by Calculated Risk on 1/03/2011 07:09:00 PM

Monday, January 03, 2011

Consumer Bankruptcy Filings increase 9% in 2010

From the American Bankruptcy Institute: Consumer Bankruptcy Filings increase 9 percent in 2010

U.S. consumer bankruptcies increased 9 percent nationwide in 2010 from the previous year, according to the American Bankruptcy Institute (ABI) relying on data from the National Bankruptcy Research Center (NBKRC). The data showed that the overall consumer filing total for the 2010 calendar year (Jan. 1 – Dec. 31, 2010) reached 1,530,078 compared to the 1,407,788 total consumer filings recorded during 2009. Annual consumer filings have increased each year since the Bankruptcy Abuse Prevention and Consumer Prevention Act was enacted in 2005.This is slightly below ABI's forecast for 1.6 million filings last year. The following graph shows the annual consumer bankruptcy filings based on data from the U.S. Courts (and the ABI for 2010).

“The steady climb of consumer filings notwithstanding the 2005 bankruptcy law restrictions demonstrate that families continue to turn to bankruptcy as a result of high debt burdens and stagnant income growth,” said ABI Executive Director Samuel J. Gerdano. “We expect that consumer filings will continue to rise in 2011.”

Wednesday, September 01, 2010

Personal Bankruptcy Filings: Down from July, Up from August 2009

by Calculated Risk on 9/01/2010 06:54:00 PM

Note: The number of filings is volatile month to month - and August is frequently a bit lower than July.

From the American Bankruptcy Institute: August Consumer Bankruptcy Filings fall 8 Percent this Month

The 127,028 consumer bankruptcies filed in August represented a 8 percent decrease nationwide over the 137,698 filings recorded in July 2010, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). Though a decrease from the previous month, NBKRC’s data also showed that the August 2010 consumer filings represented a 6 percent increase from the 119,874 consumer filings recorded in August 2009. ...

“While monthly filings are volatile, consumer bankruptcies are still the highest they have been since Congress overhauled the bankruptcy law in 2005,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings remain on track to top 1.6 million filings in 2010.”

Click on graph for larger image in new window.

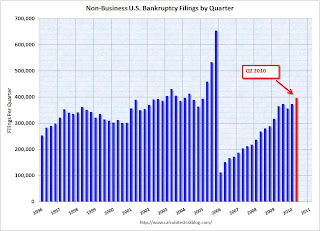

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

In 2005 the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted. Since then the number of bankruptcy filings has increased steadily.

Tuesday, August 03, 2010

Personal Bankruptcy Filings up 9% in July

by Calculated Risk on 8/03/2010 05:42:00 PM

From the American Bankruptcy Institute: July Consumer Bankruptcy Filings up 9 Percent from last Month, Year

The 137,698 consumer bankruptcies filed in July represented a 9 percent increase nationwide over the 126,434 filings recorded in July 2009, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). NBKRC’s data also showed that the July consumer filings represented a 9 percent increase from the 126,270 consumer filings recorded in June 2010. Chapter 13 filings constituted 28 percent of all consumer cases in July, a slight increase from June.

“Debt burdens, unemployment and an uncertain economic climate continue to weigh on consumers,” said ABI Executive Director Samuel J. Gerdano. “The pace of consumer filings this year remains on track to top 1.6 million filings.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Excluding 2005, when the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted (really a pro-lender act), the record year was in 2003 when 1.62 million personal bankruptcies were filed. This year will be close to that level.

Monday, July 12, 2010

Bankruptcy and 2nd Liens

by Calculated Risk on 7/12/2010 11:12:00 AM

From Catherine Curan writing at the NY Post: Liening on banks

Underwater homeowners are jumping onto an unexpected financial life raft that lets them escape crippling second mortgage debts and keep their homes -- Chapter 13 bankruptcy.For many borrowers, this makes a Chapter 13 bankruptcy a better choice than a foreclosure. With a foreclosure, the borrower loses the house - and the 2nd lien holder might still pursue the borrower (unless they release the lien for some compensation, like under HAFA).

...

How it works is this: If the home is appraised at less than the value of the first mortgage, the owner can apply for permission in bankruptcy court to reclassify the second mortgage debt. That changes it from a secured debt, which must be repaid, into an unsecured debt, which does not have to be paid in full. The homeowner can then focus on paying off the first mortgage.

"This is the only time where you see such a huge percentage of houses worth less than the first loan, allowing us to basically get rid of the second loan," says [New York City bankruptcy attorney David Shaev of Shaev & Fleischman], who estimates that 20 percent of his Chapter 13 clients who own homes qualify for this type of workout. "We're at a unique place in history."

With a bankruptcy - under certain circumstances - the borrower keeps the house, and the 2nd lien is converted to unsecured debt and does not have to be paid in full. This is probably part of the reason for sharp increase in bankruptcy filings.

Friday, July 02, 2010

Personal Bankruptcy Filings up 14% in first 6 months of 2010

by Calculated Risk on 7/02/2010 01:45:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings up 14 percent through First Half of 2010

U.S. consumer bankruptcy filings totaled 770,117 nationwide during the first six months of 2010 (Jan. 1-June 30), a 14 percent increase over the 675,351 total consumer filings during the same period a year ago, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The consumer filings for the first half of 2010 represent the highest total since 2005, when Congress enacted the Bankruptcy Abuse Prevention and Consumer Protection Act to try and stem the tide of filings, although the number of monthly consumer filings has been steadily decreasing since March.

"Years of rising consumer debt and low savings rates, combined with the housing and unemployment crises, are causing bankruptcy levels not seen since the 2005 amendments to the Bankruptcy Code," said ABI Executive Director Samuel J. Gerdano. "We expect that there will be more than 1.6 million new bankruptcy filings by year end."

The overall June consumer filing total of 126,270 was 8.5 percent more than the 116,365 consumer filings recorded in June 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Excluding 2005, when the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted (really a pro-lender act), the record year was in 2003 when 1.62 million personal bankruptcies were filed. This year will be close to that level.

Saturday, June 26, 2010

Second Liens and Personal Bankruptcy

by Calculated Risk on 6/26/2010 12:31:00 PM

From Mary Ellen Podmolik at the Chicago Tribune: Moral bankruptcy?

[Filing bankruptcy] may seem an extreme riff on the difficult decisions homeowners make to unburden themselves of debt owed on properties that have lost substantial value. Lawyers and housing counselors say, however, that personal bankruptcy filings are becoming more commonplace as debt-holders seek sums due them, particularly on second "piggyback" mortgages used to buy homes.I suspect eliminating debt from 2nd liens is one of the reasons there has been a surge in personal bankruptcy filings this year. The deep recession and high unemployment rate are probably the main reasons.

"It's a big trend," said Dan Lindsey, a supervisory attorney at the Legal Assistance Foundation of Metropolitan Chicago. "Banks are having a hard enough time dealing with the first mortgages. The second (mortgages), there's no equity there to collect so they're being charged off and sold to debt buyers and rearing their ugly heads later. It's a drastic last resort to file Chapter 7, but in some cases it's appropriate."

...

"My other option was to say I'll roll the dice with the bank," [former homeowner Del] Phillips said. "Will they really come after me? I wouldn't put it past the bank industry to do that. It's going to kill me to pay a bank for a house I no longer owned. I was, like, there's no way I'm going to pay the bank another dime."

Wednesday, June 02, 2010

Personal Bankruptcy Filings increase 9% compared to May 2009

by Calculated Risk on 6/02/2010 05:48:00 PM

From the American Bankruptcy Institute: May Consumer Bankruptcy Filings up 9 Percent from Last Year

The 136,142 consumer bankruptcies filed in May represented a 9 percent increase nationwide over the 124,838 filings recorded in May 2009, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). NBKRC’s data also showed that the May consumer filings represented a 6 percent decrease from the 144,490 consumer filings recorded in April 2010. ...

“While consumer filings dipped slightly from last month, housing debt and other financial burdens weighing on consumers are still a cause for concern,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings this year remain on track to top 1.6 million filings.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Based on the comment from Gerdano, it appears the ABI has increased their forecast to over 1.6 million filings this year from their earlier forecast of just over 1.5 million filings this year.

Excluding 2005, when the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted (really a pro-lender act), the record was in 2003 when 1.62 million personal bankruptcies were filed. This year will be close to that level.

I wonder how many of these bankruptcy filings are by homeowners who lost their homes in foreclosure and are now trying to extinguish any related recourse debt (1st or 2nd)?

Tuesday, May 04, 2010

Personal Bankruptcy Filings Up 15% Compared to April 2009

by Calculated Risk on 5/04/2010 08:34:00 AM

From Bloomberg:

Filings totaled almost 146,000 in April, according to data compiled by Automated Access to Court Electronic Records, a service of Oklahoma City-based Jupiter ESources LLC. March filings were about 158,000.The April filing total represented a 15 percent increase from April 2009 total. This is the 2nd highest month since the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 was enacted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

The American Bankruptcy Institute (ABI) is forecasting over 1.5 million filings in 2010. This is an increase from the just over 1.4 million filings in 2004. I think the ABI forecast is low ...

Friday, April 02, 2010

Personal Bankruptcy Filings Surge in March

by Calculated Risk on 4/02/2010 01:59:00 PM

From the American Bankruptcy Institute: March Consumer Bankruptcy Filings Reach Highest Monthly Total Since 2005 Bankruptcy Overhaul

The 149,268 consumer bankruptcies filed in March represented the highest monthly consumer filing total since Congress overhauled the Bankruptcy Code in 2005, according to the American Bankruptcy Institute (ABI) relying on data from the National Bankruptcy Research Center (NBKRC). The March filing total represented a 34 percent increase from the February filing total of 111,693 and a 23 percent increase from March 2009 total of 121,413. Chapter 13 filings constituted 25 percent of all consumer cases in March, representing a 2 percent decrease from February.

“The sustained economic pressures of unemployment coupled with high pre-existing debt burdens are a formula for consumer filings to surpass 1.5 million filings,” said ABI Executive Director Samuel J. Gerdano. “As consumers continue to look to bankruptcy for financial shelter, annual filings will likely equal those averaged in the years leading up to the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005.”

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Note: The NY Times uses a different source that puts the March bankruptcy filings at 158,141.

The ABI's forecast for over 1.5 million filings is at about the same level as prior to when the banker friendly "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" (BAPCPA) took effect - and an increase from the just over 1.4 million filings in 2004. I think the ABI forecast is low ...

Thursday, April 01, 2010

NY Times on Wage Garnishment

by Calculated Risk on 4/01/2010 11:54:00 PM

From John Collins Rudolf at the NY Times: Moves to Garnish Pay Rise as More Debtors Fall Behind (ht Ann)

One of the worst economic downturns of modern history has produced a big increase in the number of delinquent borrowers, and creditors are suing them by the millions.I'm surprised there isn't a move to rework the Orwellian-named "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". We definitely need a consumer financial protection agency. Look at this example from the Times story:

...

Bankruptcy can clear away most debts. Yet sweeping changes to federal law in 2005 — pushed by the banking lobby — complicated that process and more than doubled the average cost of filing, to more than $2,000. Many low-income debtors must save for months before they can afford to go broke.

Ruth M. Owens, a disabled Cleveland woman, was sued by Discover Bank in 2004 for an unpaid credit card. Ms. Owens offered a defense, sending a handwritten note to the court.

“After paying my monthly utilities, there is no money left except a little food money and sometimes it isn’t enough,” she wrote.

Robert Triozzi, a judge at the time, heard the case. He found that over a period of several years, Ms. Owens had paid nearly $3,500 on an original balance of $1,900. But Discover was suing her for $5,564, mostly for late fees, compound interest, penalties and other charges. He called Discover’s actions “unconscionable” and threw the case out.

Tuesday, March 02, 2010

ABI: Personal Bankruptcy Filings Up 14% from February 2009

by Calculated Risk on 3/02/2010 06:10:00 PM

From the American Bankruptcy Institute: February Consumer Bankruptcy Filings up 14 Percent over Last Year

The 111,693 consumer bankruptcies filed in February represented a 14 percent increase nationwide over the 98,344 filings recorded in February 2009, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). NBKRC’s data also showed that the February 2010 consumer filings represented a 9 percent increase over the 102,254 consumer filings recorded in January 2010. ...

“While Congress and the Obama administration continue to consider measures to reduce high unemployment and mortgage burdens, families with increasing debt loads have little choice but to continue to turn to bankruptcy for financial relief,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings this year will likely surpass 1.5 million filings, or the same number of annual filings averaged in the years leading up to the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005.”

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter (Q1 2010 is estimated based on January and February data).

The ABI's forecast for over 1.5 million filings is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect.

Tuesday, February 02, 2010

ABI: Personal Bankruptcy Filings Up 15% from January 2009

by Calculated Risk on 2/02/2010 06:11:00 PM

A couple of key points:

From the American Bankruptcy Institute: January Consumer Bankruptcy Filings Decrease 10 Percent from December

The 102,254 consumer bankruptcies filed in January represented a 10 percent decrease nationwide from the 113,274 consumer filings recorded in December, according to the American Bankruptcy Institute (ABI) relying on data from the National Bankruptcy Research Center (NBKRC). NBKRC’s data also showed that the January 2010 consumer filings represented a 15 percent increase over the 88,773 consumer filings recorded in January 2009.

“While January represented a drop in filings from the previous month, high unemployment rates, unsustainable mortgage burdens and other economic stresses will push more consumers to seek the financial relief of bankruptcy in 2010,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings this year will likely surpass the 1.4 million consumer filings recorded in 2009.”

emphasis added

Wednesday, November 25, 2009

Bankruptcy Filings Increase 34 Percent

by Calculated Risk on 11/25/2009 05:10:00 PM

From the U.S. Courts: Bankruptcy Filings Up 34 Percent over Last Fiscal Year

Bankruptcy cases filed in federal courts for fiscal year 2009 totaled 1,402,816, up 34.5 percent over the 1,042,993 filings reported for the 12-month period ending September 30, 2008, according to statistics released today by the Administrative Office of the U.S. Courts.

The federal Judiciary’s fiscal year is the 12-month period ending September 30. The bankruptcies reported today are for October 1, 2008 through September 30, 2009.

...

For the 12-month period ending September 30, 2009, business filings totaled 58,721, up 52 percent from the 38,651 business filings in the 12-month period ending September 30, 2008. Non-business filings totaled 1,344,095, up 34 percent from the 1,004,342 non-business bankruptcy filings in September 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the bankrutpcy filings over the last year per 1,000 population by states and territories.

Nevada makes sense with close to 70% of homeowners underwater. And Michigan is the state with the highest unemployment rate, and a large percentage of homeowners underwater. But I'm not sure why Tennessee is #2.

Wednesday, November 04, 2009

ABI: Personal Bankruptcy Filings Increase in October

by Calculated Risk on 11/04/2009 11:21:00 AM

From the American Bankruptcy Institute: October Consumer Bankruptcy Filings Reach New Highs, Up 28 Percent Over Last Year

The 135,913 consumer bankruptcy filings in October represented a 27.9 percent increase over last October's monthly total of 106,266, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The October 2009 consumer filings represented an 8.9 percent increase from the September 2009 total of 124,790. Chapter 13 filings constituted 28.5 percent of all consumer cases in October, a slight increase from the September rate.

"The nearly 9 percent increase in consumer bankruptcy filings in October, together with a 7 percent jump reported in business cases, demonstrates the sustained stress on the U.S. economy," said ABI Executive Director Samuel J. Gerdano. ABI forecasts that total bankruptcies this year will exceed 1.4 million, the highest number since 2005.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute. Q4 is three times the October rate.

The quarterly rate is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.18 million personal bankruptcy filings through Oct 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcy filings by year end.

Sunday, November 01, 2009

CIT Board Approves Bankruptcy Filing

by Calculated Risk on 11/01/2009 03:53:00 PM

Press Release: CIT Board of Directors Approves Proceeding with Prepackaged Plan of Reorganization with Overwhelming Support of Debtholders

And from the NY Times Dealbook: CIT Files for Bankruptcy

On Sunday afternoon, the company filed for Chapter 11 — but under a so-called prepackaged bankruptcy plan that will enable it to emerge from court protection by the end of the year.And from the WSJ:

Sunday’s filing, made in a Manhattan federal court, caps months of efforts by CIT to stay alive.

One loser from a bankruptcy would be the U.S. Treasury. Late last year it injected $2.3 billion of funds from the Troubled Asset Relief Program ... The government investment is likely to be wiped out ...CIT provides financing for about one million small businesses, so the key question is how will this impact the ability of many small businesses to obtain financing.

Even if CIT emerges intact, its lending capacity could drop to less than 20% of what it was two years ago, according to an estimate by Brian Charles, a debt analyst at R.W. Pressprich & Co.

Friday, October 30, 2009

Report: CIT to File Bankruptcy on Sunday

by Calculated Risk on 10/30/2009 02:08:00 PM

From the WSJ: CIT, Icahn Reach Tentative Deal Over Lender's Restructuring

As part of further discussions with CIT, Mr. Icahn has agreed to back down while the company restructures in bankruptcy court. ...This debt-for-equity swap makes the most sense and would allow CIT to continue to operate.

The company plans to file for bankruptcy in New York as soon as Sunday night or early Monday, said people familiar with the matter. CIT is poised to enter bankruptcy with enough creditor support to approve its reorganization plan and shorten its stay in Chapter 11 ...

... CIT asked bondholders to vote on a prepackaged bankruptcy plan, which would give most bondholders new debt it values at 70 cents on the dollar, and all the equity in a restructured company.

Note: CIT provides financing for about one million small businesses, so a prepackaged bankruptcy that allows the company to continue to operate would be helpful. Small businesses are already having trouble obtaining credit, and this might be impacting hiring plans (see from Melinda Pitts at Macroblog: Prospects for a small business-fueled employment recovery )

Wednesday, October 28, 2009

In re Olga: of Bankruptcy and Foreclosure

by Calculated Risk on 10/28/2009 09:23:00 PM

CR Note: This is a guest post from albrt.

In re Olga: of Bankruptcy and Foreclosure.

An article by a person named Morgenson appeared in the New York Times last weekend, calling to our collective attention a New York bankruptcy case that adds to our collective knowledge of our collective foreclosure problem. Driven by a suspicion that the article would have helped us understand more if it had been written by someone other than the aforesaid Morgenson, your intrepid foreclosure correspondent dug into the record and filed the following report.

Picking on Poor Gretchen

First, for recent arrivals, there is a long and honored history at this site of Picking on Poor Gretchen. In this case I want to congratulate Morgenson, as it appears she did break this story herself rather than picking it up, unattributed, from bloggers. Let me also say I am not necessarily the best person to carry on the tradition of Picking on Poor Gretchen. I experimented with journalism in my youth, and I know how difficult it can be to get enough actual facts in a short time to fill up the number of column inches your editor is expecting from you.

But the more I thought about the Times article, the harder it was to escape the conclusion that Brad Delong is right – the print dinosaurs are doomed, and they have done it to themselves. The first few paragraphs of Morgenson’s purported article are appallingly fact-free and hyperbolic, or as Tanta put it, “Morgenson’s valid points are drowning in a sea of sensational swill.”

The article begins:

FOR decades, when troubled homeowners and banks battled over delinquent mortgages, it wasn’t a contest. Homes went into foreclosure, and lenders took control of the property.Morgenson deserves credit for finding this story, but it is hardly the first foreclosure-gone-wrong story of the decade, or even of the “recent foreclosure wave.” Morgenson has apparently forgotten the redoubtable Judge Boyko, who dismissed some Ohio foreclosure complaints in 2007 based on somewhat similar facts. We know Morgenson covered that story, so it is not clear to me whether the “decades” of judicial neglect and rubber stamping occurred before 2007 or after. But, well, whatever.

On top of that, courts rubber-stamped the array of foreclosure charges that lenders heaped onto borrowers and took banks at their word when the lenders said they owned the mortgage notes underlying troubled properties.

* * *

But some judges are starting to scrutinize the rules-don’t-matter methods used by lenders and their lawyers in the recent foreclosure wave.

So What Happened In This Case?

Most of the sensational swill is in the first few paragraphs of this Times story. Once you get past the first third, Morgenson’s facts are basically correct. Unfortunately, much of the context is missing. For example, one of the things you would never guess from reading the Times article is that it matters whether you’re talking about a bankruptcy case or a foreclosure case. That is Takeaway Lesson Number One from this case: Bankruptcy is different from foreclosure.

The purpose of a foreclosure case is usually to allow a lender to take back collateral after the borrower stops paying on a loan. It should not be a surprise that lenders often win such cases, frequently by default. By contrast, the purpose of a bankruptcy case is to allow the debtor to restructure debt, distribute the available assets fairly among creditors, and extinguish debt that can’t realistically be paid. It should not be surprising that debtors “win” bankruptcy cases more often than foreclosure cases, especially if the debtor can show the lender has not followed the rules.

I will call the debtor in this case “Olga.” Her last name is redacted because she doesn’t seem to be seeking publicity. Olga filed bankruptcy under Chapter 13, which is a section of the bankruptcy code allowing individuals with regular income to develop a three or five year plan to pay their debts under supervision of a trustee. The debtor is protected from bill collectors, and most debts that can’t reasonably be paid are discharged. Chapter 13 theoretically allows the debtor to keep a mortgaged home if the debtor can catch up on payments within the plan period. The bankruptcy judge does not have the power to change the loan contract much, though, so many people can’t keep their homes using Chapter 13 unless the lender can somehow be “persuaded” to modify the loan.

But Olga was willing to try. She gave notice to creditors and filed a plan, among other things, and her mortgage servicer (PHH Mortgage Corp.) filed a proof of claim with a schedule stating how much was allegedly owed on Olga’s house. Olga’s lawyer noticed that PHH’s paperwork was not very complete, so he sent some information requests. He was not satisfied with the response, so he filed a motion to have PHH’s proof of claim expunged.

Olga’s Motion to Expunge

Mortgage servicers have important rights under the various contracts associated with the loan, but the servicer frequently is not, and PHH in this case was not, the actual owner of the note or the mortgage. In addition, the paperwork provided by PHH was woefully incomplete. Woefully incomplete paperwork can mean something different in bankruptcy than it does in foreclosure.

When your paperwork is woefully incomplete in a foreclosure case, you can ask for a delay or you can drop the case or have it dismissed, and you usually get another chance. Bankruptcy, by contrast, is kind of a one-shot deal by nature. The judge will add up all the debts, add up all the money available, approve a plan, and that’s it. Very limited do-overs.

Olga’s motion listed a number of problems:

These items are explained a little bit more in Olga’s Response to the lender’s objection to her motion to expunge the proof of claim, which is a pretty good summary of things borrowers might want to think about when they are considering whether to contest foreclosures. MERS was a nominee at some point, but was not directly involved in the case.

My impression is that Olga’s lawyer did not expect the proof of claim to be expunged, and was primarily interested in getting more information and forcing the lender to negotiate. Bankruptcy Judge Robert Drain had other ideas – he expunged the claim.

The Aftermath

This is probably not the end of the story because, as Olga’s lawyer explained, a title company probably will not insure the title if Olga tries to sell the house without taking any further action. Judge Drain did not explain much in his order, but what seems to have gotten his attention is the likelihood that the note and mortgage really never were properly assigned to the securitization trust.

Takeaway Lesson Number Two from this case is that, if Judge Drain is right, this is not a nothingburger. This could apply to a large number of securitized mortgages based on the language of the securitization documents themselves, not on the quirks of local law. The decision has been appealed to the district court, so we will likely find out more unless the case settles.

Morgenson also noted that this decision was by a “federal judge.” It is probably worth noting that bankruptcy judges are not quite the same as U.S. District Court judges. Bankruptcy judges are not appointed for life, they only have jurisdiction over matters that are related to bankruptcy, and their decisions are appealable to a District Court judge, as happened in this case. But bankruptcy judges have a lot of power over core bankruptcy matters. This particular judge was the one who slashed executive compensation in the Delphi case.

In my opinion, Takeaway Lesson Number Three is this: lenders would probably have been better off with a reasonable cramdown provision in the bankruptcy laws. As Tanta explained in her cramdown post, home mortgages were often modified in bankruptcy proceedings before 1993. Morgenson’s claim that all types of court proceedings have uniformly favored lenders “for decades” is wrong, but the bankruptcy laws got a lot worse for consumers in 1993 and again in 2005. In the absence of reasonable solutions imposed by a bankruptcy judge, lawyers for debtors and home mortgage lenders sometimes act like Reagan and Brezhnev, threatening each other with nuclear options and hoping none of the tactical warheads go off prematurely. Which is what seems to have happened in this case.

CR Note: This is a guest post from albrt.

Sunday, October 25, 2009

Capmark Files Bankruptcy

by Calculated Risk on 10/25/2009 07:39:00 PM

No surprise ...

Press Release: Capmark Financial Group Inc. Seeks To Restructure Balance Sheet Through Chapter 11 Reorganization Process

Capmark Financial Group Inc. ("Capmark") today announced that Capmark and certain of its subsidiaries have filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware. Capmark intends to use the reorganization process to implement a restructuring that reduces its corporate debt and maximizes value for its stakeholders. Capmark`s businesses are continuing to operate in the ordinary course.More from Bloomberg: Lender Capmark Financial Group Files for Bankruptcy

Capmark Bank, which recently received $600 million of new equity from Capmark, is not part of the filing.

Tuesday, October 13, 2009

Report: CIT Nears Bankruptcy, CEO to Resign

by Calculated Risk on 10/13/2009 08:23:00 AM

From Reuters: CIT debt swap struggles, bankruptcy looms. Reuters is reporting that "sources familiar with the matter" say bondholders are showing little interest in the debt exchange offer and a bankruptcy is now more likely.

Also this morning CIT announced that CEO Jeffrey Peek is resigning effective Dec 31st.

The possible bankruptcy of CIT is a major concern because CIT provides financing for about one million small businesses. And small businesses are already having trouble obtaining credit.

From Peter Goodman in the NY Times: Credit Tightens for Small Businesses

Many small and midsize American businesses are still struggling to secure bank loans, impeding their expansion plans and constraining overall economic growth ...Also see: Small Business and Employment

Most banks expect their lending standards to remain tighter than the levels of the last decade until at least the middle of 2010, according to a survey of senior loan officers conducted by the Federal Reserve Board. ... Bankers worry about the extent of losses on credit card businesses ...[and] are also reckoning with anticipated failures in commercial real estate. Until the scope of these losses is known, many lenders are inclined to hang on to their dollars rather than risk them on loans to businesses in a weak economy ...

A CIT bankruptcy will probably lead to even tighter credit for many small businesses exacerbating the current credit situation.

Friday, October 02, 2009

ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

by Calculated Risk on 10/02/2009 12:41:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Surge Past One Million During First Nine Months of 2009

Consumer bankruptcies totaled 1,046,449 filings through the first nine months of 2009 (Jan. 1-Sept. 30), the first time since the 2005 bankruptcy overhaul that filings have surged past the 1 million mark during the first three calendar quarters of a year, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The filings for the first three-quarters of 2009 were the highest total since the 1,350,360 consumer filings through the first nine months of 2005.

"Bankruptcy filings continue to climb as consumers look to shelter themselves from the effects of rising unemployment rates and housing debt," said ABI Executive Director Samuel J. Gerdano. "The consumer filing total through the first nine months is consistent with our expectation that consumer bankruptcies will top 1.4 million in 2009."

The September 2009 consumer filing total reached 124,790, a 41 percent increase from the 88,663 consumer filings in September 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!