by Calculated Risk on 6/02/2009 06:26:00 PM

Tuesday, June 02, 2009

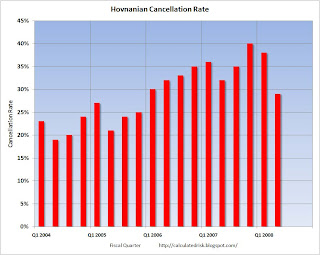

Homebuilder Cancellation Rate

"Our contract cancellation rate of 24% for the second quarter is at a more normalized level, the likes of which we have not reported since the third quarter of 2005,"The surge in cancellation rates was an important story after the bubble burst. Now it appears cancellation rates might be returning to more normal levels.

Ara K. Hovnanian, President and CEO Hovnanian Enterprises, June 2, 2000

The following graph shows the average cancellation rates for some selected homebuilders that I've been tracking.

Click on graph for larger image in new window.

Click on graph for larger image in new window.There appears to be a seasonal pattern (fewer cancellations in Q1), but most of the builders are reporting the lowest cancellation rates since the bubble burst.

The cancellation rate could rise again if mortgage rates move higher, but this is a little bit of good news for the builders. Here are a couple of comments I posted last month:

Pulte: The cancellation rate improved to 21% for the first quarter of 2009 compared with 47% for the fourth quarter of 2008 and 28% for the first quarter of 2008.

D.R. Horton: The Company’s cancellation rate (cancelled sales orders divided by gross sales orders) for the second quarter of fiscal 2009 was 30%.

These cancellation rates are still above normal (Note: "Normal" for Horton is in the 16% to 20% range, so 30% is still high.), but these are the lowest cancellation rates for most builders since late 2005 or early 2006.

Tuesday, November 11, 2008

Toll: Record Low Homebuyer Demand

by Calculated Risk on 11/11/2008 10:01:00 AM

"Unfortunately, the preliminary signs of stability we had discussed in early September, during our 2008 third quarter earnings call, were upended by the past month's financial crisis. Results of this crisis -- accelerating fears of job losses, a large decline in consumer spending, a significant capital crunch, increased credit market disruption, and plummeting stock market values -- all contributed to drive our cancellations up to 233 units (about 30% of current-quarter-contracts, or 9% of beginning-quarter-backlog), and drive home buyer confidence and our traffic and demand down to record lows."From MarketWatch: Home builder says buyer traffic, demand plummet after financial crisis

Robert Toll, CEO Toll Brothers, Nov 11, 2008

Unfortunately, the preliminary signs of stability we had discussed in early September, during our 2008 third quarter earnings call, were upended by the past month's financial crisis," said Chief Executive Robert Toll in a prepared statement.Not surprising. Also the cancellation rate rose to 30%, far above Toll's historical average of 7%, but still below the record highs of recent years.

The crisis contributed to pushing up cancellations and drove homebuyer confidence and the company's traffic and demand to record lows, the CEO said, pointing to "accelerating fears of job losses, a large decline in consumer spending, a significant capital crunch, increased credit market disruption, and plummeting stock market values."

...

"Given the significant uncertainty surrounding sales paces, cancellation rates, market direction, unemployment trends and numerous other aspects of the overall economy, we are not comfortable offering delivery, revenue or earnings guidance for the coming year," said Chief Financial Officer Joel Rassman.

Tuesday, August 05, 2008

D.R. Horton: Cancellation Rate Increases

by Calculated Risk on 8/05/2008 11:26:00 AM

D.R. Horton reported this morning: D.R. Horton, Inc. Reports Fiscal 2008 Third Quarter Results. All the numbers are grim:

The quarterly results included $330.4 million in pre-tax charges to cost of sales for inventory impairments and write-offs of deposits and pre-acquisition costs related to land option contracts that the Company does not intend to pursue ... Homes closed in the current quarter totaled 6,167, compared to 9,643 homes closed in the year ago quarter.Horton also reported that their cancellation rate increased to 39% in fiscal Q3 (calendar Q2 as shown on graph).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Declining cancellation rates was one of the few pieces of good news for homebuilders recently.

This graph shows that cancellation rates had started to decline from the peak in Q3 2007 (the start of the credit crunch). Cancellations rates vary between builders because of different requirements when the contract is signed (some builders put more effort into qualifying borrowers and require larger downpayments than others).

For Horton, their normal cancellation rate is 16% to 20%. An increase to 39% is bad news.

Wednesday, June 04, 2008

Cancellations, Yet Again

by Calculated Risk on 6/04/2008 12:04:00 PM

First, the outlook for housing is negative. Just because I mention a few minor shreds of good news for housing, doesn't mean my view has changed. It hasn't, especially for existing home sales and prices.

OK, for those hoping to buy at lower prices, the outlook is rosy. Now that we’ve gotten the semantics out of the way, the overall outlook remains negative for house sales and prices. With tighter lending standards, demand will remain weak, and supply is already at record levels and still rising - especially the supply of distressed homes. This record supply, combined with continuing weak demand, will put pressure on house prices, probably for several years, in real terms, in many areas.

Now let’s return to cancellations. The cancellation issue can be confusing.

When looking at new home sales, we are interested in net sales, but the Census Bureau reports gross new sales. A simple equation would be:

Sales (net) = Sales (gross) – Cancellations + Sales of earlier cancellations.In the long run, the cancellation terms balance out, and the Census Bureau numbers are what we want. In other words, Sales(net) = sales(gross). But in the short run, with cancellations increasing, the Census Bureau probably overestimates sales; and with cancellations decreasing, the Census Bureau underestimates sales.

We don’t have the raw data for cancellations and sales of earlier cancellations. However the public builders typically report net sales and cancellation rates. Using the public data, we can estimate net vs. gross sales for the industry, and adjust the Census Bureau estimates accordingly. Luckily the analysis isn’t too difficult: when cancellations rates are rising, net sales are typically below gross sales, and when the cancellation rates are falling, net sales are usually above gross sales. Right now cancellation rates are falling and the builders are reporting they are reducing their inventory of “unintended spec homes”, and net sales are above gross sales.

Currently cancellation rates are still significantly above normal for the home builders. As an example, Toll Brothers just announced a cancellation rate of 24.9%, far above their historical rate of 7%. But the key for adjusting the Census Bureau numbers is that the cancellation rate has declined from 38.9% two quarters ago. What matters for this calculation is the change in cancellation rate over the previous six months since that is the time it typically takes to build a home.

The same is true for other builders. Another example is Hovnanian: they reported a cancellation rate of 29%, down from 40% two quarters ago. Hovanian averaged 23% cancellation rate in 2004 and 2005 (cancellation rates are builder specific because of their downpayment and pre-qualification requirements).

Since cancellations rates are now falling, this suggests that the Census Bureau is currently underestimating sales for new homes. This is not a positive comment about these individual builders, but this helps analyze the entire market.

Tuesday, June 03, 2008

Hovnanian Reports Huge Loss

by Calculated Risk on 6/03/2008 10:01:00 PM

Here are some words that shareholders hate:

"We expect to persevere ..."Expect? Oh yeah, that inspires confidence.

CEO Ara K. Hovnanian, June 3, 2008

From Reuters: Hovnanian reports 2Q loss grows tenfold (hat tip barely)

[T]he company reported a net loss of $340.7 million, or $5.29 per share, for the quarter that ended April 30. This compared with a loss of $30.7 million, or 49 cents per share, for the same period a year ago.Ouch. That is much worse than expected.

And the little bit of good news:

Hovnanian's contract cancellation rate, excluding the joint ventures, improved to 29 percent from 38 percent last quarter and 32 percent in last year's second quarter.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Hovnanian cancellation rate by quarter since 2004 (note that Hovnanian just finished fiscal Q2 2008).

The cancellation rate is now declining after peaking last year at 40%. One of the key reasons to track cancellation rates is to estimate the error in the Census Bureau numbers. Since it takes about 6 months to build a home, the usual comparison is current quarter vs. 6 months ago. The cancellation rate is declining (from 40% to 29%) and that suggests that the Census Bureau is currently underestimating sales.

Note that Hovnanian's cancellation rate was in the 20% range during the boom years (Toll Brothers' cancellation rate was running around 4.5% in 2004). The cancellation rate tends to be builder specific because of different down payment and pre-qualification requirements.

Friday, May 30, 2008

New Home Sales and Cancellations

by Calculated Risk on 5/30/2008 11:21:00 AM

Barry Ritholtz discusses the impact of revisions and cancellations with regards to the New Home sales report: April New Home Sales - Revisited. I'll have more on revisions, but I'll try to clear up cancellations first. Barry writes:

Cancellations: Of course, none of the new home sales data includes cancellations, which were running north of 30% -- and with the recently tightened credit, it may be even worse.Yes. New home sales data doesn't include cancellations, and cancellations were probably just over 30% in Q1 2008 (based on my survey of public builder reports), but ...

Cancellations are not getting worse. In fact they are getting better. For most builders, cancellation rates peaked in Q3 2007 (with the credit crunch) and have improved significantly since then. And it's the change in cancellation rates that matter when analyzing the New Home data.

This is a key point: right now the Census Bureau is probably underestimating sales!

Here is how the Census Bureau handles cancellations:

The Census Bureau does not make adjustments to the new home sales figures to account for cancellations of sales contracts. The Survey of Construction (SOC) is the instrument used to collect all data on housing starts, completions, and sales. This survey usually begins by sampling a building permit authorization, which is then tracked to find out when the housing unit starts, completes, and sells. When the owner or builder of a housing unit authorized by a permit is interviewed, one of the questions asked is whether the house is being built for sale. If it is, we then ask if the house has been sold (contract signed or earnest money exchanged). If the respondent reports that the unit has been sold, the survey does not follow up in subsequent months to find out if it is still sold or if the sale was cancelled. The house is removed from the "for sale" inventory and counted as sold for that month. If the house it is not yet started or under construction, it will be followed up until completion and then it will be dropped from the survey. Since we discontinue asking about the sale of the house after we collect a sale date, we never know if the sales contract is cancelled or if the house is ever resold. Therefore, the eventual purchase by a subsequent buyer is not counted in the survey; the same housing unit cannot be sold twice. As a result of our methodology, if conditions are worsening in the marketplace and cancellations are high, sales would be temporarily overestimated. When conditions improve and these cancelled sales materialize as actual sales, our sales would then be underestimated since we did not allow the cases with cancelled sales to re-enter the survey. In the long run, cancellations do not cause the survey to overestimate or underestimate sales.The housing outlook is grim, but there is no need to borrow trouble. We are now in a period of improving cancellation rates, and this means the Census Bureau is likely underestimating actual sales.

emphasis added

Tuesday, May 06, 2008

New Home Inventory and Cancellations

by Calculated Risk on 5/06/2008 03:44:00 PM

Inventory numbers from the Census Bureau do not include cancellations - and although cancellation rates are still above normal, the rate has declined from the record levels of last year.

As examples, D.R. Horton reported a cancellation rate of 33% for the most recent quarter, down from 48% in the Fall of 2007. And Centex reported a cancellation rate of 29%, below the mid-30s of 2007.

Each builder has their own downpayment and cancellation policies. Some builders require much higher downpayments and therefore have lower cancellation rates. For Centex, a cancellation rate in the low 20s was normal during good times. For D.R. Horton, a cancellation rate below 20% was common during the boom.

Cancellation rates are important when analyzing the New Home data from the Census Bureau. What matters is the change in cancellation rates, not the absolute level. Falling cancellation rates mean the Census Bureau is probably underestimating sales, and underestimating the decline in inventory. This graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders. This suggests that inventory levels are now declining. Unfortunately this number can only be calculated on a quarterly basis, and not until several of the homebuilders file their quarterly reports with the SEC.

This graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders. This suggests that inventory levels are now declining. Unfortunately this number can only be calculated on a quarterly basis, and not until several of the homebuilders file their quarterly reports with the SEC.

My inventory estimate is 560 thousand (as opposed the Census Bureau reported 468 thousand) as of the end of March. This is actually positive news, since the inventory level decreased by 42 thousand in Q1 by this method. This also suggests the Census Bureau understated sales slightly in Q1.

Also note that most condominiums are not included in new home inventory (or new home sales) from the Census Bureau. Areas with significant condominium developments probably have higher levels of inventory.

Home Builder D.R. Horton: $1.3 Billion Loss

by Calculated Risk on 5/06/2008 09:25:00 AM

From MarketWatch: D.R. Horton swings to $1.3 billion loss

D.R. Horton's latest quarterly results included $834.1 million in pretax charges related to inventory impairments and land options it's walking away from.A little good news: This is lowest cancellation rate for Horton in a year. The cancellation rate peaked at 48% last fall.

...

Reflecting ongoing weakness in the residential market, D.R. Horton's net sales orders fell to 7,528 homes from 9,983 homes a year ago. The cancellation rate, measured by cancelled sales orders divided by gross sales orders, was 33% in the fiscal second quarter.

Thursday, May 01, 2008

Centex: Cancellation Rate Falls

by Calculated Risk on 5/01/2008 02:54:00 PM

On cancellation rates:

"Our cancellation rate continues to fall at 29%, it's the lowest in over a year."It makes sense that cancellation rates are now falling. It takes about 6 months to build a new home, so anyone who bought after the August credit crisis was probably aware of the tighter lending standards and falling house prices, and made their plans accordingly. Still some buyers have probably been unable to sell their existing homes, and the cancellation rate remains high by historical standards.

Each builder has their own downpayment and cancellation policies. Some builders require much higher downpayments and therefore have lower cancellation rates. For Centex, a cancellation rate in the low 20s was normal during good times, and the cancellation rate increased to the mid to high 30s for most of the last couple of years.

Cancellation rates are important when analyzing the New Home data from the Census Bureau. What matters is the change in cancellation rates, not the absolute level. Falling cancellation rates mean the Census Bureau is probably underestimating sales, and underestimating the decline in inventory.

On land:

Analyst: I was wondering kind of bigger picture as you guys go to the asset-light model, and you think about that, in the near term, you're going to be buying more finished lots. How long is it going to take you to take those lots and make them buildable? Is there a delay to get final permitting on this stuff? I guess with that, when you think longer term who is going to be owning the land that's going to be delivering the land to you and what kind of returns are they going to require on that land, and do you think that's a sustainable model in, let's say, 50, 70, 80% of your markets, something like that?Centex believes these private developers are defaulting - "land and the lots are going back to banks" - and it will take some time for the banks to price the land correctly (and recognize their losses). It is interesting that Centex is going to an asset-light model - remember that nonsense about the builders being "land banks" a few years ago?

Centex: Those are good questions, and they don't have finite answers right at the moment. The land has not corrected yet. The land is largely in the hands of private developers, and those private developers have bank borrowings against that land, and we're finding now that the land and the lots are going back to banks. There's thousands and thousands of developed lots in virtually every market with the highest being Atlanta at about 145,000 vacant developed lots. Phoenix has nearly 90,000, or 60,000. Even Dallas/Fort Worth has as many as 90,000 vacant developed lots. So the supply will be there for sometime to come. We believe it needs to go back to the banks. We're already beginning to work with banks on securing some land positions for the future, but of course that's going to be a process that takes some time, and we expect the latter half of this year.

emphasis added

How times have changed!

Centex believes most of the price declines are behind them (for new homes), but they are still worried about tighter lending standards:

What's really unknown is the sales prices. While we're not trying to compete and don't try to compete with foreclosures, the credit markets are continuing to tighten. Credit underwriting standards are continuing to tighten. So as we focus on what's necessary to qualify our buyers, there may still continue to be pressure on prices from just the credit side. Again, I think we believe most of that is behind us. And much less in front of us.Overall this was a relatively positive conference call. Although they clearly stated "There are no markets improving", their markets aren't getting significantly worse - and they are making progress working down their inventory.

Friday, April 18, 2008

Home Builder NVR: Cancellation Rate Declines in Q1

by Calculated Risk on 4/18/2008 02:07:00 PM

Press Release: NVR, Inc. Announces First Quarter Results

The cancellation rate in the first quarter of 2008 was 22% compared to 16% in the first quarter of 2007 and 32% in the fourth quarter of 2007.The following graphs shows NVR's reported cancellations rates by quarter since the beginning of 2005.

Click on graph for larger image.

Click on graph for larger image.Although the current cancellation rate is still historically high, it is below the previous two quarters. This probably means that the Census Bureau is now under reporting new home sales. I discussed this in our recent newsletter:

[I]t appears cancellation rates have peaked for the homebuilders. This makes sense for two reasons: the new home cycle is typically just over six months from signed contract to the buyer taking occupancy of the home, so new home buyers who bought before August 2007 were hit by the credit crisis, and cancelled in large numbers. But now we are starting to see the cancellation rate decline because those who bought after August of last year were probably aware of the credit crisis. Also, the home builders have responded to the high cancellation rates by requiring larger deposits, actually qualifying buyers, and in some cases guaranteeing the house price (if the price declines further, the builder will rebate the difference to the buyer).

...

During periods of rising cancellation rates, the Census Bureau overstates New Home sales and understates the increase in inventory. Conversely, during periods of declining cancellation rates, the Census Bureau understates sales. For more on cancellations, see the Census Bureau statement.

By my calculations, the inventory of new homes is currently understated by about 108K. See this blog post.

The good news is cancellations appear to have peaked, and several builders have reported slightly declining cancellation rates. For example, KB Home reported that their cancellation rate improved to 53% in fiscal Q1 2008, from 58% in Q4 2007, and Lennar reported their cancellation rate declined to 26% in fiscal Q1 2008, from 33% in Q4 2007.

This improvement in cancellation rates (if it continues) means that the Census Bureau will understate sales—and also understate the decline in inventory.

Thursday, March 20, 2008

Dow Jones Reports Home Builder Cancellation Rate Now 43%

by Calculated Risk on 3/20/2008 02:33:00 PM

Dow Jones reported today that the average home builder cancellation rate is currently 43%.

From Dow Jones: For Home Builders, Cancellations Create Expensive Problem (no link yet)

Many contracted buyers, spooked by falling home prices or suddenly unsure of their financial state, are fleeing before closing. The average cancellation rate now tops 43% - leaving builders saddled with even more unplanned, unsold and unwanted homes.Unfortunately the article doesn't provide the cancellation rate for previous periods, other than to state "the average cancellation rate dipped slightly in the fourth quarter".

The data I compile (probably a subset of the Dow Jones data) shows the cancellation rate dipped slightly to just below 40% in Q4, from a peak of 42.5% in Q3 2007.

Cancellations rates are important when following the reported new home sales and inventory from the Census Bureau. The Census Bureau doesn't include cancellations in their report.

The actual sales could be calculated as total houses sold minus cancellations in the month. The total houses sold would include new sales, plus sales of houses cancelled in previous periods.

We could write this as:

Total Sales = Sales(new) + Sales(Previous cancellations) - Cancellations

But the Census Bureau reports sales as Sales(new) only, and they ignore both factors of cancellations (if a house was sold previously, then cancelled, then resold, it isn't included in the sales numbers). This works fine as long as cancellation rates are fairly steady.

However, with rising cancellation rates, the Census Bureau overstates sales, and understates the increase in inventory (or overstates a decrease in inventory). For cancellation adjusted inventory, see my post: Housing Starts, New Home Sales and Cancellations

The opposite is also true: during periods of declining cancellations, the Census Bureau under reports sales, and overstates inventory. This will be very important in the coming year, since cancellation rates will likely decline as builders require larger deposits and take other steps to avoid cancellations.

Wednesday, February 06, 2008

Toll: Challenging Times Ahead

by Calculated Risk on 2/06/2008 10:40:00 AM

From MarketWatch: Toll's home-building revenue falls 22%

Toll Brothers Inc. doesn't see any end in sight to the U.S. housing market's woes as the luxury home builder said Wednesday that first quarter home-construction revenue fell 22% compared to the same period last year.On cancellations:

"The housing market remains very weak in most areas. Based on current traffic and deposits, we are not yet seeing much light at the end of the tunnel," said Robert Toll, chairman and CEO.

In FY 2008's first quarter, the Company had 257 cancellations totaling approximately $198.0 million, compared to 436 cancellations totaling $318.9 million in FY 2007's first quarter, and 417 cancellations totaling $328.5 million in FY 2007's fourth quarter.Tracking cancellations is important because the Census Bureau does not adjust new home sales (and inventory) with cancellations. Toll's cancellation rate is usually lower than the industry because historically Toll has required larger deposits than other homebuilders. Although the absolute number of cancellations declined, the Toll cancellation rate in Q1 was 28% vs. 29% in Q1 2007, or essentially unchanged.

Thursday, November 08, 2007

Q3 Adjusted New Home Inventory based on Cancellations

by Calculated Risk on 11/08/2007 02:04:00 PM

The Census Bureau, during periods of rising cancellation rates, overstates New Home sales and understates the increase in inventory. Conversely, during periods of declining cancellation rates, the Census Bureau understates sales. Here is discussion from the the Census Bureau on cancellations. Note: this shouldn't be confused with revisions that are unrelated to cancellations.

Using cancellation rates from several of the publicly traded home builders, we can estimate the actual new home inventory (as opposed to the inventory reported by the Census Bureau). Note: The Census Bureau breaks down the inventory as Completed, Under Construction, and Not Started. The following chart show the reported and cancellation adjusted inventory levels for the hard inventory (excluding the "Not Started" category). Click on graph for larger image.

Click on graph for larger image.

At the end of Q3, this analysis shows the Census Bureau is currently understating the hard inventory of new home sales by about 100,000 units. Even though the Census Bureau data indicated a slight decline in new home inventory in the third quarter, the adjusted inventory increased because of rising cancellation rates.

The second graph shows the reported Months of Supply for new homes, and the adjusted Months of Supply based on homebuilder cancellations. At the end of Q3, the Census Bureau reported the seasonally adjusted Months of Supply for new homes was 8.3 months. Adjusting for cancellations, the actual months of supply was 11.0 months!

However, it isn't just the inventory of new homes for sale that will impact the homebuilders. Existing homes are a competing product for new homes, and the record inventory of existing homes for sale will also pressure home-building activity. Also, it's not just the level of inventory that matters, but also the level of distressed inventory. We are already seeing record levels of foreclosures in some states, and IMO it is about to get much worse. I'll have more on total and distressed inventory soon.

Toll: High Cancellations

by Calculated Risk on 11/08/2007 11:22:00 AM

From MarketWatch: Toll's home orders drained by cancellations

Toll Brothers ... said Thursday its net orders for new homes in the latest quarter fell 35% from a year earlier as cancellations increased, pointing to further losses in the residential housing market.First, these higher cancellations mean the New Home inventory numbers from the Census Bureau will be too low. See this discussion on how the Census Bureau handles cancellations. Note: Toll is one of the companies I use to calculate the adjusted New Home inventory. I should have an update for Q3 soon.

"We continue to believe that excess supply created by cancellations, speculative buyers, and overly ambitious builders; customer concerns about selling their existing homes; and a general lack of confidence are the primary impediments to our market's recovery," said Chief Executive Robert Toll in a statement.

He said tighter lending standards and inability to obtain mortgages as a result of the subprime mess do not appear to be a "major factor" affecting its mostly affluent buyers. However, he said a tougher mortgage market may make it more difficult for buyers to sell their existing houses and move into a Toll house.

...

The builder had 417 cancellations during the quarter, while net contracts totaled 656 homes. Toll said the cancellations were heavily concentrated in high-priced markets and product lines.

"Unfortunately, the pace of customer cancellations increased in this fourth quarter," Rassman said. "We, and other reporting builders, have observed that October's activity appeared weaker than September's. These trends suggest that we still have challenging times ahead, which we believe are reflected in our estimates for fourth quarter impairments."

Second, Toll is probably correct about the minimal direct impact of tighter lending standards on high end homes. However, as Toll noted, if the high end buyers can't sell their homes, they can't buy Toll's homes.

Wednesday, October 31, 2007

Moody's: D.R. Horton, Ryland May be Cut to "Junk"

by Calculated Risk on 10/31/2007 12:59:00 PM

From Reuters: Moody's may cut D.R. Horton, Ryland, into junk

Moody's ... said it may cut its ratings on D.R. Horton Inc and Ryland Group Inc into junk territory ...

The builders have struggled to generate free cash flow, "in part because of their limited success to date in reducing actual inventory, in part because of continuing high cancellation rates, and in part because of the fiercely competitive environment the two companies face in most of their markets," Moody's said in a statement.

"Exacerbating the situation, especially in the case of Horton, is the elevated level of (speculative) inventory," Moody's said.

Wednesday, October 24, 2007

Homebuilder Reports: Pulte and MDC

by Calculated Risk on 10/24/2007 06:21:00 PM

M.D.C. Holdings Announces Third Quarter 2007 Results

MDC received orders, net of cancellations, for 1,228 homes with an estimated sales value of $365.0 million during the 2007 third quarter, compared with net orders for 2,120 homes with an estimated sales value of $678.0 million during the same period in 2006. For the nine months ended September 30, 2007, the Company received net orders for 5,756 homes with a sales value of $1.92 billion, compared with orders for 8,658 homes with a sales value of $2.95 billion for the nine months ended September 30, 2006.Pulte Homes Reports Third Quarter 2007 Financial Results

During the third quarter and first nine months of 2007, the Company's approximate order cancellation rates were 57% and 44%, respectively, compared with rates of 49% and 40% experienced during the same periods in 2006.

Net new home orders for the third quarter were 4,582 homes, valued at $1.3 billion, which represent declines of 37% and 47%, respectively, from prior year third quarter results.Just plain ugly.

Added: Ryland Reports Results for the Third Quarter of 2007

New orders of 1,876 units for the quarter ended September 30, 2007, represented a decrease of 20.9 percent, compared to new orders of 2,372 units for the same period in 2006. For the third quarter of 2007, new order dollars declined 27.0 percent to $491.4 million from $673.2 million for the third quarter of 2006. Backlog at the end of the third quarter of 2007 decreased 36.6 percent to 4,334 units from 6,835 units at the end of the third quarter of 2006. At September 30, 2007, the dollar value of the Company’s backlog was $1.2 billion, reflecting a decline of 41.6 percent from September 30, 2006.

Tuesday, October 23, 2007

Centex Posts Large Loss

by Calculated Risk on 10/23/2007 05:33:00 PM

From the WSJ: Centex Posts $644 Million Loss Amid Continued Housing Woes

Centex Corp. reported a fiscal second-quarter loss, as the company recorded $983 million in impairments and other land charges, continuing a bloody season for U.S. home builders.The positive news is that Centex reduced their inventory "of unsold homes by 28% to 4,708" and their "cancellation rate decreased to 35.4%".

...

Revenue fell 21% to $2.22 billion.

...

"Market conditions were extremely challenging during the quarter, reflecting the serious disruptions in the credit and mortgage markets that occurred during that period," said Chairman and Chief Executive Tim Eller in a prepared statement late Tuesday. "In response, we meaningfully reduced prices in order to improve affordability for our home buyers."

Tuesday, October 16, 2007

D.R. Horton: 48% Cancellations

by Calculated Risk on 10/16/2007 10:48:00 AM

From D.R. Horton, Inc. Reports Net Sales Orders for the Fourth Quarter of Fiscal Year 2007

D.R. Horton, Inc. ... the largest homebuilder in the United States, Tuesday (October 16, 2007), reported net sales orders for the fourth quarter ended September 30, 2007 of 6,374 homes ($1.3 billion), compared to 10,430 homes ($2.5 billion) for the same quarter of fiscal year 2006. Net sales orders for fiscal year 2007 totaled 33,687 homes ($8.2 billion), compared to 51,980 homes ($13.9 billion) for fiscal year 2006. The Company's cancellation rate (sales orders cancelled divided by gross sales orders) for the fourth quarter of fiscal 2007 was 48%.emphasis added

Donald R. Horton, Chairman of the Board, said, "Market conditions for new home sales declined in our September quarter as inventory levels of both new and existing homes remained high while pricing remained very competitive. We also experienced reduced mortgage availability due to tighter lending standards, and buyers continued to approach the home buying decision cautiously. We expect the housing environment to remain challenging.

The year ago cancellaton rate was 40%. Last quarter was 39%. Horton's normal cancellation rate is in the 16% to 20% range.

Saturday, October 13, 2007

You Want Cancellations?

by Calculated Risk on 10/13/2007 12:12:00 PM

From the WaPo: Reston Builder's Cancellations Reflect Industry

Comstock Homebuilding Cos. of Reston yesterday reported that even though it sold 81 houses in the third quarter, 78 sales were canceled, a net of just three sales in three months and a striking reminder of the building industry's deepening troubles.Now that is a cancellation rate!

"Market conditions have continued to deteriorate throughout the year," Christopher Clemente, the company's chief executive, said in a statement.

This is a small builder in the D.C. area. Emphasis added.

Thursday, October 11, 2007

Beazer Homes Reports 68% Cancellation Rate

by Calculated Risk on 10/11/2007 09:23:00 PM

From the WSJ: Beazer Homes Reports Surge In Cancellations of Orders

Beazer reported that 68% of its prospective home buyers canceled their orders in the company's fiscal fourth quarter, which ended Sept. 30. The cancellation rate was almost double the 36% of customers who canceled orders and gave up deposits in the prior quarter.With rising cancellation rates, the monthly New Home sales number from the Census Bureau is probably too high, and their estimate of the increase in inventory is too low. My current estimate is the Census Bureau underestimated new home inventory by 77K at the end of Q2, based on cancellations rates at several of the largest public homebuilders. Cancellations rates climbed again in Q3 because of tighter lending requirements (68% cancellations is probably the high end because of special problems at Beazer).

Beazer is one of the first large builders to detail results from September ...