by Calculated Risk on 1/25/2020 08:11:00 AM

Saturday, January 25, 2020

Schedule for Week of January 26, 2020

The key reports scheduled for this week are the advance estimate of Q4 GDP and December New Home sales. Other key indicators include December Personal Income and Outlays and November Case-Shiller house prices.

For manufacturing, the Dallas and Richmond Fed manufacturing surveys will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is for 730 thousand SAAR, up from 719 thousand in November.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January.

8:30 AM: Durable Goods Orders for December. The consensus is for a 0.5% increase in durable goods.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.This graph shows the Year over year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.4% year-over-year increase in the Comp 20 index for December.

10:30 AM: Richmond Fed Survey of Manufacturing Activity for January. This is the last of regional manufacturing surveys for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.5% increase in the index.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 211,000 last week.

8:30 AM: Gross Domestic Product, 4th quarter 2019 (Advance estimate). The consensus is that real GDP increased 2.1% annualized in Q4, the same as in Q3.

10:00 AM: the Q4 2019 Housing Vacancies and Homeownership from the Census Bureau.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 48.5, up from 48.2 in December.

10:00 AM: University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 99.1.

Friday, January 24, 2020

Q4 GDP Forecasts: 1.2% to 2.2%

by Calculated Risk on 1/24/2020 12:49:00 PM

The preliminary estimate of Q4 GDP will be released on Thursday, January 30th. The consensus is that annualized real GDP increased 2.2% in Q4.

From Merrill Lynch

We expect GDP growth in 4Q to hold steady at 2.0% qoq saar. [Jan 24 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.2% for 2019:Q4 and 1.7% for 2020:Q1. [Jan 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.8 percent on January 17. [Jan 17 estimate]CR Note: These estimates suggest real GDP growth will be between 1.2% and 2.2% annualized in Q4.

BLS: December Unemployment rates at New Series Lows in Eight States

by Calculated Risk on 1/24/2020 10:52:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in December in 11 states, higher in 4 states, and stable in 35 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eight states had jobless rate decreases from a year earlier, 1 state had an increase, and 41 states and the District had little or no change. The national unemployment rate, 3.5 percent, was unchanged over the month but was 0.4 percentage point lower than in December 2018.

...

South Carolina, Utah, and Vermont had the lowest unemployment rates in December, 2.3 percent each. The rates in Colorado (2.5 percent), Florida (3.0 percent), Georgia (3.2 percent), Illinois (3.7 percent), Oregon (3.7 percent), South Carolina (2.3 percent), Utah (2.3 percent), and Washington (4.3 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.1 percent.

emphasis added

Click on graph for larger image.

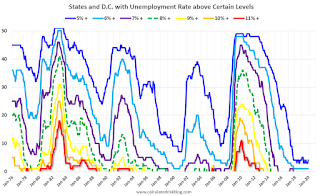

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue). Note that Alaska is at a series low (since 1976). Three states and the D.C. have unemployment rates above 5%; Alaska, Mississippi and West Virginia.

A total of twelve states are at a series low: Alabama, Alaska, California, Colorado, Florida, Georgia, Illinois, Nevada, Oregon, South Carolina, Utah and Washington.

Sacramento Housing in December: Sales Up 12.7% YoY, Active Inventory down 38.8% YoY

by Calculated Risk on 1/24/2020 08:30:00 AM

From SacRealtor.org: December market sees inventory drop 27%

December closed with 1,244 sales, up slightly from 1,242 in November. Compared to one year ago (1,104), the current figure is up 12.7%.1) Overall sales increased to 1,244 in December, up from 1,104 in December 2018. Sales were up slightly from November 2019 (previous month), and up 12.7% from December 2018.

...

Over the last three months the Active Listing Inventory has decreased from 2,301 units in October to 1,803 units in November to 1,315 units for December. From October to December, this is a 43% decrease. From November to December, this is a 27% decrease. The Months of Inventory dropped from 1.5 to 1.1 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. [Note: Compared to December 2018, inventory is down 38.8%] .

...

The Median DOM (days on market) increased from 15 to 19 and the Average DOM increased from 29 to 32. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

2) Active inventory was at 1,315, down from 2,149 in December 2018. That is down 38.8% year-over-year. This is the eighth consecutive month with a YoY decline following 20 months of YoY increases in inventory.

Thursday, January 23, 2020

Hotels: Occupancy Rate Increases Year-over-year

by Calculated Risk on 1/23/2020 04:43:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 18 January

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 12-18 January 2020, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 13-19 January 2019, the industry recorded the following:

• Occupancy: +1.1% to 58.9%

• Average daily rate (ADR): +5.2% to US$130.99

• Revenue per available room (RevPAR): +6.4% to US$77.16

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The early average occupancy rate in 2020 is tracking the last few years.

Seasonally, the 4-week average of the occupancy rate will increase over the next several months..

Data Source: STR, Courtesy of HotelNewsNow.com

LA area Port Traffic Down Year-over-year in December

by Calculated Risk on 1/23/2020 01:30:00 PM

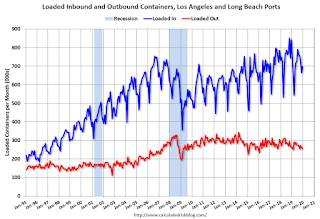

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.7% in December compared to the rolling 12 months ending in November. Outbound traffic was down 0.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports had been increasing (although down in 2019), and exports have mostly moved sideways over the last 8 years - but have also moved down recently.

Kansas City Fed: "Tenth District Manufacturing Activity Nearly Flat in January"

by Calculated Risk on 1/23/2020 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Nearly Flat in January

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity was nearly flat in January while expectations for future activity expanded.Another weak Tenth District manufacturing report.

“Regional factory activity was down only slightly in January, and firms reported a modest increase in employment,” said Wilkerson. “Contacts reported slightly less difficulty finding workers than six months ago, but still over 60 percent of firms were experiencing labor shortages.”

...

The month-over-month composite index was -1 in January, slightly higher than -5 in December and -2 in November. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The slight decrease in district manufacturing activity was driven by declines in: nonmetallic mineral products, primary metal, fabricated metal products, computer and electronic products, beverage and tobacco products, and printing manufacturing, while several other industries improved. Most month-over-month indexes remained slightly negative in January, and inventories continued to decline. However, the month-over-month employment index rose back into positive territory for the first time in over six months and the supplier delivery time index was also slightly positive.

emphasis added

Weekly Initial Unemployment Claims Increase to 211,000

by Calculated Risk on 1/23/2020 08:33:00 AM

The DOL reported:

In the week ending January 18, the advance figure for seasonally adjusted initial claims was 211,000, an increase of 6,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 204,000 to 205,000. The 4-week moving average was 213,250, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 216,250 to 216,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,250.

This was lower than the consensus forecast.

Wednesday, January 22, 2020

Thursday: Unemployment Claims

by Calculated Risk on 1/22/2020 06:55:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Maintaining Longer-Term Lows For Now

Mortgage rates remained in line with 3-month lows today for the average lender. Several lenders offered marginally better terms compared to yesterday, but in those cases, the only changes were to the upfront costs associated with the same rates quoted yesterday. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED 3.625 -3.75%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, up from 214,000 last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

AIA: "Architecture Billings Index Ends Year on Positive Note"

by Calculated Risk on 1/22/2020 02:16:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Ends Year on Positive Note

Demand for design services in December increased for the third month in a row, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 52.5 for December reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). During December, both the new project inquiries and design contracts scores were positive, posting scores of 58.7 and 53.4 respectively.

“Despite the ongoing slowdown in billings in the Northeast, balanced growth across sectors and regions looks more positive for the coming year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Factors outside of the construction sector, such as trade policy and international events, could still impact demand for design services, however recent fears about a downturn in construction activity have largely subsided.”

...

• Regional averages: West (54.0); South (52.2); Midwest (51.9); Northeast (44.0)

• Sector index breakdown: commercial/industrial (54.0); multi-family residential (51.0); mixed practice (50.8); institutional (50.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.5 in December, up from 51.9 in November. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 8 of the previous 12 months, suggesting some increase in CRE investment in 2020.