by Calculated Risk on 10/19/2018 01:25:00 PM

Friday, October 19, 2018

BLS: Unemployment Rates Lower in 9 states in September, Six States at New Series Lows

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in September in 9 states, higher in 4 states, and stable in 37 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Sixteen states had jobless rate decreases from a year earlier and 34 states and the District had little or no change.

...

Hawaii had the lowest unemployment rate in September, 2.2 percent. The rates in Arkansas (3.5 percent), California (4.1 percent), Idaho (2.7 percent), South Carolina (3.3 percent), Texas (3.8 percent), and Washington (4.4 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 6.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 6% (dark blue).

A Few Comments on September Existing Home Sales

by Calculated Risk on 10/19/2018 11:19:00 AM

Earlier: NAR: Existing-Home Sales Declined to 5.15 million in September

A few key points:

1) The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Overall this is a reasonable level for existing home sales, and the recent weakness is no surprise given the increase in mortgage rates.

2) Inventory is still low, but was up 1.1% year-over-year (YoY) in September. This was the second consecutive year-over-year increase in inventory, and the first YoY increases since May 2015.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in September. The consensus was for sales of 5.30 million SAAR, Lawler estimated the NAR would report 5.20 million SAAR in September, and the NAR actually reported 5.15 million.

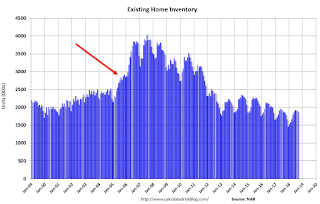

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase significantly and still be at normal levels. No worries.

Sales NSA in September (420,000, red column) were well below sales in September 2017 (462,000, NSA), and the lowest for September since 2012.

Sales NSA through September (first nine months) are down about 2.1% from the same period in 2017.

This is a small YoY decline in sales to-date - it is likely that higher mortgage rates are impacting sales, and it is possible there has been an impact from the changes to the tax law (eliminating property taxes write-off, etc).

NAR: Existing-Home Sales Declined to 5.15 million in September

by Calculated Risk on 10/19/2018 10:10:00 AM

From the NAR: Existing-Home Sales Decline Across the Country in September

Existing-home sales declined in September after a month of stagnation in August, according to the National Association of Realtors®. All four major regions saw no gain in sales activity last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 3.4 percent from August to a seasonally adjusted rate of 5.15 million in September. Sales are now down 4.1 percent from a year ago (5.37 million in September 2017).

...

Total housing inventory at the end of September decreased from 1.91 million in August to 1.88 million existing homes available for sale, and is up from 1.86 million a year ago. Unsold inventory is at a 4.4-month supply at the current sales pace, up from 4.3 last month and 4.2 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (5.15 million SAAR) were down 3.4% from last month, and were 4.1% below the September 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.88 million in September from 1.91 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.88 million in September from 1.91 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 1.1% year-over-year in September compared to September 2017.

Inventory was up 1.1% year-over-year in September compared to September 2017. Months of supply was at 4.3 months in September.

As expected by CR readers, sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low, but appears to be bottoming. I'll have more later ...

Merrill on House Prices

by Calculated Risk on 10/19/2018 08:47:00 AM

A few excerpts from a Merrill Lynch note on house prices:

Home prices nationally, as measured by the S&P CoreLogic Case-Shiller index are running at 6.0% yoy as of the latest data in July. Assuming some modest slowing into the end of the year, we believe we are on track for home prices to end up 5.0% this year, as measured by 4Q/4Q change. As we look ahead into next year, we expect the slowing in home prices to persist, leaving home price appreciation (HPA) of 3% at the end of 2019.

…

Home prices are ultimately anchored to a fair value which is a function of income growth. Based on the OECD’s methodology, we compare nominal Case-Shiller home prices with disposable income per capita, indexed to 100 in 1Q 2000 (Chart 4) which shows the overvaluation during the housing bubble given the irrational exuberance in the market and easy credit conditions. The housing bust left prices to tumble back below fair value. Based on our calculation, prices are once again overvalued on a national level, albeit not nearly as much as during the bubble period. Over time the overvaluation can be solved in two ways: 1) home prices grow at a rate below income for a period of time to close the gap; 2) home prices decline to correct the valuation difference. The pull to fair value can be quite strong.

Click on graph for larger image.

Click on graph for larger image.This chart from Merrill Lynch shows their calculation of house prices vs. disposable income.

Thursday, October 18, 2018

Friday: Existing Home Sales

by Calculated Risk on 10/18/2018 09:01:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.30 million SAAR, down from 5.34 million in August. Housing economist Tom Lawler expects the NAR will report sales of 5.20 million SAAR. Take the under!

A key will be the increase in inventory.

• Also at 10:00 AM: State Employment and Unemployment (Monthly) for September 2018

Phoenix Real Estate in September: Sales down 6% YoY, Active Inventory down 7.5% YoY

by Calculated Risk on 10/18/2018 06:18:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales declined to 6,897 from 7,328 in September 2017. Sales were down 14.2% from August, and down -5.9% from September 2017.

2) Active inventory was at 16,643, down from 17,997 in September 2017. This is down 7.5% year-over-year. This is the smallest YoY decrease in almost two years. In many cities, it appears the inventory decline has ended, but not yet in Phoenix.

This is the twenty-third consecutive month with a YoY decrease in inventory in Phoenix.

Months of supply increased from 2.47 in August to 2.93 in September. This is still low.

Lawler: Deaths, Immigration, and “the Demographics”

by Calculated Risk on 10/18/2018 03:53:00 PM

From housing economist Tom Lawler: Deaths, Immigration, and “the Demographics”

Projections of the US population by characteristics, especially age, are key inputs into intermediate and long term forecasts for such key economic variables as labor force growth, household growth, and social security and Medicare expenditures. For the “adult” population, the key drivers of intermediate term population projections by age are the starting estimates of the population by age, deaths by age, and net international migration by age. Many analysts rely on “official” Census population projections to formulate forecasts of other key economic variables. Unfortunately, such reliance can be problematic, for various reasons. First, Census only releases intermediate and long term population projections every couple of years, and these projections can become quite dated (the projections from the end of 2014, which were the “latest” official projections until March of this year, overstated “actual” population growth from 2014 to 2017 by about one million.) Second, even “recent” official projections can be dated – e.g., the starting point for the Census population projections released earlier this year was the “Vintage 2016” estimates, which have been superseded by the “Vintage 2017” estimates. Third, “official” population projections may have “unrealistic” or out of date assumptions. For example, the latest Census population projections have unrealistic forecasts for US deaths by age, and questionable assumptions about US net international migration by age. And finally, there is considerable uncertainty in the current political environment about the outlook for US immigration policy, and analysts may want to use either their own assumptions about net international migration, or different “scenarios” for net international migration, to generate forecasts of other key economic variables.

While many folks who talk about the “demographic” outlook focus primarily on the current age distribution of the population, net international migration is also a key driver of adult population growth, and labor force growth. For example, the latest US population estimates (July 1, 2017) show that the US “prime” working age population (25-54) increased by 0.35% from July 1, 2016 to July 1, 2017. If there had been no international migration, however, the US prime working age population would actually have declined very slightly over this period.

Given the issues related to official US population projections, analysts attempting to project key economic variables dependent on population projections are faced with challenging choices: either using official projections knowing there are issues with these projections, or producing their own population projections. The latter choice faces its own issues, as analysts would need to formulate their own projections of deaths by age (and whatever other characteristic they are interested in), as well as their own projections of net international migration by age.

Using more realistic assumptions about death rates by age (calibrated to the latest statistics from the National Center for Health Statistics) and what I believe are more realistic assumptions on the age distribution of net international migration (NIM), I have produced US population projections by age under different NIM assumptions through 2021. I have also produced what household growth and labor force growth would be under those scenarios assuming that headship rates and labor force participation rates by age group remained constant at 2017 levels. I did not do this because I am projecting flat headship rates or labor force participation rates, but instead I wanted to show the sensitivity of forecasts to population assumptions.

My starting point was July 1, 2017 (the latest official estimates of the population by age), and I assumed that NIM for 2018 was the same as that shown in the latest Census population projections (since we’re already in the latter part of 2018, sensitivities from 2017 did not seem very useful to me.)

The scenarios I chose were (1) no international migration (this is not necessarily the same as zero net international migration, which only means that immigration inflows equal emigration outflows); (2) NIM equal to those shown in the latest Census projections; and (3) a “Trumpy” scenario, where NIM is lower than the latest Census projections by 20% in 2019, 30% in 2020, and 35% in 2o21.

The results for these various scenarios are shown in the table below. I also including what such “flat headship rates/LFPs” forecasts would have produced for this period if one used either the “official” Census 2014 population projections of the “official” Census 2017 population projections.

| Household Growth and Labor Force Growth Rates Projections Assume Flat Headship Rates and LFP Rates by Age, Alternative Scenarios | ||||

|---|---|---|---|---|

| Household Growth (number) | ||||

| 2019 | 2020 | 2021 | Annual Average | |

| No International Migration, Adjusted Death/NIM | 1,010,107 | 963,727 | 879,765 | 951,200 |

| "Trumpy" NIM, Adjusted Death/NIM | 1,234,580 | 1,172,179 | 1,084,845 | 1,163,868 |

| Census NIM, Adjusted Death/NIM | 1,290,696 | 1,259,509 | 1,190,910 | 1,247,038 |

| Official Census 2017 | 1,348,905 | 1,334,801 | 1,284,162 | 1,322,623 |

| Official Census 2014 | 1,460,383 | 1,446,511 | 1,393,524 | 1,433,473 |

| Labor Force Growth Rate (%) | ||||

|---|---|---|---|---|

| 2019 | 2020 | 2021 | CAGR | |

| No International Migration, Adjusted Death/NIM | 0.054% | 0.037% | 0.032% | 0.041% |

| "Trumpy" NIM, Adjusted Death/NIM | 0.337% | 0.292% | 0.275% | 0.301% |

| Census NIM, Adjusted Death/NIM | 0.407% | 0.400% | 0.403% | 0.403% |

| Official Census 2017 | 0.445% | 0.446% | 0.458% | 0.450% |

| Official Census 2014 | 0.530% | 0.529% | 0.535% | 0.531% |

Let’s first start with household growth. Analysts using the “official” Census 2014 Population Projections (which were the latest available until this March) could credibly argue that “official” population projections suggested that household formations over the next three years could easily average over 1.4 million.

If those same analysts updated their projections using the Census population projections released this March, they would have reduced their three-year household forecast by about 8%, or about 111 thousand a year.

If those same analysts used NCHS-based death rates by age (instead of the clearly wrong death rates used in the Census 2017 projections), they would have reduced their household growth forecast by an additional 76,000 a year.

If those same analysts believed that a “Trumpy” immigration bill along the lines of certain proposed Republican bills were likely, then they would lower their household growth forecast by ANOTHER 83,000 a year. Now let’s switch to labor force growth. The Census 2014 population projections suggested that even if labor force participation rates by age remained flat at 2017 levels, the labor force would grow by about 0.53% a year over the next three years. That number is reduced to 0.45% under the latest official projections; lowered to 0.40% under a “better assumptions” scenario; reduced to 0.3% under a “Trumpy” scenario; and in the absence of any international migration there would be virtually no labor force growth over the next few years unless labor force participation rates by age increased.

Obviously, the outlook for household growth, labor force growth, and other key economic variable over the next several years is at least partly dependent on projections of the US population. Folks need to realize, however, that the “demographic” outlook is not as clear as some might lead you to believe, and that forecasts based on “official” population projections are not useful just because they are “official.”

I’ll have more on this topic sometime later this year.

Look Ahead to Existing Home Sales for September

by Calculated Risk on 10/18/2018 12:37:00 PM

The NAR is scheduled to release Existing Home Sales for September at 10:00 AM tomorrow.

The consensus is for 5.30 million SAAR, down from 5.34 million in August. Housing economist Tom Lawler estimates the NAR will reports sales of 5.20 million SAAR for September and that inventory will be up 4.3% year-over-year. Based on Lawler's estimate, I expect existing home sales to be below the consensus for September.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8+ years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month, in August 2018, the consensus was for sales of 5.36 million on a seasonally adjusted annual rate (SAAR) basis. Lawler also estimated 5.36 million, and the NAR reported 5.34 million (both the consensus and Lawler were very close).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last eight years, the consensus average miss was 144 thousand, and Lawler's average miss was 67 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | --- |

| 1NAR initially reported before revisions. | |||

Earlier: Philly Fed Manufacturing Survey Suggested "Steady" Growth in October

by Calculated Risk on 10/18/2018 10:01:00 AM

Earlier: From the Philly Fed: October 2018 Manufacturing Business Outlook Survey

egional manufacturing activity continued to grow in October, according to results from this month’s Manufacturing Business Outlook Survey. The survey’s broad indicators for general activity, new orders, shipments, and employment remained positive and near their readings in September. The firms reported continued growth in employment and an increase in the average workweek this month. Expectations for the next six months remained optimistic.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity edged down slightly, from 22.9 in September to 22.2 this month. Nearly 36 percent of the manufacturers reported increases in overall activity this month, while 14 percent reported decreases. … The firms continued to report overall higher employment. More than 30 percent of the responding firms reported increases in employment this month, while 11 percent of the firms reported decreases in employment. The current employment index increased 2 points to 19.5. The firms also reported a longer workweek this month, as the workweek index increased from 14.6 to 20.8.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

This suggests the ISM manufacturing index will show solid expansion again in October.

Weekly Initial Unemployment Claims decreased to 210,000

by Calculated Risk on 10/18/2018 08:36:00 AM

The DOL reported:

In the week ending October 13, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 211,750, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 250 from 209,500 to 209,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 211,750.

This was lower than the the consensus forecast. The low level of claims suggest few layoffs.