by Calculated Risk on 11/30/2020 10:41:00 AM

Monday, November 30, 2020

Dallas Fed: "Texas Manufacturing Expansion Moderates" in November

From the Dallas Fed: Texas Manufacturing Expansion Moderates

Texas factory activity expanded in November for the sixth consecutive month, though at a markedly slower pace, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 25.5 to 7.2, indicating a deceleration in output growth.This was the last of the regional Fed surveys for November.

Other measures of manufacturing activity also point to slower growth this month, as the indexes remained positive but came in below last month’s readings. The new orders index dropped 13 points to 7.2, and the growth rate of orders index fell five points to 9.7. The capacity utilization index dropped from 23.0 to 6.9, and the shipments index fell from 21.9 to 13.7.

Perceptions of broader business conditions continued to improve in November, though the indexes retreated from their October levels. The general business activity index remained positive but fell from 19.8 to 12.0. Similarly, the company outlook index fell from 17.8 to 11.0. Uncertainty regarding companies’ outlooks continued to rise, though the index declined from 11.0 to 7.2.

Labor market measures indicated stronger growth in employment and work hours. The employment index ticked up three points to 11.7, suggesting a slight pickup in hiring. Twenty-five percent of firms noted net hiring, while 13 percent noted net layoffs. The hours worked index moved up from 3.7 to 9.7.

emphasis added

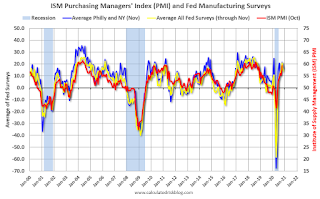

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM manufacturing index for November will be released tomorrow, December 1st. Based on these regional surveys, the ISM manufacturing index will likely decrease in November from the October level. The consensus is for a reading of 57.5%, down from 59.3%.

Note that these are diffusion indexes, so readings above 0 (or 50 for the ISM) means activity is increasing (it does not mean that activity is back to pre-crisis levels).