by Calculated Risk on 11/17/2023 01:16:00 PM

Friday, November 17, 2023

Lawler: Early Read on Existing Home Sales in October

Today, in the CalculatedRisk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in October

Excerpt:

Chart of the Week: Mortgage Rates Follow MBS Yields, Not 10-Year Treasury YieldsThere is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

For an explanation of “why”, see Lawler: Update on Mortgage/Treasury Spreads

From Tom Lawler:

30 Year FRM: Optimal Blue Conventional Conforming 30-year Fixed-Rate Mortgage where LTV<=80% and FICO>740.

CC MBS Yield: Yield on notional par agency 30-year MBS

Note: there is some “spurious” volatility in the mortgage spreads because Optimal Blue measures rate lock activity throughout the day while the MBS and Treasury yields reflect late afternoon yields.

October Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

by Calculated Risk on 11/17/2023 09:19:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: October Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

Excerpt:

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/

Total starts were down 4.2% in October compared to October 2022. And starts year-to-date are down 11.3% compared to last year.

Starts have been down year-over-year for 16 of the last 18 months (May and July 2023 were the exceptions), and total starts will be down this year - although the year-over-year comparisons are somewhat easier in Q4.

Housing Starts Increased to 1.372 million Annual Rate in October

by Calculated Risk on 11/17/2023 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in October were at a seasonally adjusted annual rate of 1,372,000. This is 1.9 percent above the revised September estimate of 1,346,000, but is 4.2 percent below the October 2022 rate of 1,432,000. Single‐family housing starts in October were at a rate of 970,000; this is 0.2 percent above the revised September figure of 968,000. The October rate for units in buildings with five units or more was 382,000.

Building Permits:

Privately‐owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,487,000. This is 1.1 percent above the revised September rate of 1,471,000, but is 4.4 percent below the October 2022 rate of 1,555,000. Single‐family authorizations in October were at a rate of 968,000; this is 0.5 percent above the revised September figure of 963,000. Authorizations of units in buildings with five units or more were at a rate of 469,000 in October.

emphasis added

Click on graph for larger image.

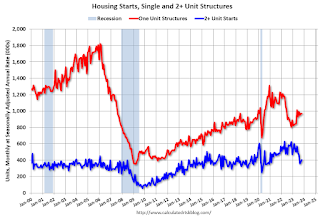

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased in October compared to September. Multi-family starts were down 30.0% year-over-year in October.

Single-family starts (red) increased in October and were up 13.1% year-over-year.

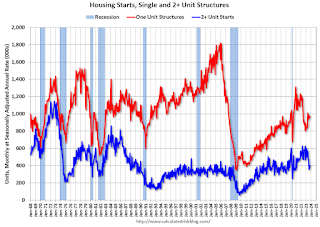

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse in single-family starts.

Total housing starts in October were above expectations and starts in August and September were revised up, combined.

I'll have more later …

Thursday, November 16, 2023

Friday: Housing Starts

by Calculated Risk on 11/16/2023 08:01:00 PM

Friday:

• At 8:30 AM ET, Housing Starts for October. The consensus is for 1.345 million SAAR, down from 1.358 million SAAR.

• At 10:00 AM, State Employment and Unemployment (Monthly) for October 2023

Realtor.com Reports Active Inventory UP YoY

by Calculated Risk on 11/16/2023 01:10:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending Nov 11, 2023

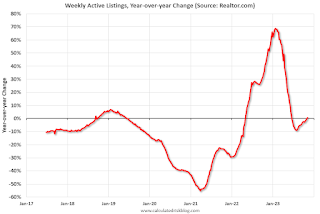

• Active inventory increased slightly, with for-sale homes 0.6% above year ago levels.

For 20 straight weeks, the number of homes available for sale registered below that of the previous year. However, active listings exceeded last year’s levels this week, reversing the recent trend.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 6.4% from one year ago.

Since mid-2022, new listings have registered lower than prior year levels, as the mortgage rate lock-in effect freezes homeowners with low-rate existing mortgages in place. Over the last three weeks, however, the trend has reversed as new listings during the week outpaced the same week in the previous year by 6.4%, a jump relative to the previous week.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up 0.6% year-over-year following 20 consecutive weeks with a YoY decrease in inventory.

NAHB: Builder Confidence Decreased in November

by Calculated Risk on 11/16/2023 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 34, down from 40 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment Down Again, but Better Building Conditions are in View

High mortgage rates that approached 8% earlier this month continue to hammer builder confidence, but recent economic data suggest housing conditions may improve in the coming months.

Builder confidence in the market for newly built single-family homes in November fell six points to 34 in November, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the fourth consecutive monthly drop in builder confidence, as sentiment levels have declined 22 points since July and are at their lowest level since December 2022. Also of note, nearly the entire HMI data for November was collected before the latest Consumer Price Index was released and showed that inflation is moderating.

“The rise in interest rates since the end of August has dampened builder views of market conditions, as a large number of prospective buyers were priced out of the market,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “Moreover, higher short-term interest rates have increased the cost of financing for home builders and land developers, adding another headwind for housing supply in a market low on resale inventory. While the Federal Reserve is fighting inflation, state and local policymakers could also help by reducing the regulatory burdens on the cost of land development and home building, thereby allowing more attainable housing supply to the market.”

“While builder sentiment was down again in November, recent macroeconomic data point to improving conditions for home construction in the coming months,” said NAHB Chief Economist Robert Dietz. “In particular, the 10-year Treasury rate moved back to the 4.5% range for the first time since late September, which will help bring mortgage rates close to or below 7.5%. Given the lack of existing home inventory, somewhat lower mortgage rates will price-in housing demand and likely set the stage for improved builder views of market conditions in December.”

...

All three major HMI indices posted declines in November. The HMI index gauging current sales conditions fell six points to 40, the component charting sales expectations in the next six months dropped five points to 39 and the gauge measuring traffic of prospective buyers dipped five points to 21.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 49, the Midwest dropped three points to 36, the South fell seven points to 42 and the West posted a six-point decline to 35.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast.

Industrial Production Decreased 0.6% in October

by Calculated Risk on 11/16/2023 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

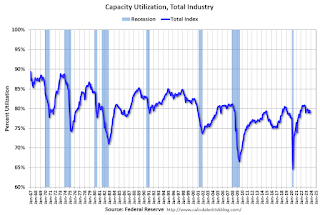

Industrial production declined 0.6 percent in October. Manufacturing output fell 0.7 percent. Much of this decline was due to a 10 percent drop in the output of motor vehicles and parts that was affected by strikes at several major manufacturers of motor vehicles—the index for manufacturing excluding motor vehicles and parts edged up 0.1 percent. The index for utilities decreased 1.6 percent, and the output of mines increased 0.4 percent. Total industrial production in October was 0.7 percent below its year-earlier level. Capacity utilization moved down 0.6 percentage point to 78.9 percent in October, a rate that is 0.8 percentage point below its long-run (1972–2022) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.9% is 0.8% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

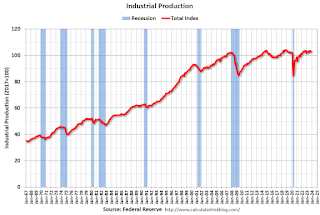

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 102.7 mostly due to the strikes. This is above the pre-pandemic level.

Industrial production was below consensus expectations.

Weekly Initial Unemployment Claims Increase to 231,000

by Calculated Risk on 11/16/2023 08:30:00 AM

The DOL reported:

In the week ending November 11, the advance figure for seasonally adjusted initial claims was 231,000, an increase of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 217,000 to 218,000. The 4-week moving average was 220,250, an increase of 7,750 from the previous week's revised average. The previous week's average was revised up by 250 from 212,250 to 212,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 220,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, November 15, 2023

Thursday: Industrial Production, Unemployment Claims, Homebuilder Survey

by Calculated Risk on 11/15/2023 08:02:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, up from 217 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of -11.0, down from -9.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.4% decrease in Industrial Production, and for Capacity Utilization to decrease to 79.4%.

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 40, unchanged from 40. Any number below 50 indicates that more builders view sales conditions as poor than good.

• At 11:00 AM, the Kansas City Fed manufacturing survey for November.

3rd Look at Local Housing Markets in October

by Calculated Risk on 11/15/2023 02:48:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in October

A brief excerpt:

NOTE: Starting next month, I’ll add some comparisons to 2019 (pre-pandemic)!There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

This is the third look at several early reporting local markets in October. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in October were mostly for contracts signed in August and September. Since 30-year fixed mortgage rates were in the 7.1% in August and 7.2% in September, compared to the high-5% range the previous year, closed sales were down year-over-year in October.

...

In October, sales in these markets were down 9.5%. In September, these same markets were down 15.3% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in September for these markets. However, this is where seasonal adjustments make a difference.

There was one more working day in October 2023 compared to October 2022, the opposite of September when there was one fewer working day in 2023 compared to 2022. So, for October, the seasonally adjusted decline will be larger than the NSA decline.

...

The data so far suggests the October existing home sales report will show another significant YoY decline, perhaps close to 4 million SAAR (early guess of Seasonally Adjusted Annual Rate), and maybe slightly above the cycle low of 3.96 million SAAR last month. This will be the 26th consecutive month with a YoY decline in sales.

...

More local markets to come!