by Calculated Risk on 5/20/2022 01:21:00 PM

Friday, May 20, 2022

Q2 GDP Forecasts: 2.5% to 3.0%

From BofA:

We have revised down our GDP forecast for 2022 and 2023 to 2.6% and 1.5% from 2.7% and 1.8% previously. [Q2 3.0% revised down from 3.5%] [May 20 estimate]From Goldman:

emphasis added

we left our Q2 GDP tracking estimate unchanged at +2.6% (qoq ar) and our past-quarter GDP tracking estimate for Q1 unchanged at -1.5%. [May 19 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 2.4 percent on May 18, down from 2.5 percent on May 17. [May 18 estimate]

Lawler: The Sharp increase in Monthly Payments in Selected Metro Areas

by Calculated Risk on 5/20/2022 10:31:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: Lawler: The Sharp increase in Monthly Payments in Selected Metro Areas

Excerpt:

According to Mortgage News Daily, the interest rate on a 30-year fixed-rate mortgage for a prime borrower putting 20% down increased to 5.45% earlier this week from 3.14% a year ago. Such an increase would result in a 31.6% jump in the monthly principal and interest (P&I) payment on a mortgage with a fixed dollar amount. However, the increase in the monthly P&I payment for a typical home bought today compared to a year ago would be massively higher than 31.6%, as home prices nationally are up by over 20% from a year earlier, and by much more in many markets. In addition, that means a 20% down payment has risen sharply as well.There is much more in the post. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

Below is a table showing the year-over-year increase in a 20% down payment and the P&I payment for a 30-year FRM for the US and for several metro areas on a “typical” single-family home. ...

Click on table for larger image.

...

It is not the absolute mortgage rate, rather the change in monthly payments that is causing the slowdown in the housing market.

Black Knight: "Mortgage Delinquencies Hit Yet Another Record Low in April"

by Calculated Risk on 5/20/2022 08:00:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Hit Yet Another Record Low in April, Driven by Continued Improvement Among Seriously Past-Due Loans

• The national delinquency rate fell to 2.80% in April, down four basis points from March, hitting a new record low for the second consecutive monthAccording to Black Knight's First Look report, the percent of loans delinquent decreased 1.3% in April compared to March and decreased 40% year-over-year.

• Overall delinquencies are down nearly 40% from last year as the mortgage market continues to recover from pandemic-related impacts

• The number of borrowers who are a single payment past due increased 7.9% month-over-month, following typical seasonal patterns

• This was offset by strong improvement among borrowers who are three or more payments past due – with volumes falling by 8% month-over-month

• Though such serious delinquencies have fallen between 6%-12% in each of the past 14 months, volumes remain more than 55% above pre-pandemic levels

• Despite still-elevated serious delinquency levels, foreclosure starts dropped nearly 12% from March and are holding well below pre-pandemic levels – though active foreclosures edged slightly higher

• Prepayment activity fell by 19.1% from March and 61.8% from a year ago as interest rates continued their sharp ascent in April

emphasis added

The percent of loans in the foreclosure process increased 2.3% in April and were up 13.5% over the last year. (First year-over-year increase in almost 10 years - but from very low levels)

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 2.80% in April, down from 2.84% in March.

The percent of loans in the foreclosure process increased in April to 0.32%, from 0.32% in March.

The number of delinquent properties, but not in foreclosure, is down 1,004,000 properties year-over-year, and the number of properties in the foreclosure process is up 20,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2022 | Mar 2022 | Apr 2021 | Apr 2020 | |

| Delinquent | 2.80% | 2.84% | 4.66% | 6.45% |

| In Foreclosure | 0.32% | 0.32% | 0.29% | 0.40% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,496,000 | 1,513,000 | 2,500,000 | 3,400,000 |

| Number of properties in foreclosure pre-sale inventory: | 173,000 | 169,000 | 153,000 | 211,000 |

| Total Properties | 1,669,000 | 1,682,000 | 2,653,000 | 3,611,000 |

Thursday, May 19, 2022

Realtor.com Reports Weekly Inventory Up 5% Year-over-year

by Calculated Risk on 5/19/2022 02:58:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released this morning from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending May 14, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory.

• Active inventory moved convincingly into positive territory for the first time since 2019. While last week’s positive inventory improvement rounded to 0%, this week’s data built on that trend in a notable way, leading to the biggest year over year gain since March 2019. Our April Housing Trends Report showed that the active listings count remained 60 percent below its level right at the onset of the pandemic. This means that today’s buyers have just 2 homes to consider for every 5 homes that were available for sale just before the pandemic. In other words, homes for sale are still limited. However, more sellers combined with a slowing level of sales activity is causing a relatively rapid transition in conditions.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.

Here is a graph of the year-over-year change in inventory according to realtor.com. Note: I corrected a sign error in the data for Feb 26, 2022.Note the rapid increase in the YoY change, from down 30% at the beginning of the year, to up 5% YoY now. It will be important to watch if that trend continues.

The previous week, inventory was unchanged YoY according to Realtor.com. That is close to the 1.5% increase that Altos reported for the similar period. I expect Altos to report a stronger year-over-year increase in inventory on Monday.

Hotels: Occupancy Rate Down 5.9% Compared to Same Week in 2019

by Calculated Risk on 5/19/2022 12:40:00 PM

U.S. hotel performance improved from the previous week, according to STR‘s latest data through May 14.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

May 8-14, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 66.5% (-5.9%)

• Average daily rate (ADR): $148.31 (+10.5%)

• Revenue per available room (RevPAR): $98.59 (+4.1%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

More Analysis on April Existing Home Sales

by Calculated Risk on 5/19/2022 10:46:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 5.61 million SAAR in April

Excerpt:

Sales in April (5.61 million SAAR) were down 2.4% from the previous month and were 5.9% below the April 2021 sales rate.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/ (Most content is available for free, so please subscribe).

The second graph shows existing home sales by month for 2021 and 2022.

Sales declined 5.9% year-over-year compared to March 2021. This was the eighth consecutive month with sales down year-over-year.

...

A key milestone will be when inventory is up year-over-year (YoY). My current guess is inventory will be up YoY next month in the NAR report. Inventory will still be historically very low.

Also note that 30-year mortgage rates averaged 4.98% in April according to Freddie Mac. Now rates are around 5.45%. Sometimes people rush to buy as rates rise - anticipating further rate increases. However, eventually, higher rates will suppress demand. It seems likely we will see a further negative impact on sales from higher rates, and more inventory in the coming months.

NAR: Existing-Home Sales Decreased to 5.61 million SAAR in April

by Calculated Risk on 5/19/2022 10:12:00 AM

From the NAR: Existing-Home Sales Retract 2.4% in April

Existing-home sales recorded a third straight month of declines, slipping slightly in April, according to the National Association of Realtors®. Month-over-month sales were split amongst the four major U.S. regions, with two areas posting gains and the other two experiencing waning in April. Year-over-year sales struggled, as each of the four regions reported dips.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, slid 2.4% from March to a seasonally adjusted annual rate of 5.61 million in April. Year-over-year, sales dropped 5.9% (5.96 million in April 2021).

...

Total housing inventory at the end of April amounted to 1,030,000 units, up 10.8% from March and down 10.4% from one year ago (1.15 million). Unsold inventory sits at a 2.2-month supply at the current sales pace, up from 1.9 months in March and down from 2.3 months in April 2021.

emphasis added

Click on graph for larger image.

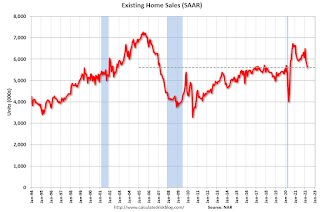

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.61 million SAAR) were down 2.4% from the previous month and were 5.9% below the April 2021 sales rate.

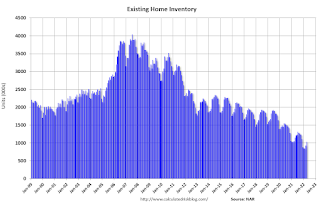

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.03 million in April from 0.93 million in March.

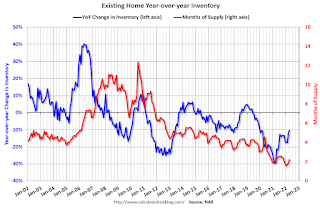

According to the NAR, inventory increased to 1.03 million in April from 0.93 million in March.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 10.4% year-over-year (blue) in April compared to April 2021.

Inventory was down 10.4% year-over-year (blue) in April compared to April 2021. Months of supply (red) increased to 2.2 months in April from 1.9 months in March.

This was close to the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Increase to 218,000

by Calculated Risk on 5/19/2022 08:33:00 AM

The DOL reported:

In the week ending May 14, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 21,000 from the previous week's revised level. The previous week's level was revised down by 6,000 from 203,000 to 197,000. The 4-week moving average was 199,500, an increase of 8,250 from the previous week's revised average. The previous week's average was revised down by 1,500 from 192,750 to 191,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 199,500.

The previous week was revised down.

Weekly claims were higher than the consensus forecast.

Wednesday, May 18, 2022

Thursday: Unemployment Claims, Philly Fed Mfg, Existing Home Sales

by Calculated Risk on 5/18/2022 09:01:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 210 thousand up from 203 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 16.7, down from 17.6.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.62 million SAAR, down from 5.77 million.

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 66.5% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 220.7 | --- | ≥2321 | |

| New Cases per Day3🚩 | 99,347 | 81,031 | ≤5,0002 | |

| Hospitalized3🚩 | 16,624 | 14,258 | ≤3,0002 | |

| Deaths per Day3 | 273 | 317 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

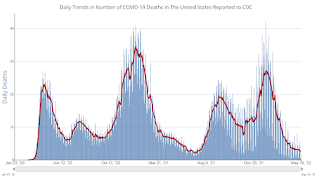

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.

Average daily deaths bottomed in July 2021 at 214 per day.

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/18/2022 02:43:00 PM

From housing economist Tom Lawler:

Based on publicly available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.57 million in April, down 3.5% from March’s preliminary pace and down 6.5% from last April’s seasonally adjusted pace. Unadjusted sales should show a larger YOY % decline, reflecting this April’s lower business day count compared to last April’s.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY % decline in the inventory of existing homes for sale last month was significantly lower than was the case last month, and other indicators suggest the inventory in May will be up YOY.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 15.2% from last April.

CR Note: The National Association of Realtors (NAR) is scheduled to release April existing home sales on Thursday, May 19, 2022, at 10:00 AM ET. The consensus is for 5.62 million SAAR.