by Calculated Risk on 3/30/2021 11:26:00 AM

Tuesday, March 30, 2021

Real House Prices and Price-to-Rent Ratio in January

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 11.2% year-over-year in January

It has been fifteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 29% above the previous bubble peak. However, in real terms, the National index (SA) is about 3% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 5% below the bubble peak.

The year-over-year growth in prices increased to 11.2% nationally.

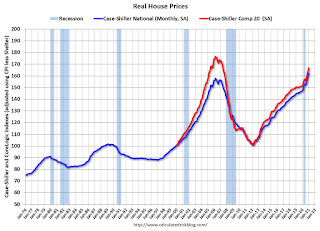

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $294,000 today adjusted for inflation (47%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

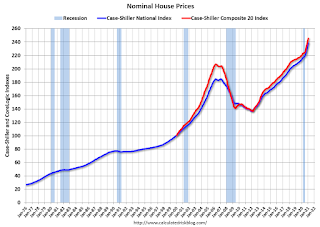

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is 3% above the bubble peak, and the Composite 20 index is back to early 2005.

In real terms, house prices are at 2005 levels.

Note that inflation was negative for a few months last year, and that also boosted real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving mostly sideways, but picked up recently.

On a price-to-rent basis, the Case-Shiller National index is back to December 2004 levels, and the Composite 20 index is back to June 2004 levels.

In real terms, prices are back to 2005 levels, and the price-to-rent ratio is back to 2004.

Case-Shiller: National House Price Index increased 11.2% year-over-year in January

by Calculated Risk on 3/30/2021 09:09:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3 month average of November, December and January prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Reports 11.2% Annual Home Price Gain to Start 2021

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported an 11.2% annual gain in January, up from 10.4% in the previous month. The 10-City Composite annual increase came in at 10.9%, up from 9.9% in the previous month. The 20-City Composite posted an 11.1% year-over-year gain, up from 10.2% in the previous month.

Phoenix, Seattle, and San Diego continued to report the highest year-over-year gains among the 20 cities in January. Phoenix led the way with a 15.8% year-over-year price increase, followed by Seattle with a 14.3% increase and San Diego with a 14.2% increase. All 20 cities reported higher price increases in the year ending January 2021 versus the year ending December 2020.

...

Before seasonal adjustment, the U.S. National Index posted a 0.8% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 0.8% and 0.9% respectively in January. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.2%, and the 10-City and 20-City Composites both posted increases of 1.2% as well. In January, 19 of 20 cities reported increases before seasonal adjustment, and all 20 cities reported increases after seasonal adjustment.

“The strong price gains that we observed in the last half of 2020 continued into the first month of the new year. In January 2021, the National Composite Index rose by 11.2% compared to its year-ago levels,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “The trend of accelerating prices that began in June 2020 has now reached its eighth month and is also reflected in the 10- and 20-City Composites (up 10.9% and 11.1%, respectively). The market’s strength is broadly-based: all 20 cities rose, and all 20 cities gained more in the 12 months ended in January 2021 than they had gained in the 12 months ended in December 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.2% in January (SA) from December.

The Composite 20 index is up 1.2% (SA) in January.

The National index is 29% above the bubble peak (SA), and up 1.2% (SA) in January. The National index is up 75% from the post-bubble low set in December 2011 (SA).

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 10.9% compared to January 2020. The Composite 20 SA is up 11.1% year-over-year.

The National index SA is up 11.2% year-over-year.

Note: According to the data, prices increased in 20 cities month-over-month seasonally adjusted.

Price increases were above expectations. I'll have more later.

Monday, March 29, 2021

Tuesday: Case-Shiller House Prices

by Calculated Risk on 3/29/2021 09:00:00 PM

From Matthew Graham at Mortgage News Daily: MBS RECAP: New Week, New Weakness

The new week wasted very little time in reinforcing the realities of 2021. This is a rising rate environment until further notice and any rapid correction toward lower rates will take some serious motivation. ... [30 year fixed 3.37%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for January. The consensus is for a 10.7% year-over-year increase in the Comp 20 index.

• Also at 9:00 AM, FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

March 29 COVID-19 Vaccinations, New Cases, Hospitalizations

by Calculated Risk on 3/29/2021 08:20:00 PM

Note: I've been posting this data daily for over a year. I'll stop once 70% of the population over 18 has had at least one dose of vaccine, new cases are under 5,000 per day, and hospitalizations below 3,000.

According to the CDC, 145.8 million doses have been administered. 20.4% of the population over 18 is fully vaccinated, and 36.7% of the population over 18 has had at least one dose (94.7 million people have had at least one dose).

And check out COVID Act Now to see how each state is doing.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) 7 day average (line) of positive tests reported.

This data is from the CDC.

The second graph shows the number of people hospitalized.

This data is also from the CDC.

This data is also from the CDC.The CDC cautions that due to reporting delays, the area in grey will probably increase.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 4.96%"

by Calculated Risk on 3/29/2021 04:00:00 PM

Note: This is as of March 21st.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 4.96%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 9 basis points from 5.05% of servicers’ portfolio volume in the prior week to 4.96% as of March 21, 2021. According to MBA’s estimate, 2.5 million homeowners are in forbearance plans.

...

“The share of loans in forbearance decreased for the fourth straight week, dropping below 5 percent for the first time in a year. New forbearance requests remained at their lowest level since last March, and the pace of exits increased,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “More than 17 percent of borrowers in forbearance extensions have now exceeded the 12-month mark.”

Fratantoni added, “Many homeowners need this support, even as there are increasing signs that the pace of economic activity is picking up as the vaccine rollout continues. Those who have an ongoing hardship due to the pandemic and want to extend their forbearance beyond the 12-month point need to contact their servicer. Servicers cannot automatically extend forbearance terms without the borrower’s consent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat relative to the prior week at 0.05%, the lowest level since the week ending March 15, 2020."

Update: Framing Lumber Prices Up Sharply Year-over-year

by Calculated Risk on 3/29/2021 01:36:00 PM

Here is another monthly update on framing lumber prices.

This graph shows CME framing futures through Mar 29th.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Clearly there is another surge in demand for lumber.

Housing Inventory March 29th Update: At Record Lows

by Calculated Risk on 3/29/2021 10:49:00 AM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Dallas Fed: "Texas Manufacturing Activity Accelerates Sharply" in March

by Calculated Risk on 3/29/2021 10:43:00 AM

From the Dallas Fed: Texas Manufacturing Activity Accelerates Sharply

Texas factory activity expanded at a markedly faster pace in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, surged 28 points to 48.0, its highest reading in the survey’s 17-year history.This was the last of the regional Fed surveys for March.

Other measures of manufacturing activity also pointed to sharply faster growth this month. The new orders index rose 18 points to 30.5, and the growth rate of orders index rose 11 points to 22.7. The capacity utilization index rocketed from 16.5 to 46.1, an all-time high. The shipments index rose 17 points to 33.1.

Perceptions of broader business conditions improved markedly in March. The general business activity index posted another double-digit increase, rising 12 points to 28.9. The company outlook index shot up 15 points to 25.8, its highest reading since mid-2018. The outlook uncertainty index edged down to 5.5.

Labor market measures indicated robust growth in employment and work hours. The employment index came in at 18.8, up from 12.7 and well above average.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The ISM manufacturing index for March will be released on Thursday, April 1st. Based on these regional surveys, the ISM manufacturing index will likely increase from the February level (the consensus is for an increase to 61.2 from 60.8 in February).

Seven High Frequency Indicators for the Economy

by Calculated Risk on 3/29/2021 08:26:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of March 28th.

The seven day average is down 42.6% from the same week in 2019 (57.4% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - and TSA data has moved up in 2021.

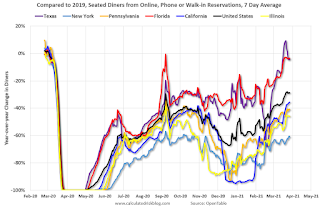

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 27, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, then slumped with the huge winter surge in cases. Dining is picking up again - and is close to 2019 in Texas and Florida.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $22 million last week, down about 88% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Even when occupancy increases to 2009 levels, hotels will still be hurting.

This data is through March 20th. Hotel occupancy is currently down 15.4% compared to same week in 2019). Note: Occupancy was up year-over-year, since occupancy declined sharply at the onset of the pandemic. However, occupancy is still be down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of March 19th, gasoline supplied was off about 5.6% (about 94.4% of the same week in 2019).

Gasoline supplied was up year-over-year, since at one point, gasoline supplied was off almost 50% YoY in 2020.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through March 27th for the United States and several selected cities.

This data is through March 27th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 62% of the January 2020 level. It is at 55% in Chicago, and 61% in Houston (the Houston dip was a weather related decline) - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. This data is through Friday, March 26th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, March 28, 2021

Sunday Night Futures

by Calculated Risk on 3/28/2021 07:50:00 PM

Weekend:

• Schedule for Week of March 28, 2021

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 futures are down 11 and DOW futures are down 57 (fair value).

Oil prices were mostly unchanged over the last week with WTI futures at $60.73 per barrel and Brent at $64.38 per barrel. A year ago, WTI was at $15, and Brent was at $22 - so WTI oil prices are UP sharply year-over-year (oil prices collapsed at the beginning of the pandemic).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.85 per gallon. A year ago prices were at $1.97 per gallon, so gasoline prices are up $0.88 per gallon year-over-year.