by Calculated Risk on 7/16/2019 08:45:00 AM

Tuesday, July 16, 2019

Retail Sales increased 0.4% in June

On a monthly basis, retail sales increased 0.4 percent from May to June (seasonally adjusted), and sales were up 3.4 percent from June 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for June 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $519.9 billion, an increase of 0.4 percent from the previous month, and 3.4 percent above June 2018. … The April 2019 to May 2019 percent change was revised from up 0.5 percent to up 0.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in June.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.The increase in June was above expectations, however sales in April and May were revised down. Overall a solid report.

Monday, July 15, 2019

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey, Fed Chair Powell

by Calculated Risk on 7/15/2019 07:28:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Little-Changed Despite Bond Market Gains

Mortgage rates were mostly flat to begin the new week, even though underlying bond markets were in stronger territory. … Mortgage-backed bonds have improved somewhat throughout the day. At face value, that seems like it should help mortgage rates and indeed it might. The issue is that there hasn't been quite enough improvement for the average lender to go to the trouble of adjusting rates in the middle of the business day. [Most Prevalent Rates 30YR FIXED - 4.0%]Tuesday:

emphasis added

• At 8:30 AM, Retail sales for June is scheduled to be released. The consensus is for 0.1% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

• At 10:00 AM, The July NAHB homebuilder survey. The consensus is for a reading of 65, up from 64. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 1:00 PM, Speech, Fed Chair Jerome Powell, Aspects of Monetary Policy in the Post-Crisis Era, At the French G7 Presidency 2019 – Bretton Woods: 75 Years Later, Thinking About the Next 75, Paris, France

House Prices and Median Household Income

by Calculated Risk on 7/15/2019 05:17:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

Last week I posted House Prices to National Average Wage Index. I mentioned another measure - house prices to the Median Household income.

This graph uses an annual average of the Case-Shiller house price index - and the nominal median household income through 2017 (from the Census Bureau).

This graph shows the ratio of house price indexes divided by the Median Household Income through 2017 (the HPI is first multiplied by 1000).

This uses the annual average National Case-Shiller index since 1976.

As of 2017, house prices were above the median historical ratio - but far below the bubble peak.

Ten Years Ago: The Sluggish Recovery Began

by Calculated Risk on 7/15/2019 10:16:00 AM

Note: This is the 15th year I've been writing this blog. Sometimes it is fun to look back, especially at turning points. Starting in January 2005, I was very bearish on housing - and in early 2007, I predicted a recession.

However in 2009 I became more optimistic. For example, in February 2009, I wrote: Looking for the Sun (Note: that post shocked many readers since I had been very bearish).

And here are a couple of posts I wrote exactly 10 years ago on July 15, 2009:

Is the Recession Over?

Show me the Engines of Growth

Back in February I pointed out that I expected to see some economic rays of sunshine this year. But I never expected an immaculate recovery forecast from the FOMC.I also noted - because the recovery would be sluggish, and jobless at first - that I'd expect the NBER to wait some time before dating the recession. The NBER finally dated the end of the recession in September 2010:

Although I've argued repeatedly that a "Great Depression 2" was extremely unlikely, I think the other extreme - an immaculate recovery - is also unlikely.

CAMBRIDGE September 20, 2010 - The Business Cycle Dating Committee of the National Bureau of Economic Research met yesterday by conference call. At its meeting, the committee determined that a trough in business activity occurred in the U.S. economy in June 2009. The trough marks the end of the recession that began in December 2007 and the beginning of an expansion. The recession lasted 18 months, which makes it the longest of any recession since World War II.Along the way, in February 2012, I called the bottom for housing: The Housing Bottom is Here

Currently I'm still mostly positive on the economy and still not on recession watch. Of course I'm concerned about policy (trade, immigration, etc).

NY Fed: Manufacturing "Business activity rebounded modestly in New York State"

by Calculated Risk on 7/15/2019 08:35:00 AM

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity grew modestly in July. After declining substantially last month, the general business conditions index returned to positive territory, rising thirteen points to 4.3.This was slightly above the consensus forecast.

After falling below zero last month, the index for number of employees slid further, dropping six points to -9.6, pointing to a decline in employment levels. The average workweek index, at 3.8, signaled somewhat longer workweeks.

emphasis added

Sunday, July 14, 2019

Sunday Night Futures

by Calculated Risk on 7/14/2019 07:41:00 PM

Weekend:

• Schedule for Week of July 14, 2019

Monday:

• At 8:30 AM, The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 0.5, up from -8.6.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $60.25 per barrel and Brent at $66.76 barrel. A year ago, WTI was at $68, and Brent was at $71 - so oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.79 per gallon. A year ago prices were at $2.88 per gallon, so gasoline prices are down about 3% year-over-year.

30 Year Mortgage Rates increase to 4.0%

by Calculated Risk on 7/14/2019 09:13:00 AM

From Matthew Graham at Mortgage News Daily: Highest Mortgage Rates in More Than 3 Weeks

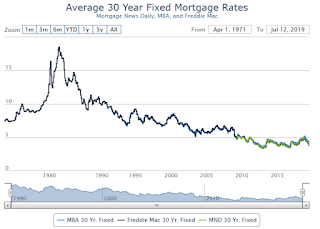

Mortgage rates moved decisively higher this week as the underlying bond market finally began shifting gears. After the Fed meeting in June, rates moved to the lowest levels in more than 2 years and had been holding in a narrow range since then. [30YR FIXED - 4.0%]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30 year fixed rates from three sources (MND, MBA, Freddie Mac). Go to MND and you can adjust the graph for different time periods.

Saturday, July 13, 2019

Schedule for Week of July 14, 2019

by Calculated Risk on 7/13/2019 08:11:00 AM

The key reports this week are June housing starts and retail sales.

For manufacturing, the Industrial Production report and the July New York and Philly Fed manufacturing surveys will be released.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of 0.5, up from -8.6.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.1% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for 0.1% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.0% on a YoY basis in May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 65, up from 64. Any number above 50 indicates that more builders view sales conditions as good than poor.

1:00 PM: Speech, Fed Chair Jerome Powell, Aspects of Monetary Policy in the Post-Crisis Era, At the French G7 Presidency 2019 – Bretton Woods: 75 Years Later, Thinking About the Next 75, Paris, France

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June. This graph shows single and total housing starts since 1968.

The consensus is for 1.260 million SAAR, down from 1.269 million SAAR in May.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 209 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 4.5, up from 0.3.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

10:00 AM: State Employment and Unemployment (Monthly) for June 2019

Friday, July 12, 2019

Q2 Review: Ten Economic Questions for 2019

by Calculated Risk on 7/12/2019 03:42:00 PM

At the end of last year, I posted Ten Economic Questions for 2019. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2019 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q2 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2019: Will housing inventory increase or decrease in 2019?

"I expect to see inventory up again year-over-year in December 2019. My reasons for expecting more inventory are 1) inventory is still historically low (inventory in November 2018 was the second lowest since 2000), 2) higher mortgage rates, and 3) further negative impact in certain areas from new tax law."According to the May NAR report on existing home sales, inventory was up 2.7% year-over-year in May, and the months-of-supply was at 4.3 months. It is early, and the inventory build has slowed recently as mortgage rates declined, but I still expect some increase in inventory this year.

9) Question #9 for 2019: What will happen with house prices in 2019?

"If inventory increases further year-over-year as I expect by December 2019, it seems likely that price appreciation will slow to the low single digits - maybe around 3%."If is very early, but the CoreLogic data for May showed prices up 3.6% year-over-year. The April Case-Shiller data showed prices up 3.5% YoY - and slowing. Currently it appears price gains will slow in 2019.

8) Question #8 for 2019: How much will Residential Investment increase?

"Most analysts are looking for starts and new home sales to increase to slightly in 2019. For example, the NAHB is forecasting a slight increase in starts (to 1.269 million), and no change in home sales in 2019. And Fannie Mae is forecasting a slight increase in starts (to 1.265 million), and for new home sales to increase to 619 thousand in 2019.Through May, starts were down 5.3% year-over-year compared to the same period in 2018. New home sales were up 4.0% year-over-year. It is early, but it appears starts will be down slightly or flat this year, and new home sales will be up.

My sense is the weakness in late 2018 will continue into 2019, and starts will be down year-over-year, but not a huge decline. My guess is starts will decrease slightly in 2019 and new home sales will be close to 600 thousand."

7) Question #7 for 2019: How much will wages increase in 2019?

"As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3.5% in 2019 according to the CES."Through June 2019, nominal hourly wages were up 3.1% year-over-year. It is early, but so far wages have disappointed in 2019.

6) Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

"My current guess is just one hike in the 2nd half of the year."It now appears the Fed will cut rates a few times this year.

5) Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

The Fed is projecting core PCE inflation will increase to 2.0% to 2.1% by Q4 2019. There are risks for higher inflation with the labor market near full employment, however I do think there are structural reasons for low inflation (demographics, few employment agreements that lead to wage-price-spiral, etc).It is early, but inflation several measures of inflation are close to the Fed's target, however core PCE has been soft.

So, although I think core PCE inflation (year-over-year) will increase in 2019 and be around 2% by Q4 2019 (up from 1.9%), I think too much inflation will still not be a serious concern in 2019.

4) Question #4 for 2019: What will the unemployment rate be in December 2019?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the mid 3's by December 2019 from the current 3.7%. My guess is based on the participation rate being mostly unchanged in 2019, and for decent job growth in 2019, but less than in 2018 or 2017.The unemployment rate was at 3.7% in June.

3) Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

So my forecast is for gains of around 133,000 to 167,000 payroll jobs per month in 2019 (about 1.6 million to 2.0 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics.Through June 2019, the economy has added 1,033,000 thousand jobs, or 172,000 per month. This is slightly above my forecast, and it appears job growth will slow this year compared to 2018.

2) Question #2 for 2019: How much will the economy grow in 2019?

"Looking to 2019, fiscal policy will still be a positive for growth - although the boost will fade over the course of the year, and become a drag in 2020. And oil prices declined sharply in late 2018, and this will be a drag on economic growth in 2019. Auto sales are mostly moving sideways, and housing has been under pressure due to higher mortgage rates and the new tax plan.GDP growth was solid in Q1 at 3.1%, although the underlying details were weaker than the headline number. Forecasts for Q2 are around 1.5%. Last year I was forecasting a pickup in growth - and that happened - and this year I expect growth to slow.

These factors suggest growth will slow in 2019, probably to the low 2s -and maybe even a 1 handle."

1) Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

My forecasts are based on a limited negative impact from Mr. Trump - and I hope that remains the case. But he is a key downside risk for the economy.This week, Fed Chair Powell highlighted trade and immigration policies as headwinds for the economy. It appears the administration's policies are starting to negatively impact the economy.

The Fed will probably lower rates this year, and it appears new home sales might be higher than I originally expected, and inflation is lower than I expected.

Q2 GDP Forecasts: Around 1.5%

by Calculated Risk on 7/12/2019 11:19:00 AM

From Merrill Lynch:

We continue to track 1.7% for 2Q GDP growth. [July 12 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.5% for 2019:Q2 and 1.8% for 2019:Q3. [July 12 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2019 is 1.4 percent on July 10, up from 1.3 percent on July 3. [July 10 estimate]CR Note: These estimates suggest real GDP growth will be around 1.5% annualized in Q2.