by Calculated Risk on 3/19/2019 01:25:00 PM

Tuesday, March 19, 2019

CAR: "California home sales rebound in February"

The CAR reported: California home sales rebound in February; median price dips, C.A.R. reports

California home sales bounced back in February after hitting the lowest sales level in more than 10 years the previous month, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today. February’s annual sales level was the highest in six months, and the monthly growth in sales was the highest since January 2011.Here is some inventory data from the NAR and CAR (ht Tom Lawler).

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 399,080 units in February, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the February pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

February’s sales figure was up 11.3 percent from the revised 358,470 level in January and down 5.6 percent from home sales in February 2018 of 422,910. February’s decline was the smallest since July 2018, and the sales total was just shy of the 400,000 benchmark.

“Lower interest rates and stabilizing home prices motivated would-be buyers to get off the fence in February,” said C.A.R. President Jared Martin. “With mortgage rates reaching their lowest point in a year, housing affordability improved as buyers’ monthly mortgage payments became more manageable. Instead of the double-digit growth rates that we observed a few months ago, monthly mortgage payments increased by 2.7 percent, the smallest increase in the last 12 months.”

...

“While we expected the federal government shutdown during most of January to temporarily interrupt closings because of a delay in loan approvals and income verifications, the impact on January’s home sales was minimal,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “The decline in sales was more indicative of demand side issues and was broad and across all price categories and regions of the state. Moreover, growing inventory over the past few months has not translated into more sales.”

...

While statewide active listings have been increasing from the previous year at a double-digit pace for the last eight months, February’s rate was the smallest growth rate in the past six months and the third month in a row that listings decelerated. February’s active listings were up 19.2 percent from a year ago.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, improved on a year-over-year basis but was flat on a month-to-month basis. The Unsold Inventory Index was 4.6 months in February, unchanged from January but up from 3.9 months in February 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate. The jump in the UII from a year ago can be attributed to the moderate sales decline and the sharp increase in active listings.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | NA | 19.2% |

Housing Inventory Tracking

by Calculated Risk on 3/19/2019 10:42:00 AM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 4.6% year-over-year (YoY) in January, this was the sixth consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, and Sacramento (through February) and Phoenix, and total existing home inventory as reported by the NAR (through January). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 105% YoY in Las Vegas in February (red), the eight consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 17% year-over-year in Houston in February.

Inventory is a key for the housing market. I expect a further increase in inventory in 2019, but overall I think inventory will still be fairly low.

Also note that inventory in Seattle was up 164% year-over-year in February (not graphed)!

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 3/19/2019 09:22:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 9 March

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 3-9 March 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 4-10 March 2018, the industry recorded the following:

• Occupancy: -2.4% to 66.8%

• Average daily rate (ADR): +0.8% to US$132.01

• Revenue per available room (RevPAR): -1.7% at US$88.15

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019 - close to the previous 4 years.

Seasonally, the occupancy rate will mostly move sideways during the Spring travel season, and then increase during the Summer.

Data Source: STR, Courtesy of HotelNewsNow.com

Monday, March 18, 2019

"Mortgage Rates Hold 14-Month Lows"

by Calculated Risk on 3/18/2019 05:20:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Hold 14-Month Lows

Mortgage rates didn't budge today--a logical result with no signs of life in underlying bond markets. In the current case, this is just fine with us considering the bond market has gone silent while remaining at the best levels in 14 months. [30YR FIXED - 4.375%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since 2014.

This graph is interactive, and you could view mortgage rates back to the mid-1980s - click here for graph.

Goldman: FOMC Preview

by Calculated Risk on 3/18/2019 02:53:00 PM

Note: Over the weekend I wrote some thoughts on the FOMC meeting this week.

A few excerpts from a note by Goldman Sachs economists David Mericle and Jan Hatzius: March FOMC Preview: Are We There Yet?

• The main question for the March meeting is just how far Fed officials will take the new theme of patience and the new perspective on inflation in their next set of projections.

• The economic projections are likely to change only modestly. We expect a downgrade to the 2019 GDP growth projections ...

• The FOMC is also likely to announce that balance sheet runoff will conclude at the end of Q3 or in Q4. ...

• Our own forecast continues to be for a hike in December of this year ... the risks are tilted toward delay and our probability-weighted forecast is now just 0.4 net hikes for 2019.

Sacramento Housing in February: Sales Down 10% YoY, Active Inventory up 16% YoY

by Calculated Risk on 3/18/2019 11:24:00 AM

From SacRealtor.org: February sees increase in sales volume, sales price

The month closed with 1,015 total sales, a 13.5% increase from the 894 sales of January. Compared to the same month last year (1,131), the current figure is down 10.3%.CR Note: Inventory is still low - months of inventory is at 2.0 months, probably closer to 4 months would be normal - and this is the smallest YoY increase since January 2018.

...

The Active Listing Inventory decreased, falling 4.8% from 2,095 to 1,994 units. The Months of Inventory decreased 13% from 2.3 to 2 Months. [Note: Compared to February 2018, inventory is up 15.7%] .

...

The Average DOM (days on market) increased again, rising from 40 to 43. The Median DOM remained at 27. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

NAHB: Builder Confidence "Steady" in March

by Calculated Risk on 3/18/2019 10:04:00 AM

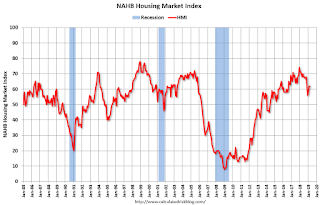

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 62 in March, unchanged from 62 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Holds Steady in March

Builder confidence in the market for newly-built single-family homes held steady at 62 in March, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

“Builders report the market is stabilizing following the slowdown at the end of 2018 and they anticipate a solid spring home buying season,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn.

“In a healthy sign for the housing market, more builders are saying that lower price points are selling well, and this was reflected in the government’s new home sales report released last week,” said NAHB Chief Economist Robert Dietz. “Increased inventory of affordably priced homes – in markets where government policies support such construction - will enable more entry-level buyers to enter the market.”

…

The HMI component charting sales expectations in the next six months rose three points to 71, the index gauging current sales conditions increased two points to 68, and the component measuring traffic of prospective buyers fell four points to 44. Looking at the three-month moving averages for regional HMI scores, the Northeast posted a five-point gain to 48, the South was up three points to 66 and West increased two points to 69. The Midwest posted a one-point decline to 51.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was close to the consensus forecast.

Sunday, March 17, 2019

Sunday Night Futures

by Calculated Risk on 3/17/2019 08:34:00 PM

Weekend:

• Schedule for Week of March 17, 2019

• FOMC Preview

Monday:

• 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 63, up from 62. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up slightly over the last week with WTI futures at $58.39 per barrel and Brent at $67.07 per barrel. A year ago, WTI was at $62, and Brent was at $65 - so WTI oil prices are down less than 10% year-over-year, and Brent is up slightly.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.54 per gallon, so gasoline prices are unchanged year-over-year.

FOMC Preview

by Calculated Risk on 3/17/2019 12:19:00 PM

The consensus is that there will no change in policy at the FOMC meeting this week, and that the Fed will continue to emphasize "patience". Also the Fed is expected to announce the conclusion of the balance sheet runoff later this year (perhaps around September)

There might some slight downward revisions in the economic projections.

Here are the December FOMC projections.

The FOMC is projecting Q4 over the previous Q41, and 2018 came in at 3.1% real growth. (Note: Annual real GDP increased 2.9% in 2018)

Most analysts expect growth to slow in 2019, and Q1 forecasts are around 1% (many below 1%). So projections for 2019 might be revised down further.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.0 to 3.1 | 2.3 to 2.5 | 1.8 to 2.0 |

| Sep 2018 | 3.0 to 3.2 | 2.4 to 2.7 | 1.8 to 2.1 |

The unemployment rate was at 3.8% in February. (The unemployment rate averaged 3.8% in Q4 2018). The unemployment rate projection for 2019 will probably be unchanged or revised up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.7 | 3.5 to 3.7 | 3.5 to 3.8 |

| Sep 2018 | 3.7 | 3.4 to 3.6 | 3.4 to 3.8 |

As of December 2018, PCE inflation was up 1.7% from December 2017. This was below the projected range for 2018. However oil prices have stabilized (after falling sharply), and it seems likely any revision to 2019 projections will be minor.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 1.8 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 2.0 to 2.1 | 2.0 to 2.1 | 2.1 to 2.2 |

PCE core inflation was up 1.9% in December year-over-year. Any change to Core PCE inflation for 2019 will probably be minor.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 1.9 to 2.0 | 2.0 to 2.1 | 2.1 to 2.2 |

In general the data has been somewhat softer than the FOMC's December projections.

Saturday, March 16, 2019

Schedule for Week of March 17, 2019

by Calculated Risk on 3/16/2019 08:12:00 AM

The key report this week is February existing home sales.

For manufacturing, the March Philly Fed manufacturing survey will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 63, up from 62. Any number above 50 indicates that more builders view sales conditions as good than poor.

No major economic releases scheduled. Note: Housing Starts for February will be released on March 26th.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 229 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of 4.4, up from -4.1.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.08 million SAAR, up from 4.94 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.08 million SAAR, up from 4.94 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for February 2019