by Calculated Risk on 1/14/2011 12:43:00 PM

Friday, January 14, 2011

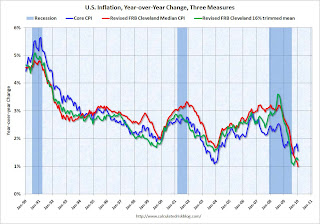

Core measures of inflation increase in December

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.7% annualized rate) in December. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.6% annualized rate) during the month. ...So these three measures: core CPI, median CPI and trimmed-mean CPI, all increased less than 1% over the last 12 months.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.5% (6.2% annualized rate) in December. The CPI less food and energy increased 0.1% (1.1% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 0.6%, the trimmed-mean CPI rose 0.8%, the CPI rose 1.5%, and the CPI less food and energy rose 0.8%

However, all three increased in December at an annualized rate - although still below the Fed's target of around 2%. The headline CPI number reflects the surge in oil prices.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows these three measure of inflation on a year-over-year basis.

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year.

Note: The Cleveland Fed has a discussion of a number of measures of inflation: Measuring Inflation

The indexes for rent and owners' equivalent rent both increased in December.

The indexes for rent and owners' equivalent rent both increased in December.By these measures rents have bottomed and are starting to increase again (this fits with earlier reports of falling vacancy rates and rising rents). I don't expect rents to push up inflation very much (I think core inflation will stay low for some time with all the slack in the system), but rising rents suggests that the excess rental housing units are being absorbed - a necessary step for an eventual recovery in residential investment.

Wednesday, May 19, 2010

CPI declines 0.1%, Core CPI Flat

by Calculated Risk on 5/19/2010 08:30:00 AM

From the BLS report on the Consumer Price Index this morning:

On a seasonally adjusted basis, the Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in April...Owners' equivalent rent (OER) is now down slightly year-over-year.

The index for all items less food and energy was unchanged in April, as it was in March. The shelter index and its major components of rent and owners' equivalent rent were all unchanged in April.

The disinflationary trend continues - and with all the slack in the system (especially the 9.9% unemployment rate), it is hard to see inflation picking up any time soon. The high unemployment rate and low measured inflation suggest the Fed will hold the Fed funds rate at the current level for some time.

Sunday, February 21, 2010

Graph of Core CPI, and Cleveland Fed Measures of Inflation

by Calculated Risk on 2/21/2010 05:00:00 PM

A combination of significant resource slack, and a policy of pushing down rents (an unintended consequence of the first time homebuyer tax credit), pushed core inflation (CPI minus food and energy) negative in January for the first time since 1982. This was no surprise.

Professor Krugman has more and suggests focusing on the Cleveland Fed measures of inflation:

[C]ore CPI has been behaving erratically lately, making me doubt whether it’s still a good guide to underlying inflation (by which I mean the trend in prices that, unlike commodity prices, have a lot of inertia).That inspired me to put all three measures on one graph:

What I find myself looking at these days are the Cleveland Fed “trimmed” inflation measures, which exclude outlying large price movements; the ultimate trim is the median, the rise in the price of the median category. And these indicators tell a story of dramatic disinflation in the face of a weak economy ... We may have to start calling the Fed chairman Bernanke-san, after all.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in core CPI, and the two Clevelend Fed measures of inflation (median and trimmed mean). All three measures are moving down.

If we just look at the last three months, Core CPI is essentially unchanged and the Median is only up at about a 0.5% annual rate.

Despite all the talk about the Fed possibly raising the Fed funds rate in the 2nd half of 2010, with high unemployment and low measured inflation, it is very unlikely that the Fed will raise the Fed Funds rate any time soon - probably not until 2011 at the earliest.

Thursday, October 15, 2009

CPI: Owners' Equivalent Rent Declines for First Time Since 1992

by Calculated Risk on 10/15/2009 09:01:00 AM

From the BLS: Consumer Price Index Summary

On a seasonally adjusted basis, the Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in September, the Bureau of Labor Statistics reported today. The increase was less than the 0.4 percent rise in August. The index has decreased 1.3 percent over the last 12 months on a not seasonally adjusted basis.And on rents:

The increase occurred despite declines in the indexes for rent and owners' equivalent rent, the first decreases in those indexes since 1992.The decrease in OER was at an annual rate of 1.7%. And rents will continue to fall for some time.

Also, it is now official, there will be no increase in Social Security benefits next year (see: Social Security: No Increase to 2010 Benefits or Maximum Contribution Base)

Friday, August 14, 2009

CPI Flat, BLS Rent Measures Decline Slightly

by Calculated Risk on 8/14/2009 08:34:00 AM

From the BLS: Consumer Price Index Summary

On a seasonally adjusted basis, the CPI-U was unchanged in July following a 0.7 percent increase in June ... The index for all items less food and energy [Core] rose 0.1 percent in July following a 0.2 percent increase in June.Not only is the index for lodging off sharply, but the BLS measures for rent declined slightly (rounded to flat). Owners' equivalent rent (OER) is the largest component of CPI, and even though rents have been falling in most areas, OER was still increasing. The decline in July OER was very small, but it is a start.

...

The index for shelter fell 0.2 percent and the household energy index declined 0.3 percent. Within the shelter group, the indexes for rent and owners' equivalent rent were both unchanged in July after rising 0.1 percent in June. The index for lodging away from home turned down in July, falling 2.1 percent after increasing 0.3 percent in June, and has fallen 8.9 percent over the past 12 months.

Over the last 12 months, CPI has fallen 2.1 percent, the largest 12 month decline since 1950.

Wednesday, July 15, 2009

CPI up 0.7%; Core CPI up 0.2%

by Calculated Risk on 7/15/2009 08:31:00 AM

From the Census Bureau:

On a seasonally adjusted basis, the CPI-U increased 0.7 percent in June after rising 0.1 percent in May. The acceleration was largely caused by the gasoline index, which rose 17.3 percent in June and accounted for over 80 percent of the increase in the all items index.CPI is now off 1.2% year-over-year (YoY) - the largest YoY decline since the 1950s, but core CPI is up 1.7%.

...

The index for all items less food and energy rose 0.2 percent in June following a 0.1 percent increase in May.

...

The index for shelter rose 0.1 percent for the second straight month, as did the indexes of two of its major components, rent and owners' equivalent rent.

Meanwhile owners' equivalent rent (OER) is up 1.9% year-over-year, although only up 0.1% in June. I expect OER to decline soon.

Wednesday, April 15, 2009

Consumer Prices Decline Slightly in March

by Calculated Risk on 4/15/2009 08:42:00 AM

From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The index has decreased 0.4 percent over the last year, the first 12 month decline since August 1955.But for some reason, owners' equivalent rent increased again in March:

On a seasonally adjusted basis, the CPI-U decreased 0.1 percent in March after rising 0.4 percent in February. The decrease was due to a downturn in the energy index ... The index for all items less food and energy increased 0.2 percent for the third month in a row.

The shelter index was virtually unchanged in March. The indexes for rent and owners' equivalent rent [OER] both rose 0.2 percent, but these increases were offset by a 2.4 percent decrease in the index for lodging away from home. This was the sixth straight monthly decline in that index, which has fallen 7.8 percent over the past year.So CPI is picking up the decline in hotel room rates, but the survey is apparently missing the widespread decline in residential rents.

This is important because OER accounts for almost one-fourth of CPI. CPI ex-OER is off -0.2% in March.

Wednesday, February 18, 2009

Bernanke and Fed Minutes

by Calculated Risk on 2/18/2009 02:06:00 PM

Fed Chairman Ben Bernanke spoke today: Federal Reserve Policies to Ease Credit and Their Implications for the Fed's Balance Sheet. Bernanke made a comment that could be interpreted as inflation targeting:

Later today, with the release of the minutes of the most recent FOMC meeting, we will be making an additional significant enhancement in Federal Reserve communications: To supplement the current economic projections by governors and Reserve Bank presidents for the next three years, we will also publish their projections of the longer-term values (at a horizon of, for example, five to six years) of output growth, unemployment, and inflation, under the assumptions of appropriate monetary policy and the absence of new shocks to the economy. These longer-term projections will inform the public of the Committee participants' estimates of the rate of growth of output and the unemployment rate that appear to be sustainable in the long run in the United States, taking into account important influences such as the trend growth rates of productivity and the labor force, improvements in worker education and skills, the efficiency of the labor market at matching workers and jobs, government policies affecting technological development or the labor market, and other factors. The longer-term projections of inflation may be interpreted, in turn, as the rate of inflation that FOMC participants see as most consistent with the dual mandate given to it by the Congress--that is, the rate of inflation that promotes maximum sustainable employment while also delivering reasonable price stability.And here is the "inflation target" from the Fed:

This seems to move the Fed closer to an official inflation target, and the Fed is probably hoping this will increase inflation expectations (since deflation is the current primary concern).1.7 to 2.0 percent inflation, as measured by the price index for personal consumption expenditures (PCE).

Most participants judged that a longer-run PCE inflation rate of 2 percent would be consistent with the dual mandate; others indicated that 1-1/2 or 1-3/4 percent inflation would be appropriate.

Friday, January 16, 2009

CPI declines 0.7% in December

by Calculated Risk on 1/16/2009 08:34:00 AM

From Rex Nutting at MarketWatch: Consumer prices show smallest gain in 54 years

The consumer price index fell 0.7% in December, the third decline in a row, led by an 8.3% drop in energy prices and a 0.1% drop in food prices.More later on CPI.

...

Core prices - which exclude food and energy prices - were flat in December for the second straight month ...

Consumer prices were up 0.1% in 2008, the slowest annual inflation since prices fell 0.7% in 1954. The core CPI was up 1.8% in 2008, the lowest increase since 2003.

Tuesday, September 16, 2008

CPI Declines slightly on Falling Oil Prices

by Calculated Risk on 9/16/2008 08:32:00 AM

From the BLS: Consumer Price Index

On a seasonally adjusted basis, the CPI-U decreased 0.1 percent in August, following a 0.8 percent increase in July. The index for energy fell 3.1 percent in August after three consecutive sharp increases.Core inflation:

The index for all items less food and energy increased 0.2 percent in August after increasing 0.3 percent in July.Interesting, the BLS reported a sharp decline (1.1 percent) in the lodging away from index, suggesting pricing weakness for hotels.

This is a little bit of good news, and takes some of the pressure off the Fed. However, the CPI has still increased 5.1% (SAAR) during the first eight months of 2008 - way too high for comfort.

Thursday, August 14, 2008

Consumer Prices Increase Sharply

by Calculated Risk on 8/14/2008 08:57:00 AM

From MarketWatch: Consumer prices jump 0.8% in July

U.S. consumer prices jumped a greater-than-expected 0.8% in July, marked by big increases in energy, food, clothing and cigarettes, the Labor Department reported Thursday.

The core consumer price index - which excludes volatile food and energy prices - rose 0.3% for the second straight month.

...

Consumer prices are up 5.6% in the past year, the biggest year-over-year increase since January 1991. The CPI has surged at a 10.6% annualized rate in the past three months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year change in inflation, both CPI and Core inflation (less food and energy). Using CPI, inflation is at the highest level in 17 years.

Also note that CPI has persistently been running ahead of Core for most of the last 5+ years. This is mostly due to the huge increase in energy prices (and food too).

The good news is inflation should slow as energy prices fall (if they continue to decline). And inflation helps with real house prices too!

Thursday, May 08, 2008

Tim Duy: Misunderstanding the CPI

by Calculated Risk on 5/08/2008 10:53:00 AM

Professor Tim Duy writes at Economist's View: Misunderstanding the CPI. This is an excellent discussion of CPI, and review of David Loenhardt's article yesterday in the NY Times: Seeing Inflation Only in the Prices That Go Up.

Also, here is a great graphic showing the relative size of all of the components of CPI: All of Inflation’s Little Parts (hat tip Eyal). Notice the size of "owner's equivalent rent" (OER).

Dr. Duy discusses OER and then concludes:

[T]he debate over the use of OER in the CPI is something of a false debate. In my opinion, it misses the point entirely. The debate is not whether housing costs are miscalculated in the CPI – the BLS’s basic methodology is appropriate to achieve their objective. The debate is whether or not the Fed should include assets prices, such as home prices, in their policy objective of price stability. Just because there is a valid argument that the Fed should be using a measure other than (or in addition to) consumer prices does not imply that the CPI is flawed. It implies that the construction of monetary policy is flawed. In effect, the BLS is unfairly criticized for the Fed’s policy error.

Monday, April 14, 2008

Food Riots and Falling Russian Oil Production

by Calculated Risk on 4/14/2008 09:45:00 PM

Here are two scary stories:

From CNN: Riots, instability spread as food prices skyrocket

Riots from Haiti to Bangladesh to Egypt over the soaring costs of basic foods have brought the issue to a boiling point and catapulted it to the forefront of the world's attention, the head of an agency focused on global development said Monday.From the WSJ: Russian Output Slumps As Oil Hits New Highs

Russian output fell for the first time in a decade in the first three months of this year, according to the International Energy Agency, which represents industrialized oil-consuming countries. It said Russian production averaged about 10 million barrels a day, a 1% drop from the first-quarter of 2007.These stories are related. High food prices are due in large part to high oil prices.

Falling oil prices would really help cushion the U.S. recession. If oil prices stay high because of global demand - then at least U.S. exports will probably be strong. But if oil prices stay high because of falling production, then the recession will be much worse than I currently expect. And the impact on the World's poor will be severe.

These stories are much scarier than the TED spread expanding again.

Friday, April 11, 2008

Import Prices Jump

by Calculated Risk on 4/11/2008 09:33:00 AM

From the WSJ: Import Prices Show Pervasive Jump, Even When Oil Costs Are Excluded

Import prices surged in March, lifted by not only oil but also the biggest jump in nonpetroleum costs on record, a worrisome sign for inflation.Rising import prices have a somewhat small impact on U.S. inflation, because total imports (about $2.3 trillion in 2007) are relatively small compared to GDP ($13.8 trillion in 2007) - or about 17% of GDP. But the 5.4% increase in import prices does add - as a rough estimate - about 1% to U.S. inflation.

Overall import prices rose 2.8% last month, after increasing an unrevised 0.2% in February, the Labor Department said Friday. ...

During the 12 months since March 2007, prices increased 15%. ...

Excluding petroleum, all other import prices rose 1.1% in March, after increasing 0.7% in February. Prices excluding petroleum increased 5.4% in the 12 months since March 2007, nearly double the 2.8% climb between March 2006 and March 2007.

Also, increases in the trade deficit, associated with rising prices (as opposed to more imported goods and services), is unwelcome news.

Saturday, March 22, 2008

DeLong Sounds the Alarm

by Calculated Risk on 3/22/2008 04:33:00 PM

From Professor Delong: Sounding the Alarm on the Financial Crisis

"Stage III of a financial crisis is when a central bank runs out of ammunition--when pushing interest rates too the floor and swapping out all of its assets does not restore the good equilibrium. Then you face a threefold choice: depression, inflation, or public intervention. Depression is to be avoided. Inflation--resolving the financial crisis by printing enough money to boost the price level far enough that all of a sudden everyone's incomes and real asset values are high enough to pay off their nominal debts--is generally best avoided too. As John Maynard Keynes wrote more than eighty years ago: "The Individualistic Capitalism of today, precisely because it entrusts saving to the individual investor and production to the individual employer, presumes a stable measuring-rod of value, and cannot be efficient--perhaps cannot survive--without one."I do not believe we've reached what Professor DeLong calls Stage III of a financial crisis - and I don't think the Fed is out of ammunition - but I think DeLong is correct that we should be planning ahead. The Fed can only do so much, and DeLong is arguing we should be prepared if it becomes clear the Fed is ineffective.

So if Depression is unthinkable, and inflation is best avoided, this leaves public action. If the good equilibrium has vanished - as it looks like it has - because the supply of risky assets is too large for financial intermediaries to want to hold them given their capital, then the central government has to take action: to boost or to make financial intermediaries boost their capital so that they will demand more risky assets at high prices, and to diminish the supply of risky assets offered on the financial markets by either a) guaranteeing some of them or b) by buying up some of them itself.

It's time to start thinking. If we don't want to wind up in a deep depression or a big inflation, it is time to recognize might well run out of ammunition in dealing with this financial crisis, and figure out what kind of government action we want to see, and how we can set in in motion quickly if it becomes necessary."

Along those lines, Professor Krugman writes: Weird Interest Rates.

Treasury rates have plunged close to zero, even though Fed funds is still 2.25%. Since open-market operations take place in Treasuries, I take this to mean that the Fed may not actually be able to reduce short-term rates much from current levels — which means, in turn, that conventional monetary policy has been taken off the table.