by Calculated Risk on 5/16/2019 04:30:00 PM

Thursday, May 16, 2019

Comments on April Housing Starts

Earlier: Housing Starts Increased to 1.235 Million Annual Rate in April

Total housing starts in April were above expectations, and starts for February and March were revised up.

The housing starts report showed starts were up 5.7% in April compared to March, and starts were down 2.5% year-over-year compared to April 2018.

Single family starts were down 4.3% year-over-year, and multi-family starts were up 1.4%.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were down 2.5% in April compared to April 2018.

The year-over-year weakness in April was in the single family sector.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year are the most difficult.

My guess is starts will be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY decline we saw in February and March.

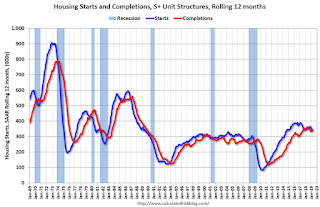

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now.

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

CAR: "California home sales stumble into spring home buying season"

by Calculated Risk on 5/16/2019 03:14:00 PM

The CAR reported: California home sales stumble into spring home buying season as median price sets another record

California home sales remained muted entering the spring homebuying season as soft buyer demand continues to challenge the market, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that the YoY increase has been slowing in both California and Nationally.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 396,760 units in April, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the April pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

April’s sales figure was down 0.1 percent from the 397,210 level in March and down 4.8 percent from home sales in April 2018 of 416,750. Sales remained below the 400,000 level for the ninth consecutive month and have fallen on a year-over-year basis for a full year.

“Weak buyer demand, largely prompted by elevated home prices, is playing a role in the softening housing market,” said C.A.R. President Jared Martin. “However, with low interest rates, cooling competition and an increase in homes to choose from, buyers can take advantage of a more balanced housing market.”

...

Encouragingly, the growth in active listings from the year prior decelerated for the fourth straight month. The number of homes available for sale increased only 10.8 percent from last April, but still enough to provide a much-needed supply of homes for sale. The growth in active listings has fallen from more than 30 percent at the end of 2018 suggesting that the market is becoming more balanced, rather than experiencing a full-scale exodus of sellers in California.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, dipped on a month-to-month basis but edged up on a year-over-year basis. The Unsold Inventory Index was 3.4 months in April, down from 3.6 months in March but up from 3.2 months in April 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate. The jump in the UII from a year ago can be attributed to the moderate sales decline and the sharp increase in active listings.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.2% | 19.2% |

| Mar-19 | 2.4% | 13.4% |

| Apr-19 | NA | 10.8% |

Philly Fed Mfg "Current Indicators Suggest Continued Growth" in May

by Calculated Risk on 5/16/2019 10:56:00 AM

From the Philly Fed: May 2019 Manufacturing Business Outlook Survey

Results from the May Manufacturing Business Outlook Survey suggest continued growth for the region’s manufacturing sector. The survey’s indexes for general activity, shipments, and employment increased from their April readings. The new orders index remained positive but decreased modestly. The survey’s future activity index, after falling in recent months, was little changed, while the firms’ forecast for future employment improved.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased from 8.5 in April to 16.6 this month.

...

On balance, the firms continued to report increases in employment. The employment diffusion index increased 4 points to 18.2, its highest reading in five months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

These early reports suggest the ISM manufacturing index will show expansion again in May, and probably at about the faster pace than in April.

Housing Starts Increased to 1.235 Million Annual Rate in April

by Calculated Risk on 5/16/2019 08:47:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1,235,000. This is 5.7 percent above the revised March estimate of 1,168,000, but is 2.5 percent below the April 2018 rate of 1,267,000. Single‐family housing starts in April were at a rate of 854,000; this is 6.2 percent above the revised March figure of 804,000. The April rate for units in buildings with five units or more was 359,000.

Building Permits:

Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,296,000. This is 0.6 percent above the revised March rate of 1,288,000, but is 5.0 percent below the April 2018 rate of 1,364,000. Single‐family authorizations in April were at a rate of 782,000; this is 4.2 percent below the revised March figure of 816,000. Authorizations of units in buildings with five units or more were at a rate of 467,000 in April.

emphasis added

Click on graph for larger image.

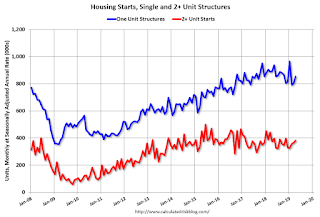

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in April compared to March. Multi-family starts were unchanged year-over-year in April.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) increased in April, and were down 4% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in April were above expectations, and starts for February and March were revised up.

I'll have more later …

Weekly Initial Unemployment Claims Decrease to 212,000

by Calculated Risk on 5/16/2019 08:33:00 AM

The DOL reported:

In the week ending May 11, the advance figure for seasonally adjusted initial claims was 212,000, a decrease of 16,000 from the previous week's unrevised level of 228,000. The 4-week moving average was 225,000, an increase of 4,750 from the previous week's unrevised average of 220,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 225,000.

This was below the consensus forecast.

Wednesday, May 15, 2019

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 5/15/2019 09:25:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 219 thousand initial claims, down from 228 thousand last week.

• At 8:30 AM, Housing Starts for April. The consensus is for 1.200 million SAAR, up from 1.139 million SAAR in March.

• At 8:30 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 9.3, up from 8.5.

Leading Index for Commercial Real Estate Declines in April

by Calculated Risk on 5/15/2019 04:06:00 PM

From Dodge Data Analytics: Dodge Momentum Index Dips in April

The Dodge Momentum Index fell 0.5% in April to 144.3 (2000=100) from the revised March reading of 145.1. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The retreat in April was the result of the commercial component falling 1.0% while the institutional component rose a scant 0.2%.

The Momentum Index has clearly lost some impetus over the last twelve months. The overall Momentum Index is down 8.5% since April 2018, with the commercial component 4.7% lower and the institutional component 13.9% lower. However, over the past several months the Momentum Index has moved in a crab-like fashion with neither strong gains or losses. This suggests that there continues to be a reasonably healthy number of projects in the planning pipeline to support a moderate level of construction activity in the coming months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 144.3 in April, down from 145.1 in March.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year".

Retail Sales decreased 0.2% in April

by Calculated Risk on 5/15/2019 12:21:00 PM

On a monthly basis, retail sales decreased 0.2 percent from March to April (seasonally adjusted), and sales were up 3.1 percent from April 2018.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for April 2019, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $513.4 billion, a decrease of 0.2 percent from the previous month, but 3.1 percent above April 2018. Total sales for the February 2019 through April 2019 period were up 3.0 percent from the same period a year ago. The February 2019 to March 2019 percent change was revised from up 1.6 percent to up 1.7 percent (±0.2 percent).

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.4% in April.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.0% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.0% on a YoY basis.The increase in April was well below expectations. Sales in March were revised up, and sales in February were revised down. A weak report.

U.S. Births decreased in 2018, "Lowest number of births in 32 years"

by Calculated Risk on 5/15/2019 12:08:00 PM

From the National Center for Health Statistics: Births: Provisional Data for 2018. The NCHS reports:

The provisional number of births for the United States in 2018 was 3,788,235, down 2% from 2017 and the lowest number of births in 32 years. The general fertility rate was 59.0 births per 1,000 women aged 15–44, down 2% from 2017 and another record low for the United States. The total fertility rate declined 2% to 1,728.0 births per 1,000 women in 2018, another record low for the nation. Birth rates declined for nearly all age groups of women under 35, but rose for women in their late 30s and early 40s. The birth rate for teenagers aged 15–19 was down 7% in 2018 to 17.4 births per 1,000 women; rates declined for both younger (aged 15–17) and older (aged 18–19) teenagers.Here is a long term graph of annual U.S. births through 2018.

Click on graph for larger image.

Click on graph for larger image.Births have declined for four consecutive years following increases in 2013 and 2014.

With fewer births, and less net migration, demographics will not be as favorable as I was expecting a few years ago.

There is much more in the report.

NAHB: "Builder Confidence Posts Solid Gain in May"

by Calculated Risk on 5/15/2019 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 66 in May, up from 63 in April. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Posts Solid Gain in May

Builder confidence in the market for newly-built single-family homes rose three points to 66 in May, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today. Builder sentiment is at its highest level since October 2018.

“Builders are busy catching up after a wet winter and many characterize sales as solid, driven by improved demand and ongoing low overall supply,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn. “However, affordability challenges persist and remain a big impediment to stronger sales.”

“Mortgage rates are hovering just above 4 percent following a challenging fourth quarter of 2018 when they peaked near 5 percent. This lower-interest rate environment, along with ongoing job growth and rising wages, is contributing to a gradual improvement in the marketplace,” said NAHB Chief Economist Robert Dietz. “At the same time, builders continue to deal with ongoing labor and lot shortages and rising material costs that are holding back supply and harming affordability.”

…

All the HMI indices posted gains in May. The index measuring current sales conditions rose three points to 72, the component gauging expectations in the next six months edged one point higher to 72 and the metric charting buyer traffic moved up two points to 49.

Looking at the three-month moving averages for regional HMI scores, the Northeast posted a six-point gain to 57, the West increased two points to 71, the Midwest gained one point to 54, and the South rose a single point to 68.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast.