by Calculated Risk on 9/18/2019 02:01:00 PM

Wednesday, September 18, 2019

FOMC Statement: 25bp Decrease

Information received since the Federal Open Market Committee met in July indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports have weakened. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-3/4 to 2 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair, John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against the action were James Bullard, who preferred at this meeting to lower the target range for the federal funds rate to 1-1/2 to 1-3/4 percent; and Esther L. George and Eric S. Rosengren, who preferred to maintain the target range at 2 percent to 2-1/4 percent.

emphasis added

AIA: "Substantial Decline in Architecture Billings"

by Calculated Risk on 9/18/2019 12:45:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Substantial Decline in Architecture Billings

Demand for design services in August took a markedly downward swing compared to July’s already soft score, according to a new report released today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 47.2 in August showed a significant drop in architecture firm billings compared to the July score of 50.1. Any score below 50 indicates a decrease in billings. The design contracts score also declined to 47.9 in August, representing a rare dip for this indicator. Billings in the West stayed modestly positive while all other regions remained in negative territory.

“The sizeable drop in both design billings and new project activity, coming on the heels of six months of disappointing growth in billings, suggests that the design expansion that began in mid-2012 is beginning to face headwinds,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Currently, the weakness is centered at firms specializing in commercial/industrial facilities as well as those located in the Midwest. However, there are fewer pockets of strength in design activity now, either by building sector or region than there have been in recent years.”

...

• Regional averages: West (51.2); Northeast (49.1); South (48.2); Midwest (46.4)

• Sector index breakdown: institutional (50.6); multi-family residential (50.5); commercial/industrial (46.9); mixed practice (46.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 47.2 in August, down from 50.1 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 9 of the previous 12 months, suggesting some further increase in CRE investment in 2019 - but this is the weakest six month stretch since 2012, and might suggest some decline in CRE investment in 2020.

Comments on August Housing Starts

by Calculated Risk on 9/18/2019 10:37:00 AM

Earlier: Housing Starts increase to 1.364 Million Annual Rate in August, Highest in 12 Years

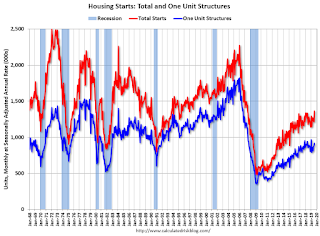

Total housing starts in August were above expectations, and starts for June and July were revised up combined. This was the highest level of starts in 12 years.

The housing starts report showed starts were up 12.3% in August compared to July, and starts were up 6.6% year-over-year compared to August 2018.

Single family starts were up 3.4% year-over-year, and multi-family starts were up 13.7% YoY. Much of the strength this month was in the volatile multi-family sector, still - overall - this was a strong report.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were up 6.6% in August compared to August 2018.

Year-to-date, starts are down 1.8% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year were the most difficult.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it seems likely starts will be up in 2019 compared to 2018.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts.

As I've been noting for several years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Housing Starts increase to 1.364 Million Annual Rate in August, Highest in 12 Years

by Calculated Risk on 9/18/2019 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in August were at a seasonally adjusted annual rate of 1,364,000. This is 12.3 percent above the revised July estimate of 1,215,000 and is 6.6 percent above the August 2018 rate of 1,279,000. Single‐family housing starts in August were at a rate of 919,000; this is 4.4 percent above the revised July figure of 880,000. The August rate for units in buildings with five units or more was 424,000.

Building Permits:

Privately‐owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,419,000. This is 7.7 percent above the revised July rate of 1,317,000 and is 12.0 percent above the August 2018 rate of 1,267,000. Single‐family authorizations in August were at a rate of 866,000; this is 4.5 percent above the revised July figure of 829,000. Authorizations of units in buildings with five units or more were at a rate of 509,000 in August.

emphasis added

Click on graph for larger image.

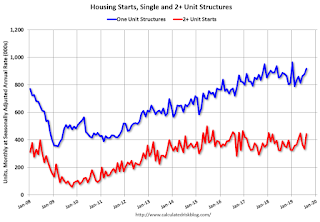

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in August compared to July. Multi-family starts were down 13.7% year-over-year in August.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last several years.

Single-family starts (blue) increased in August, and were up 3.4% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in August were above expectations, and starts for June and July were revised up combined. A strong report.

I'll have more later …

MBA: Mortgage Applications "Flat" in Latest Weekly Survey

by Calculated Risk on 9/18/2019 07:00:00 AM

From the MBA: Mortgage Applications Flat in Latest MBA Weekly Survey

Mortgage applications decreased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 13, 2019. Last week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index decreased 4 percent from the previous week and was 148 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 16 percent compared with the previous week and was 15 percent higher than the same week one year ago.

...

“The jump in U.S. Treasury rates at the end of last week caused mortgage rates to increase across the board, with the 30-year fixed-rate mortgage climbing to 4.01 percent – the highest in seven weeks,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinancing activity dropped as a result, driven solely by conventional refinances.”

Added Kan, “The purchase index increased for the third straight week to the highest reading since July. Additionally, the average loan amount on purchase applications increased to its highest level since June. This is a likely a sign that the underlying demand for buying a home remains strong, despite some of the recent volatility we have seen.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.01 percent from 3.82 percent, with points decreasing to 0.37 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity. Now activity has declined a little as rates have increased.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year.

Tuesday, September 17, 2019

Wednesday: FOMC Announcement, Housing Starts

by Calculated Risk on 9/17/2019 07:20:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for August. The consensus is for 1.250 million SAAR, up from 1.191 million SAAR.

• During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. The Fed is expected to lower the Fed Funds rate 25bps at this meeting..

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/17/2019 03:47:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in August

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.42 million in August, unchanged from July’s preliminary estimate and down 1.3% from last August’s seasonally adjusted pace. Unadjusted sales will probably be down slightly from a year ago, with the SA/NSA gap reflecting this August’s lower business day count relative to last August’s.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale at the end of August should be about 2.1% lower than last August.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up by about 5.5% from last August.

CR Note: The National Association of Realtors (NAR) is scheduled to released August existing home sales on Thursday at 10:00 AM ET. The consensus is for 5.38 million SAAR.

CAR on California: "Low interest rates boost California housing market"

by Calculated Risk on 9/17/2019 12:47:00 PM

The CAR reported: Low interest rates boost California housing market as median home price sets another record, C.A.R. reports

The lowest mortgage interest rates in nearly three years helped jump start California’s housing market to post the first year-over-year sales gain and highest sales level in 15 months, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that this is the second consecutive YoY decrease in inventory in California since early 2018.

Fueled by mortgage interest rates at near-three-year lows, California’s housing market recorded a second consecutive year-over-year sales increase while the median home price reached a new high, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 406,100 units in August, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the August pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

August’s sales figure was down 1.3 percent from the 411,630 level in July and up 1.6 percent from home sales in August 2018 of 399,600. While cumulative sales through the first eight months of the year were down from last year, the pace of decline has improved significantly at -4.1 percent since the -12.5 percent recorded in January.

“Housing demand has exhibited signs of improvement in recent months as lower rates continued to reduce the cost of borrowing for home buyers,” said C.A.R. President Jared Martin. “However, buyers remain cautious, and many are reluctant to jump in because of the economic and market uncertainty that continue to linger, and that is keeping growth subdued despite significantly lower rates.”

...

After 15 straight months of year-over-year increases, active listing fell 8.9 percent from year ago, marking the first back-to-back decline since March 2018 and the largest since December 2017.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was 3.2 months in August, unchanged from July and down from 3.3 months in August 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.2% | 19.2% |

| Mar-19 | 1.8% | 13.4% |

| Apr-19 | 1.7% | 10.8% |

| May-19 | 2.1% | 7.4% |

| Jun-19 | -0.05% | 2.4% |

| Jul-19 | -1.6 | -2.1% |

| Aug-19 | NA | -8.9% |

NAHB: "Builder Confidence Hits Yearly High in September "

by Calculated Risk on 9/17/2019 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in September, up from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Hits Yearly High in September

Builder confidence in the market for newly-built single-family homes rose one point to 68 in September from an upwardly revised August reading of 67, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Sentiment levels have held in the mid- to upper 60s since May and September’s reading matches the highest level since last October.

“Low interest rates and solid demand continue to fuel builders’ sentiments even as they continue to grapple with ongoing supply-side challenges that hinder housing affordability, including a shortage of lots and labor,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn.

“Solid household formations and attractive mortgage rates are contributing to a positive builder outlook,” said NAHB Chief Economist Robert Dietz. “However, builders are expressing growing concerns regarding uncertainty stemming from the trade dispute with China. NAHB’s Home Building Geography Index indicates that the slowdown in the manufacturing sector is holding back home construction in some parts of the nation, although there is growth in rural and exurban areas.”

…

The HMI index gauging current sales conditions increased two points to 75 and the component measuring traffic of prospective buyers held steady at 50. The measure charting sales expectations in the next six months fell one point to 70.

Looking at the three-month moving averages for regional HMI scores, the Northeast posted a two-point gain to 59, the West was also up two points to 75 and the South moved one point higher to 70. The Midwest was unchanged at 57.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.

Industrial Production Increased in August

by Calculated Risk on 9/17/2019 09:24:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.6 percent in August after declining 0.1 percent in July. Manufacturing production increased 0.5 percent, more than reversing its decrease in July. Factory output has increased 0.2 percent per month over the past four months after having decreased 0.5 percent per month during the first four months of the year. In August, the indexes for utilities and mining moved up 0.6 percent and 1.4 percent, respectively. At 109.9 percent of its 2012 average, total industrial production was 0.4 percent higher in August than it was a year earlier. Capacity utilization for the industrial sector increased 0.4 percentage point in August to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2018) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.9% is 1.9% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in August to 109.9. This is 26% above the recession low, and 4.3% above the pre-recession peak.

The change in industrial production and increase in capacity utilization were above consensus expectations.