by Calculated Risk on 3/21/2023 10:49:00 AM

Tuesday, March 21, 2023

NAR: Existing-Home Sales Increased to 4.58 million SAAR in February; Median Prices Declined YoY

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Increased to 4.58 million SAAR in February; Median Prices Declined YoY

Excerpt:

On prices, the NAR reported:There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ Please subscribe!The median existing-home price for all housing types in January was $363,000, a decline of 0.2% from February 2022 ($363,700), as prices climbed in the Midwest and South yet waned in the Northeast and West. This ends a streak of 131 consecutive months of year-over-year increases, the longest on record.Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

The YoY change in the median price peaked at 25.2% in May 2021 and prices are now down 0.2% YoY. Median house prices increased 0.5% from January to February and have declined 12.3% from the peak in June 2022 (NSA).

It is likely the Case-Shiller index will be down soon year-over-year.

Note that closed sales in February were mostly for contracts signed in December and January. Mortgage rates, according to the Freddie Mac PMMS, decreased to around 6.4% in December and 6.3% in January, and that provided a boost to closed sales in February. March sales will be for contracts signed in January and February, and mortgage rates averaged 6.3% in February too (spiking at the end of the month), so the impact from the recent increase in rates won’t happen until the April or May report.

NAR: Existing-Home Sales Increased to 4.58 million SAAR in February

by Calculated Risk on 3/21/2023 10:11:00 AM

From the NAR: Existing-Home Sales Surged 14.5% in February, Ending 12-Month Streak of Declines

Existing-home sales reversed a 12-month slide in February, registering the largest monthly percentage increase since July 2020, according to the National Association of REALTORS®. Month-over-month sales rose in all four major U.S. regions. All regions posted year-over-year declines.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops – vaulted 14.5% from January to a seasonally adjusted annual rate of 4.58 million in February. Year-over-year, sales fell 22.6% (down from 5.92 million in February 2022).

...

Total housing inventory registered at the end of February was 980,000 units, identical to January and up 15.3% from one year ago (850,000). Unsold inventory sits at a 2.6-month supply at the current sales pace, down 10.3% from January but up from 1.7 months in February 2022.

emphasis added

Click on graph for larger image.

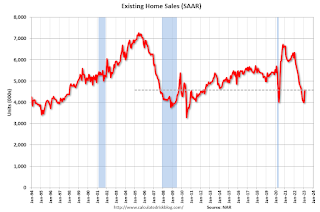

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (4.58 million SAAR) were up 14.5% from the previous month and were 22.6% below the February 2022 sales rate.

According to the NAR, inventory was unchanged at 0.98 million in February from 0.98 million in January.

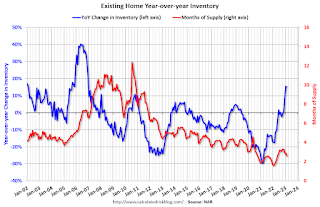

According to the NAR, inventory was unchanged at 0.98 million in February from 0.98 million in January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 15.3% year-over-year (blue) in February compared to February 2022.

Inventory was up 15.3% year-over-year (blue) in February compared to February 2022. Months of supply (red) declined to 2.6 months in February from 2.9 months in January.

This was well above the consensus forecast (but at Lawler's projection). I'll have more later.

Monday, March 20, 2023

Tuesday: Existing Home Sales

by Calculated Risk on 3/20/2023 09:01:00 PM

Shifting gears to today's MOVEMENT (since that what matters after all), rates are HIGHER today than they were on Friday. Most lenders ended up raising rates during the business day in response to bond market losses. In terms of 30yr fixed rates, the average lender ended up about an eighth of a percent (.125) higher compared to Friday morning. [30 year fixed 6.67%]Tuesday:

emphasis added

• At 10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 4.15 million SAAR, up from 4.00 million. Housing economist Tom Lawler expects the NAR to report sales of 4.51 million SAAR for February (well above consensus).

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 0.60% in February"

by Calculated Risk on 3/20/2023 05:10:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 0.60% in February

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 4 basis points from 0.64% of servicers’ portfolio volume in the prior month to 0.60% as of February 28, 2023. According to MBA’s estimate, 300,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points to 0.28%. Ginnie Mae loans in forbearance decreased 9 basis points to 1.28%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased 5 basis points to 0.78%.

“The forbearance rate decreased for both independent mortgage bank and depository servicers across all investor types in February,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Even with the fewer days in the month – which often causes a drop in timely monthly payments – overall servicing portfolio performance declined only slightly to 95.8 percent, while performance of post-forbearance workouts stayed essentially flat at 76.0 percent.”

Added Walsh, “The February results on mortgage performance is welcome news, given recent increases in delinquencies for other credit types such as credit cards and auto loans. However, with the possibility of a recession this year, we may see some deterioration in performance – particularly for government loans.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans has been decreasing, declined to 0.60% in February from 0.64% in January.

At the end of February, there were about 300,000 homeowners in forbearance plans.

First House Price Index goes Negative Year-over-year

by Calculated Risk on 3/20/2023 02:55:00 PM

This is for asking prices of a "common" home. Haus released their weekly Common Haus Price Index (CHPI) today showing a 0.2% decrease in asking house prices year-over-year.

From Common Haus Price Index (CHPI) at Haus: The weekly Common Haus Price Index

Each week, Haus releases the Common Haus Price Index (CHPI), a home price index of asking prices for the most common American home: a three-bed, two-bath, 1,500-square-foot home built in 1977 on a quarter-acre lot.As I mentioned this morning, it is possible that the NAR will report tomorrow that closing median prices were down year-over-year in February, although housing economist Tom Lawler expects the NAR to report prices up just over 1% in February.

...

Following a sharp increase in home prices during spring 2021, the cost of the most common home in America fell during June 2021, with prices holding steady into the beginning of 2022. For the week ending March 17, 2023, prices were up -0.2% year over year, and the price of the most common U.S. home was $352,497.

House Prices: Rust or Bust?

by Calculated Risk on 3/20/2023 09:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter:

House Prices: Rust or Bust? It is possible the Median House Price will be Down YoY in February

A brief excerpt:

Back in 2005, a real estate agent asked me if I thought house prices would “rust or bust”. My answer in 2005 was “bust”!There is more in the article. You can subscribe at https://calculatedrisk.substack.com/

For the current situation, I’d argue this is more like the 1978 to 1982 period, and my answer now is “rust” (see: House Prices: 7 Years in Purgatory).

On Friday, I posted housing economist Tom Lawler’s early read on February existing home sales. Lawler projects that the NAR will report sales of 4.51 million on a Seasonally Adjusted Annual Rate (SAAR) basis, well above the consensus forecast of 4.15 million SAAR. The NAR reports tomorrow; take the over!

Let me add a little color on February existing home sales and prices

Goldman Expects the FOMC to Pause

by Calculated Risk on 3/20/2023 08:40:00 AM

Yesterday I wrote: FOMC Preview: Uncertainty, Likely 25bp Hike, Maybe Pause

This morning Goldman Sachs economist David Mericle wrote: March FOMC Preview: Pause

We expect the FOMC to pause at its March meeting this week because of stress in the banking system. ... This would mean taking a pause in the inflation fight, but that should not be such a problem. ...The inflation problem actually looks less urgent now than last summer because near-term inflation expectations have fallen sharply and long-term inflation expectations have remained anchored.

...

The economic projections will likely show somewhat higher GDP growth in 2023, a lower unemployment rate in 2023, and small upward revisions to the inflation numbers. ... We have left our Fed forecast unchanged beyond March and continue to expect three additional 25bp rate hikes in May, June, and July, which would raise the funds rate to a peak of 5.25-5.5%.

emphasis added

Housing March 20th Weekly Update: Inventory Increased 0.4% Week-over-week

by Calculated Risk on 3/20/2023 08:30:00 AM

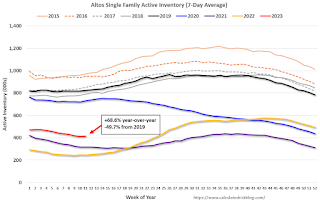

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Sunday Night Futures

by Calculated Risk on 3/20/2023 12:32:00 AM

Weekend:

• Schedule for Week of March 19, 2023

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures and DOW futures are unchanged (fair value).

Oil prices were down over the last week with WTI futures at $66.37 per barrel and Brent at $72.57 per barrel. A year ago, WTI was at $105, and Brent was at $114 - so WTI oil prices are DOWN 37% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.40 per gallon. A year ago, prices were at $4.23 per gallon, so gasoline prices are down $0.83 per gallon year-over-year.

Sunday, March 19, 2023

FOMC Preview: Uncertainty, Likely 25bp Hike, Maybe Pause

by Calculated Risk on 3/19/2023 11:48:00 AM

There is uncertainty regarding FOMC policy this month due to the banking issues. Just two weeks ago, the debate appeared to be between a 25bp hike and a 50 bp hike at the March meeting. On March 7th, Fed Chair Powell said:

… the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.However, expectations are now that the FOMC will announce a 25bp rate increase in the federal funds rate at the FOMC meeting this week, and they might even pause.

emphasis added

"[W]e look for the Fed to raise its target range for the federal funds rate by 25bp to 4.75-5.0%. The recent market turbulence stemming from distress in several regional banks certainly calls for more caution ... In the absence of further events, policymakers are likely to conclude that inflation stability remains a key monetary policy priority and, given that the economic data point to real side resilience and inflation persistence, a view a 25bp rate hike is warranted. Forward guidance, however, is likely to be somewhat dovish, highlighting the emergence of downside risk to the outlook and the policy rate path."

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 0.4 to 1.0 | 1.3 to 2.0 | 1.6 to 2.0 | |

The unemployment rate was at 3.6% in February, just above the 50-year low. The FOMC has been criticized for projecting a significant employment recession this year, and they will probably revise down their projected unemployment rate for Q4 2023.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 4.4 to 4.7 | 4.3 to 4.8 | 4.0 to 4.7 | |

As of January 2023, PCE inflation was up 5.4% year-over-year from January 2022, and, in general, inflation has been close to expectations. However, after accounting for the unusual dynamics related to the pandemic, inflation is likely lower than expected. The FOMC will likely leave their inflation projections mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 2.9 to 3.5 | 2.3 to 2.7 | 2.0 to 2.2 | |

PCE core inflation was up 4.7% in January year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | |

| Dec 2022 | 3.2 to 3.7 | 2.3 to 2.7 | 2.0 to 2.2 | |