by Calculated Risk on 11/24/2020 12:37:00 PM

Tuesday, November 24, 2020

Real House Prices and Price-to-Rent Ratio in September

Here is the post earlier on Case-Shiller: Case-Shiller: National House Price Index increased 7.0% year-over-year in September

It has been over fourteen years since the bubble peak. In the Case-Shiller release today, the seasonally adjusted National Index (SA), was reported as being 22.2% above the previous bubble peak. However, in real terms, the National index (SA) is still about 2% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 10% below the bubble peak.

The year-over-year growth in prices increased to 7.0% nationally.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $291,000 today adjusted for inflation (45%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

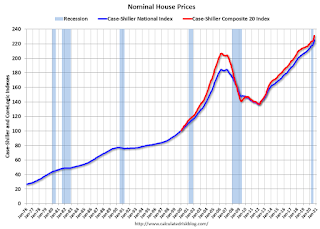

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to November 2005 levels, and the Composite 20 index is back to January 2005.

In real terms, house prices are at 2005 levels.

Note that inflation was negative for a few months earlier this year, and that boosted real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving mostly sideways, but picked up recently.

On a price-to-rent basis, the Case-Shiller National index is back to July 2004 levels, and the Composite 20 index is back to January 2004 levels.

In real terms, prices are back to 2005 levels, and the price-to-rent ratio is back to 2004.

Note: November Employment Report Will Show a Decrease of 93,000 Temporary Census Workers

by Calculated Risk on 11/24/2020 11:09:00 AM

The Census Bureau released an update today on 2020 Census Paid Temporary Workers

As of the October reference week, October 11th - 17th, there were 99,490 decennial Census temporary workers.

As of the November reference week, November 8th - 14th, there were 6,464 temp workers.

That is a decrease of 93,026 temporary jobs.

In August, the employment report showed a gain of 238,000 temporary 2020 Census workers, boosting the headline number.

In September, the employment report showed a decrease of 41,000 temporary 2020 Census workers, reducing the headline number.

In October, the employment report showed a decrease of 147,311 temporary Census employment.

Case-Shiller: National House Price Index increased 7.0% year-over-year in September

by Calculated Risk on 11/24/2020 09:11:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P CoreLogic Case-Shiller Index Shows Annual Home Price Gains Soared to 7% in September

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 7.0% annual gain in September, up from 5.8% in the previous month. The 10-City Composite annual increase came in at 6.2%, up from 4.9% in the previous month. The 20-City Composite posted a 6.6% year-over-year gain, up from 5.3% in the previous month.

Phoenix, Seattle and San Diego continued to report the highest year-over-year gains among the 19 cities (excluding Detroit) in September. Phoenix led the way with an 11.4% year-over-year price increase, followed by Seattle with a 10.1% increase and San Diego with a 9.5% increase. All 19 cities reported higher price increases in the year ending September 2020 versus the year ending August 2020.

...

The National Index posted a 1.2% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 1.3% and 1.2% respectively, before seasonal adjustment in September. After seasonal adjustment, the National Index posted a month-over-month increase of 1.4%, while the 10-City and 20-City Composites both posted increases of 1.2% and 1.3% respectively. In September, all 19 cities (excluding Detroit) reported increases before seasonal adjustment, and after seasonal adjustment.

Housing prices were notably – I am tempted to say ‘very’ – strong in September,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index gained 7.0% relative to its level a year ago, well ahead of August’s 5.8% increase. The 10- and 20-City Composites (up 6.2% and 6.6%, respectively) also rose at an accelerating pace in September. The strength of the housing market was consistent nationally – all 19 cities for which we have September data rose, and all 19 gained more in the 12 months ended in September than they had done in the 12 months ended in August.

“A trend of accelerating increases in the National Composite Index began in August 2019 but was interrupted in May and June, as COVID-related restrictions produced modestly-decelerating price gains. Our three monthly readings since June of this year have all shown accelerating growth in home prices, and September’s results are quite strong. The last time that the National Composite matched September’s 7.0% growth rate was more than six years ago, in May 2014. This month’s increase may reflect a catch-up of COVID-depressed demand from earlier this year; it might also presage future strength, as COVID encourages potential buyers to move from urban apartments to suburban homes. The next several months’ reports should help to shed light on this question.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.3% in September (SA) from August.

The Composite 20 index is up 1.3% (SA) in September.

The National index is 22.2% above the bubble peak (SA), and up 1.4% (SA) in September. The National index is up 65% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.2% compared to September 2019. The Composite 20 SA is up 6.6% year-over-year.

The National index SA is up 7.0% year-over-year.

Note: According to the data, prices increased in 19 cities month-over-month seasonally adjusted.

Price increases were above expectations. I'll have more later.

Monday, November 23, 2020

Tuesday: Case-Shiller House Prices

by Calculated Risk on 11/23/2020 09:48:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for September. The consensus is for a 5.8% year-over-year increase in the National index for September.

• Also at 9:00 AM, FHFA House Price Index for September. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for November.

November 23 COVID-19 Test Results; Record Hospitalizations

by Calculated Risk on 11/23/2020 07:30:00 PM

Note: Week-over-week case growth is slowing, so maybe cases per day will peak soon (A virtual Thanksgiving is recommended by the CDC). Stay Safe!!!

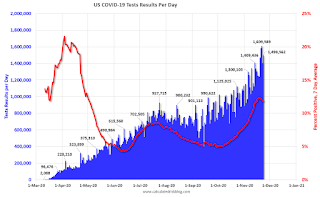

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,498,562 test results reported over the last 24 hours.

There were 150,975 positive tests.

Over 26,500 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.1% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

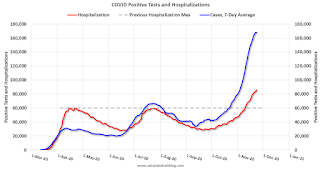

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

• 7-day average cases are at a new record.

• 7-day average deaths at highest level since May.

• Record Hospitalizations.

November Vehicle Sales Forecast: "Second Straight Month-to-Month Decline"

by Calculated Risk on 11/23/2020 05:50:00 PM

From Wards: November U.S. Light-Vehicle Sales Forecast for Second Straight Month-to-Month Decline (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for November (Red).

Sales have bounced back from the April low, but will likely be down around 7% year-over-year in November.

The Wards forecast of 15.7 million SAAR, would be down about 3% from October.

This would put sales in 2020, through November, down about 16% compared to the same period in 2019.

MBA Survey: "Share of Mortgage Loans in Forbearance Increases Slightly to 5.48%"

by Calculated Risk on 11/23/2020 04:00:00 PM

Note: This is as of November 15th.

From the MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.48%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased from 5.47% of servicers’ portfolio volume in the prior week to 5.48% as of November 15, 2020. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

“A marked slowdown in forbearance exits, as well as a slight rise in the share of Ginnie Mae, portfolio, and PLS loans in forbearance, led to an overall increase for the first time since early June. The decline in exits in the prior week follows a flurry of them last month, when many borrowers reached the six-month point in their forbearance terms,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The share of GSE loans in forbearance continued its downward trend and have now declined every week for six straight months.”

Added Fratantoni, “Incoming housing market data remain quite strong, with existing-home sales in October reaching their fastest pace since 2005, and the inventory of homes on the market hitting a record low. However, renewed weakness in the latest job market data indicate that many homeowners are continuing to experience severe hardships due to the pandemic and still need the support that forbearance provides.”

...

By stage, 21.32% of total loans in forbearance are in the initial forbearance plan stage, while 76.76% are in a forbearance extension. The remaining 1.92% are forbearance re-entries.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has been trending down for the last few months.

The MBA notes: "Weekly forbearance requests as a percent of servicing portfolio volume (#) increased to 0.09 percent from 0.08 percent the previous week."

There wsan't a pickup in forbearance activity related to the end of the extra unemployment benefits.

Chicago Fed National Activity "Index Suggests Economic Growth Increased in October"

by Calculated Risk on 11/23/2020 01:09:00 PM

Note: This is a composite index of other data.

From the Chicago Fed: Index Suggests Economic Growth Increased in October

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.83 in October from +0.32 in September. Three of the four broad categories of indicators used to construct the index made positive contributions in October, and three of the four categories increased from September. The index’s three-month moving average, CFNAI-MA3, fell to +0.75 in October from +1.37 in September.This graph from the Chicago Fed shows the Chicago Fed National Activity Index by category.

emphasis added

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Black Knight: National Mortgage Delinquency Rate Decreased in October

by Calculated Risk on 11/23/2020 09:47:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Mortgage Delinquencies Decline for Fifth Consecutive Month in October; Record-Low Rates Push Prepayment Activity to 16-Year High

• Mortgage delinquencies improved again in October, falling to 6.44%, the lowest level since MarchAccording to Black Knight's First Look report, the percent of loans delinquent decreased 3.3% in October compared to September, and increased 90% year-over-year.

• Despite five consecutive months of improvement, there are still more than 3.4 million delinquent mortgages, nearly twice as many as there were entering the year

• Serious delinquencies – loans 90 or more days past due – improved in October as well, but volumes remain at more than five times (+1.8 million) pre-pandemic levels

• October’s 4,700 foreclosure starts marked a nearly 90% year-over-year reduction as widespread moratoriums remain in place, while active foreclosure inventory set yet another record low at 178,000

• Record-low interest rates again pushed prepayment activity higher, with October’s prepayment rate of 3.17% setting the highest single-month mark in more than 16 years

emphasis added

The percent of loans in the foreclosure process decreased 1.6% in October and were down 31% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 6.44% in October, down from 6.66% in September.

The percent of loans in the foreclosure process decreased in October to 0.33%, from 0.34% in September.

The number of delinquent properties, but not in foreclosure, is up 1,651,000 properties year-over-year, and the number of properties in the foreclosure process is down 77,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2020 | Sept 2020 | Oct 2019 | Oct 2018 | |

| Delinquent | 6.44% | 6.66% | 3.39% | 3.64% |

| In Foreclosure | 0.33% | 0.34% | 0.48% | 0.52% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 3,437,000 | 3,542,000 | 1,786,000 | 1,884,000 |

| Number of properties in foreclosure pre-sale inventory: | 178,000 | 181,000 | 255,000 | 267,000 |

| Total Properties | 3,616,000 | 3,722,000 | 2,041,000 | 2,152,000 |

Seven High Frequency Indicators for the Economy

by Calculated Risk on 11/23/2020 08:50:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of Nov 22nd.

The seven day average is down 60% from last year (40% of last year).

There has been a slow increase from the bottom, and appears to have increased for the Thanksgiving week holiday.

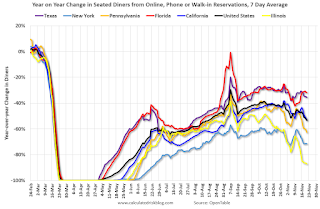

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through November 21, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York - and only down slightly in the southern states.

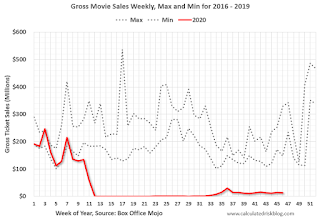

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through November 19th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Data is from BoxOfficeMojo through November 19th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales have picked up slightly over the last couple of months, and were at $13 million last week (compared to usually around $250 million per week during the Thanksgiving blockbuster period).

Some movie theaters have reopened (probably with limited seating).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - prior to 2020).

This data is through November 14th. Hotel occupancy is currently down 32.7% year-over-year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Since there is a seasonal pattern to the occupancy rate, we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

| Week Ending | YoY Change, Occupancy Rate |

|---|---|

| 9/19 | -31.9% |

| 9/26 | -31.5% |

| 10/3 | -29.6% |

| 10/10 | -29.2% |

| 10/17 | -30.7% |

| 10/24 | -31.7% |

| 10/31 | -29.0% |

| 11/7 | -35.9% |

| 11/14 | -32.7% |

This suggests no improvement over the last 9 weeks, and occupancy might be getting worse.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week last year of .At one point, gasoline supplied was off almost 50% YoY.

As of November 13th, gasoline supplied was off about 10.2% YoY (about 89.8% of last year).

Note: People driving instead of flying might have boosted gasoline consumption.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through November 21st for the United States and several selected cities.

This data is through November 21st for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 50% of the January level. It is at 36% in Chicago, and 54% in Houston - and declining recently.

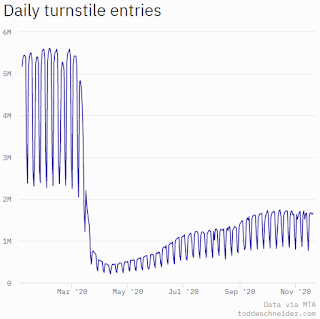

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data for this year.

This graph is from Todd W Schneider. This is daily data for this year.This data is through Friday, November 20th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".