by Calculated Risk on 4/18/2018 05:28:00 PM

Wednesday, April 18, 2018

Thursday: Unemployment Claims, Philly Fed Mfg Survey

From Matthew Graham at Mortgage News Daily: Mortgage Rates Inch Higher as Bonds Suggest More Trouble Ahead

Mortgage rates moved higher today as bond markets continued a mildly weaker trend for the month of April. Bonds (which underlie rates) are under pressure for a variety of reasons. The most notable headwinds are longer-term and bigger-picture. Rates responded to these headwinds in a fairly big way in Jan/Feb and have basically been "taking a break" since then.Thursday:

Rates have moved very little during this "break," with most borrowers being quoted the same NOTE rate on any given day in the past 2 months. Upfront costs have been the only way the modulate the EFFECTIVE rate of the average lender's 30yr fixed quote. [30YR FIXED - 4.5%]

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 233 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of 20.1, down from 22.3.

Fed's Beige Book: "Modest to moderate" expansion, "concern about tariffs"

by Calculated Risk on 4/18/2018 02:31:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Dallas based on information collected on or before April 9, 2018."

Economic activity continued to expand at a modest to moderate pace across the 12 Federal Reserve Districts in March and early April. Outlooks remained positive, but contacts in various sectors including manufacturing, agriculture, and transportation expressed concern about the newly imposed and/or proposed tariffs. Consumer spending rose in most regions, with gains noted for nonauto retail sales and tourism, but mixed results for vehicle sales. Manufacturing activity grew moderately, and demand for nonfinancial services was mostly solid. Residential construction and real estate activity expanded further, although low home inventories continued to constrain sales in several Districts. Loan demand increased, and commercial real estate activity and construction improved since the last report. Transportation services activity expanded in over half of the reporting Districts, buoyed by increases in port traffic and/or air, rail and/or trucking shipments. Agricultural conditions were little changed or worsened on net, in part due to persistent drought conditions. Contacts in the energy sector cited a pickup in activity, except in the Richmond District, where coal production was flat and natural gas production dipped slightly.

...

Widespread employment growth continued, with most Districts characterizing growth as modest to moderate. Labor markets across the country remained tight, restraining job gains in some regions. Contacts continued to note difficulty finding qualified candidates across a broad array of industries and skill levels. Reports of labor shortages over the reporting period were most often cited in high-skill positions, including engineering, information technology, and health care, as well as in construction and transportation. Businesses were responding to labor shortages in a variety of ways, from raising pay to enhancing training to increasing their use of overtime and/or automation, among other strategies. Upward wage pressures persisted but generally did not escalate; most Districts reported wage growth as only modest.

emphasis added

Housing Inventory Tracking

by Calculated Risk on 4/18/2018 01:47:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

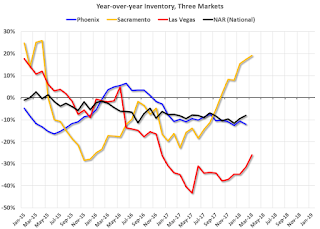

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas and Sacramento (through March), and also Phoenix and total existing home inventory as reported by the NAR (both through February 2018).

This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 19% year-over-year in March (inventory still very low), and has increased year-over-year for six consecutive months.

Also note the inventory is still down sharply in Las Vegas (red), but the YoY decline has been getting smaller.

I'll try to add a few other markets.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing.

AIA: "Architecture billings remain positive in March"

by Calculated Risk on 4/18/2018 10:31:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings remain positive in March

he American Institute of Architects (AIA) today reported that architecture firm billings rose for the sixth consecutive month in March, although the pace of growth slowed modestly from February.

Overall, the AIA’s Architecture Billings Index (ABI) score for March was 51.0 (any score over 50 indicates billings growth), which still reflects a healthy business environment. While business conditions softened somewhat at firms located in the Northeast region, billings remained strong at firms located in the South and West regions.

“New project activity coming into architecture firms continues to grow at a solid pace. As a result, project backlogs—in excess of six months at present— are at their highest post-recession level,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Business remains strong in the South and West, and firms with a residential specialization continue to set the pace.”

...

• Regional averages: West (53.4), Midwest (50.7), South (53.2), Northeast (49.0)

• Sector index breakdown: multi-family residential (53.4), institutional (49.7), commercial/industrial (53.1), mixed practice (51.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in March, down from 52.0 in February. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 4/18/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 13, 2018.

... The Refinance Index increased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.66 percent, with points unchanged at 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

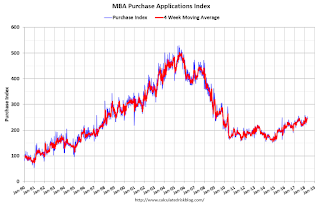

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, April 17, 2018

Wednesday: Beige Book, Architecture Billings Index

by Calculated Risk on 4/17/2018 07:23:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Comments on March Housing Starts

by Calculated Risk on 4/17/2018 11:59:00 AM

Earlier: Housing Starts increased to 1.319 Million Annual Rate in March

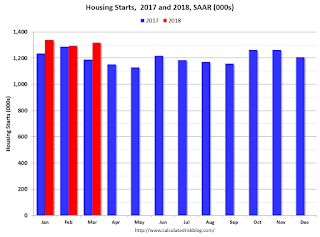

The housing starts report released this morning showed starts were up 1.9% in March compared to February, and starts were up 10.9% year-over-year compared to March 2017.

The increase in starts was mostly due to the volatile multi-family sector.

This first graph shows the month to month comparison between 2018 (blue) and 2017 (red).

Starts were up 10.9% in March compared to March 2017.

Note that starts in March, April and May of 2017 were weaker than other months, so this was a fairly easy comparison.

Through three months, starts are up 8.0% year-to-date compared to the same period in 2017.

Single family starts were up 5.2% year-over-year, and down 3.7% compared to February.

Multi-family starts were down 23.7% year-over-year, and up 16.1% compared to February (multi-family is volatile month-to-month).

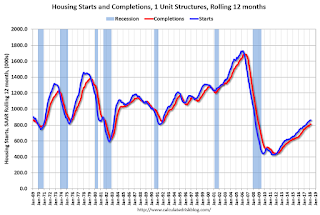

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have caught up to starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in a year or so.

As I've been noting for a few years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

Industrial Production Increased 0.5% in March

by Calculated Risk on 4/17/2018 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.5 percent in March after increasing 1.0 percent in February; the index advanced 4.5 percent at an annual rate for the first quarter as a whole. After having climbed 1.5 percent in February, manufacturing production edged up 0.1 percent in March. Mining output rose 1.0 percent, mostly as a result of gains in oil and gas extraction and in support activities for mining. The index for utilities jumped 3.0 percent after being suppressed in February by warmer-than-normal temperatures. At 107.2 percent of its 2012 average, total industrial production was 4.3 percent higher in March than it was a year earlier. Capacity utilization for the industrial sector moved up 0.3 percentage point in March to 78.0 percent, a rate that is 1.8 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.0% is 1.8% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 107.2. This is 23% above the recession low, and 2% above the pre-recession peak.

Housing Starts increased to 1.319 Million Annual Rate in March

by Calculated Risk on 4/17/2018 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,319,000. This is 1.9 percent above the revised February estimate of 1,295,000 and is 10.9 percent above the March 2017 rate of 1,189,000. Single-family housing starts in March were at a rate of 867,000; this is 3.7 percent below the revised February figure of 900,000. The March rate for units in buildings with five units or more was 439,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,354,000. This is 2.5 percent above the revised February rate of 1,321,000 and is 7.5 percent above the March 2017 rate of 1,260,000. Single-family authorizations in March were at a rate of 840,000; this is 5.5 percent below the revised February figure of 889,000. Authorizations of units in buildings with five units or more were at a rate of 473,000 in March.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in March compared to February. Multi-family starts were up 23.8% year-over-year in March.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years (although moving up over the last few months)

Single-family starts (blue) decreased in March, and are up 5.2% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in March were above expectations, and starts for January and February were revised up.

I'll have more later ...

Monday, April 16, 2018

Tuesday: Housing Starts, Industrial Production

by Calculated Risk on 4/16/2018 08:29:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back to Unchanged After Starting Higher

Mortgage rates began the day at higher levels, as bond markets lost ground overnight. Bonds dictate rates, and "losing ground" means bond prices are falling. When bond prices fall, rates move higher.Tuesday:

...

As bonds improved, most lenders ended up releasing positively-revised rate sheets. After the revisions, today's mortgage rates ended up in substantially similar territory to last Friday's. [30YR FIXED - 4.5%]

emphasis added

• At 8:30 AM ET, Housing Starts for March. The consensus is for 1.269 million SAAR, up from 1.236 million SAAR in February.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to decrease to 78.0%.