by Calculated Risk on 2/21/2019 10:12:00 AM

Thursday, February 21, 2019

NAR: Existing-Home Sales Decreased to 4.94 million in January

From the NAR: Existing-Home Sales Drop 1.2 Percent in January

Existing-home sales experienced a minor drop for the third consecutive month in January, according to the National Association of Realtors®. Of the four major U.S. regions, only the Northeast saw an uptick in sales activity last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 1.2 percent from December to a seasonally adjusted annual rate of 4.94 million in January. Sales are now down 8.5 percent from a year ago (5.40 million in January 2018).

...

Total housing inventory at the end of January increased to 1.59 million, up from 1.53 million existing homes available for sale in December, and represents an increase from 1.52 million a year ago. Unsold inventory is at a 3.9-month supply at the current sales pace, up from 3.7 months in December and from 3.4 months in January 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (4.94 million SAAR) were down 1.2% from last month, and were 8.5% below the January 2018 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.59 million in January from 1.53 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

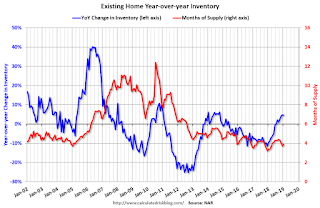

According to the NAR, inventory increased to 1.59 million in January from 1.53 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 4.6% year-over-year in January compared to January 2018.

Inventory was up 4.6% year-over-year in January compared to January 2018. Months of supply was at 3.9 months in January.

For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...

Philly Fed Mfg "Weakened" in February

by Calculated Risk on 2/21/2019 09:11:00 AM

From the Philly Fed: February 2019 Manufacturing Business Outlook Survey

Manufacturing conditions in the region weakened this month, according to firms responding to the February Manufacturing Business Outlook Survey. The indicators for general activity, new orders, and shipments fell into negative territory, but the indicator for employment remained positive. Input prices also moderated notably this month. The survey’s indexes for future conditions were mostly steady, with firms remaining generally optimistic about growth over the next six months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The index for current manufacturing activity in the region decreased from a reading of 17.0 in January to -4.1 this month. This is the index’s first negative reading since May 2016. Both the new orders and shipments indexes also fell this month. The current new orders index decreased nearly 24 points to -2.4, and the current shipments index decreased 17 points to -5.3.

The firms continued to add to their payrolls this month. The current employment index improved from a reading of 9.6 in January to 14.5 this month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

This suggests the ISM manufacturing index will show expansion again in February, but at a level than in January.

Weekly Initial Unemployment Claims decreased to 216,000

by Calculated Risk on 2/21/2019 08:38:00 AM

The DOL reported:

In the week ending February 16, the advance figure for seasonally adjusted initial claims was 216,000, a decrease of 23,000 from the previous week's unrevised level of 239,000. The 4-week moving average was 235,750, an increase of 4,000 from the previous week's unrevised average of 231,750. This is the highest level for this average since January 20, 2018 when it was 237,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 235,750.

This was lower than the consensus forecast.

Wednesday, February 20, 2019

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg, Durable Goods

by Calculated Risk on 2/20/2019 09:04:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 239 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

• Also at 8:30 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of 14.5, down from 17.0.

• At 10:00 AM, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.05 million SAAR, up from 4.99 million. See: Existing Home Sales for January: Take the Under

Existing Home Sales for January: Take the Under

by Calculated Risk on 2/20/2019 05:23:00 PM

The NAR is scheduled to release Existing Home Sales for January at 10:00 AM on Thursday, February 21st.

The consensus is for 5.05 million SAAR, up from 4.99 million in December. Housing economist Tom Lawler estimates the NAR will reports sales of 4.92 million SAAR for January and that inventory will be up 6.6% year-over-year. Based on Lawler's estimate, I expect existing home sales to be below the consensus for January.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 9 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month, in December 2018, the consensus was for sales of 5.24 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated the NAR would report 4.97 million, and the NAR reported 4.99 million (as usual Lawler was closer than the consensus).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last eight plus years, the consensus average miss was 144 thousand, and Lawler's average miss was 67 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | --- |

| 1NAR initially reported before revisions. | |||

California Existing Homes in January: "Home sales fall to lowest level in more than 10 years"

by Calculated Risk on 2/20/2019 03:31:00 PM

The CAR reported: California home sales fall to lowest level in more than 10 years, C.A.R. reports

Housing demand in California remained subdued for the ninth consecutive month in January as economic and market uncertainties sent home sales to their lowest level since April 2008, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler).

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 357,730 units in January, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the January pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

January’s sales figure was down 3.9 percent from the revised 372,260 level in December and down 12.6 percent from home sales in January 2018 of 409,520. January marked the ninth consecutive month of decline and the sixth month in a row that sales were below 400,000, dipping to the lowest level since April 2008.

“California continued to move toward a more balanced market as we see buyers having greater negotiating power and sellers making concessions to get their homes sold as inventory grows,” said C.A.R. President Jared Martin. “While interest rates have dropped down to the lowest point in 10 months, potential buyers are putting their homeownership plans on hold as they wait out further price adjustments.”

...

“While we expected the federal government shutdown during most of January to temporarily interrupt closings because of a delay in loan approvals and income verifications, the impact on January’s home sales was minimal,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “The decline in sales was more indicative of demand side issues and was broad and across all price categories and regions of the state. Moreover, growing inventory over the past few months has not translated into more sales.”

...

Statewide active listings rose for the 10th consecutive month after nearly three straight years of declines, increasing 27 percent from the previous year.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, increased year-to-year from 3.6 months in January 2018 to 4.6 months in January 2019. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate. The jump in the UII from a year ago can be attributed to the double-digit sales decline and the sharp increase in active listings.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 5.5% | 30.6% |

| Jan-19 | 6.6%1 | 27% |

| 1Estimate from Tom Lawler | ||

FOMC Minutes: "A variety of considerations that supported a patient approach to monetary policy"

by Calculated Risk on 2/20/2019 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 29-30, 2019. A few excerpts:

Almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve's asset holdings later this year. Such an announcement would provide more certainty about the process for completing the normalization of the size of the Federal Reserve's balance sheet.

…

Participants pointed to a variety of considerations that supported a patient approach to monetary policy at this juncture as an appropriate step in managing various risks and uncertainties in the outlook. With regard to the domestic economic picture, additional data would help policymakers gauge the trajectory of business and consumer sentiment, whether the recent softness in core and total inflation and inflation compensation would persist, and the effect of the tightening of financial conditions on aggregate demand. Information arriving in coming months could also shed light on the effects of the recent partial federal government shutdown on the U.S. economy and on the results of the budget negotiations occurring in the wake of the shutdown, including the possible implications for the path of fiscal policy. A patient approach would have the added benefit of giving policymakers an opportunity to judge the response of economic activity and inflation to the recent steps taken to normalize the stance of monetary policy. Furthermore, a patient posture would allow time for a clearer picture of the international trade policy situation and the state of the global economy to emerge and, in particular, could allow policymakers to reach a firmer judgment about the extent and persistence of the economic slowdown in Europe and China.

Participants noted that maintaining the current target range for the federal funds rate for a time posed few risks at this point. The current level of the federal funds rate was at the lower end of the range of estimates of the neutral policy rate. Moreover, inflation pressures were muted, and asset valuations were less stretched than they had been a few months earlier. Many participants suggested that it was not yet clear what adjustments to the target range for the federal funds rate may be appropriate later this year; several of these participants argued that rate increases might prove necessary only if inflation outcomes were higher than in their baseline outlook. Several other participants indicated that, if the economy evolved as they expected, they would view it as appropriate to raise the target range for the federal funds rate later this year.

Participants observed that a patient posture in these circumstances was consistent with their general approach to setting the stance of policy, in which they were importantly guided by the implications of incoming data for the economic outlook. Some participants noted that, while global economic and financial developments had been important factors leading to a patient monetary policy posture, those developments mattered because they affected assessments of the policy rate path most consistent with achievement of the Committee's dual-mandate goals of maximum employment and price stability. Many participants observed that if uncertainty abated, the Committee would need to reassess the characterization of monetary policy as "patient" and might then use different statement language.

emphasis added

Phoenix Real Estate in January: Sales down 12% YoY, Active Inventory up 10% YoY

by Calculated Risk on 2/20/2019 11:59:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales declined to 5,357 from 6,082 in January 2018. Sales were down 16.3% from December, and down 11.9% from January 2018.

2) Active inventory was at 18,990, up from 17,330 in January 2018. This is up 9.6% year-over-year. This is the third consecutive month with a YoY increase in active inventory.

The last three months - with a YoY increase - followed twenty-four consecutive months with a YoY decrease in inventory in Phoenix.

Months of supply increased from 3.23 in December to 4.28 in January. This is still somewhat low (also January is seasonally a slow sales month).

AIA: "Strong start to 2019 for architecture billings"

by Calculated Risk on 2/20/2019 09:58:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Strong start to 2019 for architecture billings

Starting the year on a strong note, architecture firm billings growth strengthened in January to a level not seen in the previous twelve months according to a new report released today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for January was 55.3 compared to 51.0 in December. Indicators of work in the pipeline, including inquiries into new projects and the value of new design contracts, also strengthened in January.

“The government shutdown affected architecture firms but doesn’t appear to have created a slowdown in the profession,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “While AIA did hear from a few firms that were experiencing significant cash flow issues due to the shutdown, the data suggests that the majority of firms had no long-term impact.”

...

• Regional averages: South (54.7), Midwest (54.4), Northeast (52.4), West (51.5)

• Sector index breakdown: mixed practice (53.8), institutional (52.9), commercial/industrial (52.6), multi-family residential (52.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 55.3 in January, up from 51.0 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 16 consecutive months, suggesting a further increase in CRE investment in 2019.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 2/20/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications increased 3.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 15, 2019.

... The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 3 percent higher than the same week one year ago.

...

“Mortgage rates held steady on mixed economic news, as core inflation remained firm, while retail sales in December were much weaker than expected. However, overall application activity picked up over the week,” said Joel Kan, MBA’s Associate Vice President of Industry Surveys and Forecasts. “After four consecutive declines, purchase applications increased almost 2 percent over the week and 2.5 percent compared to a year ago – showing some promise as we edge closer to the spring homebuying season.”

Added Kan, “Most rates remained close to 10-month lows, which allowed some borrowers with an incentive to refinance to capitalize. The 30-year fixed rate was essentially unchanged at 4.66 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.66 percent from 4.65 percent, with points decreasing to 0.42 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 3% year-over-year.