by Calculated Risk on 8/27/2019 10:10:00 AM

Tuesday, August 27, 2019

Richmond Fed: "Manufacturing Activity Was Moderate in August"

From the Richmond Fed: Manufacturing Activity Was Moderate in August

Fifth District manufacturing activity was moderate in August, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite index rose from −12 in July to 1 in August, buoyed by increases in the indexes for shipments and new orders. However, the third component, employment, fell.This was the last of the regional Fed surveys for August.

...

Survey results suggested that many firms saw employment decline while the average workweek increased in August. Respondents reported persistent wage growth but still struggled to find workers with the necessary skills.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

The regional surveys were weak again in August, but slightly better than in July.

Based on these regional surveys, it seems likely the ISM manufacturing index for August will be weak again.

Case-Shiller: National House Price Index increased 3.1% year-over-year in June

by Calculated Risk on 8/27/2019 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Phoenix Replaces Las Vegas as Top City in Annual Gains According to the S&P CoreLogic Case-Shiller Index

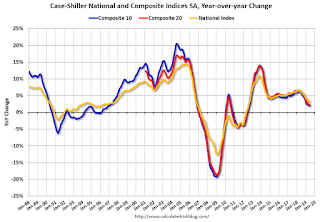

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.1% annual gain in June, down from 3.3% in the previous month. The 10-City Composite annual increase came in at 1.8%, down from 2.2% in the previous month. The 20-City Composite posted a 2.1% year-over-year gain, down from 2.4% in the previous month.

Phoenix, Las Vegas and Tampa reported the highest year-over-year gains among the 20 cities. In June, Phoenix led the way with a 5.8% year-over-year price increase, followed by Las Vegas with a 5.5% increase, and Tampa with a 4.7% increase. Six of the 20 cities reported greater price increases in the year ending June 2019 versus the year ending May 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.6% in June. The 10-City Composite posted a 0.2% increase and the 20-City Composite reported a 0.3% increase for the month. After seasonal adjustment, the National Index recorded a 0.2% month-over-month increase in June. The 10-City and the 20-City Composites did not report any gains. In June, 19 of 20 cities reported increases before seasonal adjustment, while 17 of 20 cities reported increases after seasonal adjustment.

“Home price gains continue to trend down, but may be leveling off to a sustainable level,” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “The average YOY gain declined to 3.0% in June, down from 3.1% the prior month. However, fewer cities (12) experienced lower YOY price gains than in May (13).

“The southwest (Phoenix and Las Vegas) remains the regional leader in home price gains, followed by the southeast (Tampa and Charlotte). With three of the bottom five cities (Seattle, San Francisco, and San Diego), much of the west coast is challenged to sustain YOY gains. For the second month in a row, however, only Seattle experienced outright decline with YOY price change of -1.3%. The U.S. National Home Price NSA Index YOY price change in June 2019 of 3.1% is exactly half of what it was in June 2018. While housing has clearly cooled off from 2018, home price gains in most cities remain positive in low single digits. Therefore, it is likely that current rates of change will generally be sustained barring an economic downturn.”

emphasis added

Click on graph for larger image.

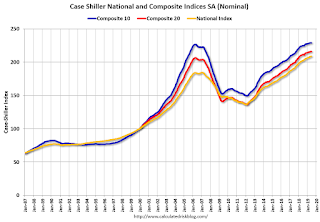

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.0% from the bubble peak, and down slightly in June (SA) from May.

The Composite 20 index is 4.5% above the bubble peak, and up slightly (SA) in June.

The National index is 13.2% above the bubble peak (SA), and up 0.2% (SA) in June. The National index is up 53.1% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 1.9% compared to June 2018. The Composite 20 SA is up 2.2% year-over-year.

The National index SA is up 3.1% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, August 26, 2019

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 8/26/2019 07:38:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Mixed Versus Friday, Depending on Lender

Mortgage rates are sort of all over the place at the moment, and almost never where you'd expect. Those who haven't been following the bond market too closely generally expect higher rates than what we've been seeing recently. Those who are well-versed in the longstanding relationship between mortgages and Treasury yields generally expect rates to have fallen MUCH faster than they actually have.Tuesday:

…

All of the above having been said, the average lender is still very close to the lowest levels in 3 years. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]

emphasis added

• At 9:00 AM, S&P/Case-Shiller House Price Index for June. The consensus is for a 2.3% year-over-year increase in the Comp 20 index for June.

• Also at 9:00 AM, FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

Freddie Mac: Mortgage Serious Delinquency Rate declined in July

by Calculated Risk on 8/26/2019 04:35:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in July was 0.61%, down from 0.63% in June. Freddie's rate is down from 0.78% in July 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since November 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for July soon.

Merrill and Goldman on Housing

by Calculated Risk on 8/26/2019 01:03:00 PM

A few excerpts from two research pieces on housing.

From Merrill Lynch: Housing: something for everyone What comes next?

[W]e are making some tweaks to the housing forecast. Housing starts are likely to edge down this year to 1.24mn but recover next year. Existing home sales should also come in lower this year at 5.30 million and hold around this pace in 2020. The story for new home sales is a bit better with 650k this year and 660k next. In other words, further sideways motion for housing activity, leaving it a benign factor for the overall economy.From Goldman Sachs: Can Lower Rates Still Boost Housing?

[O]ur estimate of the lag time between changes in interest rates and housing activity suggests the bulk of the boost is yet to come. ... we update our outlook for the growth boost from housing via both the homebuilding channel and the impact of refinancing, mortgage equity withdrawal, and housing wealth effects on consumer spending. Our model points to a healthy rebound to a 4% growth pace of residential investment in 2019H2 and an increase in the total contribution from housing to GDP growth from -0.05pp in H1 to +0.15pp in H2.CR Notes: This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Click on graph for larger image.

Click on graph for larger image.Year-to-date, starts are down 3.1% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year were the most difficult.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it is possible starts will be unchanged or up slightly in 2019 compared to 2018.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).Year-to-date (through July), sales are up 4.1% compared to the same period in 2018.

The second half comparisons will be easier, so sales should be higher in 2019 than in 2018.

So my view is housing will be a positive for the economy in the 2nd half of 2019.

Dallas Fed: "Texas Manufacturing Expansion Picks Up Pace"

by Calculated Risk on 8/26/2019 10:35:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Picks Up Pace

Texas factory activity expanded at a faster clip in August, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, shot up nine points to 17.9, its highest reading in nearly a year.Some improvement, but another weak regional report.

Other measures of manufacturing activity also suggested faster expansion in August. The shipments index rose seven points to 17.6, and the capacity utilization index rose five points to 15.7, both reaching 11-month highs. The new orders index moved up from 5.5 to 9.3, while the growth rate of orders index was largely unchanged at 1.8.

Perceptions of broader business conditions improved in August. The general business activity index pushed into positive territory for the first time in four months, rising nine points to 2.7. Similarly, the company outlook index rose to 5.0 following three months in negative territory. However, the index measuring uncertainty regarding companies’ outlooks jumped nine points to 18.6, a reading well above average.

Labor market measures suggested slower growth in employment and work hours in August. The employment index remained positive but retreated 11 points to 5.5, a level closer to average. Eighteen percent of firms noted net hiring, while 12 percent noted net layoffs. The hours worked index edged down to 4.0.

emphasis added

Chicago Fed "Index points to slower economic growth in July"

by Calculated Risk on 8/26/2019 08:44:00 AM

From the Chicago Fed: Index points to slower economic growth in July

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to –0.36 in July from +0.03 in June. All four broad categories of indicators that make up the index decreased from June, and all four categories made negative contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved up to –0.14 in July from –0.30 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 25, 2019

Sunday Night Futures

by Calculated Risk on 8/25/2019 08:48:00 PM

Weekend:

• Schedule for Week of August 25, 2019

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for July. This is a composite index of other data.

• Also at 8:30 AM, Durable Goods Orders for July from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for August.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 14 and DOW futures are down 143 (fair value).

Oil prices were up over the last week with WTI futures at $53.22 per barrel and Brent at $58.53 barrel. A year ago, WTI was at $70, and Brent was at $74 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.58 per gallon. A year ago prices were at $2.83 per gallon, so gasoline prices are down 25 cents year-over-year.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 8/25/2019 12:52:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 17 August

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 11-17 August 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 August 2018, the industry recorded the following:

• Occupancy: -1.0% to 71.7%

• Average daily rate (ADR): +0.4% to US$130.89

• Revenue per available room (RevPAR): -0.6% at US$93.90

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years - but has been a little soft YoY in recent weeks.

Seasonally, the occupancy rate will now start to decline as the peak summer travel season ends.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, August 24, 2019

Schedule for Week of August 25, 2019

by Calculated Risk on 8/24/2019 08:11:00 AM

The key report this week is second estimate of Q2 GDP.

Other key reports include Personal Income and Outlays for July and Case-Shiller house prices for June.

For manufacturing, the August Richmond and Dallas Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for August.

9:00 AM: S&P/Case-Shiller House Price Index for June.

9:00 AM: S&P/Case-Shiller House Price Index for June.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 2.3% year-over-year increase in the Comp 20 index for June.

9:00 AM: FHFA House Price Index for May 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August. This is the last of the regional surveys for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 2nd quarter 2019 (second estimate). The consensus is that real GDP increased 2.0% annualized in Q2, down from the advance estimate of 2.1% in Q2.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, up from 209 thousand last week.

10:00 AM: Pending Home Sales Index for July. The consensus is for a 0.3% decrease in the index.

8:30 AM ET: Personal Income and Outlays, July 2019. The consensus is for a 0.3% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for August). The consensus is for a reading of 92.3.