by Calculated Risk on 10/24/2018 04:47:00 PM

Wednesday, October 24, 2018

Housing and Recessions

Following the weak new home sales report, I'd like to update a couple of graphs.

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

Since I wrote that post, new home sales and housing starts have weakened.

For the bottoms and troughs for key housing activity, here is a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

RI as a percent of GDP has been sluggish recently, mostly due to softness in multi-family residential. And it is too early to say that single family housing starts and new home sales have turned down.

Also, look at the relatively low level of RI as a percent of GDP, new home sales and single family starts compared to previous peaks. To have a significant downturn from these levels would be surprising.

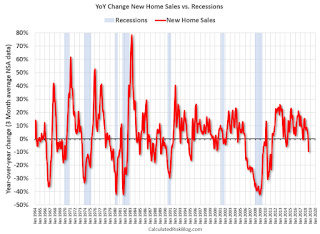

Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. The one exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Although new home sales were down sharply in September, the decline isn't that large historically (at least not yet).

Fed's Beige Book: Economic Growth "modest to moderate", Some Housing Weakness

by Calculated Risk on 10/24/2018 02:05:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Richmond based on information collected on or before October 15, 2018. "

Economic activity expanded across the United States, with the majority of Federal Reserve Districts reporting modest to moderate growth. New York and St. Louis indicated slight growth, overall, while Dallas reported robust growth driven by strong manufacturing, retail, and nonfinancial services activity. On balance, manufacturers reported moderate output growth; however, several Districts indicated that firms faced rising materials and shipping costs, uncertainties over the trade environment, and/or difficulties finding qualified workers. Demand for transportation services remained strong. Labor shortages were broadly noted and were linked to wage increases and/or constrained growth. Reports on commercial and residential real estate were mixed, although several Districts saw rising home prices and low levels of inventory.And some signs of weaker housing market, as an example:

Single-family home sales were steady to down modestly in the suburbs around New York, including northern New Jersey. One contact ascribed some of this weakness to changes in federal tax law that limit deductibility of homeowner costs.

The inventory of homes on the market has risen throughout most of the District--particularly for smaller units in New York City. Still, current inventory levels remain quite low, particularly in upstate New York. Home price trends have been mixed, with values continuing to rise in upstate New York, Long Island, and northern New Jersey, but holding steady across New York City and its northern suburbs. Prices of new condos in New York City, as well as prices at the high end of the condo market more generally, have weakened noticeably.

emphasis added

A few Comments on September New Home Sales

by Calculated Risk on 10/24/2018 12:35:00 PM

New home sales for September were reported at 533,000 on a seasonally adjusted annual rate basis (SAAR). This was well below the consensus forecast, and the three previous months were revised down significantly. A very weak report.

Sales in September were down 13.2% year-over-year compared to September 2017. This was a large YoY decline, although some of the decline might be related to the impact of the hurricanes. However the largest declines were in the North East and the West, and those declines were not hurricane related.

It is not time to panic - or start looking for a recession - but this was a very weak report.

On Inventory: Months of inventory is now above the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch very closely.

Earlier: New Home Sales decrease sharply to 553,000 Annual Rate in September.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

New home sales had been up year-over-year every month this year prior to this report. Not only were sales down YoY in September, but with revisions, sales were down slightly YoY in June too.

Sales are only up 3.5% through September compared to the same period in 2017.

This is below my forecast for 2018 for an increase of about 6% over 2017. As I noted early this year, there were downside risks to that forecast, primarily higher mortgage rates, but also higher costs (labor and material), the impact of the new tax law, and other possible policy errors. Also new home sales had a strong Q4 2017, so the comparisons will be more difficult - and sales might even be down for the year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

AIA: "Architecture firm billings slow but remain positive in September"

by Calculated Risk on 10/24/2018 11:46:00 AM

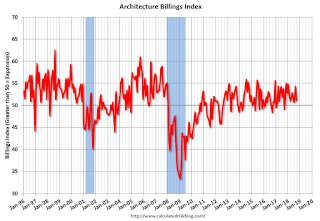

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture firm billings slow but remain positive in September

Architecture firm billings growth slowed in September but remained positive for the twelfth consecutive month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for September was 51.1 compared to 54.2 in August. However, continued strength in new projects coming into architecture firms points to billings growth in the coming months.

“Similar to the strong conditions we’ve seen nationally, architecture firms located in the Midwest and Southern regions of the country continued to report very strong billings in September,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, billings were soft at firms located in the Northeast again, where they have declined or been flat for the entire year so far.”

...

• Regional averages: Midwest (59.7), South (54.1), West (53.1), Northeast (46.6)

• Sector index breakdown: institutional (55.1), multi-family residential (54.9), mixed practice (53.4), commercial/industrial (50.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.1 in September, down from 54.2 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 12 consecutive months, suggesting a further increase in CRE investment into 2019.

New Home Sales decrease sharply to 553,000 Annual Rate in September

by Calculated Risk on 10/24/2018 10:15:00 AM

The Census Bureau reports New Home Sales in September were at a seasonally adjusted annual rate (SAAR) of 553 thousand.

The previous three months were revised down significantly.

"Sales of new single‐family houses in September 2018 were at a seasonally adjusted annual rate of 553,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.5 percent below the revised August rate of 585,000 and is 13.2 percent below the September 2017 estimate of 637,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in September to 7.1 months from 6.5 months in August.

The months of supply decreased in September to 7.1 months from 6.5 months in August. The all time record was 12.1 months of supply in January 2009.

This is above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of September was 327,000. This represents a supply of 7.1 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In September 2018 (red column), 41 thousand new homes were sold (NSA). Last year, 50 thousand homes were sold in September.

The all time high for September was 99 thousand in 2005, and the all time low for September was 24 thousand in 2011.

This was well below expectations of 625,000 sales SAAR, and the previous months were revised down significantly. I'll have more later today.

Black Knight: National Mortgage Delinquency Rate Increased in September

by Calculated Risk on 10/24/2018 08:31:00 AM

From Black Knight: Black Knight’s First Look: Seasonal, Calendar and Hurricane-Related Pressures Result in Largest Single-Month Mortgage Delinquency Increase in Nearly a Decade

• Mortgage delinquencies rose more than 13 percent in September, the largest single-month rise since November 2008According to Black Knight's First Look report for September, the percent of loans delinquent increased 13.2% in September compared to August, but decreased 9.8% year-over-year.

• 16 of the last 19 Septembers have seen delinquencies increase, averaging a 5.2 percent rise over that time frame, the largest of any month during the calendar year

• September 2018 also ended on a Sunday, which typically creates strong upward pressure on delinquencies

• Hurricane Florence-related delinquencies spiked 38 percent month-over-month, with more than 6,000 borrowers already missing a payment as a direct result of the storm

• Foreclosure starts posted a double-digit monthly decline, hitting a nearly 18-year low at just 40,000 for the month

• Both the inventory of loans in active foreclosure and the foreclosure rate have now fallen below their pre-recession averages for the first time since the financial crisis

The percent of loans in the foreclosure process decreased 4.5% in September and were down 26.0% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.97% in September, up from 3.52% in August.

The percent of loans in the foreclosure process decreased in September to 0.52% from 0.54% in August.

The number of delinquent properties, but not in foreclosure, is down 196,000 properties year-over-year, and the number of properties in the foreclosure process is down 90,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Sept 2018 | Aug 2018 | Sept 2017 | Sept 2016 | |

| Delinquent | 3.97% | 3.52% | 4.40% | 4.27% |

| In Foreclosure | 0.52% | 0.54% | 0.70% | 1.00% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,049,000 | 1,818,000 | 2,245,000 | 2,165,000 |

| Number of properties in foreclosure pre-sale inventory: | 268,000 | 280,000 | 358,000 | 509,000 |

| Total Properties | 2,317,000 | 2,099,000 | 2,603,000 | 2,674,000 |

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 10/24/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications rose 4.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 19, 2018. The previous week’s results did not include an adjustment for the Columbus Day holiday.

... The Refinance Index increased 10 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 0.2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since February 2011, 5.11 percent from 5.10 percent, with points decreasing to 0.52 from 0.55 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 0.2% year-over-year.

Tuesday, October 23, 2018

Wednesday: New Home Sales, Beige Book

by Calculated Risk on 10/23/2018 07:00:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for August 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for September from the Census Bureau. The consensus is for 625 thousand SAAR, down from 629 thousand in August.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

"Mortgage Rates Barely Budge Despite Market Volatility"

by Calculated Risk on 10/23/2018 05:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Barely Budge Despite Market Volatility

Mortgage rates didn't move much for the second day this week. Unlike yesterday, there was a relatively massive amount of volatility in underlying financial markets. This was especially true for stocks and the US Treasury market (which sets the tone for the broader bond market where mortgages operate). Even if we look specifically at mortgage-backed securities (MBS), we see some of the best gains this month.

In fact, mortgage rates likely would have ended the day with more noticeable improvement if the gains had remained intact. Unfortunately, the strength began to erode in the late morning hours. Bonds had benefited from massive stock losses, but starting just after 10am, stocks began to bounce back while bonds weakened (weaker bonds = higher rates). Momentum kicked into higher gear later in the day and several lenders who had offered decent improvements this morning were forced to recall rates sheets and reissue new, higher rates.

The net effect is that the average lender is now showing only modestly lower rates compared to yesterday's latest offerings. Like yesterday the change is only measurable in terms of upfront costs. Actual NOTE rates are unchanged (lower upfront costs imply lower "effective rates"). [30YR FIXED - 5.0%]

emphasis added

Quarterly Housing Starts by Intent

by Calculated Risk on 10/23/2018 11:52:00 AM

Here is a graph I haven't updated in some time. From the Census Bureau "Started and Completed by Purpose of Construction" through Q2 2018.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 8% in Q2 2018 compared to Q2 2017.

Owner built starts were unchanged year-over-year. And condos built for sale not far above the record low, but up 11% compared to Q2 2017.

The 'units built for rent' (blue) had increased significantly following the great recession, but are now moving mostly sideways.