by Calculated Risk on 7/28/2022 09:01:00 PM

Thursday, July 28, 2022

Friday: June Personal Income and Outlays

• At 8:30 AM ET, Personal Income and Outlays, June 2022. The consensus is for a 0.5% increase in personal income, and for a 0.9% increase in personal spending. And for the Core PCE price index to increase 0.5%. PCE prices are expected to be up 6.6% YoY, and core PCE prices up 4.7% YoY.

• At 9:45 AM, Chicago Purchasing Managers Index for July.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 51.1.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2 | 126,272 | 127,478 | ≤5,0001 | |

| Hospitalized2🚩 | 37,069 | 35,500 | ≤3,0001 | |

| Deaths per Day2 | 364 | 382 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

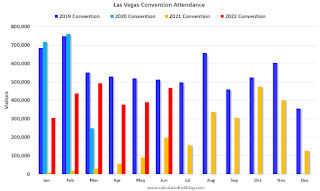

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Las Vegas June 2022: Visitor Traffic Down 7.8% Compared to 2019

by Calculated Risk on 7/28/2022 03:18:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

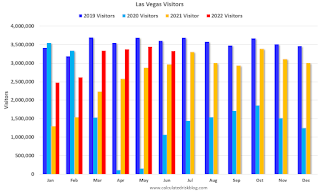

From the Las Vegas Visitor Authority: May 2022 Las Vegas Visitor Statistics

Las Vegas saw another strong month of visitation in June as the destination hosted over 3.3M visitors, about 12% ahead of last June but approx. 8% behind June 2019.

With room inventory reflecting the net impacts of the openings of the Virgin Hotel Las Vegas and Resorts World since the middle of last year, overall hotel occupancy reached 82.7%, 6.8 pts ahead of last June but down 9.0 pts vs. June 2019. Weekend occupancy welcomed a fourth consecutive month at or above 90% and Midweek occupancy reached 80% for the first time since February 2020 (up 9.1 pts YoY but down 9.7 pts vs. June 2019).

ADR approached $157, 22.7% ahead of last June and over 30% above June 2019 while RevPAR neared $130 for the month, +33.7% YoY and +17.5% over June 2019.

Click on graph for larger image.

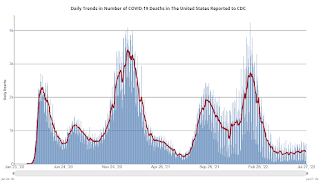

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 7.8% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Median vs Repeat Sales Index House Prices

by Calculated Risk on 7/28/2022 01:14:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Median vs Repeat Sales Index House Prices

Excerpt:

Perhaps the timeliest house price report for existing homes is the monthly existing home sales report from the National Association of Realtors® (NAR). Each month the NAR reports the median prices for closed sales. Note: Median prices are distorted by the mix (repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices).

But even the median price is lagged. For example, the recently released June report was mostly for contracts signed in April and May.

Here is a graph comparing the YoY change in the NAR median prices vs the Case-Shiller National Index:

The YoY change in the median price peaked at 25.2% in May 2021 and slowed to 13.3% in June (still very strong increase in YoY prices). The median price is not seasonally adjusted, and typically declines in July, and I expect a larger than normal decline this July.

In general, the median price leads the Case-Shiller index, and I expect the Case-Shiller to show significantly slower YoY growth over the next several months.

A Few Comments on Q2 GDP and Investment

by Calculated Risk on 7/28/2022 10:00:00 AM

Note: The second graph - residential investment as a percent of GDP - is useful in predicting a Fed induced recession. RI as a percent of GDP usually turns down well in advance of a recession. This will be something to watch.

Earlier from the BEA: Gross Domestic Product, Second Quarter 2022 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 0.9 percent in the second quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent. ...The advance Q2 GDP report, at -0.9% annualized, was below expectations, primarily due to a negative impact from a decrease in inventories.

The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

Personal consumption expenditures (PCE) increased at a 1.0% annualized rate in Q2.

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So, the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern didn't apply.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) decreased at a 14.0% annual rate in Q2. Equipment investment decreased at a 2.7% annual rate, and investment in non-residential structures decreased at a 11.7% annual rate.

On a 3-quarter trailing average basis, RI (red) is down, equipment (green) is up, and nonresidential structures (blue) is still down.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP decreased in Q2.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single-family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

BEA: Real GDP decreased at 0.9% Annualized Rate in Q2

by Calculated Risk on 7/28/2022 08:38:00 AM

From the BEA: Gross Domestic Product, Second Quarter 2022 (Advance Estimate)

Real gross domestic product (GDP) decreased at an annual rate of 0.9 percent in the second quarter of 2022, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP decreased 1.6 percent. ...PCE increased at a 1.0% rate, and residential investment decreased at a 14.0% rate. Change in private inventories was a huge drag in Q2, subtracting 2.01 percentage points. The advance Q2 GDP report, with 0.9% annualized decline, was below expectations.

The decrease in real GDP reflected decreases in private inventory investment, residential fixed investment, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by increases in exports and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased.

emphasis added

I'll have more later ...

Weekly Initial Unemployment Claims at 256,000

by Calculated Risk on 7/28/2022 08:34:00 AM

The DOL reported:

In the week ending July 23, the advance figure for seasonally adjusted initial claims was 256,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 10,000 from 251,000 to 261,000. The 4-week moving average was 249,250, an increase of 6,250 from the previous week's revised average. The previous week's average was revised up by 2,500 from 240,500 to 243,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 249,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, July 27, 2022

Thursday: Q2 GDP, Unemployment Claims

by Calculated Risk on 7/27/2022 09:01:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 248 thousand down from 251 thousand last week.

• Also, at 8:30 AM, Gross Domestic Product, 2nd quarter (advance estimate), and annual update. The consensus is that real GDP increased 0.4% annualized in Q2, up from -1.6% in Q1.

• At 11:00 AM, Kansas City Fed Survey of Manufacturing Activity for July. This is the last of the regional surveys for July.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Day2🚩 | 127,786 | 126,610 | ≤5,0001 | |

| Hospitalized2🚩 | 36,909 | 35,126 | ≤3,0001 | |

| Deaths per Day2 | 366 | 391 | ≤501 | |

| 1my goals to stop daily posts, 27-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

FOMC Statement: Raise Rates 75 bp; "Ongoing increases appropriate"

by Calculated Risk on 7/27/2022 02:02:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Russia's war against Ukraine is causing tremendous human and economic hardship. The war and related events are creating additional upward pressure on inflation and are weighing on global economic activity. The Committee is highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2-1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lael Brainard; James Bullard; Susan M. Collins; Lisa D. Cook; Esther L. George; Philip N. Jefferson; Loretta J. Mester; and Christopher J. Waller.

emphasis added

Real House Prices and Price-to-Rent Ratio in May

by Calculated Risk on 7/27/2022 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Real House Prices and Price-to-Rent Ratio in May

Excerpt:

It has been over 16 years since the bubble peak. In the Case-Shiller release yesterday, the seasonally adjusted National Index (SA), was reported as being 65% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 16% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is about 7% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). As an example, if a house price was $200,000 in January 2000, the price would be almost $334,000 today adjusted for inflation (67% increase). That is why the second graph below is important - this shows "real" prices (adjusted for inflation). ...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is 16.0% above the bubble peak, and the Composite 20 index is 7.4% above the bubble peak in early 2006.In real terms, house prices are now above the previous peak levels. There is an upward slope to real house prices, and it has been over 16 years since the previous peak, but real prices appear historically high (Of course interest rates had been very low).

NAR: Pending Home Sales Decreased 8.6% in June

by Calculated Risk on 7/27/2022 10:07:00 AM

From the NAR: Pending Home Sales Fell 8.6% in June

Pending home sales decreased in June, following a slight increase in May, according to the National Association of REALTORS®. All four major regions posted month-over-month and year-over-year pullbacks, the largest of which occurred in the West.This was well below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, dipped 8.6% to 91.0 in June. Year-over-year, transactions shrank 20.0%. An index of 100 is equal to the level of contract activity in 2001.

"Contract signings to buy a home will keep tumbling down as long as mortgage rates keep climbing, as has happened this year to date," said NAR Chief Economist Lawrence Yun. "There are indications that mortgage rates may be topping or very close to a cyclical high in July. If so, pending contracts should also begin to stabilize."

According to NAR, buying a home in June was about 80% more expensive than in June 2019. Nearly a quarter of buyers who purchased a home three years ago would be unable to do so now because they no longer earn the qualifying income to buy a median-priced home today.

...

The Northeast PHSI slid 6.7% compared to last month to 80.9, down 17.6% from June 2021. The Midwest index dropped 3.8% to 93.7 in June, a 13.4% decline from a year ago.

The South PHSI slipped 8.9% to 108.3 in June, a decrease of 19.2% from the previous year. The West index slumped 15.9% in June to 68.7, down 30.9% from June 2021.

emphasis added