by Calculated Risk on 2/28/2013 07:53:00 PM

Thursday, February 28, 2013

Friday: Personal Income and Outlays, ISM Mfg Index, Construction Spending, Auto Sales, Consumer sentiment

There are several key economic releases on Friday. First, the Personal Income and Outlays report for January will be released. This will give some idea of how consumer spending is holding up following the payroll tax increase at the beginning of the year. Note that Personal Income will be off sharply in January since some people took income in December to avoid higher taxes in 2013. Don't be shocked by a large one month decline in income!

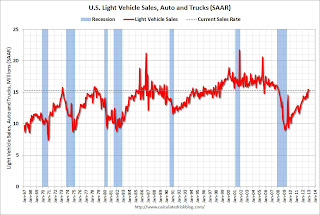

Another key release is light vehicles sales for February. The automakers will release results all day, and I'll post an estimate of the seasonally adjusted annual sales rate around 4 PM ET. Strong auto sales in February, combined with the ongoing housing recovery, would be a positive sign for the economy going forward.

As always, the ISM manufacturing index could move the markets. The regional surveys have been mixed, although the Markit Flash PMI was fairly strong, and the Chicago PMI increased in February.

Friday economic releases:

• At 8:30 AM ET, Personal Income and Outlays for January. The consensus is for a 2.1% decrease in personal income in January, and for 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 76.0.

• At 10:00 AM, ISM Manufacturing Index for February. The consensus is for PMI to decline to 52.8%. (above 50 is expansion).

• Also at 10:00 AM, Construction Spending for January. The consensus is for a 0.6% increase in construction spending.

• All day: Light vehicle sales for February. The consensus is for light vehicle sales to be at 15.2 million SAAR in February (Seasonally Adjusted Annual Rate) down from 15.3 SAAR in January.

Freddie Mac: $4.5 Billion Net Income, No Treasury Draw, REO Declines

by Calculated Risk on 2/28/2013 05:51:00 PM

From Freddie Mac: Freddie Mac Fourth Quarter 2012 Financial Results

Net income for the fourth quarter of 2012 was $4.5 billion, compared to $2.9 billion for the third quarter of 2012. The increase primarily reflects a shift from a provision for credit losses in the third quarter to a benefit for credit losses in the fourth quarter due to a decrease in the volume of newly delinquent single-family loans and continued improvement in national home prices, as well as a higher income tax benefit primarily driven by the favorable resolution of tax matters with the Internal Revenue Service (IRS). These favorable impacts were partially offset by higher net security impairments.On Real Estate Owned (REO), Freddie acquired 82,818 properties in 2012, and disposed of 94,296, and the total REO fell to 49,077 at the end of the year.

...

Freddie Mac does not require a draw from Treasury for the fourth quarter of 2012 because the company had positive net worth at December 31, 2012. The company’s $8.8 billion net worth at December 31, 2012 reflects $4.9 billion in net worth at September 30, 2012 and fourth quarter comprehensive income of $5.7 billion, partially offset by the $1.8 billion quarterly dividend payment to Treasury on the company’s senior preferred stock.

From Freddie:

In 2012, REO dispositions continued to exceed the volume of REO acquisitions. We believe our single-family REO acquisition volume in 2012 and 2011 was less than it otherwise would have been due in part to the length of the single-family foreclosure timeline, particularly in states where judicial foreclosures (those conducted under the supervision of the court) are required.

During 2012, our REO property inventory declined most in the West region primarily due to increased disposition activity and strengthening home prices in California.

The North Central region comprised 42 percent of our REO property inventory at December 31, 2012. We continue to have a significant number of properties in our REO inventory that we are unable to list because they are occupied or in states with a redemption period, particularly in Michigan, Minnesota and Illinois. States with redemption periods require a period of time after foreclosure during which the borrower may reclaim the property.

Click on graph for larger image.

Click on graph for larger image.This graph shows REO inventory for Freddie.

For FDIC insured institutions, the FDIC reports the dollar value of REOs, and the dollar value declined again in Q4. After Fannie announces results I'll post a graph of REO for the F's (Fannie, Freddie, and the FHA).

Restaurant Performance Index: Expansion in January

by Calculated Risk on 2/28/2013 03:15:00 PM

From the National Restaurant Association: Restaurant Performance Index Hit Five-Month High in January as Operators’ Optimism Grew

Driven by a more optimistic outlook among restaurant operators, the National Restaurant Association's Restaurant Performance Index (RPI) rose to its highest level in five months. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 100.6 in January, up 1.0 percent from December and its highest level since August 2012. In addition, January represented the first time in four months that the RPI rose above 100, which signifies expansion in the index of key industry indicators.

“Although the current situation indicators were mixed in January, restaurant operators were decidedly more optimistic about sales growth and the economy in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Operators’ outlook for same-store sales, capital spending and the overall economy all improved, which propelled the Expectations Index to its highest level in eight months.”

...

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 99.7 in January – up 0.6 percent from December’s level. Although restaurant operators reported net positive same-store sales results in January, softness in the customer traffic and labor indicators outweighed the performance, which resulted in a Current Situation Index reading below 100 for the fifth consecutive month.

Click on graph for larger image.

Click on graph for larger image.The index increased to 100.6 in January, up from 99.7 in December (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

Kansas City Fed: Regional Manufacturing contracted in February

by Calculated Risk on 2/28/2013 01:30:00 PM

This is the last of the regional manufacturing surveys for February, and the results have been mixed. From the Kansas City Fed: Tenth District Manufacturing Survey Contracted Further

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity contracted further in February, and factories’ expectations weakened somewhat.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“Factory activity fell more sharply in February than in previous months. Some contacts cited disruptions due to bad weather, and many firms noted that possible federal spending cuts were hurting business,” said Wilkerson. However, capital spending plans for later in the year improved considerably.”

The month-over-month composite index was -10 in February, down from -2 in January and -1 in December ...

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through February), and five Fed surveys are averaged (blue, through February) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

The average of the five regional surveys was slightly negative again, but improved from January.

The ISM index for February will be released tomorrow, Friday, March 1st, and these surveys suggest another weak reading. However the Chicago PMI (released this morning) indicated stronger expansion, and the Markit Flash PMI for February was solid too. So the ISM PMI will probably show sluggish expansion.

Fed: Consumer Debt increased slightly in Q4, "Deleveraging Process Decelerates"

by Calculated Risk on 2/28/2013 11:00:00 AM

From the NY Fed: Total Consumer Debt Up Slightly as Deleveraging Process Decelerates

In its latest Household Debt and Credit Report, the Federal Reserve Bank of New York announced that in the fourth quarter of 2012 outstanding consumer debt increased slightly ($31 billion), breaking the downward trend observed since the fourth quarter of 2008. The increase was primarily due to a rise in non-housing debt and the stabilization of mortgage debt.Here is the Q4 report: Quarterly Report on Household Debt and Credit

Total consumer indebtedness was $11.34 trillion, 0.3% higher than the previous quarter but considerably lower than its peak of $12.68 trillion in the third quarter of 2008. While outstanding mortgage debt remained roughly flat, originations of new mortgages rose to $553 billion, a fifth consecutive quarterly increase.

Non-housing debt balances increased for the third straight quarter and now stand at $2.75 trillion, up 1.4% in the fourth quarter. All non-housing components increased; auto loans up $15 billion, student loans up $10 billion and credit cards up $5 billion.

“The data provides early evidence that consumers may be reaching the end of the four year deleveraging cycle, though we’ll need to see if this is sustained in upcoming quarters,” said Andrew Haughwout, vice president and economist at the New York Fed. “At the same time, we observed mixed developments, mortgage originations increased and fewer accounts entered the foreclosure pipeline but delinquency rates remain considerably higher than pre-crisis levels.”

emphasis added

Mortgages, the largest component of household debt, were roughly flat. Mortgage balances shown on consumer credit reports stand at $8.03 trillion, roughly unchanged from the level in 2012Q3. Home equity lines of credit (HELOC) were the only product to see a substantive decline in the fourth quarter; balances dropped by $10 billion (1.7%) and now stand at $563 billion. Non-housing household debt balances increased for the third consecutive quarter and now stand at 2.75 trillion, up by 1.3% in the fourth quarter. All non-housing components increased, with auto loans up by $15 billion; student loans up by $10 billion, and credit card balances up by $5 billion.Here are two graphs:

...

About 336,000 consumers had a bankruptcy notation added to their credit reports in 2012Q4, a 21% drop from the same quarter last year, and the eighth consecutive drop in bankruptcies on a year-over-year basis.

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt increased slightly in Q4.

Student debt is still increasing. From the NY Fed:

Outstanding student loan balances increased by $10 billion during the fourth quarter, to a total of $966 billion as of December 31, 2012.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). From the NY Fed:

Overall, delinquency rates continued to improve in 2012Q4. As of December 31, 8.6% of outstanding debt was in some stage of delinquency, compared with 8.9% in 2012Q3. About $978 billion of debt is delinquent, with $712 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

LPS: Mortgage delinquencies decreased in January

by Calculated Risk on 2/28/2013 09:56:00 AM

Note: From the Chicago ISM for February: "The Chicago Purchasing Managers reported the Chicago Business Barometer rose for a second month, up 1.2 points to 56.8, its highest level since last March." PMI: Increased to 56.8 from 55.6. (Above 50 is expansion). Employment: at 55.7, down from 58.0. New orders increased to 60.2 from 58.2. This was above expectations of a reading of 55.0.

LPS released their First Look report for January today. LPS reported that the percent of loans delinquent decreased in January compared to December, and declined about 8% year-over-year. Also the percent of loans in the foreclosure process declined further in January and were down significantly over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 7.03% from 7.17% in December. Note: the normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 3.41% in January from 3.44% in December.

The number of delinquent properties, but not in foreclosure, is down about 11% year-over-year (413,000 fewer properties delinquent), and the number of properties in the foreclosure process is down 21% or 461,000 properties year-over-year.

The percent (and number) of loans 90+ days delinquent and in the foreclosure process is still very high, but the number of loans in the foreclosure process is now steadily declining.

LPS will release the complete mortgage monitor for January in early March.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| Jan 2013 | Dec 2012 | Jan 2012 | |

| Delinquent | 7.03% | 7.17% | 7.67% |

| In Foreclosure | 3.41% | 3.44% | 4.23% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,974,000 | 2,031,000 | 2,159,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,531,000 | 1,545,000 | 1,759,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,703,000 | 1,716,000 | 2,164,000 |

| Total Properties | 5,208,000 | 5,292,000 | 6,082,000 |

Weekly Initial Unemployment Claims decrease to 344,000

by Calculated Risk on 2/28/2013 08:30:00 AM

Note: Q4 GDP growth was revised up from slightly negative to slightly positive. From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 0.1 percent in the fourth quarter of 2012 ... In the advance estimate, real GDP declined 0.1 percent.I'll have more on GDP later.

The DOL reports:

In the week ending February 23, the advance figure for seasonally adjusted initial claims was 344,000, a decrease of 22,000 from the previous week's revised figure of 366,000. The 4-week moving average was 355,000, a decrease of 6,750 from the previous week's revised average of 361,750.The previous week was revised up from 362,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 355,000 - just above the lowest 4-week average since the recession.

Weekly claims were below the 360,000 consensus forecast.

Wednesday, February 27, 2013

Thursday: Q4 GDP, Unemployment Claims

by Calculated Risk on 2/27/2013 09:17:00 PM

From the WaPo: Obama to meet congressional leaders on ways to avoid sequester impact

President Obama will meet with congressional leaders Friday at the White House to discuss a way to avoid the fallout of deep spending cuts ...This will not have a huge negative impact (defaulting on the debt would have been serious), but this is still unnecessary.

Among the sequester’s possible impacts, the head of the Federal Aviation Administration warned Wednesday, are major flight delays and the closure of hundreds of air traffic control towers at smaller airports across the country.

“Flights to major cities like New York, Chicago and San Francisco could experience delays, in some instances up to 90 minutes during peak hours, because we’ll have fewer controllers on staff,” FAA administrator Michael P. Huerta said in a speech to an American Bar Association forum in Washington. ... Should the cuts occur as scheduled, travelers would begin to notice the impact in mid-April, according to the [National Air Traffic Controllers Association].

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 362 thousand last week.

• Also at 8:30 AM, Q4 GDP (second estimate). This is the second estimate of GDP from the BEA. The consensus is that real GDP increased 0.5% annualized in Q4, revised up from a negative 0.1% in the advance report.

• At 9:45 AM, the Chicago Purchasing Managers Index for February. The consensus is for a decrease to 55.0, down from 55.6 in January.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for February will be released. This is the last of the regional surveys for February, and most of the surveys have indicated expansion.

• Also at 11:00 AM, The Federal Reserve Bank of New York will release the Q4 2012 Quarterly Report on Household Debt and Credit

Lawler: A few highlights from the Q4 FDIC Quarterly Banking Profile

by Calculated Risk on 2/27/2013 03:39:00 PM

From economist Tom Lawler:

Yesterday the FDIC released its “Quarterly Banking Profile” for Q4/2012. Some of the “headline highlights” from the report, which reflects the activity at and performance of FDIC-insured financial institutions, were:

“Net Income Is More Than a Third Higher Than in Fourth Quarter 2011” despite the fact that “Banks See (Net Interest) Margins Erode,” as net income was “(bolstered by higher noninterest income and lower provisions for loan losses.” The jump in noninterest income was driven “primarily by higher gains on loan sales (up $2.4 billion, or 132.4 percent, over fourth quarter 2011), increased trading revenue (up $1.9 billion, or 75.3 percent), and reduced losses on sales of foreclosed property (down $1.2 billion, or 72 percent).” The higher gains on loans sales were driven by gains on sales of mortgages – partly reflecting higher origination volumes, but mainly reflecting extraordinarily large mortgage origination margins, which in turn partly reflected the unintended consequences of current government policy.

According to the report, the percent of loans and leases that were “noncurrent” last quarter fell to 3.60% -- the lowest rate since the end of 2008 – from 3.68% in the previous quarter and 4.19% in the fourth quarter of 2011. The % of loans secured by one-to-four family residential properties that were noncurrent last quarter was actually up from the fourth quarter of 2011, partly reflecting higher default rates on junior mortgage loans.

| % of Loans & Leases Noncurrent, FDIC-Insured Financial Institutions | |||||

|---|---|---|---|---|---|

| 2012:Q4 | 2012:Q3 | 2012:Q2 | 2012:Q1 | 2011:Q4 | |

| Total Loans & Leases | 3.60% | 3.86% | 3.90% | 4.11% | 4.19% |

| Loans Secured by 1-4 Family Res. Mortgages | 7.82% | 8.07% | 7.80% | 7.84% | 7.70% |

| Closed-End First Lien 1-4 Family Residential Mortgages | 9.49% | 9.88% | 9.75% | 9.87% | 10.00% |

| Closed-End 2nd Lien 1-4 Family Residential Mortgages | 5.09% | 5.47% | 3.86% | 3.76% | 3.50% |

| Home Equity Lines of Credit | 2.88% | 2.88% | 2.62% | 2.65% | 1.83% |

| Other Loans & Leases | 1.62% | 1.84% | 2.01% | 2.28% | 2.44% |

Click on graph for larger image.

Click on graph for larger image.On the REO front, the report showed that the carrying value of one-to-four family REO properties at FDIC institutions declined to $8.3375 billion at the end of December, down from $8.7663 billion at then end of September and $11.6376 billion at the end of 2011.

Bernanke: Sequester could lead to "less deficit reduction"

by Calculated Risk on 2/27/2013 11:46:00 AM

At this point the biggest downside risk to the US economy is from cutting the deficit too quickly. The deficit is already declining and will continue to decline for the next few years. Additional short term deficit reduction will probably be counter productive (the focus should be on long term deficit reduction, especially health care costs). The "sequester" is bad policy - but it will probably happen anyway. Dumb.

From Brad Plumer at the WaPo Wonkblog: Bernanke: The sequester could make it harder to reduce the deficit, not easier

Federal Reserve Chairman Ben Bernanke had something to say about sequestration during his testimony before the House Banking Committee on Tuesday. He thinks the looming spending cuts could actually make it harder, not easier, to reduce the deficit. Why? They’ll hurt growth:

The CBO estimates that deficit-reduction policies in current law will slow the pace of real GDP growth by about 1-1/2 percentage points this year, relative to what it would have been otherwise.The logic here is simple enough. The sequestration cuts will drag down economic growth this year, which will mean that fewer Americans will have jobs and less tax revenue will pour in. Nothing cures deficits like stronger economic growth. And right now, Congress’s policies are standing in the way of stronger growth.

A significant portion of this effect is related to the automatic spending sequestration that is scheduled to begin on March 1, which, according to the CBO’s estimates, will contribute about 0.6 percentage point to the fiscal drag on economic growth this year. Given the still-moderate underlying pace of economic growth, this additional near-term burden on the recovery is significant.

Moreover, besides having adverse effects on jobs and incomes, a slower recovery would lead to less actual deficit reduction in the short run for any given set of fiscal actions.

Pending Home Sales index increased in January

by Calculated Risk on 2/27/2013 10:14:00 AM

From the NAR: January Pending Home Sales Up in All Regions

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 4.5 percent to 105.9 in January from a downwardly revised 101.3 in December and is 9.5 percent above January 2012 when it was 96.7. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The January index is the highest reading since April 2010 when it hit 110.9, just before the deadline for the home buyer tax credit. Aside from spikes induced by the tax credits, the last time there was a higher reading was in February 2007 when it reached 107.9.

The PHSI in the Northeast rose 8.2 percent to 84.8 in January and is 10.5 percent higher than January 2012. In the Midwest the index increased 4.5 percent to 105.0 in January and is 17.7 percent above a year ago. Pending home sales in the South rose 5.9 percent to an index of 119.3 in January and are 11.3 percent higher January 2012. In the West the index edged up 0.1 percent in January to 102.1 but is 1.5 percent below a year ago.

emphasis added

Also the NAR economist lowered his forecast for sales in 2013 to 5.0 million. With limited inventory at the low end, and fewer foreclosures, we might see flat or even declining existing home sales this year. The key for sales is that the number of conventional sales is increasing while foreclosure and short sales decline.

MBA: Mortgage Applications Decrease

by Calculated Risk on 2/27/2013 09:09:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

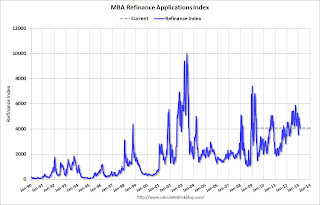

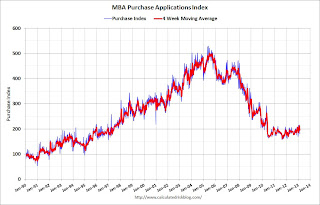

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier and is at its lowest level since the week ending December 28, 2012.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.77 percent from 3.78 percent, with points increasing to 0.48 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance activity is down over the last five weeks. Activity is still very high, but is declining from the levels of 2012.

There has been a sustained refinance boom for over a year, and 77 percent of all mortgage applications are for refinancing.

The second graph shows the MBA mortgage purchase index. The purchase index was at the low for the year last week, but the 4-week average of the index has generally been trending up over the last six months.

The second graph shows the MBA mortgage purchase index. The purchase index was at the low for the year last week, but the 4-week average of the index has generally been trending up over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Tuesday, February 26, 2013

Wednesday: Durable Goods, Pending Home Sales, Bernanke

by Calculated Risk on 2/26/2013 09:40:00 PM

This is interesting, from the WSJ: Miami Condo Loan Marks Milestone

[A] group of lenders led by Birmingham, Ala.-based Regents Financial Corp. has agreed to lend $160 million to the developers of the Mansions at Acqualina, an ultraluxury, 47-story tower under construction in Sunny Isles Beach, near Miami.This is a pretty low risk loan - with the large number of presales and 50% downpayments - but it means lenders are a little more willing to make loans.

...

The loan is the first debt deal of more than $100 million for a new condo development since the housing boom ... The lender required the builder to have completed $320 million in presales, and stipulated 50% downpayments from buyers as a condition of the loan

Wednesday economic releases:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Also at 8:30 AM, Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for January. The consensus is for a 3.0% increase in the index.

• Also at 10:00 AM, Repeat to House: Fed Chairman Ben Bernanke will deliver the "Semiannual Monetary Policy Report to the Congress", Before the Committee on Financial Services, U.S. House of Representatives

Misc: Sales Ratio Existing to New Home Sales, FHFA House Prices, Richmond Fed Mfg Survey

by Calculated Risk on 2/26/2013 06:01:00 PM

A couple of earlier released ... another index shows house prices increased in 2012, and the Richmond Fed survey suggested regional manufacturing expanded in February.

• From the FHFA: U.S. House Prices Rose 1.4 Percent in Fourth Quarter 2012

U.S. house prices rose 1.4 percent from the third quarter to the fourth quarter of 2012 according to the Federal Housing Finance Agency’s (FHFA) seasonally adjusted purchase-only house price index (HPI). The HPI is calculated using home sales price information from Fannie Mae and Freddie Mac mortgages. Seasonally adjusted house prices rose 5.5 percent from the fourth quarter of 2011 to the fourth quarter of 2012. FHFA’s seasonally adjusted monthly index for December was up 0.6 percent from November.• From the Richmond Fed: Manufacturing Activity Rebounded In February; Expectations Rose

“The fourth quarter was another strong one for house prices, as it was the third consecutive quarter where U.S. price growth exceeded one percent,” said FHFA Principal Economist Andrew Leventis. “While a significant number of homes remained in the foreclosure pipeline, the actual number of homes available for sale was very low and fell over the course of the quarter.”

FHFA’s expanded-data house price index, a metric introduced in August 2011 that adds transaction information from county recorder offices and the Federal Housing Administration to the HPI data sample, rose 1.6 percent over the latest quarter. Over the latest four quarters, that index is also up 5.5 percent.

emphasis added

In February, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained eighteen points, settling at 6 from January's reading of −12. Among the index's components, shipments rose twenty-one points to 10, the gauge for new orders moved up seventeen points to end at 0, and the jobs index increased thirteen points to 8.• Earlier I posted a graph that shows the "distressing gap" between new and existing home sales. I've argued that this gap has been mostly caused by distressed sales (foreclosures and short sales) and that eventually the gap would close.

Other indicators also suggested strengthening in February. The index for capacity utilization moved higher, adding twenty-nine points to 11, and the index for backlogs of orders gained seven points to end at −12. The delivery times index stabilized, picking up four points to end at 4, while both our gauges for inventories were lower in February. The raw materials inventory index lost seven points to finish at 16, and the finished goods inventories moved down eleven points to end at 12.

Hiring activity at District plants was mixed in February. The manufacturing employment index moved up thirteen points to settle at 8, while the average workweek indicator remained weak, tacking on just two points to end at −2. However, the wage index held steady at 11.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

Click on graph for larger image.

Click on graph for larger image.In general the ratio has been trending down, and I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier on New Home Sales:

• New Home Sales at 437,000 SAAR in January

• A few Comments on New Home Sales

• New Home Sales graphs

Earlier on House Prices:

• Case-Shiller: Comp 20 House Prices increased 6.8% year-over-year in December

• Real House Prices and Price-to-Rent Ratio

• All Current House Price Graphs

Real House Prices and Price-to-Rent Ratio

by Calculated Risk on 2/26/2013 02:41:00 PM

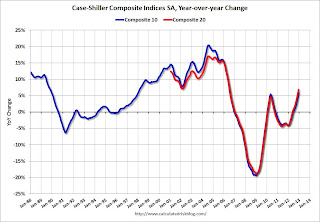

For December, Case-Shiller reported the seventh consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in December suggests that house prices probably bottomed earlier in 2012 (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase for each month in 2012.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.6% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 1.9% |

| Sep-12 | 2.9% |

| Oct-12 | 4.2% |

| Nov-12 | 5.5% |

| Dec-12 | 6.8% |

I expect the year-over-year change will slow going forward, but the lack of inventory might push prices up more than I expect in 2013. That is why I'm watching inventory closely.

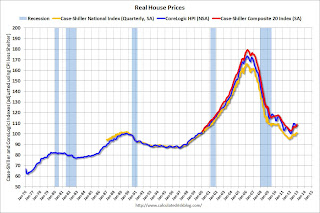

Here are some updates to a few graphs ... Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through December) in nominal terms as reported.In nominal terms, the Case-Shiller National index (SA) is back to Q2 2003 levels (and also back up to Q3 2010), and the Case-Shiller Composite 20 Index (SA) is back to October 2003 levels, and the CoreLogic index (NSA) is back to January 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to October 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

A few Comments on New Home Sales

by Calculated Risk on 2/26/2013 12:36:00 PM

1) January is seasonally the weakest month of the year for new home sales, so January has the largest positive seasonal adjustment. Also this was just one month with a sales rate over 400 thousand - and we shouldn't read too much into one month of data. But this was the highest level since July 2008 and it is clear the housing recovery is ongoing.

2) Although there was a large increase in the sales rate, sales are still near the lows for previous recessions. This suggest significant upside over the next few years (based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years).

3) Housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades. Note: The key downside risk is too much austerity too quickly, but that is a different post.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or an increase of around 22% to 25% on an annual basis for the 367 thousand in 2012.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through January. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Click on graph for larger image.

Click on graph for larger image.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 437,000 SAAR in January

• New Home Sales graphs

New Home Sales at 437,000 SAAR in January

by Calculated Risk on 2/26/2013 10:00:00 AM

NOTE: Federal Reserve Chairman Ben Bernanke testimony Testimony by Chairman Bernanke on the Semiannual Monetary Policy Report to the Congress

Here is the C-Span Link

On New Home Sales:

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 437 thousand. This was up from a revised 378 thousand SAAR in December (revised up from 369 thousand).

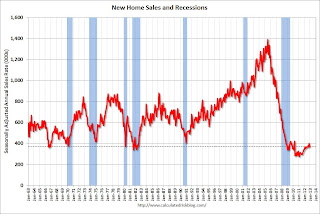

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in January 2013 were at a seasonally adjusted annual rate of 437,000 ... This is 15.6 percent above the revised December rate of 378,000 and is 28.9 percent above the January 2012 estimate of 339,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in January to 4.1 months from 4.8 months in December.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of January was 150,000. This represents a supply of 4.1 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was just above the record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In January 2013 (red column), 31 thousand new homes were sold (NSA). Last year only 23 thousand homes were sold in January. This was the ninth weakest January since this data has been tracked. The high for January was 92 thousand in 2005.

This was above expectations of 381,000 sales in January. This is the strongest sales rate since 2008. This was another solid report. I'll have more soon ...

Case-Shiller: Comp 20 House Prices increased 6.8% year-over-year in December

by Calculated Risk on 2/26/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December and Q4 ("December" is a 3 month average of October, November and December).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities), and the quarterly National Index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Closed Out a Strong 2012 According to the S&P/Case-Shiller Home Price Indices

Data through December 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, showed that all three headline composites ended the year with strong gains. The national composite posted an increase of 7.3% for 2012. The 10- and 20-City Composites reported annual returns of 5.9% and 6.8% in 2012. Month-over-month, both the 10- and 20-City Composites moved into positive territory with gains of 0.2%; more than reversing last month’s losses.

In addition to the three composites, nineteen of the 20 MSAs posted positive year-over-year growth – only New York fell.

“Home prices ended 2012 with solid gains,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Housing and residential construction led the economy in the 2012 fourth quarter. In December’s report all three headline composites and 19 of the 20 cities gained over their levels of a year ago. Month-over-month, 9 cities and both Composites posted positive monthly gains. Seasonally adjusted, there were no monthly declines across all 20 cities.

...

“Atlanta and Detroit posted their biggest year-over-year increases of 9.9% and 13.6% since the start of their indices in January 1991. Dallas, Denver, and Minneapolis recorded their largest annual increases since 2001. Phoenix continued its climb, posting an impressive year-over-year return of 23.0%; it posted eight consecutive months of double-digit annual growth.”

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.0% from the peak, and up 0.9% in December (SA). The Composite 10 is up 6.2% from the post bubble low set in March (SA).

The Composite 20 index is off 29.2% from the peak, and up 0.9% (SA) in December. The Composite 20 is up 7.0% from the post-bubble low set in March (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 5.9% compared to December 2011.

The Composite 20 SA is up 6.8% compared to December 2011. This was the seventh consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily). This was the largest year-over-year gain for the Composite 20 index since 2006.

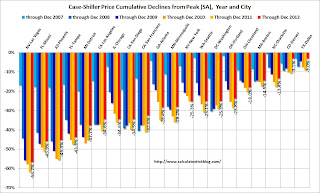

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in December seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 56.7% from the peak, and prices in Dallas only off 3.0% from the peak. Note that the red column (cumulative decline through December 2012) is above previous declines for all cities.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in December seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 56.7% from the peak, and prices in Dallas only off 3.0% from the peak. Note that the red column (cumulative decline through December 2012) is above previous declines for all cities.This was at the consensus forecast for a 6.8% YoY increase. I'll have more on prices later.

Monday, February 25, 2013

Tuesday: New Home Sales, Case-Shiller House Prices, Bernanke

by Calculated Risk on 2/25/2013 08:57:00 PM

Tomorrow will be busy ... but first from Tim Duy: ECB Should Pledge to Not Do Anything Stupid

Market participants were rattled today by the election news out of Italy, as it looks like the economically-challenged nation is now politically adrift. ...Tuesday economic releases:

...

Why should we be concerned that Italy backslides on its commitment to austerity? After all, evidence of the economic damage wrought by such policies continues to mount. If anything, a reversal of recent austerity should be welcome.

I suspect, however, that it is not the austerity that worries market participants. It is the fear that European Central Bank head Mario Draghi will threaten to pull his pledge to do whatever is takes to save the Euro in the face of Italian intransigence. The fear that European policymakers are about to partake in another grand game of chicken that once again will bring the sustainability of the single currency back into question. In short, I think that market participants fear tight monetary policy much more than loose fiscal policy. ...

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for December will be released. Although this is the December report, it is really a 3 month average of October, November and December. The consensus is for a 6.8% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 6.7% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

• Also at 9:00 AM, FHFA House Price Index for December 2012 will be released. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

• At 10:00 AM, New Home Sales for January will be released by the Census Bureau. The consensus is for an increase in sales to 381 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 369 thousand in December.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for February. The consensus is for a a reading of minus 3 for this survey, up from minus 12 in January (Below zero is contraction).

• Also at 10:00 AM, the Conference Board's consumer confidence index for February. The consensus is for the index to increase to 61.0.

• Also at 10:00 AM, Fed Chairman Ben Bernanke will deliver the "Semiannual Monetary Policy Report to the Congress", Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

Existing Home Inventory up 3.6% year-to-date in late February

by Calculated Risk on 2/25/2013 05:57:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through late February - it appears inventory is increasing at a sluggish rate.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, inventory is up 3.6%. If inventory doesn't increase more soon, then the bottom for inventory might not be until 2014.

Market Update

by Calculated Risk on 2/25/2013 04:51:00 PM

Click on graph for larger image.

By request - following the sell off today - here are a couple of stock market graphs I haven't posted in several months. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in March 2000; almost 13 years ago.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

LPS: House Price Index increased 0.1% in December, Up 5.8% year-over-year

by Calculated Risk on 2/25/2013 01:02:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses December closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.1 Percent for the Month; Up 5.8 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on December 2012 residential real estate transactions. The The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 21.9% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 52.3% from the peak in Las Vegas, 44.2% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and at a new peak in Austin!

Looking at the year-over-year price change throughout 2012 - in May, the LPS HPI turned positive and was up 0.4% year-over-year, in June the index was up 0.9% year-over-year, 1.8% in July, 2.6% in August, 3.6% in September, 4.3% in October, 5.1% in November, and now 5.8% in December. These steady increases on a year-over-year basis suggest prices bottomed early in 2012.

Note: Case-Shiller for December will be released Tuesday morning.

Dallas Fed: Regional Manufacturing Activity increases in February but at a Slower Pace

by Calculated Risk on 2/25/2013 10:39:00 AM

From the Dallas Fed: Texas Manufacturing Activity Increases but at a Slower Pace

Texas factory activity expanded in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 12.9 to 6.2, suggesting growth continued but at a slower pace.This was slightly below expectations of a reading of 4.0 for the general business activity index and suggest sluggish growth.

... The new orders index was positive for the second month in a row, although it fell from 12.2 to 2.8.

... The general business activity index was positive for the third month in a row, although it dipped from 5.5 to 2.2.

Labor market indicators were mixed in February. Hiring slowed with the employment index moving down to 2.0, and about 17 percent of employers reporting hiring and 15 percent noting layoffs. The average workweek index dipped into negative territory with a reading of –3.0, suggesting hours worked declined.

Expectations regarding future business conditions continued to reflect optimism. The index of future general business activity edged up from 9.2 to 10.8. The index of future company outlook remained unchanged at 20.1.

Chicago Fed: "Economic Growth Moderated in January"

by Calculated Risk on 2/25/2013 08:37:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Growth Moderated in January

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.32 in January from +0.25 in December. Three of the four broad categories of indicators that make up the index decreased from December, and only two of the four categories made positive contributions to the index in January.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to +0.30 in January from +0.23 in December. Given the substantial upward revisions for November and December, January’s CFNAI-MA3 marked the third consecutive reading above zero. Additionally, January’s reading suggests that growth in national economic activity was somewhat above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity "moderated" in January, and growth was somewhat above its historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, February 24, 2013

Sunday Night Futures

by Calculated Risk on 2/24/2013 09:58:00 PM

I'm frequently asked about the "Sequester". Next week the "Sequester" budget cuts will begin if government does not take any action, and over the next 7 months the sequester will require $85 billion in cuts, about half from defense programs. This is one of those really dumb policies that is hard to stop. The cuts will not be catastrophic, but as we've discussed, the deficit will decline sharply this year already, and we really don't need additional deficit reduction in the near term. Here are a couple of articles on the cuts:

From the WaPo: The big sequester gamble: How badly will the cuts hurt? and White House releases state-by-state breakdown of sequester’s effects

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for January will be released. This is a composite index of other data.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for February will be released. The consensus is a decrease to 4.0 from 5.5 in January (above zero is expansion).

Weekend:

• Summary for Week Ending Feb 22nd

• Schedule for Week of Feb 24th

The Asian markets are mostly up tonight with the Nikkei up 1.9%, and Shanghai Composite up 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 20 (fair value).

Oil prices have moved down a little recently with WTI futures at $93.00 per barrel and Brent at $113.82 per barrel.

Gasoline Prices up over 50 Cents per Gallon since December

by Calculated Risk on 2/24/2013 07:36:00 PM

From CNN: Gas prices jump, but not as high, survey finds

Over the past two weeks, prices at the pump have jumped 20 cents, adding to a total rise of nearly 54 cents over the past nine weeks, according to the Lundberg Survey.In Los Angeles prices are around $4.30 per gallon.

... And now, prices may even start to drop, says publisher Trilby Lundberg.

"I don't mean that gasoline prices cannot go up further from here," she said Sunday. "But the chief causes of the rise are out of the picture."

Crude oil prices are now going down, and wholesale prices -- which marketers and retailers pay -- are "starting to tumble," she said.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up over 50 cents per gallon from the low last December, and up 20 cents over the last two weeks. But it does appear the price increases have slowed.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Forecast: Solid Auto Sales in February

by Calculated Risk on 2/24/2013 02:18:00 PM

Note: The automakers will report February vehicle sales this coming Friday, March 1st. The consensus is for sales of around 15.2 million SAAR.

From Edmunds.com: Despite Rising Gas Prices, February Auto Sales Strong at Estimated 15.5 Million SAAR, says Edmunds.com

Edmunds.com ... forecasts that 1,198,538 new cars and trucks will be sold in the U.S. in February for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 15.5 million light vehicles. The projected sales [NSA] will be a 14.9 percent increase from January 2013, and a 4.3 percent increase from February 2012.The following table shows annual light vehicle sales, and the change from the previous year. Light vehicle sales have seen double digit growth for three consecutive years. The 2013 forecast was from Edmunds.com, but it appears sales were above expectations in January and February - and the annual forecast will probably be increased.

“Car sales are persevering despite economic factors on people’s minds like rising gas prices and the implementation of the payroll tax,” says Edmunds.com Senior Analyst Jessica Caldwell. “Pent-up demand and widespread access to credit are keeping up car sales momentum.”

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.0 | 3.7% |

| 1Forecast | ||

Housing: Some Details on the Business Model for Institutional Buyers

by Calculated Risk on 2/24/2013 10:23:00 AM

Some interesting details on institutional buyers from the Newsobserver.com: California billionaire bets on rentals with Wake home-buying spree (ht Sebastian)

[C]ompanies have raised billions from pension funds, private equity firms and other institutional investors to fuel their buying sprees. To date, these companies have focused their attention mainly on markets with large inventories of distressed homes, particularly in Arizona, Florida, Nevada and California.There is much more in the article. It is interesting that the institutional investors are moving beyond distressed properties, and even buying new homes in some areas.

What’s noteworthy about American Homes 4 Rent’s buying binge in Wake County [North Carolina] is that it isn’t just targeting distressed properties, or even existing homes. About a third of its purchases have been new homes acquired directly from homebuilders.

...

Institutional investors have invested at least $5.4 billion for purchase of single-family rentals nationwide during the past 18 months, according to Barclays, and an additional $8 billion is expected to be invested within the next couple of years. American Homes 4 Rent’s buying spree is being financed in part by a $600 million investment from the Alaska Permanent Fund, a $45 billion fund that invests royalties the state collects from oil companies.

American Homes 4 Rent is targeting homes with about 2,000 square feet that are less than 15 years old and are located in neighborhoods with better-than-average schools. The company paid around $65 to $75 per square foot for the first 1,500 homes it acquired, according to the meeting minutes, and it expects vacancy rates of 5 percent or less in its portfolio.

American Homes 4 Rent hopes to charge monthly rents equal to about 1 percent of the purchase price, and provide returns of about 6.5 percent a year to the Alaska Permanent Fund, according to the board’s meeting minutes. In three to seven years, if the housing market recovers, the portfolio could be sold or be converted into a publicly traded real estate investment trust ...

emphasis added

Yesterday:

• Summary for Week Ending Feb 22nd

• Schedule for Week of Feb 24th

Saturday, February 23, 2013

DOT: Vehicle Miles Driven declined 2.9% in December

by Calculated Risk on 2/23/2013 06:50:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -2.9% (-7.0 billion vehicle miles) for December 2012 as compared with December 2011. Travel for the month is estimated to be 236.3 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.3% (9.1 billion vehicle miles). The Cumulative estimate for the year is 2,938.5 billion vehicle miles of travel.

Traffic was down in all regions, and down 4.6% in the Northeast. The rolling 12 month total is still moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 61 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in December compared to December 2011. In December 2012, gasoline averaged of $3.38 per gallon according to the EIA. In 2011, prices in December averaged $3.33 per gallon.

Gasoline prices were up in December compared to December 2011. In December 2012, gasoline averaged of $3.38 per gallon according to the EIA. In 2011, prices in December averaged $3.33 per gallon. However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven. Maybe when we are all riding in self-driving electric cars!

Schedule for Week of Feb 24th

by Calculated Risk on 2/23/2013 01:11:00 PM

Earlier:

• Summary for Week Ending Feb 22nd

This will be a very busy week for economic data. The key reports are the January New Home sales report on Tuesday, the January Personal Income and Outlays report on Friday, and the second estimate of Q4 GDP on Thursday.

Other key reports include Case-Shiller house prices for December on Tuesday, the ISM manufacturing index on Friday, and auto sales also on Friday.

Fed Chairman Ben Bernanke will deliver the Semiannual Monetary Policy Report to the Senate on Tuesday, and to the House on Wednesday.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for February. The consensus is a decrease to 4.0 from 5.5 in January (above zero is expansion).

9:00 AM: FHFA House Price Index for December 2012. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through November 2012 (the Composite 20 was started in January 2000).

The consensus is for a 6.8% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 6.7% year-over-year, and for prices to increase 0.7% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for an increase in sales to 381 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 369 thousand in December.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February. The consensus is for a a reading of minus 3 for this survey, up from minus 12 in January (Below zero is contraction).

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for the index to increase to 61.0.

10:00 AM: Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.0% decrease in durable goods orders.

10:00 AM ET: Pending Home Sales Index for January. The consensus is for a 3.0% increase in the index.

10:00 AM: Fed Chairman Ben S. Bernanke, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 360 thousand from 362 thousand last week.

8:30 AM: Q4 GDP (second estimate). This is the second estimate of GDP from the BEA. The consensus is that real GDP increased 0.5% annualized in Q4, revised up from a negative 0.1% in the advance report.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a decrease to 55.0, down from 55.6 in January.

11:00 AM: Kansas City Fed regional Manufacturing Survey for February.

11:00 AM: The Federal Reserve Bank of New York will release the Q4 2012 Quarterly Report on Household Debt and Credit

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 2.1% decrease in personal income in January (following the surge in December due to some people taking income early to avoid higher taxes), and for 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 76.0.

10:00 AM ET: ISM Manufacturing Index for February.

10:00 AM ET: ISM Manufacturing Index for February. Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in January at 53.1% (dashed line). The employment index was at 54.0%, and the new orders index was at 53.3%. The consensus is for PMI to be decline to 52.8%. (above 50 is expansion).

10:00 AM: Construction Spending for January. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be at 15.2 million SAAR in February (Seasonally Adjusted Annual Rate) down from 15.3 SAAR in January.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be at 15.2 million SAAR in February (Seasonally Adjusted Annual Rate) down from 15.3 SAAR in January.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

Summary for Week ending February 22nd

by Calculated Risk on 2/23/2013 10:30:00 AM

Here is a summary of last week in graphs:

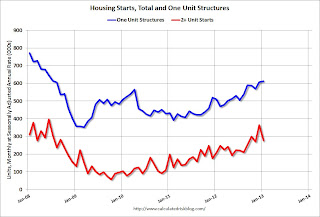

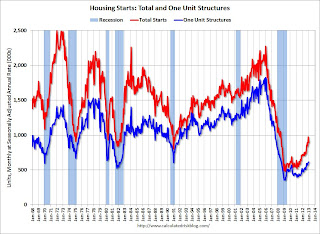

• Housing Starts decreased to 890 thousand SAAR in January, Single Family Starts Increased

Click on graph for larger image.

Click on graph for larger image.

From the Census Bureau: "Privately-owned housing starts in January were at a seasonally adjusted annual rate of 890,000. This is 8.5 percent below the revised December estimate of 973,000, but is 23.6 percent above the January 2012 rate of 720,000.

Single-family housing starts in January were at a rate of 613,000; this is 0.8 percent above the revised December figure of 608,000. The January rate for units in buildings with five units or more was 260,000."

The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in January.

Single-family starts (blue) increased to 613,000 thousand in January and are at the highest level since 2008.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing lately after moving sideways for about two years and a half years.

Total starts are up about 86% from the bottom start rate, and single family starts are up about 74 percent from the post-bubble low.

This was below expectations of 914 thousand starts in January due to the sharp decrease in the volatile multi-family sector. Starts in January were up 23.6% from January 2012.

• Existing Home Sales in January: 4.92 million SAAR, 4.2 months of supply

The NAR reported: January Existing-Home Sales Hold with Steady Price Gains, Seller’s Market Developing

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in January 2013 (4.92 million SAAR) were 0.4% higher than last month, and were 9.1% above the January 2012 rate.

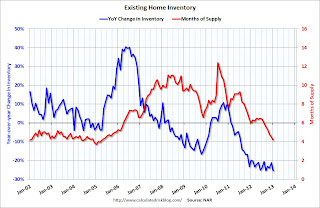

According to the NAR, inventory declined to 1.74 million in January down from 1.83 million in December. This is the lowest level of inventory since December 1999. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 25.3% year-over-year in January from January 2012. This is the 23rd consecutive month with a YoY decrease in inventory.

Inventory decreased 25.3% year-over-year in January from January 2012. This is the 23rd consecutive month with a YoY decrease in inventory.Months of supply declined to 4.2 months in January, the lowest level since April 2005.

This was at expectations of sales of 4.94 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing.

• MBA: "Mortgage Delinquency and Foreclosure Rates Finished 2012 Down Sharply"

From the MBA: Mortgage Delinquency and Foreclosure Rates Finished 2012 Down Sharply

This graph shows the percent of loans delinquent by days past due.

This graph shows the percent of loans delinquent by days past due.Loans 30 days delinquent decreased to 3.04% from 3.25% in Q3. This is just below 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.16% in Q4, from 1.19% in Q3.

The 90 day bucket decreased to 2.89% from 2.96%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 3.74% from 4.07% and is now at the lowest level since 2008.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.

This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission.The top states are Florida (12.15% in foreclosure down from 13.04% in Q3), New Jersey (8.85% down from 8.87%), New York (6.34% down from 6.46%), Illinois (6.33% down from 6.83%), and Nevada (the only non-judicial state in the top 13 at 5.87% down from 5.93%).

As Fratantoni noted, California (2.06% down from 2.63%) and Arizona (2.02% down from 2.51%) are now well below the national average by every measure.

• Key Measures show low inflation in January

This graph shows the year-over-year change for four key measures of inflation: trimmed-mean CPI, median CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.9%. Core PCE is for December and increased 1.4% year-over-year.

This graph shows the year-over-year change for four key measures of inflation: trimmed-mean CPI, median CPI, CPI less food and energy, and core PCE prices. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.9%. Core PCE is for December and increased 1.4% year-over-year.On a monthly basis, median CPI was at 2.6% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI increased 3.1% annualized. Also core PCE for December increased 0.2% annualized.

The inflation report for February will be released on March 15th, a few days before the next Fed meeting. But with this low level of inflation and the current high level of unemployment, I expect the Fed will keep the "pedal to the metal" at the meeting of March 19th and 20th.

• Weekly Initial Unemployment Claims increased to 362,000

The DOL reports:

The DOL reports:In the week ending February 16, the advance figure for seasonally adjusted initial claims was 362,000, an increase of 20,000 from the previous week's revised figure of 342,000. The 4-week moving average was 360,750, an increase of 8,000 from the previous week's revised average of 352,750.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 360,750 - the highest 4-week average since the first week of January.

Weekly claims were above the 359,000 consensus forecast.

• AIA: "Strong Surge for Architecture Billings Index"

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Strong Surge for Architecture Billings Index

From AIA: Strong Surge for Architecture Billings Index This graph shows the Architecture Billings Index since 1996. The index was at 54.2 in January, up from 51.2 in December. Anything above 50 indicates expansion in demand for architects' services.

Every building sector is now expanding and new project inquiries are strongly positive. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment in 2013.