by Calculated Risk on 9/17/2018 06:36:00 PM

Monday, September 17, 2018

Lawler: Spotlight Seattle: Inventory Shortage Abating Rapidly

Tuesday:

At 10:00 AM ET, The September NAHB homebuilder survey. The consensus is for a reading of 67, unchanged from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From housing economist Tom Lawler: Spotlight Seattle: Inventory Shortage Abating Rapidly

Here are some August residential sales and listings statistics for the City of Seattle as compiled by the Northwest MLS.

| Residential Listings and Sales, City of Seattle, August 2018 | |||

|---|---|---|---|

| August-18 | August-17 | % Change | |

| Active Listings | 1,464 | 715 | 104.8% |

| Closed Sales | 875 | 1083 | -19.2% |

| Pending Sales | 875 | 1136 | -23.0% |

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/17/2018 04:11:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.36 million, up 0.4% from July’s preliminary pace (which I believe was too low), and down 1.1% from last August’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data, as well as data from other inventory trackers, suggest that the inventory of existing homes for sale in August was up a bit last August, mainly driven by big gains in previous “hot’ markets where inventory levels were very low a year ago. I project that the NAR’s estimate of the number of existing homes for sale as the end of August will be 1.92 million, unchanged from July’s preliminary estimate and up 2.7% from last August.

Finally, local realtor/MLS data suggest that the median US existing single-family home sales price last month was up about 5.5% from last August. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: The NAR is scheduled to released August existing home sales on Thursday. The consensus is also for sales of 5.36 million SAAR, up from 5.34 million in July.

Hotels: Occupancy Rate Declines Year-over-year

by Calculated Risk on 9/17/2018 12:49:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 8 September

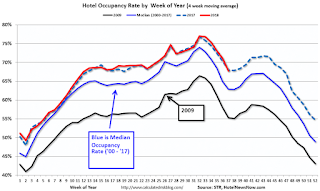

The U.S. hotel industry reported mostly negative year-over-year results in the three key performance metrics during the week of 2-8 September 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 September 2017, the industry recorded the following:

• Occupancy: -3.5% to 61.7%

• Average daily rate (ADR): +1.0% to US$121.95

• Revenue per available room (RevPAR): -2.4% to US$75.25

STR analysts note that performance percentage changes in several major markets were significantly affected by the comparison with the post-Hurricane Harvey and pre-Hurricane Irma time period in 2017.

…

Houston, Texas, reported the steepest decreases in each of the three key performance metrics: occupancy (-42.2% to 50.0%), ADR (-19.6% to US$90.73) and RevPAR (-53.6% to US$45.36). Houston’s hotel performance was lifted in the weeks and months that followed Hurricane Harvey in 2017 as properties filled with displaced residents, relief workers, insurance adjustors, media members, etc.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is just ahead of the record year in 2017.

Note: 2017 finished strong due to the impact of the hurricanes. There will be some boost to hotel occupancy in the Carolina region following hurricane Florence, but I expect the overall occupancy to be lower in 2018 than in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

LA area Port Traffic in August

by Calculated Risk on 9/17/2018 10:00:00 AM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.3% compared in August to the rolling 12 months ending in July. Outbound traffic was up 0.2% compared to the rolling 12 months ending in July.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 6 or 7 years.

It is still too early to tell about the impact of the tariffs.

Fom the NY Fed: Manufacturing "Business activity continued to grow at a solid clip in New York State"

by Calculated Risk on 9/17/2018 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity continued to grow at a solid clip in New York State, according to firms responding to the September 2018 Empire State Manufacturing Survey. The headline general business conditions index showed ongoing strength, but moved down seven points to 19.0, pointing to a slower pace of growth than last month. New orders and shipments grew moderately. Delivery times continued to lengthen, and inventories moved higher. Labor market indicators pointed to an increase in employment levels and longer workweeks. Price indexes were little changed and remained elevated, suggesting ongoing significant increases in both input prices and selling prices. Looking ahead, firms remained fairly optimistic about the six-month outlook.This was below the consensus forecast, but still a solid reading.

…

The index for number of employees held steady at 13.3 and the average workweek index was 11.5, indicating a modest increase in both employment levels and hours worked.

emphasis added

Sunday, September 16, 2018

Sunday Night Futures

by Calculated Risk on 9/16/2018 07:54:00 PM

Weekend:

• Schedule for Week of September 16, 2018

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 23.0, down from 25.6.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 5 and DOW futures are down 45 (fair value).

Oil prices were up over the last week with WTI futures at $68.79 per barrel and Brent at $77.96 per barrel. A year ago, WTI was at $50, and Brent was at $56 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.85 per gallon. A year ago prices were at $2.60 per gallon (jumped last year due to hurricane Harvey) - so gasoline prices are up 25 cents per gallon year-over-year.

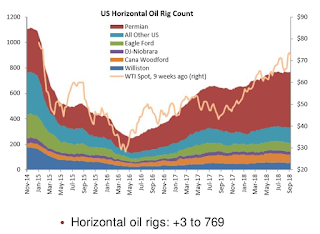

Oil Rigs: "Treading water"

by Calculated Risk on 9/16/2018 08:12:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on September 14, 2018:

• Oil rigs gained, +7 to 867

• Horizontal oil rigs were up, +3 to 769

...

• Horizontal oil rigs counts are essentially unchanged in 13 weeks

• The Permian has been flat for six weeks, and is only 4 horizontal oil rigs higher than three months ago.

• The breakeven oil price to add horizontal oil rigs came in at $72 WTI this week. This is a good bit higher than the current WTI price around $69.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Saturday, September 15, 2018

Schedule for Week of September 16, 2018

by Calculated Risk on 9/15/2018 08:11:00 AM

The key economic reports this week are August Housing Starts and Existing Home Sales.

For manufacturing, the September New York and Philly Fed surveys, will be released this week.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 23.0, down from 25.6.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 67, unchanged from 67 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

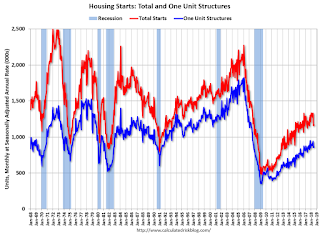

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.240 million SAAR, up from 1.168 million SAAR.

During the day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 204 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 19.2, up from 11.9.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.34 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.36 million SAAR, up from 5.34 million in July.The graph shows existing home sales from 1994 through the report last month.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: State Employment and Unemployment (Monthly) for August 2018

Friday, September 14, 2018

Lawler: Single Family Rental Market Share Shrunk Significantly in 2017

by Calculated Risk on 9/14/2018 07:34:00 PM

From housing economist Tom Lawler: Single Family Rental Market Share Shrunk Significantly in 2017

ACS estimates suggest that the renter-occupied share of total occupied single-family detached homes fell to 16.13% in 2017 from 16.76% in 2016. This renter share was the lowest since 2011.

The ACS estimate of the number of renter-occupied single-family detached homes in 2017 was 12,172,265, down 294,869 from 2016.

Lawler: Household Estimates Conundrum Alive and Well

by Calculated Risk on 9/14/2018 04:22:00 PM

From housing economist Tom Lawler: Household Estimates Conundrum Alive and Well

One of the most vexing government data issues facing housing economists is the lack of any timely and reliable estimates of the number of US households. To be sure, there is no shortage of household estimates: in addition to the decennial Census counts, Census releases four different estimates of the number of US households. Unfortunately, the estimates not only differ materially, but also show different characteristics of households (e.g., by age) and often show different growth rates over time.

This issue, labeled by Census economists several years ago as the “household estimates conundrum,” was highlighted in the recent release of US household estimates from the 2017 American Community Survey (ACS), the 2017 American Housing Survey (AHS), and the 2018 (March) Current Population Survey Annual Social and Economic Supplement (CPS/ASEC). Below is a table showing estimates of the number of US households by age group from each of these surveys, as well as 2017 estimates from the Housing Vacancy Survey, a monthly supplement to the Current Population Survey.

| Different Estimates of the Number of US Households by Select Age Groups (000's) | |||||

|---|---|---|---|---|---|

| ACS 2017 | AHS 2017 | HVS 2017 | CPS/ASEC March 2018 | CPS/ASEC March 2017 | |

| Total | 120,063 | 121,190 | 119,273 | 127,586 | 126,224 |

| 15-24 | 4,334 | 4,274 | 5,932 | 6,211 | 6,239 |

| 25-34 | 18,107 | 17,716 | 19,399 | 20,264 | 20,109 |

| 35-44 | 20,553 | 20,740 | 20,051 | 21,576 | 21,500 |

| 45-54 | 22,671 | 23,220 | 21,387 | 22,542 | 22,808 |

| 55-64 | 23,705 | 24,690 | 22,551 | 24,020 | 23,770 |

| 65+ | 30,692 | 30,550 | 29,953 | 32,973 | 31,798 |

None of these surveys is designed directly to measure the number of households; rather, they are designed to estimate the characteristics of the household population and/or the housing stock. Household estimates are then “controlled” either to independent US population estimates (CPS/ASEC) or to independent US housing stock estimates (ACS, AHS, and HVS).

If the housing stock estimates are correct but a survey overstates the overall vacancy rate, and that survey is controlled to housing stock estimates, then that survey will understate the number of households. If the population estimates are correct but the survey understates the average US household size, then that survey will overstate the number of households. Comparisons of survey estimates with decennial Census 2010 counts indicated that the ACS and HVS understated the number of US households, and the CPS/ASEC overstated the number of US households.

Aside from the total estimates, what is especially striking about the different survey results is the vastly different age distributions of households. For example, the CPS-based household estimates show that the share of US households under 35 years old is about 21%, compared to the ACS’s 18.7% and the AHS’s 18.1%. Comparisons of the surveys to Decennial Census counts showed that CPS-based household estimates significantly overstated the number of younger householders, while the ACS understated somewhat the number of younger householders.

The issue of differences in household and vacancy rate estimates was a “hot topic” following the release of Census 2010 results, and there was a flurry of working papers earlier this decade on the topic (though the papers only focused on differences in Census 2010 and the 2010 ACS, even though CPS-based differences were even larger. Since 2013, however, research appears to have stalled, which is disturbing.