by Calculated Risk on 5/31/2018 06:58:00 PM

Thursday, May 31, 2018

Friday: Employment Report, Auto Sales, ISM Manufacturing, Construction Spending

My May Employment Preview

Goldman: May Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April. The consensus is for the unemployment rate to be unchanged at 3.9%.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April. The PMI was at 57.3% in April, the employment index was at 54.2%, and the new orders index was at 61.2%.

• At 10:00 AM, Construction Spending for April. The consensus is for a 0.8% increase in construction spending.

• All day, Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).

Goldman: May Payrolls Preview

by Calculated Risk on 5/31/2018 03:02:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 205k in May, 15k above consensus. While labor supply constraints often weigh on May job creation when the labor market is beyond full employment, we believe strong jobless claims data, rebounding business surveys, and a return to normal weather suggest a pickup in payroll growth in tomorrow’s report.

... we estimate the unemployment rate remained stable at 3.9% in May. ... We estimate a 0.2% month-over-month increase in average hourly earnings (and 2.6% year-on-year)

emphasis added

May Employment Preview

by Calculated Risk on 5/31/2018 12:19:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus, according to Bloomberg, is for an increase of 190,000 non-farm payroll jobs in May (with a range of estimates between 155,000 to 220,000), and for the unemployment rate to be unchanged at 3.9%.

The BLS reported 164,000 jobs added in April.

Here is a summary of recent data:

• The ADP employment report showed an increase of 178,000 private sector payroll jobs in May. This was slightly below consensus expectations of 186,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing and non-manufacturing surveys will be released after the employment report this month.

• Initial weekly unemployment claims averaged 222,000 in May, about the same as in April. For the BLS reference week (includes the 12th of the month), initial claims were at 223,000, down from 233,000 during the reference week in April.

The slight decrease during the reference week suggests a slightly stronger employment report in May than in April.

• The final May University of Michigan consumer sentiment index decreased to 98.0 from the April reading of 98.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Merrill Lynch has introduced a new payrolls tracker based on private internal BAC data. The tracker suggests private payrolls increased by 227,000 in May, and this suggests employment growth above expectations.

• Looking back at the three previous years:

In May 2017, the consensus was for 185,000 jobs, and the BLS reported 138,000 jobs added. In May 2016, the consensus was for 158,000 jobs, and the BLS reported 38,000 jobs added. In May 2015, the consensus was for 220,000 jobs, and the BLS reported 280,000 jobs added.

• Conclusion: In general, these reports suggest a solid employment report, and probably close to expectations. The ADP report suggests a report slightly below expectations, but the reference week for unemployment claims, and the Merrill payrolls tracker suggest a stronger report. My guess is that the employment report will be close to the consensus in May.

NAR: Pending Home Sales Index Decreased 1.3% in April, Down 2.1% Year-over-year

by Calculated Risk on 5/31/2018 10:03:00 AM

From the NAR: Pending Home Sales Lose Steam in April, Decline 1.3 Percent

After two straight months of modest increases, pending home sales dipped in April to their third-lowest level over the past year, according to the National Association of Realtors. All major regions saw no gain in contract activity last month.This was well below expectations of a 0.7% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 1.3 percent to 106.4 in April from an upwardly revised 107.8 in March. With last month’s decrease, the index is down on an annualized basis (2.1 percent) for the fourth straight month.

...

The PHSI in the Northeast remained at 90.6 in April, and is 2.1 percent below a year ago. In the Midwest the index decreased 3.2 percent to 98.5 in April, and is 5.1 percent lower than April 2017.

Pending home sales in the South declined 1.0 percent to an index of 127.3 in April, but is still 2.7 percent higher than last April. The index in the West inched backward 0.4 percent in April to 94.4, and is 4.6 percent below a year ago.

emphasis added

Personal Income increased 0.3% in April, Spending increased 0.6%

by Calculated Risk on 5/31/2018 08:39:00 AM

The BEA released the Personal Income and Outlays report for April:

Personal income increased $49.5 billion (0.3 percent) in April according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $60.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $79.8 billion (0.6 percent).The April PCE price index increased 2.0 percent year-over-year and the April PCE price index, excluding food and energy, increased 1.8 percent year-over-year.

Real DPI increased 0.2 percent in April and Real PCE increased 0.4 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

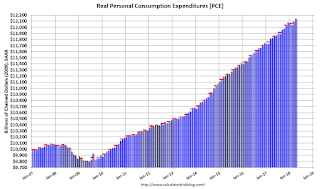

The following graph shows real Personal Consumption Expenditures (PCE) through April 2018 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was at expectations, and the increase in PCE was above expectations.

Weekly Initial Unemployment Claims decrease to 221,000

by Calculated Risk on 5/31/2018 08:33:00 AM

The DOL reported:

In the week ending May 26, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 13,000 from the previous week's unrevised level of 234,000. The 4-week moving average was 222,250, an increase of 2,500 from the previous week's unrevised average of 219,750.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 222,250.

This was close to the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, May 30, 2018

Thursday: Unemployment Claims, Personal Income and Outlays, Pending Home sales and more

by Calculated Risk on 5/30/2018 07:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher After Yesterday's Big Drop

Mortgage rates were somewhat higher today as politicians struck a more conciliatory tone in Italy. To be clear, we are indeed talking about mortgage rates in the United States in relation to European politics. It's not the first time and it likely won't be the last. [30YR FIXED - 4.5-4.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, down from 234 thousand the previous week.

• At 8:30 AM, Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 58.1, up from 57.6 in April.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.7% increase in the index.

Fed's Beige Book: "Economic activity expanded moderately", "concern about trade policy"

by Calculated Risk on 5/30/2018 02:07:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Cleveland based on information collected on or before May 21, 2018."

Economic activity expanded moderately in late April and early May with few shifts in the pattern of growth. The Dallas District was an exception, where overall economic activity sped up to a solid pace. Manufacturing shifted into higher gear with more than half of the Districts reporting a pickup in industrial activity and a third of the Districts classifying activity as "strong." Fabricated metals, heavy industrial machinery, and electronics equipment were noted as areas of strength. Rising goods production led to higher freight volumes for transportation firms. By contrast, consumer spending was soft. Nonauto retail sales growth moderated somewhat and auto sales were flat, although there was considerable variation by District and vehicle type. In banking, demand for loans ticked higher and banks reported that increased competition had led to higher deposit rates. Delinquency rates were mostly stable at low levels. Homebuilding and home sales increased modestly, on net, and nonresidential construction continued at a moderate pace. Contacts noted some concern about the uncertainty of international trade policy. Still, outlooks for near term growth were generally upbeat.

...

Employment rose at a modest to moderate rate across most Districts. Again, the Dallas District was the exception, where solid and widespread employment growth was reported. Labor market conditions remained tight across the country, and contacts continued to report difficulty filling positions across skill levels. Shortages of qualified workers were reported in various specialized trades and occupations, including truck drivers, sales personnel, carpenters, electricians, painters, and information technology professionals. Many firms responded to talent shortages by increasing wages as well as the generosity of their compensation packages. In the aggregate, however, wage increases remained modest in most Districts. Contacts in some Districts expected similar employment and wage gains in the coming months.

emphasis added

Q1 GDP Revised down to 2.2% Annual Rate

by Calculated Risk on 5/30/2018 08:35:00 AM

From the BEA: National Income and Product Accounts Gross Domestic Product: First Quarter 2018 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.2 percent in the first quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2017, real GDP increased 2.9 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 1.1% to 1.0%. Residential investment was revised down from no change to -2.0%. Most revisions were small. This was slightly below the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.3 percent. With this second estimate for the first quarter, the general picture of economic growth remains the same; downward revisions to private inventory investment, residential fixed investment, and exports were partly offset by an upward revision to nonresidential fixed investment.

emphasis added

ADP: Private Employment increased 178,000 in May

by Calculated Risk on 5/30/2018 08:24:00 AM

Private sector employment increased by 178,000 jobs from April to May according to the May ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was slightly below the consensus forecast for 186,000 private sector jobs added in the ADP report.

...

“The hot job market has cooled slightly as the labor market continues to tighten,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Healthcare and professional services remain a model of consistency and continue to serve as the main drivers of growth in the services sector and the broader labor market as well.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth is strong, but slowing, as businesses are unable to fill a record number of open positions. Wage growth is accelerating in response, most notably for young, new entrants and those changing jobs. Finding workers is increasingly becoming businesses number one problem.”

The BLS report for May will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in May.