous peak.

The third graph is for employment through June.

The third graph is for employment through June.Between the two recession in the early '80s, employment returned to the pre-recession peak.

This time employment is barely off the bottom.

And the last graph is for real personal income excluding transfer payments through May. This bottomed in Sept 2009, but has only increased slightly since then and is still 6% below the pre-recession peak.

And the last graph is for real personal income excluding transfer payments through May. This bottomed in Sept 2009, but has only increased slightly since then and is still 6% below the pre-recession peak. Once again - looking back - this measure returned to the pre-recession peak between the 1980 and 1981/1982 recessions.

Based on these graphs and the NBER memos, it would seem pretty easy to date two recessions in the early '80s. However, if another recession starts this year, it will almost certainly be dated as a continuation of the "great recession" that started in 2007. If so, I'll need more blue ink to shade all my graphs ...

Monday, April 12, 2010

Recession Measures

by Calculated Risk on 4/12/2010 11:59:00 AM

Calling the beginning or end of a recession takes time. The National Bureau of Economic Research (NBER) waits until the data is revised, and if the recovery is sluggish, this process can take from 18 months to two years or longer.

In addition, if the economy slides into recession again, the committee will only consider it a new recession if most major indicators were close to or above their previous highs. Otherwise it will just be considered a continuation of the previous recession.

A good example of the NBER calling two separate recessions was in the early '80s, from the NBER memo:

"The period following July 1980 will appear in the NBER chronology as an expansion. An important factor influencing that decision is that most major indicators, including real GNP, are already close to or above their previous highs."It will take some time for most major indicators to be above their previous high after the "great recession" because of the severe contraction as the graphs below show.

emphasis added

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.This is actually two measures: 1) real GDP, and 2) real Gross Domestic Income (GDI). For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...The NBER uses both real GDP and real GDI.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%. On all graphs the recent recession is marked as ending in July 2009 or Q3 2009 - this is preliminary and NOT an NBER determination. GDP is quarterly, the other data is monthly.

The first graph is for GDP and GDI:

Click on graph for larger image in new window.

Click on graph for larger image in new window.It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. This is the key measure, and the NBER will probably use GDP and GDI to determine the trough of the recession. Real GDP is only 2.0% below the pre-recession peak - and real GDP 2.7% below the previous peak - so both could be at new highs later this year or early in 2011, even with a sluggish recovery.

The second graph is for monthly industrial production based on data from the Federal Reserve.

The second graph is for monthly industrial production based on data from the Federal Reserve.Industrial production bottomed in June 2009. The NBER will consider this measure when trying to identify the month the recession ended. Note that industrial production is still substantially below the pre-recession levels - so it might be some time before this measure is at or above earlier levels.

Now for some less optimistic measures the NBER uses ...

The third graph is for employment. It appears the employment recession might have bottomed in February, but it will take a long time before this measure is at pre-recession levels.

The third graph is for employment. It appears the employment recession might have bottomed in February, but it will take a long time before this measure is at pre-recession levels. Historically employment was a coincident indicator for the end of recessions, but that hasn't been true for the previous two recessions (1990-1991 and 2001) and also will not be true for the "great recession" if the NBER determines an end date in July 2009.

If the NBER waits for employment to return to pre-recession levels, we might be waiting for an annoucement for a long time.

And the last graph is for real personal income excluding transfer payments. This bottomed in Sept 2009, but has moved sideways since then. This shows the effect of the stimulus programs that boosted GDP and income - but not income less transfer payments.

And the last graph is for real personal income excluding transfer payments. This bottomed in Sept 2009, but has moved sideways since then. This shows the effect of the stimulus programs that boosted GDP and income - but not income less transfer payments.This will be a key measure of a sustainable recovery, and once again it will take a long time to return to pre-recession levels.

These graphs are useful in trying to identify peaks and troughs in economic activity. My guess is the economy bottomed by most measure in Q3 2009 (probably July), but I don't expect an announcement from the NBER until the end of 2010 at the earliest - and perhaps well into 2011 or beyond.

NBER: "Premature" to Call end of Recession

by Calculated Risk on 4/12/2010 08:59:00 AM

Business Cycle Dating Committee statement:

The Business Cycle Dating Committee of the National Bureau of Economic Research met at the organization’s headquarters in Cambridge, Massachusetts, on April 8, 2010. The committee reviewed the most recent data for all indicators relevant to the determination of a possible date of the trough in economic activity marking the end of the recession that began in December 2007. The trough date would identify the end of contraction and the beginning of expansion. Although most indicators have turned up, the committee decided that the determination of the trough date on the basis of current data would be premature. Many indicators are quite preliminary at this time and will be revised in coming months. The committee acts only on the basis of actual indicators and does not rely on forecasts in making its determination of the dates of peaks and troughs in economic activity. The committee did review data relating to the date of the peak, previously determined to have occurred in December 2007, marking the onset of the recent recession. The committee reaffirmed that peak date.NBER always waits some time before declaring a recession over.

| Click on cartoon for larger image in new window. Repeat of cartoon from Eric G. Lewis |

The previous NBER announcements make it clear that NBER will not date the trough of the recession until certain economic indicators - like real GDP - are above the pre-recession levels. Any downturn before economic activity reaches pre-recession levels will probably be considered a continuation of the recession that started in December 2007.

Here is the NBER dating procedure.

Friday, October 23, 2009

U.K.: Recession Not Over

by Calculated Risk on 10/23/2009 08:30:00 AM

From Bloomberg: U.K. Economy Unexpectedly Shrinks in Longest Slump

GDP fell 0.4 percent from the previous three months, the Office for National Statistics said today in London. ... The economy has now shrunk over six quarters, the most since records began in 1955.

...

“The fact that the economy is still contracting despite the huge amount of policy stimulus supports our view that the recovery will be a long, slow process,” said Vicky Redwood, U.K. economist at Capital Economics Ltd in London and a former central bank official.

...

“This is desperately disappointing news, especially given that it was hoped that a modest recovery had begun,” said John Philpott, chief economist at the Chartered Institute of Personnel and Development. “The U.K. economy is continuing to shrink, with six quarters of contraction in output making this recession look more like a depression.”

This graph is from the Office for National Statistics: UK output decreases by 0.4 per cent

This graph is from the Office for National Statistics: UK output decreases by 0.4 per centThis is the sixth straight quarter of contraction.

Note that the U.K. reports GDP change per quarter, whereas the U.S. reports the annual rate of change. The 0.4% decline reported in the U.K. would be similar to a 1.6% decline reported in the U.S.

Tuesday, September 15, 2009

The End of the Official Recession?

by Calculated Risk on 9/15/2009 02:32:00 PM

First, a nice mention in Newsweek (thank you): The Financial Meltdown in Words (see slide 4 for a quote from Feb 2005, ht Matthew, Eric)

On the end of the recession, from Bloomberg: Bernanke Says U.S. Recession ‘Very Likely’ Has Ended

“Even though from a technical perspective the recession is very likely over at this point, it’s still going to feel like a very weak economy for some time,” Bernanke said today at the Brookings Institution in Washington, responding to questions after a speech.Although I think the official recession has probably ended, it is worth remembering that one or two quarters of GDP growth doesn't necessarily mean the recession is over. Right in the middle of the '81/'82 recession, there was one quarter when GDP increase 4.9% (annualized).

On recession dating: 1The National Bureau of Economic Research (NBER) Business Cycle Dating Committee is the recognized group for calling dating recessions in the U.S. It is always difficult to tell when a recession has ended, especially with a jobless recovery (something I expect again). As an example, it took NBER over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

From the 2003 announcement of the end of the 2001 recession:

The committee waited to make the determination of the trough date until it was confident that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in March 2001.The economy was still struggling in 2003 - especially employment - but the NBER committee members felt that any subsequent downturn would be considered a separate recession:

The committee noted that the most recent data indicate that the broadest measure of economic activity-gross domestic product in constant dollars-has risen 4.0 percent from its low in the third quarter of 2001, and is 3.3 percent above its pre-recession peak in the fourth quarter of 2000. Two other indicators of economic activity that play an important role in the committee's decisions-personal income excluding transfer payments and the volume of sales of the manufacturing and wholesale-retail sectors, both in real terms-have also surpassed their pre-recession peaks. Two other indicators the committee focuses on-payroll employment and industrial production-remain well below their pre-recession peaks. Indeed, the most recent data indicate that employment has not begun to recover at all. The committee determined, however, that the fact that the broadest, most comprehensive measure of economic activity is well above its pre-recession levels implied that any subsequent downturn in the economy would be a separate recession.This is relevant to today. It is very likely that any recovery will be very sluggish, and if the economy turns down within the next 6 to 12 months, the NBER would probably consider that a continuation of the Great Recession.

Yesterday San Francisco Fed President Janet Yellen argued the recovery would be "tepid". She pointed out that there will probably be a boost from an inventory correction in the 2nd half of 2009, but that that boost will be transitory:

I expect the biggest source of expansion in the second half of this year to come from a diminished pace of inventory liquidation by manufacturers, wholesalers, and retailers. Such a pattern is typical of business cycles. Inventory investment often is the catalyst for economic recoveries. True, the boost is usually fairly short-lived, but it can be quite important in getting things going. ...But then what happens in a couple of quarters? Where are the engines of growth? As Yellen noted:

The chances are slim for a robust rebound in consumer spending, which represents around 70 percent of economic activity. Of course, consumers are getting a boost from the fiscal stimulus package. But this program is temporary. Over the long term, consumers face daunting issues of their own.As I noted in March (see Business Cycle: Temporal Order), the usual engines for growth coming out of a recession are Personal Consumption expenditures (PCE), and Residential Investment (RI). If PCE is weak, we are left with residential investment. Although it appears RI has bottomed, I doubt we will see much of a rebound until the overhang of existing home inventory is reduced. That is one of the reason the DataQuick SoCal report this morning was so important - it might signal another downturn for sales in the existing home market (and possibly new home market).

Although I started the year looking for the sun, I remain concerned about the possibilities of a double dip recession - or at least a prolonged period of sluggish growth. And this means the unemployment rate will continue to rise well into 2010; I expect the unemployment rate to hit 10% in November (or so). See: When Will the Unemployment Rate hit 10%? .

There is an old saying: "A recession is when your neighbor loses his job, a depression is when you lose your job." Unfortunately 2010 will probably feel like a depression to a large number workers.

More on NBER and double dip recessions:

Here is the NBER dating procedure.

Note that the trough of the 1980 recession was only 12 months before the beginning of the 1981 recession, but the short recovery was fairly robust with real GDP up 4.4%. Those two recessions are frequently called a "double dip" recession, but the NBER considers them as two separate recessions.

1 Some of this post was excerpted from a previous post.

Thursday, August 27, 2009

Recession hitting Farms

by Calculated Risk on 8/27/2009 10:26:00 PM

From the WSJ: Recession Finally Hits Down on the Farm (ht Bob_in_MA)

The Agriculture Department forecast Thursday that U.S. farm profits will fall 38% this year, indicating that the slump is taking hold in rural America. ... The Agriculture Department said it expects net farm income -- a widely followed measure of profitability -- to drop to $54 billion in 2009, down $33.2 billion from last year's estimated net farm income of $87.2 billion, which was nearly a record high.And from the Chicago Fed August AgLetter:

Farmland values for the second quarter of 2009 were 3 percent lower than a year ago in the Seventh Federal Reserve District. ... Almost 30 percent of the responding bankers expected farmland values to fall in the third quarter of 2009, whereas 71 percent expected stable farmland values.This will probably mean lower food prices, from the WSJ:

For most Americans, the chill in the farm belt is related to one of the few positives they see in this economy: slowing inflation. Prices farmers are receiving for everything from corn and wheat to hogs are down sharply from last year.

Tuesday, August 25, 2009

Philly Fed State Coincident Indicators: Still a Widespread Recession in July

by Calculated Risk on 8/25/2009 11:30:00 AM

Click on map for larger image.

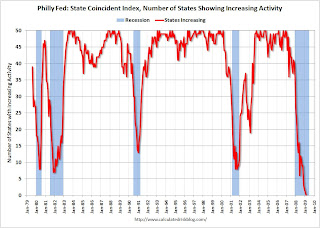

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty six states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 35 states in June, and was unchanged in 8 states. Here is the Philadelphia Fed state coincident index release for July.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2009. In the past month, the indexes increased in seven states (Louisiana, Mississippi, North Dakota, South Carolina, South Dakota, Vermont, and Wisconsin), decreased in 35, and remained unchanged in eight (Hawaii, Indiana, Nebraska, New Jersey, Oklahoma, Rhode Island, Tennessee, and Virginia) for a one-month diffusion index of -56. Over the past three months, the indexes increased in three states (Mississippi, North Dakota, and Vermont), decreased in 46, and remained unchanged in one (South Carolina) for a three-month diffusion index of -86.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

A large percentage of states showed declining activity in July. Still a widespread recession in July by this indicator ...

Monday, August 24, 2009

Chicago Fed: July National Activity Index

by Calculated Risk on 8/24/2009 10:33:00 AM

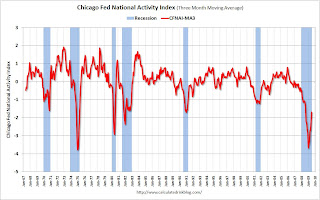

From the Chicago Fed: Index shows economic activity improved in April

The Chicago Fed National Activity Index was –0.74 in July, up from –1.82 in June. All four broad categories of indicators improved in July, while three of the four continued to make negative contributions to the index. Production-related indicators made a positive contribution to the index for the first time since October 2008 and for only the second time since December 2007.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"[T]he Chicago Fed National Activity Index (CFNAI), is a weighted average of 85 existing, monthly indicators of national economic activity. The CFNAI provides a single, summary measure of a common factor in these national economic data ...

[T]he CFNAI-MA3 appears to be a useful guide for identifying whether the economy has slipped into and out of a recession. This is useful because the definitive recognition of business cycle turning points usually occurs many months after the event. For example, even though the 1990-91 recession ended in March 1991, the NBER business cycle dating committee did not officially announce the recession’s end until 21 months later in December 1992. ...

When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures."

Note: this is based on only a few recessions, but this is one of the indicators to watch to determine when the recession ends. This suggests the economy was still in recession in July.

Of course this says nothing about economic purgatory ...

Thursday, August 20, 2009

UK: BofE Forecasts Suggests Recession is Over

by Calculated Risk on 8/20/2009 12:11:00 AM

From The Times: City taken by surprise as Bank of England’s figures herald end of recession

Britain has emerged from the worst recession since the Second World War, new Bank of England figures suggested yesterday ...Note that the GDP figures in Britain are not annualized (0.4 percent is about 1.6 percent as reported in the U.S.)

Detailed forecasts published by the Bank showed that gross domestic product (GDP) will rise by 0.2 per cent between July and September, marking the first economic expansion since the first three months of last year. The Bank expects the economy to continue to expand in the fourth quarter, by 0.4 per cent, and sustain the recovery throughout next year.

The recession has apparently ended in Japan, Germany, and France.

Tuesday, July 21, 2009

Philly Fed State Coincident Indicators: Widespread Recession in June

by Calculated Risk on 7/21/2009 11:28:00 AM

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty seven states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 46 states in June, and was unchanged in 1 state. Here is the Philadelphia Fed state coincident index release for June.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2009. In the past month, the indexes increased in three states (Mississippi, North Dakota, and Vermont), decreased in 46, and remained unchanged in one (North Carolina) for a one-month diffusion index of -86. Over the past three months the indexes increased in two states (Mississippi and North Dakota), decreased in 47, and remained unchanged in one (Montana) for a three-month diffusion index of -90.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Almost all states showed declining activity in June. Still a very widespread recession ...

Wednesday, July 15, 2009

Is the Recession Over?

by Calculated Risk on 7/15/2009 11:34:00 AM

Last night Merrill Lynch declared the recession over.

From Tom Petruno at the LA Times: 'Recession is over,' BofA Merrill Lynch tells investors

And from CNBC:

It is usually difficult to tell when a recession has ended - especially for a jobless recovery.

It took the National Bureau of Economic Research (NBER) Business Cycle Dating Committee over a year and half after the 2001 recession ended to call the trough of the cycle. And it took 21 months after the 1990-1991 recession ended for NBER to date the end of the recession.

From the 2003 announcement of the end of the 2001 recession:

The committee waited to make the determination of the trough date until it was confident that any future downturn in the economy would be considered a new recession and not a continuation of the recession that began in March 2001.The economy was still struggling in 2003 - especially employment - but the NBER committee members felt that any subsequent downturn would be considered a separate recession:

The committee noted that the most recent data indicate that the broadest measure of economic activity-gross domestic product in constant dollars-has risen 4.0 percent from its low in the third quarter of 2001, and is 3.3 percent above its pre-recession peak in the fourth quarter of 2000. Two other indicators of economic activity that play an important role in the committee's decisions-personal income excluding transfer payments and the volume of sales of the manufacturing and wholesale-retail sectors, both in real terms-have also surpassed their pre-recession peaks. Two other indicators the committee focuses on-payroll employment and industrial production-remain well below their pre-recession peaks. Indeed, the most recent data indicate that employment has not begun to recover at all. The committee determined, however, that the fact that the broadest, most comprehensive measure of economic activity is well above its pre-recession levels implied that any subsequent downturn in the economy would be a separate recession.This is relevant to today. It is very likely that any recovery will be very sluggish, and if the economy turns down within the next 6 to 12 months, the NBER would probably consider that a continuation of the Great Recession.

Here is the NBER dating procedure.

Note that the trough of the 1980 recession was only 12 months before the beginning of the 1981 recession, but the short recovery was fairly robust with real GDP up 4.4%. Those two recessions are frequently called a "double dip" recession, but the NBER considers them as two separate recessions.

I think the "official" recession will probably end sometime in the 2nd half of 2009, but the recovery will be very sluggish and there is a risk of a double dip recession. Roubini argues that the recession will end sometime in early 2010. Maybe. But I also think it will feel like a recession for some time, since the unemployment rate will probably rise through most of 2010, and stay elevated for a long period (a jobless recovery).

Tuesday, June 23, 2009

Philly Fed State Coincident Indicators: Widespread Recession

by Calculated Risk on 6/23/2009 11:59:00 AM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Forty nine states are showing declining three month activity.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 47 states in May, and was unchanged in 2 more states. Here is the Philadelphia Fed state coincident index release for May.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for May 2009. In the past month, the indexes have increased in one state (North Dakota), decreased in 47, and were unchanged in the other two (South Dakota and Vermont), for a one-month diffusion index of -92. Over the past three months, the indexes have increased in one state (again, North Dakota) and decreased in the other 49 states, for a three-month diffusion index of -96.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Note: this graph includes states with minor increases (the Philly Fed lists as unchanged).

Almost all states showed declining activity in May. Still a very widespread recession ...

Monday, April 13, 2009

End of Recessions and Unemployment Claims

by Calculated Risk on 4/13/2009 08:54:00 PM

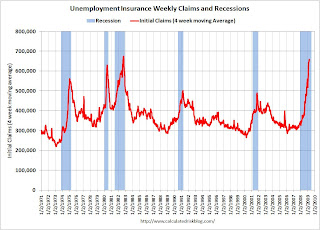

A number of forecasters have mentioned Unemployment Claims as an important indicator of the end of a recession. Professor Hamilton mentioned this last week: Initial unemployment claims and the end of recessions. Historically this is a useful indicator.

Back on March 28th, the WSJ quoted Robert J. Gordon, an economist at Northwestern University and a member of the National Bureau of Economic Research committee:

[Gordon] points to one indicator in particular with a remarkable track record: the number of Americans filing new claims for unemployment benefits. In past recessions, it has hit its peak about four weeks before the economy hit a trough and began to grow again. As of right now, the four-week average of new claims hit its peak of 650,000 in the week ended March 14. Based on the model, "if there's no further rise, we're looking at a trough coming in April or May," he said, which is far earlier than most forecasts currently anticipate.Since then, the four-week average has risen further (now at 657,250). So much for a trough in April ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the four-week average of initial unemployment claims and recessions.

Typically the four-week average peaks near the end of a recession.

Also important - in the last two recessions, initial unemployment claims peaked just before the end of the recession, but then stayed elevated for a long period following the recession - a "jobless recovery". There is a good chance this recovery will be very sluggish too, and we will see claims elevated for some time (although below the peak).

We need to see a significant decline in the four-week average before we start talking about the peak. In a note today, Goldman Sachs economist Seamus Smyth estimated a significant decline as:

Roughly speaking, a 20,000 decline in the 4-week moving average corresponds to a 50% probability that the peak has already been reached, and a 40,000 improvement to a 90% probability.So we need to see the four-week average decline by 20,000 to 40,000 or more. Don't hold your breathe ...

Tuesday, March 31, 2009

Philly Fed State Indexes: We're all Red States now!

by Calculated Risk on 3/31/2009 11:00:00 AM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. All 50 states are showing declining activity.

This is the new definition of "Red states".

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in all 50 states in February. Here is the Philadelphia Fed state coincident index release for February.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2009. The indexes decreased in all 50 states both for the month and for the past three months (one-month and three-month diffusion indexes of -100).

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.All states showed declining activity. A widespread recession ...

Thursday, March 19, 2009

Philly Fed: Continued Contraction, Employment Index at Record Low

by Calculated Risk on 3/19/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector continued to contract this month, according to firms polled for the March Business Outlook Survey. Indexes for general activity, new orders, shipments, and employment remained significantly negative. Employment losses were substantial again this month, with over half of the surveyed firms reporting declines. ...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, edged higher, from -41.3 in February to -35.0 this month. Last month's reading was the lowest since October 1990. The index has been negative for 15 of the past 16 months, a period that corresponds to the current recession ...

The current employment index fell for the sixth consecutive month, declining six points, to -52.0, its lowest reading in the history of the survey.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 15 of the past 16 months, a period that corresponds to the current recession ."

Friday, March 13, 2009

Philly Fed State Coincident Indexes: Widespread Recession

by Calculated Risk on 3/13/2009 11:06:00 AM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. Almost all states are showing declining activity over the last three months.

This is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 49 states in January (Louisiana was the one exception). Here is the Philadelphia Fed state coincident index release for January.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for January 2009. The indexes decreased in 49 states and increased in one, Louisiana, for the month (a one-month diffusion index of -96). For the past three months, the indexes have increased in one state, Wyoming; stayed flat in one state, Louisiana; and decreased in the other 48 states (a three-month diffusion index of -94).

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Last month (December) the number of states with increasing activity was reported as zero, but that has been revised to two. So the current month - with only one state showing increasing activity - is the record for fewest states with increasing activity.

Sunday, March 08, 2009

Business Cycle: Temporal Order

by Calculated Risk on 3/08/2009 03:56:00 PM

I've written extensively about using housing as a leading indicator for recessions and recoveries. Professor Leamer of the UCLA Anderson Forecast presented a very readable paper on this topic at the 2007 Jackson Hole conference: Housing and the Business Cycle

In that paper, Leamer outlined the temporal order of a typical business cycle:

The temporal ordering of the spending weakness is: residential investment, consumer durables, consumer nondurables and consumer services before the recession, and then, once the recession officially commences, business spending on the short-lived assets, equipment and software, and, last, business spending on the long-lived assets, offices and factories. The ordering in the recovery is exactly the same.I think this order can be simplified as follows (with employment added):

| Pre-Recession | Coincident with Recession | Lags Start of Recession | |

| Residential Investment | PCE | Investment, non-residential Structures | |

| Investment, Equipment & Software | |||

| Unemployment |

When I first started writing about the housing bubble - and the then coming housing bust - I pointed out that we should be very concerned because housing slumps typically lead the economy into recessions. It happened once again.

Housing usually leads the economy out of recessions too. The second table shows a simplified typical temporal order for emerging from a recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

This business cycle there are reasons that housing will not be a significant engine of recovery. It is possible - see Looking for the Sun - that new home sales and housing starts will bottom in 2009, but any recovery in housing will probably be sluggish.

That leaves Personal Consumption Expenditures (PCE) - and as households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon. So even if the economy bottoms in the 2nd half of 2009, any recovery will probably be very sluggish.

At least we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Tuesday, March 03, 2009

Transportation: Record Idle Ships, Trucking Tonnage Increases Slightly

by Calculated Risk on 3/03/2009 01:05:00 PM

From the Journal of Commerce: Idle Box Fleet Reaches 1.35M TEUs (hat tip Vincent)

Idled ocean container capacity on March 2 reached a record 1.35 million TEUs with 453 ships without work as carriers continue to axe services in the face of collapsing cargo volumes and tumbling freight rates across all trade routes.From the American Trucking Association: ATA Truck Tonnage Index Rose 3 Percent in January

The jobless figure, up from 392 vessels of 1.1 million TEUs two weeks ago, is equivalent to 10.7 percent of the world cellular container ship fleet in capacity terms, according to AXS-Alphaliner, the Paris-based consultant.

This is the highest unemployment rate in the history of container shipping and is three times the 3.5 percent jobless figure in the depth of the 2002 bear market.

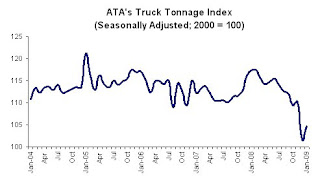

Click on graph for larger image in new window.

Click on graph for larger image in new window.The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index climbed 3 percent in January 2009, marking only the second month-to-month increase in the last seven months. Still, the gain did little to erase the revised 7.8 percent contraction in December 2008. In January, the seasonally adjusted tonnage index equaled just 104.7 (2000 = 100), its second-lowest level since October 2002. ...

Compared with January 2008, the index declined 10.8 percent, which was slightly better than December’s 12.5 percent year-over-year drop.

ATA Chief Economist Bob Costello said that there was no reason to get excited about January’s 3 percent month-to-month improvement. “Tonnage will not fall every month, and just because it rises every now and then doesn’t mean the economy is on the mend,” Costello said. “Furthermore, tonnage is contracting significantly on a year-over-year basis, which is highlighting the current weakness in the freight environment.”

Friday, February 27, 2009

Restaurant Performance Index Rebounds Slightly

by Calculated Risk on 2/27/2009 10:57:00 AM

From the National Restaurant Association (NRA): Restaurant Industry Outlook Improved Somewhat in January as Restaurant Performance Index Rebounded From December’s Record Low

The outlook for the restaurant industry improved somewhat in January, as the National Restaurant Association’s comprehensive index of restaurant activity bounced back from December’s record low. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.4 in January, up 1.0 percent from December’s record low level of 96.4.

“Despite the encouraging January gain, the RPI remained below 100 for the 15th consecutive month, which signifies contraction in the key industry indicators,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Same-store sales and customer traffic remained negative in January, and only one out of four operators expect to have stronger sales in six months.”

...

Restaurant operators reported negative customer traffic levels for the 17th consecutive month in January.

...

Along with soft sales and traffic levels, capital spending activity remained dampened in recent months. Thirty-four percent of operators said they made a capital expenditure for equipment, expansion or remodeling during the last three months, matching the proportion who reported similarly last month and tied for the lowest level on record.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

The index values above 100 indicate a period of expansion; index values below 100 indicate a period of contraction.

Based on this indicator, the restaurant industry has been contracting since November 2007. Also note the record low business investment by restaurant operators - this is happening in most industries, and is showing up as a significant decline in equipment and software investment in the GDP report (-28.8% annualized in the Q4 report!)

Monday, February 23, 2009

Chicago Fed: National Activity Index Remains Low in January

by Calculated Risk on 2/23/2009 09:58:00 AM

From the Chicago Fed: Index shows economic activity remained low in January (ht Misha)

The Chicago Fed National Activity Index was –3.45 in January, up slightly from –3.65 in December. All four broad categories of indicators made negative contributions to the index in January.

The three-month moving average, CFNAI-MA3, decreased to –3.41 in January from –2.70 in the previous month, reaching its lowest level since 1975. ... The production and income category of indicators made a large negative contribution of –1.35 to the index in January after contributing –1.53 in December. Total industrial production decreased 1.8 percent in January after declining 2.4 percent in the previous month. In particular, manufacturing production of durable goods declined 4.8 percent in January, marking its largest one-month decline since December 1974.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed: "When the CFNAI-MA3 value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun."

This is the lowest level since 1975. Just more cliff diving ...