by Calculated Risk on 1/19/2021 04:00:00 PM

Tuesday, January 19, 2021

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.37%"

Note: This is as of January 10th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.37%

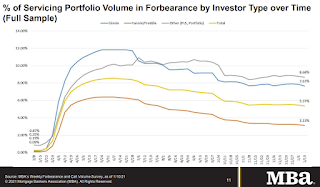

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased from 5.46% of servicers’ portfolio volume in the prior week to 5.37% as of January 10, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“The week of January 10th saw the largest – and only the second – decrease in the share of loans in forbearance in nine weeks, with declines across almost every tracked loan category,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The rate of exits from forbearance has picked up a bit over the past two weeks but remains much lower than what was seen in October and early November.”

Fratantoni added, “Job market data continue to indicate weakness, and that means many homeowners who remain unemployed will need ongoing relief in the form of forbearance. While new forbearance requests remain relatively low, the availability of relief remains a necessary support for many homeowners.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same relative to the prior week at 0.07%."