by Calculated Risk on 9/30/2008 11:01:00 PM

Tuesday, September 30, 2008

Mark-to-Market Quotes

"Suspending mark-to-market accounting, in essence, suspends reality."

Beth Brooke, global vice chair at Ernst & Young LLP, WSJ, Sept 30, 2008

"Blaming fair-value accounting for the credit crisis is a lot like going to a doctor for a diagnosis and then blaming him for telling you that you are sick."

analyst Dane Mott, JPMorgan Chase & Co., Bloomberg

"Suspending the mark-to-market prices is the most irresponsible thing to do. Accounting does not make corporate earnings or balance sheets more volatile. Accounting just increases the transparency of volatility in earnings."

Diane Garnick, Invesco Ltd., Bloomberg

Report: Senate to Vote on Bailout Wednesday Night

by Calculated Risk on 9/30/2008 09:01:00 PM

From CNN: Senate to vote on rescue plan Wednesday (hat tip pastafarian)

The Senate plans to vote on the $700 billion bank rescue plan Wednesday evening ... The bill adds new provisions - including raising the FDIC insurance cap from $100,000 to $250,000 - and will be attached to an existing revenue bill that the House also rejected Monday ... The vote is scheduled for after sundown, in observance of the Jewish holiday.

National Debt to Exceed $10 Trillion Tomorrow

by Calculated Risk on 9/30/2008 07:54:00 PM

It now looks like the National Debt will be over $10 Trillion tomorrow.

As of Sept 29th, the debt was $9,945,578,231,981.59

The surge in the National Debt over the last two weeks has been because of the Supplementary Financing Program (SFP) with the Treasury raising cash for the Fed's liquidity initiatives (announced a couple of weeks ago).

Today the Treasury sold $45 billion in 15 day Cash Management Bills that are all for the Fed. Tomorrow the Treasury will sell $50 billion in 42 day bills also for the Fed. And that Wednesday auction should put the National Debt over the $10 Trillion mark (we will know on Thursday).

For good measure, the Treasury is also selling another $45 billion for the Fed on Thursday.

The good news is the borrowing rates are pretty low!

Even though this rapid increase in the debt is being driven by the Fed's liquidity initiatives (and should be paid back), crossing $10 trillion will still be quite a milestone ...

Estimating PCE Growth for Q3 2008

by Calculated Risk on 9/30/2008 04:19:00 PM

With the focus on the bailout bill yesterday, the August release from the Bureau of Economic Analysis (BEA) of personal income and outlays almost went unnoticed.

Asha Bangalore at Northern Trust noticed:

The July-August data point to a possible drop in consumer spending during the third quarter. If the forecast is accurate, it would be the first quarterly decline since fourth quarter of 1991. Given the importance of consumer spending in GDP, a drop in consumer spending in the third quarter raises the probability of a contraction in real GDP in the third quarter.I wrote:

This report is strong evidence that the U.S. economy is in recession and that the change in Personal Consumption Expenditures (PCE) will be negative for Q3.Let me explain why:

The BEA releases Personal Consumption Expenditures monthly as part of the Personal Income and Outlays report, and quarterly as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE as reported in the GDP report. However, the quarterly change is not calculated as the change from the last month of one quarter to the last month of the next quarter. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q3, you would average real PCE for July, August and September, and then divide by the average for April, May and June. Of course you need to take this to the fourth power (for the annual rate) and subtract one (for a percentage increase). This gives the real annualized rate of change for the quarter as reported in the GDP report.

Of course the report for September hasn't been released yet, and will not be released until after the advance Q3 GDP report is released on October 30th. As an estimate, we can use the change from April to July, and the change from May to August (the Two Month Estimate) to approximate PCE growth for Q3.

Click on graph for larger image in new window.

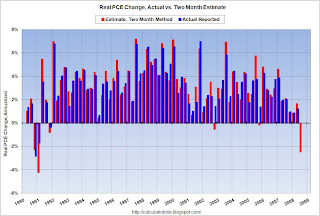

Click on graph for larger image in new window.This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.924).

Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

But in general, the two month estimate is pretty accurate. Maybe September was exceptionally strong (very unlikely from anecdotal evidence), or maybe July and August will be revised upwards, but the two month estimate suggests real PCE will decline in Q3 by about 2.4% (annual rate).

Since PCE accounts for about 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports and changes in inventories (investment will be weak).

If accurate, this will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.

FASB, SEC to Issue Accounting Guidance

by Calculated Risk on 9/30/2008 04:09:00 PM

From Bloomberg: SEC, FASB Said to Issue Guidance on Fair-Value Accounting Rules

The SEC may say companies can rely more on assumptions ...in assessing how much assets are worth ... The SEC and FASB will probably [NOT] suspend the accounting rules ...More work for accountants.

Fed's Lockhart on Financial Crisis

by Calculated Risk on 9/30/2008 02:24:00 PM

Here is a good explanation of the problems in the credit markets from Atlanta Fed President Dennis Lockhart: A Working Financial Sector Matters to Us All

Credit markets remain quite strained. This is particularly the case in interbank markets in the United States and abroad. The interbank markets are a fundamental element of the plumbing of the financial world. Banks with excess balances put them to work by lending to other banks that have clients—companies and individuals—who need the funds.And on the economy:

The loan portfolios of U.S. banks and financial institutions are, as you would expect, mostly dollar-denominated. But foreign banks in recent years have also built sizeable "books of business" in dollars. The dollar interbank credit contraction is a worldwide problem that affects not only our banks here but banks overseas, particularly in Europe.

When banks lend or take on other forms of exposure to each other, they gauge the counterparty risk. In recent weeks, there has been a widespread withdrawal of confidence in counterparties that has resulted in efforts to reduce exposure.

As part of this, maturities have shortened, risk spreads (typically measured as the interest rate spread over U.S. Treasuries) have widened, the cost of hedging against default risk (another measure of perceived counterparty risk) has risen dramatically, and the range of assets accepted as collateral has narrowed. Also, demand for liquidity provided by the Federal Reserve has intensified.

This contraction in availability and rise of the cost of credit have worsened as well for corporate and business borrowers. We've heard anecdotes confirming this from contacts throughout the Southeast. In short, Main Street is being affected.

Prior to September, we at the Federal Reserve Bank of Atlanta had a rather downbeat outlook for the second half of 2008 and early 2009. We expected—and continue to expect—a very weak second half reflecting contracting consumer spending, weaker business investment, and slower export volume.Note that Lockhart was already pessimistic before September, and for good reasons. The PCE numbers for August, released yesterday by the BEA, strongly suggest the long anticipated consumer recession has started. September will probably be worse.

Export demand has been an important factor that has helped sustain the U.S. manufacturing sector in recent months. But economic growth prospects in many of our major trading partners have weakened notably in recent months, and this weakening has dampened the outlook for the export sector.

Conditions in labor markets also have weakened. During the first half of 2008 the data showed that residential construction and related manufacturing industries were reducing their workforce while other businesses were hesitant to add to payrolls. But more recently the data suggest that layoffs have become more widespread, and hiring intentions have pulled back further.

Weak labor markets feed into weak income growth and sluggish consumer spending. Reports from retailers suggest that the outlook for the upcoming holiday season has been pared back as consumers are expected to tighten their belts further. At the same time, lending standards for most types of consumer credit have tightened.

emphasis added

And Lockhart is clearly pessimistic on business spending, layoffs, and especially the slowdown of U.S. trading partners (impacting exports). The recession is here.

Note: I think the PCE numbers were somewhat overlooked with the focus on the House vote on the bailout plan. I'll put up a somewhat technical post this afternoon on the two month method, and why it suggests a decline in PCE in Q3 (and probably a decline in Q3 GDP).

Case-Shiller Price Declines by City

by Calculated Risk on 9/30/2008 12:34:00 PM

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In Phoenix and Las Vegas, home prices have declined more than 34%. In Charlotte, prices have only declined about 2% from the peak.

This graph illustrates the point Professor Krugman made in August 2005: That Hissing Sound

When it comes to housing ... the United States is really two countries, Flatland and the Zoned Zone.There was a bubble in Flatland too caused by the rapid migration from renting to buying - facilitated by loose lending - that pushed up Flatland prices. But those bubbles were small compared to the bubbles in the Zoned Zones.

In Flatland, which occupies the middle of the country, it's easy to build houses. When the demand for houses rises, Flatland metropolitan areas, which don't really have traditional downtowns, just sprawl some more. As a result, housing prices are basically determined by the cost of construction. In Flatland, a housing bubble can't even get started.

But in the Zoned Zone, which lies along the coasts, a combination of high population density and land-use restrictions - hence "zoned" - makes it hard to build new houses. So when people become willing to spend more on houses, say because of a fall in mortgage rates, some houses get built, but the prices of existing houses also go up. And if people think that prices will continue to rise, they become willing to spend even more, driving prices still higher, and so on. In other words, the Zoned Zone is prone to housing bubbles.

Now that the bubble has burst, prices in the more bubbly Zoned Zones are falling much more than in Flatland.

Detroit is an exception with prices off 27% from the peak, even though Detroit never had a price bubble. The reason is Detroit has a weak economy and a declining population. Since housing is very durable, there is excess supply in Detroit, and prices for existing homes are below replacement costs.

Another exception is New York. Prices in New York are only off 10.6% even though New York is part of the Zoned Zone. New York had a price bubble, but until recently prices had held up pretty well. That is changing right now.

And here was Krugman's conclusion from August 2005:

Meanwhile, the U.S. economy has become deeply dependent on the housing bubble. The economic recovery since 2001 has been disappointing in many ways, but it wouldn't have happened at all without soaring spending on residential construction, plus a surge in consumer spending largely based on mortgage refinancing. .... Now we're starting to hear a hissing sound, as the air begins to leak out of the bubble. And everyone - not just those who own Zoned Zone real estate - should be worried.I think most people are worried now.

The Irish Guarantee

by Calculated Risk on 9/30/2008 10:29:00 AM

From the WSJ: Irish Government Moves to Safeguard Banking System

The Irish government Tuesday announced a surprise decision to safeguard the Irish banking system for two years, guaranteeing all deposits, covered bonds, senior debt and dated subordinated debt of the four main banks.

...

Finance Minister Brian Lenihan said the guarantee will cover €400 billion ($577.64 billion) of the €500 billion of bank assets involved. That is more than Ireland's gross domestic product of €190 billion and national debt of €45 billion.

...

Davy Research analyst Scott Rankin said: "The Irish government has taken out its bazooka."

Case-Shiller: House Prices Declined in July

by Calculated Risk on 9/30/2008 09:00:00 AM

Housing is the key. And house prices are still falling sharply ...

S&P/Case-Shiller released their monthly Home Price Indices for July this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index was off 12.3% annual rate in July (from June), and is off 21.1% from the peak.

The Composite 20 index was off 10.1% annual rate in July (from June), and is off 19.5% from the peak.

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.5% over the last year.

The Composite 20 is off 16.3% over the last year.

More on prices later ... including selected cities.

LIBOR Hits All-time High of 6.88%

by Calculated Risk on 9/30/2008 08:31:00 AM

"The money markets have completely broken down, with no trading taking place at all. There is no market any more."From Bloomberg: Libor Surges Most on Record After U.S. Congress Rejects Bailout

Christoph Rieger, Dresdner Kleinwort in Frankfurt, Sept 30, 2008

The London interbank offered rate, or Libor, that banks charge each other for such loans climbed 431 basis points to an all-time high of 6.88 percent today, the British Bankers' Association said. The euro interbank offered rate, or Euribor, for one-month loans climbed to record 5.05 percent, the European Banking Federation said. The Libor-OIS spread, a gauge of the scarcity of cash, advanced to a record.Also President Bush spoke at 8:45AM ET.

Short excerpt from Bush:

"This is not the end of the legislation process. ... This is an urgent situation. Consequences will grow worse if we don't act. If we continue on this course, the economic damage will be painful and lasting. ... Congress must act. ... We will deliver."

Bailout: Senate to Vote on Wednesday

by Calculated Risk on 9/30/2008 02:57:00 AM

From Bloomberg: Senate May Try to Revive Bank-Rescue Bill as Early as Tomorrow

The U.S. Senate will try to salvage a $700 billion financial-rescue package after the measure was defeated in the House of Representatives. ...

``They're not going to totally revamp the bill,'' said Pete Davis, president of Davis Capital Investment Ideas in Washington, who spoke to House and Senate leaders yesterday. ``They'll make some minor changes and pass it. This is all about political cover.''

Monday, September 29, 2008

Dexia Fears Grow

by Calculated Risk on 9/29/2008 09:20:00 PM

From the Financial Times: Dexia shares fall amid capital concern (hat tip avinunu)

Shares in Dexia lost more than a quarter of their value on Monday on fears that the Belgian-French financial services group needed to raise capital.This article in lesoir.be suggests that it will take 6 to 7 billion euros to save Dexia: Entre 6 et 7 milliards pour sauver Dexia

...

The board met on Monday night “to assess the international financial situation”, according to a spokesperson ...

Homeowners with Negative Equity

by Calculated Risk on 9/29/2008 07:09:00 PM

The following analysis is based on data from the Census Bureau (for 2007) and First American CoreLogic at the end of 2006. Although some of this data is a little old, it provides us with an estimate of the number of Americans household underwater (with negative equity).

According to the Census Bureau's 2007 American Community Survey there were 51,615,003 households with a mortgage in the U.S. at the end of 2007. Click on chart for larger image in new window.

Click on chart for larger image in new window.

For prices, using Case-Shiller, by the end of 2006 U.S. home prices had fallen just over 1% from the peak, but a number of homeowners were already underwater because they bought their homes with more than 100% LTV financing.

By the end of 2007, prices had fallen 10% from the peak, and 8.2 million homeowners owed more on their mortgages than their homes were worth.

As of Q2 2008, prices had fallen almost 18% from the peak, and for the graph, I estimated that prices will decline about 22.5% from the peak by the end of 2008. (this seems conservative). This means about 15.4 million households will be underwater or already foreclosed on by the end of 2008.

The last two categories are based on various estimates for the price bottom (peak-to-trough). The 30% decline was suggested by Paul Krugman in December 2007: What it takes). The 35% decline is close to the "severe recession" case presented by JPMorgan last week.

Not every homeowner with negative equity will default, in fact many of these homeowners will only be underwater by a few percent. But if we estimate one half of homeowners with negative equity will eventually default, use a 50% loss severity, and a 35% price decline (23.6 million households with negative equity), and use the median house price from the Census Bureau of $216 thousand, we get $1.3 trillion in mortgage losses for lenders.

I think this is probably high (probably fewer than 50% will default), but this does give a general idea of the potential losses. If we use one third of homeowners, the mortgage losses with a 35% peak-to-trough price decline would be about $840 billion.

Paulson to Try Again

by Calculated Risk on 9/29/2008 05:52:00 PM

From Bloomberg: Paulson to Work Quickly With Congress to Revive Plan (hat tip Ministry of Truth)

U.S. Treasury Secretary Henry Paulson said he will work with Congress to salvage a $700 billion rescue plan ...I've heard that there are enough votes in the Senate to pass the bill (probably on Wednesday night), and Paulson is probably hoping that passage in the Senate will put additional pressure on the House.

``We need to work as quickly as possible; we need to get something done,'' Paulson told reporters at the White House after meeting with President George W. Bush. ``We believe that our plan, and the plan that we developed with congressional leaders and worked so hard, is a plan that works. And we need a plan that works.''

...

House Majority Leader Steny Hoyer said the House may take up the measure again as early as this week, possibly after Senate action.

National Debt: The Race to Ten Trillion

by Calculated Risk on 9/29/2008 05:27:00 PM

Several years ago I predicted that the National Debt would reach $10 trillion by the time President Bush left office. For a short period (thanks to the housing bubble), it looked like the deficit would be less than I projected.

Back in March, with the housing bust starting to hit government revenues, it started looking like the $10 trillion projection had a chance. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the daily National Debt from TreasuryDirect). Note that the y-axis doesn't start at zero to better show the change.

Here is an update: The National debt is $9.889 trillion as of Sept 26, 2008. That leaves the debt just over $110 billion short of my projection with almost 4 months to go.

Over the last month, from August 26th to Sept 26th, the National Debt has increased $254 billion as the recession has started to significantly impact government revenues. It looks like $10 trillion will be passed very soon.

Also, the National Debt has increased a stunning $895 billion over the last 12 months (from Sept 26, 2007 to Sept 26, 2008). Shocking.

Cliff Diving

by Calculated Risk on 9/29/2008 03:40:00 PM

Dow off 6%.

S&P 500 off 7%.

NASDAQ off 7%.

With the failure of the bailout in the House, the question is now what?

There is the possibility of some arm twisting and another vote tomorrow. Another possibility is that the bill will be revised in some way to garner a few more votes.

In the short run, the government is back to acting on a case by case basis.

Bailout Plan Fails in House

by Calculated Risk on 9/29/2008 01:38:00 PM

Yes 205 No 228 ...

Dow off 500 points

The vote failed.

House Vote Nears on Bailout Plan

by Calculated Risk on 9/29/2008 01:01:00 PM

Here is the debate on C-SPAN.

Voting now ... will take about 15 minutes (so about 1:45 PM ET)

Fed to significantly expand "the capacity to provide U.S. dollar liquidity"

by Calculated Risk on 9/29/2008 10:11:00 AM

From the Fed:

In response to continued strains in short-term funding markets, central banks today are announcing further coordinated actions to expand significantly the capacity to provide U.S. dollar liquidity. Central banks will continue to work together closely and are prepared to take appropriate steps as needed to address funding pressures.Meanwhile the TED Spread from Bloomberg is at a record 3.48! Ouch.

Mitsubishi UFJ Buys 21% of Morgan Stanley

by Calculated Risk on 9/29/2008 09:46:00 AM

From MarketWatch: Mitsubishi UFJ buys 21% of Morgan Stanley for $9 billion

Mitsubishi UFJ Financial Group said Monday that they had reached a deal for the Japanese bank to buy a 21% stake in Morgan Stanley for $9 billion.At least this is private capital ...

Personal Income for August Indicates Consumer Recession

by Calculated Risk on 9/29/2008 08:36:00 AM

From the BEA: Personal Income and Outlays

Real DPI -- DPI adjusted to remove price changes -- decreased 0.9 percent in August, compared with a decrease of 1.5 percent in July.This report is strong evidence that the U.S. economy is in recession and that the change in Personal Consumption Expenditures (PCE) will be negative for Q3.

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in August, in contrast to a decrease of 0.5 percent in July.

Although these numbers may be revised, or perhaps September was surprisingly strong (unlikely), based on the two month method, the change in real PCE in Q3 will be about minus 2.4%.

With PCE accounting for almost 71% of GDP, and real PCE declining in Q3, along with declining investment, the change in GDP for Q3 should be negative.

FDIC: Citigroup to Acquire Wachovia

by Calculated Risk on 9/29/2008 08:13:00 AM

From the FDIC: Citigroup Inc. to Acquire Banking Operations of Wachovia

Citigroup Inc. will acquire the banking operations of Wachovia Corporation; Charlotte, North Carolina, in a transaction facilitated by the Federal Deposit Insurance Corporation and concurred with by the Board of Governors of the Federal Reserve and the Secretary of the Treasury in consultation with the President. All depositors are fully protected and there is expected to be no cost to the Deposit Insurance Fund. Wachovia did not fail; rather, it is to be acquired by Citigroup Inc. on an open bank basis with assistance from the FDIC.

"For Wachovia customers, today's action will ensure seamless continuity of service from their bank and full protection for all of their deposits." said FDIC Chairman Sheila C. Bair. "There will be no interruption in services and bank customers should expect business as usual."

Citigroup Inc. will acquire the bulk of Wachovia's assets and liabilities, including five depository institutions and assume senior and subordinated debt of Wachovia Corp. Wachovia Corporation will continue to own AG Edwards and Evergreen. The FDIC has entered into a loss sharing arrangement on a pre-identified pool of loans. Under the agreement, Citigroup Inc. will absorb up to $42 billion of losses on a $312 billion pool of loans. The FDIC will absorb losses beyond that. Citigroup has granted the FDIC $12 billion in preferred stock and warrants to compensate the FDIC for bearing this risk.

In consultation with the President, the Secretary of the Treasury on the recommendation of the Federal Reserve and FDIC determined that open bank assistance was necessary to avoid serious adverse effects on economic conditions and financial stability.

"On the whole, the commercial banking system in the United States remains well capitalized. This morning's decision was made under extraordinary circumstances with significant consultation among the regulators and Treasury," Bair said. "This action was necessary to maintain confidence in the banking industry given current financial market conditions."

emphasis added

Report: Citigroup Nears Deal for Wachovia

by Calculated Risk on 9/29/2008 07:55:00 AM

From the NY Times Dealbook: Citigroup Nears a Deal for Wachovia

Citigroup executives are meeting to complete the deal Monday morning, people briefed on the matter said, cautioning that the talks could unravel. Wells Fargo, which had also been in talks with Wachovia, could also revive its bid.The NY Times suggests the price would be at best "a few dollars per share" for Wachovia. Meanwhile, Wachovia's share price is cliff diving this morning off over 60% from Friday's closing price.

...

Citigroup worked feverishly to cement a deal on Sunday night, with the discussions moving past the midnight hour, according to a person briefed on the talks. Officials from the F.D.I.C. and Treasury Department stayed up late to try to get the transaction done.

Sunday, September 28, 2008

Fortis, B&B, Wachovia, Bailout Plan

by Calculated Risk on 9/28/2008 07:13:00 PM

Sunday is the new Monday ...

UPDATE 2: Der Hypo Real Estate droht die Insolvenz or in English from AFP: German mortgage bank near bankruptcy: report

Germany's Hypo Real Estate, a mortgage bank, is on the brink of bankruptcy, the daily Financial Times Deutschland reported in an advance copy of its Monday edition.Update: From the Financial Times: Fortis thrown €11bn lifeline by governments (hat tip Alain)

Fortis was thrown an €11.2bn (£8.8bn) lifeline on Sunday night as the Belgian, Dutch and Luxembourg governments combined to inject capital into the embattled banking and insurance group in a last-ditch effort to shore up confidence among savers.In the U.K., Bradford & Bingley is being nationalized. From The Telegraph: Financial crisis: Bradford & Bingley nationalisation will cost taxpayers £150bn

The partial nationalisation was announced in Brussels by Yves Leterme, Belgium’s prime minister, after a frantic weekend of talks involving ministers, central bankers and financiers.

British taxpayers will be liable for more than £150 billion of potentially toxic mortgage debt following the nationalisation of Bradford & Bingley, one of the country’s biggest mortgage lenders.Meanwhile, as mentioned in the previous post, Citigroup and Wells Fargo are in negotiations today with regulators about a potential emergency takeover of Wachovia.

Alistair Darling, the Chancellor, will announce on Monday that the Government is taking over the bank’s mortgages and selling off the savings business and the branches. Savers are reassured that their money is safe although people owning shares in the bank will lose out.

The Government may merge the bank, which has mortgages worth more than £40 billion, with the nationalised Northern Rock. Every taxpayer in Britain will be exposed to the equivalent of £5,500 in mortgage debt as a result.

And the BIG story - the proposed bailout legislation was released earlier today. See: Emergency Economic Stabilization Act of 2008 Professor Krugman is being told there are "significant changes from this draft", so there is probably more to come.

Report: Citigroup and Wells Fargo Bidding for Wachovia

by Calculated Risk on 9/28/2008 06:10:00 PM

From the NY Times: Citigroup and Wells Fargo Said to Be Bidding for Wachovia

Citigroup and Wells Fargo were locked in a bidding war on Sunday over a possible emergency takeover of the Wachovia Corporation ...Wells and Citi would probably like a structure similar to the JPMorgan deal for WaMu assets (with the FDIC seizing WaMu first). Probably all they have to do is wait ...

The government, led by the Federal Reserve and Treasury Department, has been involved in the talks as well ...

The government has ... opposed taking over Wachovia the way it did Washington Mutual earlier this week, these people said, unless its financial position deteriorates more rapidly.

...

Citigroup and Wells Fargo are unlikely to bid more than a few dollars per share for Wachovia

Draft: Emergency Economic Stabilization Act of 2008

by Calculated Risk on 9/28/2008 04:01:00 PM

From the House Financial Services Committee:

Emergency Economic Stabilization Act of 2008On suspending Mark-to-Market:

Washington, DC - Click the following links to view documents:

Emergency Economic Stabilization Act of 2008

Summary of Emergency Economic Stabilization Act of 2008

Section-by-Section of Emergency Economic Stabilization Act of 2008

SEC. 132. SUSPENSION OF MARK-TO-MARKET ACCOUNTING.And on allowing banks to earn interest and maintain a "zero reserve ratio":

(a) AUTHORITY.—The Securities and Exchange Commission shall have the authority under securities laws (as such term is defined under section 3(a)(47) of the Securities Exchange Act of 1934 (15 U.S.C. 78c(a)(47)) to suspend, by rule, regulation, or oder, the application of Statement Number 157 of the Financial Accounting Standards Board for any issuer (as such term is defined in section 3(a)(8) of such Act) or with respect to any class or category of transaction if the Commission determines that is necessary or appropriate in the public interest and is consistent with the protection of investors.

SEC. 128. ACCELERATION OF EFFECTIVE DATE.Here is the previous text (hat tip Falcor):

Section 203 of the Financial Services Regulatory Relief Act of 2006 (12 U.S.C. 461 note) is amended by striking ‘‘October 1, 2011’’ and inserting ‘‘October 1, 2008’’.

Financial Services Regulatory Relief Act of 2006 - Section 203.Here are some parts on pricing mechanism:

"Interest on Reserves and Reserve Ratios

"Federal Reserve Banks are authorized to pay banks interest on reserves under Section 201 of the Act. In addition, Section 202 permits the FRB to change the ratio of reserves a bank must maintain relative to its transaction accounts, allowing a zero reserve ratio if appropriate. Due to federal budgetary requirements, Section 203 provides that these legislative changes will not take effect until October 1, 2011."

(d) PROGRAM GUIDELINES.—Before the earlier of the end of the 2-business-day period beginning on the date of the first purchase of troubled assets pursuant to the authority under this section or the end of the 45-day period beginning on the date of enactment of this Act, the Secretary shall publish program guidelines, including the following:So it's all up to the Secretary to establish the rules. Same with Warrants - it's up to the Secretary to negotiate.

(1) Mechanisms for purchasing troubled assets.

(2) Methods for pricing and valuing troubled assets.

(3) Procedures for selecting asset managers.

(4) Criteria for identifying troubled assets for purchase.

Here is the section on transparency:

SEC. 114. MARKET TRANSPARENCY.At least transactions will be made public online.

(a) PRICING.—To facilitate market transparency, the Secretary shall make available to the public, in electronic form, a description, amounts, and pricing of assets acquired under this Act, within 2 business days of purchase, trade, or other disposition.

(b) DISCLOSURE.—For each type of financial institutions that is authorized to use the program established under this Act, the Secretary shall determine whether the public disclosure required for such financial institutions with respect to off-balance sheet transactions, derivatives instruments, contingent liabilities, and similar sources of potential exposure is adequate to provide to the public sufficient information as to the true financial position of the institutions. If such disclosure is not adequate for that purpose, the Secretary shall make recommendations for additional disclosure requirements to the relevant regulators.

Report on Bailout: Congress to Vote on Monday, Senate on Wednesday

by Calculated Risk on 9/28/2008 02:28:00 PM

From Reuters: U.S. Senate vote Wed. at earliest on bailout-sources

Legislation providing up to $700 billion to bail out the U.S. financial industry will be voted on in the U.S. Senate no earlier than Wednesday, sources close to the discussions said on Sunday.

The House of Representatives will vote on the bill on Monday, said House Financial Services Chairman Barney Frank, a Massachusetts Democrat.

Fortis Update

by Calculated Risk on 9/28/2008 02:14:00 PM

The AP is reporting: Belgian government to guarantee Fortis deposits

From Reuters: Fortis in play as Trichet joins emergency talks

It sounds like Fortis might be sold off or nationalized.

Official: Bradford & Bingley Savers to be Protected

by Calculated Risk on 9/28/2008 12:58:00 PM

As we discussed last night, B&B will be nationalized. It looks like U.K. officials have learned about bank runs from the Northern Rock collapse, and will announce some sort of plan to protect savers.

From the Telegraph: Financial crisis: Bradford & Bingley savers told money is safe

Yvette Cooper, the minister, confirmed that the Government was “stepping in” to rescue the bank, Britain’s eighth biggest mortgage lender.

"We are very clear that depositors and ordinary savers must be properly protected and they will be as part of the arrangements we will set out," Ms Cooper told the BBC.

...

A full statement will be made by Alistair Darling, the Chancellor, either late on Sunday or early on Monday morning before the stock market opens.

Pelosi: Summary of Draft Proposal

by Calculated Risk on 9/28/2008 09:44:00 AM

From Office of Speaker Nancy Pelosi -- Sept. 28, 2008

REINVEST, REIMBURSE, REFORM

IMPROVING THE FINANCIAL RESCUE LEGISLATION

Significant bipartisan work has built consensus around dramatic improvements to the original Bush-Paulson plan to stabilize American financial markets -- including cutting in half the Administration's initial request for $700 billion and requiring Congressional review for any future commitment of taxpayers' funds. If the government loses money, the financial industry will pay back the taxpayers.

3 Phases of a Financial Rescue with Strong Taxpayer Protections

CRITICAL IMPROVEMENTS TO THE RESCUE PLAN

Democrats have insisted from day one on substantial changes to make the Bush-Paulson plan acceptable -- protecting American taxpayers and Main Street -- and these elements will be included in the legislation

Protection for taxpayers, ensuring THEY share IN ANY profits

Limits on excessive compensation for CEOs and executives

New restrictions on CEO and executive compensation for participating companies:

Strong independent oversight and transparency

Four separate independent oversight entities or processes to protect the taxpayer

Transparency -- requiring posting of transactions online -- to help jumpstart private sector demand

Help to prevent home foreclosures crippling the American economy

Bailout Agreement Reached

by Calculated Risk on 9/28/2008 02:17:00 AM

From the NY Times: Breakthrough Reached in Negotiations on Bailout

Congressional leaders and the Bush administration reached a tentative agreement early Sunday...From the WSJ: Lawmakers Reach Tentative Bailout Deal

The bill includes pay limits for some executives whose firms seek help, aides said. And it requires the government to use its new role as owner of distressed mortgage-backed securities to make more aggressive efforts to prevent home foreclosures. In some cases, the government would receive an equity stake in companies that seek aid, allowing taxpayers to profit should the rescue plan work and the private firms flourish in the months and years ahead.

The White House also agreed to strict oversight of the program by a Congressional panel and conflict-of-interest rules for firms hired by the Treasury to help run the program.

"I think we're there," an exhausted Mr. Paulson said, a sentiment echoed in the statements of negotiators such as House Financial Services Chairman Barney Frank (D., Mass.) and Senate Banking Committee head Christopher Dodd (D., Conn.)Hopefully the details will be released Sunday.

Those present said the bailout plan still needs to be drafted in its final form, but a formal announcement should come some time Sunday. ...

"We worked out everything," said Sen. Judd Gregg, the chief Senate Republican in the talks. He said the House should be able to vote on it Sunday, and the Senate could take it up Monday.

Saturday, September 27, 2008

Pelosi: Let Americans Review Legislation Before Vote

by Calculated Risk on 9/27/2008 08:30:00 PM

"It would be my hope that this could be resolved today, that we'd have a day for the American people and members of Congress to review the legislation on the Internet."From Bloomberg: Senate Leaders Say Agreement Nears on Rescue Program

House Speaker Nancy Pelosi, Sept 27, 2008.

Reports: Fortis Near Collapse, B&B Likely to be Nationalized

by Calculated Risk on 9/27/2008 06:50:00 PM

From the Telegraph: Financial crisis: Bradford & Bingley likely to be nationalised by Treasury

The biggest buy-to-let operator is on the verge of being nationalised by the Government as time runs out on attempts to find a private buyer.From The Times: B&B and Fortis both in crisis

B&B’s shares will be suspended when the stock market opens on Monday. By that point, the Government will either nationalise the bank or announce a deal to sell it.

[T]he deal will require public support, with many of the one million B&B mortgages left with the Treasury. As a result, taxpayers are likely to be left holding the mortgages most likely to default from the £40 billion portfolio.

BELGIUM’s Fortis is this weekend poised to become the first large continental bank to fall victim to the credit crunch, as the global chaos continues with Bradford & Bingley and American savings giant Wachovia both teetering on the brink.

The Belgian central bank and the country’s regulator are paving the way for a bailout of the huge banking and insurance group, which has a £540 billion balance sheet and a market value of £12 billion.

In Britain, the fate of Bradford & Bingley will be decided today. Fren-etic talks between the Bank of England, the Financial Services Authority and the government have been taking place this weekend to save the troubled mortgage bank.

...

If no buyers come forward, B&B will be nationalised and broken up. However, while the fate of B&B offers a fascinating insight into the hardship faced by financial institutions, in terms of international significance the problems faced by Fortis are far more serious.

Bailout: Meetings Continue

by Calculated Risk on 9/27/2008 04:40:00 PM

Not much new except a new thread...

According to the WSJ the meeting started at 3PM ET with four negotiators: Senators Dodd (D-Connecticut) and Gregg (R-New Hampshire), and Congressman Frank (D-Massachusetts) and Blunt (R-Missouri).

The story notes that the Treasury is pushing for a larger initial installment ($500 billion as opposed to $250 billion). Also the insurance idea might be included as optional, although I think everyone realizes no one will be interested.

Bush: Bailout Plan "soon"

by Calculated Risk on 9/27/2008 10:24:00 AM

From MarketWatch: Bush confident of financial rescue plan bill 'very soon'

President Bush said Saturday morning he's confident that Congress will pass a bill ... "very soon." ... The president also stressed ... "our entire economy is in danger." Negotiators from Congress and the administration are returning to talks Saturday with an eye toward finalizing a deal by Sunday.During the Presidential debate, Senator McCain said he would vote for the bill, and Senator Obama said he wanted to see the details, but he would probably support the bill too.

We will probably have more details sometime this weekend.

Office Space: Rents Decline in New York

by Calculated Risk on 9/27/2008 08:46:00 AM

From the NY Sun: Wall St. Woes Give Rise to Talk of 'Black September'

"Due to the recent events, rents are down by at least 10% to 15% and trending downward," the president of Newmark Knight Frank, James Kuhn, said.The financial crisis is now hitting New York office space, and this will impact many of the recent commercial deals that were based on overly optimistic rent projections. The lenders didn't offer 'liar loans' on CRE like for residential, but they did offer loans based on optimistic pro forma projections - and the results will be the same: rising defaults.

...

"An increase in availability of approximately 10 million square feet would imply an increase in the New York office vacancy rate to 8.5%," [chief economist at REIS, Sam Chandan] said.

"Current and anticipated increases in sublet availabilities are fomenting greater competition for the smaller pool of prospective tenants. The full measure of sublet availabilities will depend, in large part, on the job losses that ultimately follow from the current wave of consolidations in the banking sector. The risks are to the downside that a near term spikes in layoffs and a resulting rise in sublet availabilities will coincide with anemic demand for space, undercutting occupancy. Even a modest slowdown, as we have already observed in the New York market, confutes the underwriting assumptions that prevailed in the period leading up to the last year's investment peak."

...

Mr. Slocum of Capital One said: "The key issue is what happens to the overleveraged properties purchased and financed in the past three years. In many cases, the financial projects were based on rising rents and debt markets remaining stable. Many of the loans required the borrowers to provide interest reserves, but they will likely exhaust over the 2009-2010 time frame." He added: "It always comes back to cash flow on commercial real estate. Properties financed on true cash flow should be fine."

emphasis added

Friday, September 26, 2008

Roubini: Why the Treasury TARP bailout is flawed

by Calculated Risk on 9/26/2008 09:38:00 PM

From Professor Nouriel Roubini: Why the Treasury TARP bailout is flawed

The Treasury plan (even in its current version agreed with Congress) is very poorly conceived and does not contain many of the key elements of a sound and efficient and fair rescue plan. ... It is a disgrace that no professional economist was consulted by Congress or invited to present his/her views at the Congressional hearings on the Treasury rescue plan.

Specifically, the Treasury plan does not formally provide senior preferred shares for the government in exchange for the government purchase of the toxic/illiquid assets of the financial institutions; so this rescue plan is a huge and massive bailout of the shareholders and the unsecured creditors of the firms; with $700 billion of taxpayer money the pockets of reckless bankers and investors have been made fatter under the fake argument that bailing out Wall Street was necessary to rescue Main Street from a severe recession. Instead, the restoration of the financial health of distressed financial firms could have been achieved with a cheaper and better use of public money.

Moreover, the plan does not address the need to recapitalize badly undercapitalized financial institutions: this could have been achieved via public injections of preferred shares into these firms; needed matching injections of Tier 1 capital by current shareholders to make sure that such shareholders take first tier loss in the presence of public recapitalization; suspension of dividends payments; conversion of some of the unsecured debt into equity (a debt for equity swap).

The plan also does not explicitly include an HOLC-style program to reduce across the board the debt burden of the distressed household sector; without such a component the debt overhang of the household sector will continue to depress consumption spending and will exacerbate the current economic recession.

Thus, the Treasury plan is a disgrace: a bailout of reckless bankers, lenders and investors that provides little direct debt relief to borrowers and financially stressed households and that will come at a very high cost to the US taxpayer. And the plan does nothing to resolve the severe stress in money markets and interbank markets that are now close to a systemic meltdown.

The Bailout Plan and The Debate

by Calculated Risk on 9/26/2008 06:31:00 PM

I'll post a thread on the debate tonight (starts at 9PM ET).

Here is a live feed. (hat tip AF)

Hopefully there will be some questions on the Bailout Plan. I'd like to see both Senators McCain and Obama explain the economic problem, why they see a need for the government to be involved (or not), what the purpose of the plan should be, and specifics on the plan they would propose or support.

I really don't care about lengthy discussions on how we got here and hopefully that will be avoided tonight.

Important for the comments: I encourage everyone to stay focused on economic issues only. I'll delete comments (or the entire thread) if it gets out of hand. I think this is an important issue and one of these two men will be elected President in just over one month.

My perspective: I believe there is a significant credit crisis right now. The credit markets are in severe distress and we can see evidence of this in the various credit spreads.

A number of financial institutions made bad decisions, and they now need to deleverage. For the most part these institutions can't raise private capital, and as a result they have all but stopped lending. Given a little time, this lack of lending to credit worthy borrowers will significantly impact the real economy.

In response to these problems, the government announced last week that they would present a plan to bailout the banks. Last Friday I predicted the Paulson Plan would have some of the features of the Depression era Reconstruction Finance Corporation (RFC) and make preferred stock investments in banks (with the taxpayers owning the preferred). This would help the banks recapitalize, and punish the existing shareholders by diluting their shares.

My view is that it is in the public interest to make sure the banks continue to lend to credit worthy customers. But it is not in the public interest to protect the management and shareholders of these institutions.

Over time this preferred stock would be sold on the public market. The RFC was one of most successful programs of the Depression, and has been praised by many economists including Milton Friedman.

Unfortunately that wasn't the Paulson Plan. I was very surprised. The Paulson Plan was to recapitalize the banks by paying a premium for toxic assets compared to market prices, leaving the taxpayers on the hook for any losses and rewarding the management and shareholders of the banks that made bad decisions. That is a bad idea and was immediately opposed by many economists like Paul Krugman and Nouriel Roubini who both support some sort of equity investment for taxpayers.

I would prefer that the current plan be junked, and a new RFC type plan proposed. I do feel there is a serious problem and there are reasons for some government involvement. However, at the least, I'd like to see equity investments for taxpayers.

I know that others believe any and all plans should be stopped, and there should be no government involvement. I understand that view, but I respectfully disagree.

Let's see what the candidates have to say.

Note: This week I've received hundreds of alternative proposals - many of them with very good ideas. Unfortunately I haven't had time to read them all, and I apologize for not responding to all the emails I've received. I do appreciate the input and ideas.

More Wachovia Suitors

by Calculated Risk on 9/26/2008 05:36:00 PM

Stop me if you've heard this story before ...

From the WSJ: Wachovia Explores Sale

Wachovia Corp. has entered into preliminary discussions with a handful of potential suitors, including Banco Santander SA of Spain, Wells Fargo & Co. and Citigroup Inc., according to a person familiar with the situation.Anyone else feeling a little deja vu?

...

Wachovia declined to comment on the discussions. Earlier Friday, a spokeswoman said the bank is "aggressively addressing our challenges" and "working to strategically strengthen and manage capital and liquidity in this challenging environment." The bank's deposit base, stretching from California to the Northeast, is "large and stable," the Wachovia spokeswoman added.

S&P acknowledged that WaMu's deposit base appears to be stable and the company has enough liquidity to meet all fixed obligations throughout 2010.

Financial Times, Sept 16, 2008

Report: Wachovia in Talks with Citigroup

by Calculated Risk on 9/26/2008 04:20:00 PM

From the NY Times: Wachovia Begins Early Deal Talks with Citi

Wachovia has begun preliminary talks with Citigroup about a potential merger, people briefed on the matter said Friday afternoon.Meanwhile Wachovia stock was off 27%.

National City was off 27%.

First Federal was off 45%.

Downey Savings was off 48%.

Vineyard was only off 20%.

Watching the TED Spread

by Calculated Risk on 9/26/2008 02:22:00 PM

The TED Spread from Bloomberg is still very high at 2.91, although down a little from yesterday.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

This will probably be one of the first indicators to show any benefit from any plan.

More Cliff Diving

by Calculated Risk on 9/26/2008 12:47:00 PM

Update from MarketWatch: Counterparty credit risk jumps on Wachovia concern

The CDR Counterparty Risk Index, which tracks credit-default swaps on leading banks and brokerage firms, surged more than 100 basis points to 430.2, close to a record. A basis point is one one-hundredth of a percentage point.National City stock is now off 50%.

...

Credit-default swap spreads on Wachovia widened by 827.2 basis points and now trade between 28% and 33% "upfront," according to CDR.

...

"Wachovia is now trading at distressed levels, raising the specter of another major U.S. bank failure in the near future," CDR said in a statement.

Wachovia is off 30%.

Reader BR notes that investors are reacting to JPM's marks on WaMu's loan portfolio. These published marks will force the regionals to write down the value of their paper too.

As I mentioned earler, investors appear to be asking "Who is next?"

I don't think either of these banks will be seized today, but based on the pace of failures, I'd guess a bank failure is likely.

JPMorgan House Price Projections

by Calculated Risk on 9/26/2008 10:44:00 AM

First, here is the investor presentation material from the JPMorgan conference call last night. Click on chart for larger image in new window.

Click on chart for larger image in new window.

Here are the House Price Appreciation (HPA) numbers JPM is working with.

JPMorgan presented three scenarios: a base case (with national prices falling 25% peak to trough), a deeper recession (28% decline), and a severe recession (37% decline).

Currently the Case-Shiller futures are predicting a 33% decline peak-to-trough, Goldman is forecasting 27%, and Lehman was forecasting 32%.

Also note the unemployment numbers for each scenario (7%, 7.5%, and 8% for a severe recession), and price forecasts for California and Florida.

Earlier this month, I presented three ways to look at prices: real prices, price-to-rent, and price-to-income. I've taken the JPMorgan national prices forecasts and added them to the price-to-household income chart. This graph shows the price-to-household income ratio and is based off the Case-Shiller index, and the Census Bureau's median income Historical Income Tables - Households.

This graph shows the price-to-household income ratio and is based off the Case-Shiller index, and the Census Bureau's median income Historical Income Tables - Households.

Using national median incomes and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area).

For this graph, I assumed that prices would fall over four more quarters for JPMorgan's base house price projection, over five more quarters for the "Deeper recession" projections, and over eight more quarters for the "Severe recession" projections.

Also, after reaching the price trough, I held house prices steady while incomes continue to rise mostly with inflation.

I'd expect this ratio to decline below 1.0 (like in the mid-90s), so I think the JPMorgan base case is too optimistic. My guess is that national house prices will decline somewhere between JPMorgan's "deeper recession" (28% peak to trough) and their "severe recession" (37% peak to trough) projections.

Cliff Diving: Wachovia and National City

by Calculated Risk on 9/26/2008 09:54:00 AM

Wachovia's (WB) stock price is off 22%.

National City (NCC) is off 19%.

With WaMu seized, investors are now asking who is next ...

Bush on Financial Crisis

by Calculated Risk on 9/26/2008 09:31:00 AM

UPDATE: Bush "It's hard work"

Basically Bush said:

There is no disagreement that something must be done. We are going to get a package passed. Republicans and Democrats will come together and pass a substantial rescue plan.That was it. Sorry for posting the link ...

President Bush will speak on the financial crisis and status of the Paulson Plan at 9:35AM ET

Here is the live feed from CNBC.

Economists Question Paulson's Plan

by Calculated Risk on 9/26/2008 08:31:00 AM

From the Washington Post: Away from Wall Street, Economists Question Basis of Paulson's Plan. A couple of quotes:

"There is a kind of suggestion in the Paulson proposal that if only we provide enough money to financial markets, this problem will disappear," said Joseph Stiglitz, a Nobel Prize-winning economist. "But that does nothing to address the fundamental problem of bleeding foreclosures and the holes in the balance sheets of banks."Initially many of us expected a Depression era Reconstruction Finance Corporation (RFC) type preferred stock investment to recapitalize the banks. Instead, the Paulson Plan intended to recapitalize the banks by paying a premium for troubled assets. The compromise bill discussed yesterday was a step in the right direction because of the equity sharing provision (although there was no details).

...

"The root of the issue is recapitalizing banks," said Glenn Hubbard, dean of Columbia Business School and a former chairman of President Bush's Council of Economic Advisers. "That could be done more efficiently through the government injection of preferred equity. Then the market could figure out the prices of the assets."

Apparently there will be meetings again today starting at 11:30AM ET. (scroll down to see posts on JPM / WaMu)

Videos: Wall Street Bailout

by Calculated Risk on 9/26/2008 01:27:00 AM

Senator Shelby on bailout:

And a little less serious: Debt to America!

Thursday, September 25, 2008

Paulson Plan Update and JPMorgan WaMu

by Calculated Risk on 9/25/2008 10:05:00 PM

Paulson Plan Update: No Deal Yet.

“If money isn’t loosened up, this sucker could go down.”NY Times: Bailout Plan Stalls After Day of Talks; Paulson Heads Back to Capitol Hill

President Bush, Sept 25, 2008

The day began with an agreement that Washington hoped would end the financial crisis that has gripped the nation. It dissolved into a verbal brawl in the Cabinet Room of the White House, warnings from an angry president and pleas from a Treasury secretary who knelt before the House speaker and appealed for her support.From the WSJ: Leaders Wrangle Over Bailout

...

It was an implosion that spilled out from behind closed doors into public view in a way rarely seen in Washington. Left uncertain was the fate of the bailout, which the White House says is urgently needed to fix broken financial and credit markets ...

[The] House Republican leader, John A. Boehner of Ohio, surprised many in the room by declaring that his caucus could not support the plan to allow the government to buy distressed mortgage assets from ailing financial companies.

Mr. Boehner pressed an alternative that involved a smaller role for the government, and Mr. McCain, whose support of the deal is critical if fellow Republicans are to sign on, declined to take a stand.

The talks broke up in angry recriminations, according to accounts provided by a participant and others who were briefed on the session, and were followed by dueling press conferences and interviews rife with partisan finger-pointing.

It was unclear if an agreement would still come together Thursday night: The emergence of a competing plan was threatening to derail a carefully crafted compromise previously taking shape.On JPM Wamu (scroll down for earlier posts), here is the investor presentation. Basically JPMorgan - in an asset only acquisition - acquired the toxic WaMu loan portfolio and deposit base (all branches). JPMorgan paid the FDIC $1.9 billion, and they expect to take write-downs of $30 billion to $54 billion on the WaMu toxic loans. That is the primary cost of the acquisition - the write-downs.

Earlier Thursday, congressional leaders had hammered together the outline of a compromise that involved allotting the bailout money in installments. However, after a meeting at the White House -- attended by President George W. Bush, congressional leaders and the two presidential candidates -- the gathering broke without announcing a deal, despite widespread expectations that one was imminent.

One cause of the delay: opposition from House Republicans who have tried to fashion an alternative "free market" plan that, instead of relying heavily on taxpayer money, could let banks buy insurance for the troubled assets weighing down their books.

The holding company is responsible for all lawsuits (good luck). The shareholders are wiped out, and so are most of the bondholders. See the previous post for a couple of interesting charts. I will post on their house price assumptions tomorrow.

JPMorgan Conference Call

by Calculated Risk on 9/25/2008 09:09:00 PM

JPMorgan announces investor conference call:

JPMorgan Chase & Co. (NYSE: JPM) will host a conference call at 9:15 p.m. (Eastern Time) tonight, September 25, 2008. You may access the conference call by dialing 1-877-238-4671 (U.S. and Canada) / 1-719-785-5594 (International) - access code: 814030 or via live audio webcast at www.jpmorganchase.com under Investor Relations/Investor Presentations. Materials and further communication will be available on this website at the time of the call.Presentation material should be here.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here are the bad asset details. Also see page 16 for assumptions.

Wow. They expect 44% peak-to-trough price declines in California (58% if severe recession).

Here are the House Price Appreciation numbers JPM is working with.

Here are the House Price Appreciation numbers JPM is working with.

FDIC: WaMu Closed, No Cost to Insurance Fund

by Calculated Risk on 9/25/2008 09:00:00 PM

JPMorgan Chase Acquires Banking Operations of Washington Mutual

FDIC Facilitates Transaction that Protects All Depositors and Comes at No Cost to the Deposit Insurance Fund

JPMorgan Chase acquired the banking operations of Washington Mutual Bank in a transaction facilitated by the Federal Deposit Insurance Corporation. All depositors are fully protected and there will be no cost to the Deposit Insurance Fund.

"For all depositors and other customers of Washington Mutual Bank, this is simply a combination of two banks," said FDIC Chairman Sheila C. Bair. "For bank customers, it will be a seamless transition. There will be no interruption in services and bank customers should expect business as usual come Friday morning."

JPMorgan Chase acquired the assets, assumed the qualified financial contracts and made a payment of $1.9 billion. Claims by equity, subordinated and senior debt holders were not acquired.

"WaMu's balance sheet and the payment paid by JPMorgan Chase allowed a transaction in which neither the uninsured depositors nor the insurance fund absorbed any losses," Bair said.

Washington Mutual Bank also has a subsidiary, Washington Mutual FSB, Park City, Utah. They have combined assets of $307 billion and total deposits of $188 billion.

Thursday evening, Washington Mutual was closed by the Office of Thrift Supervision and the FDIC named receiver.

WaMu thread: Looking for Details

by Calculated Risk on 9/25/2008 08:41:00 PM

No word from FDIC.

JPMorgan announces investor conference call:

JPMorgan Chase & Co. (NYSE: JPM) will host a conference call at 9:15 p.m. (Eastern Time) tonight, September 25, 2008. You may access the conference call by dialing 1-877-238-4671 (U.S. and Canada) / 1-719-785-5594 (International) - access code: 814030 or via live audio webcast at www.jpmorganchase.com under Investor Relations/Investor Presentations. Materials and further communication will be available on this website at the time of the call.

JPMorgan to Buy WaMu Operations

by Calculated Risk on 9/25/2008 07:55:00 PM

Note: Live bloggin' the confence call at 9:15 ET.

CNBC reports: FDIC to Seize WaMu and Sell Deposits to JPMorgan

The Federal Deposit Insurance Corp will seize Washington Mutual and sell its deposits to JPMorgan Chase for an undisclosed sum, CNBC has learned. The deal is expected to be announced during a Thursday night conference call at 9:15 p.m. ET.JPMorgan announces investor conference call:

JPMorgan Chase & Co. (NYSE: JPM) will host a conference call at 9:15 p.m. (Eastern Time) tonight, September 25, 2008. You may access the conference call by dialing 1-877-238-4671 (U.S. and Canada) / 1-719-785-5594 (International) - access code: 814030 or via live audio webcast at www.jpmorganchase.com under Investor Relations/Investor Presentations. Materials and further communication will be available on this website at the time of the call.From the WSJ: J.P. Morgan to Rescue Faltering WaMu

A replay of the conference call will be available beginning at approximately 1:00 a.m. on September 26 through midnight, Thursday, October 9 by telephone at (888) 348-4629 (U.S. and Canada); access code: 942856 or (719) 884-8882 (International). The replay will also be available via webcast on www.jpmorganchase.com under Investor Relations, Investor Presentations.

J.P. Morgan Chase & Co. was expected to announce as early as Thursday night a deal to acquire the bulk of Washington Mutual Inc.'s operations in a deal that would mark the end of independence for what once was the largest U.S. thrift.Looking for details ...

From the NY Times: Regulators Broker Deal on Washington Mutual (hat tip Walt)

Washington Mutual, the nation’s largest savings and loan, agreed Thursday to sell assets and some branches to JPMorgan Chase in a government-brokered deal to rescue the troubled bank, according to people briefed on the deal.

The deal is expected to be discussed at 9:15 p.m. on a conference call for investors held by JPMorgan.

Deal or no Deal: The Situation remains Fluid

by Calculated Risk on 9/25/2008 06:04:00 PM

From MarketWatch: No deal reached at White House, officials say

President Bush was unable to seal a deal between Republicans and Democrats on his $700 billion mortgage rescue plan, officials said.From the WSJ: White House Meeting Ends With Bailout Still in Flux

[O]ne opponent of the tentative agreement, Sen. Richard Shelby (R., Ala.) told reporters after the meeting with President Bush that lawmakers still haven't reached an agreement on financial bailout legislation. "I don't believe we have an agreement," said Sen. Shelby, the ranking Republican on the Senate Banking Committee. "There are still a lot of different opinions."Who knows. I think there will be some sort of deal this weekend before Congress goes into recess (September 26 is the Target for Adjournment).

...

Sen. Bob Corker (R., Tenn.) said: "I believe that we will pass this legislation before the markets open on Monday."

Bailout: Agreement on Principles

by Calculated Risk on 9/25/2008 04:58:00 PM

Agreement on PrinciplesNot much here. We need details on the equity sharing and other provisions.

1. Taxpayer Protectiona. Requires Treasury Secretary to set standards to prevent excessive or inappropriate executive compensation for participating companies2. Oversight and Transparency

b. To minimize risk to the American taxpayer, requires that any transaction include equity sharing

c. Requires most profits to be used to reduce the national debta. Treasury Secretary is prohibited from acting in an arbitrary or capricious manner or in any way that is inconsistent with existing law3. Homeownership Preservation

b. Establishes strong oversight board with cease and desist authority

c. Requires program transparency and public accountability through regular, detailed reports to Congress disclosing exercise of the Treasury Secretary’s authority

d. Establishes an independent Inspector General to monitor the use of the Treasury Secretary’s authority

e. Requires GAO audits to ensure proper use of funds, appropriate internal controls, and to prevent waste, fraud, and abusea. Maximize and coordinate efforts to modify mortgages for homeowners at risk of foreclosure4. Funding Authority

b. Requires loan modifications for mortgages owned or controlled by the Federal Government

c. Directs a percentage of future profits to the Affordable Housing Fund and the Capital Magnet Fund to meet America’s housing needsa. Treasury Secretary’s request for $700 billion is authorized, with $250 billion available immediately and an additional $100 billion released upon his or her certification that funds are needed

b. final $350 billion is subject to a Congressional joint resolution of disapproval

The Cost of the Bailout

by Calculated Risk on 9/25/2008 03:53:00 PM

When I read the intial proposal (admittedly very vague), it appeared the Treasury could churn the $700 billion, and therefore could possibly end up losing all of it (like a gambler at a slot machine "reinvesting" all their winnings).

Although we still haven't seen the proposal, Bernanke noted yesterday (if I heard him correctly) that the plan didn't intend to reinvest any proceeds after a sale. So if Treasury bought MBS for $70 million and sold it for $50 million, the loss would be $20 million - but they wouldn't reinvest the $50 million and lose even more. Those proceeds would be returned to the Treasury.

As far as total losses, here are the some comments from PIMCO's Bill Gross in an interview with Mathew Padilla at Mortgage Insider: Taxpayers can gain from $700 billion rescue

Gross said the government must find the right price between the market value of the assets they are buying and the value they have on paper at the banks holding them.And on CNBC, Warren Buffett said (hat tip Bernie):

...

“It’s certainly possible if done right for the Treasury to make money for the tax payer,” Gross said.

emphasis added

[T]hey shouldn't buy these debt instruments at what the institutions paid. They shouldn't buy them at what they're carrying, what the carrying value is, necessarily. They should buy them at the kind of prices that are available in the market. People who are buying these instruments in the market are expecting to make 15 to 20 percent on those instruments. If the government makes anything over its cost of borrowing, this deal will come out with a profit. And I would bet it will come out with a profit, actually.Unfortunately the plan is to buy the assets at a premium to market prices and probably at prices close to, or even above, the carrying value.

The WSJ Real Time Economics blog has more: Running Numbers on Treasury Bailout Plan

In a research note Thursday, Goldman Sachs estimated that there are probably about $1.15 trillion in distressed assets in the market.The Goldman research note included calculations for losses also (ranging from none to $200 billion), although these were more examples than projections.

...

That number is higher than the figure proposed by the Treasury, but it represents the face value of the mortgages. Since the discussion focuses on delinquent or foreclosed loans, the government should be getting a discount. Paying as high as 70 cents on the dollar would translate into $1 trillion in buying power for $700 billion.

Price is still the key. Since Treasury doesn't plan on churning the $700 billion, the losses will be a portion of the amount invested - and the losses depend on how much Treasury pays (or overpays!) for the assets. The losses are unknowable at this point, but probably in the zero to $300 billion range. My guess - until we know more on pricing - would be towards the high side of that range.

FDIC Responds to Bloomberg Story on Deposit Insurance Fund

by Calculated Risk on 9/25/2008 03:12:00 PM

From the FDIC: Open Letter to Bloomberg News about FDIC Deposit Insurance Fund

Bloomberg reporter David Evans' piece ("FDIC May Need $150 Billion Bailout as Local Bank Failures Mount," Sept. 25) does a serious disservice to your organization and your readers by painting a skewed picture of the FDIC insurance fund. Let me be clear: The insurance fund is in a strong financial position to weather a significant upsurge in bank failures. The FDIC has all the tools and resources necessary to meet our commitment to insured depositors, which we view as sacred. I do not foresee – as Mr. Evans suggests – that taxpayers may have to foot the bill for a "bailout."

Let's look at the real facts about the FDIC insurance fund. The fund's current balance is $45 billion – but that figure is not static. The fund will continue to incur the cost of protecting insured depositors as more banks may fail, but we continually bring in more premium income. We will propose raising bank premiums in the coming weeks to ensure that the fund remains strong. And, at the same time, we will propose higher premiums on higher risk activity to create economic incentives for poorly managed banks to change their risk profiles. The fund is 100 percent industry-backed. Our ability to raise premiums essentially means that the capital of the entire banking industry – that's $1.3 trillion – is available for support.

Moreover, if needed, the FDIC has longstanding lines of credit with the Treasury Department. Congress, understanding the need to ensure that working capital is available to the FDIC to provide bridge funding between the time a bank fails and when its assets are sold, provided broad authority for us to borrow from Treasury's Federal Financing Bank. If necessary, we can potentially raise very large sums of working capital, which would be paid back as the FDIC liquidates assets of failed banks. As per our authorizing statute, any money we might borrow from the Treasury must be paid back from industry assessments. Only once in the FDIC's history have we had to borrow from the Treasury – in the early 1990s – and that money was paid back with interest in less than two years.

Finally, Mr. Evans' suggestion that the "government" could ever be "on the hook for uninsured deposits" demonstrates a misunderstanding of FDIC insurance. To protect taxpayers, we are required to follow the "least cost" resolution, which means that uninsured depositors are paid in full only if this is the least costly option for the FDIC. This usually occurs when a bidder for the failed bank is willing to pay a higher price for the entire deposit franchise. We are authorized to deviate from the "least cost" resolution only where a so-called "systemic risk" exception is made. This is an extraordinary procedure which we have never invoked. And again, any money we borrow from the Treasury Department must be repaid through industry assessments.

I am confident in the strength of the FDIC's resources to make good on our sacred pledge to insured depositors. And, remember, no depositor has ever lost a penny of insured deposits, and never will.

Report: Bailout to be in Installments

by Calculated Risk on 9/25/2008 02:40:00 PM

From the WSJ: Agreement Reached on Bailout Ahead of High-Level Meeting

... lawmakers agreed to legislative principles that would approve Treasury's request for the funds, but would break it into installments ... Treasury would have access to $250 billion immediately, with another $100 billion to follow if needed. Congress would be able to block the last installment through a vote if it was unhappy with the program.This was one of the good suggestions that came from Congress (and probably all of you).

WaMu Cliff Diving

by Calculated Risk on 9/25/2008 01:29:00 PM

WaMu's stock price now off 31%.

Fitch and S&P both cut their ratings earlier this week. And any hope for a deal is apparently fading ...

Bank Failure Friday might be interesting tomorrow. With $310 billion in assets (hat tip Nemo), WaMu would be the biggest bank failure in history - in fact it would be larger than the previous top ten added together (although maybe not in inflation adjusted terms).

UPDATE: Analyst Richard Bove put an estimage on a WaMu failure, from Bloomberg: FDIC May Need $150 Billion Bailout as Local Bank Failures Mount (hat tip Michael Brian)

A federal takeover of Washington Mutual, which has assets of $310 billion, could cost taxpayers $24 billion ... according to Richard Bove, an analyst at Miami-based Ladenburg Thalmann & Co.

Report: Dodd says Agreement Reached on Bailout

by Calculated Risk on 9/25/2008 01:10:00 PM

Update: From CNBC: Lawmakers Say Financial Bailout Agreement Reached

CNBC Headline:

Sen. Dodd: "Fundamental" Agreement Reached on Bailout.

WSJ Headline:

Rep. Frank says Congress 'on track' to pass rescue plan.

Still no details.

Pelosi Says Bailout Will be Passed

by Calculated Risk on 9/25/2008 11:13:00 AM

From MarketWatch: House Speaker Pelosi reassures market on rescue plan

Pelosi said the exact timing of the House vote would depend on the outcome of closed-door meetings currently underway on Capitol Hill.No details yet ...

Credit Spreads: Off the Charts

by Calculated Risk on 9/25/2008 10:47:00 AM

We've been tracking the TED spread as a measure of distress in the credit markets (the difference between the LIBOR interest rate and the three month T-bill). Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

The TED spread has increased to 3.27% this morning. Completely off the charts! Here is the TED Spread from Bloomberg.

And the following graph is the A2/P2 spread from the Fed's commercial paper report. The A2/P2 Spread hit 409bp yesterday. This is literally off the chart compared to any previous period.

When the A2/P2 spread spiked to 160 last year that was considered shocking; now that spike looks minor. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for many of these companies the risk of default is close to zero. This is the high quality CP. Lower rated companies also issue CP and this is the A2/P2 rating.