by Calculated Risk on 1/20/2021 01:03:00 PM

Wednesday, January 20, 2021

AIA: "Architecture Billings continue to lose ground" in December

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings continue to lose ground

Demand for design services from U.S. architecture firms took a pointed dip last month, according to a new report from the American Institute of Architects (AIA).

The pace of decline during December accelerated from November, posting an Architecture Billings Index (ABI) score of 42.6 from 46.3 (any score below 50 indicates a decline in firm billings). Meanwhile, the pace of growth of inquiries into new projects remained flat from November to December with a score of 52.4, though the value of new design contracts stayed in negative territory with a score of 48.5.

“Since the national economic recovery appears to have stalled, architecture firms are entering 2021 facing a continued sluggish design market,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “However, the recently passed federal stimulus funding should help shore up the economy in the short-term, and hopefully by later this year there should be relief as COVID vaccinations become more widespread. Recent project inquiries from prospective and former clients have been positive, suggesting that new work may begin picking up as we move into the spring and summer months.”

...

• Regional averages: South (46.8); Midwest (43.6); West (43.4); Northeast (38.8)

• Sector index breakdown: mixed practice (48.0); commercial/industrial (47.2); multi-family residential (46.1); institutional (38.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 42.6 in December, down from 46.3 in November. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index has been below 50 for ten consecutive months. This represents a significant decrease in design services, and suggests a decline in CRE investment through most of 2021 (This usually leads CRE investment by 9 to 12 months).

This weakness is not surprising since certain segments of CRE are struggling, especially offices and retail.

LA Area Port Traffic: Strong Imports, Weak Exports in December

by Calculated Risk on 1/20/2021 11:51:00 AM

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

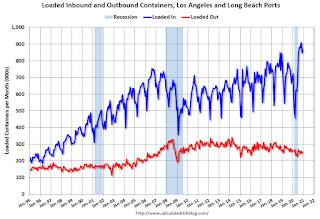

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.0% in December compared to the rolling 12 months ending in October. Outbound traffic was down 0.1% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were up 24% YoY in December, and exports were down 1% YoY.

NAHB: Builder Confidence Decreased to 83 in January

by Calculated Risk on 1/20/2021 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 83, down from 86 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Down on Rising Material Prices, Upsurge in COVID-19 Cases

Rising material costs led by a huge upsurge in lumber prices, along with a resurgence of the coronavirus across much of the nation, pushed builder confidence in the market for newly built single-family homes down three points to 83 in January, according to the latest NAHB/Wells Fargo Housing Market Index (HMI) released today. Despite the drop, builder sentiment remains at a strong level.

“Despite robust housing demand and low mortgage rates, buyers are facing a dearth of new homes on the market, which is exacerbating affordability problems,” said NAHB Chairman Chuck Fowke. “Builders are grappling with supply-side constraints related to lumber and other material costs, a lack of affordable lots and labor shortages that delay delivery times and put upward pressure on home prices. They are also concerned about a changing regulatory environment.”

“While housing continues to help lead the economy forward, limited inventory is constraining more robust growth,” said NAHB Chief Economist Robert Dietz. “A shortage of buildable lots is making it difficult to meet strong demand and rising material prices are far outpacing increases in home prices, which in turn is harming housing affordability.”

...

All three major HMI indices fell in January. The HMI index gauging current sales conditions dropped two points to 90, the component measuring sales expectations in the next six months fell two points to 83 and the gauge charting traffic of prospective buyers decreased five points to 68.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell six points to 76, the Midwest was up two points to 83, the South fell one point to 86 and the West posted a one-point loss to 95.

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast, but still a very strong reading..

Housing and homebuilding have been one of the best performing sectors during the pandemic.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 1/20/2021 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 15, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 87 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 15 percent higher than the same week one year ago.

“Mortgage rates increased across the board last week, with the 30-year fixed rate rising to 2.92 percent – its highest level since November 2020 – and the 15-year fixed rate increasing for the first time in seven weeks to 2.48 percent. Market expectations of a larger than anticipated fiscal relief package, which is expected to further boost economic growth and lower unemployment, have driven Treasury yields higher the last two weeks,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “After a post-holiday surge of refinances, higher rates chipped away at demand. There was a 5 percent drop in refinance activity, driven by a 13.5 percent pullback in government refinances.”

Added Kan, “Purchase applications remained strong based on current housing demand, rising over the week and up a noteworthy 15 percent from last year. Homebuyers in early 2021 continue to seek newer, larger homes. The average loan size for purchase loans jumped to $384,000, the second highest level in the survey.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 2.92 percent from 2.88 percent, with points increasing to 0.37 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year. Note that refinance activity really picked up in February 2020.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, January 19, 2021

Wednesday: Homebuilder Survey

by Calculated Risk on 1/19/2021 09:03:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 86, unchanged from 86 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

• During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

January 19 COVID-19 Test Results

by Calculated Risk on 1/19/2021 06:44:00 PM

The testing data is probably still light due to the holiday, but it is possible the 7-day average cases has peaked. Stay safe! I'm looking forward to not posting this data in a few months.

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,698,121 test results reported over the last 24 hours.

There were 144,047 positive tests.

Over 55,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.5% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.37%"

by Calculated Risk on 1/19/2021 04:00:00 PM

Note: This is as of January 10th.

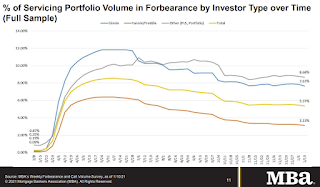

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.37%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased from 5.46% of servicers’ portfolio volume in the prior week to 5.37% as of January 10, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“The week of January 10th saw the largest – and only the second – decrease in the share of loans in forbearance in nine weeks, with declines across almost every tracked loan category,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The rate of exits from forbearance has picked up a bit over the past two weeks but remains much lower than what was seen in October and early November.”

Fratantoni added, “Job market data continue to indicate weakness, and that means many homeowners who remain unemployed will need ongoing relief in the form of forbearance. While new forbearance requests remain relatively low, the availability of relief remains a necessary support for many homeowners.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.07%."

Update Then and Now: With Column Excluding Pandemic

by Calculated Risk on 1/19/2021 03:01:00 PM

A few indicators comparing four years ago and today (and a column after three years - excluding the pandemic) ...

| Jan-17 | Jan-20 | Dec-20 | |

|---|---|---|---|

| Vehicle Sales1 | 16.7 | 16.9 | 16.4 |

| Employment change2 | 2,591 | 2,195 | -704 |

| Unemployment Rate3 | 4.7% | 3.5% | 6.7% |

| Participation Rate4 | 62.8% | 63.4% | 61.5% |

| Housing Starts5 | 1,056 | 1,262 | 1,278 |

| New Home Sales6 | 486 | 644 | 679 |

| Mortgage Delinquency Rate7 | 6.1% | 4.6% | 8.3% |

| GDP Growth8 | 2.3% | 2.5% | 1.0% |

| Budget Deficit9 | 3.2% | 4.6% | 16.0% |

| S&P 50010 | 2,269 | 3,317 | 3,800 |

| 1millions, SAAR (average previous 4 years, or 3 years for Jan 2020) 2Thousands (Average previous 4 years, or 3 years for Jan 2020) 3Most Recent Month 4Most Recent Month 5Thousands, SAAR (average previous 4 years, or 3 years for Jan 2020) 6Thousands, SAAR (average previous 4 years, or 3 years for Jan 2020) 7Annual GDP growth (over previous 4 years, or 3 years for Jan 2020). Q4 2020 estimated at 5.0% annual rate. 8Source: MBA, Quarterly including in-foreclosure (most recent quarter) 9Source: CBP: Annual, fiscal 2016, 2019, and 2020 10Jan 20, 2017, Jan 21, 2020 and Jan 19, 2021 | |||

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/19/2021 01:41:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 6.62 million in December, down 1.0% from November’s preliminary pace and up 19.7% from last December’s seasonally adjusted pace.

Local realtor reports, as well as reports from national inventory trackers, suggest that the YOY decline in the inventory of existing homes for sale was slightly greater in December than November, though what that means for the NAR inventory estimate is unclear. As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months.

Finally, local realtor/MLS reports suggest the median existing single-family home sales price last month was up by about 13% from last December.

CR Note: The National Association of Realtors (NAR) is scheduled to release December existing home sales on Friday, January 22, 2021 at 10:00 AM ET. The consensus is for 6.55 million SAAR.

Then and Now

by Calculated Risk on 1/19/2021 11:58:00 AM

A few indicators comparing four years ago and today ...

| Jan-17 | Dec-20 | |

|---|---|---|

| Vehicle Sales1 | 16.7 | 16.4 |

| Employment change2 | 10,364 | -2,818 |

| Unemployment Rate3 | 4.7% | 6.7% |

| Participation Rate4 | 62.8% | 61.5% |

| Housing Starts5 | 1,056 | 1,278 |

| New Home Sales6 | 486 | 679 |

| Mortgage Delinquency Rate7 | 6.1% | 8.3% |

| Budget Deficit8 | 3.2% | 16.0% |

| S&P 5009 | 2,269 | 3,790 |

| 1millions, SAAR (average previous 4 years) 2Thousands (over previous 4 years) 3Most Recent Month 4Most Recent Month 5Thousands, SAAR (average previous 4 years) 6Thousands, SAAR (average previous 4 years) 7Source: MBA, Quarterly including in-foreclosure (most recent quarter) 8Annual, fiscal 2016 vs. 2020 9Jan 20, 2017 vs Jan 19, 2021 | ||