by Calculated Risk on 7/12/2019 09:29:00 AM

Friday, July 12, 2019

Hotels: Occupancy Rate Increased Year-over-year

From HotelNewsNow.com: STR: US hotel results for week ending 6 July

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 30 June through 6 July 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 1-7 July 2018, the industry recorded the following:

• Occupancy: +2.6% to 65.3%

• Average daily rate (ADR): +2.6% to US$127.31

• Revenue per available room (RevPAR): +5.2% to US$83.18

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, close to-date compared to the previous 4 years.

Seasonally, the occupancy rate will now stay at a high level during the Summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, July 11, 2019

LA area Port Traffic Down Year-over-year in June

by Calculated Risk on 7/11/2019 04:05:00 PM

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

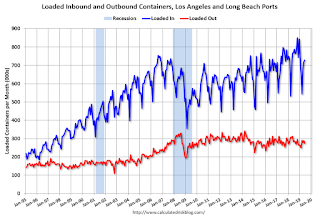

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.4% in June compared to the rolling 12 months ending in May. Outbound traffic was down 0.3% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 8 years.

Cleveland Fed: Key Measures Show Inflation Close to 2% YoY in June, Core PCE below 2%

by Calculated Risk on 7/11/2019 11:19:00 AM

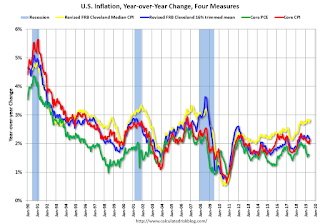

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.7% annualized rate) in June. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for June here. Motor fuel was down 36% annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (0.7% annualized rate) in June. The CPI less food and energy rose 0.3% (3.6% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.1%, and the CPI less food and energy rose 2.1%. Core PCE is for May and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 3.7% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 3.6% annualized.

Overall, these measures are at or above the Fed's 2% target (Core PCE is below 2%).

First Look at 2020 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/11/2019 10:15:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.4 percent over the last 12 months to an index level of 249.747 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2018, the Q3 average of CPI-W was 246.352.

The 2018 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.4% year-over-year in June, and although this is very early - we need the data for July, August and September - my current guess is COLA will probably be between 1% and 2% this year, the smallest increase since 2016.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2018 yet, but wages probably increased again in 2018. If wages increased the same as in 2017, then the contribution base next year will increase to around $137,600 in 2020, from the current $132,900.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

BLS: CPI increased 0.1% in June, Core CPI increased 0.3%

by Calculated Risk on 7/11/2019 08:39:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in June on a seasonally adjusted basis, the same increase as in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.6 percent before seasonal adjustment.Inflation was above expectations in June. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.3 in June, its largest monthly increase since January 2018.

...

The all items index increased 1.6 percent for the 12 months ending June, a smaller increase than the 1.8-percent rise for the period ending May. The index for all items less food and energy rose 2.1 percent over the last 12 months, and the food index increased 1.9 percent. The energy index, in contrast, declined 3.4 percent over the last 12 months.

emphasis added

Weekly Initial Unemployment Claims decreased to 209,000

by Calculated Risk on 7/11/2019 08:35:00 AM

The DOL reported:

In the week ending July 6, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 221,000 to 222,000. The 4-week moving average was 219,250, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 222,250 to 222,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 219,250.

This was lower than the consensus forecast.

Wednesday, July 10, 2019

Thursday: CPI, Unemployment Claims, Fed Chair Powell Testimony

by Calculated Risk on 7/10/2019 10:31:00 PM

This should be interesting: The BLS told me today that the "newest set of Labor Force projections through 2028 is set to be released Wednesday September 4th 2019".

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 216 thousand initial claims, down from 221 thousand last week.

• At 8:30 AM, The Consumer Price Index for June from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking Committee, Washington, D.C

FOMC Minutes: "the case for somewhat more accommodative policy had strengthened"

by Calculated Risk on 7/10/2019 03:19:00 PM

From the Fed: Minutes of the Federal Open Market Committee, June 18-19, 2019. A few excerpts:

In their discussion of monetary policy decisions at this meeting, participants noted that, under their baseline outlook, the labor market was likely to remain strong with economic activity growing at a moderate pace. However, they judged that the risks and uncertainties surrounding their outlooks, particularly those related to the global economic outlook, had intensified in recent weeks. Moreover, inflation continued to run below the Committee's 2 percent objective; similarly, inflation for items other than food and energy had remained below 2 percent as well. In addition, some readings on inflation expectations had been low. The increase in risks and uncertainties surrounding the outlook was quite recent and nearly all participants agreed that it would be appropriate to maintain the current target range for the federal funds rate at 2-1/4 to 2-1/2 percent at this meeting. However, they noted that it would be important to monitor the implications of incoming information and global economic developments for the U.S. economic outlook. A couple of participants favored a cut in the target range at this meeting, judging that a prolonged period with inflation running below 2 percent warranted a more accommodative policy response to firmly center inflation and inflation expectations around the Committee's symmetric 2 percent objective.

With regard to the outlook for monetary policy beyond this meeting, nearly all participants had revised down their assessment of the appropriate path for the federal funds rate over the projection period in their SEP submissions, and some had marked down their estimates of the longer-run normal level of the funds rate as well. Many participants indicated that the case for somewhat more accommodative policy had strengthened. Participants widely noted that the global developments that led to the heightened uncertainties about the economic outlook were quite recent. Many judged additional monetary policy accommodation would be warranted in the near term should these recent developments prove to be sustained and continue to weigh on the economic outlook. Several others noted that additional monetary policy accommodation could well be appropriate if incoming information showed further deterioration in the outlook. Participants stated a variety of reasons that would call for a lower path of the federal funds rate. Several participants noted that a near-term cut in the target range for the federal funds rate could help cushion the effects of possible future adverse shocks to the economy and, hence, was appropriate policy from a risk-management perspective. Some participants also noted that the continued shortfall in inflation risked a softening of inflation expectations that could slow the sustained return of inflation to the Committee's 2 percent objective. Several participants pointed out that they had revised down their estimates of the longer-run normal rate of unemployment and, as a result, saw a smaller upward contribution to inflation pressures from tight resource utilization than they had earlier. A few participants were concerned that inflation expectations had already moved below levels consistent with the Committee's symmetric 2 percent objective and that it was important to provide additional accommodation in the near term to bolster inflation expectations. A few participants judged that allowing inflation to run above 2 percent for some time could help strengthen the credibility of the Committee's commitment to its symmetric 2 percent inflation objective.

emphasis added

Houston Real Estate in June: Sales down 5% YoY, Inventory Up 11%

by Calculated Risk on 7/10/2019 12:27:00 PM

From the HAR: Houston Home Sales Fall Shy of Last June's Record, But Continue to Outpace 2018

Despite continued strength in the Houston real estate market fueled by more robust inventory and low interest rates, June home sales could not match the historic levels of a year earlier, in June of 2018. According to the latest monthly report from the Houston Association of REALTORS® (HAR), single-family home sales were down 3.4 percent. However, on a year-to-date basis, sales are still outpacing 2018’s record volume.Still on pace for record sales in Houston.

June marked the first month of 2019 with declining single-family home sales, due to the record-breaking levels of one year earlier. Realtors sold a total of 8,097 units versus 8,385 a year earlier. That translates to a 3.4 percent decline. On a year-to-date basis, however, single-family home sales are running 1.4 percent ahead of 2018’s record pace.

...

June sales of all property types totaled 9,461. That is down 5.1 percent compared to the same month last year. Total dollar volume for the month declined 3.1 percent to $2.9 billion.

“We knew it would be difficult to top last June’s record-breaking sales volume, but the Houston real estate market remains strong and now offers prospective buyers an even greater selection of housing than they’ve had in some time,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “Consumers also continue to show interest in rental properties, which had another impressive performance in June.

...

Total active listings, or the total number of available properties, climbed 11.0 percent to 45,262. ...

emphasis added

Merrill: "The Fed cut is on for July"

by Calculated Risk on 7/10/2019 12:06:00 PM

A few excerpts from a Merrill Lynch research note: The Fed cut is on for July

Fed Chair Powell delivered a dovish testimony, hinting strongly at an upcoming cut. We now expect a 25bp cut at the July 31st meeting followed by two more cuts at the next two meetings. We are sticking with our forecast of a cumulative 75bp of easing … The Fed seems to be willing to dismiss the better data from the US and instead is focusing on the weaker global data. Indeed, when Powell was asked if the strong jobs report changed his views on cuts, he stated "no". Rather Powell emphasized that "it appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook. Inflation pressures remain muted."