by Calculated Risk on 9/19/2018 06:54:00 PM

Wednesday, September 19, 2018

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg, Flow of Funds

Note: The weekly claims report will be for the week ending September 15th. Hurricane Florence impacted the Carolinas starting around September 13th, so there might be some increase in claims due to the hurricane, but it is more likely a bump in claims will happen this week (to be reported next week).

Thursday:

• At 8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 204 thousand the previous week.

• At 8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 19.2, up from 11.9.

• At 10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.34 million in July.

• At 12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Nine Years Ago: Fast or Sluggish Recovery?

by Calculated Risk on 9/19/2018 04:05:00 PM

This is my 14th year writing this blog, and sometimes it is fun to look back at earlier predictions.

In the early stages of the recovery (September 2009), a number of analysts were predicting a rapid recovery (see: A couple of Bullish Views). My view was that the recovery would be sluggish. First, I quoted from some optimistic views, and then wrote:

I disagree with these views. … Although I started the year expecting a bottom in new home sales and single family housing starts (and it appears that has happened), there is still too much existing home inventory for much of an increase in the short term.Note: Housing starts did bottom in 2009, and then mostly moved sideways for the next couple of years.

...

[C]onsumers will remain under pressure as they repair their household balance sheets … This time housing will remain under pressure until the number of excess housing units (both owner occupied and rentals) decline to more normal levels.

So I think an "Immaculate Recovery" is very unlikely.

House prices didn't bottom for a few more years (from February 2012: The Housing Bottom is Here).

Click on graph for larger image.

Click on graph for larger image.And, according to the NY Fed, household debt didn't bottom until Q2 2013.

This graph shows aggregate consumer debt. Household debt previously peaked in 2008, and bottomed in Q2 2013.

Housing and household debt were drags on the economy for several years, and the recovery was sluggish. In addition, demographics weren't favorable (see: Demographics and GDP: 2% is the new 4%)

[U]sually following a recession, there is a brief period of above average growth - but not this time due to the financial crisis and need for households to deleverage. So we didn't see a strong bounce back (sluggish growth was predict on the blog for the first years of the recovery). … And overall, we should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis.For 2018, most analysts (including me) predicted a pickup in growth, for example on Jan 1, 2018, I wrote:

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.Recently the discussion has turned to the causes and timing of the next recession. See my Update: Predicting the Next Recession and Professor Krugman's column today: A Smorgasbord Recession? (Wonkish) . For now, the economy is fine (I'm not on recession watch).

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

AIA: "August architecture firm billings rebound"

by Calculated Risk on 9/19/2018 12:30:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: August architecture firm billings rebound as building investment spurt continues

Architecture firm billings rebounded solidly in August, posting their eleventh consecutive month of growth, according to a report released today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for August was 54.2 compared to 50.7 in July (any score over 50 represents billings growth). Most of the growth continues to come from the South and the multi-family residential sector.

“Billings at architecture firms in the South continue to lead the healthy increase in design activity that we’ve seen across the profession in recent months,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Nationally, growth across all building sectors remains solidly positive.”

...

• Regional averages: West (54.2), Midwest (52.5), South (57.0), Northeast (46.9)

• Sector index breakdown: multi-family residential (55.6), institutional (52.3), commercial/industrial (53.6), mixed practice (51.7)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.2 in August, up from 50.7 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018 and into 2019.

Comments on August Housing Starts

by Calculated Risk on 9/19/2018 09:33:00 AM

Earlier: Housing Starts Increased to 1.282 Million Annual Rate in August

Housing starts in August were above expectations, and starts for June and July were revised up. Most of the increase, and upward revisions, were due to the multi-family starts that are volatile month-to-month.

The housing starts report released this morning showed starts were up 9.2% in August compared to July (and August starts were revised up), and starts were up 9.4% year-over-year compared to August 2017.

Multi-family starts were up 38% year-over-year, and single family starts were down slightly year-over-year.

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were up 9.4% in August compared to August 2017.

Through eight months, starts are up 6.9% year-to-date compared to the same period in 2017. That is a decent increase.

Note that 2017 finished strong, so the year-over-year comparisons will be more difficult in Q4.

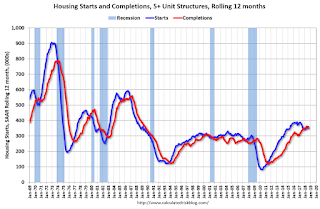

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a couple more years, or more, of increasing single family starts and completions.

Note: Two months ago, in response to numerous articles discussing the "slowing housing market" and some suggesting "housing has peaked", I wrote: Has Housing Market Activity Peaked? and Has the Housing Market Peaked? (Part 2). My view - that there will be further growth in housing starts - remains the same.

Housing Starts Increased to 1.282 Million Annual Rate in August

by Calculated Risk on 9/19/2018 08:37:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in August were at a seasonally adjusted annual rate of 1,282,000. This is 9.2 percent above the revised July estimate of 1,174,000 and is 9.4 percent above the August 2017 rate of 1,172,000. Single-family housing starts in August were at a rate of 876,000; this is 1.9 percent above the revised July figure of 860,000. The August rate for units in buildings with five units or more was 392,000.

Building Permits:

Privately-owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,229,000. This is 5.7 percent below the revised July rate of 1,303,000 and is 5.5 percent below the August 2017 rate of 1,300,000. Single-family authorizations in August were at a rate of 820,000; this is 6.1 percent below the revised July figure of 873,000. Authorizations of units in buildings with five units or more were at a rate of 370,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply in August compared to July. Multi-family starts were up 38% year-over-year in August.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years. This is the middle of the range.

Single-family starts (blue) increased in August, and were down slightly year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in August were above expectations, and starts for June and July were both revised up.

I'll have more later ...

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 9/19/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 14, 2018. Last week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since April 2011, 4.88 percent, from 4.84 percent, with points decreasing to 0.44 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, September 18, 2018

Wednesday: Housing Starts

by Calculated Risk on 9/18/2018 07:30:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Officially Highest in at Least 5 Years

Things are slightly worse for mortgage rates, which only generally follow the 10yr Treasury yield … today's rates are the highest in at least 5 years for some lenders (there were a few days in the middle of September 2013 that were worse) and the highest in 7 years for any other lenders. In both cases, we're talking about average conventional 30yr fixed quotes of 4.75% to 4.875% for top tier scenarios.Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for August. The consensus is for 1.240 million SAAR, up from 1.168 million SAAR.

• During the day, The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

Phoenix Real Estate in August: Sales down 1% YoY, Active Inventory down 8% YoY

by Calculated Risk on 9/18/2018 05:16:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report", table below):

1) Overall sales in August were down 0.9% year-over-year.

2) Active inventory is down 7.8% year-over-year. This is the smallest YoY decrease in almost two years. In many cities, it appears the inventory decline might be ending, but not yet in Phoenix.

This is the twenty-second consecutive month with a YoY decrease in inventory in Phoenix.

| August Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Sales | YoY Change | Active Inventory | YoY Change | |

| Aug-13 | 7,055 | --- | 18,176 | --- |

| Aug-14 | 6,428 | -8.9% | 24,220 | 33.3% |

| Aug-15 | 7,010 | 9.1% | 19,113 | -21.1% |

| Aug-16 | 7,843 | 11.9% | 19,570 | 2.4% |

| Aug-17 | 8,113 | 3.4% | 17,360 | -11.3% |

| Aug-18 | 8,036 | -0.9% | 16,010 | -7.8% |

"Inactive, Disconnected, and Ailing: A Portrait of Prime-Age Men Out of the Labor Force"

by Calculated Risk on 9/18/2018 01:03:00 PM

Some new research on our of the labor force prime age men: Inactive, Disconnected, and Ailing: A Portrait of Prime-Age Men Out of the Labor Force (ht Noah Smith)

This report is intended to enrich our understanding of who these prime-age "inactive" men are. It summarizes evidence from past research and fills out our picture of these men, providing some details about their past and present social and emotional lives. We introduce an under-utilized dataset little-known to economists and sociologists, the "National Epidemiological Survey on Alcohol and Related Conditions-III," or NESARC-III.CR Note: This is a reason why considering both demographics AND long term trends is important when trying to forecast the Labor Force Participation Rate (LFPR) and to estimate the remaining slack in the labor market. See: Labor Slack and the Participation Rate (Spreadsheet included)

Consistent with other survey data, the NESARC-III indicates that in 2013, 11 percent of prime-age men were outside the labor force. Roughly 45 percent of them indicate that their current situation involves illness or disability. Roughly 15 percent of inactive men are in school, 5 to 10 percent are retired, and another 5 to 10 percent are homemakers or caregivers. About a quarter of prime-age inactive men do not fit any of these categories. Contrary to the common view that most of these men have "dropped out" of the labor force after becoming discouraged by the job market, few prime-age inactive men indicate this to be true, and only 12 percent of able-bodied prime-age inactive men indicate in household surveys that they want a job or are open to taking one.

We confirm research by other scholars that a large number of inactive men are unambiguously and seriously sick or disabled. We provide new information, showing that many inactive men have poor physical health, poor mental health, or both. Over one-third of them (and nearly three in five disabled inactive men) are in the bottom quarter, nationally, of both physical and mental health.

Inactive men have fewer skills than employed men and live in poorer homes, often relying on public safety nets to get by. Two-thirds of inactive men personally received government assistance in the preceding year. One-third of inactive men have been incarcerated (including nearly half of disabled inactive men). Along with other evidence presented here on mobility-impeding behavior, such high incarceration rates suggest employment challenges.

emphasis added

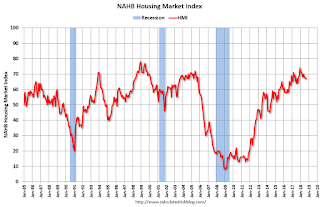

NAHB: Builder Confidence at 67 in September

by Calculated Risk on 9/18/2018 10:04:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 67 in September, unchanged from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Remains Firm in September

Builder confidence in the market for newly-built single-family homes remained unchanged at a solid 67 reading in September on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Despite rising affordability concerns, builders continue to report firm demand for housing, especially as millennials and other newcomers enter the market,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “The recent decline in lumber prices from record-high levels earlier this summer is also welcome relief, although builders still need to manage construction costs to keep homes competitively priced.”

“A growing economy and rising incomes combined with increasing household formations should boost demand for new single-family homes moving forward,” said NAHB Chief Economist Robert Dietz. “However, housing affordability is becoming a challenge, as builders face overly burdensome regulations and rising material costs exacerbated by an escalating trade skirmish. Interest rates are also forecasted to keep rising.”

...

The HMI index measuring current sales conditions rose one point to 74 and the component gauging expectations in the next six months increased two points to 74. Meanwhile, the metric charting buyer traffic held steady at 49.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose one point to 54 and the South remained unchanged at 70. The West edged down a single point to 73 and the Midwest fell three points to 59.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was at the consensus forecast, and a solid reading.