by Calculated Risk on 3/30/2023 12:26:00 PM

Thursday, March 30, 2023

Realtor.com Reports Weekly Active Inventory Up 57% YoY; New Listings Down 20% YoY

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from chief economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Mar 25, 2023

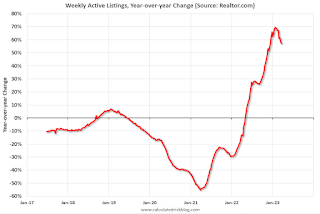

• Active inventory growth continued to climb with for-sale homes up 57% above one year ago. Inventories of for-sale homes rose, but at a slightly slower pace than the previous week for a second time as the smaller number of hopeful homebuyers still outnumber new sellers on the market. Growth in the number of homes for sale is primarily being driven by longer time on market and needs to be put into context. The number of homes for-sale in March surpasses the two most recent years, but is still roughly only half of what was typical for this time of year in 2017 to 2019.

...

• New listings–a measure of sellers putting homes up for sale–were again down, this week by 20% from one year ago. For 38 weeks, the number of newly listed homes has trailed the prior year. The gap was steady this week, but at a fairly low level. In fact, March data show that the number of new listings to hit the market was nearly on par with the low in April 2020 when a large number of activities were curtailed in the early days of the pandemic.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory is still up sharply year-over-year - from record lows - however, the YoY increase has slowed recently.

Inflation Adjusted House Prices 4.6% Below Peak

by Calculated Risk on 3/30/2023 09:45:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 4.6% Below Peak; Price-to-rent index is 7.9% below recent peak

Excerpt:

It has been 17 years since the bubble peak. In the January Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 60% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is at the bubble peak.

These inflation adjusted indexes have been declining for eight months in real terms.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be almost $340,000 today adjusted for inflation (70% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index.

Q4 GDP Growth Revised Down to 2.6% Annual Rate

by Calculated Risk on 3/30/2023 08:37:00 AM

From the BEA: Gross Domestic Product, Fourth Quarter and Year 2022 (Third Estimate), GDP by Industry, and Corporate Profits

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2022), according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 1.4% to 1.0%. Residential investment was revised up from -25.9% to -25.1%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.7 percent. The revision primarily reflected downward revisions to exports and consumer spending (refer to "Updates to GDP"). Imports, which are a subtraction in the calculation of GDP, were revised down.

emphasis added

Weekly Initial Unemployment Claims increase to 198,000

by Calculated Risk on 3/30/2023 08:34:00 AM

The DOL reported:

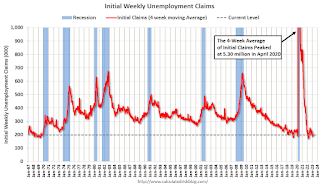

In the week ending March 25, the advance figure for seasonally adjusted initial claims was 198,000, an increase of 7,000 from the previous week's unrevised level of 191,000. The 4-week moving average was 198,250, an increase of 2,000 from the previous week's unrevised average of 196,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 198,250.

The previous week was unrevised.

Weekly claims were slightly above the consensus forecast.

Wednesday, March 29, 2023

Thursday: GDP, Unemployment Claims

by Calculated Risk on 3/29/2023 08:32:00 PM

Thursday:

• At 8:30 AM ET, Gross Domestic Product, 4th Quarter and Year 2022 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 2.7% annualized in Q4, unchanged from the second estimate.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 196 thousand initial claims, up from 191 thousand last week.

Philly Fed: State Coincident Indexes Increased in all 50 States in January (3-Month Basis)

by Calculated Risk on 3/29/2023 03:01:00 PM

From the Philly Fed:

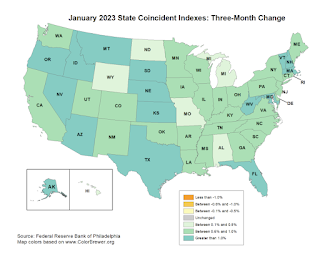

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2023. Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100. Additionally, in the past month, the indexes increased in 49 states and remained stable in one state, for a one-month diffusion index of 98. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 1.0 percent over the past three months and 0.4 percent in January.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is all positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In January, 50 states had increasing activity including minor increases.

Year-over-year Rent Growth Continues to Decelerate

by Calculated Risk on 3/29/2023 10:19:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Year-over-year Rent Growth Continues to Decelerate

A brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through February 2023, except CoreLogic is through January and Apartment List is through March 2023.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures are now increasing.

The CoreLogic measure is up 5.7% YoY in January, down from 6.4% in December, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 6.3% YoY in February, down from 6.9% YoY in January, and down from a peak of 17.0% YoY in February 2022.br />

The ApartmentList measure is up 2.6% YoY as of March, down from 3.0% in February, and down from a peak of 18.0% YoY November 2021.

...

My suspicion is year-over-year rent increases will slow further over the coming months with slow household formation, and as more supply comes on the market. It is possible that we will see a year-over-year decline in rents sometime this year. As ApartmentList analysts noted: “2023 could be the first time since the early stages of the pandemic that we see property owners competing for renters”.

NAR: Pending Home Sales Increased 0.8% in February; Down 21.1% Year-over-year

by Calculated Risk on 3/29/2023 10:04:00 AM

From the NAR: Pending Home Sales Grew for Third Straight Month, Up 0.8% in February

Pending home sales grew in February for the third consecutive month, according to the National Association of REALTORS®. Three U.S. regions posted monthly gains, while the West declined. All four regions saw year-over-year decreases in transactions.Expectations had been for a 3.0% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index (PHSI)* — a forward-looking indicator of home sales based on contract signings — improved 0.8% to 83.2 in February. Year-over-year, pending transactions dropped by 21.1%. An index of 100 is equal to the level of contract activity in 2001.

“After nearly a year, the housing sector’s contraction is coming to an end,” said NAR Chief Economist Lawrence Yun. “Existing-home sales, pending contracts and new-home construction pending contracts have turned the corner and climbed for the past three months.”

...

The Northeast PHSI raised 6.5% from last month to 72.5, a drop of 17% from February 2022. The Midwest index improved 0.4% to 84.9 in February, a decline of 16.5% from one year ago.

The South PHSI grew 0.7% to 99.3 in February, dropping 21.7% from the prior year. The West index decreased 2.4% in February to 64.6, shrinking 28.4% from February 2022.

emphasis added

MBA: Mortgage Purchase Applications Increased in Weekly Survey

by Calculated Risk on 3/29/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 24, 2023.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 3 percent compared with the previous week. The Refinance Index increased 5 percent from the previous week and was 61 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 35 percent lower than the same week one year ago.

“Application activity increased as mortgage rates declined for the third straight week. The 30-year fixed rate declined to 6.45 percent, the lowest level in over a month,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “While the 30-year fixed rate remained 1.65 percentage points higher than a year ago, homebuyers responded, leading to a fourth straight increase in purchase applications. Home price growth has slowed markedly in many parts of the country, which has helped to improve buyers’ purchasing power. Purchase applications remain over 30 percent behind last year’s pace, but recent increases, along with data from other sources showing an uptick in home sales, is a welcome development.”

Added Kan, “Refinance activity also picked up last week, but remains 61 percent below last year’s pace. Most homeowners still have rates significantly lower than current levels, leaving only a small pool of borrowers with an incentive to refinance.”

..

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.45 percent from 6.48 percent, with points decreasing to 0.62 from 0.66 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 35% year-over-year unadjusted.

Tuesday, March 28, 2023

Wednesday: Pending Home Sales

by Calculated Risk on 3/28/2023 08:59:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 3.0% decrease in the index.