by Calculated Risk on 12/01/2020 12:57:00 PM

Tuesday, December 01, 2020

Update: Framing Lumber Prices Up 50% Year-over-year

Here is another monthly update on framing lumber prices.

This graph shows CME framing futures through Nov 30th.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

Clearly there was a surge in demand for lumber mid-year - then the mills started catching up - but demand remains strong.

Construction Spending Increased 1.3% in October

by Calculated Risk on 12/01/2020 10:38:00 AM

From the Census Bureau reported that overall construction spending decreased in June:

Construction spending during October 2020 was estimated at a seasonally adjusted annual rate of $1,438.5 billion, 1.3 percent above the revised September estimate of $1,420.4 billion. The October figure is 3.7 percent above the October 2019 estimate of $1,386.8 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,093.7 billion, 1.4 percent above the revised September estimate of $1,078.9 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $344.8 billion, 1.0 percent above the revised September estimate of $341.4 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 6% below the previous peak.

Non-residential spending is 10% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 6% above the previous peak in March 2009, and 32% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 14.5%. Non-residential spending is down 8.2% year-over-year. Public spending is up 3.7% year-over-year.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential, and public spending (depending on disaster relief), will be under pressure. For example, lodging is down 23% YoY, multi-retail down 19% YoY, and office down 8% YoY.

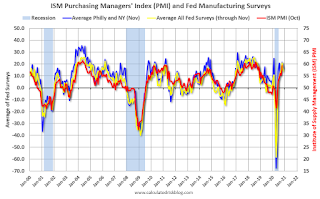

ISM Manufacturing index Decreased to 57.5 in November

by Calculated Risk on 12/01/2020 10:07:00 AM

The ISM manufacturing index indicated expansion in November. The PMI was at 57.5% in November, down from 59.3% in October. The employment index was at 48.4%, down from 53.2% last month, and the new orders index was at 65.1%, down from 67.9%.

From ISM: Manufacturing PMI® at 57.5%; November 2020 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector grew in November, with the overall economy notching a seventh consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This was at expectations, however the employment index moved below 50 (contraction).

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

"The November Manufacturing PMI® registered 57.5 percent, down 1.8 percentage points from the October reading of 59.3 percent. This figure indicates expansion in the overall economy for the seventh month in a row after a contraction in April, which ended a period of 131 consecutive months of growth. The New Orders Index registered 65.1 percent, down 2.8 percentage points from the October reading of 67.9 percent. The Production Index registered 60.8 percent, a decrease of 2.2 percentage points compared to the October reading of 63 percent. The Backlog of Orders Index registered 56.9 percent, 1.2 percentage points higher compared to the October reading of 55.7 percent. The Employment Index returned to contraction territory at 48.4 percent, 4.8 percentage points down from the October reading of 53.2 percent. The Supplier Deliveries Index registered 61.7 percent, up 1.2 percentage points from the October figure of 60.5 percent. The Inventories Index registered 51.2 percent, 0.7 percentage point lower than the October reading of 51.9 percent. The Prices Index registered 65.4 percent, down 0.1 percentage point compared to the October reading of 65.5 percent. The New Export Orders Index registered 57.8 percent, an increase of 2.1 percentage points compared to the October reading of 55.7 percent. The Imports Index registered 55.1 percent, a 3-percentage point decrease from the October reading of 58.1 percent."

emphasis added

This suggests manufacturing expanded at a slower pace in November than in October.

CoreLogic: House Prices up 7.3% Year-over-year in October

by Calculated Risk on 12/01/2020 08:00:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Gaining Momentum: Annual U.S. Home Prices Appreciated 7.3% in October, CoreLogic Reports

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2020. Nationally, home prices increased 7.3% in October 2020, compared with October 2019, marking the fastest annual appreciation since April 2014. On a month-over-month basis, home prices increased by 1.1% compared to September 2020.

...

Home prices climbed in recent months due to heightened demand and ongoing home supply constraints. The supply shortage could further intensify as COVID-19 cases continue to rise and would-be sellers remain hesitant about putting their homes on the market. However, to keep up with the rising demand, new home construction surged in October and builder confidence reached a new high for the third consecutive month. The decreased pressure on supply could moderate home price growth over the next year. This is reflected in the CoreLogic HPI Forecast, which shows home prices slowing to 1.9% by October 2021. However, should the economic recovery from the pandemic be more robust, then we would expect projections for home price performance to improve.

“Home buyers have been spurred by record-low mortgage rates and an urgency to buy or upgrade to more space, especially as much of the American workforce continues to work from home,” said Frank Martell, president and CEO of CoreLogic. “First-time buyers in particular should remain a big part of next year’s home purchases, as the largest wave of millennials is heading into prime home-buying years.”

“The pandemic has shifted home buyer interest toward detached rather than attached homes,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Detached homes offer more living space and are typically located in less densely populated neighborhoods. And while prices of single-family detached homes posted an annual increase of 7.9% in October, the price of attached homes rose only 4.5% year over year.”

emphasis added

Monday, November 30, 2020

Tuesday: ISM Manufacturing, Construction Spending, Fed Chair Powell Testimony

by Calculated Risk on 11/30/2020 09:46:00 PM

Tuesday:

• At 10:00 AM ET, ISM Manufacturing Index for November. The consensus is for 57.5%, down from 59.3%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

• Also at 10:00 AM, Testimony, Fed Chair Jerome Powell, Coronavirus Aid, Relief, and Economic Security Act, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

• All day, Light vehicle sales for November. The consensus is for 16.2 million SAAR in November, unchanged from the BEA estimate of 16.2 million SAAR in October (Seasonally Adjusted Annual Rate).

November 30 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/30/2020 07:45:00 PM

Note: The data has been distorted over the holiday weekend.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,365,100 test results reported over the last 24 hours.

There were 147,074 positive tests.

Almost 37,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.7% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• Record Hospitalizations (Almost 100,000)

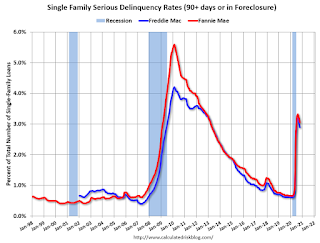

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in October

by Calculated Risk on 11/30/2020 04:08:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 3.05% in October, from 3.20% in September. The serious delinquency rate is up from 0.67% in October 2019.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.82% are seriously delinquent (up from 5.81% in September). For loans made in 2005 through 2008 (3% of portfolio), 9.84% are seriously delinquent (unchanged from 9.84%), For recent loans, originated in 2009 through 2018 (95% of portfolio), 2.57% are seriously delinquent (down from 2.74%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

Las Vegas Visitor Authority: No Convention Attendance, Visitor Traffic Down 49% YoY in October

by Calculated Risk on 11/30/2020 02:11:00 PM

From the Las Vegas Visitor Authority: October 2020 Las Vegas Visitor Statistics

Visitor volume continued to ramp‐up in October as the destination hosted approx. 1.86M visitors, about half of last October's tally but up 9% from last month.Here is the data from the Las Vegas Convention and Visitors Authority.

With continued hotel re‐openings at the end of Sep and in early Oct, the room tally of open properties in October represented 140,658 rooms. Total occupancy was 46.9% for the month as weekend occupancy reached 64.2% and midweek occupancy reached 38.6%.

Average daily rates among open properties reached $104.54 (‐3.3% MoM, ‐22.8% YoY) while RevPAR came in at roughly $49, down ‐59.7% vs. last October.

* Reflects weighted average of daily room tallies

Click on graph for larger image.

Click on graph for larger image. The blue and red bars are monthly visitor traffic (left scale) for 2019 and 2020. The dashed blue and orange lines are convention attendance (right scale).

Convention traffic in October was down 100% compared to October 2019.

And visitor traffic was down 49% YoY.

The casinos started to reopen on June 4th (it appears about 94% of rooms have now opened).

Dallas Fed: "Texas Manufacturing Expansion Moderates" in November

by Calculated Risk on 11/30/2020 10:41:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Moderates

Texas factory activity expanded in November for the sixth consecutive month, though at a markedly slower pace, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 25.5 to 7.2, indicating a deceleration in output growth.This was the last of the regional Fed surveys for November.

Other measures of manufacturing activity also point to slower growth this month, as the indexes remained positive but came in below last month’s readings. The new orders index dropped 13 points to 7.2, and the growth rate of orders index fell five points to 9.7. The capacity utilization index dropped from 23.0 to 6.9, and the shipments index fell from 21.9 to 13.7.

Perceptions of broader business conditions continued to improve in November, though the indexes retreated from their October levels. The general business activity index remained positive but fell from 19.8 to 12.0. Similarly, the company outlook index fell from 17.8 to 11.0. Uncertainty regarding companies’ outlooks continued to rise, though the index declined from 11.0 to 7.2.

Labor market measures indicated stronger growth in employment and work hours. The employment index ticked up three points to 11.7, suggesting a slight pickup in hiring. Twenty-five percent of firms noted net hiring, while 13 percent noted net layoffs. The hours worked index moved up from 3.7 to 9.7.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM manufacturing index for November will be released tomorrow, December 1st. Based on these regional surveys, the ISM manufacturing index will likely decrease in November from the October level. The consensus is for a reading of 57.5%, down from 59.3%.

Note that these are diffusion indexes, so readings above 0 (or 50 for the ISM) means activity is increasing (it does not mean that activity is back to pre-crisis levels).

NAR: Pending Home Sales Decrease 1.1% in October

by Calculated Risk on 11/30/2020 10:02:00 AM

From the NAR: Pending Home Sales Dip 1.1% in October

Pending home sales fell slightly in October, according to the National Association of Realtors. Contract activity was mixed among the four major U.S. regions, with the only positive month-over-month growth happening in the South, although each region achieved year-over-year gains in pending home sales transactions.This was below expectations for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 1.1% to 128.9 in October, the second straight month of decline. Year-over-year, contract signings rose 20.2%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI slid 5.9% to 112.3 in October, a 18.5% increase from a year ago. In the Midwest, the index fell 0.7% to 119.6 last month, up 19.6% from October 2019.

Pending home sales in the South increased 0.1% to an index of 151.1 in October, up 21.0% from October 2019. The index in the West remained the same in October, at 116.8, which is up 20.8% from a year ago.

emphasis added