by Calculated Risk on 7/23/2018 11:59:00 AM

Monday, July 23, 2018

A Few Comments on June Existing Home Sales

Earlier: NAR: Existing-Home Sales Decline in June, Inventory UP Year-over-year

The big story in the monthly existing home report was that inventory was UP year-over-year for the first time since 2015. I've write more about this.

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in April. The consensus was for sales of 5.45 million SAAR, Lawler estimated the NAR would report 5.35 million SAAR in June, and the NAR actually reported 5.38 million.

2) Inventory is still very low, but increased 0.5% year-over-year (YoY) in June. This was the 1st year-over-year increase since June 2015, following 36 consecutive months with a year-over-year decline in inventory.

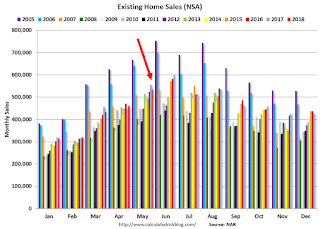

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in June (570,000, red column) were below sales in June 2017 (600,000, NSA).

Sales NSA through June (first six months) are down about 2.2% from the same period in 2017.

This is a small decline - but it is possible there has been an impact from higher interest rates and / or the changes to the tax law (eliminating property taxes write-off, etc).

NAR: Existing-Home Sales Decline in June, Inventory UP Year-over-year

by Calculated Risk on 7/23/2018 10:11:00 AM

From the NAR: Existing-Home Sales Subside 0.6 Percent in June

Existing-home sales decreased for the third straight month in June, as declines in the South and West exceeded sales gains in the Northeast and Midwest, according to the National Association of Realtors®. The ongoing supply and demand imbalance helped push June’s median sales price to a new all-time high.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 0.6 percent to a seasonally adjusted annual rate of 5.38 million in June from a downwardly revised 5.41 million in May. With last month’s decline, sales are now 2.2 percent below a year ago.

...

Total housing inventory at the end of June climbed 4.3 percent to 1.95 million existing homes available for sale, and is 0.5 percent above a year ago (1.94 million) – the first year-over-year increase since June 2015. Unsold inventory is at a 4.3-month supply at the current sales pace (4.2 months a year ago).

emphasis added

Click on graph for larger image.

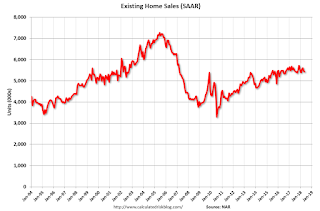

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June (5.38 million SAAR) were 0.6% lower than last month, and were 2.2% below the June 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.95 million in June from 1.87 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.95 million in June from 1.87 million in May. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 0.5% year-over-year in June compared to June 2017.

Inventory increased 0.5% year-over-year in June compared to June 2017. Months of supply was at 4.3 months in June.

Sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low, but appears to be bottoming. I'll have more later ...

Chicago Fed "Index points to a rebound in economic growth in June"

by Calculated Risk on 7/23/2018 08:37:00 AM

From the Chicago Fed: Index points to a rebound in economic growth in June

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rebounded to +0.43 in June from –0.45 in May. Two of the four broad categories of indicators that make up the index increased from May, and three of the four categories made positive contributions to the index in June. The index’s three-month moving average, CFNAI-MA3, edged up to +0.16 in June from +0.10 in May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in June (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, July 22, 2018

Monday: Existing Home Sales

by Calculated Risk on 7/22/2018 08:23:00 PM

Weekend:

• Schedule for Week of July 22, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for June. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, up from 5.43 million in May. Housing economist Tom Lawler estimates the NAR will reports sales of 5.35 million SAAR for June and that inventory will be down 4.1% year-over-year.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $68.24 per barrel and Brent at $73.18 per barrel. A year ago, WTI was at $47, and Brent was at $48 - so oil prices are up 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.83 per gallon. A year ago prices were at $2.27 per gallon - so gasoline prices are up 56 cents per gallon year-over-year.

Existing Home Sales: Take the Under for June

by Calculated Risk on 7/22/2018 08:55:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8+ years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

As an example, for last month, May 2018, the consensus was for sales of 5.56 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated 5.47 million, and the NAR reported 5.43 million (the consensus missed by 130 thousand compared to 40 thousand for Lawler).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

For June 2018, the consensus is that the NAR will report sales of 5.45 million SAAR. However, housing economist Tom Lawler estimates the NAR will report sales of 5.35 million.

Lawler's estimate is a little below the consensus, so I'd take the under for June. Note: The NAR is scheduled to report June Existing Home Sales tomorrow, Monday, July 23rd at 10:00 AM ET.

Over the last eight years, the consensus average miss was 147 thousand, and Lawler's average miss was 68 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, July 21, 2018

Schedule for Week of July 22, 2018

by Calculated Risk on 7/21/2018 08:11:00 AM

The key economic reports this week are the advance estimate of Q2 GDP, and June New and Existing Home Sales.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, up from 5.43 million in May.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, up from 5.43 million in May.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.35 million SAAR for June and that inventory will be down 4.1% year-over-year.

9:00 AM: FHFA House Price Index for May 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for July.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 669 thousand SAAR, down from 689 thousand in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 207 thousand the previous week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.2% increase in durable goods orders.

10:00 AM: the Q2 2018 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for July.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Advance estimate). The consensus is that real GDP increased 4.2% annualized in Q2, up from 2.0% in Q1.

10:00 AM: University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 97.2, up from 97.1.

Friday, July 20, 2018

Oil Rigs: "A brutal week for rig counts"

by Calculated Risk on 7/20/2018 03:28:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 20, 2018:

• A brutal week for rig counts

• Total oil rigs fell, -5 to 858

• Horizontal oil rig counts came in -7 to 762

...

• A year ago, operators were adding rigs at $50 WTI; now they are withdrawing rigs at $70 WTI.

• All this begs the underlying economics of shale production after 500 horizontal oil rigs have been added in this cycle.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

State Unemployment since 1976

by Calculated Risk on 7/20/2018 01:29:00 PM

Earlier I posted the BLS release for state unemployment rates in June. I've been posting a graph showing the number of states with unemployment rates above certain levels since 2006.

Since all of the state series began in 1976, below is a graph showing state unemployment rates since 1976.

Only one state has never had an unemployment rate below 6% (Alaska with a minimum is 6.3% in 1999). So Dark Blue on the graph below never reaches zero.

For interest, note the impact of Hurricane Katrina in 2005 when the unemployment rate for Louisiana increased sharply from 5.4% to 11.3% in one month, and the unemployment rate for Mississippi increased from 6.9% to 9.8%.

This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

At the worst of the early '80s recession, there were 18 states with an employment rate at or above 11%.

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

BLS: Unemployment Rates Lower in 9 states in June, Oregon at New Low

by Calculated Risk on 7/20/2018 10:08:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in June in 9 states, higher in 3 states, and stable in 38 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Ten states had jobless rate decreases from a year earlier and 40 states and the District had little or no change. The national unemployment rate rose by 0.2 percentage point from May to 4.0 percent but was 0.3 point lower than in June 2017.

...

Hawaii had the lowest unemployment rate in June, 2.1 percent. The rate in Oregon (4.0 percent) set a new series low. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Has Housing Market Activity Peaked?

by Calculated Risk on 7/20/2018 08:43:00 AM

Following the release of housing starts this week, Sharon Nunn wrote in the WSJ: Housing Market Stumbles at the Beginning of Summer. She quoted Ian Shepherdson, chief economist at Pantheon Macroeconomics as telling clients: “Housing market activity – sales and construction – likely has peaked for this cycle."

If correct, that would be significant for the economy.

First, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Also I think the growth in multi-family starts is behind us, and that multi-family starts peaked in June 2015. See: Comments on June Housing Starts

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

If new home sales and single family starts have peaked that would be a significant warning sign. Although housing is under pressure from policy (negative impact from tax, immigration and trade policies), I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.