by Calculated Risk on 5/26/2022 01:12:00 PM

Thursday, May 26, 2022

Realtor.com Reports Weekly Inventory Up 9% Year-over-year

Today, in the Calculated Risk Real Estate Newsletter: Realtor.com Reports Weekly Inventory Up 9% Year-over-year

Excerpt:

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released this morning from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 21, 2022.. Note: They have data on list prices, new listings and more, but this focus is on inventory.• Active inventory continued to grow, rising 9% above one year ago. In a few short weeks, we’ve observed a significant turnaround in the number of homes available for sale, going from essentially flat two weeks ago, to +5% last week, to +9% this week. This is the biggest year over year gain ever observed in our weekly data history which goes back to 2017, and the first consecutive weeks of gains since 2019. This is a milestone to celebrate, but should be understood in context. Our April Housing Trends Report showed that the active listings count remained 60 percent below its level right at the onset of the pandemic. This means that April’s buyers had just 2 homes to consider for every 5 homes that were available for sale just before the pandemic. May data in summary is likely to show that even as the market is adjusting rapidly, the number of homes for sale remains limited compared to pre-pandemic conditions.Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.

Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 9% YoY now. It will be important to watch if that trend continues. It appears that inventory growth is accelerating, as demand declines.

May Vehicle Sales Forecast: Decrease to 13.4 million SAAR

by Calculated Risk on 5/26/2022 12:42:00 PM

From WardsAuto: May U.S. Light-Vehicle Sales to Fall from April, But Q2 Still Expected to Improve on Q1 (pay content). Brief excerpt:

"With expectations that higher inventory at the end of the month will lead June’s results to rebound from May’s sequential decline, the second quarter's annualized rate is pegged to rise to 14.3 million units from Q1's 14.1 million."

Click on graph for larger image.

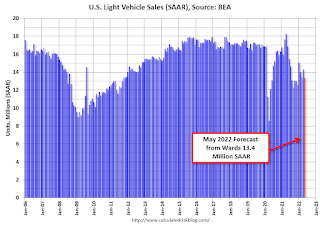

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for May (Red).

The Wards forecast of 13.4 million SAAR, would be down about 6% from last month, and down 20% from a year ago (sales were solid in May 2021, as sales recovered from the depths of the pandemic, and weren't yet significantly impacted by supply chain issues).

NAR: Pending Home Sales Decreased 3.9% in April

by Calculated Risk on 5/26/2022 10:03:00 AM

From the NAR: Pending Home Sales Descend 3.9% in April

Pending home sales slipped in April, as contract activity decreased for the sixth consecutive month, the National Association of Realtors® reported. Only the Midwest region saw signings increase month-over-month, while the other three major regions reported declines. Each of the four regions registered a drop in year-over-year contract activity.This was below expectations of a 1.9% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, slid 3.9% to 99.3 in April. Year-over-year, transactions fell 9.1%. An index of 100 is equal to the level of contract activity in 2001.

"Pending contracts are telling, as they better reflect the timelier impact from higher mortgage rates than do closings," said Lawrence Yun, NAR's chief economist. "The latest contract signings mark six consecutive months of declines and are at the slowest pace in nearly a decade."

...

Month-over-month, the Northeast PHSI fell 16.20% to 74.8 in April, a 14.3% drop from a year ago. In the Midwest, the index rose 6.6% to 100.7 last month, down 2.8% from April 2021.

Pending home sales transactions in the South dipped 4.7% to an index of 119.0 in April, down 10.3% from April 2021. The index in the West slipped 4.3% in April to 85.9, a 10.5% decrease from a year prior.

emphasis added

Weekly Initial Unemployment Claims Decrease to 210,000

by Calculated Risk on 5/26/2022 08:38:00 AM

The DOL reported:

In the week ending May 21, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 8,000 from the previous week's unrevised level of 218,000. The 4-week moving average was 206,750, an increase of 7,250 from the previous week's unrevised average of 199,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 206,750.

The previous week was unrevised.

Weekly claims were lower than the consensus forecast.

Q1 GDP Growth Revised down to minus 1.5% Annual Rate

by Calculated Risk on 5/26/2022 08:33:00 AM

From the BEA: Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary), First Quarter 2022

Real gross domestic product (GDP) decreased at an annual rate of 1.5 percent in the first quarter of 2022 (table 1), according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 6.9 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 2.7% to 3.1%. Residential investment was revised down from 2.1% to 0.4%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the decrease in real GDP was 1.4 percent. The update primarily reflects downward revisions to private inventory investment and residential investment that were partly offset by an upward revision to consumer spending

emphasis added

MBA: "Mortgage Application Payments Jumped 8.8 Percent to $1,889 in April"

by Calculated Risk on 5/26/2022 07:00:00 AM

This is a new monthly affordability index from the Mortgage Bankers Association (MBA).

From the MBA: Mortgage Application Payments Jumped 8.8 Percent to $1,889 in April

Homebuyer affordability decreased in April, with the national median payment applied for by applicants rising 8.8 percent to $1,889 from $1,736 in March. This is according to the Mortgage Bankers Association's (MBA) Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey (WAS).This will likely increase further in May.

“Rapid home-price growth, low inventory, and an 80-basis-point surge in mortgage rates slowed purchase applications in April, with the typical borrower’s principal and interest payment increasing $153 from March and $569 from a year ago,” said Edward Seiler, MBA's Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. “Despite strong employment and wage growth, housing affordability has worsened since the start of the year. Mortgage payments are taking up a larger share of homebuyers’ incomes, and sky-high inflation is making it more difficult for some would-be buyers to save for a down payment or come up with the additional cash they need to afford a higher monthly payment.”

Added Seiler, “MBA’s updated forecast calls for mortgage rates to remain above 5 percent for most of 2022, but prospective homebuyers should start to see moderation from the double-digit price appreciation reported for well over a year in most of the country.”

Click on graph for larger image.

The national PAPI (Figure 1) increased 7.8 percent to 162.7 in April from 150.9 in March, meaning payments on new mortgages take up a larger share of a typical person’s income. Compared to April 2021 (120.2), the index jumped 27.0 percent. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased 9.6 percent to $1,236 from $1,129 in March.

emphasis added

Wednesday, May 25, 2022

Thursday: GDP, Unemployment Claims, Pending Home Sales

by Calculated Risk on 5/25/2022 09:01:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand up from 218 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2021 (Second estimate). The consensus is that real GDP decreased 1.3% annualized in Q1, up from the advance estimate of -1.4%.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 1.9% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.6% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 221.1 | --- | ≥2321 | |

| New Cases per Day3🚩 | 104,399 | 99,215 | ≤5,0002 | |

| Hospitalized3🚩 | 19,724 | 16,965 | ≤3,0002 | |

| Deaths per Day3🚩 | 288 | 273 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

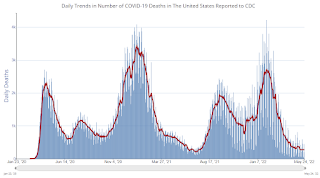

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Philly Fed: State Coincident Indexes Increased in 50 States in April

by Calculated Risk on 5/25/2022 04:09:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2022. Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100. Additionally, in the past month, the indexes increased in all 50 states, for a one-month diffusion index of 100. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 1.1 percent over the past three months and 0.3 percent in April.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is all positive on a three-month basis.

Source: Philly Fed.

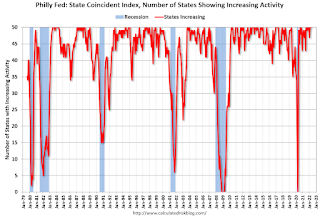

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In April all 50 states had increasing activity including minor increases.

FOMC Minutes: "Risks to inflation were skewed to the upside"; 50bp increases likely appropriate at next couple of meetings

by Calculated Risk on 5/25/2022 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, May 3–4, 2022. Excerpt on the "Plans for Reducing the Size of the Balance Shee"t:

In their discussion of risks to the outlook, participants emphasized that they were highly attentive to inflation risks and would continue to monitor closely inflation developments and inflation expectations. They agreed that risks to inflation were skewed to the upside and cited several such risks, including those associated with ongoing supply bottlenecks and rising energy and commodity prices—both of which were exacerbated by the Russian invasion of Ukraine and COVID-related lockdowns in China. Also mentioned were the risks associated with nominal wage growth continuing to run above levels consistent with 2 percent inflation over time and the extent to which households' high savings since the onset of the pandemic and healthy balance sheets would support greater-than-expected underlying momentum in consumer spending and contribute to upside inflation pressures. In addition, some participants emphasized that persistently high inflation heightened the risk that longer-term inflation expectations could become unanchored; in that case, the task of returning inflation to 2 percent would be more difficult. Uncertainty about real activity was also seen as elevated. Various participants noted downside risks to the outlook, including risks associated with the Russian invasion and COVID-related lockdowns in China and the likelihood of a prolonged rise in energy and commodity prices.

Several participants who commented on issues related to financial stability noted that the tightening of monetary policy could interact with vulnerabilities related to the liquidity of markets for Treasury securities and to the private sector's intermediation capacity. A couple of participants pointed to increased risks in financial markets linked to commodities following Russia's invasion of Ukraine, which had led to higher prices and volatility across a wide range of energy, agricultural, and metal products. These participants observed that the trading and risk-management practices of some key participants in commodities markets were not fully visible to regulatory authorities and noted that central counterparties (CCPs) needed to remain capable of managing risks associated with heightened volatility or that margin requirements at CCPs could give rise to significant liquidity demands for large banks, broker-dealers, and their clients.

In their consideration of the appropriate stance of monetary policy, all participants concurred that the U.S. economy was very strong, the labor market was extremely tight, and inflation was very high and well above the Committee's 2 percent inflation objective. Against this backdrop, all participants agreed that it was appropriate to raise the target range for the federal funds rate 50 basis points at this meeting. They further anticipated that ongoing increases in the target range for the federal funds rate would be warranted to achieve the Committee's objectives. Participants also agreed that it was appropriate to start reducing the size of the Federal Reserve's balance sheet on June 1, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that would be issued in conjunction with the postmeeting statement. Participants judged that an appropriate firming of the stance of monetary policy, along with an eventual waning of supply–demand imbalances, would help to keep longer-term inflation expectations anchored and bring inflation down over time to levels consistent with the Committee's 2 percent longer-run goal.

All participants reaffirmed their strong commitment and determination to take the measures necessary to restore price stability. To this end, participants agreed that the Committee should expeditiously move the stance of monetary policy toward a neutral posture, through both increases in the target range for the federal funds rate and reductions in the size of the Federal Reserve's balance sheet. Most participants judged that 50 basis point increases in the target range would likely be appropriate at the next couple of meetings. Many participants assessed that the Committee's previous communications had been helpful in shifting market expectations regarding the policy outlook into better alignment with the Committee's assessment and had contributed to the tightening of financial conditions.

All participants supported the plans for reducing the size of the balance sheet. This reduction, starting on June 1, would work in parallel with increases in the target range for the policy rate in firming the stance of monetary policy. A number of participants remarked that, after balance sheet runoff was well under way, it would be appropriate for the Committee to consider sales of agency MBS to enable suitable progress toward a longer-run SOMA portfolio composed primarily of Treasury securities. Any program of sales of agency MBS would be announced well in advance. Regarding risks related to the balance sheet reduction, several participants noted the potential for unanticipated effects on financial market conditions.

Participants agreed that the economic outlook was highly uncertain and that policy decisions should be data dependent and focused on returning inflation to the Committee's 2 percent goal while sustaining strong labor market conditions. At present, participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook. Participants observed that developments associated with Russia's invasion of Ukraine and the COVID-related lockdowns in China posed heightened risks for both the United States and economies around the world. Several participants commented on the challenges that monetary policy faced in restoring price stability while also maintaining strong labor market conditions. In light of the high degree of uncertainty surrounding the economic outlook, participants judged that risk-management considerations would be important in deliberations over time regarding the appropriate policy stance. Many participants judged that expediting the removal of policy accommodation would leave the Committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.

emphasis added

The Household Mystery: Part II

by Calculated Risk on 5/25/2022 09:51:00 AM

Today, in the Calculated Risk Real Estate Newsletter: The Household Mystery: Part II

Brief excerpt:

Recently there have been two papers that shed some light on this mystery.You can subscribe at https://calculatedrisk.substack.com/.

From SF Fed economist John A. Mondragon and Professor Johannes Wieland: Housing Demand and Remote Work. The authors showed that areas with more work from home (WFH) saw larger house price increases.In this paper we show that the shift to remote work caused a large increase in housing demand. In turn, this increase in housing demand caused house prices and rents to increase sharply. Based on our cross-sectional estimates controlling for migration spillovers, we argue that remote work accounts for at least one half of the 24% increase in house prices from December 2019 to November 2021.And from Federal Reserve economists Daniel García and Andrew Paciorek: The Remarkable Recent Rebound in Household Formation and the Prospects for Future Housing Demand

emphasis added ©Mondragon and WielandThis note updates our previous work on household formation and living arrangements from the summer of 2020. At that early stage in the pandemic, the data showed a dramatic decline in headship rates as millions of Americans changed their living arrangements, many by remaining with or moving back in with parents and older relatives. …Putting these two papers together - it is very possible that work-from-home drove some of the likely sources of household formation over the last 18 months.

In contrast, over the past year and a half there has been a remarkable rebound in the headship rate, driven in large part by a return to the pre-pandemic rates at which younger adults lived with parents or older family members. This rebound has been an important contributor to a huge increase in housing demand.