by Calculated Risk on 5/17/2018 10:43:00 AM

Thursday, May 17, 2018

NY Fed Q1 Report: "Total Household Debt Rises for 15th Straight Quarter, Led by Mortgages, Student Loans"

From the NY Fed: Total Household Debt Rises for 15th Straight Quarter, Led by Mortgages, Student Loans

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $63 billion (0.5%) to $13.21 trillion in the first quarter of 2018. It was the 15th consecutive quarter with an increase, and the total is now $536 billion higher than the previous peak of $12.68 trillion, from the third quarter of 2008. Further, overall household debt is now 18.5% above the post-financial-crisis trough reached during the second quarter of 2013. The Report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

Mortgage balances—the largest component of household debt—rose by $57 billion during the first quarter, to $8.94 trillion. Balances on home equity lines of credit (HELOC) continued their downward trend, declining by $8 billion, to $436 billion. The median credit score of newly originating mortgage borrowers increased from 755 to 761.

"While housing wealth is at an all-time high, it has shifted into the hands of older and more creditworthy borrowers, in part because of tight mortgage lending standards," said Andrew Haughwout, senior vice president at the New York Fed. "An increased amount of available home equity should make the household balance sheet more resilient in the event of a financial shock, though that may not be an option for lower-credit-score borrowers."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Aggregate household debt balances increased in the first quarter of 2018, for the 15th consecutive quarter, and are now $536 billion higher than the previous (2008Q3) peak of $12.68 trillion. As of March 31, 2018, total household indebtedness was $13.21 trillion, a $63 billion (0.5%) increase from the fourth quarter of 2017. Overall household debt is now 18.5% above the 2013Q2 trough.

Mortgage balances, the largest component of household debt, increased somewhat during the first quarter. Mortgage balances shown on consumer credit reports on March 31 stood at $8.94 trillion, an increase of $57 billion from the fourth quarter of 2017. Balances on home equity lines of credit (HELOC) continued their downward trend, declining by $8 billion, and are now at $436 billion. Non-housing balances saw a $14 billion increase in the first quarter. Auto loans grew by $8 billion. Student loan balances increased by $29 billion and credit cards declined by $19 billion.

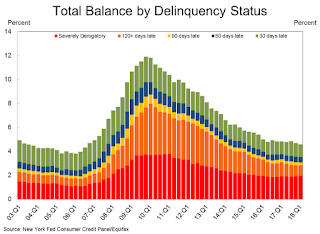

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate decreased in Q1. From the NY Fed:

Aggregate delinquency rates improved in the first quarter of 2018. As of March 31, 4.6% of outstanding debt was in some stage of delinquency. Of the $605 billion of debt that is delinquent, $407 billion is seriously delinquent (at least 90 days late or “severely derogatory”). The flow into 90+ day delinquency for credit card balances has been increasing notably for the last year, while the flow into 90+ day delinquency for auto loan balances has been slowly trending upward since 2012.There is much more in the report.

About 192,000 consumers had a bankruptcy notation added to their credit reports in 2018Q1, the lowest observed in the 19 year history of the data.