by Calculated Risk on 2/17/2021 07:18:00 PM

Wednesday, February 17, 2021

February 17 COVID-19 Test Results and Vaccinations

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 16th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 56.1 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.67 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.5 million tests per day over the last week. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,338,441 test results reported over the last 24 hours.

There were 66,089 positive tests.

Almost 48,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 7 days was 5.2%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are still above the previous peaks.

Lawler: Early Read on Existing Home Sales in January

by Calculated Risk on 2/17/2021 04:29:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.48 million in January, down 4.1% from December’s preliminary pace and up 19.6% from last January’s seasonally adjusted pace. Unadjusted sales should show a smaller YOY gain, reflecting this January’s lower business day count relative to last January’s.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY decline in the inventory of existing homes for sale was larger in January than in December, though what that means for the NAR inventory estimate is unclear. As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 13.7% from last January.

(Note that this month’s EHS report will include benchmark seasonal adjustment revisions.)

CR Note: The National Association of Realtors (NAR) is scheduled to release January existing home sales on Friday, February 19, 2021 at 10:00 AM ET. The consensus is for 6.60 million SAAR.

NY Fed Q4 Report: "Total Household Debt Increased in Q4 2020, Newly Originated Mortgages Reach Record High"

by Calculated Risk on 2/17/2021 11:19:00 AM

From the NY Fed: Total Household Debt Increased in Q4 2020, Newly Originated Mortgages Reach Record High

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows that total household debt increased by $206 billion (1.4%) to $14.56 trillion in the fourth quarter of 2020, driven in part by a steep increase in mortgage originations. The total debt balance is now $414 billion higher than the year prior.

...

Mortgage balances—the largest component of household debt—surpassed $10 trillion in the fourth quarter, increasing by $182 billion to $10.04 trillion at the end of December. While credit card balances increased by $12 billion over the quarter, they were $108 billion lower than they had been at the end of 2019, the largest year over year decline since the series began in 1999. This overall decline is consistent with continued weakness in consumer spending and revolving balance paydowns by card holders.

Auto and student loan balances increased by $14 billion and $9 billion, respectively. In total, non-housing balances (including credit card, auto loan, student loan, and other debts) increased by $37 billion during the fourth quarter but remained below end-2019 levels.

Newly originated mortgages reached a record high and auto loan originations reached their second highest quarterly volume since 2000. Mortgage originations, which include refinances, were at $1.2 trillion, surpassing in nominal terms the volumes seen during the historic refinance boom in 2003Q3. Auto loan originations, which includes both loans and leases, were down slightly from the record high seen in the third quarter but were at the second highest level for the series, at $162 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q4. Household debt previously peaked in 2008, and bottomed in Q3 2013.

From the NY Fed:

Aggregate household debt balances increased by $206 billion in the fourth quarter of 2020, a 1.4% rise from 2020Q3, and now stand at $14.56 trillion. Balances are $414 billion higher than at the end of 2019.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q4. From the NY Fed:

Aggregate delinquency rates have continued to decline in the fourth quarter and continuing what was seen in the second and third, reflecting an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. As of late December, 3.2% of outstanding debt was in some stage of delinquency, a 0.2 percentage point decrease from the third quarter, and 1.6 percentage points lower than the rate observed in the fourth quarter of 2019 and before the Covid pandemic hit the United States. Of the $462 billion of debt that is delinquent, $349 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders’ books but upon which they continue to attempt collection).There is much more in the report.

The uptake in forbearances continues to be visible in the delinquency transition rates for mortgages. The share of mortgages that transitioned to early delinquency ticked down to a low 0.4%, as the option to enter forbearance remained. Meanwhile, 54% of loans in early delinquency transitioned to current. Foreclosures remain on pause for most loans due to the CARES-provisioned moratorium, and the fourth quarter saw only 14,000 new foreclosure starts.

NAHB: Builder Confidence Increased to 84 in February

by Calculated Risk on 2/17/2021 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 84, up from 83 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence: High Demand Offsets Higher Costs – For Now

Strong buyer demand helped offset supply chain challenges and a surge in lumber prices as builder confidence in the market for newly built single-family homes inched up one point to 84 in February, according to the latest NAHB/Wells Fargo Housing Market Index (HMI).

Lumber prices have been steadily rising this year and hit a record high in mid-February, adding thousands of dollars to the cost of a new home and causing some builders to abruptly halt projects at a time when inventories are already at all-time lows.

However, demand conditions remain solid due to demographics, low mortgage rates and the suburban shift to lower cost markets, but we expect to see some cooling in growth rates for residential construction in 2021 due to cost factors, supply chain issues and regulatory risks.

...

The HMI index gauging current sales conditions held steady at 90, while the component measuring sales expectations in the next six months fell three points to 80. The gauge charting traffic of prospective buyers rose four points to 72.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose two points to 78, the Midwest fell one point to 81, the South dropped two points to 84 and the West posted a two-point loss to 93.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was slightly above the consensus forecast, and a very strong reading.

Housing and homebuilding have been one of the best performing sectors during the pandemic.

Industrial Production Increased 0.9 Percent in January

by Calculated Risk on 2/17/2021 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production increased 0.9 percent in January. Manufacturing output rose 1.0 percent, about the same as its average gain over the previous five months. Mining production advanced 2.3 percent, while the output of utilities declined 1.2 percent. At 107.2 percent of its 2012 average, total industrial production in January was 1.8 percent lower than its year-earlier level. Capacity utilization for the industrial sector increased 0.7 percentage point in January to 75.6 percent, a rate that is 4.0 percent below its long-run (1972–2020) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still below the level in February 2020.

Capacity utilization at 75.6% is 4.0% below the average from 1972 to 2019.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in January to 107.2. This is 1.9% below the February 2020 level.

The change in industrial production was above consensus expectations.

Retail Sales increased 5.3% in January

by Calculated Risk on 2/17/2021 08:37:00 AM

On a monthly basis, retail sales increased 5.3 percent from December to January (seasonally adjusted), and sales were up 7.4 percent from January 2020.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for January 2021, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $568.2 billion, an increase of 5.3 percent from the previous month, and 7.4 percent above January 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 5.4% in January.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 8.6% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 8.6% on a YoY basis.The increase in January was well above expectations, however sales in November and December were revised down, combined.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/17/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 12, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 51 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 15 percent higher than the same week one year ago.

“Expectations of faster economic growth and inflation continue to push Treasury yields and mortgage rates higher. Since hitting a survey low in December, the 30-year fixed rate has slowly risen, and last week climbed to its highest level since November 2020,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The uptick in rates has slightly dampened refinance activity, with MBA’s index falling for the second week in a row, and the overall share dipping below 70 percent for the first time since last October.”

Added Kan, “The housing market in early 2021 continues to be constrained by low inventory and higher prices. Conventional and government applications to buy a home declined last week, but purchase activity overall is still strong – up 15 percent from last year. The average purchase loan size hit another survey high at $412,200, partly due to a larger drop in FHA applications, which tend to have smaller-than average loan sizes.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 2.98 percent from 2.96 percent, with points increasing to 0.43 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been volatile recently depending on rates.

With near record low rates, the index remains up significantly from last year (but will be down year-over-year in early March - since rates fell sharply at the beginning of the pandemic).

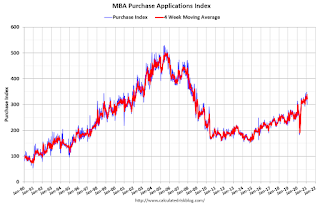

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, February 16, 2021

Wednesday: Retail Sales, PPI, Industrial Production, Homebuilder Survey, Q4 Report on Household Debt

by Calculated Risk on 2/16/2021 09:06:00 PM

From Matthew Graham at Mortgage News Daily: Rates Surge; Time To Adjust Your Mortgage Game Plan

Recovery prospects, renewed focus on stimulus, inflation concerns, a brighter covid outlook, etc... All of these are reasons for an ongoing, gradual trend toward higher rates in 2021 (i.e. general bond market weakness) but none of them really explain why the bond market had its worst day in months today specifically.Wednesday:

...

In outright terms, the average 30yr fixed rate is still under 3%, so the world (of low rates) is far from over. [30 year fixed 2.96%]

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for January is scheduled to be released. The consensus is for a 1.0% increase in retail sales.

• Also at 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.4% increase in PPI, and a 0.3% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 74.8%.

• At 10:00 AM, The February NAHB homebuilder survey. The consensus is for a reading of 83, unchanged from 83. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 11:00 AM, NY Fed: Q4 Quarterly Report on Household Debt and Credit

February 16 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/16/2021 07:20:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th. Heroes that filled a critical void! Quality government data will likely be available soon.

From Bloomberg on vaccinations as of Feb 16th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 56.1 million doses have been given, according to a state-by-state tally. In the last week, an average of 1.67 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.5 million tests per day over the last week. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,060,442 test results reported over the last 24 hours.

There were 56,312 positive tests.

Over 46,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

The percent positive over the last 24 hours was 5.3%. The percent positive is calculated by dividing positive results by total tests (including pending).

Both cases and hospitalizations have peaked, but are still above the previous peaks.

Portland Real Estate in January: Sales Up 11% YoY, Inventory Down 48% YoY

by Calculated Risk on 2/16/2021 04:57:00 PM

Note: I'm posting data for many local markets around the U.S. The story is the same everywhere ... inventory is at record lows.

For Portland, OR:

Closed sales in January 2021 were 1,847, up 11.1% from 1,663 in January 2020.

Active Listings in January 2021 were 1,922, down 48.3% from 3,715 in January 2020.

Months of Supply was 1.0 Months in January 2021, compared to 2.2 Months in January 2020.