by Calculated Risk on 11/25/2020 02:05:00 PM

Wednesday, November 25, 2020

FOMC Minutes: "Concerned about the possibility of a further resurgence of the virus that could undermine the recovery"

From the Fed: Minutes of the Federal Open Market Committee, November 4-5, 2020. A few excerpts:

Participants continued to see the uncertainty surrounding the economic outlook as quite elevated, with the path of the economy highly dependent on the course of the virus; on how individuals, businesses, and public officials responded to it; and on the effectiveness of public health measures to address it. Participants cited several downside risks that could threaten the recovery. While another broad economic shutdown was seen as unlikely, participants remained concerned about the possibility of a further resurgence of the virus that could undermine the recovery. The majority of participants also saw the risk that current and expected fiscal support for households, businesses, and state and local governments might not be sufficient to sustain activity levels in those sectors, while a few participants noted that additional fiscal stimulus that was larger than anticipated could be an upside risk. Some participants commented that the recent surge in virus cases in Europe and the reimposition of restrictions there could lead to a slowdown in economic activity in the euro area and have negative spillover effects on the U.S. recovery. Some participants raised concerns regarding the longer-run effects of the pandemic, including sectoral restructurings that could slow employment growth or an acceleration of technological disruptions that could be limiting the pricing power of some firms.

emphasis added

A few Comments on October New Home Sales

by Calculated Risk on 11/25/2020 01:14:00 PM

New home sales for October were reported at 999,000 on a seasonally adjusted annual rate basis (SAAR). Sales for the previous three months were revised up.

This was above consensus expectations of 975,000, and was the third highest sales rate since 2006 (behind August and September - that were both revised up). Clearly low mortgages rates, low existing home supply, and low sales in March and April (due to the pandemic) have led to a strong increase in sales. Favorable demographics (something I wrote about many times over the last decade) and a surging stock market have probably helped new home sales too.

Earlier: New Home Sales at 999,000 Annual Rate in October.

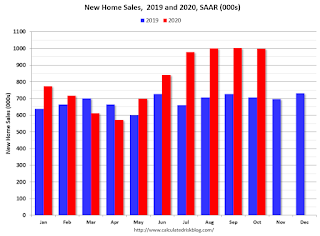

This graph shows new home sales for 2019 and 2020 by month (Seasonally Adjusted Annual Rate).

New home sales were up 41.5% year-over-year (YoY) in October. Year-to-date (YTD) sales are up 20.6% (This is even above my optimistic forecast for 2020!).

And on inventory: since new home sales are reported when the contract is signed - even if the home hasn't been started - new home sales are not limited by inventory (except if no lots are available). Inventory for new home sales is important in that it means there will be more housing starts if inventory is low (like right now) - and fewer starts if inventory is too high (not now).

Personal Income decreased 0.7% in October, Spending increased 0.5%

by Calculated Risk on 11/25/2020 10:24:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income decreased $130.1 billion (0.7 percent) in October according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $134.8 billion (0.8 percent) and personal consumption expenditures (PCE) increased $70.9 billion (0.5 percent).The October PCE price index increased 1.2 percent year-over-year and the October PCE price index, excluding food and energy, increased 1.4 percent year-over-year.

Real DPI decreased 0.8 percent in October and Real PCE increased 0.5 percent. The PCE price index was unchanged from September. The PCE price index excluding food and energy was also unchanged.

emphasis added

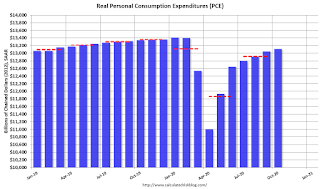

The following graph shows real Personal Consumption Expenditures (PCE) through October 2020 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was much lower than expected, and the increase in PCE was above expectations.

New Home Sales at 999,000 Annual Rate in October

by Calculated Risk on 11/25/2020 10:12:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 999 thousand.

The previous three months were revised up.

Sales of new single-family houses in October 2020 were at a seasonally adjusted annual rate of 999,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.3 percent below the revised September rate of 1,002,000, but is 41.5 percent above the October 2019 estimate of 706,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

This is the third highest sales rate since 2006 (just below the last two months).

The second graph shows New Home Months of Supply.

The months of supply was unchanged in October at 3.3 months from 3.3 months in September.

The months of supply was unchanged in October at 3.3 months from 3.3 months in September. The all time record high was 12.1 months of supply in January 2009. The all time record low is 3.3 months in September and October 2020.

This is below the normal range (about 4 to 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of September was 284,000. This represents a supply of 3.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is low, and the combined total of completed and under construction is lower than normal.

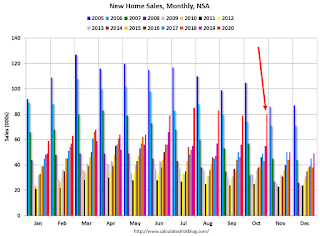

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2020 (red column), 80 thousand new homes were sold (NSA). Last year, 55 thousand homes were sold in October.

The all time high for October was 105 thousand in 2005, and the all time low for October was 23 thousand in 2010.

This was slightly above expectations and sales in the three previous months were revised up. I'll have more later today.

Q3 GDP Growth Unchanged at 33.1% Annual Rate

by Calculated Risk on 11/25/2020 08:44:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2020 (Second Estimate); Corporate Profits, Third Quarter 2020 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 33.1 percent in the third quarter of 2020, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 31.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down slightly to 40.6% from 40.7%. Residential investment was revised up from 59.3% to 62.3%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month that also showed an increase in real GDP of 33.1 percent. With the second estimate, upward revisions to nonresidential fixed investment, residential investment, and exports were offset by downward revisions to state and local government spending, private inventory investment, and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, were revised up

emphasis added

Weekly Initial Unemployment Claims increased to 778,000

by Calculated Risk on 11/25/2020 08:38:00 AM

The DOL reported:

In the week ending November 21, the advance figure for seasonally adjusted initial claims was 778,000, an increase of 30,000 from the previous week's revised level. The previous week's level was revised up by 6,000 from 742,000 to 748,000. The 4-week moving average was 748,500, an increase of 5,000 from the previous week's revised average. The previous week's average was revised up by 1,500 from 742,000 to 743,500.This does not include the 311,675 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 319,694 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 748,500.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 6,037,690 (SA) from 6,452,002 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,147,753 receiving Pandemic Unemployment Assistance (PUA) that increased from 8,681,647 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

This was worse than expected.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 11/25/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 20, 2020.

... The Refinance Index increased 5 percent from the previous week and was 79 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 19 percent higher than the same week one year ago.

“30-year fixed mortgage rates dropped seven basis points to 2.92 percent, another record low in MBA’s survey. Weekly mortgage rate volatility has emerged again, as markets respond to fiscal policy uncertainty and a resurgence in COVID-19 cases around the country. The decline in rates ignited borrower interest, with applications for both home purchases and refinancing increasing on a weekly and annual basis,” said Joel Kan, MBA’s Associate Vice President of Industry and Economic Forecasting. “The ongoing refinance wave has continued into November. Both the refinance index and the share of refinance applications were at their highest levels since April, as another week of lower rates drew more convntional loan borrowers into the market.”

Added Kan, “Amidst strong competition for a limited supply of homes for sale, as well as rapidly increasing home prices, purchase applications increased for both conventional and government borrowers. Furthermore, purchase activity has surpassed year-ago levels for over six months.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to a survey low of 2.92 percent from 2.99 percent, with points decreasing to 0.35 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 19% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, November 24, 2020

Wednesday: New Home Sales, GDP, Unemployment Claims, Personal Income & Outlays, FOMC Minutes and More

by Calculated Risk on 11/24/2020 09:40:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 710 thousand from 742 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 3nd quarter 2020 (Second estimate). The consensus is that real GDP increased 33.1% annualized in Q3, unchanged from the advance estimate of GDP.

• Also at 8:30 AM, Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.9% increase in durable goods orders.

• At 10:00 AM, Personal Income and Outlays for October. The consensus is for a 0.1% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• Also at 10:00 AM, New Home Sales for October from the Census Bureau. The consensus is for 975 thousand SAAR, up from 959 thousand in September.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for November). The consensus is for a reading of 77.0.

• At 2:00 PM, FOMC Minutes, Meeting of November 4-5, 2020

November 24 COVID-19 Test Results; Record Hospitalizations, Deaths Increasing

by Calculated Risk on 11/24/2020 07:11:00 PM

Note: Week-over-week case growth has slowed, and will probably show a decline over the holiday weekend. However, it is likely that cases will pickup again the following week. Stay Safe!!!

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,519,223 test results reported over the last 24 hours.

There were 166,672 positive tests.

Over 28,500 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.0% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in October

by Calculated Risk on 11/24/2020 05:08:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in October was 2.89%, down from 3.04% in September. Freddie's rate is up from 0.61% in October 2019.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Note: Fannie Mae will report for October soon.