by Calculated Risk on 5/18/2018 10:06:00 AM

Friday, May 18, 2018

BLS: Unemployment Rates Lower in 4 states in April; California, Hawaii and Wisconsin at New Series Lows

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in April in 4 states and stable in 46 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twelve states had jobless rate decreases from a year earlier and 38 states and the District had little or no change. The national unemployment rate edged down from March to 3.9 percent and was 0.5 percentage point lower than in April 2017

...

Hawaii had the lowest unemployment rate in April, 2.0 percent. The rates in California (4.2 percent), Hawaii (2.0 percent), and Wisconsin (2.8 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Thursday, May 17, 2018

Hotels: Occupancy Rate increases Year-over-Year, On Pace for Record Year

by Calculated Risk on 5/17/2018 07:12:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 12 May

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 6-12 May 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 7-13 May 2017, the industry recorded the following:

• Occupancy: +0.8% to 68.5%

• Average daily rate (ADR): +3.5% to US$130.06

• evenue per available room (RevPAR): +4.4% to US$89.03

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Update: Housing Inventory Tracking

by Calculated Risk on 5/17/2018 03:16:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento (all through April), and also total existing home inventory as reported by the NAR (through March 2018).

Note: For Phoenix, there was a discrepancy between the "Market Report" and the "Stats Report". For this graph, I'm using the Stats Report.

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 18% year-over-year in April (inventory was still very low), and has increased year-over-year for seven consecutive months.

Also note the inventory is still down 19.5% in Las Vegas (red), but the YoY decline has been getting smaller - and it is very possible that inventory will up year-over-year in Las Vegas later this year.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. It appears the inventory decline might be ending in some markets.

Earlier: Philly Fed Manufacturing Survey "Suggest a pickup in growth" in May

by Calculated Risk on 5/17/2018 01:12:00 PM

From the Philly Fed: May 2018 Manufacturing Business Outlook Survey

Results from the May Manufacturing Business Outlook Survey suggest a pickup in growth of the region’s manufacturing sector. The survey’s indexes for general activity, new orders, shipments, and employment increased from their readings in April. A notable share of firms also reported higher prices for their own manufactured goods this month. The survey’s future indexes, measuring expectations for the next six months, reflected continued optimism.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased 11 points, from 23.2 in April to 34.4 this month. Over 43 percent of the manufacturers reported increases in overall activity this month, while 9 percent reported decreases. ... The firms continued to report overall increases in employment. Nearly 37 percent of the responding firms reported increases in employment, while 6 percent reported decreases this month. The current employment index edged 3 points higher to 30.2, its highest reading in seven months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

This suggests the ISM manufacturing index will show solid expansion again in May, and probably stronger than in April.

NY Fed Q1 Report: "Total Household Debt Rises for 15th Straight Quarter, Led by Mortgages, Student Loans"

by Calculated Risk on 5/17/2018 10:43:00 AM

From the NY Fed: Total Household Debt Rises for 15th Straight Quarter, Led by Mortgages, Student Loans

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $63 billion (0.5%) to $13.21 trillion in the first quarter of 2018. It was the 15th consecutive quarter with an increase, and the total is now $536 billion higher than the previous peak of $12.68 trillion, from the third quarter of 2008. Further, overall household debt is now 18.5% above the post-financial-crisis trough reached during the second quarter of 2013. The Report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

Mortgage balances—the largest component of household debt—rose by $57 billion during the first quarter, to $8.94 trillion. Balances on home equity lines of credit (HELOC) continued their downward trend, declining by $8 billion, to $436 billion. The median credit score of newly originating mortgage borrowers increased from 755 to 761.

"While housing wealth is at an all-time high, it has shifted into the hands of older and more creditworthy borrowers, in part because of tight mortgage lending standards," said Andrew Haughwout, senior vice president at the New York Fed. "An increased amount of available home equity should make the household balance sheet more resilient in the event of a financial shock, though that may not be an option for lower-credit-score borrowers."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Aggregate household debt balances increased in the first quarter of 2018, for the 15th consecutive quarter, and are now $536 billion higher than the previous (2008Q3) peak of $12.68 trillion. As of March 31, 2018, total household indebtedness was $13.21 trillion, a $63 billion (0.5%) increase from the fourth quarter of 2017. Overall household debt is now 18.5% above the 2013Q2 trough.

Mortgage balances, the largest component of household debt, increased somewhat during the first quarter. Mortgage balances shown on consumer credit reports on March 31 stood at $8.94 trillion, an increase of $57 billion from the fourth quarter of 2017. Balances on home equity lines of credit (HELOC) continued their downward trend, declining by $8 billion, and are now at $436 billion. Non-housing balances saw a $14 billion increase in the first quarter. Auto loans grew by $8 billion. Student loan balances increased by $29 billion and credit cards declined by $19 billion.

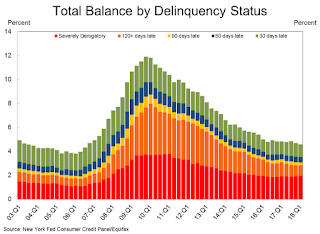

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate decreased in Q1. From the NY Fed:

Aggregate delinquency rates improved in the first quarter of 2018. As of March 31, 4.6% of outstanding debt was in some stage of delinquency. Of the $605 billion of debt that is delinquent, $407 billion is seriously delinquent (at least 90 days late or “severely derogatory”). The flow into 90+ day delinquency for credit card balances has been increasing notably for the last year, while the flow into 90+ day delinquency for auto loan balances has been slowly trending upward since 2012.There is much more in the report.

About 192,000 consumers had a bankruptcy notation added to their credit reports in 2018Q1, the lowest observed in the 19 year history of the data.

Weekly Initial Unemployment Claims increase to 222,000, 4-week average lowest since 1969

by Calculated Risk on 5/17/2018 08:33:00 AM

The DOL reported:

In the week ending May 12, the advance figure for seasonally adjusted initial claims was 222,000, an increase of 11,000 from the previous week's unrevised level of 211,000. The 4-week moving average was 213,250, a decrease of 2,750 from the previous week's unrevised average of 216,000. This is the lowest level for this average since December 13, 1969 when it was 210,750.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,250.

This was higher than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, May 16, 2018

Thursday: Unemployment Claims, Philly Fed Mfg, NY Fed Household Debt and Credit Report

by Calculated Risk on 5/16/2018 06:51:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 211 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 22.0, down from 23.2.

• At 11:00 AM, The New York Fed will release their Q1 2018 Household Debt and Credit Report

Phoenix Real Estate in April: Sales down 9% or up 4%?

by Calculated Risk on 5/16/2018 04:03:00 PM

Yesterday I reported that sales in Phoenix were down 9% in April compared to April 2017. This was based on the monthly ARMLS Market Report.

Housing economist Tom Lawler pointed out that the Stat report, also from the ARMLS, shows April sales were up 3.7% year-over-year! Quite a difference.

On inventory, the Market report showed inventory down 25.7% year-over-year, and the Stat report showed inventory only down 9.9% year-over-year. Another huge difference.

I'm trying to understand why the two reports are so different (I've always used the Market Report).

The bottom line is sales in Phoenix on a year-over-year basis were either down 9% or up 3.7%. And inventory was either down 25.7% or down 9.9%.

MBA: Mortgage Delinquency Rate decreased in Q1

by Calculated Risk on 5/16/2018 12:56:00 PM

From the MBA: Mortgage Delinquencies Down in 1st Quarter of 2018

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally-adjusted rate of 4.63 percent of all loans outstanding at the end of the first quarter of 2018.

The delinquency rate was down 54 basis points from the previous quarter, and was eight basis points lower than one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The percentage of loans on which foreclosure actions were started during the first quarter was 0.28 percent, up three basis points from the last quarter, but down two basis points from one year ago.

“Mortgage delinquencies decreased from the previous quarter across all loan types – conventional, VA, and in particular, FHA – as the effects of the September hurricanes dissipated,” according to Marina Walsh, MBA’s Vice President of Industry Analysis.

“The strong economy, low unemployment rate, tax refunds and bonuses and home price appreciation were key factors that helped push delinquencies down in the first quarter. Of course, there are offsetting factors that may put upward pressure on delinquency rates in future quarters, including: a difficult recovery for some borrowers in hurricane-impacted states; the aging of loan portfolios; higher interest rates that limit a borrower’s rate-term refinance options; higher energy prices; stretching of housing affordability given limited supply; and the easing of credit overlays as mortgage market conditions have changed.”

...

Mortgage delinquencies dropped across all stages of delinquency in the first quarter of 2018 compared to the fourth quarter of 2017. The 30-day delinquency dropped 27 basis points from the previous quarter, while the 60-day and 90-day delinquency buckets dropped by 9 and 18 basis points respectively.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 1.16 percent, down 3 basis points from the fourth quarter of 2017 and 23 basis points lower than one year ago. This was the lowest foreclosure inventory rate since the third quarter of 2006. In addition to the strong economy and increasing home equity levels, extended storm-related foreclosure moratoria continue to play a factor in keeping foreclosure inventory at historic lows.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.61 percent in the first quarter of 2018, a decrease of 30 basis points from last quarter, and a decrease of 15 basis points from last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans delinquent decreased in Q1, as "the effects of the September hurricanes dissipated".

The percent of loans in the foreclosure process continues to decline, and is close to normal levels.

Comments on April Housing Starts

by Calculated Risk on 5/16/2018 11:35:00 AM

Earlier: Housing Starts decreased to 1.287 Million Annual Rate in April

The housing starts report released this morning showed starts were down 3.7% in April compared to March, and starts were up 10.5% year-over-year compared to April 2017.

The decrease in starts was mostly due to the volatile multi-family sector.

This first graph shows the month to month comparison between 2018 (blue) and 2017 (red).

Starts were up 10.5% in April compared to April 2017.

Note that starts in March, April and May of 2017 were weaker than other months, so this was a fairly easy comparison.

Through four months, starts are up 8.0% year-to-date compared to the same period in 2017.

Single family starts were up 7.2% year-over-year, and up 0.1% compared to March 2018.

Multi-family starts were up 18.7% year-over-year, and down 11.3% compared to March 2018 (multi-family is volatile month-to-month).

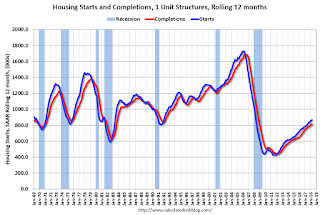

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have caught up to starts (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.