by Calculated Risk on 11/13/2018 08:33:00 AM

Tuesday, November 13, 2018

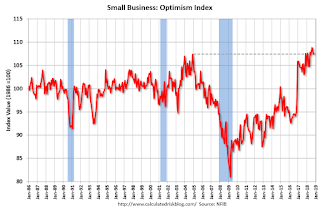

Small Business Optimism Index decreased in October

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): October 2018 Report: Small Business Optimism Index

The Optimism Index shed a modest 0.5 points, with slight declines in five components, no change in four of them, and one increase, landing at 107.4.

..

Job creation was solid in October at a net addition of 0.15 workers per firm (including those making no change in employment), unchanged from September. Sixteen percent (up 3 points) reported increasing employment an average of 3.3 workers per firm and 11 percent (unchanged) reported reducing employment an average of 2.9 workers per firm (seasonally adjusted). Sixty percent reported hiring or trying to hire (down 1 point), but 53 percent (88 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill (unchanged). Twenty-three percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 1 point), 2 points below the record high reached in August. Thirty-eight percent of all owners reported job openings they could not fill in the current period, equal to last month’s record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 107.4 in October.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, November 12, 2018

Long Beach: "Port sees brisk holiday imports, slower exports"

by Calculated Risk on 11/12/2018 02:43:00 PM

From the Port of Long Beach: October Cargo Strong in Long Beach

For the second consecutive year, the Port of Long Beach has broken its October record for cargo, as volumes rose 5.4 percent compared to the same month in 2017. October 2018 was also the third-busiest month in the Port’s 107-year history.Imports are up, exports are down. I'll post a graph once the Port of Los Angeles reports October traffic.

Marine terminals handled 705,408 twenty-foot equivalent units (TEUs) of container cargo in October. Inbound containers increased 7.4 percent, to 364,084 TEUs. Export TEUs totaled 119,837 TEUs, a 5 percent decline. Empty containers shipped overseas grew 8.5 percent, to 221,487 TEUs.

Port of Long Beach Executive Director Mario Cordero said the results illustrate the evolving effects of the U.S.-China trade war.

“Our higher import volumes suggest some retailers expect U.S. consumers will be big spenders this holiday season,” said Cordero. “Other importers are rushing shipments to beat escalating tariffs. At the same time, the trade war has clearly slowed American exports to China.”

emphasis added

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 11/12/2018 11:09:00 AM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 20.9% under Mr. Trump - compared to up 51.4% under Mr. Obama for the same number of market days.

Las Vegas: Visitor Traffic down 1.3%, Convention Attendance down 2.7% compared to same Period in 2017

by Calculated Risk on 11/12/2018 08:55:00 AM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2017, visitor traffic declined 1.7% compared to 2016, but was still 8% above the pre-recession peak.

Convention attendance set a new record in 2017, but is down 2.7% in 2018 compared to the same period in 2017. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention attendance was down 2.7% through September compared to the same period in 2017.

Visitor traffic was down 1.3% through September compared to the same period in 2017.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the declines in 2017 and 2018 are a little concerning for the Vegas area.

Sunday, November 11, 2018

Sunday Night Futures

by Calculated Risk on 11/11/2018 07:48:00 PM

Thank you to all the veterans! Especially to my 96 years young father who flew a Corsair off the USS Bennington in the Pacific during WWII, and also served in Korea and Vietnam.

Weekend:

• Schedule for Week of November 11, 2018

Monday:

• Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $60.81 per barrel and Brent at $71.10 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.68 per gallon. A year ago prices were at $2.55 per gallon, so gasoline prices are up 13 cents per gallon year-over-year.

U.S. Heavy Truck Sales up 18% Year-over-year in October

by Calculated Risk on 11/11/2018 11:47:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2018 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 366 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 515 thousand SAAR in October, down from the recent peak of 539 thousand SAAR in September, and up from 436 thousand SAAR in October 2017.

With the recent decline oil prices, and softness in housing, heavy truck sales will probably decline over the next few months.

Saturday, November 10, 2018

Schedule for Week of November 11, 2018

by Calculated Risk on 11/10/2018 08:11:00 AM

The key economic reports this week are October CPI and Retail Sales.

For manufacturing, October industrial production, and the November New York, Philly and Kansas City Fed surveys, will be released this week.

Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

6:00 AM: NFIB Small Business Optimism Index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for October from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 214 thousand the previous week.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.5% increase in retail sales.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.5% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.1% on a YoY basis.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 20.0, down from 21.1.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 20.0, down from 22.2.

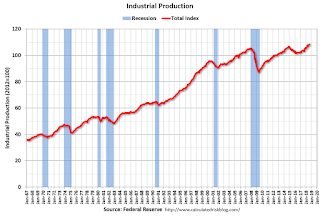

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

10:00 AM: State Employment and Unemployment (Monthly) for October 2018

11:00 AM: NY Fed: Q3 Quarterly Report on Household Debt and Credit

11:00 AM: the Kansas City Fed manufacturing survey for November.

Friday, November 09, 2018

Oil Rigs Increased, Oil Prices Fall

by Calculated Risk on 11/09/2018 04:06:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on November 9, 2018:

• Oil rigs in total were up sharply, +12 to 886CR Note: Meanwhile oil prices have been falling, from MarketWatch: U.S. oil extends slide into bear market, down 10 sessions in a row

• Horizontal oil rigs gained more modestly, +3 at 778

U.S. crude-oil futures on Friday posted a 10th straight session decline, extending their drop into a bear market, as output increases fueled concerns of surging supplies.

…

On Friday, West Texas Intermediate crude for December delivery CLZ8, -1.29% lost 48 cents, or 0.8%, to settle at $60.19 a barrel on the New York Mercantile Exchange, for the lowest front-month contract settlement since March 8, according to FactSet data. Prices lost 4.7% for the week, tallying their fifth straight weekly drop.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q4 GDP Forecasts

by Calculated Risk on 11/09/2018 01:25:00 PM

From Merrill Lynch:

We continue to track 3.7% for 3Q GDP and 2.8% for 4Q. [Nov 9 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 2.9 percent on November 9, unchanged from November 2. The nowcast of the contribution of inventory investment to fourth-quarter real GDP growth inched down from -0.05 percentage points to -0.08 percentage points after this morning's Producer Price Index release from the U.S. Bureau of Labor Statistics and this morning's wholesale trade report from the U.S. Census Bureau. [Nov 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q4 stands at 2.7%. News from this week's data releases increased the nowcast for 2018:Q4 by 0.1 percentage point. A positive surprise from producer prices data accounted for most of the increase.[Nov 9 estimate]CR Note: These early estimates suggest GDP in the high 2s for Q4.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 11/09/2018 10:55:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 3 November

The U.S. hotel industry reported mostly flat year-over-year results in the three key performance metrics during the week of 28 October through 3 November 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 29 October through 4 November 2017, the industry recorded the following:

• Occupancy: -0.7% to 62.9%

• Average daily rate (ADR): +0.7% to US$124.81

• Revenue per available room (RevPAR): -0.1% to US$78.54

…

Houston, Texas, registered the steepest declines in occupancy (-23.5% to 60.6%) and RevPAR (-30.8% to US$61.90). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com